Executive Summary: Grab Attention To Your Information Memorandum

By Lior Ronen | Founder, Finro Financial Consulting

The Information Memorandum (IM) is as a crucial document, bridging potential investors with the opportunities that businesses present. At the heart of this comprehensive document lies the Executive Summary, a section that often determines whether the door to further engagement opens or closes.

This segment serves not just as an introduction but as a compelling invitation into the investment potential of your business.

The significance of the Executive Summary cannot be overstated. Within the concise confines of this section, businesses must encapsulate their essence, achievements, and aspirations, all while capturing the attention and imagination of busy investors and lenders.

It's a unique challenge that requires clarity, precision, and a touch of persuasion to ensure that the reader, often pressed for time, finds enough interest to delve deeper into the document.

Creating a compelling Executive Summary is akin to delivering an elevator pitch on paper. It must be inviting, clear, and powerful enough to make readers want to explore further, serving as a beacon that guides them through the detailed landscape of your business plan and investment proposal.

This introduction aims to provide you with the insights and strategies needed to craft an Executive Summary that not only resonates with potential investors but also sets the tone for the valuable information that follows.

In this article, we will delve into the art and science of creating an effective Executive Summary. We will explore the key components of this vital section, offer tips on balancing brevity with impact, and suggest ways to enhance readability and engagement.

By the end, you will be equipped with the knowledge to craft an Executive Summary that not only stands out but succinctly communicates your business's value and potential to prospective investors.

Creating an engaging and effective Executive Summary is a critical step for entrepreneurs seeking investment. It requires a delicate balance of clarity, conciseness, and compelling content to capture and retain investor interest. By strategically presenting key business aspects—such as the company's mission, unique selling points, financial health, and specific funding needs—within a well-designed and readable format, entrepreneurs can make a strong first impression.

This process not only demonstrates the business's value proposition but also its potential for growth and return on investment, encouraging further exploration and discussion among potential investors.

The Art of First Impressions

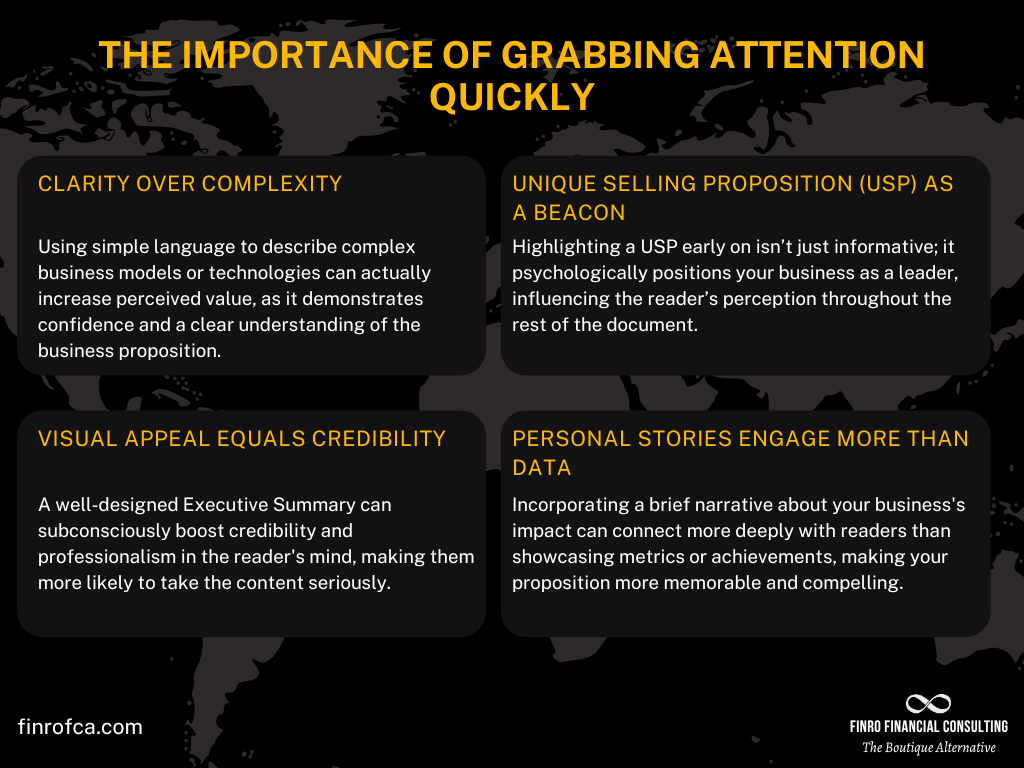

In the realm of investment, first impressions are not just important; they are everything. With investors and lenders constantly inundated with opportunities, the ability of your Executive Summary to quickly grab and hold attention determines its effectiveness.

