Financial Modeling for Fintech Startups in 2025

By Lior Ronen | Founder, Finro Financial Consulting

Financial modeling remains a key component for fintech startups as we move toward 2025.

Most companies still rely on tried-and-true tools like spreadsheets, yet new revenue streams and business models mean that assumptions and projections must be updated.

Fintech today is exploring subscription services, API monetization, and digital wallet innovations that change traditional cost structures and revenue forecasts.

These shifts bring both challenges and opportunities, making it essential to refine your approach to forecasting, expense planning, and cash flow management for better decision-making and investor confidence.

Fintech startups must build resilient financial models that blend traditional metrics with forward-looking insights, accurately forecasting revenues from both established and emerging streams while managing expenses, cash flow, and human capital strategically. By continuously refining assumptions with up-to-date market data and regulatory trends, and by monitoring key financial and operational indicators, these models not only support sound decision-making but also drive sustainable growth. Tailored, iterative approaches that balance core financial rigor with innovative, fintech-specific variables empower startups to navigate funding cycles, market fluctuations, and competitive pressures, positioning them for long-term success.

- What We Call Fintech in 2025?

- Revenue Forecasting for Fintech Startups

- Expense Planning and Cost Structures

- Payroll and Human Capital Management

- Cash Flow Management

- Key Performance Indicators (KPIs) for Fintech Success

- Best Practices for Building a 2025-Ready Fintech Financial Model

- Why Choose Finro as Your Fintech Startup Financial Modeling Consultant

- Conclusion

- Key Takeaways

- Answers to The Most Asked Questions

What We Call Fintech in 2025?

Fintech once focused on digitizing basic banking functions and facilitating simple mobile payments. Back then, companies aimed to offer essential online services that streamlined transactions, with limited technology integration and a narrow view of financial services.

For example, early online banking was primarily about basic account management and bill payments—a digital extension of traditional brick-and-mortar operations.

Today, fintech covers a much broader spectrum. Companies use advanced technologies like artificial intelligence, blockchain, and data analytics to provide innovative solutions that go beyond traditional banking. Business models now include subscription services, API monetization, and decentralized finance, all while maintaining a strong focus on customer personalization and regulatory compliance.

Consider neo-banks such as Revolut and N26, which have elevated the user experience by incorporating real-time analytics and blockchain elements. Embedded finance platforms like Stripe and Square further demonstrate how financial services can integrate seamlessly into other industries. Global trends also influence the sector, as frameworks such as PSD2 in Europe and evolving data privacy regulations worldwide reshape operational standards.

Looking ahead, startups are expected to experiment with new revenue streams and cost structures that reflect evolving customer needs and compliance requirements. This shift calls for financial models that capture fresh income sources and adapt to changing expense profiles. Future business models may feature revenue sharing, tiered subscription plans, and fee-based premium services.

Moreover, global regulatory changes—including enhanced anti-money laundering measures and stricter data privacy standards—will demand more agile financial projections. These factors reinforce the need for financial models that are both robust and flexible in capturing the complexities of tomorrow’s fintech environment.

With these considerations in mind, we now turn our attention to revenue forecasting for fintech startups.

Revenue Forecasting for Fintech Startups

Building on our previous sections, where we explored fintech’s evolution and the fundamentals of revenue models, this section delves into revenue forecasting and projections tailored for fintech startups.

Accurate forecasting is vital for startups operating in a landscape that blends traditional income streams with innovative business models.

Here, we first outline the key revenue models powering fintech today and then explain a data-driven approach to projecting revenue that moves beyond simple guesstimates.

Understanding Fintech Revenue Models

In 2025, fintech startups draw revenue from both traditional income streams and innovative models. In this subsection, we explore the key revenue models shaping the fintech landscape today.

In today’s market, fintech companies employ a variety of revenue models that showcase the industry’s diversity. Traditional revenue streams, such as transaction fees, interest income, and commission-based charges, remain important.

