Company Valuations: The Heart of M&As

By Lior Ronen | Founder, Finro Financial Consulting

You know what's great? Pizza. Especially when you're throwing a pizza party with friends.

Now, let's imagine two of your friends, each owning an awesome pizza shop, decide they want to combine their shops into one epic pizza empire.

That's basically a business version of what we call a merger or acquisition (or M&A for short).

But here's the tricky part: how do they decide who brings what to this new pizza party?

Who gets to be in charge of the pepperoni? And who gets to sprinkle on that oh-so-important cheese?

That's where something called 'company valuation' comes into play.

Just like figuring out how many slices each person gets at a pizza party, company valuation helps figure out the worth of each pizza shop, or in the business world, each company.

And trust me, just like you'd want to make sure everyone gets a fair slice at your pizza party, you'd want to ensure everyone gets a fair deal in a merger or acquisition.

In this article, we'll dive deeper into why company valuation is so important for M&As and how professional valuation services can make sure no one walks away feeling short-changed.

So, if you're ready to learn more about the ultimate business pizza party, keep on reading!

In the ideal case of a merger and acquisition (M&A) deal, companies blend like unique pizza toppings, each adding distinct value to forge a more innovative and robust enterprise. The turbulent tech M&A market of 2023, with its significant downturn and subsequent rebound forecasts, underscores the critical role of precise valuations.

These valuations serve as the foundation for successful negotiations, guiding strategic decisions and ensuring companies are aptly prepared for their M&A journeys. As startups enter this dynamic arena, their readiness—highlighted by clear financials, compelling value propositions, robust teams, scalable operations, and strategic insight—becomes crucial. Such preparation not only positions them for success but also contributes to the broader narrative of industry evolution and economic resilience.

Understanding Mergers and Acquisitions (M&A): The Basics

Mergers and acquisitions (M&A) represent key strategic transactions in the business world, involving the consolidation or purchase of companies to bolster growth, expand market reach, and enhance competitive advantage.

A merger occurs when two companies combine to form a single entity, sharing resources, markets, and profits. In contrast, an acquisition is when one company purchases another, with the acquired company either being absorbed into the buyer's operations or continuing to operate as a subsidiary.

These transactions are pivotal for companies looking to access new technologies, enter different markets, achieve economies of scale, or streamline operational efficiencies.

The M&A process is intricate, involving careful negotiation, due diligence, valuation, and integration planning to ensure the combined entities can achieve their strategic goals and deliver value to shareholders.

Understanding the dynamics of mergers and acquisitions is essential for grasping the strategic moves companies make to stay competitive and grow in an ever-evolving business landscape.

This article delves into the crucial role of company valuation in M&As, the impact of these transactions on the business environment, and the strategic considerations for startups looking to navigate the M&A pathway successfully.

Why Company Valuation is Crucial in M&As?

Let's stick with our pizza party metaphor for a bit longer.

Imagine showing up to a pizza party and realizing that you have to trade your own pizza slices for those from other guests.

You'd want to make sure that you're trading your extra cheese slice for something equally delicious, right? Not just a plain ol' margherita!

That's exactly what it's like during a merger or an acquisition.

Company valuation is like figuring out just how tasty each slice of your company's pizza is.

When two companies decide to merge, or when one company decides to acquire another, they need to agree on the value of their respective businesses.

It's all about making sure that everyone gets a fair slice of the pie.

Why is it so important, you ask?

Well, without a proper company valuation, one party could end up getting less than their fair share. And nobody wants to walk away from a pizza party – or a business deal – feeling like they got short-changed.

Not only that, but a well-conducted company valuation can provide key insights for business leaders, helping them to understand their company's strengths and weaknesses, and informing their strategy going forward.

It's like knowing which pizzas at your party are crowd favorites and which ones are being left to go cold.

In the next section, we'll look at how company valuation services can help make sure that everyone gets their fair share at the M&A pizza party.

The Role of Company Valuation Services

Just as a skilled chef knows exactly how to create the perfect pizza, a professional company valuation service knows how to accurately assess a company's worth.

Their role is vital when two companies decide to merge or when one business wants to acquire another.

But what exactly do they do?

First and foremost, company valuation services use a range of methods to calculate the value of a business.

They look at financial documents, market analysis, economic conditions, and a whole lot more.

It's a complex process, but to put it simply: they're determining the 'price tag' for your business.

Not only that, they provide a neutral perspective. Let's face it, if you've built a business from the ground up, it's easy to become emotionally attached and overestimate its value. A valuation service will provide an unbiased view, ensuring that the price is fair and accurate.

