How to Create a Budget for Your Tech Startup?

By Lior Ronen | Founder, Finro Financial Consulting

Creating a solid budget is one of the most valuable tools for tech startups aiming to balance growth with careful cash flow management.

Unlike traditional businesses, tech startups face a unique mix of expenses: R&D, cloud infrastructure, customer acquisition costs, and often high burn rates.

Without a well-planned budget, it’s easy for spending to spiral, leaving the business vulnerable in crucial growth stages.

This guide explores practical budgeting strategies tailored specifically for tech startups.

We’ll break down core budgeting methods, tips for setting realistic financial targets, and how to align spending with both immediate and long-term goals.

A tech startup’s budget should align spending with growth goals by using methods like fixed-variable, activity-based, or zero-based budgeting. Setting realistic targets through revenue forecasting, factoring in fundraising, and managing debt helps create a flexible budget framework. Preparation steps, such as gathering data, identifying high-cost areas, and analyzing variances, refine budget accuracy. Regular reviews and tech-specific KPIs, like CAC, LTV, and MRR, enable startups to adapt their budget, maintaining financial health and supporting sustainable growth.

- Understanding Startup Budgeting Needs

- Core Budgeting Methods for Startups

- Setting a Startup Budget Target

- Revenue Forecasting for Startups

- Fundraising and Investment Projections

- Balancing Debt and Cash Flow

- Preparing the Budget

- Gathering Historical Data

- Identifying and Prioritizing High-Cost Areas

- Analyzing Prior Budgets and Variances

- Building the Budget for a Startup

- Tips for Tech Startup Budgeting Success

- Conclusion

Understanding Startup Budgeting Needs

Creating an effective budget is about more than just planning expenses; it’s a tool for guiding a startup’s growth.

For tech startups, budgeting has specific challenges and advantages that require a targeted approach, helping founders not only manage cash flow but also make informed decisions as they scale.

Importance of Budgeting

For startups, budgeting isn’t just a formality; it’s a lifeline. A well-planned budget helps founders keep an eye on cash flow, balancing investments in growth areas with available resources.

In early stages, when revenue may still be unpredictable and expenses are high, tracking every dollar is critical to extending the runway.

Knowing where the money’s going gives startups more control over their burn rate, helping them stay agile and make strategic decisions based on what the business truly needs.

Effective budgeting isn’t just about surviving the first few years—it’s about setting up the financial framework to scale in a sustainable way.

Unique Considerations for Tech Startups

Tech startups have specific budget challenges that set them apart from traditional small businesses.

For instance, R&D costs are often higher as they build and refine new products, so budgeting for these ongoing expenses is key.

Then there’s customer acquisition: many tech startups allocate a substantial portion of their budget to reach new users and grow their market share, whether through digital marketing, sales teams, or partnerships.

Another significant factor is cloud infrastructure and related tech costs, like AWS or Azure fees, software subscriptions, and data storage.

These expenses may grow alongside customer numbers or usage levels, making them less predictable but vital to track.

By focusing on these unique areas, tech startups can build a budget that realistically reflects their needs and keeps the business prepared for rapid growth or changes in demand.

With an understanding of the budgeting essentials for tech startups, it’s time to look at the practical methods that can help structure your budget effectively.

Let’s explore the three main budgeting approaches for startups and how to choose the one that best fits your business.

