Understanding Information Memorandums: A Comprehensive Guide

By Lior Ronen | Founder, Finro Financial Consulting

Information Memorandums (IMs) are key documents used by businesses when they're looking to raise money or get bought by another company.

Think of an IM as a detailed resume for a company—it tells potential investors or prospective buyers everything they need to know: what the business does, how it makes money, who runs it, and why it's a good opportunity.

This article will explain what an IM is, what it's used for, and how it's different when a company wants to merge with another company (M&A) versus when a startup is trying to get investment.

We'll go through each part of an IM, including how companies are valued, to make it clear what information is included and why it matters.

Whether you're part of a company looking to attract investment or someone interested in investing, this guide will help you understand the importance of IMs and how to use them effectively.

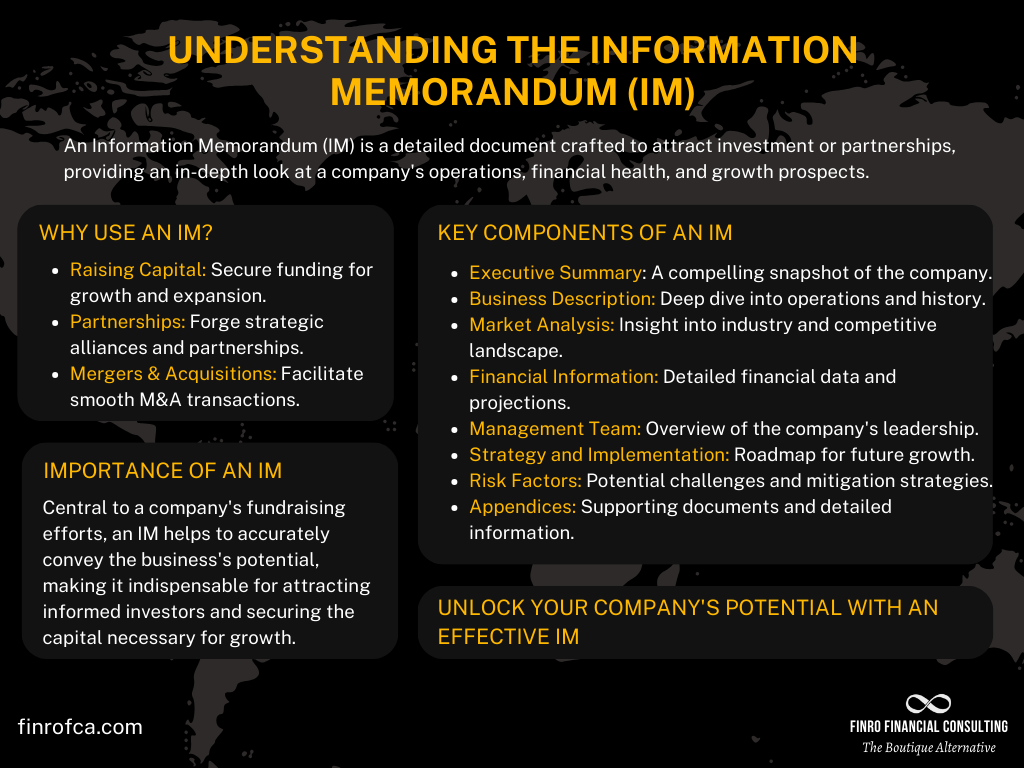

An Information Memorandum (IM) is a critical document for businesses seeking investment, offering a detailed overview of the company's operations, strategic objectives, financial health, and growth prospects. It serves various purposes, including fundraising, mergers and acquisitions (M&A), and debt offerings, tailored to showcase the company's value proposition to potential investors, acquirers, or lenders.

Through sections like executive summary, business description, market analysis, and financial information, an IM highlights key performance indicators, benchmarks against industry leaders, and comparisons with other niches, providing a comprehensive picture of the company's competitive edge and future potential. The document culminates in an investment offer and risk analysis, aiming to secure trust and investment by demonstrating a well-thought-out plan for value creation and success.

- What is an Information Memorandum (IM)?

- What is an IM Used For?

- Differences Between IM for M&A and IM for Startup Fundraising

- Structure of an Information Memorandum

- Executive Summary

- Business Description

- Market Analysis

- Strategy and Implementation

- Financial Information

- Management Team

- Valuation

- Investment Offer

- Risk Factors

- Appendices

- Supporting Themes: KPIs, Benchmarks, and Niche Comparisons

- Conclusion

What is an Information Memorandum (IM)?

An Information Memorandum (IM) is basically a detailed report about a company that's looking for money or a partnership. It's like a pitch, but way more detailed.

This document is packed with everything an investor or another company might want to know before they decide to put their money into the business. It covers what the company does, how it earns money, its plans for growth, and the team behind the scenes.

Why Do Companies Use IMs?

