Essential Guide to Managing Bootstrapped Startup Expenses

By Lior Ronen | Founder, Finro Financial Consulting

Starting a business with your own funds isn’t just about being cost-effective; it’s about being resourceful. Bootstrapping demands a sharper focus on where every dollar goes.

When you’re self-funded, you don’t have a big safety net from outside investors, so each expense carries a little more weight. You need to make financial choices that move the business forward without overextending yourself.

This guide is here to walk you through practical, straightforward ways to manage startup expenses wisely. From keeping a close eye on cash flow to embracing lean operations, we’ll cover the essentials that can help you stretch your budget further and grow sustainably.

We’ll also look at simple, cost-effective strategies for marketing, managing fixed costs, and using technology to streamline operations—all tailored for the needs of a bootstrapped business.

Expense management isn’t about cutting corners; it’s about knowing where to invest and where to save. Let’s get into the key practices that can help your business thrive without burning through your budget.

Building a sustainable, bootstrapped startup requires a disciplined approach to managing cash flow, prioritizing essential expenses, minimizing fixed costs, and leveraging affordable technology and automation. By focusing on efficient, scalable solutions and avoiding unnecessary debt, founders can maintain financial flexibility and enhance operational resilience.

Strategic use of resources, including cost-effective marketing and careful debt management for revenue-generating assets, lays a solid foundation for long-term growth. Staying adaptable and reassessing financial priorities as the business evolves ensures that growth is both controlled and sustainable, positioning the startup for success in an unpredictable landscape.

- Understanding Cash Flow: The Heartbeat of Your Bootstrapped Startup

- Prioritize Essential Expenses: Separating Needs from Wants

- Adopt Lean Operations: Maximizing Efficiency with Minimal Resources

- Optimize Marketing Costs: Spending Smart to Drive Growth

- Limit Fixed Costs: Prioritizing Financial Flexibility

- Leverage Technology and Automation for Cost Efficiency

- Avoid Unnecessary Debt: Financial Discipline for Sustainable Growth

- Conclusion

Understanding Cash Flow: The Heartbeat of Your Bootstrapped Startup

Cash flow is the steady movement of money going in and out of your business. Think of it as the heartbeat that keeps your startup alive and functioning.

For any business, but especially a bootstrapped one, maintaining healthy cash flow is critical—it’s what allows you to cover costs, seize opportunities, and keep your business on solid ground.

When you're self-funded, tracking cash flow is more than just a good practice; it’s essential for survival. It gives you a clear view of what’s coming in from customers, where money is going, and if your spending aligns with your actual earnings.

Staying on top of cash flow helps you make informed decisions and adjust quickly if funds get tight.

Let’s look at a few key tips that can help you manage cash flow effectively.

Regularly Review Cash Flow

Set up a consistent routine to check your cash flow. This doesn’t need to be an overly complex process—a weekly or monthly review will help you stay aware of any changes, large expenses, or trends in income and spending.

By keeping a close eye on cash flow, you can spot issues early and avoid surprises that could disrupt your business.

Plan for Large Expenses

Big costs can be a major drain on cash flow if they catch you off guard. If you know a large expense is coming up, such as equipment upgrades or a software renewal, set aside funds in advance. By planning for these costs, you ensure they don’t interfere with daily operations or force you into an unplanned search for extra funds.

Identify and Focus on Revenue-Generating Sources

Not all revenue streams are created equal. In a bootstrapped startup, it’s crucial to know which products, services, or clients bring in the most reliable income.

By focusing on these sources, you can prioritize efforts that have the most impact on your cash flow and set yourself up for more stable growth. Identify the parts of your business that truly drive revenue and look for ways to expand or improve them.

Understanding your cash flow is just the first step. Now, let’s talk about how to manage expenses wisely by focusing on the essentials.

In the next section, we’ll explore how to prioritize spending so that your budget supports the growth of your bootstrapped business without unnecessary waste.