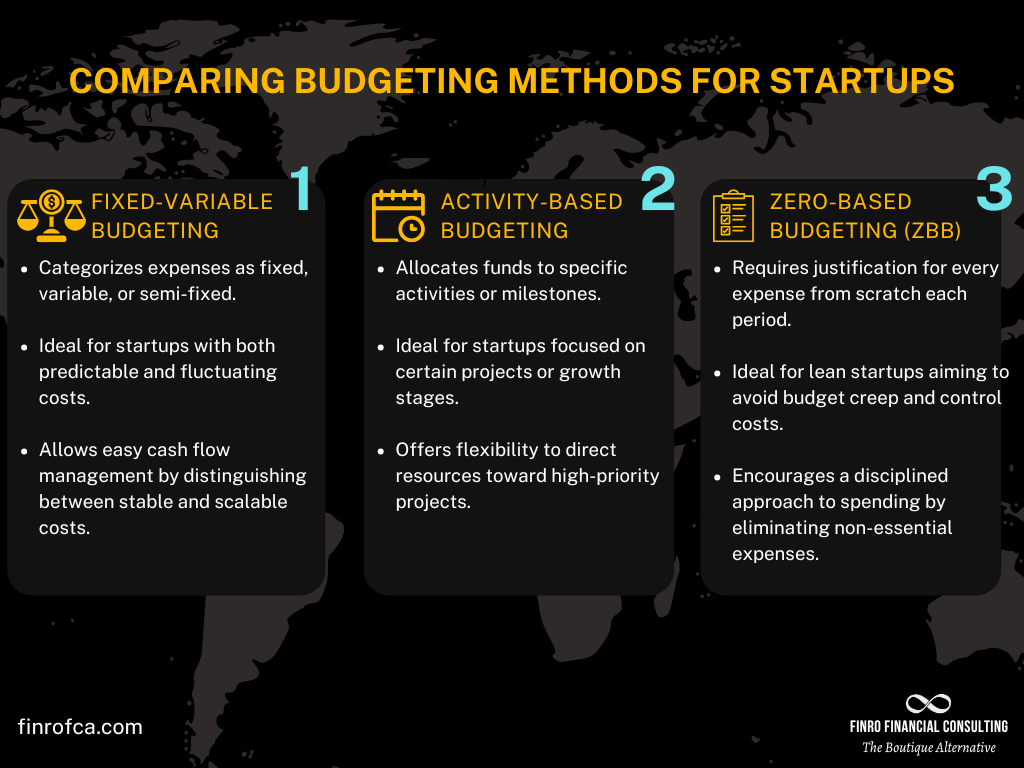

Core Budgeting Methods for Startups

With a solid understanding of the unique budgeting needs for tech startups, the next step is to choose a budgeting method that aligns with your goals and resources.

Each approach—Fixed-Variable Budgeting, Activity-Based Budgeting, and Zero-Based Budgeting—offers distinct advantages, helping startups allocate resources efficiently, track spending, and maintain control over cash flow.

Fixed-Variable Budgeting

Fixed-variable budgeting is a straightforward approach that categorizes expenses into three groups: fixed, variable, and semi-fixed costs.

This method is useful for startups with varying revenue streams and can help founders maintain control over core expenses while managing cash flow.

Fixed Costs: These are expenses that remain constant regardless of sales or customer numbers, such as rent, salaries, and software licenses. For example, a startup using a fixed SaaS platform for team communication will pay a set fee every month.

Variable Costs: These costs fluctuate based on sales or usage levels. In a tech startup, variable costs might include AWS fees for cloud hosting or payment processing fees, which rise as customer usage increases.

Semi-Fixed Costs: Semi-fixed (or semi-variable) costs start as fixed costs up to a certain level and then become variable. A tech startup’s customer support team, for instance, may need additional staff as user numbers grow, creating semi-fixed payroll expenses.

Use Case: Consider a SaaS startup with a lean team and a limited runway. By using fixed-variable budgeting, the founders can clearly identify and control their fixed expenses, such as office rent and essential software.

This structure enables them to project cash flow accurately and scale by cautiously adding variable costs, like increased AWS capacity, as their user base grows.

Activity-Based Budgeting

Activity-based budgeting allows startups to allocate funds based on specific activities, milestones, or projects, rather than general categories. This method gives startups flexibility to focus their budget on priority areas, aligning spending with key business goals.

Budget by Milestone: A startup might budget according to product development phases, for example, by allocating more funds for the initial development phase and preparing for a product launch.

Budget by Activity: Alternatively, funds can be divided among activities like post-sales support, marketing campaigns, and new feature rollouts. Each activity receives funding based on its anticipated ROI and strategic importance.

Example: A tech startup developing an app could use a roadmap with major product milestones: an MVP launch, initial user acquisition, and subsequent feature updates. By budgeting for each milestone separately, the founders can manage cash flow and focus resources on completing each stage successfully, without overextending on less critical areas.

Zero-Based Budgeting (ZBB)

Zero-based budgeting is a lean approach where all expenses must be justified from scratch each year or budget period. Unlike traditional budgeting, which assumes incremental growth, ZBB requires startups to validate every dollar they plan to spend.

