Startup Funding Stages: Breaking Down The Funding Journey From Idea to Exit

By Lior Ronen | Founder, Finro Financial Consulting

As any seasoned entrepreneur will tell you, transforming a brilliant idea into a successful business is no small feat.

It requires vision, hard work, and the fuel that powers the journey: funding.

Navigating the maze of startup funding can be daunting. From the early whispers of an idea craving its first cash infusion to the grand finale of an exit, each stage of funding is a critical step on the path to growth and success.

But fear not! You don't need to be a finance wizard to understand the essentials of this journey.

In this article, we're breaking down the startup funding stages in simple, straightforward language. Whether you're a budding entrepreneur dreaming of your own startup or a curious mind eager to understand how businesses grow, we've got you covered.

From pre-seed to exit, we'll explore the what, why, and how of each funding stage, shedding light on the pathway that turns ideas into thriving businesses.

So, grab your metaphorical backpack, and let's break down the journey from idea to exit together!

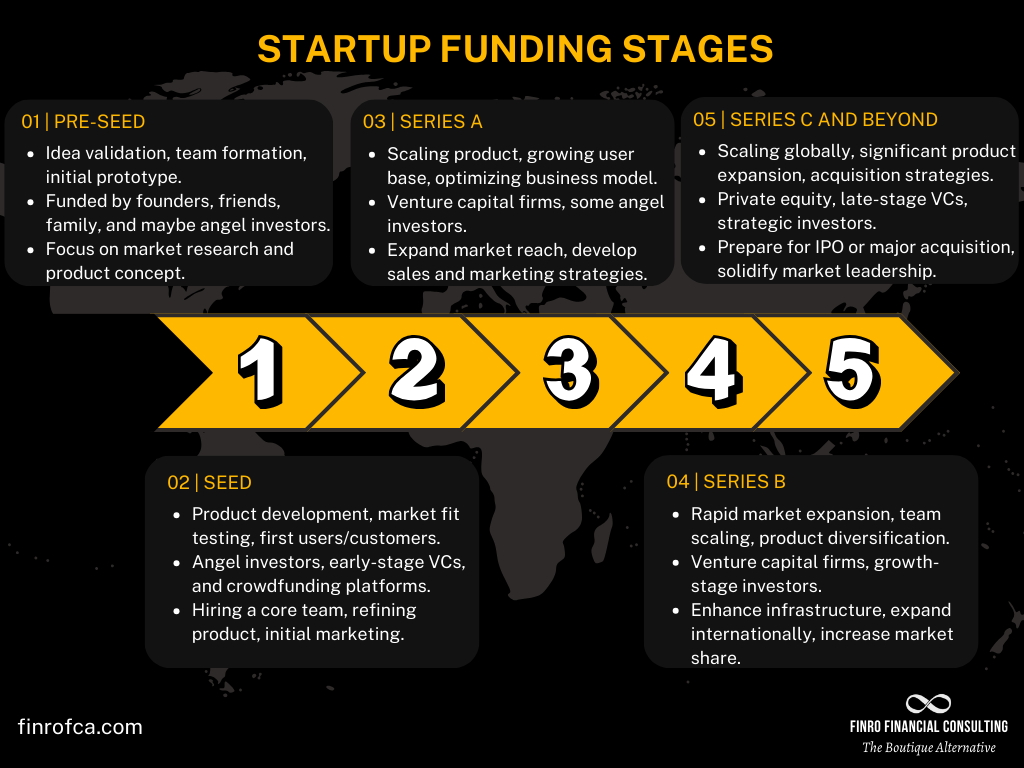

Navigating the startup funding journey from pre-seed to exit is a pivotal process for entrepreneurs, where initial ideas are transformed into thriving businesses through strategic financial support. Beginning with the grassroots validation and initial funding in the pre-seed and seed stages, startups progressively scale up through Series A, B, and C rounds, each phase attracting a more diverse array of investors and demanding more sophisticated business strategies.

