Cracking the Code: What VCs Look for in Startups

By Lior Ronen | Founder, Finro Financial Consulting

Every day, passionate entrepreneurs dream of building the next big thing, but securing the funding to make those dreams a reality can be a daunting task.

Enter the enigmatic world of venture capital (VC) – where money meets potential, and investors bet on the future of groundbreaking ideas.

But what exactly makes VCs tick?

What separates the funded few from the countless pitches left unheard? Understanding what these investors are looking for is crucial for any aspiring entrepreneur hoping to land the golden ticket to growth.

In this article, we'll lift the veil on the VC selection process, decoding the key factors that make startups stand out and unlock the secrets to attracting their coveted investment.

Buckle up, and get ready to dive into the heart of what truly ignites the funding fire for venture capitalists.

Landing venture capital investments require more than just a great idea. Investors seek startups that tackle significant problems with unique solutions, have clear and scalable business models with potential for profitability, and boast skilled and diverse teams with a proven track record.

Aligning your startup with the VC's investment focus and offering value beyond funding strengthens your appeal. Understanding their preferred exit strategy and staying ahead of industry trends further demonstrate your potential. Remember, fundraising is a two-way street - find investors who share your vision and can be true partners in your growth journey.

Mapping the Players: VCs, Angels, and Accelerators

Before we dive into the coveted secrets of VC attraction, let's first establish who these mysterious players are.

In the startup funding world, you'll encounter three main characters:

1. Venture Capitalists (VCs): Picture them as the all-stars in the startup funding league.

These power players, wielding hefty funds from heavy-hitters like pension funds and corporations, are in it for the full journey that kicks off right after you've got your idea on paper.

They're not just about the later innings; some VC funds are scouting for fresh talent, betting on early-stage startup companies with just enough traction to pique their interest.

Others prefer to enter the game when a startup's already on a winning streak, eyeing mature businesses poised for a home run.

And here's the latest play: a growing league of pre-seed VCs is stepping up to the plate, ready to back the very early-stage startups alongside angel investors, showing that there's room in this game for every level of startup ambition.

2. Angel Investors: Picture them as the benevolent guardians of early-stage dreams.

These are usually wealthy individuals who invest their own money in promising startups they believe in. They often inject initial capital, offer mentorship, and connect budding entrepreneurs to valuable networks.

Unlike venture capital firms, angel investors typically invest smaller amounts and might be more flexible with terms.

3. Accelerators: Imagine them as boot camps for startups. These intensive programs provide funding, mentorship, resources, and connections over a fixed period, aiming to propel startups towards rapid growth and investor readiness.

While they might invest some seed capital, accelerators’ main focus is on providing support and structure to early-stage ventures.

So, where does your startup fit in? While these entities share the goal of supporting innovative ideas, they differ in the stage they invest in, funding size, expectations, and level of involvement.

Understanding these differences will help you navigate the funding landscape and find the best match for your specific needs.

| Player | Stage They Invest In | Typical Funding Size | Investment Expectations | Level of Involvement |

|---|---|---|---|---|

| Venture Capitalists (VCs) | Later-stage (traction & growth) | Large | High returns, equity stake | Moderate to high |

| Angel Investors | Early-stage (potential & promise) | Smaller | Growth, mentorship, network connections | Low to moderate |

| Accelerators | Early-stage (idea & development) | Seed capital | Rapid growth, investor readiness | High (intensive program) |

The Venture Capital Playbook: the VC Business Model

Having just mapped out the key financiers in the startup arena, it's time to zoom in on the business model of one of the most influential players: Venture Capitalists (VCs).

These aren't your average Joe investors; they're the major leagues of funding, managing colossal pots of money aimed at nurturing business from budding to booming.

So, how do venture capital funds roll? Their business model is like a fine-tuned engine designed to drive high returns. It's a classic case of a high-risk, high-reward model. VCs invest early on in new companies, take significant risks, and benefit from a high return on investment.

Here's the scoop: VC investors gather funds from entities with deep pockets – think pension funds, university endowments, and affluent individuals.

VC funds are actually partnerships between an active investment manager who serves as the general partner of the fund (usually a venture capitalist) and the limited partners (these are the investors who back the fund).

They then inject this capital into new businesses with high-growth potential, spreading their bets across many portfolio companies to cushion the inherent risks of the startup world.

But here's where it gets juicy – VCs aren't just tossing money into the wind and hoping for the best. They're strategic, seeking equity in these startups, which means they own a slice of the pie.

As these companies scale and succeed, the value of their equity (ownership stake) shoots up. The ultimate payday comes when a startup either hits the jackpot with an IPO (initial public offering), gets acquired by a bigger fish, or finds another way to provide returns, translating into a windfall for the VCs.