Expense Justification: Every new expense must support the startup’s core goals, and departments are not guaranteed the same budget they had previously.

Cost Efficiency: ZBB encourages a culture of cost control by challenging the necessity of each expense and finding ways to fund new projects without increasing the total budget.

Scenario: A cash-conscious tech startup in its early stages uses ZBB to rigorously assess its expenses. Instead of rolling over last year’s budget, they require every department—marketing, development, and operations—to justify its spending based on anticipated returns. This approach helps them avoid budget creep, control operational costs, and make lean growth decisions while focusing on essential activities.

With these budgeting methods in mind, the next step is to set realistic financial targets. Let’s dive into the essentials of defining a startup budget target and aligning it with projected revenue, funding, and operational needs.

Setting a Startup Budget Target

With a clear understanding of your startup’s unique budgeting needs and the methods available, it’s time to set a realistic budget target.

This target will act as a guiding framework, helping you align financial resources with business goals while managing cash flow effectively.

Here, we’ll explore the key elements to consider: revenue forecasting, potential fundraising, and debt management.

Revenue Forecasting for Startups

At Finro, we believe that accurate revenue projections are built on understanding the customer journey, rather than relying on vague assumptions.

For SaaS startups, this means focusing on a data-driven, user journey approach, which provides a realistic, actionable roadmap for growth.

Traditional methods, like simple year-over-year percentage increases or “guesstimates,” often lack context and fail to capture the nuances of real business dynamics.

These approaches may lead to surface-level projections that miss critical insights, such as how different factors influence customer acquisition and retention.

Instead, we recommend mapping out the customer journey, from the first interaction to conversion, and using measurable inputs at each stage. Here’s how this approach works:

Marketing Channel: Start with your monthly marketing budget and break down how much it costs to reach potential customers. Calculate your cost-per-click and clickthrough rate to estimate how many visitors you’ll bring to your site or platform.

Conversion Rates: Track each conversion stage. For example, if customers sign up for a trial or demo, identify the first conversion rate (percentage of visitors who take this action). Then, calculate the second conversion rate—the percentage of trial or demo users who ultimately sign up for a paid plan.

Price Point and Assumptions: Based on the conversion rates and your pricing assumptions, you can estimate total monthly revenue. Understanding how pricing adjustments impact revenue will also give you flexibility to experiment and refine your projections as your user base grows.

Using this user journey method grounds revenue forecasts in tangible customer interactions and real business drivers, providing a clearer picture of how marketing and sales efforts translate into revenue.

By focusing on actual conversion points and customer behavior, you can make informed decisions and adjust strategies to optimize growth.

With revenue projections in place, the next step is to consider how additional funding, investments, and debt management fit into your overall budget target.

Fundraising and Investment Projections

Fundraising is often a lifeline for startups, especially during early stages when revenue is still ramping up. Any planned fundraising should be incorporated into your budget target, as new funds can significantly impact your spending capacity and growth trajectory.

When planning for fundraising, it’s crucial to align budget milestones with expected fundraising rounds.

For instance, if you anticipate a new funding round in six months, ensure your current budget can sustain the business until then. This alignment helps you stay on track, meet investor expectations, and avoid budget shortfalls.

Including potential investments in your budget also allows you to plan for key expenses that support growth—like scaling the team, enhancing technology, or launching new marketing campaigns—without compromising cash flow.

Setting clear milestones linked to your budget and funding rounds can make your business more attractive to investors by showing a structured financial strategy.

Balancing Debt and Cash Flow

Debt can be a useful tool for startups, but it also comes with responsibilities that need to be managed carefully within the budget. Business loans or credit lines often help bridge cash flow gaps or fund early growth initiatives, but they also create financial obligations.

Including debt repayment in your budget ensures that you’re prepared to meet these obligations without jeopardizing essential expenses.

To maintain a healthy balance, it’s wise to set aside funds for debt repayments and unexpected financial needs.

Building an emergency fund can help the business manage sudden cash flow issues or cover unforeseen expenses, providing a buffer that protects your core budget.

This approach not only supports financial stability but also demonstrates to potential investors or lenders that you’re managing debt responsibly.