This journey culminates in the preparation for an exit, a phase that not only offers a return on investment but also sets the stage for future innovation. Throughout this evolutionary path, startups must adapt, refine their offerings, and strategically position themselves to capture the interest of investors and market opportunities, ultimately turning bold visions into tangible success.

- The Journey Begins: Understanding Startup Funding

- Pre-Seed Funding: Planting the First Financial Seeds

- Seed Financing: Nurturing Startup Growth

- Series A Funding: Accelerating Growth

- Series B Funding: Scaling New Heights

- Series C Funding: The Growth Catalyst

- Preparing for an Exit: The Culmination of a Startup's Journey

- Conclusion

The Journey Begins: Understanding Startup Funding

So, what's the deal with startup funding, and why does it sound like every entrepreneur's first big quest?

Well, in the simplest terms, startup funding is the fuel that gets the business engine running. It's the cash that startups need to turn their ideas into reality, covering everything from the lightbulb moment in someone's garage to the day-to-day expenses of running a growing company.

But why is it so crucial? Imagine trying to build a house without buying materials or hiring skilled workers.

No matter how amazing the blueprint is, without resources, it's just a dream. The same goes for startups.

Funding allows entrepreneurs to hire talent, develop products, market their brand, and, crucially, keep the lights on while they're at it. It's not just about survival; it's about having the means to sprint ahead in the race.

The journey of securing funding is a tale as old as time in the business world, but each startup's path is unique.

It begins with an initial idea that's so compelling it attracts initial backers—friends, family, or angel investors willing to bet on the dream.

From there, it evolves through various stages, each with its own challenges and milestones.

Ultimately, the goal for many is reaching an exit—a point where the founders can sell their company for a tidy sum or go public, offering shares to the public in a stock exchange.

This not only marks a significant payday for the founders and their early backers but also the transition of the startup into a mature, sustainable business.

Understanding this journey is like mapping out a treasure hunt.

Each stage of funding is a crucial landmark, guiding entrepreneurs through uncharted territories.

From pre-seed rounds that kickstart the adventure to the series funding that scales the business, and finally, to the exit that marks the treasure spot, each step is pivotal.

In essence, startup funding is more than just collecting cash; it's about strategically gathering the resources needed at each phase of growth. It's a testament to the belief in an idea and its potential to change the market, if not the world.

As we dive deeper into each stage, remember, it's this journey of transformation that turns simple ideas into enterprises that thrive and endure.

Pre-Seed Funding: Planting the First Financial Seeds

The pre-seed funding stage is where every startup's financial journey begins, characterized by:

Idea validation, team formation, initial prototype. At this stage, entrepreneurs work on proving that their idea has potential. They might build a prototype or develop a business plan to showcase the feasibility of their concept.

Funded by founders, friends, family, angel investors, and sometimes accelerators. The initial capital often comes from personal savings, contributions from friends and family, angel investors, or accelerators, which are programs designed to jump-start early-stage startups by providing funding, mentorship, and resources in exchange for equity.

Focus on market research and product concept. The goal is to understand the target market's needs and how the proposed product or service meets those needs better than existing solutions.

