Fintech KPIs: The Metrics That Define Success in Financial Technology

By Lior Ronen | Founder, Finro Financial Consulting

Key Performance Indicators (KPIs) are more than just data points—they’re the foundation of a fintech company’s success.

Whether you’re managing a digital bank, a lending platform, or a payment gateway, understanding what to measure and leveraging those insights effectively can shape the future of your business.

Operating at the intersection of finance and technology, fintech businesses navigate a landscape where trust, speed, and efficiency drive outcomes.

KPIs provide a roadmap for tracking performance, addressing challenges, and seizing opportunities. They answer essential questions: Are customers staying engaged? Is your user acquisition strategy sustainable? Are operations optimized for growth?

Selecting the right KPIs is critical for staying competitive, building trust, and scaling effectively.

Let’s start by exploring what makes fintech unique and why this industry demands tailored performance metrics.

KPIs are essential tools for fintech companies to measure performance, make data-driven decisions, and adapt to evolving industry trends. By aligning metrics with business goals, fintechs can enhance operational efficiency, improve customer retention, secure investor confidence, and proactively manage risks. As emerging technologies like AI, blockchain, and ESG considerations shape the industry, adopting and refining relevant KPIs ensures fintech businesses remain competitive, innovative, and well-positioned for growth.

- What Is Fintech?

- What Are KPIs?

- Key Fintech KPIs: Metrics That Matter

- Financial Performance Metrics

- Customer Behavior and Engagement Metrics

- Operational and Risk Metrics

- Operational and Risk Metrics

- How to Select and Monitor KPIs for Your Fintech Business?

- Real-World Applications of Fintech KPIs

- Benefits of Using KPIs in Fintech

- Future of Fintech KPIs: Adapting to Industry Trends

- Conclusion

- Key Takeaways

- Answers to The Most Asked Questions

What Is Fintech?

Fintech, short for financial technology, refers to the use of innovative technology to improve, automate, or redefine financial services. It bridges the gap between traditional financial systems and modern technological advancements, making financial services more accessible, efficient, and user-friendly.

This industry covers a wide range of sectors, each addressing specific needs within the financial ecosystem. Key areas include:

Digital Banking: Offering customers seamless online and mobile banking experiences.

Lending Platforms: Enabling peer-to-peer lending, microloans, and alternative credit solutions.

Payment Solutions: Streamlining transactions through digital wallets, payment gateways, and contactless payments.

Insurtech: Innovating insurance processes, from claims management to policy underwriting.

Wealth Management: Providing tools for investment planning, robo-advisors, and personalized financial guidance.

The unique blend of finance and technology means fintech businesses face challenges unlike those in traditional finance or tech sectors.

Unlike traditional banks, fintech companies must rapidly adapt to changing customer expectations, integrate cutting-edge technologies, and navigate stringent regulatory landscapes.

This complexity requires performance metrics that go beyond generic indicators, capturing the nuances of both financial stability and technological innovation.

To truly measure success in fintech, businesses need specialized KPIs that address the dual demands of trust and scalability. With this understanding of fintech’s unique nature, let’s explore the concept of KPIs and why they are indispensable for tracking and achieving business goals.

What Are KPIs?

Now that we’ve explored the unique nature of fintech and its key areas, let’s shift focus to Key Performance Indicators (KPIs)—the tools that help fintech businesses navigate this complex landscape.

KPIs are measurable values that indicate how effectively a company is achieving its goals. In simple terms, they’re the benchmarks that show whether your business is on track, whether it’s improving, or where it might need adjustments. From tracking customer acquisition costs to analyzing transaction success rates, KPIs turn raw data into actionable insights.

For any business, KPIs serve three main purposes:

Measuring Performance: They quantify success against defined objectives, such as revenue growth or customer satisfaction.

Identifying Trends: KPIs help spot patterns and shifts in customer behavior, market conditions, or operational efficiency.

Driving Decisions: They provide a solid foundation for making strategic, data-driven decisions rather than relying on intuition.

While generic KPIs like Customer Acquisition Cost (CAC), Lifetime Value (LTV), and Churn Rate are essential for understanding overall business health, fintech companies face challenges that require additional, industry-specific metrics.

These include fraud detection rates, loan default percentages, and digital adoption rates—KPIs that reflect the blend of financial rigor and technological innovation.

Understanding what to measure and why is key to building a KPI framework that works for your fintech business. Next, we’ll dive into the specific KPIs that define success in this fast-evolving sector.