This initial engagement is crucial because it sets the stage for everything that follows. A compelling start can pique curiosity, encouraging the reader to invest their time in exploring the depths of your Information Memorandum.

The challenge lies in the sheer volume of proposals an investor might receive, coupled with the limited time they have. Your Executive Summary must stand out amid a sea of documents, each vying for attention.

It's not just about presenting facts but doing so in a way that is immediately engaging and resonates with the reader's interests and investment goals.

Strategies for Making a Strong First Impression through Your Executive Summary

Crafting an Executive Summary that makes a lasting first impression involves several strategic elements. Here are some key strategies to consider:

Start with a Hook: Begin your Executive Summary with a compelling statement or a striking fact about your business or the market opportunity. This hook should be relevant and powerful enough to intrigue the reader and make them want to learn more.

Clear and Concise Messaging: Clarity is paramount. Use straightforward language to describe what your business does and why it matters. Avoid jargon and complex sentences that might obscure your message. Conciseness ensures that your key points are digestible and memorable.

Highlight the Unique Selling Proposition (USP): Early in the summary, articulate what makes your business unique and why it stands a better chance of success compared to others. This could be your innovative technology, market positioning, or a novel business model. Your USP is your beacon; it should shine brightly and clearly.

Visual Appeal: Don't underestimate the power of formatting and design in making your Executive Summary inviting. Use bullet points, headers, and perhaps a key graphic or chart that encapsulates critical data or success metrics. A visually appealing document is more likely to be read and remembered.

Engage with a Story: Where possible, weave in a narrative element. A brief story about how your business addresses a pressing need or solves a significant problem can be more engaging than a simple list of achievements or data points. Stories resonate on a human level and can make your proposition more relatable.

Leverage Testimonials or Endorsements: If you have them, briefly include testimonials or endorsements from reputable sources, customers, or industry figures. These can serve as powerful endorsements of your business's credibility and potential right at the outset.

Focus on the Reader’s Interest: Tailor your summary to address the interests and concerns of your potential investors. Highlight aspects like market growth, return on investment, and risk mitigation strategies early on to align with what investors are looking for.

Implementing these strategies can significantly enhance the impact of your Executive Summary, ensuring that it not only captures attention but also maintains it, setting a positive tone for the detailed exposition to follow. Remember, the goal is to make your Executive Summary not just a summary, but an invitation to a promising investment journey.

Key Components of an Effective Executive Summary

An Executive Summary's strength lies not only in its ability to capture attention but also in its capacity to communicate the core essence of a business and its value proposition succinctly and compellingly.

This section dives into the fundamental elements that should be woven into every Executive Summary to create a narrative that resonates with potential investors and lenders. Understanding and incorporating these components will not only provide clarity and insight into your business but also highlight the opportunities and advantages that make your venture worthy of consideration.

We will explore each of these critical elements in detail, offering insights into how to effectively articulate your company's overview, showcase your investment highlights, present a summary of your financials, and clearly outline your funding requirements and what investors stand to gain.

These components are the building blocks of a compelling Executive Summary, serving as a condensed version of your Information Memorandum that captivates from the first line and leaves a lasting impression.

By emphasizing the importance of each element and how they contribute to the overall narrative of your business, this section will equip you with the tools to craft an Executive Summary that not only stands out but also succinctly communicates the essence of your business and the value of the investment opportunity it represents.

Part 1: Company Overview

Crafting a concise yet informative company overview is the first critical step in making your Executive Summary impactful. This section sets the stage, offering investors a clear lens through which to view your business. Here’s how to approach it:

How to Succinctly Describe What Your Business Does

Be Clear and Direct: Start with a straightforward statement that encapsulates what your business does. Avoid industry jargon and complex terminology. The goal is to be understood by someone completely unfamiliar with your sector.

Focus on the Solution: Highlight the problem your business solves or the need it fulfills. This approach helps to immediately position your business as necessary and relevant.