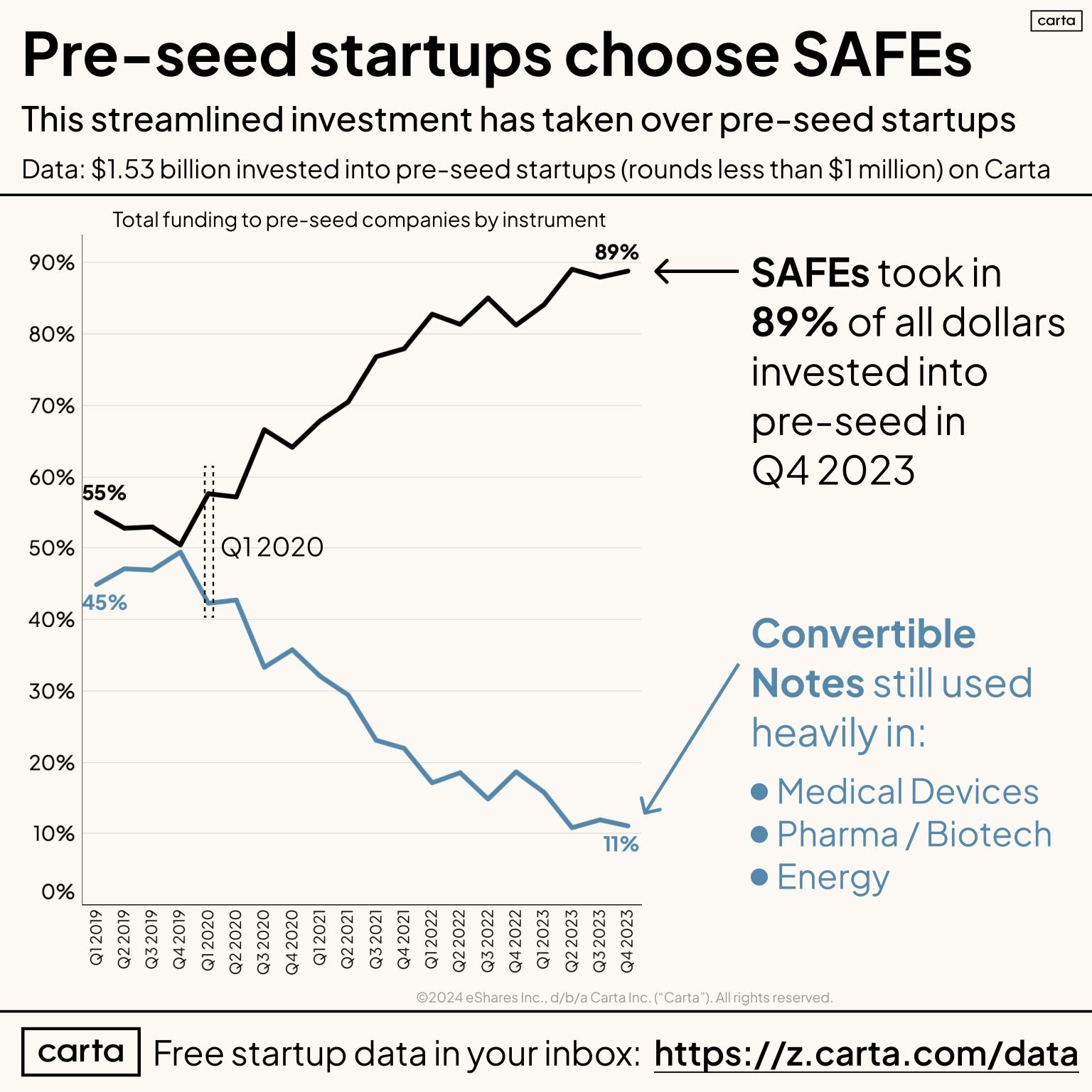

An interesting trend in pre-seed funding is the preference for using Simple Agreements for Future Equity (SAFEs) or convertible notes as financing instruments.

SAFEs are investment contracts that allow investors to convert their cash into a stake of equity at a future date, usually at a discount and following a triggering event like a funding round.

They were created to simplify early-stage investments, eliminating the need to determine a company's valuation immediately.

Convertible notes, on the other hand, are short-term debt that converts into equity, typically in conjunction with a future financing round.

Like SAFEs, they allow startups to raise capital without immediately setting a valuation but include interest and have a maturity date, unlike SAFEs.

In 2023, a staggering 89% of pre-seed rounds utilized SAFEs, underscoring their popularity among early-stage startups and investors.

This mechanism allows investors to convert their initial investment into equity at a later financing round, typically at a discounted rate.

Furthermore, the average amount of money raised through SAFEs in pre-seed rounds in 2023 was $660k.

This figure highlights the significant role that SAFEs play in getting startups off the ground, providing them with the essential capital to validate their business idea, build a team, and start developing their product.

