Startup Financial Model in 2025: Real Goal and Use Cases

By Lior Ronen | Founder, Finro Financial Consulting

Startup Financial Model traditionally gets a lot of attention for its role in attracting investors. While fundraising is an important use, the model offers much more. It serves as a practical tool for guiding strategy, aligning teams, and managing day-to-day operations.

This article explains why understanding the various use cases of a Startup Financial Model can add significant value to your business. We’ll cover its key components, outline common pitfalls, and share best practices that go beyond just securing funds.

Let’s start by looking at the broader picture and exploring how a well-built financial model can serve multiple functions for your startup.

A robust startup financial model serves as a strategic compass that drives internal decision-making and investor engagement by leveraging realistic assumptions, detailed unit economics, and continuous scenario planning. Modern tools and real-time data integrations further enhance accuracy and adaptability, while avoiding common pitfalls such as overoptimistic projections and outdated information. Partnering with Finro refines this framework, ensuring it aligns with market realities and investor expectations, ultimately empowering sustainable growth in a dynamic tech landscape.

- What is a Startup Financial Model?

- Multiple Use Cases of a Startup Financial Model

- The Real Goal: Uncovering Insights & Guiding Growth

- Essential Elements of a High-Impact Startup Financial Model

- Leveraging Tools & Technology

- Why Choose Finro as Your Financial Modeling Partner?

- Conclusion

- Key Takeaways

- Answers to The Most Asked Questions

What is a Startup Financial Model?

A financial model is a structured representation of a company’s financial performance.

It uses historical data and assumptions about the future to forecast key financial metrics, such as revenue, expenses, cash flow, and growth. Essentially, it’s a detailed framework that provides insight into how various factors influence a business’s performance over time.

But, a startup is more than a neat arrangement of numbers and charts.

It acts as a decision-making tool that helps guide choices across your business.

Rather than being limited to a document for fundraising purposes, it provides a framework for planning strategy, managing operations, and evaluating performance over time.

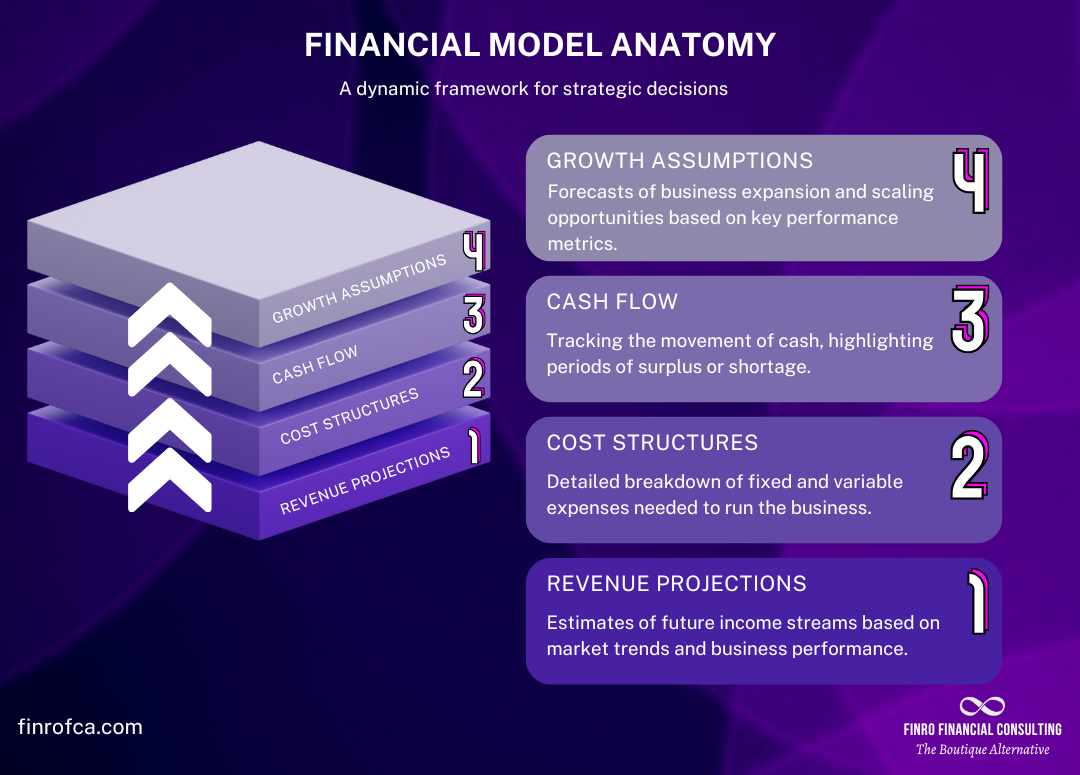

At its foundation, the model is built on several key components. Revenue projections help you estimate the income your startup might generate.

