Why Every Tech Startup Needs a Financial Model That Adapts?

By Lior Ronen | Founder, Finro Financial Consulting

Most startups think of a financial model as a necessary box to check—a spreadsheet that forecasts revenue and costs. But the real value of a startup financial model goes beyond predictions; it’s a tool for understanding how your decisions today will shape the business tomorrow.

For tech founders, it means getting clarity on what drives growth, which costs matter most, and how to adapt as new challenges emerge. A strong model doesn’t just map out projections; it becomes the backbone of smart planning.

For early-stage startups, particularly in tech, there’s a lot of uncertainty. How will you acquire users?

What should your pricing look like? And where do you even begin to forecast costs?

A good financial model tackles these questions and, more importantly, gives you the flexibility to adapt your assumptions as you learn more about the market and your users.

So, what’s the real goal?

A financial model is there to keep you on track, to make sure your startup’s decisions are rooted in something concrete—even as things change.

A financial model is a critical tool for startups, enabling founders to make informed decisions, test assumptions, and adapt to changing circumstances. By balancing simplicity with necessary detail, clearly documenting assumptions, and focusing on scalability, a well-structured model serves as a dynamic resource for both planning and communication with stakeholders.

Avoiding common pitfalls, such as over-complication or lack of transparency, ensures the model remains effective and actionable. Ultimately, a strong financial model not only reflects the current state of the business but also supports sustainable growth and strategic decision-making as the startup evolves.

- Defining the True Purpose of a Startup Financial Model

- Core Components of a Startup Financial Model

- Revenue Forecasting and User Acquisition

- Cost of Goods Sold (COGS) and Operational Expenses

- Cash Flow and Burn Rate

- Scalability and Flexibility

- How a Financial Model Evolves with the Startup?

- Practical Tips for Building a Startup Financial Model

- Common Mistakes to Avoid

- Conclusion

Defining the True Purpose of a Startup Financial Model

A startup financial model is not a crystal ball. Its main purpose isn’t to predict where you’ll be in five years but rather to serve as a tool that keeps your business grounded in reality, even as you work toward growth.

The strength of a good financial model lies in its ability to help you navigate key assumptions, assess risks, and evaluate potential growth paths in a structured way.

At its core, a financial model is a planning tool that lets you test assumptions and adjust strategies without risking real-world capital.

When a new opportunity arises—say, a different user acquisition channel or a shift in product focus—the model gives you a way to explore how this change could affect your finances over time.

In that sense, it becomes a framework to continuously challenge, update, and refine your business model as you learn more about the market.

This model also acts as a baseline for future decision-making.

By providing a clear picture of your current financial position and trajectory, it ensures that every major move, from hiring to marketing spend, aligns with your goals and constraints.

As the startup evolves, this model becomes an anchor point for comparing where you are versus where you thought you’d be, enabling smart, data-driven adjustments along the way.

With the purpose of the model defined, the next step is to look at the essential components that bring it to life and ensure it’s built for adaptability.

Core Components of a Startup Financial Model

As we’ve covered, the purpose of a startup financial model goes beyond predictions—it’s about creating a flexible tool to guide decision-making and prepare for various scenarios.

To build a model that genuinely supports these goals, it’s crucial to focus on a few key components.

Let’s break down these core areas and explore how each contributes to a strong, adaptable financial model.

Revenue Forecasting and User Acquisition

Revenue projections are the backbone of any financial model, but accurately forecasting revenue for a startup is no easy task. For tech startups, where growth can be highly unpredictable, using targeted approaches like cohort analysis and the “user journey” method can provide a more structured and realistic view.

With cohort analysis, you’re grouping users based on shared characteristics or actions—like acquisition date or usage patterns—and tracking their behavior over time.

This helps in identifying trends in customer retention and revenue generation across different groups, making revenue forecasts more grounded in actual user behavior.

