Biotech Valuation Multiples: 2025 Insights & Trends

By Lior Ronen | Founder, Finro Financial Consulting

Biotech has always been a high-stakes industry. The combination of cutting-edge science, long development cycles, and regulatory hurdles makes it one of the most complex sectors to evaluate. But despite the risks, investors keep coming back. The potential upside is just too big to ignore.

Valuation multiples help make sense of this market. Whether it’s a pre-revenue startup working on the next breakthrough therapy or an established biotech company with commercial-stage drugs, multiples offer a way to benchmark value.

The problem?

Biotech doesn’t fit neatly into traditional valuation frameworks. Revenue might not exist yet. Profits could be years away. And the outcome of a single clinical trial can send valuations soaring or crashing overnight.

That’s why biotech multiples vary so widely across different niches. Cell and gene therapy companies trade differently than diagnostics firms. Synthetic biology startups follow a different trajectory than biopharmaceutical giants.

This article breaks down how biotech valuation multiples work, what’s driving them in 2025, and what to watch for across different segments of the industry.

To go beyond the high-level trends, you can download the full 2025 Biotech Valuation Multiples Database—featuring detailed valuation data for 200 biotech companies across public, private, and M&A markets.

Download here and gain instant access to real-world biotech valuation benchmarks for just €32.90.

But before diving into valuation, it’s important to define what biotech actually includes. Some companies are obvious fits, while others sit on the edge of the definition. Let’s break it down.

Biotech valuations are driven by future potential, not current financials, with FDA approvals, clinical success, and partnerships as key factors. High-risk sectors like biopharma and gene therapy command premium multiples, while diagnostics and biotech tools offer steadier valuations. Private biotech firms often trade at higher multiples than public ones, though IPOs and M&A deals can compress valuations. Macroeconomic conditions and funding cycles further shape the industry, making data-driven insights essential for investors and founders.

- What is Biotech? Industry Overview & Key Niches

- Understanding Biotech Valuation

- Why do Biotech Valuations Differ from Other Industries?

- The Unique Challenges of Valuing Biotech Startups & Public Companies

- The Importance of Financial Projections, Market Potential & Regulatory Milestones

- Key Valuation Methods for Biotech Companies

- Revenue Multiple: Benchmarking Growth Potential

- EBITDA Multiple: When It Matters in Biotech

- Discounted Cash Flow (DCF): Estimating Future Value

- Biotech Industry Breakdown: Niches & Valuation Insights

- Key Drivers of Biotech Valuation in 2025

- Download the Full 2025 Biotech Valuation Dataset

- Conclusion

- Key Takeaways

- Answers to The Most Asked Questions

What is Biotech? Industry Overview & Key Niches

Biotech is one of those industries where the definition can get blurry. At its core, it’s about applying biology to solve problems—whether in healthcare, agriculture, or industrial processes.

But not everything that involves biology qualifies as biotech. Let’s start by looking at what counts as biotech before breaking down what falls outside the definition.

What’s Included in Biotech?

Biotech is a broad industry, but what ties it together is the use of living systems to develop new products and solutions. At its core, biotech includes companies working on drug development, diagnostics, synthetic biology, and computational biology.

Some focus on creating new treatments, like gene therapies and biologic drugs, while others specialize in advanced diagnostics, making it easier to detect diseases at earlier stages.

Synthetic biology companies engineer biological systems to manufacture everything from sustainable materials to lab-grown proteins, while bioinformatics firms use AI and data science to accelerate drug discovery and genomic research.

While biotech overlaps with other parts of the healthcare and life sciences industries, what sets it apart is its reliance on biological processes. Whether it’s harnessing DNA sequencing for precision medicine, using AI to analyze vast genomic datasets, or developing entirely new forms of medicine at the cellular level, biotech companies are fundamentally built around biology as a core technology.

What’s Not Considered Biotech?

The lines between biotech, pharmaceuticals, and healthcare technology can be blurry, but there are key differences.

Traditional pharmaceutical companies, for example, focus primarily on chemical-based drugs rather than biologics, making them distinct from biotech firms that rely on genetic engineering, monoclonal antibodies, or RNA-based therapies.

Similarly, medical device companies—those that develop pacemakers, imaging tools, or robotic surgical systems—fall outside the biotech space, even though they contribute to medical innovation.

Healthcare IT and telemedicine platforms also sit outside of biotech, despite playing a growing role in modern healthcare. While these companies use technology to improve patient care and streamline operations, they don’t work with biological systems in the way biotech firms do.

Even within life sciences, certain areas—such as hospital equipment suppliers or general laboratory services—are considered separate from biotech, as their focus is on infrastructure rather than biological innovation.

The Main Niches in Biotech

Biotech isn’t a single industry—it’s an umbrella term for several distinct segments. Each has different business models, risk profiles, and valuation drivers.

1. Biopharmaceuticals (Therapeutics & Drug Development): The largest biotech segment, focused on developing biologic drugs, monoclonal antibodies, and gene therapies. Valuations here are heavily tied to clinical trial success, regulatory approvals, and potential blockbuster drugs.

2. Diagnostics & Medical Testing: This niche includes genetic testing, liquid biopsy, and molecular diagnostics. Advances in precision medicine have pushed valuations higher, but reimbursement challenges and competition can limit upside.

3. Synthetic Biology & Biomanufacturing: Companies engineering biological systems to create everything from biofuels to lab-grown meat. This space is growing fast, though scaling production remains a major challenge.