Cost structures break down your spending, giving you a clear picture of what it takes to keep the business running. Cash flow estimates indicate how money moves through the company, highlighting periods when funding might be tight or abundant.

Lastly, growth assumptions allow you to plan for future expansion and scale your operations thoughtfully.

While some models remain static—a snapshot of your financial plans at one moment—a more effective approach is to design a model that adapts as circumstances change.

Startups face an environment where market conditions and business realities can shift quickly.

At Finro, we strive to incorporate as many manual assumptions as reasonable, allowing our clients to adjust these inputs over time and keep their model current with their evolving business.

This flexibility ensures that your financial planning remains relevant and useful as new information comes in, supporting both short-term needs and long-term goals.

| Aspect | Static Model | Adaptive Model |

|---|---|---|

| Definition | A one-time snapshot of your startup’s finances with fixed numbers. | A flexible framework that incorporates new information and updates assumptions over time. |

| Key Traits |

|

|

| Manual Input Points | Minimal manual updates; numbers remain fixed. | Includes manual assumptions for revenue, costs, and growth that can be adjusted over time. |

| Visual Representation | Often depicted with a locked icon or a "frozen" snapshot. | Shown with refresh symbols or gears to indicate flexibility and ongoing updates. |

| Usage | Primarily used for fixed analysis and fundraising pitches. | Used for ongoing monitoring, strategic planning, and adapting to changes. |

Multiple Use Cases of a Startup Financial Model

A Startup Financial Model is often seen as just a tool for attracting investors, but its benefits extend far beyond that initial impression.

In reality, the model is a versatile asset that plays a critical role in various areas of your business.

It not only provides a foundation for investor pitches but also offers insights that help shape strategic decisions, optimize operations, and ensure your startup is prepared for potential challenges.

This section explores the multiple use cases of a Startup Financial Model, illustrating how it supports fundraising, strategic planning, operational efficiency, scenario testing, and team alignment.

By understanding these diverse applications, you can leverage your model to drive sustainable growth and maintain a competitive edge in a constantly evolving market.

Fundraising & Investor Relations

Clear, data-driven forecasts form the backbone of any compelling pitch. Investors appreciate detailed projections that are rooted in realistic assumptions, as these provide tangible evidence that your business plan has been carefully thought through.

A robust financial model not only underlines your startup’s potential for revenue and growth but also demonstrates that you understand the financial dynamics of your business.

This instills investor confidence and creates a stronger narrative during fundraising discussions. While these forecasts are crucial, it is important to remember that they represent only one aspect of the model’s capabilities, setting the stage for its broader utility across the organization.

Strategic Planning & Decision-Making

Your financial model provides critical insights that help shape your product roadmap, guide market expansion, and set pricing strategies. By clearly outlining expected revenues, costs, and growth trajectories, the model becomes a strategic guidepost, ensuring that every business decision is aligned with your long-term goals.

It enables you to evaluate various strategic options by simulating potential outcomes, making it easier to identify which initiatives offer the most promise. With these insights, you can prioritize projects, allocate resources more efficiently, and make informed decisions that keep your startup on a clear path toward sustainable growth.

Operational Efficiency & Resource Allocation

Accurate tracking of burn rate and runway is essential for effective cash flow management, and your financial model plays a key role in this process. It acts as a financial control tool, monitoring how cash flows in and out of the business and highlighting any potential shortfalls before they become critical issues.

This ensures that every team has the necessary resources to execute plans without overspending. By having a clear picture of your operational metrics, you can better manage day-to-day expenses and allocate resources where they are most needed. This operational clarity is particularly valuable during periods of rapid change, helping you maintain stability and avoid unexpected financial pitfalls.