And it's not just about the exit; VCs also rake in the dough through management fees, typically around 2% of the invested funds annually.

This covers the nitty-gritty of running the VC show.

But make no mistake, the big game is in the capital gains from successful exits – that's where VCs score the home runs that justify the risks and the intense scouting and mentoring they provide.

In essence, VCs are the talent scouts and coaches of the business world, investing in a team of startups, guiding them to the big leagues, and banking on their success to turn a profit. They play the long game, often with a 10-year fund lifecycle, knowing that while not every startup will hit a home run, the ones that do will more than make up for the strikeouts.

So, when you pitch to a VC, remember you're pitching to a business that thrives on turning visionary ideas into lucrative realities.

Their investment in your startup isn't just a vote of confidence; it's a strategic move in the intricate game of high-stakes investment.

Problem & Solution

Let's face it, VCs aren't looking to fund just any idea.

They're on the hunt for startups that tackle real, significant problems.

It's not enough to say you're making a "better" version of something that already exists – you need to address a pain point that people truly care about.

Think of it like this: the bigger the problem, the bigger the potential impact, and the bigger the potential ROI for investors.

But a great problem isn't enough on its own. You need a unique and differentiated solution.

Forget about "me-too" products – VCs want to see innovation, something that stands out from the crowd and offers a compelling reason for customers to switch.

Remember, they're not just investing in your product, they're betting on your ability to disrupt the market.

Finally, let's talk about market size. Even the most brilliant solution won't attract big bucks if it's only reaching a handful of people.

VCs need to see a large enough market with sustainable growth potential to ensure their investment translates into significant returns.

So, before you pitch your revolutionary gadget for dog-bone polishing, think big – does your target market have the size and longevity to excite investor wallets?

Get your expert valuation now!

Business Model & Financials

Now that we've identified a problem worth solving and a solution that stands out, let's shift our focus to the engine that drives any successful startup: the business model.

This is where VCs get to see how you plan to turn your brilliant idea into a sustainable, profitable business.

First, they'll need to see a clear and scalable model.

Think beyond just selling a product – how will you acquire customers, generate revenue, and scale your operations efficiently? VCs favor models that have the potential to reach a large audience and experience exponential growth.

Next, they'll scrutinize your path to profitability.

VCs aren't handing out money for charity – they expect a concrete plan for how your startup will become financially sustainable. This means demonstrating realistic projections for revenue, expenses, and profit margins, showcasing a clear timeline for reaching profitability.

Finally, your financial plan needs to be more than just numbers on a page.

It should tell a compelling story – one that convinces VCs you understand your finances, have a well-thought-out strategy, and can deliver substantial returns on their investment.

So, ditch the overly optimistic projections and focus on creating a realistic, data-driven plan that inspires confidence.

Remember, VCs aren't just looking for good ideas; they're looking for businesses with the potential to be financial powerhouses.

Make sure your business model and financials reflect a deep understanding of your market, a clear path to success, and the potential to turn their investment into a windfall.

