Building a Pre-Revenue Startup Valuation in 2025

By Lior Ronen | Founder, Finro Financial Consulting

Building a solid valuation for a pre-revenue startup in 2025 is challenging, yet essential.

Determining the value of a startup before it starts generating revenue is no small task.

Market conditions have shifted, and traditional valuation methods require an update to reflect new trends and available data.

This guide breaks down both established approaches and more modern techniques.

We examine qualitative methods such as the Berkus and Scorecard approaches alongside quantitative methods like Revenue Multiples, EBITDA Multiples, and Discounted Cash Flow.

Each method comes with its own set of benefits and challenges, and our aim is to help you evaluate these options with clarity.

Designed for both founders and investors, this guide offers a realistic, clear picture of a startup’s potential.

By combining time-tested practices with recent insights, you’ll be better equipped to set realistic expectations, negotiate equity, and confidently discuss your startup’s value.

Valuing pre-revenue startups in 2025 demands an integrated approach that merges traditional financial techniques with modern, data-driven insights. By focusing on qualitative factors like strong leadership, innovative products, and strategic alliances alongside dynamic quantitative tools such as revenue multiples, forward-looking EBITDA models, and rigorous discounted cash flow analyses, founders and investors can capture a startup’s true potential.

This comprehensive framework incorporates evolving macroeconomic conditions, emerging market trends, and digital traction, ensuring that assessments reflect both growth opportunities and inherent risks. Real-world examples demonstrate how expert financial due diligence transforms raw potential into actionable insights, ultimately empowering early-stage ventures to secure the capital needed for sustainable growth.

- Pre-Revenue Valuation in 2025?

- Updated Qualitative Valuation Methods

- The Berkus Method Revisited

- The Modern Scorecard Method

- Balancing Subjectivity with Data-Driven Insights

- Enhanced Quantitative Valuation Techniques

- Revenue Multiple Method in 2025

- Evolving EBITDA Multiple Method

- Discounted Cash Flow (DCF) Method for Pre-Revenue Startups

- Traditional Valuation Methods and Their 2025 Adaptations

- Key Factors Influencing Startup Valuations in 2025

- Case Studies: Finro in Action

- Conclusion

- Key Takeaways

- Answers to The Most Asked Questions

Pre-Revenue Valuation in 2025

Pre-revenue startup valuation is the process of estimating the worth of a company that hasn’t yet generated revenue. Without historical income figures to rely on, this valuation hinges on future potential, assessing factors such as the strength of the team, the quality of the product or prototype, and the size of the target market.

Essentially, it reflects expectations and the promise of what the business can achieve once it begins to earn. By combining quantitative projections with qualitative assessments, founders and investors create a credible estimate that aligns with the startup’s current progress and future plans.

Today, early-stage companies are defined by more than just the absence of sales. In 2025, pre-revenue startups typically have a developed product or prototype, an established team, and clear market potential, even if revenue hasn’t started flowing yet.

Compared to previous years, these companies face new challenges—such as evolving regulatory standards and rapid technological shifts—but also enjoy fresh opportunities like expanded global reach and improved access to real-time data.

Valuation remains a crucial element for both founders and investors, influencing equity negotiations, setting realistic expectations, and attracting the necessary capital.

Reflecting on earlier approaches, valuation techniques for early-stage startups in prior years largely centered on methods like the Berkus and Scorecard approaches, as well as quantitative techniques such as Revenue Multiples, EBITDA Multiples, and the Discounted Cash Flow model (DCF).

These methods provided a framework for estimating value when traditional financial metrics were scarce, serving as a solid starting point despite sometimes relying on subjective assessments and projections.

Today’s landscape calls for updated strategies.

Shifts in macroeconomic factors—like varying inflation rates, changes in interest rates, and evolving global trends—demand a more flexible approach.

Advances in technology and the availability of real-time data have opened the door to more data-driven and nuanced assessments. As a result, methods that were once effective need to be adapted to ensure that valuations are realistic and reflective of current market conditions.

With these evolving factors in mind, we now move on to explore the updated qualitative and quantitative valuation techniques.

In the next section, we’ll examine how these new methods integrate traditional wisdom with modern insights to better capture a startup’s true potential.

