Cybersecurity Valuation Multiples: 2025 Insights & Trends

By Lior Ronen | Founder, Finro Financial Consulting

Cybersecurity is no longer a back-office concern—it’s a front-line business priority. As cyber threats evolve and industries depend more on digital infrastructure, cybersecurity companies are at the heart of safeguarding critical systems and sensitive data.

or investors, founders, and business leaders, understanding the valuation of cybersecurity startups is about more than numbers—it’s about spotting opportunity, assessing risk, and making decisions that align with market realities.

From groundbreaking innovation in endpoint protection to sophisticated identity management solutions, the cybersecurity landscape is diverse, competitive, and growing.

If you’re curious about the factors shaping these valuations, this article covers the essentials.

For those looking for a deeper dive, we’ve compiled a detailed spreadsheet analyzing 200+ cybersecurity companies, including metrics like revenue multiples, EBITDA multiples, and more.

You can download it for €29.90 and access the full picture of this evolving market.

Let’s get started.

The cybersecurity sector is a critical pillar of the digital economy, driven by increasing digital transformation and the growing sophistication of cyber threats. With diverse niches like Cloud Security, Endpoint Security, and Identity and Access Management, companies in this space address unique challenges and opportunities.

Investors, startups, and established businesses alike rely on key valuation metrics—such as revenue multiples, EBITDA multiples, and discounted cash flow analysis—to make informed decisions. Market trends reveal rising valuations for high-growth niches, strong demand for identity solutions, and premiums for private companies. Understanding these dynamics is crucial for navigating the future of cybersecurity and leveraging the opportunities it offers.

Understanding Cybersecurity

Cybersecurity is more than just a technical requirement; it’s the backbone of our digital lives. In a world where data is as valuable as currency, the stakes for protecting it have never been higher.

Businesses, governments, and individuals all rely on cybersecurity to keep information safe, operations running smoothly, and trust intact.

Before diving into how we evaluate the worth of cybersecurity companies, let’s first grasp what cybersecurity truly entails and why it’s essential in today’s landscape.

What is Cybersecurity?

Cybersecurity refers to the practice of protecting data, systems, and networks from unauthorized access, theft, and damage caused by malicious actors.

It encompasses a wide range of technologies, processes, and practices designed to defend against attacks that can compromise the confidentiality, integrity, and availability of information.

From preventing breaches in critical infrastructure to securing personal data, cybersecurity plays a foundational role in maintaining trust and safety in our increasingly digital world.

Its importance spans industries, governments, and individuals alike, making it a priority for anyone relying on technology—which is practically everyone.

Why is Cybersecurity Essential?

The need for cybersecurity has never been greater. Digital transformation has made organizations more interconnected and reliant on technology than ever before. This dependence, however, comes with increased vulnerabilities.

Cyber threats are growing more sophisticated, targeting everything from financial institutions to healthcare systems and even individual users.

Cybersecurity isn’t just about stopping threats—it’s about enabling growth and innovation without compromising security. Companies that invest in robust cybersecurity solutions can protect their assets, comply with regulations, and foster trust with their customers. As the saying goes, security is no longer a cost—it’s an investment in resilience.

With the importance of cybersecurity established, let’s explore how we can measure and evaluate the worth of companies operating in this space.

Cybersecurity spans diverse niches, each tackling unique challenges to secure digital assets. Check out the infographic below for a closer look at these critical areas.

Now that we’ve set the stage, let’s dive into the valuation metrics that help assess cybersecurity companies.