Key Fintech KPIs: Metrics That Matter

Having laid the foundation with a clear understanding of fintech and the role of KPIs, let’s now examine the specific metrics that drive performance in this industry.

Fintech companies require a mix of financial, customer-focused, operational, and general business KPIs to effectively measure and manage success.

Below, these KPIs are organized into categories, with definitions, formulas, and their relevance to fintech sub-niches.

Financial Performance Metrics

For fintech businesses, financial health is a top priority. These metrics track profitability, liquidity, and operational efficiency, helping businesses ensure sustainable growth and stability.

Net Interest Margin (NIM) measures how efficiently a fintech company generates profit from its core financial activities. It calculates the difference between the interest income earned and the interest paid, relative to the company’s earning assets. This metric is particularly relevant for businesses involved in lending and investment, such as digital banks and peer-to-peer lending platforms, as it reflects their profitability from financial operations.

Loan-to-Deposit Ratio (LDR) evaluates the relationship between a fintech company’s loans and deposits, providing insights into its lending activity and liquidity. A high LDR can indicate aggressive lending strategies but also higher liquidity risks, while a low LDR may suggest underutilization of deposits. This KPI is critical for digital banks and other lending platforms to maintain a healthy balance between loans and deposits.

Cost-to-Income Ratio assesses operational efficiency by comparing operating expenses to net revenue. This metric is crucial for understanding how well a company manages its expenses relative to its income. A lower ratio indicates better cost management and operational efficiency, making it a key metric for insurtech firms, neobanks, and wealth management platforms.

Customer Behavior and Engagement Metrics

Customer satisfaction and retention drive long-term success. These metrics focus on understanding customer behavior, loyalty, and engagement with your fintech services.

Net Promoter Score (NPS) gauges customer satisfaction and loyalty by measuring how likely customers are to recommend the service to others. It provides a clear indicator of customer retention and overall satisfaction. High NPS scores suggest a strong customer experience, which is vital for all fintech businesses, from digital wallets to wealth management platforms.

Digital Adoption Rate tracks the percentage of customers using digital platforms for transactions and interactions. This KPI highlights the success of digital transformation efforts and the level of customer engagement. For digital banks, payment gateways, and SaaS fintech businesses, a high digital adoption rate reflects effective customer onboarding and product accessibility.

Average Transaction Value (ATV) calculates the average value of transactions processed over a specific period, offering insights into customer purchasing behavior and transaction trends. It is derived by dividing the Gross Transaction Value (GTV)—the total value of all transactions processed—by the number of transactions.

While ATV focuses on the average size of each transaction, GTV provides a broader picture of overall transaction volume. Together, these metrics help fintech companies refine pricing strategies, evaluate user activity, and identify growth opportunities. ATV and GTV are particularly valuable for payment gateways, investment platforms, and e-commerce-focused fintechs seeking to optimize their offerings and scale effectively.

Operational and Risk Metrics

Managing risk and ensuring operational reliability are critical for fintech companies. These metrics measure the security, efficiency, and performance of your platform, building trust with users.

Payment Success Rate measures the percentage of successfully processed transactions, reflecting the reliability of a company’s payment systems. A high success rate indicates robust systems and seamless user experiences, which are essential for payment processors, digital wallets, and online banking services.

Fraud Rate monitors the percentage of fraudulent activities within transactions. This metric is crucial for evaluating the security of a platform and maintaining customer trust. Fintech companies like payment gateways, lending platforms, and digital wallets rely on low fraud rates to enhance user confidence and ensure compliance with regulations.

Loan Default Rate calculates the percentage of loans where borrowers fail to make payments. This KPI is essential for assessing credit risk and profitability within lending portfolios. Peer-to-peer lenders, digital banks, and microloan providers use this metric to manage risk and optimize lending strategies.

Chargebacks indicate the frequency of transactions disputed and reversed, often due to fraud or customer dissatisfaction. This metric highlights potential weaknesses in transaction security or service quality. High chargeback rates can lead to penalties and increased costs, making this KPI critical for e-commerce payment platforms, digital wallets, and online banking services.

General Business KPIs for Fintech

While fintech-specific metrics are essential, general KPIs like CAC and LTV provide a broader view of business health, highlighting areas such as customer acquisition, retention, and revenue generation.