IMs are super important for a couple of reasons:

Raising Money: Startups and growing companies use IMs to show potential investors why they're a great investment. It's a way to say, "Here's what we do, here's where we're going, and here's how you can make money by helping us get there."

Selling or Merging the Business: When a company wants to sell itself or merge with another company, an IM can help show off its value. It's like saying, "Look at how well we're doing, and imagine how much better we could do together."

In both cases, the IM is there to make a strong case for the company. It takes a lot of the guesswork out for investors or buyers by laying out all the facts and figures they need to make a decision.

Confidential Information Memorandum (CIM) Explained

A Confidential Information Memorandum (CIM) is a specific type of Information Memorandum used primarily in the context of mergers and acquisitions (M&A).

It's a detailed document that provides an in-depth overview of a company that's up for sale, specifically designed to be shared with potential buyers under conditions of confidentiality.

The CIM includes detailed information about the company's operations, financials, management, and strategic opportunities, all while ensuring sensitive data remains protected.

Difference Between IM and CIM: While both IMs and CIMs serve to inform and attract potential investors or buyers, the key difference lies in their usage context and the level of confidentiality involved.

IMs are often used in broader investment scenarios, including fundraising rounds for startups or growth capital. They're designed to attract a wide range of investors or partners and might be less detailed about sensitive information.

CIMs, on the other hand, are tailored for M&A activities, offering a comprehensive and confidential look at a company's inner workings to a select group of potential buyers. They go into greater detail about financials, strategies, and potential synergies with the buyer, all under a confidentiality agreement to protect the company's sensitive information.

In summary, while IMs and CIMs both aim to showcase a company's value and potential to prospective investors or buyers, CIMs are more detailed and confidential, tailored specifically for M&A transactions.

Private Placement Memorandum (PPM) Explained

A Private Placement Memorandum (PPM) is a legal document used during private financing rounds to offer securities to a select group of investors.

Serving as a comprehensive disclosure document, it details the terms of the investment, describes the offered securities, outlines the risks involved, and includes company financials, ensuring that investors have all the information needed to make an educated decision.

Unlike IMs and CIMs, which are more descriptive and aimed at showcasing the company's potential and strategic fit, a PPM is focused on compliance and protection, providing a legal framework that informs investors about the specifics and risks of the investment.

Difference Between PPM, IM, and CIM:

PPMs are primarily regulatory documents for private offerings, emphasizing legal disclosures and investment risks to protect both the issuer and the investor.

IMs are marketing documents used in various fundraising contexts, designed to attract investment by highlighting the company's strategy, market potential, and growth prospects.

CIMs share similarities with IMs but are used in the specific context of M&A, with a focus on confidentiality and detailed insights into the company's financial and strategic position for potential buyers.

In essence, while IMs and CIMs market a company to potential investors or buyers, PPMs serve as a protective legal document during private securities offerings, each playing a distinct role in the broader context of corporate finance and investment.

| Document | Purpose | Primary Use | Focus |

|---|---|---|---|

| PPM | Legal document for private offerings, emphasizing legal disclosures and investment risks. | Private securities offerings to a select group of investors. | Compliance, legal disclosures, and risk. |

| IM | Marketing document for fundraising, showcasing company strategy, market potential, and growth. | Broad fundraising efforts including venture capital, growth capital. | Company's potential, strategy, and growth prospects. |

| CIM | Used in M&A, with a focus on confidentiality and detailed company insights for potential buyers. | Mergers and acquisitions (M&A), specifically tailored for potential acquirers under confidentiality. | Confidential insights into financials, strategies, and potential synergies. |

What is an IM Used For?

An Information Memorandum (IM) is like a Swiss Army knife for businesses looking to make big financial moves.

It's not just a one-trick pony; it's used in several key ways:

For Raising Money: When a business needs cash to grow, fix up, or get off the ground, it doesn't just ask for money without showing why it's a good bet. That's where an IM comes in. It lays out all the reasons why someone should invest in the business, including how it plans to make money and grow over time.

For Merging or Buying Other Businesses (M&A): Mergers and acquisitions (M&A) are when businesses either join forces or one buys another. An IM for M&A details everything a potential partner or buyer needs to know. It shows how the business stands out, its financial health, and how both sides can benefit from the deal.

For Borrowing Money: Sometimes, a business might want to borrow money instead of giving away a piece of the pie by selling shares. An IM can also be used to get lenders on board, showing them why the business is a solid enough bet to pay back the borrowed money.

Who Reads IMs?

The audience for an IM can be pretty broad. It includes:

Investors: These are the people or funds with the cash to invest in businesses. These could include angel investors, private equity funds, venture capital funds and other investors. They're always on the lookout for promising opportunities where their money can grow.

Acquirers: These are the companies or individuals interested in buying or merging with another business. They use IMs to find good matches.

Lenders: Banks or financial institutions that lend money to businesses. They read IMs to decide if a business is worth the risk of a loan.