At the same time, innovative approaches have emerged.

Subscription-based models offer predictable, recurring income, while API monetization allows companies to generate revenue by charging for access to their data or functionality.

Decentralized finance introduces unique mechanisms like staking rewards and tokenized assets, and data monetization converts customer insights into valuable market intelligence. This blend of revenue models illustrates that fintech firms can tailor their income strategies to suit varying customer segments and market demands.

When forecasting revenue, it’s crucial to account for both traditional income sources and these emerging drivers. Metrics like customer acquisition cost, lifetime value, and conversion rates become indispensable for building realistic projections.

Additionally, scenario planning plays a key role: market shifts, regulatory changes, and technological innovations can all impact revenue streams.

Incorporating different scenarios into your forecast creates a flexible model that adapts to uncertainty while providing clear insights, ensuring your financial model remains robust and reliable.

Projecting Revenues: A Data-Driven Approach

Projecting revenue starts with understanding your marketing investments. Allocate budgets across channels and track metrics such as cost per acquisition and click-through rates.

Next, break down the customer journey by assessing conversion rates—from initial interest to trial and from trial to paying customer.

This step-by-step analysis, grounded in actual performance data, forms the backbone of realistic revenue projections.

Beyond traditional indicators like average revenue per user and customer lifetime value, consider fintech-specific metrics. Evaluate how factors such as API usage rates, digital wallet transactions, and data monetization influence your revenue.

By integrating these unique elements into your model, you capture a complete view of your business’s potential.

This structured, data-driven approach builds a robust financial model that adapts to market changes and evolving customer behaviors.

Transitioning to our next section, we will explore practical tools and methodologies to integrate these insights into a comprehensive financial model tailored specifically for fintech startups.

This will equip you with the technical know-how to translate data into actionable forecasts and strategic growth plans.

Expense Planning and Cost Structures

Understanding where your money goes is just as important as knowing where it comes from.

For fintech startups, optimizing cash flow and supporting sustainable growth means closely monitoring key expense categories.

In this section, we break down expenses into four primary subsections: Customer Support, Research and Development, Sales and Marketing, and General and Administration.

Customer Support

Customer support is a critical function for fintech startups, ensuring that users receive timely assistance and building lasting trust. This function plays a pivotal role in maintaining high customer satisfaction levels, which directly influences user retention and overall brand reputation.

The costs associated with customer support typically include salaries for support staff, training programs, investments in CRM and helpdesk software, communication platforms, and sometimes outsourced services.

When planning for customer support expenses, it’s important to consider both the scale and quality of service required.

The investment in quality support not only improves user experience but also contributes to higher retention rates and positive word-of-mouth referrals. These factors, in turn, support long-term revenue growth and customer loyalty.

To forecast customer support costs effectively, analyze your current and projected customer base, review historical ticket data, and consider industry benchmarks.

Estimate the volume of support interactions expected as the customer base grows, and calculate staffing needs, software licenses, and training budgets accordingly.

Incorporating anticipated growth, seasonal variations, and potential efficiency improvements into your model will yield a more robust forecast.

Research and Development

Research and Development is at the heart of innovation in fintech, driving continuous product enhancements and the integration of emerging technologies.

For startups, R&D represents the effort to refine, improve, and expand service offerings in an increasingly competitive environment.

The associated expenses typically include software development costs, salaries for engineers and developers, technology licensing, product testing, innovation initiatives, and market research efforts.

Investing in R&D not only supports product evolution but also ensures that your startup remains agile and responsive to market demands.

By continually refining your offerings, you can better meet customer needs, differentiate your services from competitors, and maintain a competitive edge. This investment is crucial for long-term growth and sustainability in the rapidly evolving fintech landscape.

Forecasting R&D costs involves mapping out your product roadmap and identifying key development milestones.

Estimate resource requirements such as development hours, tool licenses, and associated operational costs based on historical data and industry averages.