The pre-seed stage, with its focus on the foundational aspects of a startup, is crucial for setting the stage for future success.

By leveraging instruments like SAFEs and convertible notes, startups can navigate this early phase with greater ease, laying a solid groundwork for their journey ahead.

Seed Financing: Nurturing Startup Growth

At the seed financing stage, startups are like saplings that have just been planted — they're beginning to establish their roots and need care to grow.

This stage is all about taking the startup from a concept to a company with a viable product and some initial traction.

The seed stage sees entrepreneurs refining their product, attracting their first customers, and laying down the groundwork for their business operations.

Funding at this juncture typically goes towards further product development, market research, and building a team capable of bringing the business plan to life.

A recent analysis of funding patterns reveals a fascinating ebb and flow in this critical stage of startup development. The seed funding landscape has been a reflection of the broader economic shifts witnessed over the past few years.

In the heat of the COVID-19 pandemic, there was a surge in venture capital investments, driving average funds raised to notable heights in 2021.

This boom was a response to the increased reliance on digital solutions and innovation during the pandemic. However, as the world began to emerge from the throes of the pandemic and return to a semblance of normalcy, a correction occurred in the market.

Despite this adjustment phase, the seed funding environment has shown signs of robust health, with Q3 2023 marking a record peak in both average funds raised and median valuations.

This trend signals a resilient and possibly expanding seed funding market, underpinned by investor confidence and a strong pipeline of promising startups poised for growth.

Entrepreneurs looking to secure seed funding can take this as a positive sign, indicating that while the market may have its fluctuations, the overall appetite for investing in early-stage companies remains strong.

Investors during the seed stage vary from angel investors, who are often individuals looking to support early-stage companies, to early-stage venture capitalists who bring not only capital but also mentorship and strategic guidance.

Funding mechanisms may include equity, convertible notes, and as we've seen recently, a significant preference for SAFEs — an instrument designed to make early investments straightforward and founder-friendly.

Navigating seed funding successfully sets a startup on a path to not just validate its business model but to solidify its standing in the market, preparing it for the next phase of growth.

| Aspect | Pre-Seed Funding | Seed Funding |

|---|---|---|

| Purpose | Validate idea, form team, develop prototype. | Further develop product, market fit, gain customers. |

| Investors | Founders, friends, family, angels, accelerators. | Angels, early-stage VCs, crowdfunding. |

| Capital Use | Market research, product concept, team formation. | Product development, initial marketing, hiring. |

| Funding Type | Often SAFEs or convertible notes. | Equity, convertible notes, SAFEs. |

| Average Amount | $660k raised through SAFEs (in 2023). | $2.9M raised in seed (in 2023) |

| Stage Goals | Set foundation, prepare for market entry. | Grow user base, refine business model, prepare for scaling. |

Series A Funding: Accelerating Growth

Series A funding is like a startup's first major checkpoint after proving its concept; it's where initial success is scaled into broader operations.

At this stage, a startup has validated its product in the marketplace and must now focus on taking its growth to the next level. It's about transitioning from just having a great idea to executing a plan that will make the product more widely adopted and the business more deeply rooted.

The type of investors interested in Series A are often venture capital firms, entities that bring more than just money to the table. They offer a wealth of knowledge, industry contacts, and the operational savvy to steer a growing company in the right direction.

With their involvement, the funding process becomes more rigorous, involving detailed scrutiny of the business’s viability and potential.

The injection of capital from Series A is primarily directed towards enhancing marketing strategies, hiring talent that can drive the business forward, and developing systems that can sustain larger operations.

It's a significant amount of money that goes into not just scaling the product, but also ensuring that the infrastructure of the company can support this growth.

Unlike earlier funding rounds that might have used instruments like convertible notes or SAFEs, Series A funding typically involves straight equity.

The stakes are higher, the amounts larger, and the negotiations more complex, with every detail from valuation to investor rights thoroughly hashed out.

The goals at this stage are clear-cut: refine the product to fit the market perfectly, establish a solid customer base, expand the reach, and bolster the team to manage and sustain growth.