Scenario Testing & Risk Mitigation

In an unpredictable market, being prepared for various outcomes is crucial. By incorporating best-case, worst-case, and pivot scenarios, your financial model acts as a sandbox for testing different strategies and preparing for unexpected market changes. Running these scenarios not only highlights potential risks but also allows you to explore alternative strategies that could mitigate those risks.

This proactive approach enables you to adjust your business plans quickly in response to market shifts, ensuring that your startup remains agile and resilient. In essence, scenario testing transforms your model into a risk management tool, providing a safety net for unforeseen challenges while identifying opportunities for strategic adjustments.

Team Alignment & Accountability

A well-structured financial model establishes clear targets and metrics, creating a shared vision across all departments. When everyone understands the financial goals and the key performance indicators driving those goals, it fosters a culture of accountability and collaboration.

The model serves as a central reference point that keeps everyone aligned on priorities, ensuring that all teams—from marketing to operations—are working toward the same financial objectives. This transparency not only drives internal efficiency but also helps build a cohesive strategy that everyone can rally behind, ultimately strengthening the overall performance of the organization.

Each of these use cases demonstrates that the true value of a Startup Financial Model extends far beyond fundraising. It is an essential tool for guiding strategy, optimizing operations, managing risks, and ensuring that your team is working toward shared financial goals.

The Real Goal: Uncovering Insights & Guiding Growth

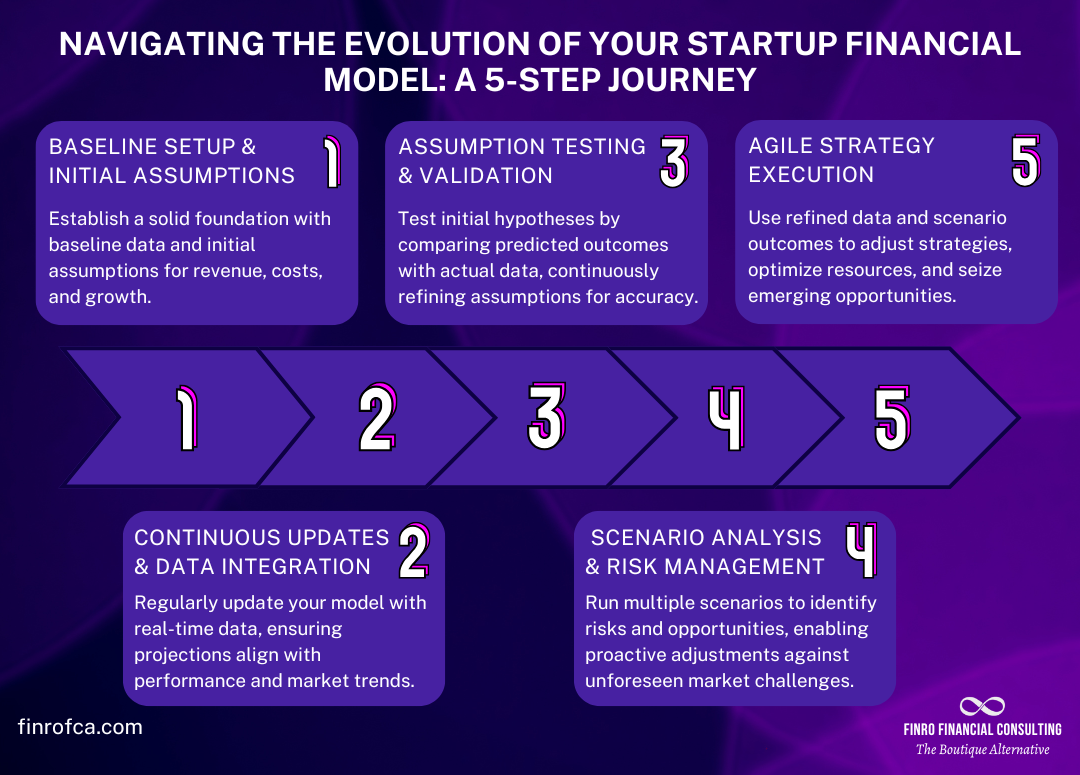

A robust Startup Financial Model begins with a well-defined foundation built on baseline data and initial assumptions about revenue, costs, and growth. This initial framework anchors your projections, setting clear expectations and providing a point of reference as your business evolves.