4. Cell & Gene Therapy: One of the most promising—and expensive—fields in biotech. Developing customized gene therapies and regenerative medicine treatments takes years and billions in funding, but successful companies can command sky-high valuations.

5. Agricultural & Industrial Biotech: Covers everything from genetically modified crops to bioengineered materials. Investors see potential, but regulatory hurdles and slow adoption in traditional industries create valuation uncertainty.

6. Microbiome & Probiotics: A newer field focused on harnessing gut bacteria for therapies and consumer health products. Still early-stage, with valuations driven more by potential than revenue.

7. Bioinformatics & Computational Biology: AI-driven drug discovery, genomics, and big data approaches to biotech. This segment is attracting significant investment as machine learning reshapes R&D.

8. Biotech Tools & Life Sciences Equipment: Companies providing lab automation, sequencing technology, and research tools. These firms tend to have steadier revenue and lower risk than drug developers, leading to different valuation benchmarks.

Why This Breakdown Matters for Valuation

Not all biotech niches are valued the same way. A company developing a cancer therapy might trade at a completely different multiple than a synthetic biology firm. Understanding these differences is key to making sense of biotech valuation trends.

With that foundation in place, let’s look at how biotech companies are valued—and why traditional valuation methods don’t always apply.

Understanding Biotech Valuation

With biotech defined and its key niches outlined, the next step is understanding how these companies are valued. Unlike traditional industries, where revenue and profitability drive valuation, biotech operates on a different playing field.

Many companies—especially in early stages—generate little to no revenue, yet they can secure billion-dollar valuations based on future potential.

Why do Biotech Valuations Differ from Other Industries?

Valuation in biotech is often more speculative than in industries with predictable revenue streams. A software company, for example, can be valued based on user growth or recurring revenue, while a manufacturing business follows standard cost and margin analysis.

Biotech, however, is driven by factors that are harder to quantify—scientific breakthroughs, regulatory approvals, and the probability of a drug or therapy making it to market.

For companies in the pre-revenue phase, valuations are built on intellectual property, research progress, and clinical trial milestones.

For revenue-generating biotech firms, valuation starts to resemble traditional industries, but with added risk factors, such as drug patent lifecycles and the impact of regulatory changes.

The Unique Challenges of Valuing Biotech Startups & Public Companies

One of the biggest challenges in biotech valuation is long development timelines. A promising therapy might take 10-15 years to move from discovery to commercialization, requiring massive R&D investments along the way. Investors must assess whether a company has enough capital to sustain operations through multiple clinical trial phases—each with its own risk of failure.

Regulatory approval is another major hurdle. Unlike tech startups that can launch products and iterate quickly, biotech companies depend on FDA, EMA, or other global regulatory bodies to approve their treatments. A single approval or rejection can send valuations soaring or collapsing overnight.

For public biotech companies, volatility is a constant challenge. Stock prices can swing dramatically based on clinical trial data, partnership announcements, or shifts in investor sentiment. Unlike more stable industries, where financial metrics provide clear valuation benchmarks, biotech requires a combination of science, financial modeling, and market analysis to gauge value.

The Importance of Financial Projections, Market Potential & Regulatory Milestones

Since biotech often lacks steady revenue in early stages, financial projections play a crucial role in valuation. Investors look at future cash flow potential based on market size, expected adoption rates, and pricing strategies.

For example, a company developing a rare disease therapy might command a premium valuation due to limited competition and high reimbursement potential.

Beyond financials, regulatory milestones serve as critical value inflection points. Advancing from preclinical to Phase 1, Phase 2, and Phase 3 trials can significantly impact a company’s valuation, as each step reduces risk and increases the likelihood of commercial success.

Market potential also shapes biotech valuations. Companies working on treatments for widespread conditions—like cancer, Alzheimer’s, or metabolic disorders—often attract higher valuations than those targeting niche diseases with limited patient populations.

However, niche markets can still be lucrative if pricing power is strong and reimbursement pathways are favorable.

Key Valuation Methods for Biotech Companies

Biotech valuation isn’t straightforward. As we’ve seen, companies in this sector operate on long timelines, depend heavily on regulatory approvals, and often have no revenue for years.

The previous section highlighted how valuation changes across different clinical phases, but how do investors actually quantify these companies?

Traditional valuation methods—like revenue multiples, EBITDA multiples, and discounted cash flow (DCF)—are all used in biotech, but they don’t apply in the same way as they do in other industries. For early-stage biotech companies, valuation is more about scientific milestones and potential future revenue rather than immediate financial performance. For more mature biotech firms, financial metrics start playing a bigger role, though risk factors remain unique compared to other sectors.

Let’s break down the key methods used to value biotech companies and how they apply in different stages of development.

Revenue Multiple: Benchmarking Growth Potential

For biotech companies that have started generating revenue, revenue multiples provide a simple way to benchmark value against peers. Investors compare a company’s valuation (market cap for public firms, or valuation in funding rounds for private firms) to its revenue to determine how much the market is willing to pay for each dollar earned.

This metric is particularly useful in biotech because many companies remain unprofitable for years due to high R&D costs.

Since traditional profit-based multiples, like price-to-earnings (P/E) or EBITDA multiples, may not be relevant, revenue multiples offer a straightforward way to assess valuation.