In short, IMs are used to tell the story of a business to people who might want to invest in it, buy it, or lend it money.

It's a crucial tool for any business looking to make a financial move.

Differences Between IM for M&A and IM for Startup Fundraising

When it comes to Information Memorandums (IMs), not all are created equal.

The focus, details, and even the audience can change depending on whether you're dealing with a merger and acquisition (M&A) or trying to get funding for a startup.

Here's how they differ:

M&A Context: Looking Back to Move Forward

Focus on Historical Performance: In M&A, companies show off their track records. They talk about how well they've done in the past because it gives a clue about how well they'll do in the future. It's like saying, "Look how good we've been at making money. Imagine what we can do together."

Synergies and Integration Opportunities: Here's where the magic of "joining forces" comes in. An IM for M&A highlights how two companies can work better together than apart. Maybe they can save money, get into new markets, or create something new. It's all about the added benefits of teaming up.

Audience: The people reading these IMs are strategic and financial buyers. They're either companies that want to expand or invest in their industry or investors looking to buy companies as a way to make money.

Startup Fundraising Context: Betting on the Future

Emphasis on Growth Potential: Startups might not have a long history to share, but they have big dreams. Their IMs talk a lot about where they're going, not just where they've been. They need to show how they plan to grow fast and big.

Innovation and Market Opportunity: Startups also need to highlight what's new and exciting about what they're doing. Maybe they've got a new tech, a fresh approach, or they're creating a market no one knew existed. This is the stuff that gets investors excited.

Audience: This time, the readers are venture capitalists and angel investors. These folks are in the business of funding companies early on, hoping they'll hit it big. They're not just looking for a solid company; they're looking for the next big thing.

So, whether you're preparing an M&A information memorandum or an IM for startup fundraising, remember who you're talking to and what they're most interested in hearing about. The right focus can make all the difference.

| Aspect | M&A Context | Startup Fundraising Context |

|---|---|---|

| Focus | Historical performance, synergies, and integration opportunities | Growth potential, innovation, and market opportunity |

| Audience | Strategic and financial buyers | Venture capitalists, angel investors |

Structure of an Information Memorandum

An Information Memorandum (IM) is like a detailed map for potential investors, guiding them through everything they need to know about a business before deciding to invest, buy, or lend.

While every business is unique and might tweak the structure a bit to better tell its story, most IMs follow a standard framework to make sure all the critical information is covered.

Here’s a breakdown of the key parts:

Executive Summary: This is the elevator pitch of your IM. It gives a snapshot of the business, highlighting the main points like what the business does, its financial health, and what's being asked from investors or lenders. It’s about grabbing attention and making a strong first impression.

Business Description: Here, you dive deeper into what the business is all about. You talk about how it started, what it offers, and why it’s different from and better than the competition. This section lays out the foundation of the business for the reader.

Market Analysis: Understanding the market is crucial for any investor. This section outlines the size of the market, growth opportunities, key trends, and where the business fits within that landscape. It’s about showing there’s a demand for what the business is offering.

Strategy and Implementation: Now that you’ve set the stage, it’s time to talk strategy. How will the business succeed? This part covers marketing plans, operational strategies, and how the business intends to grow and capture market share.

Financial Information: Numbers time. Investors want to see the money. This includes past financial performance for established businesses and projected finances for startups. It’s about showing the business can be profitable and a good financial investment.

Management Team: People invest in people. This section introduces the team behind the business, showcasing their backgrounds, expertise, and how they’re the right people to make the business succeed.

Valuation: Here’s where you talk about what the business is worth and the deal being offered to investors. It’s about setting the terms for investment and giving investors the info they need to see the potential for a good return on their investment.

Investment Offer: This part gets into the specifics of the investment proposal, including how much money is needed, what it will be used for, and the equity or interest offered in return.

Risk Factors: Every investment has risks. This section doesn’t shy away from that. It outlines the potential risks to the business and how they plan to manage or mitigate these risks.

Appendices: Extra details live here. This can include anything from technical descriptions of the product or service, legal agreements, patents, or detailed financial models.

Every section of an IM plays a crucial role in painting a comprehensive picture of the business, its potential, and why it’s a worthy investment. By following this standard structure, businesses can ensure they’re providing potential investors with all the information they need to make an informed decision.

Get your expert IM now!

Executive Summary

The Executive Summary in an Information Memorandum (IM) is the front door to your business's investment opportunity.

It needs to be inviting, clear, and powerful enough to make readers want to explore further.

This section is crucial because it's often the first (and sometimes the only) part that busy investors and lenders will read. Here's how to make it count:

Importance of a Concise, Impactful Summary

First Impressions Matter: You have a limited window to grab attention. A well-crafted summary makes a strong first impression.

Highlights Key Points: It distills the most compelling parts of your business into a digestible format.

Guides Decision-Making: A clear summary helps investors quickly understand the potential return on their investment and decide if they want to read on.

