Financial Models for SaaS Startups Investors Want

By Lior Ronen | Founder, Finro Financial Consulting

Building a successful SaaS startup isn’t just about creating a great product; it’s about proving your business is financially sound and scalable.

Investors expect more than enthusiasm—they want numbers that show how your subscription model translates into predictable revenue, controlled costs, and long-term profitability.

Financial models are the foundation of these conversations.

They’re not just spreadsheets—they’re tools to communicate your strategy, growth potential, and understanding of your market.

For SaaS startups, where recurring revenue and customer retention drive value, creating a well-structured model tailored to this business model is essential.

This article explores the core financial metrics that matter most to investors and how to build a SaaS financial model that can stand up to scrutiny.

A well-built SaaS financial model serves as a strategic tool for demonstrating a startup’s growth potential, financial health, and scalability to investors. It combines detailed revenue projections based on cohort analysis, subscription tiers, and expansion strategies, with a clear breakdown of costs such as hosting, customer support, and operating expenses.

By focusing on key metrics like CAC-to-LTV, gross margin, and churn, founders can align their projections with market benchmarks and ensure credibility. Avoiding common mistakes—such as overestimating retention, ignoring churn, or neglecting scalability stress tests—further strengthens the model. When tied to valuation methods like revenue multiples and DCF, a robust financial model not only inspires investor confidence but also lays the groundwork for sustainable growth and strategic decision-making.

- Understanding the SaaS Business Model

- Core SaaS Metrics Investors Care About

- Building a Financial Model for SaaS

- Revenue Projections: Understanding Growth and Retention

- Cost of Revenues: Breaking Down Direct Costs

- Operating Expenses: Fueling Growth and Innovation

- Cash Flow: Tracking Your Startup’s Lifeline

- How Financial Models Influence Valuation

- Investor Confidence and Financial Models

- Key Metrics That Drive Valuation

- Connecting Financial Models to Valuation Methods

- Common Mistakes to Avoid

- Conclusion

- Key Takeaways

- Answers to The Most Asked Questions

Understanding the SaaS Business Model

The SaaS business model stands out for its predictability and growth potential.

At its core, it revolves around subscription-based revenue, where customers pay a recurring fee—monthly or annually—for access to software hosted in the cloud.

This approach offers both businesses and customers flexibility, making it a dominant model for modern tech startups.

Three factors define the strength of a SaaS business: recurring revenue, scalability, and customer retention.

Recurring revenue ensures a steady income stream, allowing startups to forecast cash flow with greater accuracy.

Scalability lets companies grow without proportionally increasing costs, making profitability achievable at scale.

Finally, customer retention directly impacts long-term success; retaining customers is often far more cost-effective than acquiring new ones, and high retention boosts metrics like lifetime value (LTV).

These elements aren’t just operational—they directly shape how financial models are built.

A SaaS financial model needs to focus on projecting recurring revenue, scaling costs efficiently, and analyzing retention rates.

Each of these influences valuation, giving investors a clearer view of your growth trajectory.

With these fundamentals covered, let’s explore the key metrics that every investor expects to see in a SaaS financial model.

Core SaaS Metrics Investors Care About

Now that we’ve covered the foundations of the SaaS business model, let’s shift focus to the metrics that truly matter to investors.

These key indicators go beyond general financial figures to highlight the specific strengths and weaknesses of a SaaS business.

They not only shape how startups are valued but also provide critical insights into growth, sustainability, and profitability.

Here are the metrics every SaaS founder needs to know:

Customer Acquisition Cost (CAC): The total cost of acquiring a new customer, including marketing and sales expenses. Why It Matters: High CACs can strain cash flow, especially for early-stage startups. A financial model must account for how CAC evolves as your business scales.

Lifetime Value (LTV): The total revenue a customer is expected to generate over their relationship with your business. Why It Matters: LTV, when compared with CAC, gives a clear picture of whether your customer acquisition strategy is profitable. Investors look for a healthy LTV-to-CAC ratio (typically 3:1 or higher).

Monthly Recurring Revenue (MRR): The consistent income generated from active subscriptions each month. Why It Matters: MRR reflects the predictability of your revenue stream and is essential for forecasting future growth in a financial model.

Annual Recurring Revenue (ARR): The annualized version of MRR, highlighting the total recurring revenue expected in a year. Why It Matters: ARR provides a high-level view of your startup’s revenue potential, making it easier to benchmark against industry peers.

Churn Rate: The percentage of customers who cancel their subscriptions during a specific period. Why It Matters: High churn rates signal issues with customer satisfaction or retention strategies. Financial models need to incorporate churn to avoid overestimating growth.