A higher multiple suggests investors expect strong growth, pricing power, or a competitive advantage, while a lower multiple may indicate slower growth expectations, market skepticism, or higher risk.

However, revenue multiples don’t tell the full story. A biotech firm with an FDA-approved therapy will likely command a much higher multiple than one still in clinical trials, even if they have similar revenues.

The industry a company operates in, the stage of development, and its pipeline potential all play a role in how revenue multiples are interpreted.

Understanding how these multiples vary across different biotech niches provides deeper insight into what drives biotech valuations and how investors weigh risk versus reward.

| Factor | Public Biotech | Private Biotech |

|---|---|---|

| Revenue Multiples | Lower, more stable | Higher, driven by growth expectations |

| Valuation Basis | Financial performance, clinical milestones | Future potential, investor sentiment |

| Market Influence | Stock market fluctuations, macroeconomic factors | VC, PE, and strategic investor demand |

| Clinical Trial Impact | Stock price reacts to results | Valuation tied to next funding milestone |

| Liquidity | Shares can be traded on public exchanges | Illiquid, valuations locked until next round or exit |

| Regulatory Risk | Higher, scrutiny from public markets & investors | Lower, fewer short-term valuation adjustments |

| Exit Path | M&A, long-term growth, or dividends | IPO, M&A, or next funding round |

How Revenue Multiples Vary Across Biotech Niches

Revenue multiples vary significantly depending on the subsector of biotech.

Biopharmaceuticals & Cell/Gene Therapy: Often trade at higher revenue multiples because of strong pricing power and long product exclusivity.

Diagnostics & Medical Testing: Lower multiples compared to therapeutics, as competition is higher and margins lower.

Synthetic Biology & Biomanufacturing: Still an emerging sector, but some companies trade at high multiples due to long-term potential.

Biotech Tools & Life Sciences Equipment: More predictable revenue streams, leading to moderate multiples, often closer to traditional healthcare tech.

Public vs. Private Biotech Revenue Multiples

Public biotech companies tend to have more stable revenue multiples, influenced by market conditions, investor sentiment, and recent clinical results.

Private biotech companies often see much higher revenue multiples, as valuations in funding rounds are driven more by growth expectations than financial performance.

However, revenue multiples only work when a company has actual revenue. Many early-stage biotech firms don’t, which is why other valuation methods come into play.

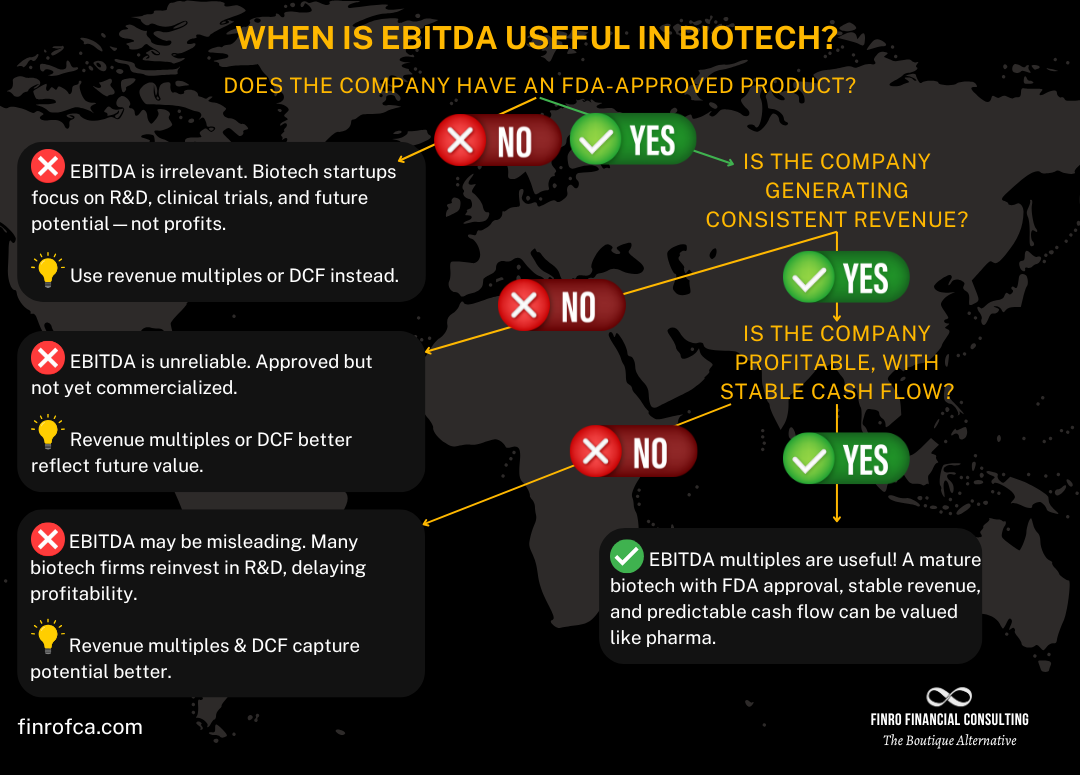

EBITDA Multiple: When It Matters in Biotech

EBITDA multiples—valuing a company based on earnings before interest, taxes, depreciation, and amortization—are widely used in traditional industries. They provide a measure of a company’s operating profitability and are commonly applied in manufacturing, retail, and software, where companies generate steady cash flow. However, in biotech, EBITDA multiples have limited applicability, especially for early-stage firms.