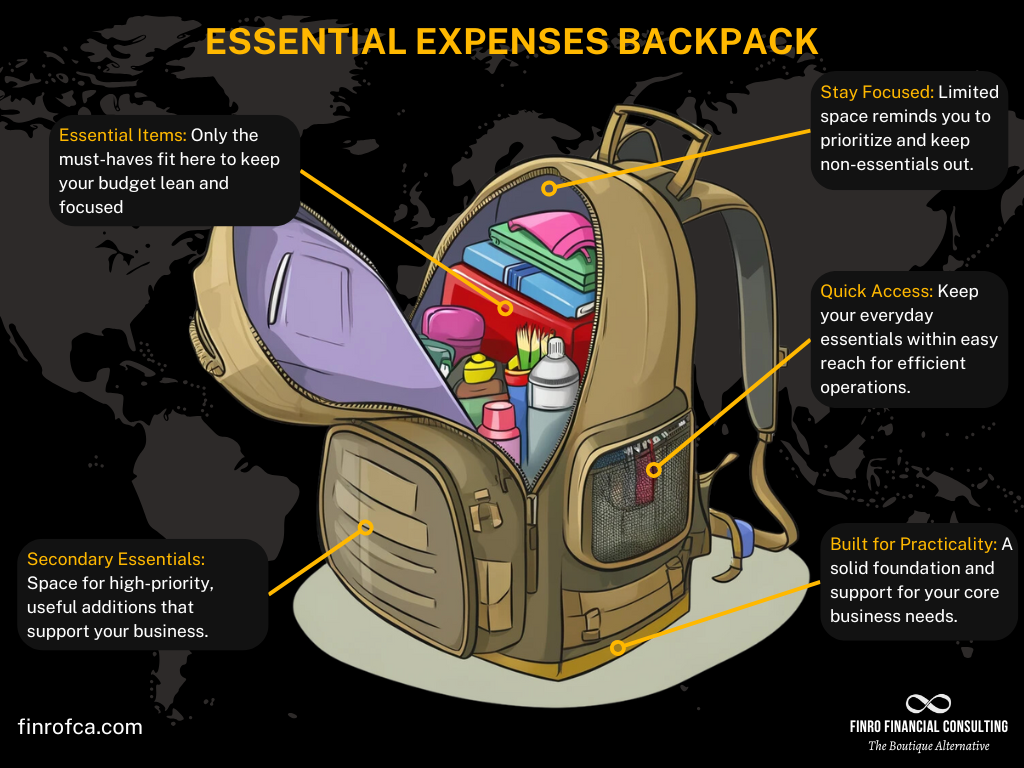

Prioritize Essential Expenses: Separating Needs from Wants

Now that you have a clear view of your cash flow, the next step is deciding how to spend it wisely. Not all expenses are created equal, especially in a bootstrapped startup where every dollar counts.

Prioritizing essential expenses—those that directly support your business operations—over non-essentials helps you allocate resources effectively and avoid stretching your budget too thin.

Distinguishing needs from wants allows you to focus on what truly drives your business forward. Essential expenses often include things like core team salaries, critical software, or production costs that are fundamental to keeping your business functional.

Non-essentials, on the other hand, may add value or convenience but aren’t strictly necessary, such as upgraded office furniture or advanced tools you can defer for later.

Create and Regularly Update a Categorized Expense List

Start by creating a categorized list of all your expenses, separating essentials from non-essentials. This list serves as a simple but powerful tool to keep your spending aligned with your priorities.

Regular updates to this list help you stay aware of where your money is going and ensure that you’re focusing on the must-haves. As your business grows, you may find that some non-essential items shift to essential as they become necessary for scaling.

Reassess Expense Priorities as the Business Evolves

What’s essential now might not be as crucial a few months down the road, and vice versa. Regularly reassessing your expenses keeps your budget flexible and responsive to changing needs.

As you introduce new products, hire more team members, or shift strategies, revisit your expense list and adjust your priorities accordingly. This practice helps you stay adaptable and ensures that your spending remains in sync with your business goals

With a clear grasp of your essential expenses, you’re one step closer to running a financially lean operation. In the next section, we’ll dive into strategies for creating efficient, streamlined processes that keep costs down and maximize output.