In addition to that, they can help with negotiation.

By having a solid, detailed valuation, you have a strong foundation to negotiate from during M&A discussions.

It ensures that you know your worth and can argue your position effectively.

Lastly, they can provide insight that helps shape the future strategy of the newly formed company post-merger or acquisition.

By thoroughly analyzing the company's historical and projected financials, market position, and potential, they provide information that can inform crucial business decisions.

In short, company valuation services play a crucial role in mergers and acquisitions.

They ensure that all parties involved know the worth of their companies, making the process fair and transparent, just like ensuring everyone gets their fair slice at a pizza party.

| Role | Description |

|---|---|

| Valuation | Uses a range of methods to calculate the business' value, including analysis of financial documents, market conditions, and more. |

| Neutrality | Provides an unbiased view of the company's worth, avoiding overestimation due to emotional attachment or biases. |

| Negotiation | Offers a detailed valuation as a foundation for negotiation during M&A discussions. |

| Insight | Helps shape future company strategy post-merger or acquisition by providing insights about the company's financials, market position, and potential. |

The Impact of M&As on the Business Landscape

In the same way that a pizza party can completely change the mood of a gathering, mergers and acquisitions can significantly alter the business landscape.

How? Let's take a closer look.

Consolidation: Mergers and acquisitions often lead to the consolidation of industries. Two competitors might merge to form a larger, more powerful entity.

This can result in reduced competition and potentially higher prices for consumers.

On the other hand, it can also lead to cost efficiencies and innovation due to combined resources.

Innovation: Speaking of innovation, M&As can often spark new ideas and drive progress.

When two companies with different strengths come together, they can pool their resources and expertise to create something truly unique and groundbreaking.

Market Expansion: M&As also provide companies with an opportunity to expand their market reach.

By acquiring a company in a different geographical area or industry, a business can quickly scale its operations and tap into a whole new customer base.

Economic Shifts: On a larger scale, M&As can influence economic shifts.

When significant deals occur, they can boost confidence in a particular industry or even the entire economy.

Conversely, a lack of M&A activity might signal economic uncertainty or industry stagnation.

In conclusion, mergers and acquisitions play a vital role in shaping the business landscape, driving innovation, and influencing economic trends. And just like a well-planned pizza party, a well-executed M&A can bring about a lot of positive changes and opportunities for growth.

The Role of Startups in M&As

Often, we tend to imagine mergers and acquisitions as big businesses absorbing smaller ones.

But what about startups? Do they play a role in this pizza party?

You bet they do! And it's an exciting one.

The Rising Startup Trend: In recent years, startups have emerged as attractive targets for M&As.

Why? Startups are often seen as agile, innovative companies that are developing novel solutions to old problems.

These qualities make them valuable to larger companies looking to stay competitive and ahead of the curve.

Access to Innovation: Startups are often at the cutting edge of technology and innovation.

When a large company acquires a startup, it's not just buying the product or service that the startup provides, it's also acquiring the startup's innovation potential.

This can be a valuable strategy for staying ahead in fast-paced industries.

Market Expansion: Startups often operate in niche markets, developing specialized solutions for specific problems.

When a larger company acquires a startup, it can quickly gain access to these niche markets and expand its overall market presence.

Cost Savings: Sometimes, acquiring a startup that has already developed a particular product or service can be more cost-effective than developing that product or service in-house.

In such cases, M&As offer a strategic advantage and potential cost savings.

So, just like the fresh toppings that give that extra zest to your pizza, startups bring a unique flavor to the M&A landscape, injecting fresh ideas, technology, and market opportunities into more established businesses.

| Role of Startups in M&As | Description |

|---|---|

| Innovation Driver | Startups, often at the cutting edge of technology and innovation, provide larger companies with access to novel solutions and fresh ideas. |

| Market Expansion | Startups operating in niche markets offer opportunities for larger companies to expand their market presence swiftly. |

| Cost Savings | M&As can provide cost savings when acquiring a startup that has already developed a particular product or service proves more cost-effective than in-house development. |

| Rising Trend | The agile and innovative nature of startups makes them attractive targets for M&As, allowing larger companies to stay competitive and ahead of the curve. |

How Startups Can Prepare for M&As

Just like making sure all the pizza toppings are fresh and ready for the party, startups must prepare themselves to become attractive propositions for potential M&As.

Here are some ways they can do this.

Maintain Clean Financial Records: One of the first things any potential buyer will look at are the startup's financial records. Keeping these clean, organized, and transparent is essential.