By establishing solid groundwork early on, you create a reliable platform upon which future insights can be layered.

As your startup grows, the model must be continually refreshed with real-time data. Regular updates are crucial to ensure that your projections remain aligned with actual performance and market conditions.

This ongoing integration of fresh data transforms the model into a living document—one that mirrors the evolving state of your business and provides timely insights for strategic decision-making.

Beyond merely updating numbers, the model serves as a tool for validating your initial hypotheses. By systematically comparing predicted outcomes with actual results, you can test assumptions about customer behavior and market demand. This process of continuous validation refines your projections, turning early assumptions into verified metrics that drive a deeper understanding of your business environment.

Preparation for uncertainty is another key aspect of a dynamic financial model. By simulating various scenarios—including optimistic, pessimistic, and contingency outcomes—you can identify potential risks and opportunities well in advance.

This proactive approach to scenario analysis enables you to mitigate risks and adjust your plans when market conditions change unexpectedly, ensuring that your strategy remains resilient.

Finally, the refined insights from your financial model empower you to execute an agile strategy. With up-to-date, validated data at your fingertips, you can confidently adjust your business plans, optimize resource allocation, and capitalize on emerging opportunities.

This data-driven adaptability ensures that your startup not only stays competitive but is also well-prepared to seize growth opportunities as they arise, making your financial model an indispensable strategic asset.

Essential Elements of a High-Impact Startup Financial Model

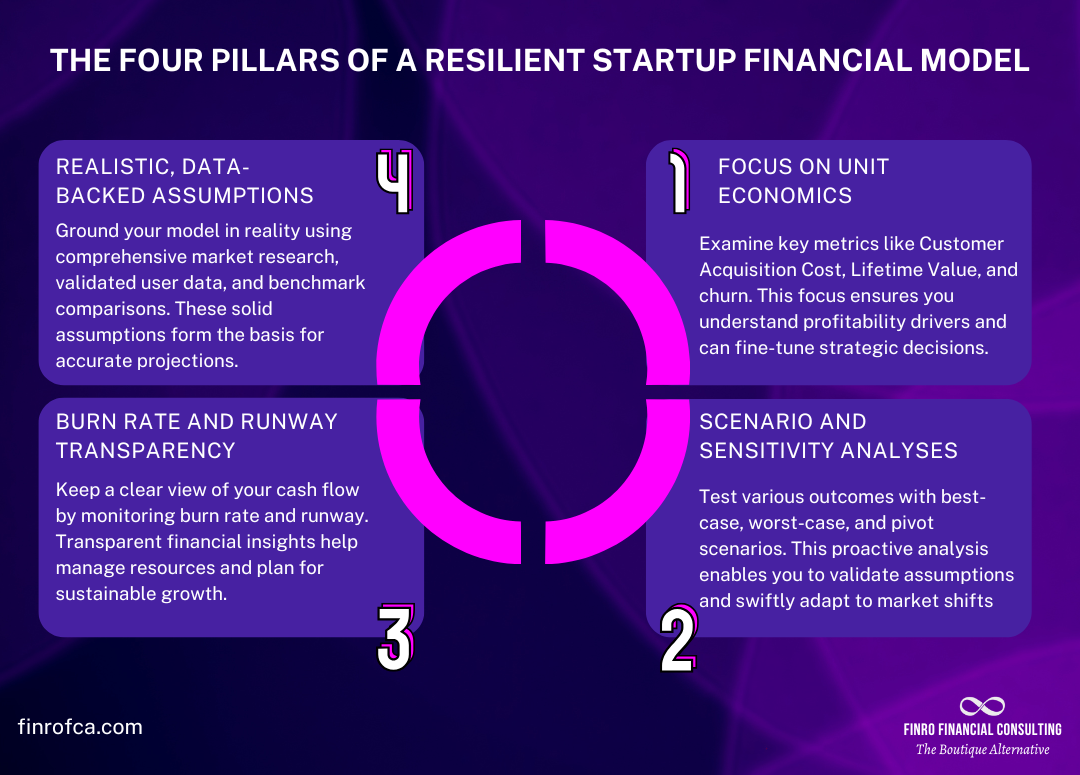

A high-impact financial model starts with realistic, data-backed assumptions. Leveraging comprehensive market research, user data, and comparable benchmarks ensures that your projections are grounded in reality rather than optimistic guesses.