Updated Qualitative Valuation Methods

Building on our discussion of how valuation methods have evolved, we now turn our focus to updated qualitative approaches.

These techniques have been refined to better capture today’s startup environment, blending established methods with fresh considerations like market agility, digital traction, and global scalability.

The Berkus Method Revisited

The Berkus Method remains a popular tool for early-stage startups, but it has been adjusted to reflect today’s startup environment.

Modern applications of this method incorporate factors beyond the original five elements by taking into account market agility and the digital traction a startup gains through online channels.

This evolution means that while the core idea of assigning value to key risk factors remains, the benchmarks have shifted to better mirror current market conditions and global scalability.

These updates ensure that the Berkus Method stays relevant as startups navigate more competitive and technologically advanced markets.

By factoring in digital reach and adaptability, the method now provides a more comprehensive picture of a startup’s potential, offering founders and investors a balanced view of both tangible and intangible assets.

The Modern Scorecard Method

The Scorecard Method has also been updated to leverage current market benchmarks and regional data more effectively.

Today, this approach integrates updated qualitative factors such as team strength and strategic partnerships, and pairs them with emerging market trends.

It allows for a more granular comparison between startups, using refined metrics that reflect recent shifts in investor expectations and market conditions.

These adjustments make the Scorecard Method a powerful tool for assessing early-stage startups.

By grounding its evaluations in fresh, region-specific data, the method helps reduce subjectivity and provides a clearer benchmark for comparing startups across different sectors and geographies.

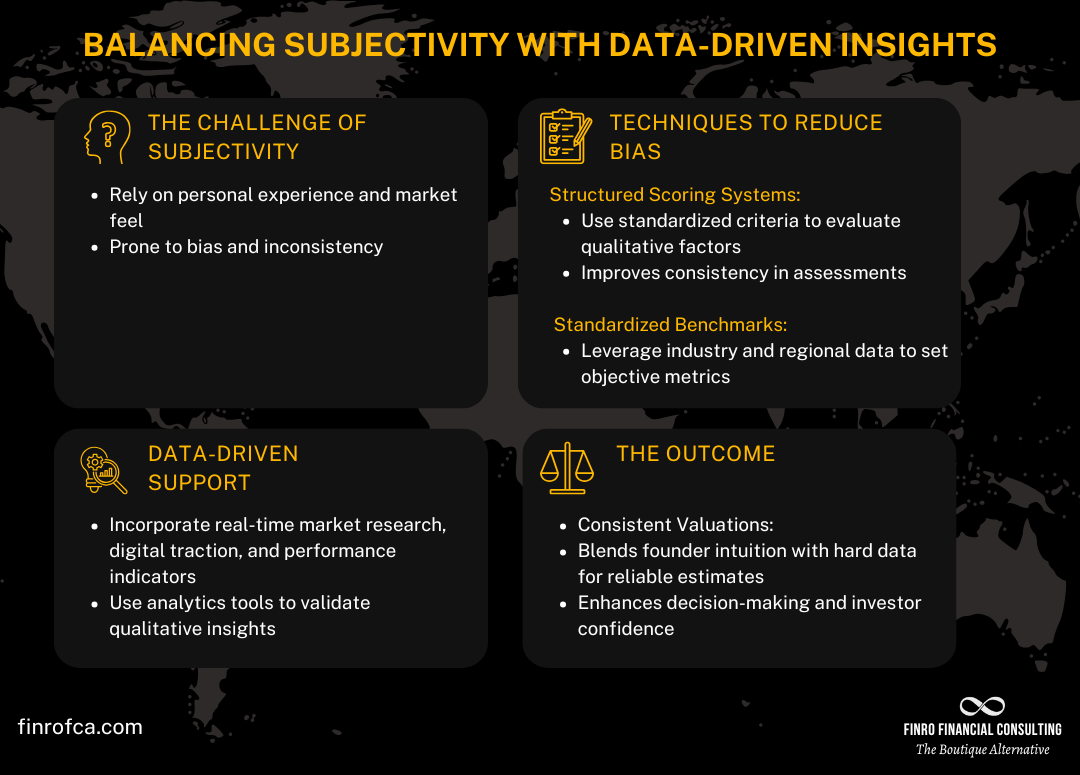

Balancing Subjectivity with Data-Driven Insights

Despite the inherent subjectivity in qualitative assessments, recent advances have made it possible to balance intuition with data-driven insights.

