Creating Effective, Jargon-Free Financial Models

By Lior Ronen | Founder, Finro Financial Consulting

Financial models are at the heart of any startup’s strategy, helping founders make informed decisions and secure investor confidence. But all too often, these models are loaded with jargon and unnecessary complexity, leaving stakeholders confused instead of reassured.

An effective startup financial model shouldn’t feel like decoding a secret language. By focusing on clarity and simplifying key concepts, you make your model accessible to a broader audience—whether it’s potential investors, advisors, or your own team.

This guide is here to help. We’ll walk through practical steps to create a jargon-free financial model that communicates your business’s potential with precision and confidence. It’s about presenting your numbers in a way that speaks to everyone, not just the experts.

A clear and concise financial model communicates a startup’s vision and strategy effectively, fostering trust and engagement among investors, advisors, and team members. By simplifying jargon, standardizing terminology, and visualizing data, startups can make their models accessible to all stakeholders, enabling better decision-making and alignment. Emphasizing clarity in financial models not only enhances understanding but also demonstrates professionalism, builds confidence, and ensures that the business’s potential is communicated with impact and precision.

- Why Simplicity Matters in Startup Financial Models?

- Breaking Down the Building Blocks of a Startup Financial Model

- Practical Tips for a Jargon-Free Financial Model

- Be Concise and Clear

- Explain Abbreviations and Acronyms

- Provide Context for Industry-Specific Terms

- Use Consistent Terminology

- Visualize for Better Understanding

- Encourage Feedback and Iteration

- The Stakeholder Perspective: Building Confidence Through Clarity

- Conclusion

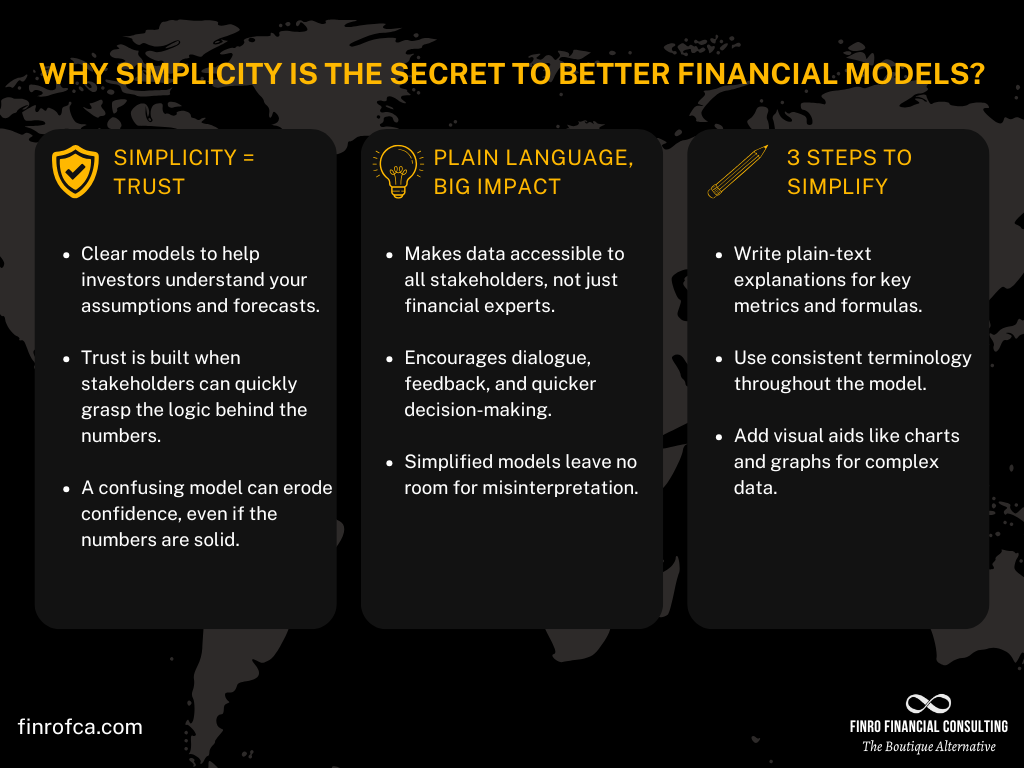

Why Simplicity Matters in Startup Financial Models?