This foundation not only boosts credibility with investors but also gives you a clear picture of where your startup stands. By basing your assumptions on reliable data, you can build a model that adapts as new information comes in and reflects the true potential of your business.

Another critical element is a strong focus on unit economics. Understanding metrics like Customer Acquisition Cost (CAC), Lifetime Value (LTV), and churn is essential for making informed strategic decisions.

By dissecting these key performance indicators, you can evaluate the profitability of individual customers and identify areas where improvements can lead to overall growth. When these metrics are integrated into your model, they offer invaluable insights that can help fine-tune marketing strategies and operational tactics.

Transparency in burn rate and runway is equally important. Cash flow is the heartbeat of any startup, and keeping a close eye on how quickly you’re spending funds versus how long your current cash reserves will last is crucial.

A clear view of your burn rate and runway not only helps you avoid surprises but also allows you to make timely adjustments to your spending and fundraising plans. This clarity ensures that you’re always prepared to weather financial challenges and sustain growth over the long term.

Finally, incorporating scenario and sensitivity analyses adds a layer of flexibility to your model. By simulating various market conditions—whether optimistic, pessimistic, or somewhere in between—you can assess how changes in key variables affect your bottom line.

These analyses enable you to build a robust model that accommodates market volatility and helps you plan for unexpected events. With a model that includes scenario planning, you’re better positioned to pivot swiftly when circumstances change, ensuring that your startup remains agile and resilient.

Leveraging Tools & Technology

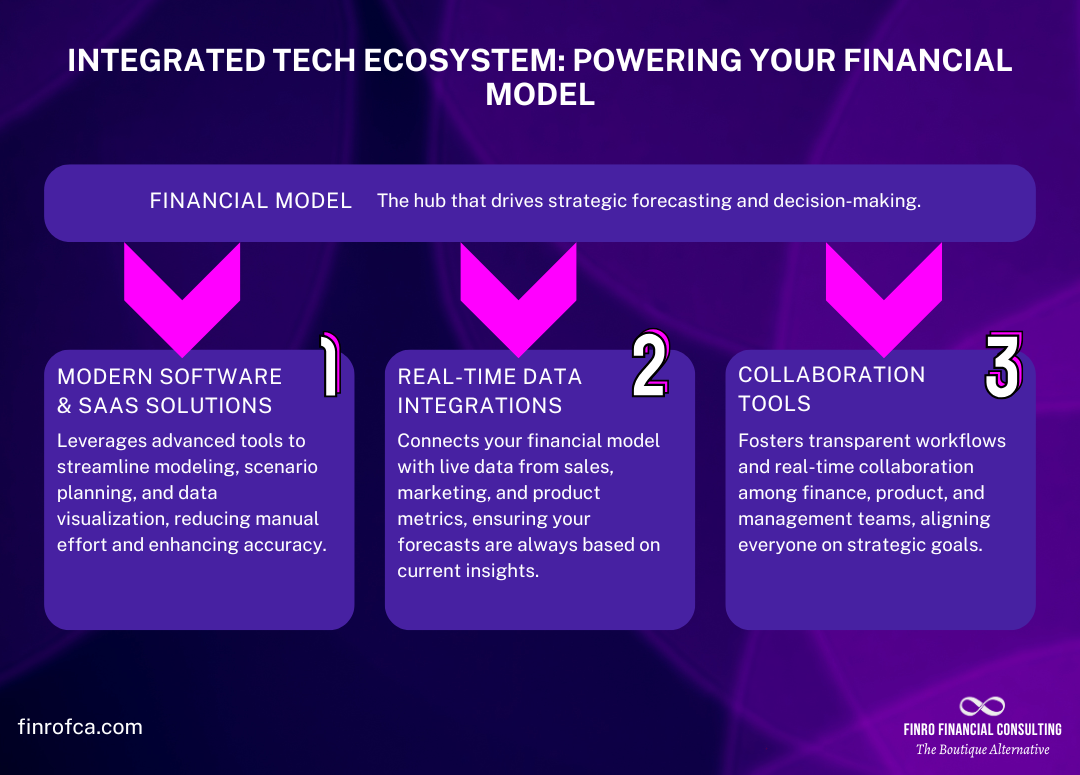

Modern software and SaaS solutions have transformed how startups handle financial modeling. These tools simplify complex tasks such as forecasting, scenario analysis, and data visualization, enabling you to build detailed models without getting bogged down in manual calculations.