With a realistic budget target in place, the next step is preparation—gathering the right data and analyzing past spending to create a practical and actionable budget for the year ahead.

Let’s dive into the preparation process to ensure that your budget is built on solid ground.

Preparing the Budget

With a budget target set based on realistic revenue projections, potential fundraising, and debt considerations, the next step is to gather the information needed to build a well-informed budget.

This involves analyzing historical data, identifying key cost areas, and reviewing past budgets to ensure an accurate and adaptable financial plan.

Gathering Historical Data

For established startups, historical financial data is invaluable for projecting future expenses.

Start by reviewing past years’ expenses to understand spending patterns and identify recurring costs.

Detailed financial records—such as monthly operational expenses, salaries, cloud service fees, and marketing spend—provide a reliable foundation for estimating next year’s needs.

For newer startups without prior budgets, industry benchmarks and peer financial data can serve as useful reference points.

Research similar businesses in your sector or stage to estimate typical costs in areas like R&D, customer acquisition, and infrastructure.

Leveraging available benchmarks allows early-stage startups to make educated assumptions and establish a baseline for spending.

Identifying and Prioritizing High-Cost Areas

Once you have baseline data, the next step is to identify and prioritize high-cost areas. Startups often have key expenses tied to cloud services, payroll, R&D, and marketing.

By listing these costs and ranking them by business impact, you can assess where to focus resources and where cost-saving opportunities might exist.

For instance, cloud infrastructure can be a significant variable expense, especially as user numbers grow. Regularly evaluating provider costs and exploring alternative solutions can help manage these expenses effectively.

Similarly, for salaries, startups may consider outsourcing or hiring contractors for specific projects instead of full-time hires, offering flexibility and cost efficiency.

Analyzing Prior Budgets and Variances

If your startup has a previous budget, reviewing it can provide valuable insights.

Analyze where the actual spending aligned or diverged from budgeted amounts, and identify the causes of any significant variances.

For instance, unexpected growth in user acquisition costs may indicate the need to refine marketing strategies or set more accurate targets.

Case Study: Take the example of a SaaS startup that overspent on marketing in the previous year. By analyzing budget variances, the founders realized that high CAC was due to an ineffective ad campaign targeting the wrong audience.

With this insight, they adjusted their marketing strategy and reallocated funds to focus on channels that attracted more qualified leads. This shift helped them reduce CAC and optimize their budget for the following year.

By systematically gathering data, prioritizing costs, and learning from past budgets, startups can build a more grounded, adaptable financial plan. With this preparation complete, it’s time to move on to the final phase: actually constructing the budget and aligning it with the company’s goals and milestones for the year ahead.

Building the Budget for a Startup

With the groundwork laid by setting a budget target, gathering essential data, and analyzing high-cost areas, it’s time to build the budget itself.

This stage involves turning your financial goals into a structured, actionable plan that aligns with your company’s milestones and growth objectives.

Here’s how to approach budget allocation and tracking to set your startup up for financial success.

Budget Allocation by Goal and Milestone

Creating a goal-oriented budget means aligning each expense with a specific milestone or objective. Start by identifying key company goals—such as product launches, user acquisition targets, or fundraising rounds—and allocating funds to support them.

For example, if a significant product launch is scheduled for Q2, allocate more resources for marketing, R&D, and customer support during that period to ensure its success.

Using a template can simplify this process. A monthly or quarterly cash flow template allows you to forecast revenue and expenses over time, helping you visualize how cash flows in and out of the business.

Break down expenses by team or department, such as development, marketing, and operations, to ensure each area has the resources needed to achieve its goals.

Categorizing expenses in this way also makes it easier to identify any areas that may be under- or overfunded and make adjustments accordingly.

Implementing the Budgeting Method and Tracking

Once your budget is built, choosing the right tools for implementation and tracking is essential.

Several tools and software options cater specifically to startup budgeting needs, from popular accounting software like QuickBooks and Xero to more specialized financial forecasting tools.

These tools enable you to monitor expenses, generate reports, and maintain a clear view of your startup’s financial health.

Monthly tracking is crucial to ensure your budget remains aligned with real-world outcomes. By comparing actual spending against forecasts each month, you can identify any variances early and make adjustments as needed.