A startup financial model isn’t just a spreadsheet; it’s a tool that tells your business’s story. When done right, it builds trust, facilitates decisions, and provides clarity about your company’s path forward. But the value of this tool depends on its ability to communicate effectively, and that’s where simplicity comes in.

Overcomplicated models—filled with jargon and unclear assumptions—can easily undermine confidence. Investors might second-guess your forecasts, and even your team could struggle to align on priorities if the numbers are too hard to follow.

Simplicity, on the other hand, signals that you have a firm grasp of your business fundamentals and can explain them to anyone who needs to understand them.

Plain language plays a crucial role in this. When financial models are easy to follow, they invite engagement and build confidence. Investors are more likely to trust projections they understand, and stakeholders are more likely to support decisions based on transparent data.

By focusing on simplicity, you’re not just improving the readability of your model—you’re strengthening its impact as a decision-making tool and as a bridge between your business and its stakeholders.

Next, let’s break down the essential elements of a startup financial model and explore how to present them clearly and effectively.

Breaking Down the Building Blocks of a Startup Financial Model

As we’ve seen, simplicity and clarity are vital for building trust and confidence in your financial model.

Now, let’s take a closer look at the core components of a startup financial model and how to present them in a way that resonates with stakeholders.

At its heart, a startup financial model is more than just numbers—it’s a story told through data. Each element plays a role in painting a clear picture of your business’s potential and growth trajectory. Here are the key building blocks and how to approach them in plain terms:

Revenue: This is your story’s protagonist, showing how your startup plans to generate income. Break revenue down by streams (e.g., product sales, subscriptions) and use straightforward labels. For example, instead of “GR” or “ARR,” write “Gross Revenue” or “Annual Recurring Revenue,” and provide a one-line description for clarity.

Costs: These are the challenges your protagonist faces—what it takes to operate your business. Separate costs into logical categories like Cost of Goods Sold (COGS) and operating expenses. Include brief explanations for non-obvious items, such as “COGS includes material and labor costs directly tied to producing our product.”

Projections: Think of these as the plot twists—what your business’s future looks like based on your assumptions. Use charts to show trends in revenue growth, cost control, or profit margins over time. Clearly outline the assumptions driving these projections, such as market growth rates or customer acquisition costs, so readers understand the basis of your forecasts.

Each of these components should work together to tell a cohesive story about your startup. Avoid presenting them as isolated numbers; instead, connect the dots.

For example, highlight how an investment in marketing impacts revenue growth or how scaling operations might initially raise costs but improve profitability in the long run.

By weaving these building blocks into a narrative, you ensure that your financial model isn’t just a set of figures but a tool that engages and persuades.

Next, we’ll explore actionable tips for keeping your model jargon-free and accessible, ensuring every stakeholder can understand your story.

Practical Tips for a Jargon-Free Financial Model

Building on the importance of simplicity and the core components of a startup financial model, let’s focus on actionable ways to make your financial model more accessible.

A jargon-free model doesn’t just communicate data—it ensures clarity for all stakeholders, no matter their level of expertise. Here are six practical tips to achieve that balance.