The “user journey” method, which we use at Finro, takes this one step further by mapping the entire user lifecycle, from initial acquisition to long-term engagement.

By forecasting revenue based on the journey of a typical user, this method allows you to account for drop-offs, conversion rates, and lifetime value in a way that aligns closely with real-world business dynamics.

It’s a practical way to see where growth is coming from and make informed decisions about where to focus acquisition efforts.

Cost of Goods Sold (COGS) and Operational Expenses

Understanding the full cost structure is just as important as forecasting revenue.

For tech startups, Cost of Goods Sold (COGS) and operational expenses often include unique drivers that need close attention, like cloud hosting fees, research and development (R&D) expenses, and software licenses.

COGS, in this context, represents the direct costs associated with delivering your product or service, such as cloud storage and data processing costs. Meanwhile, operational expenses cover broader categories, like payroll, marketing, and infrastructure.

Highlighting these drivers within the financial model can help founders understand where the bulk of spending is going and allow for adjustments as the business scales.

By breaking down costs into specific categories, you gain a clearer picture of the profitability of each revenue stream and the impact of potential cost increases.

Cash Flow and Burn Rate

Cash flow and burn rate are critical metrics for any startup, particularly in the early stages.

Burn rate reflects how quickly a startup is spending its cash reserves, and it directly impacts the runway—the amount of time before additional funding is needed.

A well-constructed financial model should outline cash inflows and outflows in a way that makes it easy to calculate burn rate and understand its implications for sustainability.

Managing cash flow isn’t just about staying solvent; it’s about ensuring you have the resources to invest in growth when needed.

By keeping a close eye on cash flow projections and adjusting expenses accordingly, startups can navigate financial challenges and extend their runway, giving them more time to achieve key milestones.

Scalability and Flexibility

For a financial model to be useful over time, it must be built with scalability and flexibility in mind. Startups often evolve quickly, testing new business models, adding revenue streams, or pivoting based on market feedback.

An adaptable financial model allows for these adjustments without requiring a complete rebuild.

Structuring the model with scalability in mind—using modular components and clear assumptions—means you can easily make significant updates, like changing the user acquisition strategy or adjusting pricing models, without having to start from scratch.

This flexibility not only saves time but ensures that your financial insights stay relevant as the business grows and adapts to new opportunities.

With the core components in place, we can now explore how to build a financial model that is both practical and easy to understand, ensuring it serves as a valuable tool for both founders and potential investors.