Techniques such as structured scoring systems and the use of standardized benchmarks help reduce bias in qualitative evaluations. This approach ensures that personal judgments about a startup’s potential are supported by objective, data-backed metrics.

In practice, balancing these elements leads to more consistent and reliable valuations. The fusion of subjective intuition with quantitative data creates a framework that captures both the vision of the founders and the measurable factors that drive success. This balance is critical for making informed decisions and setting realistic expectations for growth.

With these updated qualitative methods in place, we now have a solid foundation for assessing a startup’s potential.

Next, we turn our attention to enhanced quantitative valuation techniques that further refine the process by incorporating real-time data and advanced forecasting models.

Enhanced Quantitative Valuation Techniques

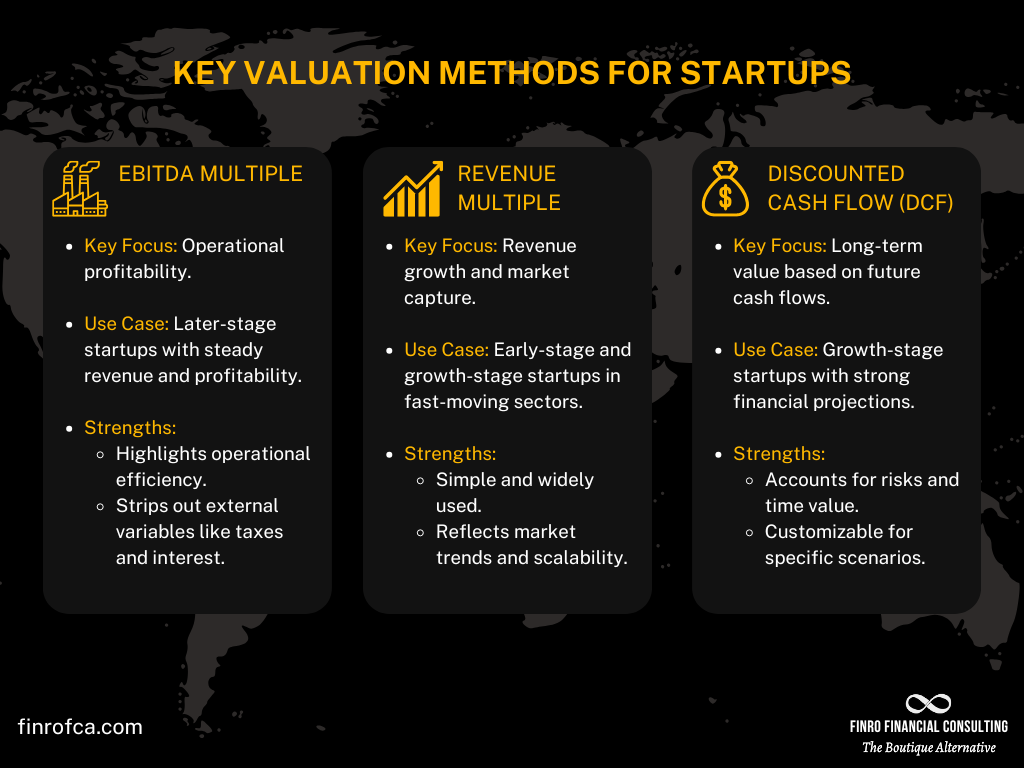

Building on our exploration of updated qualitative approaches, we now turn our focus to enhanced quantitative valuation techniques.

These methods have evolved to account for dynamic market conditions, shifting operating metrics, and increased uncertainty.

In the following sections, we’ll examine the Revenue Multiple Method, the evolving EBITDA Multiple Method, and the Discounted Cash Flow (DCF) Method as they apply to pre-revenue startups in 2025.

Revenue Multiple Method in 2025

The Revenue Multiple Method has long served as a straightforward way to project a startup’s future value by applying industry-specific multiples to estimated revenue figures.

In today’s environment, however, this approach requires adjustments to account for hypothetical revenue projections in a rapidly shifting market. Startups must now rely on detailed market research and realistic growth assumptions that reflect the inherent volatility of their sectors.