Customer Acquisition Cost (CAC) tracks how much a company spends to acquire a new customer. It is calculated by dividing total sales and marketing expenses by the number of customers acquired during a given period. CAC is particularly important for B2C fintech companies like digital banks and investment apps, which heavily invest in marketing and user acquisition.

Lifetime Value (LTV) estimates the total revenue a customer generates over their relationship with the business. This metric is a cornerstone of profitability analysis, especially when paired with CAC. For subscription-based fintech models like neobanks and wealth management platforms, LTV provides crucial insights into customer ROI and long-term revenue potential.

Churn Rate measures the percentage of customers who stop using a service within a specific time frame. It is a critical metric for identifying retention challenges and product-market fit issues. Payment gateways, lending platforms, and SaaS fintech companies use churn rate to refine strategies and improve customer satisfaction.

Revenue Per User (RPU) calculates the average revenue generated from each customer during a given period. This metric is particularly relevant for companies with freemium models or tiered pricing structures. Tracking RPU helps fintech businesses understand customer value and refine their pricing strategies to maximize revenue.

Fintech companies must choose KPIs that align with their unique goals, operations, and customer needs. Now that we’ve outlined these essential metrics, let’s explore how to select and monitor the right KPIs for your fintech business.

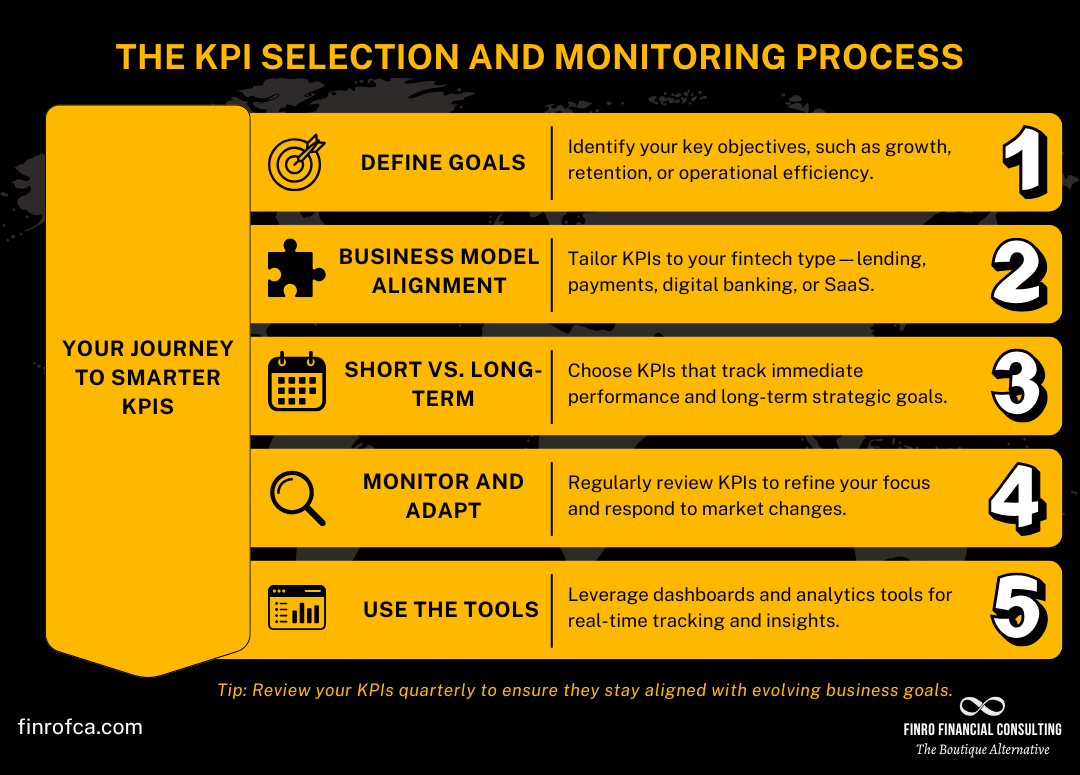

How to Select and Monitor KPIs for Your Fintech Business?

Identifying and tracking the right KPIs is essential for fintech companies looking to grow strategically and adapt to industry challenges. While the previous sections outlined the key metrics that matter, this section focuses on creating a clear, actionable process for choosing and managing KPIs that align with your business model and goals.

1. Start with a Strategy, Not Numbers

KPIs aren’t just numbers on a dashboard—they’re tools for executing your strategy. Begin by defining your core objectives. Are you focused on acquiring customers, reducing churn, optimizing operational costs, or scaling revenue?