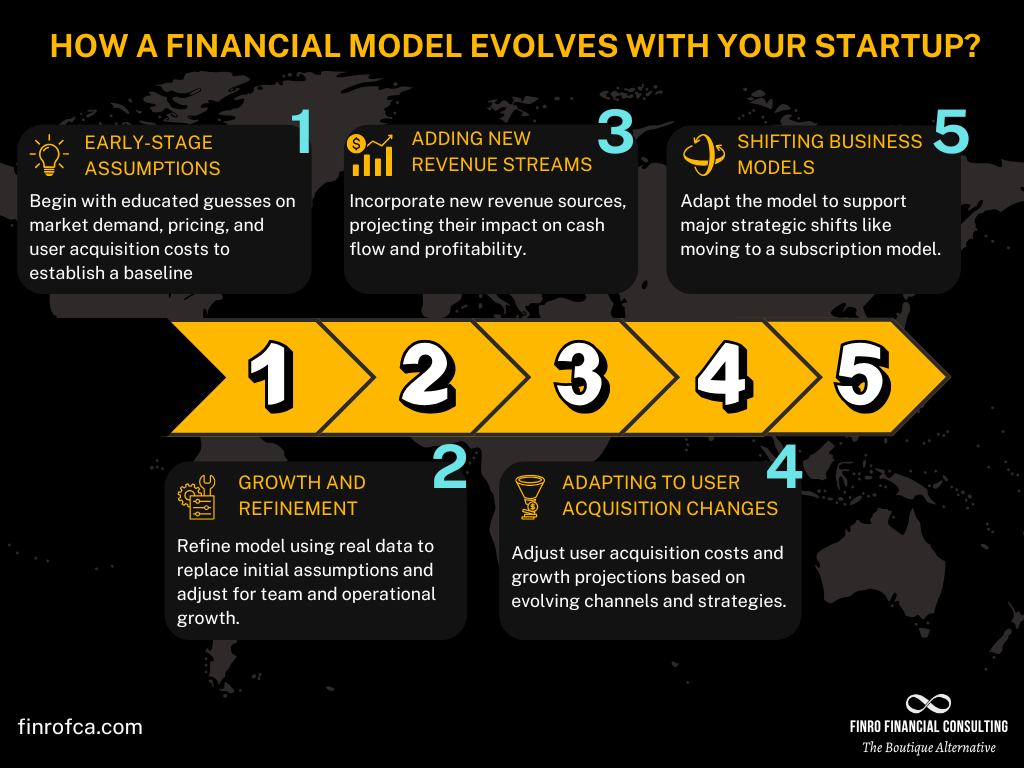

How a Financial Model Evolves with the Startup?

So far, we’ve covered the core purposes and components of a robust financial model, as well as the importance of building it for scalability and flexibility.

But a financial model isn’t static. As your startup grows and adapts, your financial model should evolve alongside it, reflecting new data, strategies, and market realities.

Early-Stage Assumptions

In the early stages, your financial model is built on a foundation of assumptions—many of which are educated guesses about market demand, user acquisition costs, and pricing.

At this stage, the model is likely simple, focusing on core metrics like cash burn and revenue growth. This initial model helps you understand the basics of your financial landscape and gives you a baseline for tracking your progress.

Growth and Refinement

As your startup gains traction, you’ll gather real-world data that either confirms or challenges your early assumptions. At this stage, the financial model becomes more refined.

You might update revenue projections based on actual user acquisition costs or adjust cost estimates as your team grows and operational needs expand. This evolution is essential, as it ensures your model reflects the true performance of your business, rather than assumptions that may no longer apply.

Adding New Revenue Streams

Growth often comes with the introduction of new revenue streams. For instance, a tech startup initially offering a single product may decide to expand into a complementary service, like consulting or a premium product feature.

Your financial model should be updated to incorporate these new revenue sources, projecting their impact on cash flow, profitability, and resource allocation.

This ability to add new streams without overhauling the model demonstrates its adaptability and relevance over time.

Adapting to User Acquisition Changes

User acquisition is a critical component for most startups, and strategies often shift as the company matures. You might start with organic channels, then transition to paid marketing, partnerships, or even sales teams.

Each channel has its own costs and expected returns, and your financial model should be flexible enough to account for these changes in your acquisition strategy. By updating assumptions and inputs for each channel, you can maintain accurate projections for user growth and acquisition costs.

Shifting Business Models

Sometimes, startups need to make significant strategic shifts, like moving from a freemium model to a subscription-based one. S

uch changes have a profound impact on revenue projections, customer lifetime value, and cash flow.

A flexible financial model allows you to test these scenarios and project the potential financial outcomes of a major pivot. This adaptability is critical for navigating growth phases and ensuring your model remains aligned with your strategic direction.

As your startup continues to grow, your financial model will become an increasingly valuable asset for decision-making, planning, and communicating with investors.

In the next section, we’ll dive into practical tips for building a financial model that’s not only accurate but also easy to understand for anyone who reads it.

Practical Tips for Building a Startup Financial Model

Now that we’ve explored how a financial model evolves alongside your startup, let’s focus on how to build one that is both effective and easy to maintain.

A well-designed model isn’t just about having accurate numbers—it’s about creating a tool that helps you make informed decisions, communicate clearly, and adapt as your business grows. Here are some key tips to keep in mind.