By using industry-specific multiples, this method provides a useful benchmark even when actual revenue figures are not yet available.

Investors and founders can compare these projections with market trends to ensure that their estimates are grounded in current economic realities.

This dynamic adaptation of the Revenue Multiple Method helps in setting more informed expectations for the startup’s future financial performance.

Evolving EBITDA Multiple Method

The EBITDA Multiple Method has also undergone significant refinement.

Historically, this approach focused on established earnings metrics, but for pre-revenue startups, it requires a forward-looking perspective.

Operating metrics and financial projections have shifted to reflect not only historical performance but also anticipated scalability and operational efficiency improvements.

Forward-looking adjustments are now incorporated to better capture the potential for operational scalability.

This evolution means that rather than relying solely on past performance indicators, the method leverages future-oriented assumptions about cost management and profit margins.

By doing so, it provides a more realistic framework for assessing the value of a startup that is still in its early stages of revenue generation.

Discounted Cash Flow (DCF) Method for Pre-Revenue Startups

The DCF method remains one of the most rigorous valuation techniques, even for pre-revenue startups.

Given the uncertainty inherent in early-stage ventures, recent adaptations have focused on revising discount rates to better reflect the elevated risk.

Longer forecast horizons are often necessary to capture the full potential of the startup, requiring careful estimation of future cash flows and their present value.

Sensitivity analysis plays a crucial role in this approach, allowing evaluators to assess how changes in key assumptions impact the overall valuation. By testing different scenarios—such as varying growth rates or shifts in operating costs—founders and investors can better understand the range of possible outcomes.

This method, though complex, offers a comprehensive view of a startup’s financial potential when executed with careful consideration of its unique risk profile.

With these enhanced quantitative techniques in mind, we now have a more robust framework for estimating a pre-revenue startup’s value.

In the next section, we will explore innovative and hybrid approaches that blend both qualitative and quantitative insights to further refine valuation estimates in today’s complex market environment.

Traditional Valuation Methods and Their 2025 Adaptations

Building on our exploration of enhanced quantitative techniques, we now shift our focus to traditional valuation methods and how they’ve been adapted for today’s pre-revenue startups.

While methods like Discounted Cash Flow (DCF) analysis, Comparable Company Analysis, and the Venture Capital (VC) Method have long been staples of startup valuation, they require adjustments to remain effective in the current market.

Commonly Used Methods

Traditional approaches such as DCF analysis, Comparable Company Analysis, and the VC Method have been the go-to tools for investors and founders for years. DCF analysis provides a rigorous, theoretically sound method by forecasting future cash flows and discounting them to their present value.

Comparable Company Analysis leverages market data from similar firms, offering a benchmark for valuation. Meanwhile, the VC Method helps investors understand the potential returns based on expected exit scenarios and ownership stakes.

In today’s environment, these methods continue to offer valuable insights but must be applied with an awareness of their limitations in a pre-revenue context.

The lack of actual cash flow and established comparables challenges the application of these models, requiring a more nuanced approach.

As a result, adapting these traditional methods to capture the unique aspects of early-stage startups is essential for providing a realistic valuation.

Adapting Methods to a Pre-Revenue Context

To effectively apply these traditional methods to pre-revenue startups, it’s crucial to incorporate qualitative metrics and a focus on growth potential.

For instance, when using DCF analysis, evaluators now place greater emphasis on forecasting assumptions that reflect the startup’s strategic vision, market opportunities, and potential for rapid scaling.

Similarly, Comparable Company Analysis involves looking at emerging industry benchmarks that capture the latest market trends and volatility.

Furthermore, adjustments are made to account for market volatility and the inherent uncertainties associated with early-stage ventures.

This means integrating data-driven insights and industry-specific multipliers to better align traditional models with today’s dynamic economic environment.

By doing so, investors and founders can derive a more balanced and realistic valuation that reflects both the potential risks and opportunities facing pre-revenue startups.

With these adaptations, traditional valuation methods continue to serve as a cornerstone for assessing startups worthwhile evolving to meet modern challenges.

Next, we turn our attention to innovative and hybrid approaches that blend qualitative and quantitative insights to further enhance the valuation process in an ever-changing market landscape.

