Startup Valuations: 2024 Trends, 2025 Takeaways

By Lior Ronen | Founder, Finro Financial Consulting

Startup valuations are everywhere—headlines, investor calls, and founder group chats. But what’s often missing is perspective. While it’s easy to get caught up in the sky-high figures everyone’s talking about, those numbers represent the exceptions, not the full story.

For most founders, understanding where your startup stands—whether it’s early stage or approaching a later round—matters far more than chasing headline valuations. 2024 brings its own trends: stronger medians, AI-driven outliers, and some much-needed market corrections.

This article unpacks the bigger picture. It’s a snapshot of where startup valuations really are in 2024, what’s influencing them, and how founders can use this data to make better decisions.

Startup valuations in 2024 reveal a dynamic landscape, with strong early-stage medians, high valuations driven by AI innovation, and corrections at later stages reflecting investor focus on profitability. Founders are encouraged to prioritize fundamentals, sustainable growth, and clear milestones over chasing outlier valuations, which often come with heightened risks. By aligning strategy with realistic benchmarks and fostering transparency with investors, startups can build resilient businesses that contribute to a balanced and thriving ecosystem in 2025.

The Full Picture: Startup Valuations Beyond the Headlines

Startup valuations often make for flashy headlines, but those eye-popping numbers you see are usually the outliers—companies that secure exceptional deals driven by hype, unique market positioning, or investor competition. While these figures dominate the news, they don’t reflect the broader landscape most founders are navigating.

To understand startup valuations, it’s essential to look at the full distribution—from the lower percentiles to the median and the highest ranges. This broader view shows how valuations vary across funding stages and industries.

It highlights two key things: the realistic benchmarks most startups can expect and how far the top performers can go.

For example:

Median valuations offer the clearest signal of market health. They represent the typical deal terms most companies at a given stage receive. In 2024, these figures are holding steady, even surpassing previous years in some cases.

Lower percentiles—like the 10th and 25th—reveal where down rounds and tougher deals are happening. This is more common at later stages as companies face investor scrutiny over profitability and slower growth.

Top-end valuations represent outliers, driven largely by sectors like AI, where innovation and investor enthusiasm remain at an all-time high.

By looking at the full span, founders gain a more grounded perspective on where their startup fits and what they can realistically aim for. Instead of chasing extremes, it becomes easier to benchmark progress and set goals aligned with both company performance and investor expectations.

Next, let’s explore the trends shaping these valuations in 2024—and why certain sectors, like AI and biotech, continue to lead the charge.

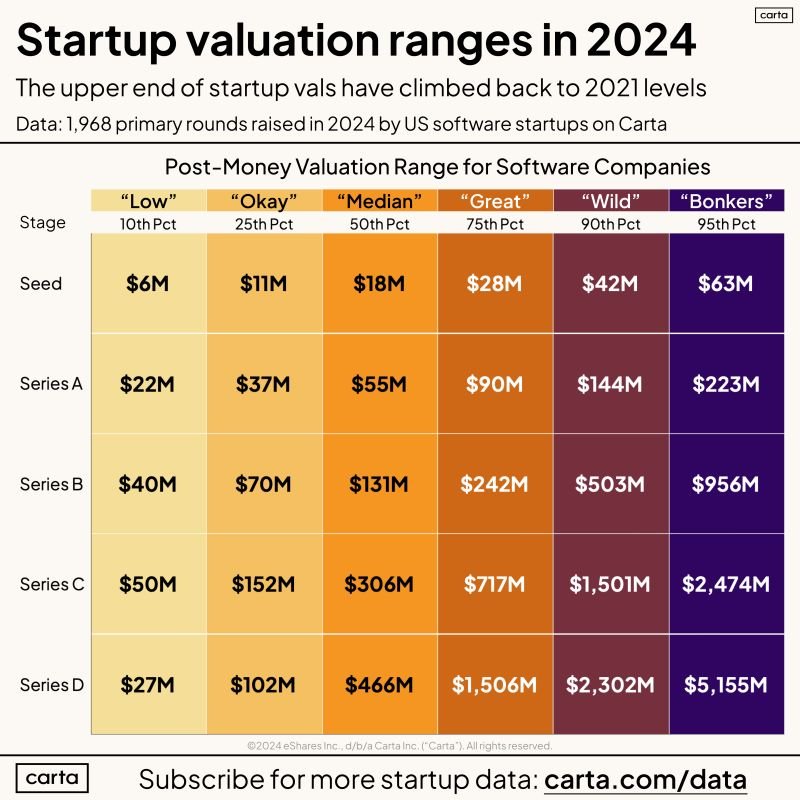

Here’s a clear snapshot of the current valuation landscape for US software startups in 2024. As you can see, valuations span a wide range across percentiles, stages, and trends—offering a more grounded perspective than what headlines often suggest.