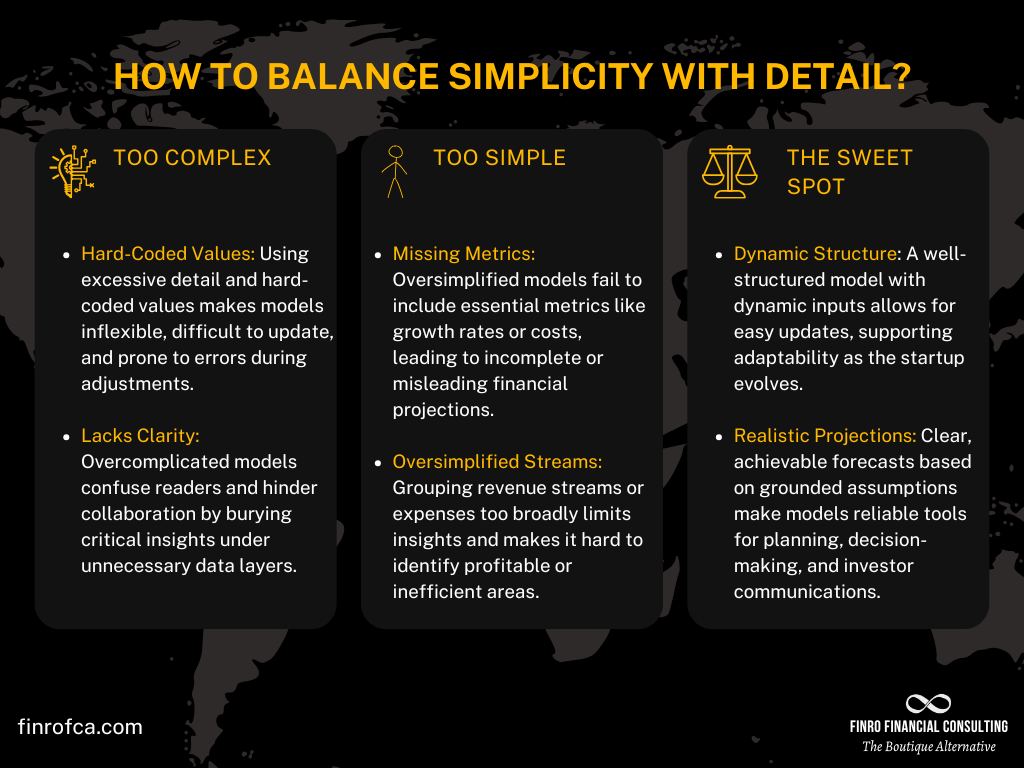

Balance Simplicity with Detail

A financial model should strike a fine balance: it must be robust enough to capture the complexities of your business but simple enough to update and interpret. Overloading your model with too much detail—like excessive granularity or unnecessary metrics—makes it harder to use effectively.

For example, instead of trying to predict every line item for marketing expenses, group related costs into broader categories. Use dynamic formulas and organized tabs to ensure the model remains flexible and easy to navigate.

A streamlined approach ensures that your model is accessible to anyone who needs to review it, from co-founders to potential investors, without overwhelming them with unnecessary complexity.

Create Clear Assumptions

Assumptions are the backbone of any financial model. Growth rates, pricing strategies, market size, user acquisition costs—these are just a few of the inputs that drive your projections. Documenting these assumptions clearly within the model is critical to avoid confusion during updates or when sharing the model with others.

Include a dedicated “Assumptions” tab in your financial model where each input is listed with an explanation. For example, if your growth rate assumes a 10% increase in monthly users, provide a note on the data source or reasoning behind it. This transparency not only keeps your model organized but also allows you to quickly adjust variables as your business evolves.

Think Like an Investor – But Don’t Model Just for Investors

It’s tempting to build a financial model solely to impress investors, but this can backfire.

Instead of guessing what investors want to see, focus on showcasing the sound business logic behind your projections. A good model highlights your market opportunity, demonstrates sustainability, and shows how your startup will achieve key milestones.