Adjust these forecasts for anticipated changes in technology costs, potential delays, and scaling efforts to create a realistic and flexible projection.

Sales and Marketing

Sales and Marketing are the primary drivers for customer acquisition and brand building in fintech startups.

These activities are essential for generating awareness, attracting new users, and converting interest into revenue.

The expenses in this category cover digital advertising, content creation, social media campaigns, as well as salaries for marketing and sales teams, and costs related to marketing automation tools, public relations, event sponsorships, and sales commissions.

An effective sales and marketing strategy not only fuels growth but also reinforces the startup’s market position. By investing in targeted campaigns and consistent brand messaging, fintech companies can improve their conversion rates and customer lifetime value. This category directly influences the top-line revenue and is critical to scaling the business.

To forecast sales and marketing expenses, analyze past campaign performance and key metrics like cost per acquisition and conversion rates.

Develop a budget based on planned marketing initiatives, projected market expansion, and seasonal trends. Factoring in planned increases in advertising spend and realistic ROI expectations will help create a dynamic forecast model that aligns with your growth objectives.

General and Administration

General and Administration expenses form the operational backbone of a fintech startup, covering all overheads that sustain day-to-day business operations.

These expenses include costs such as office rent, utilities, IT support, insurance, legal fees, and regulatory compliance expenses, along with salaries for administrative staff and management overheads. They capture the fixed costs that support the overall organizational structure and ensure smooth operations.

Although these expenses are not directly tied to revenue generation, they are essential for maintaining an efficient and compliant business environment. Effective management of general and administrative costs helps ensure that resources are allocated efficiently, supporting both stability and growth. Keeping these costs in check is vital for preserving the overall health of the business.

Forecasting general and administration costs involves reviewing current overheads and projecting them based on headcount growth and planned operational expansions.

Consider factors such as inflation, changes in office space requirements, and adjustments to regulatory fees. By combining historical data with planned organizational changes, you can build a realistic, scalable forecast for these essential expenses.

With these detailed forecasts for customer support, R&D, Sales and Marketing, and General and Administration, fintech startups can gain a comprehensive view of their cost structures.

Next, we will transition to exploring Payroll and Human Capital Management, where we examine how staffing and talent-related costs integrate into your overall financial strategy.

Payroll and Human Capital Management

Following our detailed exploration of revenue forecasting and expense planning, we now shift our focus to Payroll and Human Capital Management—a critical area for any fintech startup.

Effective management of human capital not only drives innovation and operational excellence but also plays a key role in achieving long-term financial stability.

Fintech companies require specialized skill sets to stay competitive in a rapidly evolving market. Key talent includes blockchain specialists, data scientists, cybersecurity experts, and regulatory professionals—individuals whose expertise is essential for developing secure, compliant, and innovative solutions.

Identifying these critical roles early on ensures that your startup can build a robust team capable of driving growth and adapting to market challenges.

Equally important is developing effective compensation structures that attract and retain top talent. This involves modeling competitive salaries, carefully calibrated equity packages, and performance-based bonus schemes.

Balancing these elements is crucial; the right mix not only incentivizes employees to perform at their best but also aligns their interests with the long-term success of your business. Benchmarking against industry standards and tailoring packages to reflect the unique demands of fintech are key steps in this process.

As your startup grows, scaling the team becomes a strategic imperative. Forecasting headcount growth and the associated costs—ranging from recruitment and training expenses to benefits and onboarding infrastructure—is essential for long-term planning.

A dynamic forecast that accounts for expected growth, potential turnover, and evolving market conditions ensures that your human capital investments remain sustainable and aligned with your broader business objectives.

With a solid understanding of payroll and human capital management, fintech startups are well-positioned to optimize their talent investments and drive operational efficiency.

Next, we will explore Cash Flow Management, delving into strategies that ensure liquidity and support strategic decision-making as your business scales.