Mention Your Target Market: Briefly note who your customers are or the market you serve. This provides context and scope for your operations.

The Importance of Including Your Mission and Vision to Show Long-Term Aspirations

Mission Statement: Your mission articulates your business's current objectives and approach to reaching those goals. It’s about the ‘now’ of your operations, giving insight into your business’s purpose and primary functions. A well-defined mission statement supports your business model and explains to investors why your company exists.

Vision Statement: The vision looks to the future, offering a picture of where your business aims to be in the long-term. It’s aspirational, providing a sense of direction and ambition. This communicates to investors that your business is thinking ahead and has clear goals beyond immediate profits.

Demonstrate Alignment: Including both mission and vision in your company overview demonstrates a strategic alignment between your day-to-day operations and your long-term aspirations. This reassures investors that your business has a roadmap and is poised for sustained growth.

Incorporating these elements into your company overview not only informs but also engages potential investors by clearly presenting what your business does and why it matters. It invites them into your business’s story, showing not just where you are today but where you intend to go. This foundational clarity is crucial for making your Executive Summary, and consequently your Information Memorandum, compelling and memorable.

Part 2: Investment Highlights

The Investment Highlights section of your Executive Summary serves as a powerful tool to showcase your business's strengths and potential.

By effectively presenting your unique selling points, market opportunities, and notable achievements, you create a compelling narrative that captures the interest of investors. Here’s how to craft this crucial section:

Techniques for Showcasing Your Business's Unique Selling Points and Competitive Edge

Identify Your Differentiators: Clearly articulate what sets your business apart from competitors. This could be your proprietary technology, strategic partnerships, customer service excellence, or any other aspect that gives you an advantage.

Evidence-Based Claims: Support your claims with data or evidence. If your product has a faster performance, cite studies or testimonials that back this up. Concrete evidence strengthens your competitive edge.

Connect Features to Benefits: For each unique selling point, directly link how it benefits the user or customer. This helps investors understand the practical impact of your competitive advantages.

Explaining Market Opportunity: How to Quantify Your Target Market and Its Growth Potential

Define the Market Size: Use current research or market analysis to define the size of your target market. Be specific about the geographic and demographic parameters.

Highlight Growth Trends: Present data or forecasts that illustrate the growth potential of your market. This could include trends in consumer behavior, technological advancements, or regulatory changes that will expand the market.

Relate to Your Business: Explicitly connect how your business is positioned to capitalize on this market opportunity. Emphasize any alignments with market trends or how your unique selling points meet evolving market needs.

Discussing Achievements: The Impact of Mentioning Awards, Recognitions, or Milestones

Select Noteworthy Achievements: Choose awards, recognitions, or milestones that are most relevant and impressive to your target investors. Focus on recent accomplishments to demonstrate current momentum and relevance.

Contextualize the Achievement: Briefly explain why the award or milestone is significant within your industry or market. This helps investors understand the level of competition and the importance of the achievement.

Link Achievements to Future Potential: Use your past successes to underscore your future potential. Demonstrating a track record of achievements suggests your business has the capability to continue succeeding and growing.

Investment Highlights should effectively communicate why your business is a valuable investment opportunity.

By meticulously detailing your unique selling points, the promising opportunity within your target market, and your proven track record of success, you not only inform investors but also build a compelling case for why your business deserves their attention and resources.

This section is your opportunity to shine and convince investors that your company stands out in a crowded marketplace.

Part 3: Summary of Financials

The Summary of Financials is a critical section of your Executive Summary, providing a snapshot of your business's financial health and future potential.

This section must balance transparency with optimism, presenting a clear, compelling case for investment. Here's how to effectively communicate this crucial information:

How to Present Past Performance and Financial Projections to Investors

Be Transparent and Honest: Start with a straightforward presentation of your past financial performance. Include revenue, profit margins, and other relevant financial figures to establish credibility and trust.

Use Graphs and Charts: Visual representations can make financial data more accessible and engaging. Use graphs to show growth trends, financial health over time, or comparisons to industry benchmarks.

Project Future Performance: Share financial projections that reflect realistic growth expectations. Base these projections on solid assumptions about market growth, business expansion plans, and other relevant factors. Clearly explain the rationale behind your forecasts to build confidence in your predictions.