It's a time of transformation, where startups set out to solidify their presence in the market and prove that their business can not only survive but thrive.

In essence, Series A is a testament to a startup’s resilience and potential.

It's a strategic push towards becoming a formidable player in the industry—a push that, when done right, can propel a startup from a promising newcomer to a dominant force.

Series A vs. Seed

In the journey of Series A funding, the climb from 2020 to 2023 has been steady and optimistic.

The average funds raised have consistently grown, and the median valuations have reached new heights, especially in Q3 2023.

This trend showcases a strong confidence in Series A-level startups, which are often considered to have more established market fits and scalable business models compared to their seed-stage counterparts.

Drawing a comparison with seed round trends, where the investment peak in 2021 was followed by a normalization, Series A funding has not witnessed such a dramatic fluctuation.

Instead, it has maintained a robust growth, suggesting that as startups transition from seed to Series A, they enter a funding landscape marked by heightened investor trust and a readiness to support their expansion plans.

The disparity between the seed and Series A stages could be reflective of the market's inclination to invest more heavily in businesses that have surpassed the initial validation phase and are now gearing up for scaling.

This difference between seed and Series A funding dynamics is a critical insight for entrepreneurs. It underscores the importance of the Series A stage as a signal to the market of a startup's readiness for growth and a testament to its resilience, as well as the potential for longevity in the business world.

| Aspect | Seed Funding | Series A Funding |

|---|---|---|

| Purpose | Prove concept, develop product, find product-market fit. | Scale operations, grow customer base, optimize product. |

| Investors | Angel investors, early-stage VCs, accelerators. | Venture capital firms, possibly some previous investors. |

| Capital Use | Product development, initial hires, market entry. | Expand marketing, strategic hires, scale infrastructure. |

| Funding Type | SAFEs, convertible notes, equity. | Primarily equity with more complex terms. |

| Average Amount | $2.9M in 2023 | $9.2M i 2023 |

| Median Valuation | $13.3M in 2023 | $44.3M in 2023 |

| Market Validation | Minimal to moderate; seeking proof of concept. | Demonstrated market fit and path to revenue. |

| Valuation Trends | More susceptible to market fluctuations. | Steadier growth, higher valuations. |

Series B Funding: Scaling New Heights

Series B funding represents a major milestone in the startup journey. By this stage, companies have moved beyond the development phase and are ready to take their operations to new heights.

The goal is no longer just to validate the market fit or refine the product but to scale those successes to a larger audience.

At this point, startups have a proven track record with a solid user base and consistent revenue inflow.

They've often ironed out any kinks in their business models and have a clear direction for future growth. Now, they're looking to scale up operations, which could mean ramping up production, expanding into new markets, or acquiring smaller businesses.

The investors at the Series B level are typically a mix of some who entered during the Series A round and new ones that come in due to the reduced risk and increased proof of concept.

These can include more traditional venture capital firms, late-stage investors, and sometimes, private equity funds. They're attracted by the startup's demonstrated potential for rapid growth and expansion.

Funding at this stage is about solidifying market presence and increasing market share. It often involves significant amounts to finance the aggressive growth strategies and may require strengthening the core team with experienced executives who can help manage the scale-up effectively.

With Series B funding, startups are expected to have detailed financial models and growth projections to justify the larger investments they're seeking.

It's not just about having a great product; it's about having a scalable business model and the right team to execute it.

As startups successfully navigate Series B, they're on their way to becoming well-established market players with the potential to dominate their industry or even branch out into new ones.

The successful close of Series B funding is a testament to a startup’s resilience, market adaptability, and the viability of its long-term vision.

Get your expert valuation now!

Series C Funding: The Growth Catalyst

When a startup reaches the Series C funding stage, it's already a success story. This phase is about accelerating growth and solidifying a position as a leader in the market.

Companies at this stage have a strong customer base, significant revenue, and a clear strategy for continued expansion.

