Edtech Revenue Multiples: 2025 Insights & Trends

By Lior Ronen | Founder, Finro Financial Consulting

Edtech has come a long way from being a niche market to becoming a key player in reshaping education and professional development worldwide.

As we step into 2025, the industry continues to attract attention from investors, founders, and strategists alike, not just for its innovation but for the strong financial potential it brings to the table.

The average revenue multiple for Edtech companies in 2025 stands at 8.1x, highlighting the unique growth trajectories across niches.

From the rapid expansion of K-12 solutions to the stable performance of corporate training platforms, the data provides valuable insights into market trends and future opportunities.

For those looking to dig deeper, we’ve compiled a detailed database of over 220 Edtech companies. Available as a downloadable spreadsheet for just €29.90, it offers valuation metrics, key insights, and a comprehensive view of the industry’s movers and shakers.

Let’s break down the latest data, highlight key trends, and explore how Edtech continues to shape education and business today.

Edtech in 2025 reflects a sector thriving on innovation and growing demand, with diverse niches like K-12 solutions, corporate training, and immersive learning leading the charge. Average revenue multiples stand at 8.1x, showcasing strong investor interest despite varying niche-specific dynamics.

Valuation metrics like EV/Revenue and EV/EBITDA remain critical tools for assessing startups, emphasizing scalability, market opportunity, and financial health. With shifting trends and year-over-year analysis highlighting evolving opportunities, stakeholders are poised to navigate a market defined by its potential to transform global education.

What is Edtech?

Edtech, short for educational technology, refers to the innovative tools and solutions designed to enhance teaching, learning, and training processes.

These include everything from interactive apps for young learners to sophisticated AI-driven platforms for workforce upskilling. The sector spans a wide range of niches, each addressing unique challenges within education and professional development.

For example, K-12 Education Solutions focus on creating digital tools that improve classroom learning experiences for children.

On the other end of the spectrum, Corporate Training platforms provide scalable ways for companies to enhance employee skills and knowledge, often with measurable outcomes.

The rise of Edtech has been fueled by the growing need for accessibility, flexibility, and customization in education. As traditional models struggle to keep up with evolving demands, Edtech fills the gaps with innovative, data-driven solutions.

This isn’t just about digitizing education—it’s about rethinking how we learn and grow in an increasingly connected world.

Understanding the foundational concepts of Edtech helps set the stage for evaluating its market potential. Now, let’s move forward to explore how startups in this field are valued and what makes them unique.