Key Metrics to Highlight and Their Significance in Your Industry

Identify Industry-Specific Metrics: Different industries prioritize different financial metrics. For a SaaS company, it might be Monthly Recurring Revenue (MRR) and Customer Acquisition Costs (CAC). For a retail business, inventory turnover rates and gross margin might be more relevant.

Explain the Significance of These Metrics: Don’t just list the metrics; explain why they are important for understanding your business’s performance and potential. For instance, a low CAC relative to Lifetime Value (LTV) in a SaaS business indicates efficient growth potential.

Benchmark Against Industry Averages: Where possible, compare your key metrics with industry averages. This contextualizes your performance and can highlight your competitive advantage or areas for improvement.

The Summary of Financials should serve not just as a reflection of where your business has been, but as a compelling indicator of where it is going. By presenting both past performance and future projections clearly and confidently, you demonstrate to investors that your business has a solid foundation and a clear path to continued growth and profitability.

This transparency and foresight can significantly enhance the attractiveness of your investment opportunity, as financial metrics provide a tangible measure of your business's operational efficiency, market position, and long-term viability.

Part 4: The Ask

The "Ask" section of your Executive Summary is where you articulate your funding requirements and outline how the investment will be utilized to achieve business growth and generate returns for investors.

This is a pivotal part of the document, as it directly addresses the potential investor's primary concern: the details of the investment opportunity. Here’s how to approach this crucial section effectively:

Best Practices for Clearly Stating Funding Requirements

Specify the Amount: Begin with a clear statement of the total amount of funding you are seeking. Avoid ambiguity; investors want to know exactly what you need.

Provide a Breakdown: Offer a high-level breakdown of how the funds will be allocated. This could include product development, marketing, operations, or scaling activities. It reassures investors that there’s a plan for every dollar invested.

Tie to Milestones: Where possible, connect funding requirements to specific milestones or goals. This demonstrates a strategic approach to using the funds and gives investors a timeline for when they can expect to see results.

Describing the Use of Funds and Linking it to Growth Strategies and Investor Returns

Link to Growth: Explicitly describe how the investment will fuel your business's growth. This could involve expanding into new markets, enhancing product offerings, or scaling operations. Make the direct connection between the use of funds and your growth strategy.

Illustrate the Impact on Returns: Investors are ultimately interested in the return on their investment. Provide a clear explanation of how the funds will not only enable growth but also generate returns. This might include projections of increased market share, revenue growth, or profitability.

Emphasize Alignment with Investor Goals: Tailor your message to align with the goals and interests of your potential investors. Whether they are focused on long-term growth, social impact, or short-term gains, show how the use of funds aligns with these objectives.

The Ask section is not just a request for funding; it's an opportunity to showcase your strategic thinking and your commitment to delivering value to your investors.

By clearly stating your funding requirements and linking them to concrete growth strategies and potential returns, you establish transparency and build confidence in your business's potential for success.

This section should convince potential investors that investing in your business is not just a sound decision but an exciting opportunity to be part of a promising journey towards growth and profitability.

Balancing Brevity with Impact

Creating an Executive Summary that is both brief and compelling presents a unique challenge.

This section must distill the essence of your business and its investment potential into a concise format without sacrificing the depth and appeal needed to capture investor interest. Here’s how to strike that delicate balance:

Tips for Ensuring Your Executive Summary is Both Concise and Impactful

Prioritize Key Information: Identify the most critical pieces of information that investors need to know. This includes your business model, market opportunity, competitive edge, financial highlights, and the ask. Focus on these elements to maintain conciseness.

Use Clear, Powerful Language: Choose words that convey confidence and clarity. Avoid filler language and be direct. Every sentence should add value and move the narrative forward.

Leverage Bullet Points and Headings: Breaking up text with bullet points and headings can help convey key points more efficiently. This structure also enhances readability, allowing investors to quickly grasp the essence of your proposal.

Include Only the Most Compelling Data and Metrics: While data is crucial, overload can detract from the main message. Include only the most impactful metrics and achievements that underscore your business’s potential.

Edit Ruthlessly: Once your first draft is complete, go through several rounds of editing. Aim to cut down the word count without losing the core message. This process often reveals more succinct ways to express your points.