This will make the due diligence process smoother and give the potential acquirer confidence in your business operations.

Develop a Unique Value Proposition (UVP): What sets your startup apart from others in the market? Your UVP should be clear, compelling, and demonstrable.

This could be a unique technology, a patented process, or an innovative business model.

Having a solid UVP will make your startup a more attractive acquisition target.

Build a Strong Team: A strong, dedicated team can be a significant asset in the eyes of potential buyers.

This not only demonstrates stability but also ensures that the business can continue to operate smoothly post-acquisition.

Create Scalable Systems and Processes: A startup that has systems and processes that can scale up quickly and efficiently is often more attractive to potential acquirers.

This shows that your business can handle growth, which is particularly important if the acquiring company is larger and has plans to expand your startup’s operations.

Seek Legal and Financial Advice: M&As are complex transactions with significant legal and financial implications. It's crucial for startups to seek advice from experts in this field to understand the potential impacts and to negotiate the best possible deal.

Startups are like fresh ingredients ready to spice up the M&A pizza party. With careful preparation and strategic decisions, they can make themselves an irresistible piece of the M&A pie.

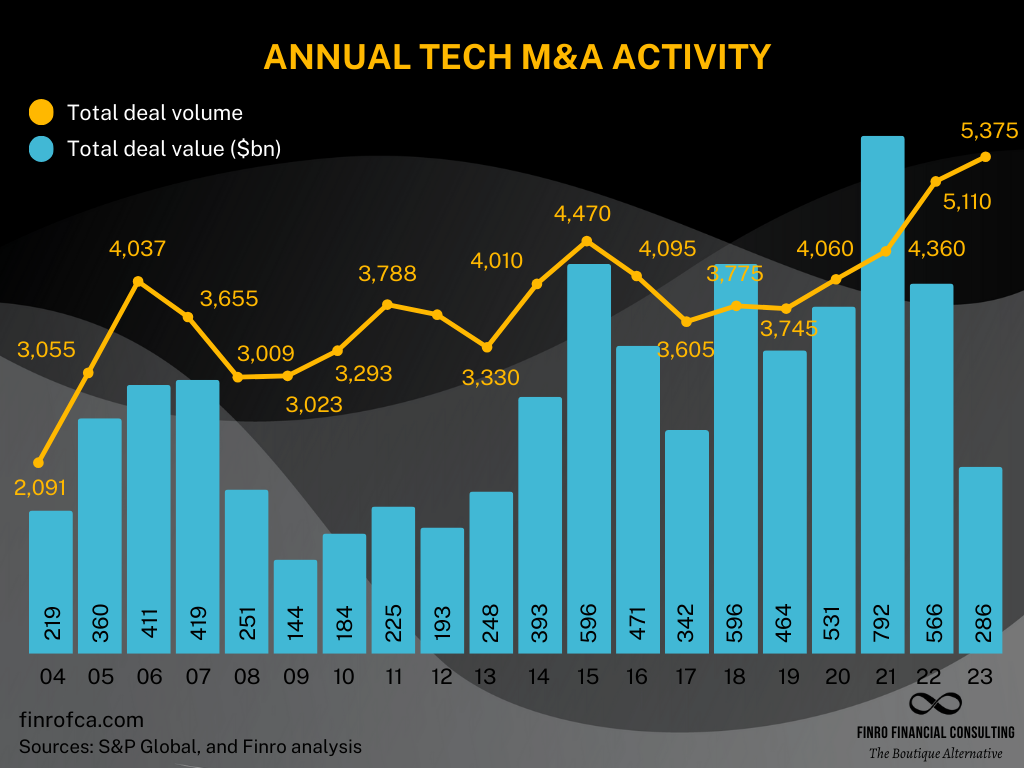

Tech M&A: 2023 in Review

The year 2023 unfolded as a challenging chapter in the realm of tech mergers and acquisitions (M&As), marked by a noticeable slump that saw spending dip to its lowest in a decade.

This downturn was emblematic of the broader post-pandemic economic recalibrations, casting a long shadow over the vibrant tech M&A landscape that had thrived in the years leading up to it.

A pivotal moment in this narrative was the historic shift in sentiment captured by industry dealmakers. After a period of pronounced caution, there emerged a near-record level of bullishness for the year ahead, signaling the largest sentiment swing in the 20 years of surveying the tech M&A sector.

This dramatic turnaround, from caution to optimism, underscores the sector's resilience and adaptability to swiftly changing market conditions.