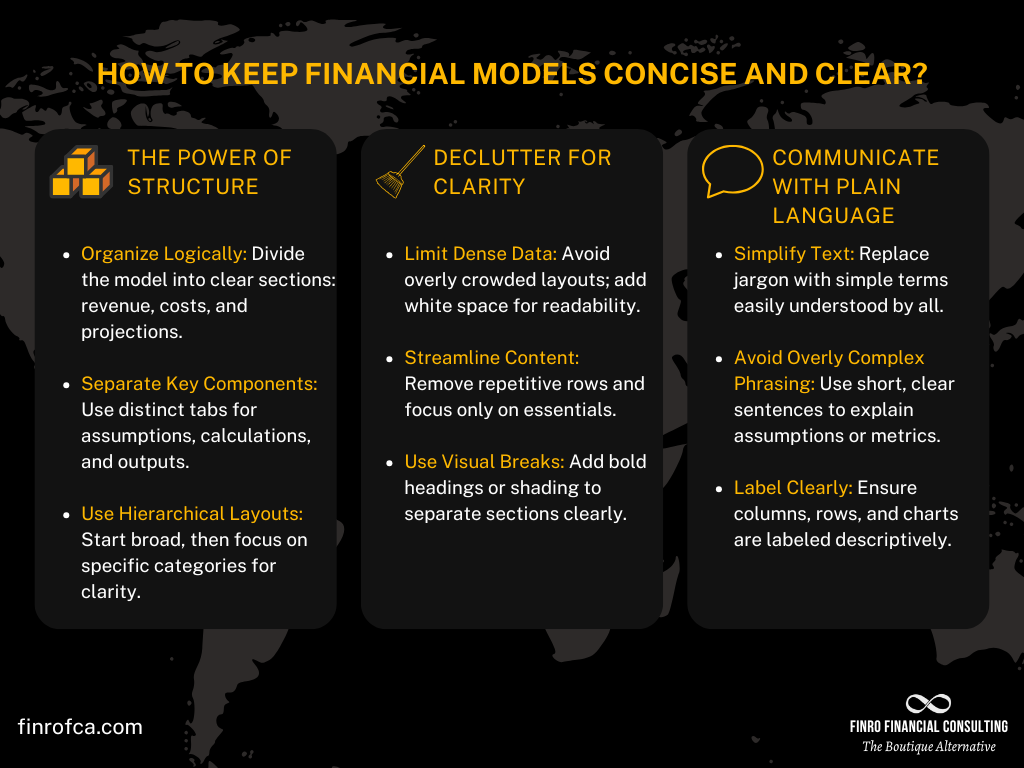

Be Concise and Clear

Simplicity is the foundation of an effective financial model. A model filled with unnecessary details, overly complex layouts, or hard-to-follow calculations can overwhelm your audience and reduce the impact of your work.

Clarity and conciseness allow your financial model to do what it’s meant to: communicate insights and guide decisions.

Being concise doesn’t mean cutting corners; it means presenting the information in a way that’s easy to understand without sacrificing accuracy. For example, when calculating revenue growth, you might be tempted to cram everything into a single, dense table or write all your assumptions in one long paragraph. This approach might save space, but it can create confusion for anyone trying to follow your thought process.

Instead, break down key components into manageable sections, each clearly labeled and logically structured. For example, rather than mixing all revenue streams (subscriptions, product sales, etc.) into one row, create separate lines for each. Add clear headings and use formatting, like bold text or shading, to distinguish sections such as revenue, costs, and projections. A well-structured model lets users scan quickly to find the information they need.

Additionally, when documenting assumptions, aim for simple, plain language. Instead of describing something like “a synergistic increase in customer lifetime value due to retention optimizations,” say, “We expect customers to stay longer, increasing their total spending over time.” This approach avoids jargon while still conveying the same idea.

Lastly, review your work for any clutter. Are there unnecessary tabs? Are you using abbreviations or shorthand that might not be obvious? Simplify these areas, ensuring that your financial model is intuitive for anyone opening it for the first time.

By focusing on concise, clear communication, you’re not just improving the readability of your financial model—you’re making it a tool that stakeholders will trust and rely on.

Explain Abbreviations and Acronyms

Abbreviations and acronyms can make financial models more concise, but they often come at the cost of clarity. While terms like CAC (Customer Acquisition Cost) or LTV (Lifetime Value) may be second nature to founders and financial experts, they can confuse investors, advisors, or team members who are less familiar with industry-specific language. The key is to bridge this gap by making these terms easy to understand.

Start by recognizing that not everyone reviewing your model has the same level of expertise. Investors or team members from non-financial backgrounds might not immediately grasp what an acronym represents or why it matters.

For example, seeing “CAC” on a revenue assumptions tab without any explanation might leave someone guessing whether it refers to a cost, a metric, or something entirely different.

To address this, include a glossary or quick reference guide within your financial model. For instance, you can dedicate a sheet to defining common terms used throughout the model. Keep definitions short and practical, like this:

CAC: The cost of acquiring a single customer, calculated by dividing total marketing and sales expenses by the number of new customers acquired.

LTV: The total revenue a customer generates over their relationship with your business.

You can also use notes or comments within the model itself. For example, hover-over tooltips or small notes in relevant cells can provide quick explanations without cluttering the layout. This is particularly useful for terms that appear repeatedly, such as ARR (Annual Recurring Revenue) or MRR (Monthly Recurring Revenue) in SaaS models.