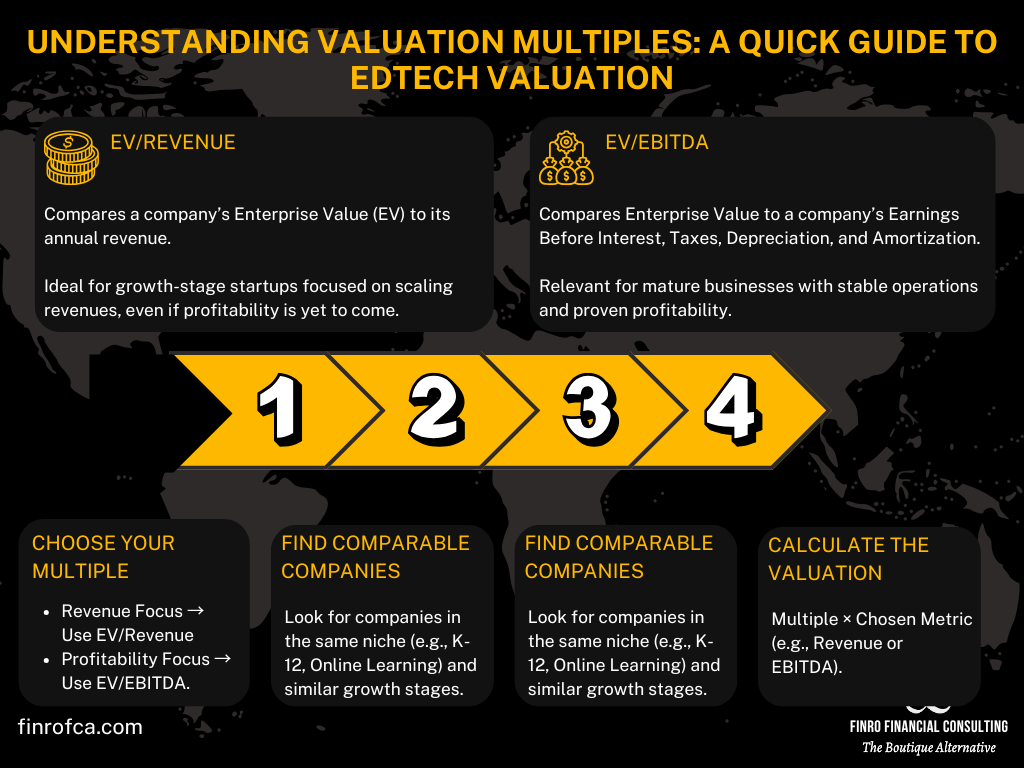

Understanding Valuation Multiples

Edtech’s significance, as discussed earlier, is reflected not just in its transformative impact on education but also in its market valuation. At the heart of understanding this market lies the concept of valuation multiples—a cornerstone in assessing the financial value of companies across industries.

Valuation multiples are ratios that compare a company’s value to a specific financial metric, such as revenue or earnings. They offer a snapshot of what the market is willing to pay for every dollar a company generates. In Edtech, the average revenue multiple of 8.1x from our latest analysis shows that investors see substantial growth and profitability potential within this space.

Two commonly used valuation multiples in Edtech are:

Enterprise Value to Revenue (EV/Rev): This measures the company’s value relative to its annual revenue. It’s particularly relevant for early-stage or growth companies where profitability may still be a goal on the horizon. The 8.1x average revenue multiple highlights the premium placed on Edtech’s revenue streams, reflecting strong investor confidence in future scalability.

Enterprise Value to EBITDA (EV/EBITDA): This measures value against a company’s earnings before interest, taxes, depreciation, and amortization. It provides insights into operational efficiency and profitability. The average Edtech EBITDA multiple is 21.1 in 2025. For niches like K-12 Education Solutions and Corporate Training, which have matured operational models, EBITDA multiples often carry significant weight.

Why do these multiples matter? They allow investors, analysts, and founders to benchmark their performance against competitors and industry averages.

High multiples may indicate strong growth potential, unique offerings, or market leadership. Conversely, lower multiples could signal operational inefficiencies or market skepticism.

However, these figures don’t tell the whole story. Industry-specific drivers like user acquisition costs, retention rates, and scalability play a crucial role in interpreting multiples. That’s why it’s essential to evaluate them in context, alongside the company’s qualitative strengths and market dynamics.

Next, we’ll dive deeper into Edtech’s key niches and how they contribute to these impressive valuation figures. By breaking down the numbers by segment, we’ll uncover the unique factors that drive growth and command premium multiples across the sector.

Detailed Breakdown of Edtech Niches

Having established a solid understanding of valuation multiples, let’s zoom into how they vary across Edtech’s diverse niches.

The Edtech industry encompasses a range of subcategories, each addressing distinct needs and opportunities, from K-12 solutions to corporate upskilling platforms.

Understanding these niches not only highlights industry trends but also helps pinpoint which sectors hold the highest valuation potential.

1.Edtech SaaS and Infrastructure

The Edtech SaaS and infrastructure segment focuses on providing scalable platforms for managing educational content, operations, and assessments. These tools empower educators and learners by streamlining processes and enhancing accessibility.

Companies like Articulate and Kajabi have been trailblazers, delivering intuitive solutions tailored to meet the needs of institutions and individual users. Private companies in this niche enjoy an average revenue multiple of 13.9x, significantly higher than the broader Edtech average. This reflects the scalability of SaaS models, bolstered by predictable, recurring revenue streams.

2. K-12 Education Solutions

K-12 education solutions cater specifically to the needs of primary and secondary education. This niche includes platforms that provide digital learning environments, tutoring solutions, and classroom management tools. Companies like GoStudent and Outschool are redefining how students engage with educational content.

The demand for these solutions has been amplified by the pandemic, as schools turned to digital platforms for continuity. With private companies achieving an average revenue multiple of 13.5x, the niche demonstrates strong market demand and a robust outlook, supported by ongoing digital transformation in schools.