For instance, instead of overemphasizing ROI calculations or aggressive growth projections, prioritize clarity and accuracy.

Show how your startup plans to acquire users, scale revenue streams, and manage costs effectively. Investors appreciate realistic models that reflect the true potential of a business rather than exaggerated forecasts designed to catch attention.

By balancing simplicity with detail, documenting assumptions, and focusing on sound business logic, your financial model will become a valuable tool for decision-making and growth.

In the next section, we’ll explore common pitfalls to avoid when building a financial model, ensuring your efforts deliver long-term value.

Common Mistakes to Avoid

A startup financial model can be one of your most valuable tools—if it’s built thoughtfully.

However, certain mistakes can undermine its effectiveness, turning it into a burden rather than an asset. Here are two common pitfalls to avoid and how to address them.

Over-Complicating the Model

It’s tempting to pack your financial model with every possible detail, aiming for precision or to impress stakeholders. However, this approach often backfires. Over-complicating a model by adding too many assumptions or overly detailed calculations can make it unwieldy and difficult to use.

For example, inputting dozens of granular metrics for marketing spend across every channel might seem thorough, but it can make updates cumbersome and lead to errors. Stakeholders reviewing your model may struggle to follow the logic or understand its relevance, ultimately reducing its impact.

How to Avoid: Focus on simplicity and clarity. Group similar data into broader categories, and prioritize the metrics that drive key decisions. Your model should provide actionable insights without overwhelming its users.

Skipping Documentation

Even a well-structured financial model can fall apart if assumptions and calculations aren’t properly documented. Failing to explain how inputs are derived or what they represent leaves the model open to misinterpretation, especially when it’s shared with investors or team members.

For instance, imagine projecting revenue growth based on a 15% monthly user increase without noting whether this assumption is based on industry benchmarks, historical performance, or intuition. This lack of transparency undermines the credibility of the entire model and can erode trust.

How to Avoid: Dedicate a section or tab in your model to assumptions. Clearly document sources, rationale, and any key calculations. This practice not only improves clarity but also makes it easier to update the model as assumptions change.

Avoiding these mistakes ensures your financial model remains a useful tool for planning, decision-making, and communicating with stakeholders. In the conclusion, we’ll tie together the key points covered and reinforce how a strong financial model drives startup success.

Conclusion

A well-crafted financial model is more than just a spreadsheet—it’s a dynamic tool that empowers founders to make informed decisions, plan for growth, and navigate uncertainty.

Whether you’re in the early stages of your startup or scaling toward Series B, your financial model should evolve alongside your business, reflecting new opportunities and challenges.

By balancing simplicity with detail, documenting clear assumptions, and building with adaptability in mind, your model becomes a foundation for strategic planning.

Avoiding common mistakes like over-complicating or skipping documentation ensures it remains accessible and reliable, whether you’re using it to guide internal decisions or communicate with investors.

Ultimately, a strong financial model helps you stay focused on what matters most: growing your business sustainably and confidently. As you continue refining your model, remember that its true value lies in its ability to adapt and support your startup’s journey.

If you’re looking for expert guidance in building a financial model tailored to your needs, Finro is here to help. Let’s create a model that doesn’t just forecast your future but helps shape it. Reach out today.

Key Takeaways

Purpose of a Financial Model: A financial model is a decision-making tool, not just a projection of future numbers.

Balance Simplicity with Detail: Avoid over-complicating the model; focus on key metrics while keeping it easy to update and interpret.

Document Assumptions Clearly: Transparent assumptions improve accuracy, understanding, and credibility, ensuring the model evolves effectively over time.

Adaptability is Critical: Build for scalability to incorporate new revenue streams, cost adjustments, or strategic shifts as the business grows.

Avoid Common Pitfalls: Steer clear of excessive complexity or missing documentation to maintain usability and relevance for stakeholders.