Cash Flow Management

Following our discussion on Payroll and Human Capital Management, we now shift our focus to Cash Flow Management—a critical element in ensuring that your fintech startup maintains sufficient liquidity and stays prepared for market shifts.

Managing cash flow effectively begins with tracking every financial movement. This involves setting up detailed forecasts for revenues, expenses, and capital investments, so you have a clear picture of all cash inflows and outflows.

By establishing a robust system to monitor these metrics, you can better understand your liquidity and proactively adjust for any variances.

Equally important is the integration of funding rounds and investment timing into your cash flow strategy.

Whether you’re planning for seed rounds, Series A/B financing, or exploring alternative funding sources, incorporating the timing and structure of these investments into your financial model is essential.

This approach allows you to synchronize your cash needs with incoming capital, ensuring that you can manage surpluses and shortfalls effectively.

Another vital component is analyzing your burn rate and runway. Determining how quickly your startup is spending cash—your burn rate—and calculating your financial runway under various scenarios helps you plan for periods of lower cash inflow.

A precise burn rate analysis allows you to anticipate funding needs, make informed operational decisions, and avoid liquidity crises during market fluctuations.

Finally, it’s crucial to plan for disruptions.

Fintech startups often face regulatory changes and market volatility that can impact cash flow unexpectedly.

Developing strategies to maintain stability—such as building reserve funds, diversifying revenue sources, or implementing cost-saving measures—ensures that you remain resilient when unexpected challenges arise.

With a solid grasp on cash flow management, fintech startups can maintain the liquidity required to weather market uncertainties and fuel growth.

Key Performance Indicators (KPIs) for Fintech Success

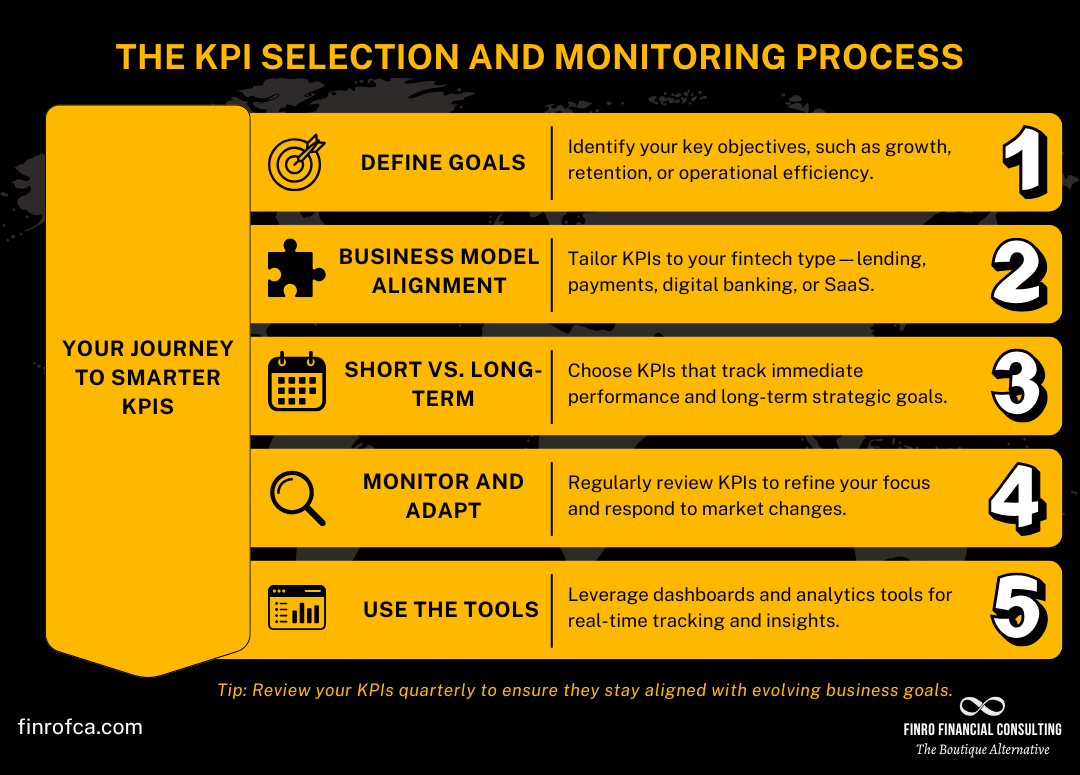

After laying the foundation with revenue forecasting, expense planning, cash flow management, and effective human capital strategies, it’s time to focus on measuring success.