3. Online Learning Platforms

Online learning platforms address a wide audience, offering resources for professional upskilling, hobbies, and general education. These platforms often operate on subscription-based models, delivering curated content libraries to their users.

Leaders like Masterclass, Coursera, and Duolingo exemplify the potential of this niche to blend education with entertainment, creating engaging and accessible learning experiences. Private companies in this space see an average revenue multiple of 10.3x, highlighting the sector’s growth potential, though it remains moderated by increasing competition.

4. Corporate Training and Workforce Upskilling

The corporate training and workforce upskilling sector focuses on helping businesses enhance their employee development programs. These platforms offer leadership training, skill-building resources, and certification courses.

Companies like Handshake, BetterUp, and Degreed are addressing a growing need for lifelong learning within organizations. Private companies in this niche command an average revenue multiple of 11.2x, underpinned by sustained demand for professional development tools and the push for organizations to stay competitive through continuous learning initiatives.

5. Higher Education Platforms

Higher education platforms are designed to support colleges and universities in improving enrollment processes, optimizing curriculum design, and enhancing student outcomes. ApplyBoard and Crimson Education are notable players, creating solutions that bridge gaps in the higher education ecosystem.

Private companies in this niche maintain an average revenue multiple of 9.2x, reflecting steady interest and reliable demand for tools tailored to higher education institutions.

6. Test Preparation and Certification Platforms

Test preparation and certification platforms focus on resources for standardized tests, professional certifications, and niche skill-based examinations. Companies like Chegg and Quizlet lead the way by making test preparation accessible and effective for diverse learners. With an average revenue multiple of 11.8x for private companies, this niche capitalizes on the ability to monetize specific market segments with high-value offerings.

7. Immersive and Specialized Learning

Immersive and specialized learning represents one of the most innovative segments in Edtech. This niche leverages emerging technologies like virtual reality (VR) and augmented reality (AR) to create experiential learning opportunities.

Strivr Labs and Labster exemplify how immersive technologies can transform education and training. Private companies in this segment have an average revenue multiple of 7.4x, reflecting its early-stage but promising potential, as institutions and businesses alike explore the benefits of experiential learning.

This detailed breakdown highlights how Edtech niches vary in focus, growth potential, and valuation metrics. To uncover how these metrics shift over time and identify the drivers behind these changes, let’s explore the evolution of Edtech revenue multiples in the next section.

Year-over-Year Analysis

Building on the detailed breakdown of Edtech niches, it’s essential to evaluate how valuation multiples for these segments have shifted over time. Year-over-year analysis provides a window into broader industry trends, uncovering the forces that drive investor sentiment and market valuations. By examining the changes between 2024 and 2025, we can identify which niches are gaining traction and which are facing challenges.

Overall Trends in Edtech Multiples

The average revenue multiple for Edtech companies has experienced a significant contraction, dropping from 17.6x in 2024 to 8.1x in 2025. This decline reflects a recalibration in market expectations following a period of heightened optimism during the pandemic.

While the demand for digital education solutions remains robust, investor enthusiasm has moderated as market saturation and economic headwinds take their toll. Despite the overall dip, Edtech continues to showcase strong potential, particularly in niches that align closely with evolving educational and workforce needs.

Highlights from Key Niches

Some Edtech niches have shown resilience and even growth in valuation multiples, while others have faced sharper declines:

1.Edtech SaaS and Infrastructure: This niche saw its average revenue multiple decrease from 20.9x in 2024 to 11.5x in 2025. The reduction, though significant, still places it above the Edtech average. The consistent demand for scalable SaaS solutions underscores the niche’s strength in attracting long-term investment.

2. K-12 Education Solutions: Valuation multiples for K-12 solutions adjusted downward from 8.6x to 7.0x, reflecting normalization after the explosive growth driven by pandemic-related school closures. The niche remains a steady performer, buoyed by continued investments in digital transformation for schools.

3. Online Learning Platforms: With a decline from 12.1x to 9.6x, this segment demonstrates resilience. Companies focusing on user engagement and personalized learning continue to attract attention despite increased competition.

4. Corporate Training and Workforce Upskilling: This niche experienced one of the sharpest declines, from 19.5x to 7.3x. The reduction reflects growing competition and the challenge of scaling enterprise sales. However, the underlying demand for workforce development tools suggests potential for recovery.