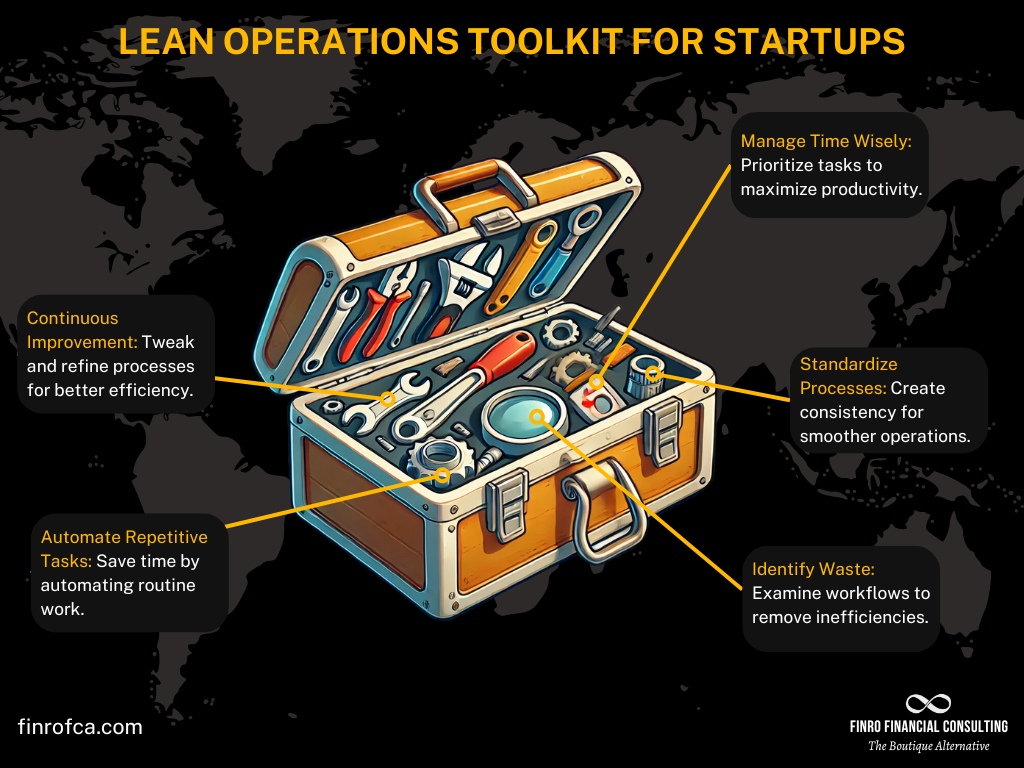

Adopt Lean Operations: Maximizing Efficiency with Minimal Resources

With a solid understanding of cash flow and a clear focus on essential expenses, it’s time to think about how to make your startup’s operations as efficient as possible. Lean operations focus on doing more with less—optimizing processes, reducing waste, and ensuring that every action adds value.

For bootstrapped startups, running lean isn’t just a choice; it’s often a necessity. Adopting lean principles can help increase profitability by lowering costs and boost flexibility by making it easier to adapt to changes.

Lean operations are all about maximizing output while minimizing resources.

This approach means identifying and eliminating anything that doesn’t directly contribute to your business goals, allowing you to run a more agile, responsive company. For startups, embracing lean practices can mean the difference between thriving and struggling to keep up.

Encourage a Culture of Continuous Improvement and Efficiency

Lean operations start with a mindset of ongoing improvement. Encourage your team to constantly look for ways to do things better, faster, or more cost-effectively. Even small adjustments can add up to significant savings over time.

This culture of improvement not only boosts efficiency but also fosters a sense of ownership and engagement among team members, as they see the impact of their contributions on the company’s success.

Consider Automating Repetitive Tasks to Save on Labor Costs

Many routine tasks can consume valuable time that could be better spent on strategic work. By automating repetitive tasks, you can free up resources and reduce the risk of errors.

For instance, consider using tools that streamline processes like data entry, customer follow-ups, or financial reporting. Automating these kinds of tasks allows your team to focus on higher-impact activities, helping the company stay lean and efficient.