The purpose of Series C is to prepare the company for a sustainable, long-term future. This could involve scaling the business even further, expanding into new markets, acquiring other companies, or developing additional products or services.

At this point, the company is likely eyeing a future initial public offering (IPO) or a lucrative acquisition.

Investors in Series C are typically larger financial institutions like hedge funds, investment banks, and private equity firms, as well as late-stage VCs.

These investors are looking for businesses that have proven they can not only survive but thrive and dominate their industry. Their investments are substantial because the risks are lower and the returns are potentially higher given the company's established track record.

Capital raised during Series C rounds is substantial, often used to scale the company rapidly. This can include international expansion, building out more robust sales and marketing teams, and investing in advanced technologies to stay ahead of the competition.

Unlike earlier rounds, the funding is less about survival and more about strategically positioning the company for the future.

It's an opportunity to push the boundaries of the company's potential and ensure it can reach its full market value, whether through public offerings or other exit strategies.

As startups close their Series C, they're not just looking at the next level of growth; they're preparing to become the new benchmark in their industry, setting the stage for a grand entrance into the public market or to become an attractive acquisition target for a major player.

| Aspect | Pre-Seed | Seed | Series A |

Series B |

Series C |

|---|---|---|---|---|---|

| Purpose | Idea validation, team assembly, prototype development. | Develop product, initial market entry, find product-market fit. | Scale business, grow customer base, optimize product. | Expand market reach, scale operations, increase market share. | Drive large-scale growth, prepare for IPO, acquire other businesses. |

| Investors | Founders, friends, family, angels, accelerators. | Angels, early-stage VCs, crowdfunding. | Venture capital firms, some angel investors. | Venture capital firms, growth-stage investors, private equity. | Hedge funds, investment banks, private equity, late-stage VCs. |

| Capital Use | Product concept, market research, team formation. | Product development, market research, early hires. | Marketing, hiring, infrastructure, expanding sales. | Scaling production, market expansion, operational growth. | International expansion, acquisitions, technology advancements. |

| Funding Type | SAFEs, convertible notes, grants. | SAFEs, convertible notes, equity. | Primarily equity with more complex terms. | Larger equity rounds, possible debt financing. | Large equity rounds, mezzanine financing, pre-IPO financing. |

| Average Amount | Typically less than $1M. | Often less than $2M. | Several million dollars, varies widely. | Tens of millions of dollars, can be higher. | $50M+, can go up to hundreds of millions depending on the company. |

| Stage Goals | Proof of concept, initial market interest. | Product launch, market fit, initial traction. | Business model refinement, market penetration. | Aggressive growth, market domination strategies. | Preparing for exit strategies, solidifying market leadership. |

Preparing for an Exit: The Culmination of a Startup's Journey

As startups progress through the stages of funding, from the initial pre-seed rounds to the expansive visions of Series C, the ultimate goal for many founders and investors alike begins to crystallize: preparing for an exit.

This stage is not merely about cashing in; it's a strategic move that marks the successful culmination of a startup's journey, offering a return on investment for those who believed in the company from its inception.

An exit strategy could take several forms, the most common being an acquisition by a larger company or going public through an Initial Public Offering (IPO).

Both avenues offer significant benefits and challenges and require meticulous preparation to ensure the best outcomes for the startup's stakeholders.

Acquisition: For many startups, being acquired by a larger, established company is an appealing exit strategy. It often provides immediate financial rewards for founders and investors and can offer the startup's technology or products a faster path to broader markets.

Preparing for an acquisition involves demonstrating consistent growth, a scalable business model, and potentially filling a strategic gap for the acquiring company.

It's about showcasing the startup as an invaluable asset that can enhance the acquirer's offerings or market position.

IPO: Opting for an IPO is a path taken by startups that have reached a significant scale and can demonstrate sustained profitability or a clear path to profit.

Going public is a complex and rigorous process, requiring transparency, adherence to regulatory standards, and the ability to attract public market investors.

Preparation involves detailed financial reporting, audits, and developing a strong narrative that highlights the company's growth potential to investors.