The benefits of this approach go beyond just avoiding confusion. When you clearly define abbreviations and acronyms, you signal that you understand your audience and are willing to take the extra step to ensure they feel informed and confident. This builds trust and makes your financial model a more effective communication tool.

Ultimately, explaining terms doesn’t just simplify your financial model—it opens the door for meaningful discussions and ensures that every stakeholder is on the same page. In the next section, we’ll explore how adding context to industry-specific terms further enhances clarity and engagement.

Provide Context for Industry-Specific Terms

Industry-specific terms are an unavoidable part of many financial models, especially in startups operating in niche markets. While these terms provide precision, they can alienate stakeholders who aren’t familiar with your industry. Providing clear context for these terms is crucial to ensuring your financial model remains accessible and effective.

Consider metrics commonly used in SaaS businesses, such as ARR (Annual Recurring Revenue) or churn rate. For someone outside the SaaS world, these terms might be unfamiliar or, worse, misinterpreted. Without additional context, they could fail to grasp the significance of these metrics in understanding your company’s performance and growth potential.

Adding context doesn’t require long explanations. Instead, briefly describe what each term means and why it matters to your business. For example:

ARR: “The revenue generated annually from active subscriptions. This metric shows the stability of recurring income streams.”

Churn Rate: “The percentage of customers who stop using our service. Lower churn indicates stronger customer retention.”

Beyond defining terms, connect them to your company’s goals or strategy. For instance, explain how reducing churn might improve your Customer Lifetime Value (LTV) or how a high ARR contributes to predictable cash flow. This connection helps stakeholders see not just what a term means but why it’s relevant to your business story.

Visuals can also play a big role in providing context. Use charts or graphs to complement your explanations. For example, show a trendline of your ARR over time alongside the definition to help illustrate the concept.

By providing context for industry-specific terms, you ensure that your financial model speaks to everyone involved, regardless of their familiarity with your industry. This builds confidence and fosters better conversations about your business’s potential.

Next, we’ll discuss how consistency in terminology across your model enhances readability and eliminates confusion.

Use Consistent Terminology

Consistency in terminology may seem like a minor detail, but it plays a major role in how effectively your financial model communicates. When terms are used inconsistently, it can create confusion and reduce trust among stakeholders, especially those unfamiliar with your business or financial modeling practices.

For example, using “profit” in one section and “net income” in another to describe the same concept can make readers wonder if they’re actually different metrics. Similarly, interchanging terms like “sales” and “revenue” without clarification might lead to unnecessary questions about whether they represent different data points.

The key is to select one term for each concept and use it consistently throughout your model. If you choose to call it “net income,” stick with that phrase rather than alternating with “profit” or “earnings.” For metrics like “CAC” (Customer Acquisition Cost) or “LTV” (Lifetime Value), define them clearly once and use those exact terms across all tabs, charts, and explanations.

Consistency isn’t just about words—it extends to formats and labels. Ensure your charts, tables, and column headers use the same terminology as your calculations. If one tab calls a line item “Operating Costs,” avoid referring to it as “Operational Expenses” elsewhere. Small inconsistencies like this can cause readers to pause and question the data’s reliability.

In addition to building clarity, consistent terminology enhances the professionalism of your financial model. A well-structured and clearly labeled model signals that you’ve put thought into both your numbers and how you communicate them, which can boost stakeholder confidence in your work.

By adopting a consistent approach, you make your financial model easier to follow, reduce the potential for misinterpretation, and improve its overall impact. Next, we’ll explore how adding visual elements, like charts and graphs, can further enhance clarity and understanding.