Gross Margin: The percentage of revenue remaining after subtracting the cost of delivering your product or service. Why It Matters: High gross margins are typical for SaaS startups and indicate scalability. They directly influence profitability and valuation multiples.

Why These Metrics Matter for Valuation

Investors rely on these metrics to gauge a SaaS startup’s health and potential. A strong CAC-to-LTV ratio shows sustainable growth, while solid MRR and ARR numbers highlight predictable income.

Gross margin and churn reflect operational efficiency and customer satisfaction, directly impacting how attractive your business is to investors.

With these metrics as the backbone, let’s now look at how to incorporate them into a financial model that’s tailored to SaaS startups.

Building a Financial Model for SaaS

A well-designed financial model is essential for SaaS startups to communicate their growth potential and financial health effectively.

This section breaks down the four core components of a SaaS financial model—revenue projections, cost of revenues, operating expenses, and cash flow—with detailed explanations and actionable insights to guide your efforts.

Revenue Projections: Understanding Growth and Retention

Revenue projections form the backbone of any financial model. For SaaS businesses, the recurring nature of revenue from subscriptions makes this process both more predictable and more complex. Here’s how to approach it effectively:

Cohort Analysis: Cohort analysis involves segmenting your customers into groups based on when they signed up or their behavior. Tracking these groups helps identify patterns such as retention, upsell potential, and churn rates. Why It’s Important: By understanding how specific cohorts behave, you can make more accurate predictions about future revenue.

Example: A SaaS company might track customers acquired during a holiday marketing campaign to measure retention and conversion to higher-tier plans.

Subscription Tiers: Most SaaS businesses offer multiple pricing tiers—basic, standard, and premium. Your financial model should reflect the distribution of customers across these tiers and their likelihood of upgrading or downgrading. Why It’s Important: Each tier has different revenue implications. Tracking movement between tiers provides insights into customer behavior.

Example: If 30% of customers on the basic tier upgrade within six months, you can include this in your MRR and ARR growth assumptions.

Upsell, Cross-Sell, and Expansion Revenue:

Upsell: Convincing customers to switch to higher-tier plans.

Cross-Sell: Selling additional products or services.

Expansion Revenue: Increasing revenue from existing customers without acquiring new ones.

Why It’s Important: These strategies can significantly boost revenue without the high costs associated with acquiring new customers.

Example: A SaaS marketing tool offers analytics as a premium add-on, driving 10% additional revenue per customer.

Pro Tip: Use historical data and industry benchmarks to ground your revenue assumptions.