Elements to Include

Before diving into the specifics, it’s essential to understand the goal of the Executive Summary. This section acts as a condensed version of your entire IM, presenting a clear and engaging overview of your business and the investment opportunity.

It sets the tone for the document and primes the reader for the detailed information that follows. To achieve this, include the following critical elements:

1. Company Overview

What You Do: Start with a clear, straightforward statement about what your business does.

Mission and Vision: Briefly touch on why your business exists and what it aims to achieve in the long run.

2. Investment Highlights

Unique Selling Points: What makes your business stand out? Highlight your competitive edge.

Market Opportunity: Show the size and growth potential of the market you’re targeting.

Achievements: Mention any significant milestones, awards, or recognitions.

3. Summary of Financials

Past Performance (if applicable): For established businesses, include key financial figures like revenue, profit margins, and growth rates.

Projections: Share your financial outlook, emphasizing how the investment will fuel growth.

Key Metrics: Highlight metrics that matter in your industry, such as customer acquisition cost, lifetime value, or churn rate.

4. The Ask

Funding Requirements: Clearly state how much funding you’re seeking.

Use of Funds: Outline how you plan to use the investment, linking it to growth strategies.

Offer to Investors: Briefly mention what’s in it for the investors, such as equity share or expected return.

Creating a compelling Executive Summary requires balancing brevity with impact. It should encapsulate the essence of your business and investment proposition, enticing readers to delve deeper into your IM.

Think of it as your business’s elevator pitch on paper: concise, informative, and persuasive.

Business Description

The Business Description section of your Information Memorandum (IM) is where you roll out the red carpet for your company, inviting investors to get a comprehensive view of what you do, how you got here, and where you aim to go.

This part is your opportunity to tell your company’s story in a way that connects emotionally and logically with potential investors.

Company's Operations, History, and Mission

Operations: Dive into the nuts and bolts of your daily operations. Explain how your business functions on a day-to-day basis, including your production methods, supply chain, customer service processes, and any other operational highlights that showcase your business's efficiency and scalability.

History: Every business has a story. Share yours by highlighting how your company came to be, significant milestones you’ve achieved, challenges you’ve overcome, and what you’ve learned along the way. This narrative can build trust and credibility with potential investors.

Mission: Your mission statement is the heartbeat of your business. It’s what guides you and keeps you focused on making a difference in your market or community. Share your mission and vision to give investors a sense of purpose and the bigger picture of what you’re striving to achieve.

Product or Service Offerings and Market Differentiators

What You Offer: Detail your products or services with a focus on the value they provide to your customers. Explain the problems they solve, the needs they meet, and why customers choose your offerings over others.

Market Differentiators: What sets your products or services apart? Highlight your unique selling points—be it innovation, quality, price, or customer experience. Explain how these differentiators give you a competitive edge in your industry.

This section is about more than just facts; it’s about framing your business in a way that highlights its uniqueness, resilience, and potential for growth.

By providing a detailed description of your company’s operations, history, mission, and what makes your offerings special, you lay the groundwork for investors to understand not just the ‘what’ and ‘how’ of your business, but the ‘why’—and it’s the ‘why’ that often turns interest into investment.

Market Analysis

In the Market Analysis section of your Information Memorandum (IM), you shift the focus from your business to the playground you operate in—the market.

This part is crucial because it shows potential investors that you understand the terrain, know where you stand, and have a plan to navigate through the competition to seize opportunities and tackle challenges.

Examination of the Industry Landscape

Industry Overview: Provide a high-level view of the industry your business belongs to, including its size, growth rate, and key characteristics. This sets the stage for understanding the potential your business has to grow within this space.

Regulatory Environment: Briefly touch on any regulations that significantly impact your industry. This shows you’re aware of external factors that could affect your operations.

Target Market Segments

Identification: Clearly define who your customers are. Break down your target market into segments, such as by demographics, geographics, psychographics, or behavioristics. This specificity helps investors see that you know exactly who you’re serving.

Market Size and Growth Potential: For each segment, provide insights into its size and potential for growth. This demonstrates the opportunity your business has to expand its customer base.

Competitive Positioning

Competitor Analysis: Identify your main competitors and what they offer. Highlight how your business differs and what advantages you have over them, whether it's product quality, price, or innovation.

Market Share: If possible, share your current market share or position within the industry to illustrate your place in the competitive landscape.

Market Trends, Opportunities, and Challenges

Trends: Discuss major trends shaping your industry, such as technological advancements, changing consumer behaviors, or economic factors. This shows you’re keeping up with industry dynamics.

Opportunities: Based on the trends and your market analysis, highlight specific opportunities your business is poised to take advantage of. This could include expanding into new markets, leveraging technology, or capitalizing on changing consumer needs.

Challenges: Be honest about the challenges facing your business and the industry as a whole. More importantly, outline your strategies for overcoming these challenges. This transparency builds trust with potential investors and shows you’re realistic and prepared.