Valuation Metrics and Their Relevance

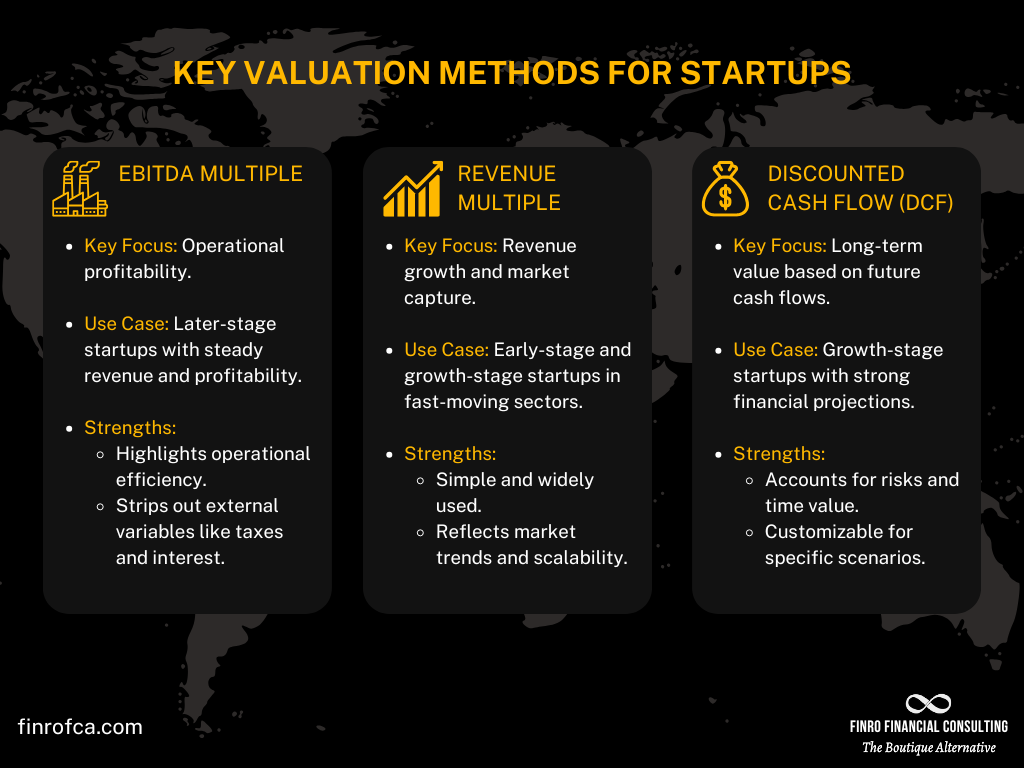

The previous sections highlighted the growing importance of cybersecurity in today’s digital landscape and provided an overview of its many niches.

Now, let’s delve into the metrics that help measure the value of cybersecurity companies, enabling investors and stakeholders to make informed decisions.

Each valuation metric offers unique insights tailored to specific business stages and operational characteristics.

Revenue Multiples (EV/Revenue)

Revenue multiples are a go-to metric for evaluating early-stage cybersecurity companies focused on growth. These companies often prioritize scaling their market presence and increasing recurring revenue streams over achieving immediate profitability.

For example, Identity and Access Management (IAM) startups often command higher revenue multiples—like 25.3x—because of their strong ARR (Annual Recurring Revenue) and the critical need for identity solutions in an increasingly remote and interconnected world.

Revenue multiples allow stakeholders to compare companies quickly, especially within niches with substantial market growth and innovation potential.

EBITDA Multiples (EV/EBITDA)

For mature cybersecurity companies, EBITDA multiples provide a window into operational efficiency and profitability. They are particularly relevant when assessing companies with a proven ability to generate profit while managing expenses effectively.

Take Endpoint Security, for instance. This niche often achieves significant EBITDA multiples, with some companies boasting figures as high as 122.8x, reflecting their established market presence and efficient operations.

These companies typically secure their revenue streams through long-term contracts and high customer retention rates.

Discounted Cash Flow (DCF)

DCF analysis goes a step further by evaluating a company’s long-term value based on its projected cash flows. This method is ideal for niches where revenue streams are stable and predictable, like Data Security.

Stable niches often benefit from DCF due to their reliance on recurring subscription-based models or ongoing demand for solutions that protect sensitive information. By projecting future cash flows, DCF highlights the intrinsic value of companies with consistent performance and growth trajectories.

By applying these valuation metrics strategically, stakeholders can better understand the value drivers within cybersecurity. Each metric offers distinct advantages depending on the company’s stage, niche, and financial profile.

Next, we’ll explore insights and trends that shape valuation dynamics across cybersecurity niches. Stay tuned for a closer look at how these metrics play out in real-world scenarios and the broader market landscape.

Trends and Insights in Cybersecurity Valuation

Having explored the valuation metrics that define cybersecurity companies, let’s turn to the broader market trends and insights shaping valuations.

These patterns provide a clearer view of where the industry is headed, which niches are thriving, and how companies are being valued across public, private, and M&A landscapes.

Overall Market Averages

Across cybersecurity, revenue multiples average 12.4x, while EBITDA multiples reach 33.7x.

These figures reflect a robust market buoyed by consistent demand for security solutions and ongoing technological innovation. While these averages provide a baseline, variations by niche reveal a deeper story about growth potential and investor priorities.

High-Growth Niches

Some cybersecurity niches stand out for their higher-than-average multiples, showcasing exceptional growth and strategic importance. Cloud Security, for instance, leads the way with public revenue multiples of 13.9x and M&A multiples of 22.7x.

The surge in remote work and migration to cloud platforms has made securing cloud environments a top priority, driving valuations upward.

Emerging Areas

The rise of Operational Technology (OT) and IoT Security underscores the increasing reliance on connected devices in industries like manufacturing, energy, and healthcare.

Investments in this area are climbing as businesses recognize the vulnerability of critical infrastructure to cyber threats.

This emerging niche reflects a growing demand for solutions that secure both traditional and modern industrial systems.

Private Companies’ Premiums

Private cybersecurity companies, particularly in high-demand niches, are commanding significant valuation premiums.

Endpoint Security startups, for example, report revenue multiples of 15.6x, signaling market optimism about their ability to scale and generate long-term value.

Investors are betting on their continued growth in response to rising threats targeting individual devices and endpoints.