Each goal should guide your KPI selection, ensuring your metrics reflect what success truly looks like for your fintech business.

For instance, if your goal is customer retention, metrics like Net Promoter Score (NPS) and Churn Rate should take priority. On the other hand, if profitability is your focus, you might zero in on Cost-to-Income Ratio or Net Interest Margin (NIM). Always let your strategy dictate your metrics, not the other way around.

2. Match KPIs to Your Business Model

Every fintech sub-niche has its own operational nuances.

A lending platform might need to monitor Loan Default Rate and Customer Acquisition Cost (CAC) to balance growth with risk, while payment gateways should focus on Payment Success Rate and Fraud Rate to ensure reliability and security.

Understanding the unique drivers of your business model ensures your KPIs are both relevant and actionable.

Collaborate with team leaders across departments to identify which metrics directly impact their performance. This alignment not only sharpens your focus but also ensures teams are invested in achieving KPI targets.

3. Think Short-Term and Long-Term

KPIs should serve as both a microscope and a telescope. Short-term KPIs, like CAC or Payment Success Rate, measure immediate operational performance, while long-term KPIs, such as Lifetime Value (LTV) or Digital Adoption Rate, provide a broader view of sustained growth and strategic impact.

For example, monitoring CAC can reveal the efficiency of your marketing efforts this quarter, but pairing it with LTV helps determine whether those efforts are building profitable, long-term customer relationships. Balancing these perspectives ensures your KPIs drive both immediate improvements and lasting success.

4. Monitor, Refine, Repeat

The fintech landscape evolves quickly, and your KPIs should evolve with it. Regular reviews—monthly, quarterly, or semi-annually—are crucial to ensure your metrics remain aligned with your business priorities. Analyze your KPIs consistently to identify trends, uncover inefficiencies, and spot opportunities.

For example, a sudden increase in Fraud Rate might indicate the need for enhanced security measures, while a plateau in Digital Adoption Rate could signal a gap in customer onboarding. Monitoring these shifts enables proactive decision-making.

5. Leverage the Right Tools

Tracking KPIs manually isn’t just inefficient—it’s risky. Investing in tools that consolidate data and provide real-time insights ensures your team has the information they need to make informed decisions. Popular options include:

Google Data Studio for accessible, customizable dashboards.

Tableau for detailed analytics and visualization.

Looker for advanced data exploration and integration.

Klipfolio for affordable, user-friendly dashboards for smaller teams.

Custom Solutions tailored to your fintech’s unique needs.

The right tools turn your KPIs from static numbers into dynamic insights that empower decision-making across your organization.

Making KPIs Work for Your Fintech Business

KPIs should not overwhelm but clarify. By anchoring them to your strategy, aligning them with your business model, and continuously refining them, you can create a data-driven framework that keeps your fintech competitive and agile.

Next, let’s look at real-world examples of how successful fintech companies have leveraged KPIs to drive growth and innovation.

Real-World Applications of Fintech KPIs

With a clear understanding of how to select and monitor KPIs, it’s time to see these metrics in action.

Fintech companies around the globe have successfully leveraged KPIs to drive growth, enhance efficiency, and secure funding.

However, there are also cautionary tales of businesses that faced setbacks due to neglecting or misusing KPIs.

Success Stories: Driving Growth Through KPIs

Fintech companies that integrate KPIs into their strategic decision-making often outperform their competitors. For instance, digital banks and neobanks frequently monitor Customer Acquisition Cost (CAC) to balance aggressive user acquisition strategies with sustainable financial models. The infographic below highlights the average CAC reported by leading digital banks and neobanks worldwide.

The visualization demonstrates how digital banks in Europe, Asia, Africa, and Latin America vary significantly in their CAC. Neobanks in regions like Latin America (e.g., NuBank with $7 CAC) have effectively leveraged localized strategies and digital adoption rates to keep costs low while acquiring millions of customers.

Conversely, European players such as Starling Bank ($45 CAC) rely on premium services and high customer lifetime value (LTV) to justify higher acquisition costs. These figures show that understanding and managing CAC is crucial for fintech scalability.

Other fintechs use KPIs like Net Interest Margin (NIM) or Payment Success Rate to track profitability or optimize transaction processes. For example, a Southeast Asian lending platform reduced its Loan Default Rate by 15% over two years by introducing AI-driven credit scoring—a KPI-driven innovation that attracted significant investor attention.