Regular tracking helps you stay agile, responding to unexpected expenses or shifting priorities without veering off course. It also provides valuable data points to refine future budgets, improving accuracy over time.

With the budget framework established, the next step is implementing financial best practices to ensure that each dollar is spent wisely. Let’s explore tips and strategies for managing your startup’s budget effectively as you grow.

Tips for Tech Startup Budgeting Success

With a structured budget in place and a roadmap for tracking and adjustments, your startup has a strong foundation for financial management.

However, budgeting isn’t a static process, especially in the dynamic world of tech startups. Here are some key tips to ensure your budget remains relevant and aligned with your business’s growth goals.

Adapt and Adjust

The startup journey is filled with unexpected changes—whether it’s new market opportunities, shifts in customer demand, or evolving competitive landscapes.

It’s crucial for startups to remain flexible and open to adjusting their budget as new insights and data emerge. If a marketing channel suddenly becomes less effective, for instance, consider reallocating funds to a more successful strategy.

By staying agile, you can ensure that your budget continues to support the company’s evolving needs and goals.

Frequent Financial Reviews

Setting a budget is only part of the process; regularly reviewing and updating it is essential to staying on track.

Establish a schedule for monthly or quarterly check-ins to assess your budget’s accuracy and alignment with current business objectives.

These reviews allow you to compare actual spending to projected costs, identify any significant variances, and make timely adjustments.

Frequent reviews not only help prevent budget overruns but also foster a proactive approach to financial management, giving you the data you need to make informed decisions.

Leveraging Tech-Specific KPIs

To get the most out of your budget, leverage tech-specific KPIs that offer valuable insights into your startup’s financial health and growth potential.

Key metrics like Customer Acquisition Cost (CAC), Lifetime Value (LTV), and Monthly Recurring Revenue (MRR) can provide a more detailed picture of performance and guide budget adjustments.

CAC (Customer Acquisition Cost): Use CAC to track the cost-effectiveness of your marketing and sales efforts. If CAC rises above your budgeted expectations, it may indicate the need to refine acquisition strategies or target different channels.

LTV (Lifetime Value): LTV shows the total revenue you can expect from a customer over their relationship with your business. By comparing LTV to CAC, you can assess the profitability of customer acquisition and make decisions on spending limits.

MRR (Monthly Recurring Revenue): For SaaS and subscription-based startups, MRR provides a consistent measure of revenue growth. Monitoring MRR helps track revenue trends, informing decisions on resource allocation and growth strategies.

By integrating these KPIs into your budgeting process, you can make more precise, data-driven adjustments that keep your budget aligned with your growth trajectory.

With these tips, your startup is well-positioned to maintain financial health and flexibility as it grows. In the final section, we’ll wrap up with a summary of the key budgeting principles to keep in mind as you navigate your startup’s financial journey.

Conclusion

Creating and managing a budget is one of the most powerful tools for guiding your tech startup toward sustainable growth. By understanding your unique budgeting needs, choosing the right methods, and setting realistic financial targets, you can build a solid financial foundation that adapts as your business evolves.

Each step in the process—from gathering historical data to aligning expenses with milestones and tracking monthly variances—adds layers of precision and control to your financial strategy.

Remember, flexibility is key. The startup environment is dynamic, and remaining agile allows you to adjust your budget as new insights and challenges arise. Regular financial reviews and the use of tech-specific KPIs, like CAC, LTV, and MRR, will help you make informed adjustments that keep your budget relevant and supportive of your business goals.

As you move forward, use this budget as a living document, revisiting it often to ensure it continues to align with your vision for growth.

With a proactive approach to budgeting, your startup will be well-prepared to navigate both challenges and opportunities, setting the stage for long-term success.

Key Takeaways

Choose the Right Budgeting Method: Select fixed-variable, activity-based, or zero-based budgeting based on startup goals and financial needs.

Set Realistic Financial Targets: Use revenue forecasts, fundraising projections, and debt management to guide budget limits.

Prioritize High-Cost Areas: Focus resources on high-impact expenses like R&D, salaries, and cloud infrastructure.

Track Financial Metrics: Leverage CAC, LTV, and MRR to inform budget adjustments and spending priorities.

Stay Flexible: Regularly review and adapt the budget to support sustainable growth and respond to new insights.