M&A Trends

Mergers and acquisitions continue to highlight strategic shifts within cybersecurity. Identity and Access Management (IAM) companies are a prime example, with acquisitions averaging revenue multiples of 12.6x.

High-profile deals, such as Duo Security’s acquisition by Cisco, reflect the growing importance of identity solutions as digital ecosystems expand.

These trends illustrate the diverse valuation landscape within cybersecurity, shaped by innovation, market demand, and strategic priorities. Understanding these patterns is crucial for investors, startups, and established companies navigating the cybersecurity space.

In the next section, we’ll look at how these insights translate into actionable strategies for stakeholders, with a focus on leveraging valuation metrics for growth, investment, and innovation. Stay tuned!

Download the Full Cybersecurity Valuation Database

Building on the detailed exploration of valuation metrics and trends in the cybersecurity market, it’s clear that having access to comprehensive data is vital for making informed decisions.

Whether you’re an investor, founder, or industry professional, granular insights into this fast-evolving sector can give you a decisive edge.

Why Download the Dataset?

Our cybersecurity valuation database offers an in-depth analysis of 220+ companies and M&A deals, covering nine key niches. It’s designed to be a go-to resource for anyone looking to understand the market better, benchmark valuations, or identify growth opportunities.

What’s Inside:

Here’s what you’ll find in this robust dataset:

Revenue Multiples: Learn how companies across niches, from Cloud Security to Identity and Access Management (IAM), are valued based on their revenue growth.

EBITDA Multiples: Gain insights into operational efficiency and profitability trends across public and private companies.

Niche-Specific Insights: Explore how different niches like Endpoint Security, Data Security, and Application Security are driving market innovation.

M&A Deal Metrics: Access exclusive details on acquisition multiples, trends, and benchmarks, such as IAM companies acquired at 12.6x revenue or Cloud Security M&A multiples averaging 22.7x.

Stay Ahead in the Cybersecurity Market:

Don’t miss out on the opportunity to gain a competitive advantage. Access the full cybersecurity valuation dataset, including 220+ companies and M&A deals, for just €29.90.

With this data, you can stay ahead of market trends, make data-driven decisions, and uncover opportunities in one of the most critical industries of our time.

Next, we’ll summarize the key takeaways from this article and highlight how these insights connect to broader trends in the cybersecurity sector.

Conclusion

The cybersecurity industry is not just a growing market; it’s a cornerstone of the digital economy. From protecting critical infrastructure to securing personal data, cybersecurity solutions are integral to fostering trust in a technology-driven world.

As we’ve explored, valuation metrics like revenue multiples, EBITDA multiples, and DCF models play a vital role in assessing the worth of companies in this dynamic sector.

Key trends such as the rise of Cloud Security, the increasing focus on IoT and Operational Technology Security, and the growing premiums for private companies highlight where the market is heading.

Whether you’re an investor identifying high-growth opportunities, a startup defining your valuation story, or an established company navigating acquisitions, understanding these trends is essential.

The insights shared in this article are just the tip of the iceberg. For a deeper dive into the cybersecurity market, including detailed data on 220+ companies and M&A deals across nine niches, the Cybersecurity Valuation Database is an invaluable resource.

It’s available for €29.90 and provides the tools to make informed, strategic decisions in this fast-evolving industry.

Cybersecurity is more than a necessity; it’s an investment in resilience and innovation. As the industry continues to evolve, staying informed will be your greatest asset in navigating the future.

Whether you’re securing your business, expanding your portfolio, or driving innovation, the opportunities in cybersecurity are vast—and they’re just getting started.

Key Takeaways

1. Cybersecurity’s Critical Role: Growing digital reliance demands robust cybersecurity to safeguard data, foster trust, and drive innovation across industries.

2. Diverse Valuation Metrics

Revenue multiples suit growth-focused firms; EBITDA highlights profitability, while DCF emphasizes long-term stability and cash flow potential.

3. High-Growth Niches: Cloud Security and Endpoint Security lead valuation multiples, reflecting market optimism for scalable and innovative solutions.

4. M&A Highlights: IAM acquisitions dominate at 12.6x multiples, showcasing strong demand for identity and access management solutions in cybersecurity.

5. Detailed Insights Available: Access a comprehensive cybersecurity database with 220+ company valuations and M&A deal benchmarks for €29.90.

Answers to The Most Asked Questions

-

Revenue multiples (growth), EBITDA multiples (profitability), and DCF (long-term cash flow potential) are core metrics for assessing cybersecurity company value.

-

Cloud Security leads with public revenue multiples of 13.9x and M&A multiples of 22.7x, reflecting its high growth potential.

-

Cybersecurity protects data and systems, fosters trust, enables digital transformation, and ensures compliance with regulations amid growing cyber threats.

-

Private companies often command higher revenue multiples, such as Endpoint Security at 15.6x, reflecting market optimism and growth expectations.

-

A comprehensive database of 220+ companies, including revenue and EBITDA multiples, is available for €17.90, offering niche-specific insights.