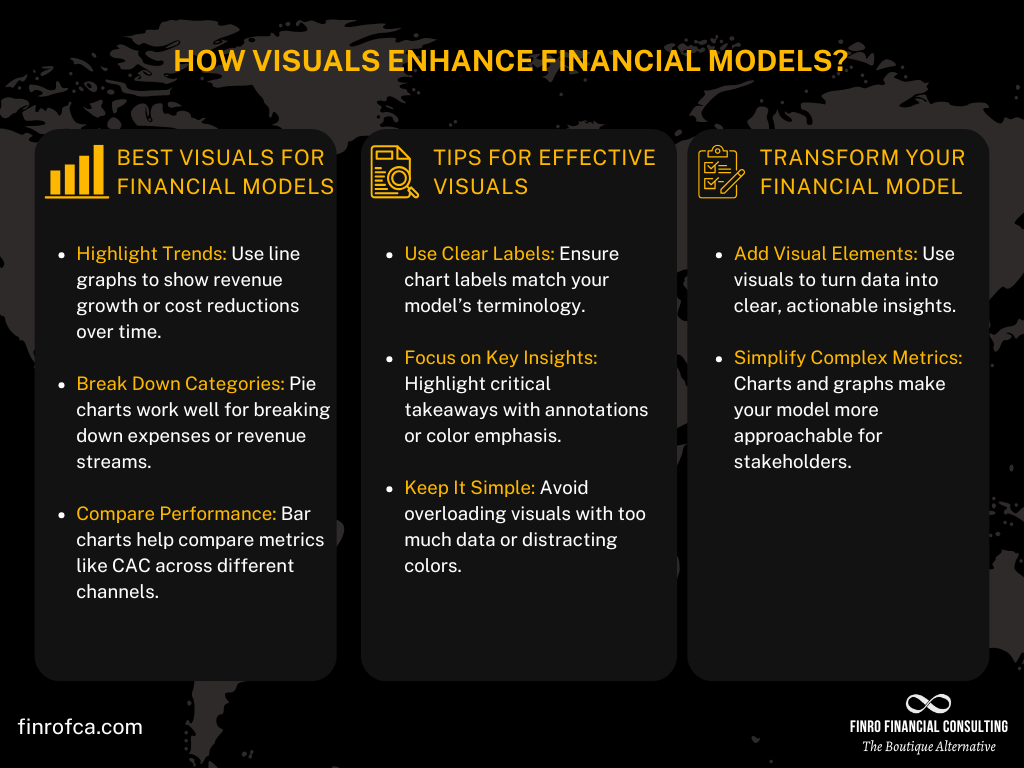

Visualize for Better Understanding

Numbers tell a story, but visuals bring it to life. Financial models often contain large amounts of data, and presenting that data purely in rows and columns can overwhelm even the most experienced stakeholder. Visual elements like charts, graphs, and tables simplify complex information, making it more engaging and easier to understand.

Think about presenting revenue growth over time. A line graph showing upward trends immediately communicates the idea far more effectively than rows of monthly revenue figures. Similarly, a pie chart can break down operating expenses into categories, giving stakeholders an instant view of where resources are allocated.

Good visuals don’t just summarize data—they highlight what’s important. For instance, you can use a bar chart to compare customer acquisition costs (CAC) across different channels, helping stakeholders quickly see which channels deliver the best return. Add brief labels or annotations to call attention to key takeaways, like “Paid ads accounted for 60% of new customers.”

When using visuals, consistency remains key. Align your graphs’ labels and terms with those in your financial model. If you refer to “Operating Costs” in your data, don’t label it “Expenses” in your chart. Choose colors that are easy to differentiate and avoid overloading a single visual with too much information.

By integrating thoughtful visuals, you make your financial model more approachable, actionable, and memorable. This isn’t just about aesthetics; it’s about ensuring stakeholders can absorb the key insights you’re presenting.

Next, we’ll discuss how to gather feedback and refine your financial model for maximum clarity and effectiveness.

Encourage Feedback and Iteration

Even the best financial models can benefit from fresh perspectives. Inviting feedback from stakeholders, whether they’re investors, advisors, or team members, ensures your model is clear, comprehensive, and aligned with their expectations. It also highlights areas where assumptions or data might need clarification or adjustment.

Feedback helps you identify blind spots. For example, you might assume that a metric like “LTV” (Customer Lifetime Value) is self-explanatory, but a stakeholder might question its calculation or relevance. This gives you the chance to refine how you present the metric or even revisit its underlying assumptions.

Iteration is just as important as gathering feedback. After receiving input, make necessary adjustments and simplify sections that caused confusion. For example, if investors frequently ask about a particular revenue assumption, consider adding a note or commentary to explain it more clearly.

Creating a feedback loop is particularly valuable for startups that update their financial models regularly. As new data becomes available or business goals evolve, revisiting the model ensures it remains relevant and easy to understand. Sharing updated versions with stakeholders shows that you value their input and are committed to transparency.