The Market Analysis not only informs investors about the current state and future prospects of the market you operate in but also demonstrates your business’s potential to succeed within this environment. By presenting a clear and comprehensive analysis, you reassure investors that your business is equipped to grow, compete, and thrive.

Strategy and Implementation

After diving into the intricacies of your business and the market landscape, the Strategy and Implementation section of your Information Memorandum (IM) is where you pivot to the future.

This is where you articulate your game plan, showing potential investors how you intend to navigate the market, outperform competitors, and capitalize on opportunities to drive growth and profitability.

Strategic Objectives

Begin by outlining your core strategic objectives. These are the high-level goals that will guide your business decisions and actions in the coming years.

They might include targets for market share, revenue growth, product development, geographic expansion, or customer acquisition and retention.

Be specific about what you aim to achieve and by when, giving investors a clear picture of your ambition and direction.

Marketing and Operational Plans

Marketing Plans: Describe how you intend to reach your target customers and communicate the value of your products or services. This might involve a mix of digital marketing, social media, traditional advertising, partnerships, sales promotions, or direct outreach. Highlight any unique marketing tactics or channels that give you an edge in capturing and retaining customers.

Operational Plans: Detail the logistics of how your business will operate to meet your growth targets. This could include plans for scaling up production, optimizing supply chains, expanding into new markets, or enhancing customer service. Explain how you've designed your operations to be efficient, scalable, and adaptable to changing market conditions.

Growth Strategies and Roadmap for Future Development

Growth Strategies: Dive into the specific strategies you'll employ to achieve your strategic objectives. This might include product line expansions, entering new markets, strategic partnerships, or leveraging technology to improve efficiency and customer experience.

Roadmap for Future Development: Present a timeline of key milestones and initiatives you plan to undertake. This roadmap should illustrate the sequence and timing of your strategic actions, giving investors a sense of how you plan to evolve and grow over time.

This section should convey a sense of forward momentum and pragmatic optimism. By laying out your strategic objectives, marketing and operational plans, and growth strategies, you're not just painting a picture of where your business stands today but where it's headed tomorrow.

This forward-looking perspective is essential for attracting investors who are not just investing in your current success but in your future potential.

Financial Information

The Financial Information section is the backbone of your Information Memorandum (IM), providing a clear window into your business's financial health and prospects.

This section is where numbers take the front stage, offering concrete evidence of your business's viability and growth potential.

It's critical for convincing potential investors that your company is not just a good idea but a solid financial investment.

Historical Financial Performance

Start by presenting your historical financial data. If you're an established business, this includes income statements, balance sheets, and cash flow statements for the past 2-5 years.

Highlight key metrics such as revenue, profit margins, EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization), and net income.

This retrospective view allows investors to assess your financial stability and track record of growth or profitability.

Revenue Trends: Discuss the trends in your revenue over the past years. Highlight any periods of significant growth or decline and explain the reasons behind these changes.

Profitability Analysis: Provide insights into your profitability trends, including gross and net margins. Explain the factors contributing to improvements or declines in profitability.

Financial Projections

Next, turn to the future with financial projections for the next 3-5 years.

This forward-looking perspective should include projected income statements, balance sheets, and cash flow statements.

It's important to show not just growth in revenue and profits, but also how this growth translates into cash flow and financial health.

Growth Assumptions: Clearly state the assumptions behind your projections, such as market growth rates, sales expansion, pricing strategies, and cost control measures. These assumptions should be realistic and defensible.

Projected Revenue and Profit: Outline your expected revenue and profit growth. Include best-case, worst-case, and most likely scenarios if possible, to demonstrate your financial planning's thoroughness and resilience to different market conditions.

Key Financial Indicators and Assumptions Behind Projections

Dive into the key financial indicators and metrics that investors should focus on.

These might include customer acquisition costs (CAC), lifetime value (LTV) of a customer, burn rate (for startups), debt-to-equity ratio, and working capital ratios, among others.

Discussing these indicators helps investors understand the financial health and operational efficiency of your business.

Operational Metrics: Connect your financial projections with operational metrics that drive them. For instance, if you project an increase in revenue, link this to expected increases in customer numbers, average sale value, or market expansion.

Sensitivity Analysis: If possible, include a sensitivity analysis to show how changes in your key assumptions could affect your financial projections. This demonstrates to investors that you've thoughtfully considered various risk factors and their potential impact on the business.

This section is where you back up your business narrative with hard data, demonstrating not just the viability of your business model but its potential for future growth and profitability. Clear, well-structured financial information can significantly bolster investor confidence, making it one of the most critical sections of your IM.

Management Team

The success of any venture often hinges not just on a great idea or a strong market presence but on the people driving the business forward.

The Management Team section of your Information Memorandum (IM) introduces the architects of the business strategy, highlighting their roles, backgrounds, and the expertise they bring to the table.