In fintech, Key Performance Indicators (KPIs) offer invaluable insights into both financial performance and operational efficiency.

Tracking these metrics not only ensures accountability but also provides a roadmap for continuous improvement and strategic growth.

Financial KPIs provide a clear snapshot of your company’s fiscal performance. Metrics such as revenue growth, gross margins, EBITDA, and cash runway help quantify profitability and liquidity.

These figures allow you to assess whether your financial strategies are translating into sustainable growth and to make informed decisions about future investments.

Operational KPIs, on the other hand, focus on the efficiency and effectiveness of your business activities. Key metrics like customer acquisition cost (CAC), lifetime value (LTV), churn rate, and transaction volumes give insight into your customer behavior and operational performance.

By closely monitoring these indicators, fintech startups can identify areas for improvement in marketing, customer retention, and service delivery.

Industry-specific KPIs are essential for benchmarking against the unique demands of the fintech sector. Metrics such as digital wallet adoption, API usage, and blockchain transaction volumes provide a targeted view of how well your products and services are resonating in the market.

These KPIs enable you to tailor your strategies to the specific challenges and opportunities within the fintech landscape.

Benchmarking your performance against industry standards and competitors is the final piece of the puzzle.

This process not only highlights your relative strengths and weaknesses but also helps set realistic targets for growth and operational excellence. Regular benchmarking ensures that your startup remains competitive and agile in a rapidly evolving market.

With a robust KPI framework in place, fintech startups can drive continuous improvement, make data-informed decisions, and effectively communicate progress to investors and stakeholders.

Next, we will transition into exploring the best practices for integrating these KPIs into your comprehensive financial model, further solidifying your strategic planning and growth trajectory.

Best Practices for Building a 2025-Ready Fintech Financial Model

After reviewing revenue forecasting, expense planning, cash flow management, and key performance indicators, we now turn our focus to best practices for building a 2025-ready fintech financial model.

A modern financial model must be agile, data-informed, and capable of incorporating both traditional financial rigor and emerging market dynamics.

Regular revisions and scenario analysis are at the heart of iterative forecasting and model updates. In a rapidly evolving fintech environment, assumptions made today may not hold tomorrow. By routinely revising your model and testing various scenarios, you ensure that your projections remain relevant and resilient against market fluctuations.

Equally critical is the integration of current market research and regulatory insights. Up-to-date market trends and compliance requirements should continuously refine your financial assumptions.

Incorporating this external intelligence helps maintain accuracy in your forecasts and ensures your model reflects the latest industry standards and regulatory landscapes.

At the same time, it’s essential to balance traditional financial principles with forward-looking metrics.

While core financial fundamentals provide a stable foundation, fintech-specific variables—such as digital adoption rates and API monetization metrics—must be woven into the model.

This balanced approach ensures that your financial projections are both robust and adaptable to the unique challenges and opportunities of the fintech sector.

By adopting these best practices—iterative updates, informed integration of market research, and a balanced mix of traditional and innovative metrics—you can construct a financial model that stands up to the demands of 2025 and beyond.

Next, we will explore why choosing Finro as your fintech startup valuation modeling consultant can further elevate your financial planning and strategic growth.

Why Choose Finro as Your Fintech Startup Financial Modeling Consultant

Having laid out best practices for constructing a 2025-ready fintech financial model, it’s time to explore why partnering with Finro can elevate your financial planning to new heights.