The Challenge of Encapsulating Your Business and Investment Proposition in a Nutshell

Conveying Complexity Simply: Your business may involve complex technologies or market dynamics. The challenge lies in simplifying these concepts without oversimplifying to the point of losing meaningful insight.

Evoking Emotion and Excitement: Inspiring excitement and emotional engagement in a brief format requires carefully chosen narratives or anecdotes that resonate with investors, illustrating potential impact and success.

Maintaining Investor Interest: With limited space, you must craft a narrative that not only informs but also engages and maintains investor interest, encouraging them to delve deeper into your full Information Memorandum.

Balancing brevity with impact in your Executive Summary is an art form that requires careful consideration, strategic planning, and meticulous editing. The goal is to leave investors informed, intrigued, and eager to learn more about your business.

By achieving this balance, you ensure that your Executive Summary acts as a compelling invitation to explore the investment opportunity you present, paving the way for meaningful engagement and, ultimately, investment.

Get your expert IM now!

Final Touches to Ensure Readability and Engagement

After crafting the content of your Executive Summary, the final touches focus on enhancing its readability and engagement.

These aspects are crucial for turning a well-written summary into an inviting, compelling document that captures and retains investor interest. Here’s how to apply these finishing touches effectively:

The Role of Language, Tone, and Formatting in Making Your Executive Summary Inviting

Language: Choose language that is professional yet accessible. Avoid industry jargon that might confuse readers not familiar with your specific field. The right language makes your summary inclusive and understandable to a broad audience.

Tone: The tone should be confident and optimistic, reflecting the potential of your business. It should resonate with the seriousness of the investment opportunity while being inviting and engaging. A positive tone can inspire confidence in your prospects.

Formatting: Well-thought-out formatting is key to readability. Use headings, subheadings, and bullet points to organize information logically. Adequate spacing and bold text can highlight important points, making the document easier to scan and digest.

Using Visuals or Infographics to Complement and Enhance the Written Content

Complement Written Information: Visuals should serve to reinforce or illustrate key points made in the text, not replace them. Use charts to depict financial growth, timelines for milestones, or diagrams to explain complex processes succinctly.

Enhance Engagement: An infographic or a well-designed chart can break the monotony of text, making the summary more visually appealing and engaging. This visual engagement can help maintain the reader’s interest throughout the document.

Ensure Clarity and Professionalism: Any visual elements included should be clear, professional, and directly relevant to the content. Poorly designed visuals can detract from the credibility of your Executive Summary. Ensure they are of high quality and add value to the narrative.

Incorporating these final touches into your Executive Summary can significantly enhance its effectiveness.

By paying careful attention to language, tone, and formatting and judiciously using visuals to complement and underscore your written content, you can create a document that informs, engages, and persuades.

This polished presentation can make your Executive Summary, and by extension, your business, stand out in a crowded investment landscape, inviting readers to explore the opportunity further and consider becoming part of your business journey.

Conclusion

Crafting an Executive Summary for your Information Memorandum is an exercise in precision, persuasion, and clarity. It stands as the gateway to your business's broader investment narrative, setting the tone for what follows.

Throughout this article, we've explored the foundational elements of an effective Executive Summary, from presenting a clear company overview to making a compelling ask, all while balancing brevity with impact and ensuring readability and engagement.

The journey of distilling your business essence into a concise, engaging summary is challenging but immensely rewarding. It demands a deep understanding of what makes your business unique and valuable, as well as the ability to communicate this effectively to potential investors.

The Executive Summary is your first, and sometimes only, opportunity to capture the attention of busy investors and convince them that your business is worth their time and investment.

Remember, the goal of the Executive Summary is not just to inform but to excite and inspire. It should leave investors with a clear understanding of your business, its market potential, financial health, and the opportunity it presents for them.

By following the guidelines outlined in this article, you're well on your way to creating an Executive Summary that does just that.

As you finalize your Executive Summary, keep in mind that it is a living document that should evolve as your business grows and as you gain more insights into what resonates with your target investors.

Continuously refining your message and presentation will help ensure that your Executive Summary remains a powerful tool in attracting investment and driving your business forward.

In conclusion, the Executive Summary of your Information Memorandum is much more than a mere overview. It's an invitation to embark on a journey, a promise of potential, and a showcase of your business's vision and value.

Crafting it with care and strategic insight can set the stage for successful investor engagement and, ultimately, the realization of your business goals.