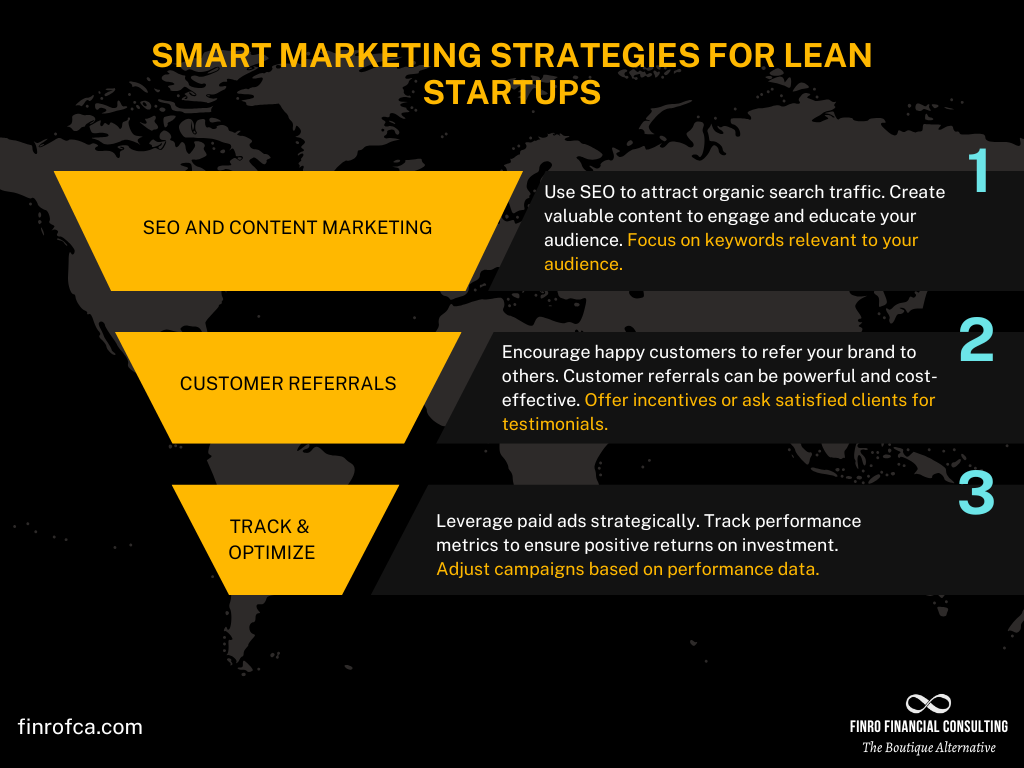

Optimize Marketing Costs: Spending Smart to Drive Growth

With lean operations in place, your startup is running efficiently, but to grow, you need to reach your audience without stretching your budget. In a crowded startup ecosystem, spending wisely on marketing is essential.

You want to maximize visibility and engagement while minimizing costs. By focusing on cost-effective strategies and utilizing free tools, you can expand your reach and build brand awareness without overspending.

Effective marketing doesn’t always require a large budget. In fact, organic marketing approaches, such as content marketing and SEO, are often the most sustainable ways for bootstrapped startups to gain traction.

These methods allow you to grow your presence over time while establishing trust and authority within your market. Paid campaigns can also be useful, but only when strategically targeted and measured for effectiveness.

Focus on SEO, Content Marketing, and Customer Referrals

Organic strategies like SEO, content marketing, and customer referrals are the backbone of a cost-effective marketing plan. SEO (Search Engine Optimization) helps your website appear in relevant searches, making it easier for potential customers to find you.

Content marketing, through blogs, videos, or guides, builds your authority and engages your audience without a significant upfront investment. Additionally, encouraging satisfied customers to spread the word can lead to valuable referrals—one of the most powerful and cost-efficient ways to attract new clients.

Track Metrics to Ensure Paid Campaigns Yield Positive Returns

When using paid campaigns, it’s essential to track metrics closely. Tools like Google Analytics, Facebook Ads Manager, and other platform-specific trackers can provide insights into how your campaigns are performing.

By monitoring metrics like click-through rates, conversions, and cost per lead, you can adjust your approach to focus on high-performing ads while reducing or eliminating underperforming ones. The goal is to ensure every dollar spent contributes meaningfully to your growth.

With a smart, lean marketing strategy in place, you’re set to grow your audience while keeping costs in check. Next, we’ll explore how to manage fixed costs effectively to maintain flexibility and financial stability as your business scales.