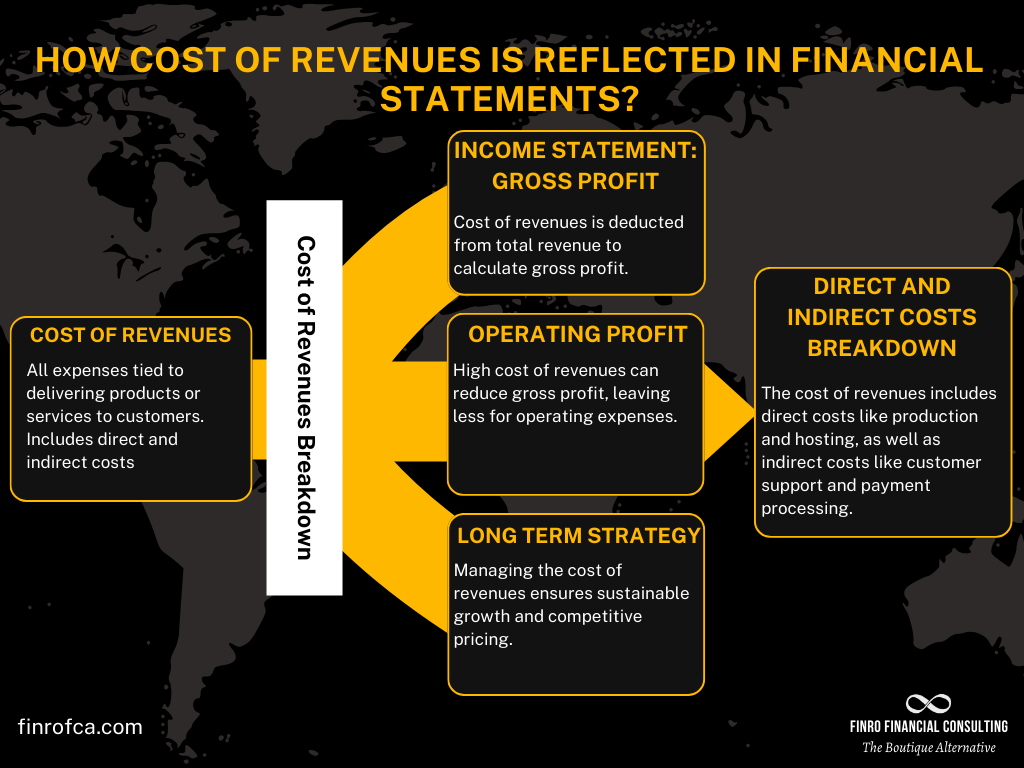

Cost of Revenues: Breaking Down Direct Costs

The cost of revenues (CoR) represents the direct expenses incurred in delivering your SaaS product. Understanding and managing these costs is critical for maintaining healthy gross margins, a key metric for investors.

Hosting Costs: These include expenses for cloud infrastructure, server maintenance, and data storage. Why It’s Important: Hosting costs tend to scale with user growth, so they should be carefully monitored.

Example: A SaaS startup using AWS might pay $1,000 monthly for storage and computing resources, increasing as more users join.

Customer Support Costs: This covers salaries for support teams and tools such as help desk software. Why It’s Important: Quality customer support improves retention and reduces churn, making it an investment in long-term revenue.

Example: Support tools like Zendesk or Intercom can cost several hundred dollars per month, scaling with user volume.

Licensing Fees: Many SaaS products rely on third-party software or APIs, which come with licensing costs. Why It’s Important: Licensing fees are fixed or usage-based and directly impact margins.

Example: A SaaS platform using an AI-powered chatbot API might incur a fee for every user interaction.

Pro Tip: Regularly review contracts with service providers to optimize hosting and licensing fees.

Operating Expenses: Fueling Growth and Innovation

Operating expenses include all indirect costs necessary to run your SaaS business. While these expenses don’t scale linearly with revenue, they play a critical role in determining your burn rate and efficiency.

Marketing and Sales: Marketing and sales expenses include costs for campaigns, software tools, and salaries for your sales team. Why It’s Important: Customer acquisition drives revenue, but inefficient spending here can inflate your CAC. Example: A SaaS startup spending $20,000 monthly on paid ads should track the ROI to ensure sustainable CAC.

Research and Development (R&D): R&D expenses include salaries for developers, product managers, and designers, as well as investments in innovation. Why It’s Important: Continuous product improvements are essential for staying competitive and retaining customers. Example: A SaaS company allocating 40% of its budget to R&D might release quarterly updates to enhance user experience.

Administrative Costs: These cover general operational expenses like legal fees, HR, and payroll services. Why It’s Important: While these costs don’t directly contribute to revenue, they are necessary to maintain compliance and support growth. Example: Legal expenses for drafting customer contracts or handling intellectual property rights.

Pro Tip: Benchmark your spending on marketing, R&D, and administrative costs against industry standards to ensure efficiency.

Cash Flow: Tracking Your Startup’s Lifeline

Cash flow is the lifeblood of your SaaS business.

Positive cash flow ensures you can sustain operations, reinvest in growth, and avoid funding gaps.

Cash Runway: The cash runway tells you how long your startup can operate before running out of money. Why It’s Important: Investors want to see a runway of at least 12-18 months, especially during early-stage funding rounds. Example: If your monthly burn rate is $50,000 and you have $600,000 in cash, you have a 12-month runway.

Burn Rate: The burn rate measures how quickly your startup is spending cash. Why It’s Important: A high burn rate is acceptable in high-growth phases, but it must be sustainable. Example: A startup burning $100,000 per month on aggressive marketing should ensure it leads to proportional revenue growth.

Scenario Planning: Scenario planning helps you prepare for uncertainties by modeling different outcomes. Why It’s Important: This allows you to anticipate challenges and make informed decisions. Example: Model a worst-case scenario where churn increases by 5% to assess its impact on revenue and runway.

Pro Tip: Build cash flow projections that align with your growth strategy and funding goals.

How Financial Models Influence Valuation

With the components of a SaaS financial model and their role in projecting growth now clearly established, it’s time to focus on how these models influence valuation.

A financial model isn’t just a document for internal planning—it’s a strategic tool that shapes how investors perceive your startup’s potential and worth.

By connecting financial projections with valuation metrics and methods, a strong model can directly enhance your credibility and ultimately the price investors are willing to pay.

Investor Confidence and Financial Models

Building investor confidence begins with demonstrating a clear understanding of your business’s mechanics, scalability, and financial health.