Common Pitfalls: When KPIs Are Ignored or Misused

While KPIs are powerful, misusing or neglecting them can lead to costly mistakes. For instance:

Ignoring CAC-LTV Ratios: Some fintech startups overemphasize customer acquisition without tracking LTV. This creates unsustainable growth where marketing costs far exceed customer lifetime revenue, leading to cash flow issues.

Focusing on Vanity Metrics: Metrics like app downloads or social media followers may look good on paper but often fail to translate into revenue or customer engagement.

Delayed KPI Adjustments: Rapid market changes can render old KPIs irrelevant. For example, during a sudden spike in fraud rates, failing to update risk-related KPIs can result in reputational damage and financial loss.

By consistently monitoring and adapting KPIs, fintechs can avoid these common pitfalls and stay agile in a competitive market.

KPIs provide a lens into the health and direction of fintech businesses, offering actionable insights to improve operations, secure funding, and scale efficiently. In the next section, we’ll discuss the future of fintech KPIs and how emerging trends will shape performance measurement in this dynamic industry.

Benefits of Using KPIs in Fintech

After exploring how KPIs are applied in real-world scenarios, it’s clear that their importance extends far beyond numbers on a dashboard.

When effectively implemented, KPIs serve as powerful tools that drive smarter decision-making, improve operational efficiency, and position fintech companies for long-term success.

Let’s explore the key benefits that fintech businesses can achieve by leveraging KPIs effectively.

1. Enhanced Decision-Making and Strategic Planning: KPIs provide actionable insights that enable fintech companies to make informed decisions at every level. By tracking metrics like Customer Acquisition Cost (CAC) and Lifetime Value (LTV), businesses can evaluate the efficiency of their marketing efforts, optimize budgets, and refine growth strategies.

Similarly, operational KPIs such as Payment Success Rate help fintechs identify and address bottlenecks in their systems, improving overall performance. With data-driven decisions, fintech companies can stay agile and aligned with their strategic objectives.

2. Improved Investor Confidence and Fundraising Outcomes: For fintech companies seeking funding, KPIs are indispensable in demonstrating growth potential and operational efficiency. Investors value clear, measurable metrics like Net Interest Margin (NIM) or Loan Default Rate, as they provide transparency into the company’s financial health and scalability.

Startups that present well-defined KPIs not only build credibility but also strengthen their ability to secure funding. By aligning their metrics with investor priorities, fintechs can effectively showcase their value proposition.

3. Better Customer Experiences and Increased Retention: Customer-centric KPIs such as Net Promoter Score (NPS) and Churn Rate help fintech companies understand user satisfaction and loyalty. These metrics highlight areas where customers are thriving and where improvements are needed, enabling businesses to deliver more personalized and engaging experiences.

For example, tracking Digital Adoption Rate can help fintechs measure how effectively they onboard customers to digital platforms, ensuring smoother transitions and higher retention rates. Happy customers are more likely to stay, refer others, and drive organic growth.

4. Proactive Risk Management and Regulatory Compliance: In an industry where trust and security are paramount, KPIs play a critical role in managing risk and ensuring compliance. Metrics like Fraud Rate and Chargebacks allow fintech companies to detect vulnerabilities and mitigate risks before they escalate.

Additionally, regulatory KPIs ensure that companies adhere to industry standards, avoiding legal penalties and maintaining customer confidence. A proactive approach to risk management not only protects the business but also strengthens its reputation in a competitive market.

By embracing KPIs as part of their operational framework, fintech companies can unlock these benefits, driving growth and maintaining a competitive edge. As we move forward, let’s explore how the future of fintech KPIs will evolve, including emerging trends and technologies shaping performance measurement in this fast-paced industry.

Future of Fintech KPIs: Adapting to Industry Trends

Having explored the transformative benefits of KPIs in fintech, it’s essential to look ahead.

The fintech industry is constantly evolving, shaped by new technologies, shifting customer expectations, and global challenges. These changes are redefining how KPIs are selected, tracked, and interpreted.

By staying ahead of these trends, fintech companies can ensure their metrics remain relevant and impactful.

1. Emerging Trends Shaping KPI Selection

The rapid adoption of technologies like artificial intelligence (AI), blockchain, and embedded finance is creating new opportunities and challenges for fintech businesses. These innovations require KPIs that can capture the nuances of emerging capabilities:

AI Integration: As fintechs adopt AI for fraud detection, credit scoring, and personalization, KPIs like model accuracy, false positive rates, and processing time will become critical for evaluating AI effectiveness.