Key Factors Influencing Startup Valuations in 2025

Building on our exploration of traditional methods adapted to the modern environment, we now turn our attention to the key factors that influence startup valuations in 2025.

These factors extend beyond financial metrics, capturing the unique elements that drive a startup’s potential in today’s complex market.

Team & Leadership

A startup’s success often begins with its team. In 2025, expectations for founders and key hires have evolved significantly. Investors now look for leadership with a proven track record, adaptability, and a deep understanding of digital transformation.

Founders who can clearly articulate a vision while demonstrating operational excellence are highly valued, as they set the tone for company culture and strategic direction.

Beyond the core team, the ability to attract and retain top talent is critical. The right team not only executes on the vision but also adapts to emerging challenges, making strong leadership a key indicator of long-term success.

This emphasis on quality leadership ensures that startups are not only built on innovative ideas but also on the capability to execute them effectively.

Product Innovation & Technology Edge

Product innovation remains a critical driver of valuation in 2025. Breakthrough technology and digital traction have become essential components in determining a startup’s perceived value.

Investors are particularly interested in companies that offer disruptive solutions or possess a technological edge that can capture significant market share.

Moreover, a startup’s ability to generate digital traction—whether through user engagement, rapid prototyping, or early adoption by key customer segments—can enhance its appeal.

This technological prowess signals not only the potential for scalability but also the resilience of the business model in the face of evolving market demands.

Market Potential & Competitive Landscape

In an increasingly interconnected world, assessing global market trends is more important than ever.

Startups that operate in large or rapidly growing markets are positioned for higher valuations, as they promise substantial returns once their products or services achieve scale.

Evaluating market potential involves analyzing both current demand and future growth trajectories across regions and segments.

At the same time, competitive disruptions play a pivotal role. A startup’s value is often influenced by its ability to differentiate itself from established players and emerging competitors.

By understanding the competitive landscape—through benchmarks, market share analysis, and industry forecasts—founders and investors can better gauge a startup’s positioning and its potential for sustained growth.

Macroeconomic Influences

Macroeconomic factors have a profound impact on startup valuations in 2025. Economic indicators such as inflation rates, interest rates, and consumer confidence levels all play a role in shaping investor sentiment and risk assessment.

Startups must navigate these fluctuations, and their valuations often reflect the broader economic environment in which they operate.

Additionally, regulatory changes and geopolitical factors add another layer of complexity. Shifts in policy, trade regulations, and political stability can affect market access and operational costs.

By incorporating these macroeconomic influences, valuations become more robust and better reflect the inherent risks and opportunities present in the current global landscape.

Strategic Partnerships & Ecosystem Positioning

Strategic partnerships are increasingly recognized as a key element in a startup’s valuation.

Alliances with established companies, industry influencers, or even strategic investors can significantly enhance credibility and market reach. Early customer feedback and successful pilot programs can also signal strong market validation and potential for rapid growth.

Ecosystem positioning involves not only direct partnerships but also the broader network effects a startup can leverage.

This includes access to distribution channels, technological platforms, and industry-specific resources. Startups that effectively position themselves within a robust ecosystem are often rewarded with higher valuations, as these networks provide both strategic support and competitive advantage.

With these key factors clearly influencing startup valuations, we gain a deeper understanding of the multidimensional nature of value in today’s market.

Next, we will explore practical examples and case studies that bring these concepts to life, illustrating how these factors translate into real-world valuation scenarios.

Case Studies: Finro in Action

Building on our discussion of the key valuation drivers, let’s take a look at some real-world examples of how Finro has helped early-stage startups navigate the complexities of valuation and strategic financial analysis.

Case Study: Spaceling

Spaceling, an early-stage tech startup gearing up for its seed funding round, needed a comprehensive financial due diligence and valuation report. Working directly with Finro’s Founder and CEO, Lior Ronen, the team received a thorough suite of documents—including a detailed due diligence report, valuation spreadsheets, and investor-ready presentation slides—all delivered within just three weeks.

Michael Sperling, Co-Founder and CEO of Spaceling, noted Lior’s exceptional grasp of the multifaceted financial model and his mastery in early-stage venture finance, which provided the startup with a sound and logical valuation to support their funding discussions.