Unlike revenue multiples, which can apply even when a company is unprofitable, EBITDA multiples require a company to have actual earnings. Many biotech startups operate at a loss for years, investing heavily in R&D, clinical trials, and regulatory approvals before generating meaningful revenue. As a result, most early-stage biotech firms don’t have positive EBITDA, making this metric largely irrelevant for valuation.

However, EBITDA multiples become useful in certain cases. Mature, revenue-generating biotech firms—those with FDA-approved drugs, a predictable revenue stream, and stable cash flows—can be valued similarly to pharmaceutical companies using EBITDA multiples. In these cases, EBITDA reflects operational efficiency and profitability, providing a more traditional valuation benchmark.

Because biotech valuations are often based on future potential rather than current profitability, EBITDA multiples play a secondary role compared to revenue multiples and DCF analysis. Understanding when EBITDA is relevant—and when it’s not—is key to applying the right valuation method for a biotech company.

| Factor | EBITDA Multiples Are Useful When… | EBITDA Multiples Don’t Apply When… |

|---|---|---|

| Company Stage | FDA-approved, commercial-stage biotech | Pre-revenue, early-stage biotech |

| Revenue Generation | Consistent revenue from drug sales | No revenue or minimal early-stage sales |

| Profitability | Positive EBITDA, profitability is predictable | High R&D costs, burning cash |

| Valuation Driver | Operational efficiency, earnings performance | Pipeline potential, future market opportunity |

| Regulatory Status | Drug has passed all approval stages | Drug still in clinical trials |

| Investor Focus | Steady growth, cash flow sustainability | High risk, long-term potential |

| Industry Comparison | More like traditional pharma companies | Valued like high-growth tech startups |

When EBITDA Multiples Matter

Mature, commercial-stage biotech firms with steady revenue and profitability can be valued using EBITDA multiples, similar to pharmaceutical companies.

Biotech tools & life sciences equipment companies also use EBITDA multiples, as they generate recurring revenue from product sales.

Why EBITDA Multiples Are Often Irrelevant in Early Biotech

Most pre-revenue biotech startups are deeply unprofitable due to high R&D expenses and long timelines to commercialization.

Valuation is driven by pipeline potential, scientific breakthroughs, and regulatory progress, not short-term profitability.

Even after product approval, biotech firms often reinvest heavily in R&D, making EBITDA a less reliable metric.

For this reason, when traditional financial metrics don’t apply, investors turn to Discounted Cash Flow (DCF) analysis to estimate future value.

Discounted Cash Flow (DCF): Estimating Future Value

Biotech valuation is unique because many companies operate for years without generating revenue while investing heavily in research and clinical trials. Traditional valuation metrics, such as revenue multiples and EBITDA multiples, often fall short in assessing these companies’ true worth. This is where Discounted Cash Flow (DCF) analysis becomes particularly useful.

DCF is a forward-looking valuation method that estimates a company’s value based on its expected future cash flows, adjusted for risk. Since biotech firms typically experience long development timelines, uncertain revenue streams, and regulatory risks, DCF helps investors determine whether a company’s future earnings potential justifies its current valuation.

Unlike revenue and EBITDA multiples, which rely on comparable company benchmarking, DCF is highly company-specific. It requires detailed assumptions about future revenue growth, R&D costs, drug approval probabilities, and market adoption rates—all of which can significantly impact a biotech firm’s valuation.

While powerful, DCF is only as good as the inputs used. Because of the high uncertainty in biotech, small changes in clinical success rates, pricing assumptions, or commercialization timelines can lead to vastly different valuation outcomes. That’s why DCF models in biotech often incorporate probability-adjusted forecasts, accounting for the likelihood of drug approvals and market entry.

Understanding how DCF works—and its key assumptions—is crucial for accurately valuing biotech companies. Next, we’ll break down how DCF applies to biotech and what factors investors must consider.

DCF is widely used for biotech valuation because it accounts for long development cycles, uncertainty, and potential future cash flows. Since biotech companies often have no revenue today but significant revenue potential in the future, DCF helps estimate their value by projecting cash flows and discounting them to present value.

Key Assumptions in DCF for Biotech

R&D Expenses: High and ongoing, but expected to decline post-commercialization.

Approval Probabilities: Modeled based on clinical stage—e.g., Phase 1 success rate ~10%, Phase 3 ~50%.

Market Adoption & Pricing: Assumptions on drug pricing, market penetration, and reimbursement rates.

Regulatory Timelines: Long approval cycles require careful risk adjustments.

Discount Rate: Higher than in other industries due to extreme risk.

DCF works well for later-stage biotech firms but is highly sensitive to assumptions, making it risky for early-stage valuations. Still, it remains one of the most widely used methods in M&A deals, IPO pricing, and institutional investment decisions.

Now that we’ve covered how biotech companies are valued, the next section explores real-world data from 2025, highlighting valuation multiples across different biotech niches, trends in public and private markets, and the key takeaways for investors and founders.

Biotech Industry Breakdown: Niches & Valuation Insights

Biotech isn’t a monolithic industry—it’s an umbrella term that covers multiple specialized sectors, each with unique business models, risk profiles, and valuation drivers.

The spreadsheet data and industry categories show clear trends in how different biotech niches are valued, reflecting factors like regulatory risk, R&D intensity, revenue predictability, and competitive landscape.

Understanding these differences is critical for investors, founders, and analysts looking to benchmark biotech valuations effectively.