The rewards of an IPO can be immense, offering substantial financial backing and increased market visibility, but it also subjects the company to the scrutiny and volatility of the public markets.

Regardless of the chosen exit path, the preparation involves a shift in focus from internal growth to external perception.

Startups must not only continue to innovate and grow but also build strong relationships with potential acquirers or public market investors and understand the legal and financial intricacies of an exit.

The journey towards an exit is the final stretch in a startup's growth story, requiring vision, patience, and strategic planning. It's a testament to a startup's resilience, the value of its innovations, and the foresight of its leaders.

As such, preparing for an exit is as much about celebrating past achievements as it is about looking forward to new beginnings.

Conclusion

From the earliest flicker of an idea in the pre-seed stage to the strategic deliberations of preparing for an exit, the journey of startup funding is a testament to the entrepreneurial spirit.

It's a path paved with challenges, learning, and growth, each funding stage marking a significant milestone in the evolution of a startup.

We've navigated through the intricate landscape of startup financing, from the grassroots funding of the pre-seed and seed stages, through the growth accelerators of Series A and B, to the expansive visions supported by Series C funding.

Each stage is uniquely tailored to support startups at different growth phases, offering the financial resources, mentorship, and strategic guidance necessary to scale new heights.

The ultimate goal for many in this journey is the preparation for an exit, a stage that signifies not just the end, but the beginning of new opportunities.

Whether through acquisition or IPO, the exit is a celebration of what the startup has achieved and a gateway to further innovation and impact.

This evolutionary path is not just about securing funds; it's about building lasting value. It's a reminder that behind every successful startup is a story of relentless pursuit, strategic thinking, and the courage to dream big.

As we look to the future, let's continue to support and invest in these stories, for they are the engines of innovation that drive our world forward.

In closing, whether you're an aspiring entrepreneur embarking on this journey for the first time or an investor looking to support the next big idea, remember that the essence of startup funding is not just in the numbers, but in the potential to transform bold visions into reality.

Here's to the dreamers, the doers, and the believers — may your journey through the startup funding stages be as rewarding as the destinations you seek to reach.

Key Takeaways

Startup funding stages transform ideas into thriving businesses via strategic financial support.

From pre-seed to exit, each funding phase demands more sophisticated business strategies and attracts diverse investors.

The journey ends in preparation for an exit, offering returns on investment and setting the stage for future innovation.

Startups adapt and refine their offerings at each stage, strategically positioning themselves to attract investors and seize market opportunities.

Successfully navigating funding stages turns bold visions into tangible success, essential for a startup's growth and sustainability.

Answers to The Most Asked Questions

-

The stages of startup funding are pre-seed, seed, Series A, Series B, Series C, and preparing for an exit.

-

The funding lifecycle of a startup begins with idea validation and initial funding in the pre-seed and seed stages, progresses through scaling up in Series A, B, and C rounds, and culminates in preparing for an exit through acquisition or IPO.

-

The text does not explicitly list three ways to fund a startup, but it implies funding can come from friends, family, angel investors, venture capital firms, accelerators, and through financial instruments like Simple Agreements for Future Equity (SAFEs) or convertible notes.

-

The rounds of funding for a startup are the pre-seed, seed, Series A, Series B, and Series C rounds.

-

The seed funding stage is where startups refine their product, attract their first customers, and lay down the groundwork for business operations. It typically involves further product development, market research, and building a team capable of executing the business plan.

-

The life cycle of startup financing involves starting with foundational funding in the pre-seed stage, moving on to validate and grow the business idea in the seed stage, accelerating growth and scaling operations through Series A, B, and C rounds, and ultimately preparing for an exit strategy that offers a return on investment.

-

Pre-seed funding is the very initial stage where entrepreneurs work on proving their idea has potential by building a prototype or developing a business plan. Seed financing follows as the next step, focusing on further developing the product, gaining initial customers, and establishing a viable business operation. Both stages are crucial for setting the foundation of a startup and preparing it for future growth stages.