The financial model you present should go beyond surface-level projections and delve into realistic, data-driven scenarios that illustrate your grasp of operational challenges and opportunities.

Investors want to see clarity, transparency, and depth.

A well-structured model that details your revenue streams, cost drivers, and cash flow trajectory signals that you’ve done your homework.

For example, breaking down revenue growth by customer cohorts or showcasing how subscription tiers impact revenue builds confidence that you’re not only prepared for growth but also equipped to navigate potential risks.

Including multiple scenarios—best case, worst case, and most likely—further shows investors that you’ve accounted for uncertainties and can adapt when needed.

Confidence from investors isn’t built solely on the numbers but also on how those numbers are presented. A financial model that is easy to follow, explains its assumptions clearly, and ties them to industry benchmarks creates a sense of trust.

This trust paves the way for investors to believe in your ability to execute the strategies you’ve outlined. As we move into key valuation metrics, it’s important to see how certain numbers within your model weigh heavily on investor decisions.

Key Metrics That Drive Valuation

The metrics in your financial model are more than just data points—they are the language investors use to evaluate the health and potential of your business. A clear example is the CAC-to-LTV ratio, which reflects the sustainability of your customer acquisition strategy.

This ratio compares the cost of acquiring a new customer (Customer Acquisition Cost) to the Lifetime Value of that customer. A strong CAC-to-LTV ratio, typically around 3:1 or higher, tells investors that your customer acquisition efforts are both efficient and profitable over time. Conversely, a low ratio might raise concerns about the scalability of your growth strategy or the effectiveness of your marketing spend.

Another critical metric is gross margin, which measures the profitability of your core operations by showing what percentage of revenue remains after subtracting the cost of delivering your service.

SaaS businesses, with their relatively low delivery costs, typically have gross margins above 70%. A high gross margin signals to investors that your business has strong scalability and the potential for substantial profits as you grow.

On the other hand, a gross margin below industry norms could indicate inefficiencies or overly high costs tied to customer support, hosting, or licensing.

When your financial model highlights these metrics clearly, it gives investors a concise way to evaluate your performance and potential. Investors rely on these indicators not only to assess your current standing but also to apply valuation multiples appropriately.

This seamless connection between metrics and valuation underscores why these figures are essential. Next, let’s explore how these metrics feed into valuation methods and shape the way SaaS businesses are valued by investors.

Connecting Financial Models to Valuation Methods

Having established the importance of metrics like CAC-to-LTV and gross margin, the next step is understanding how they tie into the valuation methods investors use to assess SaaS businesses.

Financial models aren’t just repositories for data—they’re the foundation for valuation frameworks, providing the assumptions and projections that influence an investor’s final number.

For SaaS startups, valuation often revolves around revenue multiples. Investors will typically apply a multiple to your Annual Recurring Revenue (ARR) to estimate your company’s value.

For example, a startup with $2 million in ARR might be valued at a 10x multiple if it demonstrates strong growth, high gross margins, and low churn.

However, if your financial model shows issues like inconsistent growth or inefficient customer acquisition, that multiple could drop significantly.

Another common method is the Discounted Cash Flow (DCF) model, which values a company based on its future cash flows, discounted back to their present value. Here, the accuracy and detail in your cash flow projections become critical.

Investors will scrutinize the assumptions underlying your projections, such as your burn rate, revenue growth, and operating expenses, to determine how realistic your valuation is. A financial model that connects these inputs clearly and realistically can make the DCF method work in your favor.

Ultimately, the link between your financial model and valuation methods is what investors rely on to make decisions. A clear, detailed model not only justifies your valuation but also builds trust in your ability to deliver on your business plan.

With this connection established, let’s turn our attention to the common mistakes startups should avoid when building their financial models to ensure they maximize investor confidence.

Common Mistakes to Avoid

Having explored how financial models influence valuation and the importance of key metrics and multiples, it’s equally vital to understand the pitfalls that can undermine the credibility of your projections.

Even the most sophisticated models can fall short if they rely on flawed assumptions or overlook critical factors.

Here are some common mistakes SaaS founders should avoid to ensure their financial models remain robust and reliable.

Overestimating Customer Acquisition or Retention Rates

One of the most frequent errors is being overly optimistic about how quickly you can acquire customers or how long they’ll stick around. While ambition is important, projections that lack grounding in historical data or market trends can raise red flags for investors.

For example, assuming a rapid increase in customer sign-ups without accounting for seasonal demand or realistic marketing efforts can make your revenue forecasts seem inflated.

To avoid this, use a data-driven approach to estimate acquisition and retention rates. Analyze your historical performance, compare it with industry benchmarks, and consider external factors like market saturation or competition. Investors value realism over ambition, and grounded projections help build trust in your business.