Case Study: Strategic Analysis for a Pre-Revenue Company

In another instance, Finro’s expertise was instrumental for a pre-revenue company looking to refine its investment strategy.

Through deep and accurate analysis, Lior was able to synthesize large data sets into actionable intelligence, identifying key trends and market disruptions that are critical for startups at this stage.

Mick Carolan, General Partner at Princap, emphasized Lior’s ability to offer clear, data-driven insights that significantly enhanced their strategic approach.

His prompt communication and responsiveness, despite time zone differences, further underscored the value of partnering with Finro to navigate complex market challenges.

Case Study: Navigating the Web3 Boom

Tropos AR, a pioneer at the start of the Web3 boom, turned to Finro to better understand and position themselves for a technology shift that many were only beginning to recognize.

By providing an accurate view of the evolving tech landscape, Finro helped Tropos AR manage the common pitfalls of short-term overvaluation and long-term undervaluation.

Sven Van de Perre, Co-Founder of Tropos AR, appreciated how Finro’s insights allowed them to prepare for the unfolding future with confidence—a testament to Finro’s forward-thinking approach in a rapidly changing industry.

These case studies illustrate Finro’s ability to blend deep financial expertise with a nuanced understanding of today’s startup environment. By providing tailored, timely, and strategic insights, Finro has empowered startups to build strong foundations for growth and secure the necessary capital with confidence.

Next, we’ll explore the digital tools and resources that can further support startups in their valuation journey, equipping you with practical solutions for today’s dynamic market environment.

Conclusion

In conclusion, valuing a pre-revenue startup in 2025 is both an art and a science. Today’s approach blends time-tested methods with modern, data-driven techniques to capture the full spectrum of a startup’s potential.

We’ve seen how refined qualitative methods, such as the updated Berkus and Scorecard approaches, now account for market agility, digital traction, and global scalability. Enhanced quantitative techniques—ranging from Revenue Multiples and evolving EBITDA Multiples to the DCF method—leverage real-time data and forward-looking projections to navigate today’s dynamic market environment.

Moreover, key factors like team leadership, product innovation, market potential, macroeconomic influences, and strategic partnerships play a critical role in shaping a startup’s valuation.

Real-world case studies have shown how expert analysis can transform complex financial models into actionable insights that not only secure capital but also position startups for sustainable growth.

Ultimately, the future of startup valuation lies in balancing qualitative intuition with quantitative rigor.

By embracing this holistic approach, founders and investors are better equipped to set realistic expectations, negotiate effectively, and build a strong foundation for long-term success.

Key Takeaways

The valuation process successfully blends qualitative intuition with quantitative analysis, ensuring both subjective insights and data-driven accuracy inform startup worth.

In 2025, valuation methods combine traditional approaches with data integration, emphasizing market agility and digital traction for precise startup assessments.

Strong leadership and innovative product development drive higher valuations, as experienced teams and breakthrough technologies enhance a startup’s market potential.

Macroeconomic influences and competitive landscapes impact startup valuations, with regulatory changes and global trends shaping market opportunities and investor expectations.

Strategic partnerships and ecosystem positioning bolster startup value by leveraging alliances and customer feedback to drive accelerated growth and innovation.

Answers to The Most Asked Questions

-

Pre-revenue startup valuation estimates an early company’s potential worth by analyzing factors like team strength, product innovation, market opportunity, and growth prospects rather than relying on current revenue.

-

Valuing a pre-revenue startup in 2025 involves combining traditional methods with updated qualitative assessments and data-driven quantitative models, including Revenue Multiples, EBITDA Multiples, and Discounted Cash Flow analysis.

-

Key qualitative factors include leadership quality, innovative product development, strategic partnerships, market positioning, and adaptability to digital trends and regulatory environments.

-

Macroeconomic trends like interest rates, inflation, and global market shifts influence risk assessments and investment decisions, altering financial projections and shaping investor expectations.

-

Technology improves valuation methods by providing real-time data, digital traction metrics, and predictive analytics, which enable more accurate revenue forecasts and refined risk assessments for early-stage startups.

-

Case studies offer real-world examples of how tailored valuation approaches and expert analysis lead to successful funding rounds and strategic growth, demonstrating the practical impact of refined methods.