Blockchain Adoption: Decentralized finance (DeFi) platforms and blockchain-powered payment solutions will need KPIs such as transaction confirmation time, energy consumption, and smart contract error rates.

Embedded Finance: As businesses integrate financial services directly into non-financial platforms, KPIs like partner activation rates, API success rates, and revenue per partner will take center stage.

2. Predictive Analytics: The Future of KPI Tracking

The integration of predictive analytics is transforming how fintech companies track and use KPIs. Instead of simply analyzing historical data, predictive models use machine learning to forecast trends and identify risks before they occur. This shift allows fintechs to move from reactive to proactive decision-making.

For example:

Churn Prediction: Instead of just tracking churn rate, predictive analytics can identify at-risk customers early, enabling retention efforts.

Fraud Prevention: Predictive models can flag suspicious transactions in real-time, reducing fraud rates and enhancing customer trust.

Revenue Forecasting: AI-powered projections based on user behavior and market trends help refine financial planning and strategy.

The use of predictive analytics enhances KPI relevance and helps fintechs stay agile in a competitive landscape.

3. The Growing Importance of ESG Metrics in Fintech

Environmental, Social, and Governance (ESG) considerations are becoming increasingly important across industries, and fintech is no exception. Investors, customers, and regulators are placing greater emphasis on a company’s ESG performance, requiring fintechs to adopt new metrics:

Environmental: Metrics like energy efficiency (especially for blockchain platforms), carbon footprint, and sustainable sourcing reflect a company’s environmental impact.

Social: KPIs like diversity in hiring, community impact, and customer inclusivity assess the social contribution of a business.

Governance: Metrics such as data privacy compliance, board diversity, and transparency in reporting ensure ethical business practices.

By integrating ESG metrics into their KPI frameworks, fintech companies can meet the growing demand for accountability and position themselves as responsible innovators.

The future of fintech KPIs lies at the intersection of technology, foresight, and responsibility. As fintechs adopt these emerging trends, they’ll need to redefine how they measure success to remain competitive and relevant.

Next, let’s summarize the key takeaways from this guide and explore actionable steps to implement these insights in your fintech business.

Conclusion

KPIs are more than performance metrics—they’re essential tools for fintech businesses to navigate growth, challenges, and innovation. From selecting relevant KPIs to adapting to emerging trends, building a robust data-driven foundation is critical for making informed decisions.

To get started, begin by defining your goals and selecting KPIs that align with your business model. Implement tools to monitor these metrics in real time and commit to regular reviews to adapt to changing circumstances.

As technologies like AI, blockchain, and ESG metrics shape the fintech landscape, staying proactive and refining your KPI framework will ensure your business remains competitive and future-proof.

By embracing KPIs as strategic tools, fintech companies can enhance performance, improve customer experiences, and drive growth in a fast-evolving industry. Ready to optimize your KPI strategy? Let’s start the conversation.

Key Takeaways

KPIs as Strategic Tools: Aligned KPIs clarify goals and drive data-driven decisions, fostering growth in competitive markets.

Real-World Impact: Success stories demonstrate how KPIs reduce costs, improve efficiency, and enhance customer satisfaction.

Adapting to Emerging Trends: AI, blockchain, predictive analytics, and ESG metrics require fintechs to continuously refine their KPI strategies.

Continuous Monitoring Is Key: Regular reviews ensure KPIs remain aligned with business objectives and market changes.

Collaboration Across Teams: Effective KPIs involve input from various departments, ensuring organization-wide alignment and accountability.

Answers to The Most Asked Questions

-

Fintech KPIs are key performance indicators that measure critical metrics like customer acquisition cost, payment success rate, and fraud rate to drive strategic decisions and growth.

-

KPIs provide actionable insights for optimizing operations, enhancing customer retention, securing funding, and managing risks, making them essential for fintech businesses to scale and remain competitive.

-

Fintech companies select KPIs by aligning them with their business model, goals, and unique challenges, such as transaction security, customer engagement, or profitability.

-

Examples include customer acquisition cost (CAC), lifetime value (LTV), fraud rate, payment success rate, and loan default rate, each tailored to specific fintech operations.

-

Technologies like AI, blockchain, and ESG metrics influence fintech KPIs by introducing new metrics like model accuracy, energy efficiency, and diversity in hiring practices.