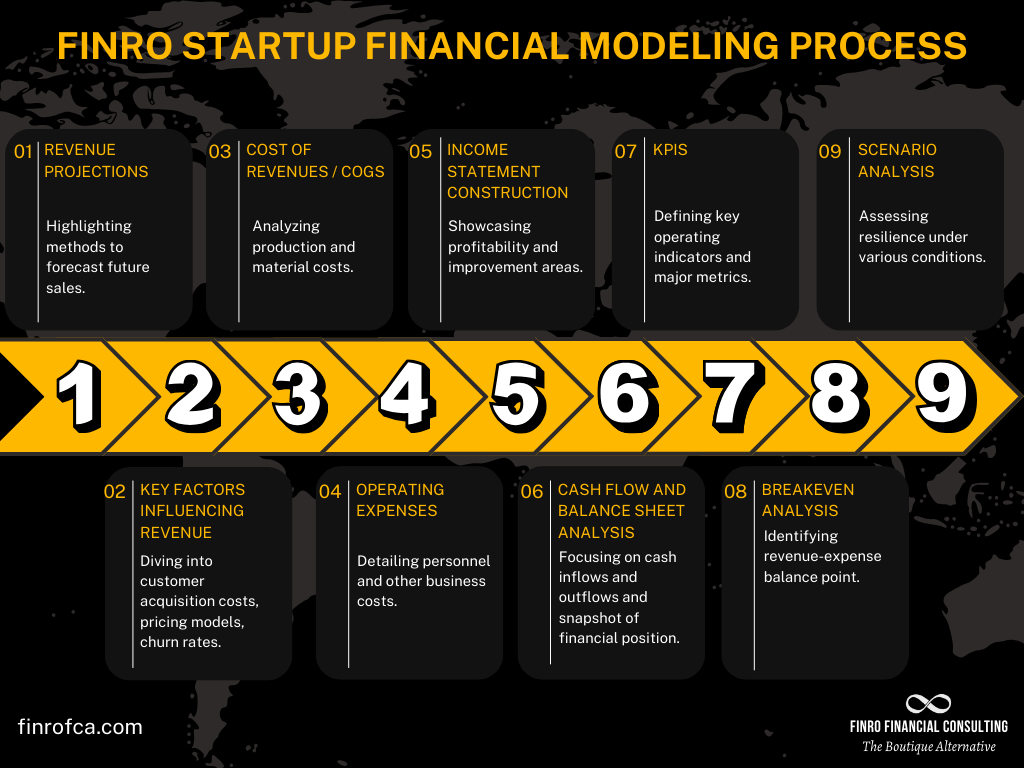

As the leading firm for startup financial modeling, we can help you build that projection. For further reading, visit this guide about our financial modeling process and our startup financial modeling services.

Team & Execution

Great ideas are alluring, but it's the team that ultimately brings them to life.

VCs know that even the most groundbreaking concept can falter without the right people at the helm. So, when they evaluate your startup, they'll be keenly assessing the team behind it.

Firstly, they'll look for skills, experience, and passion.

Do you have the expertise necessary to navigate your specific industry and execute your business plan? Does your team possess the technical know-how, marketing savvy, and operational muscle to make your vision a reality?

And let's not forget passion – VCs want to see a team that's fueled by genuine enthusiasm and relentless drive, the kind that thrives on challenges and pushes boundaries.

Secondly, diversity and well-roundedness matter.

A team with a single perspective can miss crucial blind spots. VCs value teams that bring together diverse backgrounds, experiences, and viewpoints, fostering a richer understanding of your target market and leading to more innovative solutions.

Finally, a track record of execution and overcoming challenges speaks volumes. Have you tackled similar hurdles in the past?

Did you demonstrate grit and resourcefulness in navigating difficult situations? Your past achievements and ability to adapt are strong indicators of your potential to translate your current vision into reality.

Remember, VCs aren't just investing in an idea; they're investing in the people who will make it happen. Build a team that inspires confidence, showcases diverse strengths, and demonstrates a proven ability to execute under pressure.

It's your team that will ultimately convince VCs to take a chance on your dream.

| Factor | What VCs Look For | How to Demonstrate |

|---|---|---|

| Skills & Experience | Relevant expertise, industry knowledge | Team bios, past achievements, educational background |

| Passion & Drive | Strong commitment, relentless pursuit of goals | Company culture, team interviews, mission statement |

| Diversity & Well-Roundedness | Varied perspectives, complementary strengths | Team composition, diverse backgrounds, collaborative approach |

| Track Record of Execution | Ability to overcome challenges, deliver results | Past projects, successful ventures, adaptability in difficult situations |

Market & Competition

Even the most amazing solution needs fertile ground to thrive.

This is where VCs assess the market your startup operates in, analyzing its potential and your ability to navigate the competitive landscape.

Firstly, they'll want to see a growing market with potential. Is the demand for your product or service increasing?

Is the market size significant enough to support sustainable growth?

Remember, VCs aren't looking for niche solutions; they crave markets with the potential to explode, taking their investment along for the ride.

Secondly, competition is inevitable. VCs will dissect your understanding of the existing players and how your startup will stand out. Do you have a unique value proposition that sets you apart? Can you demonstrate a clear competitive advantage that will attract and retain customers? Don't shy away from acknowledging your competitors; instead, showcase your strategic plan to conquer them.

Finally, product-market fit is the holy grail for VCs.

This means you've not only identified a problem and built a solution, but you've also validated its appeal to your target audience.

Have you conducted market research? Gathered user feedback? Achieved early traction with real customers?

Demonstrating product-market fit proves you're not just guessing; you've identified a real need and have the solution to fulfill it.

Remember, the market and competition are dynamic forces.

Show VCs you understand your landscape, have a plan to navigate it, and possess the product-market fit that sets you on the path to dominance.

This will convince them you're not just another player in the game, but a force poised to redefine it.

| Factor | What VCs Look For | How to Demonstrate |

|---|---|---|

| Market Potential | Growing market with significant size | Industry research, market projections, target audience analysis |

| Competition | Understanding of competitors, clear competitive advantage | Competitive analysis, unique value proposition, differentiation strategy |

| Product-Market Fit | Evidence of customer demand and product validation | Market research, user feedback, early traction metrics |

Investment Thesis & Alignment

Beyond the core elements of your startup, VCs also consider whether you're a "good fit" for their firm. This section dives into the crucial alignment between your venture and their investment thesis.