This section is your opportunity to showcase the strength and depth of your team, underscoring why they're uniquely positioned to lead the company to success.

Bios of Key Team Members and Their Roles

Begin by outlining the roles and responsibilities of each key team member. This includes not just the C-suite executives (CEO, CFO, CTO, etc.) but also other pivotal roles within the company that are crucial to its operation and growth. For each member, provide a brief bio that covers:

Professional Background: Summarize their career history, focusing on previous positions, achievements, and how their experiences align with their current role within your company.

Expertise: Highlight specific areas of expertise that each team member brings to the company, such as industry knowledge, technical skills, market insights, or leadership experience.

Contribution to the Company: Explain how each team member's skills and experience support the company's objectives and growth strategies. This can include past successes in launching products, growing revenue, entering new markets, or developing innovative technologies.

Experience and Expertise That Support the Company’s Objectives

After individual introductions, tie the team's collective experience and expertise back to the company's strategic objectives.

This is where you make the case for why your team, as a whole, is well-equipped to navigate the challenges ahead and capitalize on the opportunities in your market. Consider discussing:

Synergy: How the team's diverse backgrounds and skills complement each other, creating a well-rounded leadership capable of addressing various aspects of the business.

Track Record: Any notable achievements or successes that the team has accomplished together, demonstrating their ability to execute on the company's vision.

Adaptability: Examples of the team's ability to adapt to change, overcome obstacles, and pivot strategies when necessary, showcasing resilience and flexibility.

This section is not just a collection of professional bios; it's a narrative about the human capital that forms the backbone of your company. By effectively communicating the strengths and synergies of your management team, you can significantly enhance investor confidence in your company's leadership and its ability to achieve its goals.

Valuation

Valuation is a critical aspect of any Information Memorandum (IM), providing potential investors or acquirers with a clear understanding of the company's worth.

This section is where you explain how you've arrived at your company's valuation, the methodology behind it, and why it makes sense given your company's current position and future prospects.

Whether for M&A purposes or startup fundraising, the rationale behind your valuation needs to be both transparent and compelling.

For a further read about how to value a business, visit our comprehensive guide: Startup Valuation 101.

Explanation of the Valuation Methodology and Rationale

Start by detailing the valuation methods you've used. Common approaches include the Discounted Cash Flow (DCF) method, Comparable Company Analysis (CCA), or Precedent Transactions.

Each method has its strengths and is chosen based on the company's stage, industry, and available data.

Methodology: Describe the chosen valuation method(s) and why it's appropriate for your company. For instance, DCF might be used for its emphasis on future potential, while CCA (aka comparables or multiples) or Precedent Transactions might be selected for their market-relative insights.

Assumptions: Clearly outline the assumptions made during the valuation process. This includes growth rates, discount rates, and any industry-specific metrics. Assumptions should be realistic and defendable, as they significantly impact the valuation outcome.

For M&A: How Valuation Reflects Synergies and Strategic Fit

In the context of M&A, valuation goes beyond just numbers; it also considers the strategic fit and synergies between the companies involved. This can include cost savings, new market opportunities, or enhanced capabilities.

Synergies: Discuss how the merger or acquisition will create value beyond the sum of the two companies' parts. This could be through operational efficiencies, access to new markets, or technology integrations.

Strategic Fit: Explain how the companies complement each other in terms of products, services, markets, or technologies. A strong strategic fit can justify a premium valuation.

For Startup Fundraising: Justification of Pre-Money Valuation and Growth Potential

For startups, valuation is often more about growth potential than current financials. Pre-money valuation – the value of the company before the investment – needs to reflect the company's future prospects.

Growth Potential: Highlight the key drivers of growth for your company, such as market size, scalability of the business model, and innovation. This section should convincingly argue why the startup is poised for significant growth.

Pre-Money Valuation: Justify the pre-money valuation by linking it to your growth potential, competitive advantages, and the milestones you plan to achieve with the funding. The goal is to demonstrate how the valuation aligns with expected returns on investment.

The Valuation section is crucial for aligning expectations and making a strong case for your company's worth.

Whether through demonstrating synergies in an M&A scenario or showcasing growth potential for a startup seeking funding, a well-articulated valuation can significantly impact investor interest and confidence.

Investment Offer

The Investment Offer section is where the rubber meets the road in your Information Memorandum (IM). It's where you lay out the specifics of what you're asking from investors and what they stand to gain by putting their money into your venture. This clarity and transparency are crucial for building trust and making a compelling case for investment.

Details of the Investment Proposal

Start with the basics of your investment proposal. Clearly state how much capital you're seeking and under what terms. This includes:

Capital Sought: The total amount of funding you are looking to raise in this round.

Equity Offered: If applicable, specify the percentage of equity you're offering in exchange for the investment. For debt financing, detail the interest rate and repayment terms.