Finro’s expertise in fintech financial modeling is built on years of experience and a proven track record of helping startups navigate the complexities of this fast-evolving industry.

We understand that fintech startups face unique challenges—from rapidly shifting revenue streams to specialized cost structures—and we have the know-how to develop models that capture these nuances.

Our tailored, 2025-ready solutions are designed with today’s dynamic market in mind. We build custom models that integrate emerging revenue streams, evolving cost structures, and the KPIs that matter most in fintech.

This forward-thinking approach ensures that your financial planning is not only grounded in solid traditional principles but is also primed to meet future challenges head-on.

Finro offers end-to-end support that covers every aspect of financial modeling—from revenue forecasting and expense planning to cash flow management and scenario analysis.

We work closely with you to refine your assumptions, adapt your model to new market data, and ensure that your projections remain robust and reliable, empowering your strategic decision-making.

Our client success stories speak volumes. Fintech startups that have partnered with Finro have secured funding, achieved sustainable growth, and built investor confidence—all thanks to our bespoke, data-driven financial models. These real-world examples demonstrate our commitment to delivering tangible results tailored to the unique demands of the fintech sector.

Ultimately, Finro is not just a service provider—we are your strategic partner in growth. We invite you to collaborate with us for expert advice, custom financial modeling solutions, and ongoing support as your business evolves.

Ready to take your fintech financial model to the next level? Contact Finro today and let us help you build a solid foundation for long-term success. Next, we’ll conclude by summarizing the key takeaways and exploring how our comprehensive approach can be seamlessly integrated into your strategic growth plan.

Conclusion

In summary, a robust financial model is the cornerstone of success for fintech startups in 2025. Throughout this article, we’ve covered the essential components—from revenue forecasting and expense planning to cash flow management, human capital strategies, and KPI tracking. We’ve also discussed best practices for iterative updates and the importance of balancing traditional financial principles with fintech-specific variables.

By integrating these elements into a comprehensive financial model, startups can not only secure investor confidence but also make informed, data-driven decisions that foster sustainable growth. This approach allows you to anticipate market changes, manage cash flow effectively, and optimize resource allocation—all of which are critical for thriving in a competitive fintech landscape.

At Finro, we are committed to helping you build a resilient financial model that drives strategic growth and long-term success. If you’re ready to elevate your financial planning, we invite you to contact us and discover how our tailored solutions can empower your fintech startup in 2025 and beyond.

Key Takeaways

Fintech startups need a robust, adaptable financial model integrating traditional metrics with emerging fintech-specific variables to achieve consistently sustainable growth.

Data-driven revenue forecasting, expense planning, and cash flow management are critical to effectively inform strategic decisions and secure investor confidence.

Continuous model refinement, including iterative forecasting and scenario analysis, ensures resilience against market fluctuations and evolving regulatory challenges over time.

Effective human capital management, tailored compensation, and scalable team structures are essential for driving innovation and maintaining long-term competitive advantage.

Partnering with specialized consultants, like Finro, enhances strategic planning through bespoke solutions and proven industry expertise for accelerated market success.

Answers to The Most Asked Questions

-

A comprehensive fintech financial model includes revenue forecasting, expense planning, cash flow management, human capital, and key performance indicators, integrating traditional metrics with fintech-specific trends to drive strategic growth.

-

Fintech startups should combine historical data with scenario analysis, incorporating traditional revenue streams and innovative income models like subscription fees, API monetization, and DeFi mechanisms for accuracy.

-

Essential expense areas include customer support, research and development, sales and marketing, and general administration, each forecasted based on historical data, market trends, and anticipated headcount growth.

-

They manage cash flow by tracking inflows and outflows, incorporating funding rounds, analyzing burn rates, and preparing for market disruptions through proactive scenario planning and contingency strategies.

-

Partnering with Finro offers expert financial modeling tailored to fintech, comprehensive end-to-end support, proven success in securing funding, and ongoing strategic guidance for sustainable growth.