5. Higher Education Platforms: Unique among Edtech niches, this segment saw growth, with multiples rising from 4.7x to 6.2x. As universities grapple with declining enrollments and increasing administrative complexities, solutions tailored to higher education are gaining importance.

6. Test Preparation and Certification Platforms: This niche saw a steep decline, with multiples dropping from 39.6x to 6.1x. The extraordinary valuation seen previously was likely an outlier fueled by niche-specific factors, now replaced by more balanced market expectations.

7. Immersive and Specialized Learning: As a newer and more experimental category, this niche held steady at 9.0x, reflecting sustained interest in technologies like VR and AR for education and training.

Drivers Behind the Shifts

Several factors have influenced these valuation changes. The broader economic environment, including rising interest rates and tightened funding for startups, has impacted investor willingness to pay premium multiples.

Additionally, the normalization of post-pandemic growth and heightened competition have led to more cautious evaluations across the board.

This year-over-year analysis underscores how market conditions shape valuation multiples across Edtech niches. In the next section, we will explore how you can use these multiples to assess the value of Edtech companies, offering actionable insights for investors and founders alike.

How to Value an Edtech Startup?

Building on the analysis of year-over-year trends and niche-specific insights, understanding the actual process of valuing an Edtech startup is essential for founders, investors, and market observers alike.

Whether you’re evaluating a K-12 education solution or a corporate training platform, the fundamental valuation principles are the same, but the application is tailored to the nuances of the Edtech sector.

Core Approaches to Edtech Valuation

The valuation of an Edtech startup often hinges on a blend of quantitative and qualitative factors. Quantitative metrics, like revenue and earnings multiples, provide a starting point.

However, in Edtech, where many companies prioritize growth over profitability, qualitative factors often weigh heavily in determining valuation. These include market position, innovation, and the scalability of the business model.

Revenue Multiples (EV/Revenue):

Revenue multiples remain a dominant method for valuing Edtech startups, particularly those in early stages or focused on rapid growth. The 2025 analysis shows that Edtech SaaS and Infrastructure companies, for example, hold an average EV/Revenue multiple of 11.5x, reflecting the market’s premium on scalable software solutions.

Using revenue multiples, an investor might assess a startup’s potential based on projected revenue growth and compare it to the sector average.

EBITDA Multiples (EV/EBITDA):

EBITDA multiples are less frequently applied in early-stage Edtech valuations due to the sector’s general focus on growth over profitability. However, for mature companies or those aiming for a strategic sale, EV/EBITDA can serve as a critical measure of operational efficiency and profitability.

Factors Driving Valuation Premiums

Edtech valuations often vary dramatically based on a few key drivers:

Scalability of the Solution: Platforms with a global user base or those easily adaptable to different markets often command higher valuations. SaaS platforms, for instance, benefit from scalable subscription models that enhance recurring revenue streams.

Customer Stickiness and Retention Rates: Edtech startups offering solutions integrated into educational or corporate systems tend to have high retention rates, increasing their attractiveness to investors.

Market Opportunity: Startups addressing underserved niches, such as Immersive Learning or Higher Education Platforms, can achieve valuation premiums due to the unique problems they solve.

Path to Profitability: While growth often takes precedence, a clear and credible path to profitability is increasingly valued, especially in a market where investor scrutiny has heightened.

Practical Application: Example Case

Consider an Edtech startup generating $5 million in annual revenue with a growth rate of 40% year-over-year. Using the 2025 EV/Revenue average of 8.1x, this startup might achieve an enterprise value of approximately $40.5 million.

However, additional factors such as the competitive landscape, customer retention metrics, and the strength of its intellectual property could push the valuation higher or lower.

Understanding how valuation is applied provides a clear framework for interpreting the broader trends and insights shared earlier. With this foundation in place, the next section will delve into the unique challenges and considerations when applying valuation multiples to the Edtech sector, ensuring that both investors and founders approach valuations with clarity and confidence.

Edtech Valuation Database: Your Go-To Resource for 2025 Insights

With the Edtech landscape clearly mapped out and valuation methodologies explained, it’s time to turn data into actionable insights. For those seeking a deeper understanding of the sector, our updated database of 220+ Edtech companies offers a powerful resource.