Compounding the year's challenges were significant macroeconomic pressures, notably inflation and growth concerns. These factors weighed heavily on dealmaking, with more than half of the respondents in previous surveys predicting that such economic headwinds would dampen M&A activities.

Indeed, 2023's outcomes validated these concerns, as the tech sector grappled with the dual challenges of maintaining growth and navigating inflationary pressures.

Despite these hurdles, 2023 was not without its landmarks. The strategic shift towards corporate acquirers taking a more dominant stance over private equity firms marked a notable change in the M&A landscape.

This was partly propelled by the tightening of financing conditions, spurred by a series of interest rate hikes. Corporate acquirers, leveraging their positions, began to lead the recovery process, indicating a robust response to the previous year's financing challenges.

Among the significant deals that punctuated the year's narrative, Cisco's acquisition of Splunk stood out, embodying the strategic moves companies continued to pursue amidst broader market contractions.

This transaction, among others, served as a testament to the ongoing strategic recalibrations within the tech sector, highlighting the adaptability and forward-looking approaches of key players even in times of market downturns.

In sum, 2023 was a year of introspection and recalibration for the tech M&A market. Faced with unprecedented challenges, the sector demonstrated resilience, strategic adaptability, and a readiness to rebound.

As we look back, the lessons and outcomes of 2023 are set to inform and drive a more dynamic, strategic, and optimistic outlook for the years ahead.

Conclusion

Mergers and acquisitions are much like a pizza party: a dynamic blend of different ingredients, each bringing its unique flavor, all coming together to create something bigger, tastier, and more satisfying.

These ingredients are companies of all shapes and sizes in the business world.

From large corporations looking to innovate and expand their market reach to startups offering fresh ideas and specialized solutions.

Each plays a crucial role in the M&A landscape, influencing industry consolidation, sparking innovation, promoting market expansion, and driving economic shifts.

Company valuation services are the chefs of this party, setting the stage, ensuring each ingredient – each business – is valued correctly, and playing a vital role in making the M&A pizza party a success.

Their unbiased view of a company's worth, their pivotal role in negotiations, and the insightful perspective they provide to shape future company strategy are invaluable.

In the whirlwind world of M&As, startups need to be ready.

By keeping clean financial records, developing a unique value proposition, building a strong team, creating scalable systems, and seeking expert advice, startups can ensure they're well-prepared to join the M&A party when the opportunity arises.

So, whether you're a company looking to merge or acquire, a startup preparing to be an attractive acquisition, or a valuation service provider ready to assess the worth of a company, remember: your role in the M&A pizza party is critical.

It's a complex process, but with the right ingredients and a talented chef, the result can be a deliciously successful venture that reshapes the business landscape.

Key Takeaways

Valuations shape negotiations: Precise valuations are crucial for fair M&A deals, guiding negotiations and strategic decisions.

Startups fuel innovation in M&As: Agile and innovative startups are sought-after targets, bringing fresh solutions and technologies.

M&As influence market dynamics: They can alter industry landscapes, driving innovation, and market expansion.

Economic conditions impact M&As: The 2023 tech M&A downturn underscores how macroeconomic factors affect deal activities.

Preparation is key for startups: Maintaining clean financials and a unique value proposition prepares startups for successful M&A integration.

Answers to The Most Asked Questions

-

Value creation in M&A arises from combining companies to leverage their unique strengths, leading to innovation, market expansion, and increased efficiencies. These synergies contribute to a more competitive and resilient enterprise.

-

M&A deals are priced through comprehensive evaluations that consider financial documents, market analysis, and economic conditions. This involves assessing the companies' financial performance, growth prospects, and market positions to establish an equitable price.

-

The value of a merger is calculated by assessing the worth of each participating company. This includes analyzing their financial health, market share, potential for growth, and the synergies that the merger would bring. Valuation experts often use methodologies like discounted cash flow, comparables, and precedent transactions.

-

Valuation methods in M&A include discounted cash flow analysis, where future cash flows are estimated and discounted back to present value; comparables analysis, comparing the company with similar companies in the industry; and precedent transactions, looking at recent sales of similar companies.

-

Valuation is essential in mergers and acquisitions because it ensures transactions are conducted fairly, with each party receiving equitable value. It aids in successful negotiations and strategic planning, helping stakeholders understand the financial and strategic worth of their investments.

-

Valuation serves as the foundation for the M&A process, determining fair business prices, providing an unbiased view of a company's worth, facilitating negotiations with concrete financial data, and informing future strategic decisions by thoroughly analyzing the company's financials and market potential.