Use of Funds: Provide a detailed breakdown of how you plan to use the raised capital. This might include product development, market expansion, hiring key staff, or enhancing operational capabilities. Investors want to see that their money will be used efficiently to drive growth and profitability.

For M&A: Deal Structure, Offer Details, and Expected Outcomes

In the context of M&A, the investment offer needs to detail the deal structure and what it entails for all parties involved. This should cover:

Deal Structure: Describe whether the acquisition is proposed as a stock purchase, asset purchase, or merger. Include any specific conditions or contingencies that must be met.

Offer Details: Lay out the valuation figures, how they were determined, and the proposed payment terms (e.g., cash, stock, earn-out arrangements).

Expected Outcomes: Highlight the strategic benefits and synergies expected from the deal, such as increased market share, cost savings, or enhanced product offerings. Explain how these outcomes justify the offer and how they will create value for both the acquirer and the target company.

In both scenarios, your Investment Offer should be compelling, fair, and grounded in a solid understanding of your company's value and the market dynamics. It's about making a strong case for why investing in your company or proceeding with the M&A transaction is not just a sound financial decision but also an opportunity to participate in a future success story.

| Aspect | Fundraising | M&A |

|---|---|---|

| Capital Sought | Total amount of funding sought in this round. | N/A - Focus is on the acquisition value, not raising capital. |

| Equity Offered/Deal Structure | Percentage of equity offered or terms of debt financing (interest rate, repayment terms). | Deal structure (stock purchase, asset purchase, merger), including specific conditions. |

| Use of Funds/Offer Details | Detailed breakdown of how the funds will be used (product development, market expansion, etc.). | Valuation figures, how they were determined, proposed payment terms (cash, stock, earn-out arrangements). |

| Expected Outcomes | Growth and profitability potential, how the investment will drive the company's success. | Strategic benefits and synergies (market share increase, cost savings), value creation for both parties. |

Risk Factors

No investment opportunity comes without its share of risks. Being upfront about these in your Information Memorandum (IM) not only demonstrates transparency but also shows potential investors that you have a thoughtful approach to risk management. This section is about identifying the key investment and operational risks your business faces and outlining your strategies for mitigating these risks.

Identification of Key Investment and Operational Risks

Start by listing the primary risks that could impact your business or the investment's return. These might include:

Market Risks: Changes in market demand, competition intensity, or economic downturns that could affect sales and profitability.

Operational Risks: Challenges related to production, supply chain, or technology that could disrupt your business operations.

Financial Risks: Issues like cash flow shortages, high debt levels, or unexpected expenses that could affect financial stability.

Regulatory Risks: Potential changes in laws or regulations that could impact your business model or industry.

Team Risks: The risk associated with key team members leaving the company or gaps in the current team's expertise.

Mitigation of Key Risks

After identifying the risks, detail your strategies for mitigating them. This shows investors that you're not just aware of the potential hurdles but also proactive in planning to overcome them. For each risk identified, explain how you intend to mitigate it, such as:

Market Risks: Diversifying product lines, entering new markets, or adopting flexible pricing strategies to adapt to market changes.

Operational Risks: Implementing robust quality control systems, securing multiple suppliers, or investing in technology to enhance operational efficiency.

Financial Risks: Maintaining a healthy cash reserve, managing debt prudently, or implementing strict budgeting and financial controls.

Regulatory Risks: Engaging in ongoing compliance efforts, lobbying activities, or adapting business models to ensure regulatory compliance.

Team Risks: Developing internal talent, creating a strong company culture, or having a succession plan for key positions.

Highlighting these risk factors and your mitigation strategies not only builds trust with potential investors but also strengthens your business plan. It shows that you're not just optimistic about your business's future but also realistic and prepared to navigate the challenges that lie ahead.

Appendices

The Appendices section of your Information Memorandum (IM) serves as the repository for all additional information that supports the main content of your document. It's the place where investors can find detailed evidence and documentation that backs up the claims and plans you've laid out in the previous sections. Including comprehensive appendices can greatly enhance the credibility of your IM by providing the depth of information needed for thorough due diligence.

Types of Supplementary Information

Technical Details: For technology-driven companies or products, detailed technical specifications, development roadmaps, or descriptions of proprietary technologies can be included here. This information helps investors understand the complexity and innovation behind your offerings.

Patents and Intellectual Property: If your business relies on patented technology or other forms of intellectual property (IP), provide a list of these assets, along with their status and relevance to your business model. This highlights the unique competitive advantages your IP portfolio provides.

Legal Agreements: Copies of important legal documents such as incorporation papers, major contracts, partnership agreements, and any regulatory compliance documents. This demonstrates your business's legal foundation and operational legitimacy.

Financial Models and Assumptions: Detailed spreadsheets that include your financial projections, along with the assumptions used in your models. These can offer insights into your forecasting methods and business expectations.