Ignoring Churn and Its Impact on Projections

Churn is an inevitable part of any SaaS business, yet many models downplay or completely ignore its impact.

High churn rates can erode your recurring revenue base, nullifying growth from new customers.

For example, if 10% of your customers churn every month, even aggressive acquisition efforts may only replace lost revenue rather than generate meaningful growth.

Your financial model should explicitly account for churn and include strategies for reducing it, such as improving customer engagement or introducing loyalty programs. This demonstrates that you’re not only aware of the problem but are actively managing it.

Failing to Align Projections with Historical Performance or Market Benchmarks

Projections that deviate significantly from your past performance or industry standards can quickly lose credibility. If your revenue growth or gross margin projections are dramatically higher than what you’ve achieved historically, investors will question the assumptions behind them.

To address this, ensure your projections align with your startup’s historical trends and benchmarks from similar companies.

For example, if industry benchmarks show a 5% monthly MRR growth rate for early-stage SaaS companies, projecting 15% without a clear rationale will raise doubts. Aligning your forecasts with realistic expectations strengthens your case for investors.

Neglecting to Stress-Test Models for Scalability

SaaS startups are often built with the promise of scalability, but failing to stress-test your financial model can leave you unprepared for the realities of growth.

For example, as your customer base expands, hosting costs may increase disproportionately, or support teams may struggle to handle the workload. Without scalability stress tests, these hidden costs can disrupt your financial stability.

Stress-testing your model involves running different scenarios—such as faster-than-expected customer growth or a spike in churn—to identify potential bottlenecks. This allows you to refine your cost assumptions and build contingencies into your forecasts.

Demonstrating that your model can handle scale reassures investors of your operational resilience.

By avoiding these common pitfalls, you can create a financial model that not only reflects the realities of your business but also inspires confidence in its potential. With the foundation now set, let’s explore actionable next steps for leveraging your financial model to guide strategic decisions and secure investor buy-in.

Conclusion

Crafting a financial model for your SaaS startup isn’t just a box to check—it’s a strategic tool that can shape the way investors perceive your business and guide your decision-making as you scale.

A well-built model lays out a clear picture of how your business generates revenue, controls costs, and plans for growth. It highlights the metrics investors care about most, ties them to valuation methods, and provides a roadmap for navigating opportunities and challenges.

Throughout this article, we’ve explored the core components of a SaaS financial model, the key metrics that drive valuation, and how to avoid common mistakes. Whether it’s accurately projecting revenue using cohort analysis, accounting for churn, or stress-testing your model for scalability, the goal is to build a financial narrative that inspires confidence and stands up to scrutiny.

As you refine your model, remember that it’s not just about presenting numbers—it’s about telling the story of your SaaS business and its potential. Investors are looking for clarity, realism, and a deep understanding of your market. By delivering that, you’re not only improving your valuation but also laying the groundwork for long-term success.

If you’re ready to take your SaaS financial model to the next level or need expert guidance in building one, Finro is here to help. Let’s work together to ensure your model becomes a powerful tool for growth and investment. Contact us today to get started.

Key Takeaways

1. Revenue Projections Matter: Use cohort analysis, subscription tiers, and upsell strategies to create realistic and scalable revenue forecasts.

2. Focus on Key Metrics: CAC-to-LTV, churn, and gross margin directly influence SaaS valuation and investor confidence.

3. Align with Benchmarks: Projections should reflect historical performance and industry standards to ensure credibility with investors.

4. Account for Churn: Ignoring churn undermines revenue projections—build strategies to reduce it and highlight retention efforts.

5. Stress-Test Your Model: Prepare for scalability by modeling growth scenarios and identifying potential bottlenecks in costs or operations.

Answers to The Most Asked Questions

-

A SaaS financial model projects revenue, costs, and cash flow, showcasing metrics like CAC, LTV, and churn to demonstrate growth and scalability.

-

SaaS valuations often use revenue multiples, calculated by multiplying Annual Recurring Revenue (ARR) by an industry benchmark adjusted for growth, churn, and margins.

-

CAC-to-LTV ratio, churn rate, MRR/ARR growth, and gross margin are critical for showing operational efficiency and long-term revenue potential.

-

Use cohort analysis, subscription tiers, and upsell strategies to project Monthly Recurring Revenue (MRR) and Annual Recurring Revenue (ARR) accurately.

-

Avoid overestimating retention, ignoring churn, misaligning with benchmarks, or neglecting stress tests for scalability to maintain credibility with investors.