Below, we break down the key biotech segments and what’s shaping their valuations in 2025.

Biopharmaceuticals (Therapeutics & Drug Development)

Largest biotech segment, commanding high valuation multiples.

Biopharmaceuticals remain the dominant force in biotech, with valuations often driven by blockbuster drugs and the potential for exclusive market control through patents. FDA approvals serve as a major inflection point, sending valuations soaring when successful—or crashing when denied.

However, the sector faces challenges like patent cliffs, where blockbuster drugs lose exclusivity, leading to declining revenues as generics enter the market. Companies that replenish their pipelines through continuous innovation or strategic M&A tend to sustain higher valuations.

Valuation Drivers:

FDA approvals & regulatory progress

Strength of drug pipeline & exclusivity periods

Revenue scale & market dominance

Diagnostics & Medical Testing

The rise of precision medicine and at-home diagnostics is reshaping valuations.

The diagnostics sector has seen major innovation, with genetic testing, liquid biopsy, and AI-driven diagnostics improving early disease detection. The COVID-19 pandemic accelerated adoption, and now, at-home and point-of-care testing are in high demand.

M&A has become a key driver of valuation growth, with major life sciences companies acquiring innovative diagnostic startups to expand their portfolios. However, reimbursement uncertainty and competition in certain segments can keep valuations in check.

Valuation Drivers:

Market adoption of precision diagnostics

M&A activity and consolidation trends

Reimbursement policies & pricing power

Synthetic Biology & Biomanufacturing

Redefining manufacturing with engineered biology.

Synthetic biology is blurring the lines between biotech and industrial production, using engineered organisms to create sustainable chemicals, alternative proteins, and even biofuels. As companies in this space move from R&D to scaling production, valuations are rising.

Investor interest is particularly high in industrial biotech, where synthetic biology is seen as a game-changer for sustainable manufacturing. Companies that secure commercial partnerships and demonstrate cost-competitive production see the highest valuations.

Valuation Drivers:

Commercial scalability of bio-based products

Investor sentiment on sustainability & climate impact

Cost efficiency vs. traditional manufacturing

Cell & Gene Therapy

High-risk, high-reward segment with billion-dollar potential.

Cell and gene therapy has been one of the most hyped biotech fields, with groundbreaking treatments for genetic disorders, cancers, and rare diseases. The potential for one-time curative treatments means these therapies command premium pricing, but high R&D costs and long approval cycles make valuations volatile.

Large pharma partnerships play a significant role in valuation, with many small companies securing licensing deals or buyouts from major drugmakers before reaching commercialization.

Valuation Drivers:

Clinical trial success rates

Pharma licensing & acquisition deals

Pricing & market access for novel therapies

Agricultural & Industrial Biotech

Innovation in food, sustainability, and crop genetics.

Biotech isn’t just about human health—it’s transforming agriculture, food production, and industrial processes. From gene-edited crops to lab-grown meat, agricultural biotech companies are attracting investment, though commercialization challenges remain.

Regulatory approval pathways for engineered foods and public perception (e.g., GMO concerns) impact valuations. Companies that demonstrate clear consumer demand and regulatory compliance tend to attract higher valuations.

Valuation Drivers:

Adoption of gene-edited & synthetic food tech

Sustainability impact & regulatory environment

Market demand for alternative proteins & bioengineered crops

Microbiome & Probiotics

A promising field still proving its commercial potential.

Microbiome science has gained traction, with research showing the gut microbiome’s role in disease, immunity, and mental health. However, the field still faces scientific validation hurdles, as many microbiome-based therapeutics and probiotics lack regulatory approval or clinical proof.

Market demand is high, particularly in consumer health and nutrition, but valuations depend on whether companies can translate microbiome insights into approved therapies or functional products.

Valuation Drivers:

Scientific validation & regulatory approvals

Consumer adoption of microbiome-based products

Market differentiation vs. supplements & probiotics

Bioinformatics & Computational Biology

AI-powered drug discovery is changing the biotech landscape.

With the rise of machine learning, computational biology, and AI-driven drug discovery, bioinformatics companies are attracting significant investment. AI-powered platforms can accelerate target identification, biomarker discovery, and precision medicine, making drug development faster and more efficient.

However, the business model varies—some bioinformatics firms license AI platforms, while others develop their own drug pipelines, leading to different valuation strategies. Unlike traditional biotech, these companies sometimes trade at tech-sector revenue multiples due to their scalability and recurring revenue potential.

Valuation Drivers:

AI-driven efficiency in drug discovery

Business model (SaaS, partnerships, or drug pipeline)

Investor perception: biotech vs. tech-sector multiples

| Factor | AI-Driven Biotech (Bioinformatics & AI in Drug Discovery) |

Traditional Biotech (Drug Development & Therapeutics) |

|---|---|---|

| Valuation Model | SaaS-like revenue multiples, scalable software licensing | Pipeline-based, milestone-driven valuation |

| Revenue Predictability | Recurring revenue from AI platforms, partnerships, or SaaS | Uncertain revenue, dependent on clinical success |

| Time to Market | Faster deployment, no FDA approval needed for software | 10-15 years for drug development & approval |

| R&D Costs | High upfront AI model training, lower long-term costs | Heavy R&D costs for clinical trials, manufacturing |

| Risk Profile | Lower regulatory risk, software faces fewer compliance hurdles | High regulatory risk, FDA/EMA approval needed |

| Scalability | Highly scalable—AI models can be applied across multiple drug programs | Limited scalability—each drug requires separate trials |

| Market Adoption | Pharma companies integrate AI tools for discovery, efficiency gains | Market adoption depends on successful drug launch |

| M&A & Investment Trends | Acquisitions by tech and pharma giants, VC-backed scaling | Large pharma acquisitions post-clinical success |

| Revenue Multiples | Higher (like SaaS companies) due to predictable growth | Lower, dependent on clinical stage & risk |

Biotech Tools & Life Sciences Equipment

The backbone of biotech research and development.