Market Research: Full reports or summaries of market research studies that support your market analysis and business strategy. This can include customer surveys, industry analyses, and competitive research.

Team Resumes: More detailed resumes or biographies of your management team and key employees, providing further insights into their expertise and how they contribute to your business’s success.

Customer Testimonials or Case Studies: If applicable, including testimonials from satisfied customers or case studies of your product or service in action can serve as powerful endorsements of your business’s value proposition.

By carefully curating the documents and information included in the Appendices, you ensure that potential investors have access to all the material they need to make an informed decision. This section is your opportunity to provide a deeper dive into the aspects of your business that make it a compelling investment opportunity.

Supporting Themes: KPIs, Benchmarks, and Niche Comparisons

In making a compelling case for investment, it's crucial to go beyond the surface-level financials and narratives to explore the metrics and comparisons that truly showcase a company's competitive edge and potential for growth.

This section delves into the Key Performance Indicators (KPIs), benchmarks to leading players, and insightful comparisons with other niches, offering a nuanced perspective on our company's performance and strategic positioning.

Key Performance Indicators (KPIs)

Definition and Selection of KPIs: Key Performance Indicators are the vital signs of a company's health and progress towards its strategic goals. We have carefully selected KPIs that align with our core objectives, such as customer acquisition cost, lifetime value, revenue growth rate, and gross margin, among others.

Current Performance: Our current KPIs reflect a strong and growing business. For instance, our year-over-year revenue growth stands at an impressive rate, significantly above industry averages, demonstrating our successful market penetration and customer retention strategies.

Historical Trends: Looking back, our KPIs show a consistent upward trajectory. This growth is not just in revenue but also in operational efficiency and market share, underscoring our team's ability to execute our business plan effectively.

Goals and Targets: Moving forward, we've set ambitious yet achievable targets for our KPIs. These include improving our gross margin by optimizing our cost structure and increasing our customer lifetime value through enhanced service offerings and customer engagement strategies.

Benchmarks to Leading Players

Industry Benchmarks: Compared to industry benchmarks, our performance is robust. Our gross margin and customer retention rates, for example, surpass the average, highlighting our superior product quality and customer service.

Leading Players: When we compare ourselves to the leading players in our market, we hold a competitive stance in several key areas, including innovation, customer satisfaction, and agility. Our smaller size allows for quicker adaptation to market changes, a clear advantage in a rapidly evolving industry.

Analysis and Insights: These benchmarks underscore our strong position and potential within the industry. They also reveal areas for improvement, guiding our strategy towards areas where we can achieve the greatest impact.

Comparisons with Other Niches

Cross-Industry Comparisons: Drawing comparisons with successful companies in other niches, we identify broader market trends and opportunities. For example, our adoption of a subscription-based pricing model, similar to successful software companies, has resulted in predictable recurring revenue and high customer engagement.

Learning from Other Niches: By analyzing other industries, we've incorporated innovative practices into our operations, such as leveraging big data for customer insights and adopting lean manufacturing principles to reduce costs.

Innovative Benchmarks: Our willingness to look beyond our industry for benchmarks and best practices has led to the adoption of unique KPIs, such as our 'innovation index,' which measures our success in bringing new products to market compared to our competitors.

Integration with Investment Case

Supporting the Investment Thesis: These KPIs, benchmarks, and comparisons form the backbone of our investment thesis. They not only validate our current success but also highlight our potential for sustained growth and profitability in a competitive landscape.

Risk Management: By continuously monitoring these metrics, we can quickly identify and address any areas of concern, mitigating risks before they impact our business significantly.

Value Creation: Ultimately, our focus on these supporting themes is about creating value — for our customers, our employees, and our investors. By striving for excellence in these areas, we're building a company that's not just surviving but thriving in today's dynamic market.

Conclusion

Navigating the complex landscape of investment opportunities requires a compass that points beyond the surface, delving into the essence of what makes a business truly compelling.

An Information Memorandum (IM) serves as this compass, offering a detailed map that guides potential investors through the intricacies of a company's operations, strategy, financials, and more.

By providing a structured overview, from the executive summary to the appendices, an IM equips investors with the information necessary to make informed decisions.

The journey through an IM reveals not just the numbers that underpin a business's potential but the vision, the people, and the strategic positioning that set it apart.

The inclusion of KPIs, benchmarks, and niche comparisons further enriches this narrative, offering a holistic view of the company's competitive edge and growth prospects.

These elements collectively form a compelling investment thesis, demonstrating not only the business's current value but its trajectory towards future success.

In the end, the true power of an Information Memorandum lies in its ability to articulate a clear, compelling investment case, backed by rigorous analysis and transparent communication. It's a testament to a company's potential, inviting investors to embark on a journey of growth and value creation.

For entrepreneurs and business leaders, crafting a comprehensive and persuasive IM is not just about securing investment; it's about setting the stage for the next chapter in their company's story, marked by innovation, growth, and success.