Key Trends in 2024 Valuations

Now that we’ve explored the full spectrum of startup valuations let’s take a closer look at the trends shaping the landscape this year.

While the distribution shows a healthy balance across percentiles, a few standout patterns are driving valuations in 2024.

1. Resilient Early-Stage Valuations

Despite a slower deal flow compared to recent years, early-stage valuations (Seed and Series A) remain strong, rivaling their 2021 peaks.

Investors continue to back promising ideas and strong founding teams, even in a cautious market. This reflects optimism in startups’ potential to deliver long-term returns, particularly in sectors showing early signs of innovation.

2. The AI Effect on High-End Valuations

It’s no secret that AI startups are commanding premium valuations across the board. From generative AI tools to infrastructure and data intelligence, investor demand for AI-driven innovation is driving exceptional deal sizes. This trend continues to push valuations at the upper percentiles, with AI leading the charge at nearly every funding stage.

3. Down Rounds at Later Stages

Not all companies are riding the AI wave. At the Series D stage and beyond, down rounds are becoming more visible. As late-stage investors shift focus to profitability and sustainable growth, startups that overextended on prior rounds or fell short of growth targets are facing valuation resets. This correction is a natural outcome of heightened scrutiny and cautious capital deployment.

4. Unicorn Momentum Remains Strong

Even with market corrections, unicorns are still being minted at a steady clip. In the first three quarters of 2024 alone, 67 startups surpassed the $1 billion valuation mark.

While the pace may not match the frenzied highs of 2021, it signals ongoing investor confidence in companies with the right mix of traction, innovation, and market opportunity.

5. Sector-Specific Trends

Valuation trends also vary across industries:

Software and AI continue to dominate early-stage funding, reflecting their scalability and strong investor appetite.

Biotech and Hardware may lag initially but often see significant valuation jumps as they advance toward commercialization and prove their market viability.

These trends highlight both opportunities and challenges for founders. Early-stage startups benefit from strong investor interest, while later-stage companies face growing pressure to meet profitability expectations. Across all stages, AI’s influence is unmistakable.

Next, let’s discuss why comparing valuations can be more harmful than helpful—and how founders can focus on what really matters for their startup’s success.

Why Founders Should Avoid Comparing Valuations?

After reviewing the key trends and seeing how valuations vary across stages, sectors, and percentiles, it’s easy to fall into the trap of comparison.

Seeing high-end deals or hearing about outlier valuations can make any founder question their own progress. But here’s the reality: comparisons can be more harmful than helpful.

1. Valuations Are Context-Specific

A startup’s valuation isn’t just about revenue or growth—it’s shaped by multiple factors:

Sector: AI startups are commanding premium valuations, while hardware or biotech companies typically take longer to catch up.

Stage: Early-stage companies are valued on potential, while later-stage startups face increasing pressure to deliver profitability.

Market Timing: Valuations fluctuate based on investor sentiment, macroeconomic conditions, and competitive dynamics.

A Series A software company and a Series B hardware company operate in entirely different contexts. Comparing their valuations is like comparing apples to oranges.

2. Outlier Valuations Are Rare—and Risky

The outliers grabbing headlines often come with significant expectations. Startups with exceptionally high valuations face immense pressure to grow into those numbers. If growth stalls or market conditions change, these valuations can lead to down rounds, diluted ownership, and damaged investor confidence.

Rather than chasing a high number, founders should focus on achieving a valuation that aligns with their growth trajectory and long-term goals.

3. Progress Matters More Than Percentiles

Valuations are just one indicator of success, and they’re temporary. What truly matters is how well a startup delivers on its vision:

Are you hitting key milestones like customer acquisition, product development, or revenue growth?

Is your burn rate sustainable?

Are you building a strong foundation for future rounds?

Founders who focus on fundamentals will position their companies for steady, sustainable growth—regardless of where they fall on the percentile chart.

Understanding valuation trends helps you benchmark, but obsessing over comparisons can derail your focus. Your company’s success depends on its unique journey, not on matching someone else’s numbers.

Next, let’s look at the key takeaways for founders as we head into 2025—and how you can use these insights to guide your fundraising strategy.

Takeaways for Founders in 2025

With a clearer understanding of the valuation spectrum and the pitfalls of comparison, it’s time to focus on actionable insights for founders preparing for the year ahead.