Biotech tools and life sciences equipment companies are often less volatile than drug developers because they generate steady revenue from selling lab automation, sequencing technologies, and research tools.

Strategic M&A plays a major role, with larger firms acquiring cutting-edge startups to expand their product offerings. Companies in this space benefit from recurring revenue models (e.g., consumables, software, and services) rather than relying on blockbuster drugs.

Valuation Drivers:

Adoption of next-gen lab & sequencing tech

Recurring revenue from consumables & software

Industry consolidation & strategic acquisitions

Key Takeaways: How Valuation Varies Across Biotech Niches

Biopharma & cell/gene therapy command the highest multiples due to blockbuster drug potential but face high clinical risk.

Diagnostics, bioinformatics, and tools companies have more predictable revenue and often attract steady valuations.

Synthetic biology and microbiome startups are attracting investment, but their commercial success depends on scaling and regulatory clarity.

Agricultural and industrial biotech face unique challenges, but sustainability trends are driving investor interest.

Understanding these differences is critical for assessing biotech valuation multiples—each niche operates under distinct financial, regulatory, and market dynamics.

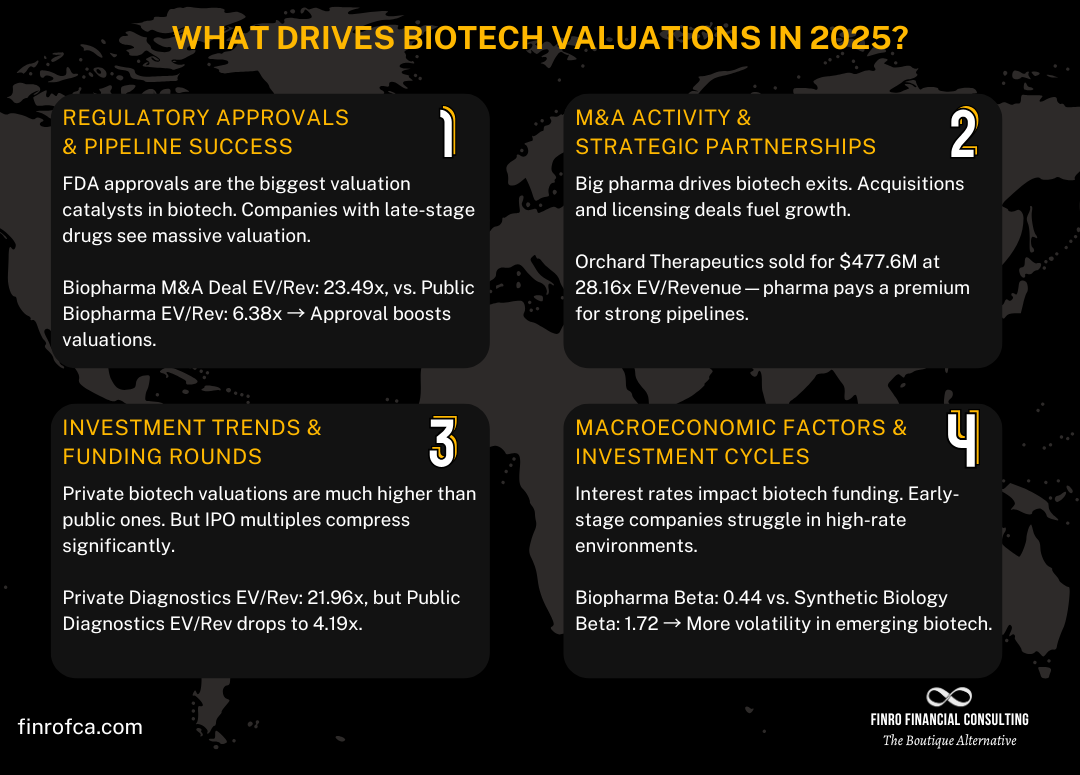

Key Drivers of Biotech Valuation in 2025

Biotech valuations are influenced by a mix of scientific progress, market forces, and investor sentiment. As we’ve seen in the industry breakdown, different biotech niches operate on distinct risk and revenue models, leading to varied valuation multiples. However, across all sectors, a few fundamental factors shape biotech valuations year after year.

In 2025, these drivers remain largely the same, but shifts in regulatory landscapes, investment flows, and economic conditions will determine how biotech companies—both public and private—are valued. Here are the four key forces impacting biotech valuations in 2025:

Regulatory Approvals & Pipeline Success

FDA and EMA decisions remain the biggest valuation catalysts.

Biotech valuations can skyrocket or collapse based on clinical trial outcomes and regulatory approvals. A single FDA approval can turn a pre-revenue biotech into a billion-dollar company overnight, while a failed Phase 3 trial can wipe out years of investor capital.

