Proptech Valuation Multiples: 2025 Insights & Trends

By Lior Ronen | Founder, Finro Financial Consulting

PropTech is reshaping the way we approach real estate, blending technology with innovation to solve problems and create opportunities. From smarter buildings to streamlined property transactions, this sector is making waves across industries and geographies.

But how do you measure its value? That’s where valuation multiples come in—offering a clear lens to assess the worth of companies revolutionizing real estate.

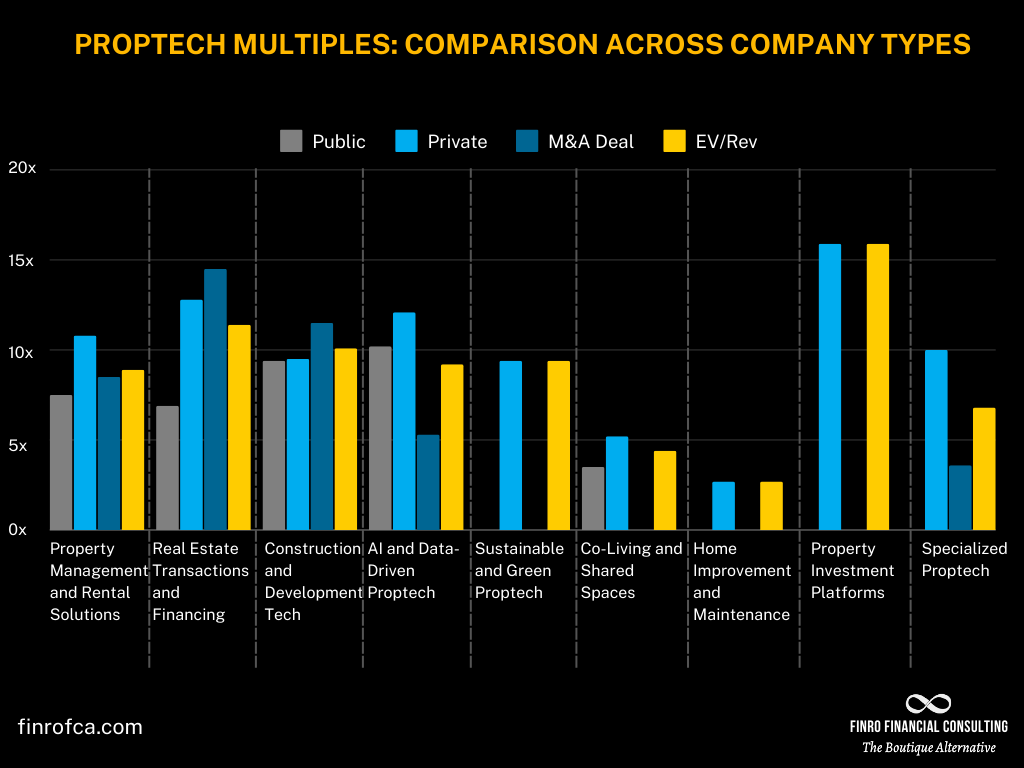

Our latest analysis reveals an average revenue multiple of 8.8x for PropTech companies in 2025. This number doesn’t just represent market sentiment; it reflects the potential investors and founders see in these cutting-edge solutions.

Whether you’re evaluating a startup’s market position or comparing niches, understanding these metrics is essential.

If you’re curious about the factors driving these valuations and want deeper insights into 150+ PropTech companies, this article breaks it all down. For an even more comprehensive dive, we’ve compiled a detailed spreadsheet covering 150+ companies, available for download at €29.90.

Now, let’s explore why PropTech is such a transformative industry and how its valuation multiples serve as a critical decision-making tool.

PropTech is revolutionizing the real estate industry by leveraging technology across diverse niches such as property management, real estate transactions, construction tech, and AI-driven solutions. With an average revenue multiple of 8.8x in 2025, valuations in this space reflect the industry’s growth potential and efficiency improvements.

Key valuation metrics, including EV/Revenue, EV/EBITDA, and DCF, provide a framework for assessing companies based on growth, profitability, and future cash flow predictions. These tools are essential for understanding market dynamics and making informed decisions in this rapidly evolving sector.

What Is PropTech?