With intuitive interfaces and customizable templates, even those with limited technical expertise can create robust, dynamic models that reflect the unique needs of their business.

Equally important is the integration of real-time data. By connecting your financial dashboards with sales, marketing, and product metrics, you ensure your model remains up-to-date with current performance indicators.

Automatic data synchronization from various systems means your forecasts and analyses are always based on the latest information, allowing you to make informed decisions quickly. This integration bridges the gap between operational data and financial planning, giving you a comprehensive view of your startup’s overall health.

Collaboration features in modern tools further enhance their value by fostering transparent workflows across departments. With shared dashboards, real-time commenting, and version control, finance, product, and management teams can work together seamlessly.

This collaborative approach not only speeds up the decision-making process but also ensures that diverse insights are incorporated into the model, ultimately driving smarter strategic planning and stronger execution across the organization.

Why Choose Finro as Your Financial Modeling Partner?

Building on our earlier discussion of how essential robust financial models are for tech startups, this section outlines why partnering with Finro can fundamentally transform your financial strategy.

For tech startups, a comprehensive financial blueprint does more than track numbers—it illuminates the future. A meticulously crafted model not only guides internal decision-making and resource allocation but also serves as a compelling tool when engaging with investors and strategic partners.

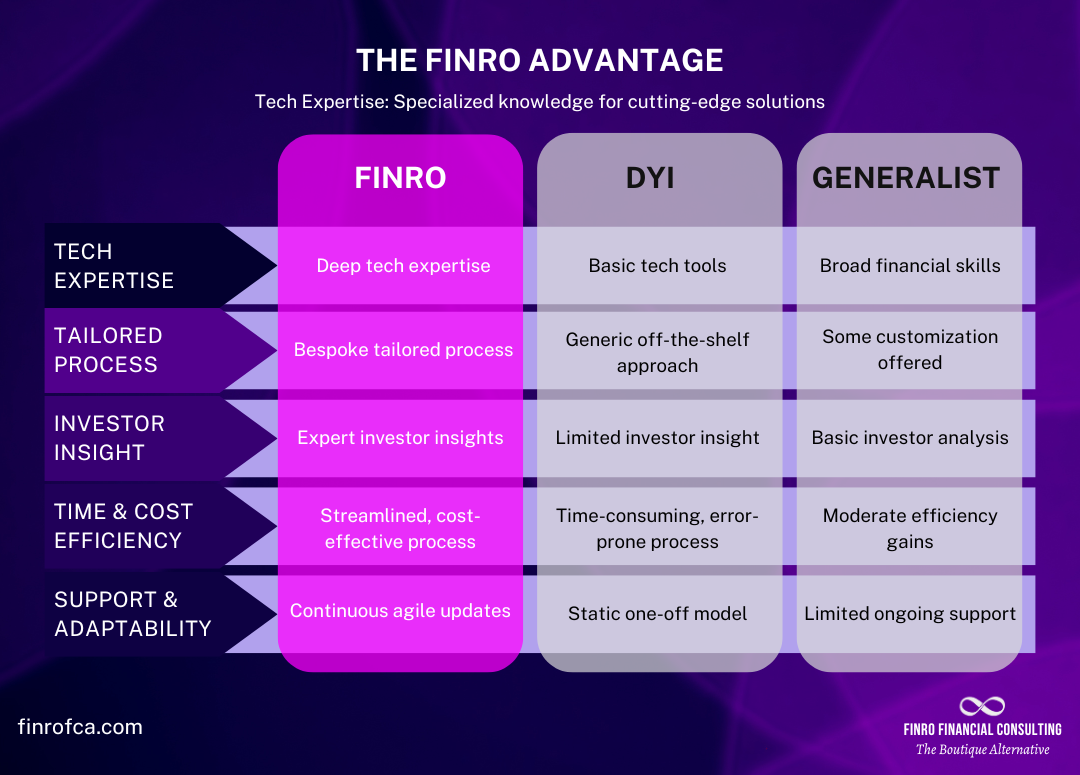

When faced with the challenge of constructing such a crucial tool, you essentially have three options: build the model yourself, rely on a generalist, or partner with specialists who truly understand the intricacies of the tech industry.