Strong pipeline = higher valuation – Companies with multiple shots on goal (i.e., multiple drugs in development) are valued more favorably.

Approval probability impacts investor confidence – Biotech firms advancing from Phase 2 to Phase 3 often see valuation jumps as success rates improve.

Regulatory scrutiny is increasing – The FDA and EMA are tightening approval standards, especially for gene therapy, microbiome treatments, and AI-driven diagnostics.

Key Takeaway: Biotechs with late-stage pipeline success will command premium valuations, while early-stage firms may struggle without strong clinical momentum.

M&A Activity & Strategic Partnerships

Big pharma remains biotech’s biggest buyer.

In an industry where drug pipelines are king, large pharmaceutical companies frequently acquire or partner with biotechs to fill their R&D gaps. In 2025, M&A trends will be shaped by:

Patent cliffs forcing acquisitions – With major drugs losing exclusivity, big pharma is buying biotech firms to secure new revenue streams.

Strategic partnerships as risk mitigation – Instead of outright acquisitions, many pharma companies are licensing assets or co-developing drugs, reducing risk exposure.

Private biotech exits through M&A – With the IPO window still uncertain, many venture-backed biotechs will seek acquisition as their primary exit strategy.

Key Takeaway: High-quality biotech firms with strong pipelines will remain M&A targets, particularly in oncology, neurology, and gene therapy.

Investment Trends & Funding Rounds

Venture capital & IPO markets will define private biotech valuations.

Biotech startups depend heavily on venture capital funding to survive the long R&D cycle. However, funding dynamics are shifting in 2025:

VC money is more selective – Investors are favoring later-stage biotechs with strong clinical data over speculative early-stage plays.

IPO market remains uncertain – After a weak IPO cycle in 2023-24, public listings are making a slow comeback, but only the strongest biotechs are making it through.

Crossover investors are back – Funds that invest in both private & public biotechs are re-entering the space, boosting valuations of pre-IPO companies.

Key Takeaway: Biotechs with strong clinical data will secure funding, but weaker companies will struggle without proof-of-concept milestones.

Macroeconomic Factors & Investment Cycles

Inflation, interest rates, and risk appetite shape biotech capital flows.

Biotech is a capital-intensive industry, and macroeconomic conditions directly impact valuations:

Interest rates affect capital availability – Higher rates make biotech funding more expensive, pressuring early-stage firms.

Market volatility impacts public biotech – Investor sentiment shifts quickly based on economic outlooks, leading to biotech stock swings.

Defensive plays in biotech – In times of economic uncertainty, investors favor profitable, commercial-stage biotech over high-risk startups.

Key Takeaway: If interest rates remain high, early-stage biotech will face funding challenges, while established firms will attract more capital.

With these valuation drivers in mind, the next section will examine real-world biotech valuation multiples, analyzing public vs. private companies, recent funding rounds, and M&A deals.

Biotech valuations are influenced by a mix of scientific progress, market forces, and investor sentiment. As we’ve seen in the industry breakdown, different biotech niches operate on distinct risk and revenue models, leading to varied valuation multiples. However, across all sectors, a few fundamental factors shape biotech valuations year after year.

In 2025, these drivers remain largely the same, but shifts in regulatory landscapes, investment flows, and economic conditions will determine how biotech companies—both public and private—are valued. Here are the four key forces impacting biotech valuations in 2025:

Regulatory Approvals & Pipeline Success

FDA and EMA decisions remain the biggest valuation catalysts.

Biotech valuations can skyrocket or collapse based on clinical trial outcomes and regulatory approvals. A single FDA approval can turn a pre-revenue biotech into a billion-dollar company overnight, while a failed Phase 3 trial can wipe out years of investor capital.

Strong pipeline = higher valuation – Companies with multiple shots on goal (i.e., multiple drugs in development) are valued more favorably.

Approval probability impacts investor confidence – Biotech firms advancing from Phase 2 to Phase 3 often see valuation jumps as success rates improve.

Regulatory scrutiny is increasing – The FDA and EMA are tightening approval standards, especially for gene therapy, microbiome treatments, and AI-driven diagnostics.

Key Takeaway: Biotechs with late-stage pipeline success will command premium valuations, while early-stage firms may struggle without strong clinical momentum.

M&A Activity & Strategic Partnerships

Big pharma remains biotech’s biggest buyer.

In an industry where drug pipelines are king, large pharmaceutical companies frequently acquire or partner with biotechs to fill their R&D gaps. In 2025, M&A trends will be shaped by:

Patent cliffs forcing acquisitions – With major drugs losing exclusivity, big pharma is buying biotech firms to secure new revenue streams.

Strategic partnerships as risk mitigation – Instead of outright acquisitions, many pharma companies are licensing assets or co-developing drugs, reducing risk exposure.

Private biotech exits through M&A – With the IPO window still uncertain, many venture-backed biotechs will seek acquisition as their primary exit strategy.

Key Takeaway: High-quality biotech firms with strong pipelines will remain M&A targets, particularly in oncology, neurology, and gene therapy.

Investment Trends & Funding Rounds

Venture capital & IPO markets will define private biotech valuations.

Biotech startups depend heavily on venture capital funding to survive the long R&D cycle. However, funding dynamics are shifting in 2025:

VC money is more selective – Investors are favoring later-stage biotechs with strong clinical data over speculative early-stage plays.