Firstly, they'll assess if your startup falls within their investment focus and expertise. Do you operate in an industry or with technologies that align with their investment priorities and areas of knowledge? VCs back businesses they understand and can provide strategic guidance, so demonstrating this alignment increases your chances of resonating with them.

Secondly, consider how the VC can add value beyond just funding. Can they connect you with key industry players, offer valuable mentorship, or open doors to critical resources? Highlighting the unique value they bring beyond the check can make your proposition even more appealing.

Finally, don't underestimate the importance of cultural fit. Building a successful partnership requires mutual respect, open communication, and shared values. Research the VC firm's culture, values, and communication style to assess if it aligns with your own. Remember, you'll be working closely with them for some time, so finding a compatible partner is crucial.

Ultimately, remember that this is a two-way street. While VCs are evaluating you, you should also be assessing them to ensure they can be the right partner for your long-term growth. Find firms that believe in your vision, align with your values, and can truly add value beyond just the capital they inject.

| Factor | What VCs Look For | How to Demonstrate |

|---|---|---|

| Investment Focus & Expertise | Alignment with their industry & technology priorities | Understand their portfolio, highlight relevant experience |

| Value Beyond Funding | Networks, mentorship, strategic guidance | Showcase potential collaborations, highlight specific needs |

| Cultural Fit | Shared values, open communication, mutual respect | Research firm culture, emphasize aligned values |

Beyond the Basics: Unlocking Additional Considerations

While the five key factors discussed so far form the core of what VCs look for, there are some additional considerations that may come into play depending on your specific situation.

1. Traction & Metrics (Early-Stage vs. Later-Stage Startups):

Early-Stage: If you're in the early stages, VCs will focus on potential rather than proven results. Traction metrics like active users, early sales, or user engagement become vital indicators of your startup's growth potential. Demonstrating rapid progress and a clear path to scaling your traction will resonate with early-stage investors.

Later-Stage: For later-stage ventures, VCs expect to see established traction and strong financial metrics. Revenue growth, profitability projections, and market share capture become crucial. Showcasing a clear path to a successful exit (like acquisition or IPO) further strengthens your position.

2. Exit Strategy (How VCs Expect Their Investment Returned):

VCs invest with the ultimate goal of seeing their investment return a profit. Understanding their preferred exit strategy is crucial. Some VCs favor acquisitions, while others target IPOs. Aligning your own exit vision with theirs demonstrates strategic foresight and increases their confidence in your long-term plan.

3. Industry Trends & Emerging Opportunities:

Staying ahead of the curve is key. Demonstrating awareness of key industry trends and how your startup capitalizes on emerging opportunities can impress VCs. Showcasing your ability to navigate and thrive in a dynamic market sets you apart from the competition.

Remember: While these additional considerations may not be deal-breakers for every VC, understanding them can provide valuable insights into tailoring your pitch and highlighting aspects that resonate with specific investors.

Conclusion

Securing venture capital isn't about magic tricks or hidden formulas. It's about building a strong foundation, understanding what VCs value, and showcasing your potential to become a game-changer.

By focusing on the key factors explored in this article – from a compelling problem and solution to a skilled team and a well-aligned vision – you can navigate the VC landscape with confidence.

Remember, the journey to securing funding is just the beginning.

Be prepared to answer tough questions, demonstrate your resilience, and build genuine relationships with potential investors. Embrace the feedback, refine your pitch, and constantly strive to exceed expectations.

The world of venture capital may seem shrouded in mystery, but by demystifying its core principles and aligning yourself with investor expectations, you can unlock the door to the resources and connections that can propel your startup to incredible heights.

So, take a deep breath, showcase your passion, and get ready to embark on the exciting journey towards turning your vision into a reality.

Key Takeaways

VC investments seek startups solving big problems with unique solutions and clear, scalable business models.

Investors prefer startups with proven track records, diverse teams, and alignment with their investment focus.

Understanding VC's preferred exit strategies and staying ahead of industry trends are crucial for attracting investment.

Fundraising is reciprocal; choose investors who share your vision and can offer more than just funding.

Securing VC funding demands a solid foundation, strategic alignment, and showcasing potential as a market disruptor.

Answers to The Most Asked Questions

-

Venture capitalists look for startups tackling significant problems with unique solutions, clear and scalable business models, potential for profitability, and skilled, diverse teams with a proven track record.

-

In founders, VCs look for skills, experience, passion, diversity, well-roundedness, and a track record of execution and overcoming challenges.

-

VCs assess startups by evaluating the problem and solution, business model and financials, team and execution, market and competition, and investment thesis and alignment with the VC's focus.

-

Angel investors typically invest in the early stages of a startup, often injecting initial capital and offering mentorship and network connections.