PropTech, short for property technology, represents the convergence of real estate and technology to create innovative solutions for buying, renting, building, and managing properties. By leveraging advancements such as AI, IoT, and blockchain, PropTech transforms traditional real estate practices, making them more efficient, transparent, and user-friendly.

This industry has gained significant traction as it tackles inefficiencies that have plagued real estate for decades. From streamlining property searches with AI-driven platforms to automating building management systems with IoT, PropTech offers tools that save time, reduce costs, and enhance user experiences.

Consider how digital platforms now enable virtual tours, simplifying home-buying decisions without ever stepping foot on the property, or how property management software automates rent collection and maintenance requests.

But PropTech’s significance extends beyond convenience. It’s redefining how stakeholders interact with real estate, fostering sustainable practices like smart energy management in buildings and enabling new business models such as co-working and shared living spaces.

As this sector continues to evolve, its innovations are shaping the future of real estate, making it more adaptable to the needs of today’s consumers and businesses.

Key PropTech Niches

Building on the foundation of what PropTech is, this section highlights the niches shaping the industry. These categories illustrate how companies leverage technology to disrupt traditional processes and add value across the real estate ecosystem.

Property Management and Rental Solutions

This niche focuses on software and platforms that streamline property operations, enhance tenant experiences, and optimize rental processes. Companies like ServiceTitan, Guesty, and Appfolio offer tools for rent collection, maintenance tracking, tenant communication, and lease management.

These solutions aim to reduce inefficiencies, enhance operational visibility, and create seamless experiences for both property managers and tenants. For instance, Guesty empowers short-term rental managers with an all-in-one platform for booking, guest services, and financial management.

Real Estate Transactions and Financing

Digital platforms have redefined the way properties are bought, sold, and financed. Companies like Zillow, Pacaso, and Opendoor use AI-driven insights and seamless interfaces to simplify property searches, streamline transactions, and accelerate the financing process.

These platforms enable homebuyers to make informed decisions and allow real estate professionals to close deals faster. Opendoor, for example, uses predictive analytics to provide instant offers, removing uncertainty from property sales.

AI and Data-Driven PropTech

Advanced analytics and AI applications are transforming real estate operations. Companies like CoStar, Stonal, and XYZ Reality provide insights that were once unattainable. AI-powered tools support tasks like automated property valuations, virtual tours, and market forecasting. XYZ Reality, for instance, offers augmented reality solutions for construction sites, ensuring projects align with architectural plans in real-time.

Construction and Development Tech

This niche emphasizes technological innovation in construction processes, materials, and designs. Companies like Procore, Trimble, and Autodesk lead the way by providing platforms that enhance project planning, streamline workflows, and optimize resource allocation.

For example, Procore offers a comprehensive platform that connects stakeholders, enabling better collaboration and decision-making across all construction phases.

Co-Living and Shared Spaces

With urbanization driving demand for flexible housing solutions, co-living platforms are transforming traditional rental models. Companies like Airbnb, Vacasa, and Deskimo focus on providing shared living spaces tailored to affordability and community. Vacasa, for example, helps property owners manage and rent vacation homes, maximizing occupancy and revenue through tech-driven optimization.

Home Improvement and Maintenance

This niche addresses the challenges of maintaining and upgrading properties by providing tools for repairs, renovations, and upkeep. Companies like Roofr, Houm, and Inspectify make it easier for property owners and managers to identify and complete maintenance tasks efficiently. Inspectify offers inspection tools that generate detailed reports, enabling users to plan improvements or negotiate property deals effectively.

Sustainable and Green PropTech

Sustainability is a growing priority, and companies in this niche are creating solutions that promote eco-friendly real estate practices. Firms like Atmos, Green Canopy NODE, and FloodFlash develop technologies to reduce energy consumption, integrate renewable energy, and mitigate climate risks. For example, Green Canopy NODE focuses on energy-efficient building designs that significantly lower carbon footprints.

Property Investment Platforms

Investment platforms like Holidu, Keyzy, and Ciudadela democratize access to real estate investments, enabling individuals and institutions to invest in properties with ease. These platforms often provide data-driven insights and portfolio management tools, making real estate investment more accessible. Holidu, for instance, offers vacation rental investments with analytics that maximize returns for investors.