IPO market remains uncertain – After a weak IPO cycle in 2023-24, public listings are making a slow comeback, but only the strongest biotechs are making it through.

Crossover investors are back – Funds that invest in both private & public biotechs are re-entering the space, boosting valuations of pre-IPO companies.

Key Takeaway: Biotechs with strong clinical data will secure funding, but weaker companies will struggle without proof-of-concept milestones.

Macroeconomic Factors & Investment Cycles

Inflation, interest rates, and risk appetite shape biotech capital flows.

Biotech is a capital-intensive industry, and macroeconomic conditions directly impact valuations:

Interest rates affect capital availability – Higher rates make biotech funding more expensive, pressuring early-stage firms.

Market volatility impacts public biotech – Investor sentiment shifts quickly based on economic outlooks, leading to biotech stock swings.

Defensive plays in biotech – In times of economic uncertainty, investors favor profitable, commercial-stage biotech over high-risk startups.

Key Takeaway: If interest rates remain high, early-stage biotech will face funding challenges, while established firms will attract more capital.

With these valuation drivers in mind, the next section will examine real-world biotech valuation multiples, analyzing public vs. private companies, recent funding rounds, and M&A deals.

Download the Full 2025 Biotech Valuation Dataset

The previous sections covered key biotech valuation trends, industry multiples, and the major factors driving biotech startup valuations. But if you need detailed, data-backed insights, you’ll want access to the full dataset.

What’s Inside the Dataset?

Company Data: Revenue multiples, EBITDA multiples, and latest valuations for 200 biotech companies, including both public and private firms. Public company data includes ticker, market cap, debt levels, and beta for deeper benchmarking.

M&A Deal Data: Details on recent biotech acquisitions, including buyer, target company, deal value, revenue, and EBITDA multiples—showing how biotech exits are priced.

Valuation Multiples: Revenue and EBITDA multiples segmented by public, private, and M&A deals across eight biotech niches, from biopharma to AI-driven drug discovery.

Verified Sources: Every data point is sourced from reliable industry reports, financial filings, and transaction databases for accuracy and transparency.

Who is This Data For?

Investors: Identify undervalued biotech startups, track market trends, and spot acquisition targets.

Biotech Founders: Benchmark your company’s valuation against industry standards and prepare for funding rounds.

Analysts & M&A Professionals: Use real biotech multiples for dealmaking, financial modeling, and investment strategy.

📥 Get Instant Access for Only €32.90

For just €32.90, gain immediate access to the latest biotech valuation dataset—helping you make better investment, fundraising, and acquisition decisions in this fast-moving industry.

This is the go-to resource for anyone needing accurate biotech valuation benchmarks—whether you’re investing, fundraising, or advising on M&A deals.

Conclusion

Biotech is one of the most dynamic and complex industries when it comes to valuation. Unlike traditional sectors where revenue, EBITDA, and cash flow drive valuations, biotech operates on a different set of rules—where clinical milestones, regulatory approvals, and future potential dictate investor sentiment and market value.

Through this article, we’ve explored:

✅ How biotech valuations differ across niches, from biopharma and gene therapy to bioinformatics and synthetic biology.

✅ Key valuation drivers shaping 2025, including FDA approvals, M&A trends, investment cycles, and macroeconomic forces.

✅ Real-world valuation multiples based on public, private, and M&A biotech deals.

✅ How to benchmark biotech companies using the latest revenue and EBITDA multiples.

For investors, founders, and analysts, biotech valuations require a deep understanding of both financial metrics and industry-specific risks. The companies that succeed are not just those with strong revenue potential, but those that can navigate clinical trials, secure strategic partnerships, and scale effectively in competitive markets.

To get the full picture, our 2025 Biotech Valuation Multiples Database provides detailed insights into 200 biotech companies, covering revenue multiples, EBITDA multiples, and recent M&A transactions.

Biotech valuations will continue to evolve, shaped by scientific breakthroughs, regulatory shifts, and market dynamics—but with data-driven insights, you can stay ahead of the curve.

Key Takeaways

Future Potential Drives Valuation: Biotech companies are often valued on pipeline success, clinical milestones, and regulatory approvals, not current financials.

High-Risk Niches Command Premiums: Biopharma, gene therapy, and synthetic biology typically have higher valuation multiples due to their breakthrough potential.

Private Biotech Trades Higher: Private companies often see inflated valuations compared to public biotech, though multiples compress post-IPO or M&A.

Macroeconomics Matter: Interest rates, investment cycles, and market sentiment influence biotech funding, with early-stage companies hit hardest by economic downturns.

Data-Driven Insights Are Essential: Investors, founders, and analysts need valuation benchmarks to navigate biotech’s unique risk-reward landscape.

Answers to The Most Asked Questions

-

Biotech valuation depends on clinical progress, FDA approvals, and future revenue potential, often using revenue multiples, EBITDA multiples, and DCF models instead of traditional financial metrics.

-

Investors price in future potential—a biotech firm with a strong pipeline and clinical success can be worth billions before generating sales.

-

Regulatory approvals, M&A activity, investment trends, and macroeconomic conditions drive biotech multiples, with late-stage companies commanding higher valuations due to reduced risk.

-

Yes, private biotech firms typically have higher revenue multiples than public ones, as valuations are based on growth potential, not market fluctuations.

-

The 2025 Biotech Valuation Multiples Database provides valuation multiples for 200+ biotech companies across public, private, and M&A markets. Download for €32.90.