Incorporating feedback not only strengthens your financial model but also builds trust with your audience. Stakeholders are more likely to engage with and support your projections when they feel their questions and concerns have been addressed.

With the building blocks of a clear, jargon-free financial model now in place, let’s explore how these strategies come together to strengthen relationships with your stakeholders and drive better decision-making.

The Stakeholder Perspective: Building Confidence Through Clarity

A startup’s financial model is more than just numbers and projections—it’s a communication tool that shapes how stakeholders perceive your business.

Whether you’re working with investors, advisors, or team members, clarity in your financial model is essential to building trust and confidence. A well-structured, easy-to-follow model shows that you understand your business and are prepared to navigate its complexities.

Investors, for example, often evaluate dozens of financial models as they assess opportunities. A model that’s clear and straightforward stands out, making it easier for them to grasp your assumptions and vision.

Clarity reduces the likelihood of unnecessary questions and builds their confidence in your ability to execute. Conversely, a confusing or inconsistent model might raise red flags about your preparedness, even if the underlying numbers are strong.

Advisors and mentors also benefit from a clear financial model. They’re there to help you refine your strategy and identify risks, but their input depends on their ability to understand your numbers.

When your model is clear, they can provide more precise feedback and offer actionable insights without wasting time deciphering complex terms or disorganized data.

Clarity isn’t just for external stakeholders. Within your team, a well-crafted financial model ensures everyone is aligned on goals, priorities, and resource allocation.

For example, if your model clearly outlines the relationship between marketing spend and revenue growth, your marketing team can better advocate for budget increases based on tangible ROI projections. When team members can see how their efforts contribute to the broader business strategy, it fosters engagement and accountability.

Clarity in Action: A Success Story

A SaaS startup preparing for a seed funding round decided to simplify its financial model after struggling to gain traction with investors. By replacing jargon-heavy terms like “synergistic growth in ARR” with plain language—“Our subscription revenue is projected to grow 20% annually”—and visualizing customer acquisition trends with a simple line graph, they immediately saw a shift in investor feedback.

Questions about the model decreased, discussions about the business strategy deepened, and within two months, they secured the funding they needed.

Another example comes from an e-commerce startup refining their internal financial model to better communicate priorities to their operations team. By breaking down costs into categories like “shipping expenses” and “product sourcing,” and pairing those with visual comparisons of spending trends, they enabled their team to identify inefficiencies and cut costs by 15% in just six months.

These stories highlight the transformative power of a clear financial model. Whether you’re seeking funding, refining strategy, or aligning your team, clarity is the foundation for stronger relationships and smarter decision-making.

Conclusion

A startup financial model is more than just projections and calculations—it’s a tool to communicate your vision, strategy, and potential. By focusing on clarity, consistency, and accessibility, you transform your model into a bridge between your numbers and your stakeholders, whether they’re investors, advisors, or team members.

Simplicity and clarity don’t just make your model easier to understand; they build trust. Investors are more likely to believe in your projections, advisors can provide sharper insights, and your team can align their efforts with confidence. Each stakeholder sees your business not just as a set of numbers, but as a well-planned, cohesive strategy.

We’ve covered how to simplify complex jargon, standardize terminology, and visualize your data for maximum impact. These steps aren’t just about aesthetics—they’re about ensuring your financial model works as an effective communication tool. The more accessible your model, the more powerful it becomes in driving decisions and fostering engagement.

In the fast-paced world of startups, clarity can be your competitive edge. A financial model that speaks to everyone, regardless of expertise, is more than a spreadsheet—it’s a catalyst for growth, collaboration, and success. Now it’s your turn to take these strategies and build a financial model that not only reflects your business but elevates it.

Key Takeaways

Clarity Builds Trust: A clear financial model fosters investor confidence, strengthens team alignment, and enhances stakeholder engagement.

Simplify Complex Jargon: Replace industry terms with plain language to make your financial model accessible to all stakeholders.

Use Consistent Terminology: Standardize terms across your financial model to avoid confusion and maintain professionalism.

Visuals Enhance Understanding: Charts and graphs simplify complex data, highlight trends, and improve stakeholder comprehension of key metrics.

Iterate with Feedback: Gather input from stakeholders to refine and improve your financial model, ensuring clarity and accuracy.