These niches illustrate the vast potential of PropTech to address inefficiencies and unlock new opportunities across real estate and construction. Each category tackles industry-specific challenges, from property management to sustainable practices, creating a dynamic and growing ecosystem.

Next, we’ll explore how valuation multiples provide critical insights into the performance and potential of these PropTech companies.

How to Value a PropTech Company?

Building on the understanding of PropTech and its diverse niches, it’s essential to discuss how valuation metrics are applied in this evolving sector.

PropTech valuations, like those of other tech-driven industries, rely on established financial metrics to assess company performance and potential.

Here’s how the three most common methods—Revenue Multiples (EV/Revenue), EBITDA Multiples (EV/EBITDA), and Discounted Cash Flow (DCF)—are used to evaluate PropTech companies.

Revenue Multiples (EV/Revenue)

For early-stage PropTech companies, especially those focused on growth rather than profitability, EV/Revenue is a vital metric. This multiple compares a company’s enterprise value (EV) to its revenue, offering a snapshot of how the market values its ability to generate income.

High revenue multiples often reflect investor confidence in the company’s scalability and market potential. For example, companies like ServiceTitan and Zillow—operating in high-growth niches such as property management and real estate transactions—command strong EV/Revenue multiples due to their robust revenue streams and expansive market opportunities.

EBITDA Multiples (EV/EBITDA)

As PropTech companies mature, the focus often shifts from growth to profitability and operational efficiency. EV/EBITDA is particularly relevant for firms with steady cash flows and a proven business model.

This metric evaluates a company’s valuation relative to its earnings before interest, taxes, depreciation, and amortization (EBITDA), highlighting its operational health.

Firms like Trimble, with established revenue streams and efficient cost structures, demonstrate the applicability of EBITDA multiples in assessing operational success and sustainability.

Discounted Cash Flow (DCF)

For a deeper dive into a company’s intrinsic value, especially those with unpredictable earnings or long-term growth plans, the DCF method is indispensable. By forecasting future cash flows and discounting them back to their present value, DCF provides a comprehensive view of what a company is worth today based on its expected performance tomorrow.

In the PropTech world, where many companies operate on innovative business models and unproven markets, DCF is often used alongside other metrics to validate valuations. For instance, companies like Green Canopy NODE, focused on sustainable building solutions, leverage future-oriented approaches like DCF to showcase the long-term value of their eco-friendly initiatives.

These valuation metrics are not mutually exclusive; instead, they are often used together to paint a more nuanced picture of a company’s worth. Understanding which metric to apply depends on the company’s stage, market position, and growth trajectory.

Next, we’ll dive into the specific valuation trends across key PropTech niches, exploring how these metrics vary and what they reveal about the industry’s landscape.

Practical Steps to PropTech Valuation

Building on our understanding of PropTech niches and valuation metrics, it’s time to connect the dots.

Whether you’re an investor evaluating a potential deal or a founder preparing for a funding round, knowing how to apply valuation methods is critical.

Let’s explore how to value a PropTech company effectively.

Step 1: Analyze the Business Model

Start with understanding the company’s revenue streams and market positioning. For instance, companies like Plume and Houzz thrive on scalable platforms, making revenue multiples (EV/Revenue) a relevant metric. Meanwhile, companies focusing on operational efficiency, such as Green Canopy NODE, benefit from analysis through EV/EBITDA.

Step 2: Assess the Financial Performance

Dive into key financial data such as revenue growth, EBITDA margins, and cash flow. For high-growth early-stage companies like Symbium or Atmos, revenue multiples offer a snapshot of market potential. Conversely, mature players like Trimble or CoStar may warrant EBITDA-focused evaluation, reflecting their profitability and efficiency.

Step 3: Apply DCF for Future Projections

Discounted Cash Flow (DCF) analysis becomes crucial when the company has a predictable cash flow trajectory. By projecting future revenues and costs, you can estimate intrinsic value. This method often reveals the long-term potential of sustainable-focused players like FloodFlash or Atmos.

Step 4: Benchmark Against Industry Comps

Leverage industry benchmarks to validate your analysis. For example, the dataset reveals that the average revenue multiple for PropTech companies is 8.8x, offering a useful baseline to compare individual company valuations.

Step 5: Factor in Unique Market Dynamics

Each niche has its unique growth drivers. AI-driven companies like CoStar or VTS may command higher multiples due to their innovative edge. Similarly, sustainable PropTech like Green-Basilisk might attract premium valuations because of their alignment with global ESG trends.