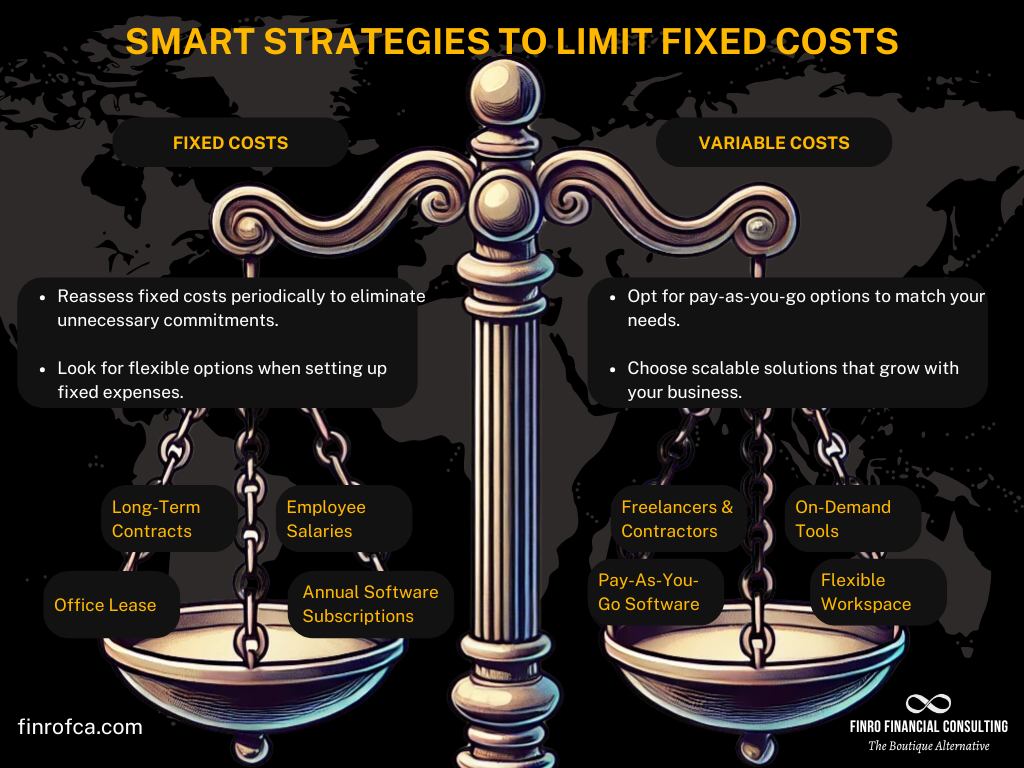

Limit Fixed Costs: Prioritizing Financial Flexibility

After optimizing your marketing spend, another critical step for financial health is managing your fixed costs. In a bootstrapped startup, maintaining flexibility is key, and one of the best ways to do that is by minimizing fixed costs wherever possible.

Unlike variable costs, which fluctuate based on usage or production levels, fixed costs remain consistent regardless of how much you earn or spend. High fixed costs can lock your budget into place, making it difficult to adjust to new opportunities or unexpected challenges.

Reducing fixed costs allows you to allocate resources more flexibly and scale as needed. This approach means that, when circumstances change, your financial commitments don’t weigh you down, and you can adapt your spending to match your current needs.

Opt for Scalable, Pay-As-You-Go Options Where Possible

One effective way to limit fixed costs is to choose scalable, pay-as-you-go options instead of long-term contracts. For example, using cloud-based software with monthly subscriptions rather than annual licenses enables you to adjust your usage according to your needs.

Similarly, consider coworking spaces or flexible leases for office space rather than committing to a fixed long-term lease. These options allow you to pay only for what you need, keeping your overhead low and adaptable.

Reassess Fixed Costs Periodically

Fixed costs can become invisible over time, continuing in the background even when they’re no longer essential. Make it a habit to regularly review all your fixed expenses and assess whether each cost is still serving your business’s goals.

For instance, you may find that a particular software subscription or service is underutilized or that you can renegotiate a better deal. By staying vigilant about fixed costs, you’ll prevent your budget from becoming weighed down by unnecessary commitments.

With your fixed costs under control, your startup can maintain the agility needed to grow sustainably. Next, we’ll explore how technology and automation can further enhance your efficiency, helping you save both time and money as you scale.