The risks of a DIY approach or hiring a generalist are significant—they can lead to overlooked details, misinterpreted market signals, and a failure to present a persuasive narrative to potential investors.

This is where Finro stands apart. With deep expertise in tech market dynamics and a structured, methodical approach, Finro delivers tailored financial models that reflect the unique complexities of your business.

Our approach goes beyond simple number-crunching; we design models that capture variable revenue streams, agile cost structures, and the specific challenges and opportunities inherent in tech startups.

Finro’s process is comprehensive and dynamic, ensuring every aspect of your financial strategy is carefully analyzed and accurately represented. Our models not only forecast growth but also spotlight potential risks and opportunities for optimization.

This dual focus on internal efficiency and external credibility means you can confidently present your financial strategy to investors, secure funding, and make informed strategic decisions.

Ultimately, partnering with Finro means aligning with a team committed to translating your vision into a tangible, strategic asset.

Our specialized expertise ensures that your financial model is not only accurate and comprehensive but also tailored to highlight your startup’s unique value in a competitive market.

Conclusion

A Startup Financial Model is much more than a spreadsheet—it’s a strategic framework that guides growth, attracts investors, and helps navigate uncertainty. By outlining realistic assumptions, focusing on unit economics, and leveraging modern tools, startups can build a financial roadmap that supports both day-to-day operations and long-term goals.

Avoiding common pitfalls like over-optimistic projections or neglecting regular updates is crucial for staying on track in a rapidly evolving market.

Yet the real power of a financial model lies in its ability to align teams, validate assumptions, and foster agility. This is especially true in the tech sector, where rapid innovation and shifting market demands require a level of expertise that goes beyond generic number-crunching.

A specialized partner like Finro brings deep tech industry insight, a tailored process, and investor-focused strategies—all of which help transform a financial model from a simple planning tool into a strategic asset.

Whether you’re a budding startup looking for early-stage guidance or a more established tech company preparing for the next funding round, the choice of who helps craft your financial model can have a profound impact.

By working with a firm that understands the nuances of your industry, you’ll ensure that your forecasts, risk analyses, and strategic plans are not only accurate but also compelling to investors and stakeholders. Ultimately, a robust, well-informed financial model is the cornerstone of sustainable growth, enabling your startup to make confident decisions and chart a course toward lasting success.

Key Takeaways

A comprehensive financial model guides growth and attracts investors by effectively providing actionable insights, realistic forecasts, and data-driven strategic planning.

Realistic, data-backed assumptions ensure accuracy, prevent overestimation, and build a solid foundation for reliable financial projections and effective strategic decision-making.

An agile financial model facilitates quick pivots, adapts to market changes, and incorporates feedback for ongoing operational and strategic improvements.

Regular updates and scenario analyses mitigate risks, keep projections current, and empower startups to navigate uncertainties with informed, agile decision-making.

Specialized financial expertise enhances credibility, aligns models with investor expectations, and delivers tailored insights that unlock a startup’s growth potential.

Answers to The Most Asked Questions

-

A startup financial model is a structured, dynamic tool that forecasts revenue, evaluates cash flow, and projects growth based on market data and realistic assumptions.

-

It is crucial because it guides strategic decision-making, helps secure investment by demonstrating financial viability, and provides a clear roadmap for sustainable growth.

-

Build your model using data-backed assumptions, market research, and industry benchmarks, then update it regularly to reflect actual performance and emerging market trends.

-

Avoid over-optimistic revenue projections, ignoring market validation, and treating the model as a static document; these mistakes can lead to misaligned strategies and cash flow issues.

-

A specialized partner brings deep tech expertise, tailored processes, and investor insights, reducing risks and ensuring your model accurately reflects your startup’s unique dynamics.

-

Finro’s expertise delivers comprehensive, dynamic models that integrate real-time data, mitigate risks, and align with investor expectations, ultimately positioning your startup for sustainable growth.