Whether you’re an investor assessing opportunities, a founder benchmarking your valuation, or a professional researching market trends, this spreadsheet provides unparalleled value for just €29.90.

What’s Inside the Database?

The database is a comprehensive compilation of the most up-to-date information on Edtech companies across public, private, and M&A categories. It includes:

Detailed Valuation Metrics: Revenue and EBITDA multiples broken down by niche and company type.

Historical Comparisons: Year-over-year data trends that highlight shifts in valuation.

Market Leaders and Innovators: Insights into the top players shaping the sector.

Diverse Niches: From K-12 Education Solutions to Immersive Learning, the database spans the breadth of the Edtech ecosystem.

Why Download the Database?

This resource isn’t just data; it’s a tool to inform smarter decisions. Investors can benchmark prospective deals, founders can refine their funding narratives, and analysts can back their forecasts with industry-specific benchmarks. The clarity it offers saves time and enhances decision-making, making it an essential asset for anyone serious about Edtech.

For a limited time, the database is available for download at just €29.90. Once purchased, you’ll gain immediate access to a wealth of information, organized and ready to use. Make your decisions with confidence and precision—this level of insight is just a click away.

With the tools and insights now at your fingertips, it’s time to bring everything together.

The concluding section will recap the key takeaways from this report and set the stage for future Edtech trends and valuation updates. Stay ahead of the curve and informed—read on to wrap up this comprehensive look at Edtech valuation in 2025.

Conclusion

The Edtech sector continues to be a vibrant and dynamic space, driven by innovation and a growing demand for education solutions across diverse niches. From corporate upskilling platforms to immersive learning tools, each segment of the industry tells a story of adaptation and opportunity.

Our analysis of valuation multiples reveals a nuanced picture—one where niche-specific trends and year-over-year changes shape the broader investment narrative.

We’ve explored the key valuation metrics, broken down the market by niches, and provided actionable insights for valuing startups. Along the way, we’ve highlighted how Edtech companies, whether public, private, or involved in M&A, are leveraging technology to transform education globally.

For those who want to go deeper, our updated database of 220+ Edtech companies offers a unique opportunity to access detailed insights at your fingertips. At just €29.90, it’s a small investment to gain clarity in a rapidly evolving market.

As we look ahead, the Edtech landscape will undoubtedly continue to shift, influenced by technological advancements, regulatory changes, and evolving consumer preferences. Staying informed and agile is key to making the most of these changes—whether you’re an investor, founder, or analyst.

Thank you for taking this journey through the 2025 Edtech valuation landscape. We hope this report equips you with the knowledge and tools to make better, more informed decisions in this exciting sector. For regular updates and deeper insights, keep an eye out for our next analysis.

Key Takeaways

Edtech’s Average Revenue Multiple: 2025 analysis reveals an 8.1x revenue multiple, highlighting robust growth across diverse Edtech niches.

Niche-Specific Insights: Edtech SaaS and Infrastructure lead valuation metrics, followed by K-12 solutions, online learning, and workforce upskilling.

Year-over-Year Trends: A decline in overall multiples underscores market stabilization, but niche-specific opportunities remain strong.

Valuation Techniques: Combining multiples and startup-specific metrics is critical for accurate valuation in this competitive and innovative sector.

Comprehensive Resource: A detailed database of 220+ Edtech companies offers valuable insights for deeper exploration of industry trends.

Answers to The Most Asked Questions

-

The 2025 analysis reveals an average revenue multiple of 8.1x for EdTech, with variations across niches like EdTech SaaS and Infrastructure (11.5x) and K-12 Education Solutions (7.0x).

-

Valuing an EdTech involves combining industry-specific valuation multiples, such as EV/Revenue and EV/EBITDA, with startup-specific metrics like growth potential, market fit, and revenue scalability.

-

Startup valuation is calculated by applying valuation multiples (EV/Revenue or EV/EBITDA) to financial metrics, often adjusted for growth, profitability, and risk factors. Alternative methods include Discounted Cash Flow (DCF) for future cash flow projections.

-

The best method depends on the startup’s stage and financial visibility. Early-stage startups often rely on EV/Revenue multiples, while more mature startups may use EV/EBITDA or DCF for a nuanced approach.