Leverage Technology and Automation for Cost Efficiency

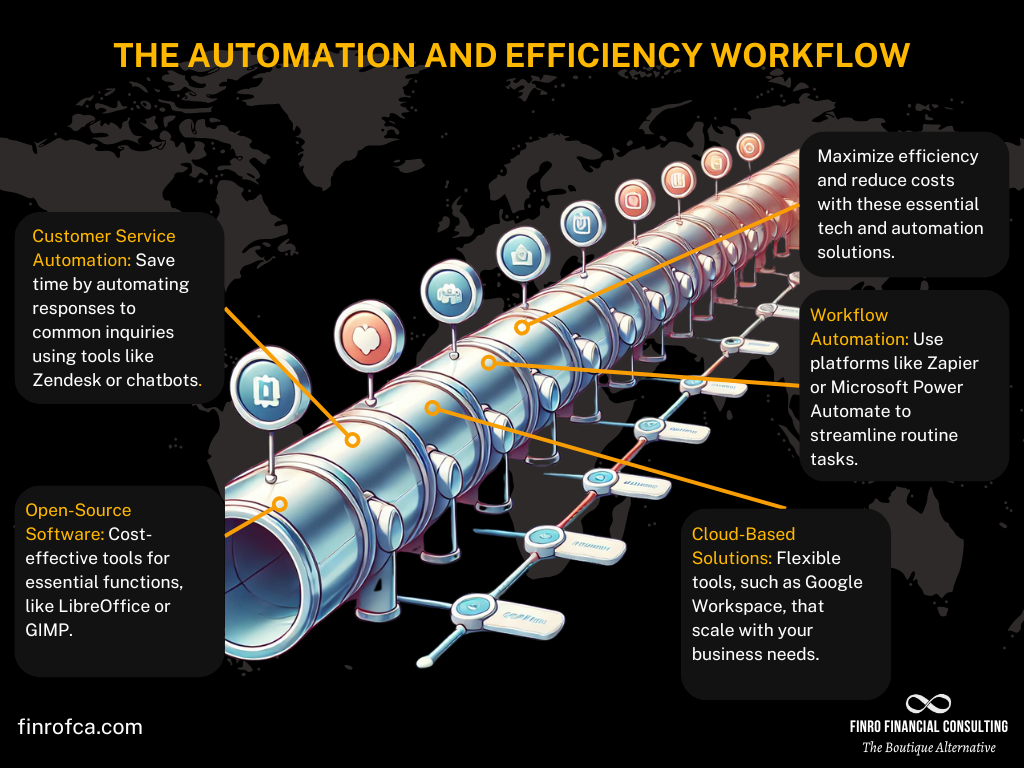

With fixed costs minimized, the next step in running a lean startup is leveraging technology to streamline operations and cut down on expenses. In today’s digital age, affordable and even free tech solutions are available for almost every business need, from customer service to project management.

Using technology and automation wisely can free up valuable time and resources, allowing you to focus on growth while keeping costs under control.

By adopting automation tools and cloud-based solutions, your startup can operate more efficiently without requiring significant upfront investments. Automation reduces the need for manual, repetitive tasks, allowing your team to work on high-impact areas, while cloud-based software keeps your infrastructure light and scalable.

Use Open-Source Software

Open-source software is a powerful option for bootstrapped startups, providing functionality similar to paid tools without the hefty price tag. Tools like LibreOffice for office suites, GIMP for graphic design, and WordPress for website management offer robust capabilities for essential business functions.

With open-source solutions, you can run many aspects of your business at minimal cost, leaving more resources for growth-related expenses.

Automate Customer Service

Customer service is essential but can quickly become time-consuming and costly. Automating routine interactions through chatbots, automated email responses, or helpdesk platforms can make customer service more efficient.

Tools like Zendesk or Freshdesk offer automation features that handle common questions and direct customers to resources, allowing your team to focus on more complex inquiries.

Adopt Cloud-Based Solutions

Cloud-based software is often more affordable and flexible than traditional, on-premise software. For example, Google Workspace provides email, file storage, and collaboration tools in one package, while project management tools like Trello or Asana help teams stay organized without heavy IT infrastructure.

These platforms often operate on a pay-as-you-go model, so you can scale your usage as your business grows, paying only for what you need.

With technology and automation integrated into your operations, your startup is better equipped to operate efficiently and cost-effectively. In the next section, we’ll discuss strategies for avoiding unnecessary debt, ensuring that your business remains financially healthy and resilient.