Valuations are not just numbers—they are tools to align expectations, drive negotiations, and plan for the future. Here’s how you can use what we’ve covered to position your startup for success in 2025.

1. Leverage Valuation Trends to Set Realistic Expectations

The trends from 2024 provide a useful benchmark, but they are starting points, not guarantees. Whether you’re raising a seed round or preparing for a later stage, align your valuation goals with the realities of your sector, stage, and growth trajectory.

Early-Stage Founders: Highlight your potential, team strength, and market opportunity.

Later-Stage Founders: Be ready to demonstrate measurable progress, unit economics, and a clear path to profitability.

2. Focus on Fundamentals, Not Headlines

Investors are more selective than ever, and they’re looking for companies with substance.

Strong financials, product-market fit, and operational efficiency matter more than an inflated valuation. By focusing on these fundamentals, you can build trust and attract the right investors who share your vision.

3. Build a Sustainable Growth Story

Your valuation is a reflection of your growth story—how you’ve performed so far and how you plan to scale. In 2025, investors will continue favoring startups that:

Hit Milestones: From user acquisition to product launches, demonstrate consistent progress.

Maintain Efficiency: Show that your burn rate aligns with your runway and growth goals.

Navigate Challenges: Prove resilience in a competitive and evolving market.

4. Use Valuation as a Strategic Tool

A well-thought-out valuation isn’t just about funding—it’s about long-term strategy. By understanding your company’s valuation, you can make smarter decisions about ownership, funding needs, and exit strategies.

Avoid chasing a “vanity” number that might limit flexibility in future rounds.

Valuations are a snapshot, not the full story. They offer a momentary view of your company’s worth, but the real value lies in how you use that information to grow and adapt. Next, we’ll explore how these insights translate into practical steps for fundraising, planning, and scaling your startup effectively.

A Healthy Startup Ecosystem Is a Balanced One

he takeaways for 2025 highlight a crucial point: success doesn’t come from chasing headlines or inflated valuations—it comes from building a solid foundation, focusing on progress, and aligning strategy with reality.

This perspective doesn’t just benefit individual startups; it strengthens the entire ecosystem.

1. Balance Drives Sustainability

The startup ecosystem thrives when there’s a balance between ambition and sustainability. Early-stage funding fuels innovation, while later-stage rigor ensures that only the most resilient companies scale successfully.

By understanding valuation trends and resisting the pull of outliers, founders can contribute to a healthier market where long-term value creation takes priority.

2. Valuations Reflect a Collective Story

Every valuation, whether high or low, is a reflection of broader market conditions and investor sentiment. Resilient median figures signal that the ecosystem is stabilizing, even as corrections in later stages address past excesses.

Founders should take comfort in knowing that strong fundamentals will continue to attract the capital needed to grow, even in a more measured environment.

3. The Importance of Transparency

Clear communication between founders and investors is more important than ever. Sharing realistic expectations, achievable milestones, and a clear vision fosters trust and sets the stage for long-term partnerships. A balanced ecosystem relies on transparency at every stage—from seed to IPO.

The ecosystem’s health depends on startups that focus on progress, sustainability, and a collaborative approach to growth.

Conclusion

Startup valuations tell a dynamic story, shaped by trends, sector-specific nuances, and the balance between ambition and sustainability.

In 2024, we’ve seen strong early-stage performance, the rising dominance of AI, and necessary corrections at later stages. As we move into 2025, founders have the opportunity to take these lessons and use them as a guide for navigating the next chapter.

The key takeaway? Your valuation is a tool, not the goal. Building a resilient, growth-focused business is what truly defines success—both for your startup and for the ecosystem as a whole. Stay focused on milestones, align your strategy with your stage, and embrace realistic benchmarks.

2025 is set to bring new challenges and opportunities. By prioritizing sustainability and collaboration, founders can position their startups for long-term growth and contribute to a healthier, more balanced market. Here’s to your success in the year ahead!

Key Takeaways

Valuations Reflect Context: Sector, stage, and market timing heavily influence startup valuations—comparisons can be misleading.

AI Leads High Valuations: AI startups dominate upper-percentile valuations, driving significant investor interest in 2024.

Early-Stage Stability: Strong median valuations highlight investor optimism in seed and Series A funding despite slower deal flow.

Focus on Fundamentals: Sustainable growth, milestones, and operational efficiency matter more than headline-grabbing numbers.

Balanced Growth Wins: Avoid chasing vanity metrics; align valuation goals with long-term strategy and sector-specific benchmarks.