Understanding these steps provides a roadmap for navigating PropTech valuation. Next, we’ll explore the opportunities this data unlocks for deeper insights into the industry.

Download the Full PropTech Valuation Database

The previous sections provided a deep dive into the PropTech industry, covering its key niches and valuation methodologies.

However, understanding a market as diverse and fast-moving as PropTech often requires going beyond broad insights to focus on detailed, data-driven analysis.

That’s where our comprehensive PropTech Valuation Database comes in.

Why the Database Matters

This curated database includes financial and valuation metrics for 150+ PropTech companies, spanning public companies, private startups, and M&A deals. It’s the ultimate tool for anyone seeking to explore PropTech opportunities or benchmark company performance. Whether you’re a founder, investor, or analyst, this resource helps you save time and make informed decisions.

What You’ll Find Inside

Here’s what makes the database invaluable:

Company Details: Includes names, niches, and public/private status for a clear market overview.

Valuation Metrics: Access EV/Revenue and EV/EBITDA multiples across niches to compare performance effectively.

Market Insights: Understand how different business models and strategies influence valuations.

Growth Patterns: Identify high-potential areas based on financial performance and market trends.

Who Can Benefit?

This database is tailored for anyone involved in PropTech:

Founders: Gauge how your company compares to peers in your niche.

Investors: Identify promising opportunities and evaluate exit potential.

Consultants and Analysts: Access reliable data for research and strategic planning.

How to Get It

For €29.90, you’ll gain access to this ready-to-use Excel spreadsheet. Instead of spending countless hours on research, you can have all the relevant insights at your fingertips.

Let’s move forward to our concluding thoughts and explore how you can apply these insights to stay ahead in the ever-evolving PropTech industry.

Final Thoughts on PropTech Valuation

Building on the detailed analysis, methodologies, and database insights shared so far, it’s clear that PropTech is not just reshaping the real estate industry—it’s setting the stage for a more efficient, transparent, and data-driven future. Understanding how to assess and compare valuations is no longer a luxury for stakeholders but a necessity for making smarter, well-informed decisions.

The Bigger Picture

PropTech’s wide range of niches—from Property Management to AI-driven solutions—highlights its adaptability and potential for innovation. By aligning valuation methods like EV/Revenue, EV/EBITDA, and DCF with specific niches, businesses and investors can uncover opportunities that match their goals, risk tolerance, and timelines.

Applying the Insights

The valuation landscape isn’t static—it evolves with market trends, regulatory shifts, and technological advancements. Whether you’re planning an acquisition, considering funding rounds, or benchmarking a startup, the frameworks and tools provided in this article and the PropTech Valuation Database equip you with actionable insights to navigate this complexity effectively.

Staying Ahead

PropTech’s growth trajectory shows no signs of slowing down, and being prepared is key. With tools like the valuation database and a clear understanding of the valuation process, you can confidently make strategic decisions that position you ahead of the curve.

From market trends to actionable data, this article has aimed to simplify a complex topic, leaving you better equipped to leverage PropTech’s potential. Whether you’re an investor, founder, or analyst, now is the time to apply these insights to unlock value in this transformative sector.

Key Takeaways

PropTech Overview: Revolutionizing real estate with tech-driven innovations across multiple niches.

Valuation Metrics: EV/Revenue for growth, EV/EBITDA for profitability, DCF for intrinsic value analysis.

Niche Insights: AI-driven PropTech and sustainable solutions lead in growth potential and valuation diversity.

Market Data: PropTech valuation averages at 8.8x EV/Revenue, reflecting broad industry appeal.

Strategic Tools: Comprehensive PropTech Valuation Database aids informed decisions for investors, founders, and analysts.

Answers to The Most Asked Questions

-

The average revenue multiple for PropTech companies in 2025 is 8.8x.

-

Use EV/Revenue for growth, EV/EBITDA for profitability, or DCF for future cash flow projections.

-

AI-Driven PropTech and Sustainable PropTech show significant growth and valuation potential.

-

They highlight market potential for early-stage, high-growth companies with limited profitability.

-

Growth rate, market demand, profitability, operational efficiency, and niche-specific trends.