Avoid Unnecessary Debt: Financial Discipline for Sustainable Growth

With cost efficiency, automation, and lean operations in place, your startup is set up to make the most of its resources. Yet, as you expand, the temptation to take on debt can arise.

While debt can be a powerful tool for growth, it can also become a heavy burden if used without caution.

For bootstrapped startups, financial discipline is essential; avoiding unnecessary debt helps you stay agile and maintain control over your business’s financial future.

Taking on debt for non-essential expenses, like office upgrades or non-critical technology, can quickly drain cash flow without contributing to long-term value.

Instead, consider debt only when it enables a revenue-generating opportunity—such as investing in new equipment or expanding a high-demand product line. By using debt selectively and managing it carefully, you can ensure it supports your growth rather than hindering it.

Use Debt Only for Revenue-Generating Assets

If debt becomes necessary, prioritize using it for assets that will directly generate revenue or improve profitability. For example, borrowing to invest in a new product line that meets a clear market demand or to fund equipment that will increase production can make strategic sense.

This approach ensures that your debt is self-sustaining, as the revenue generated by these assets helps cover repayment.

Manage Credit Cards and Short-Term Debt Cautiously

Credit cards and short-term loans can offer flexibility, but they also come with high interest rates that can accumulate quickly.

Use these tools sparingly and only for essential, short-term needs. Whenever possible, pay off the balance in full each month to avoid interest charges.

For expenses that require a longer repayment period, consider options with lower interest rates to avoid the financial strain that high-interest debt can impose.

With careful debt management and disciplined spending, your startup is positioned for sustainable growth. In the next section, we’ll bring it all together, exploring strategies to reinforce financial resilience and ensure long-term success.

Conclusion

By following a disciplined approach to cash flow management, cost efficiency, and strategic spending, you’ve set the foundation for sustainable growth.

From prioritizing essential expenses to leveraging technology and avoiding unnecessary debt, each step you’ve taken builds on the previous one, creating a robust financial strategy for your bootstrapped startup.

Sustaining this financial resilience isn’t just about one-time decisions; it requires ongoing evaluation and adaptability. Regularly review your costs, reassess your priorities, and look for opportunities to further optimize your operations.

The startup landscape can be unpredictable, but by staying flexible and grounded in these financial principles, your business will be well-prepared to weather challenges and capitalize on growth opportunities.

Regularly Reassess and Adapt

As your startup grows, your financial needs and priorities may shift. A flexible, adaptable approach to financial management allows you to pivot as necessary, whether that means investing in new growth opportunities or scaling back on non-essential expenses during lean periods.

Make it a habit to regularly revisit your budget, debt, and expense priorities to ensure they align with your current goals and market conditions.

Keep Building Efficiency with Technology and Automation

As you expand, technology and automation will continue to play a crucial role in scaling your business without proportionally increasing costs.

Keep exploring new tools and platforms that can simplify your processes, enhance customer experience, and support your team. Staying updated on the latest tech solutions will keep your operations lean and efficient as you grow.

Maintain Financial Discipline for Long-Term Stability

Financial discipline is a cornerstone of long-term success. Avoid the pitfalls of overspending or taking on debt that doesn’t contribute directly to revenue generation.

Maintain a strategic, thoughtful approach to all financial decisions, balancing the need for growth with the importance of stability. By staying disciplined, you create a sustainable pathway to growth and avoid the financial strain that can come with rapid scaling.

Building a bootstrapped startup comes with unique challenges, but with the right strategies in place, you can create a resilient business poised for success. Each step you’ve implemented—from managing cash flow and controlling costs to leveraging technology and exercising caution with debt—strengthens your business’s foundation. As you continue on this journey, remember that adaptability, resourcefulness, and financial discipline will be your greatest assets. Here’s to building a strong, sustainable future for your startup.

Key Takeaways

Prioritize Essential Expenses: Focus spending on critical needs to maximize financial efficiency.

Optimize Cash Flow: Regularly track inflows and outflows to maintain a healthy cash flow.

Leverage Technology and Automation: Use affordable automation tools to streamline processes and reduce costs.

Limit Fixed Costs: Choose flexible, pay-as-you-go options to maintain financial agility.

Avoid Unnecessary Debt: Only use debt for assets that drive revenue growth, managing it with caution.