Scenario Analysis: Navigating Uncertainty in Startup Financial Models

By Lior Ronen | Founder, Finro Financial Consulting

Scenario analysis is one of a startup's most powerful tools, particularly for financial modeling.

This technique isn't just about playing it safe; it's a strategic approach to forecasting and preparing for various possible futures. For startups in the tech sector, where innovation races ahead and markets can shift overnight, understanding the "what ifs" isn't just helpful—it's crucial.

Scenario analysis helps map out the financial implications of various future events, from highly probable to more speculative. It goes beyond traditional forecasting by predicting likely outcomes and preparing for the less expected ones.

This approach is especially relevant for tech startups, which often face volatile markets, regulatory uncertainties, and rapid technological changes.

Whether it's regulatory approval, a sudden market shift, or even global events affecting supply chains, scenario analysis arms startups with the insight to make informed decisions, pivot strategies effectively, and communicate with investors transparently about potential risks and opportunities.

In this article, we'll dive into how scenario analysis can guide startups through the uncertainties of launching and growing a tech business.

We'll explore its significance in evaluating the impact of binary events, assisting pre-revenue startups in strategizing for success, and aligning financial projections with market realities.

Through this lens, scenario analysis emerges not just as a tool for risk management but as a cornerstone of strategic planning in the unpredictable tech landscape.

Navigating the complexities of the tech startup landscape demands a keen understanding of both potential future challenges and the current financial intricacies of the business. Scenario analysis and specialized financial modeling stand out as crucial strategies for startups aiming to adapt and thrive amidst uncertainties. Through scenario analysis, startups gain insights into how binary events could pivot their trajectory, allowing for preemptive strategic adjustments.

Complementing this, specialized financial modeling, particularly with the expertise of firms like Finro Financial Consulting, provides a comprehensive and insightful view into a startup's financial future, tailored to the unique dynamics of the tech industry. This dual approach not only prepares startups for various market conditions but also enhances their appeal to investors, laying a solid foundation for growth, innovation, and market leadership.

- The Value of Scenario Analysis in Anticipating Binary Events

- Scenario Analysis for Pre-Revenue Startups

- Aligning Startup Projections with Market Realities

- Implementing Scenario Analysis in Your Startup’s Financial Model

- Benefits of Choosing Finro As Your Financial Modeling Consultant

- Navigating the Future: Embracing Scenario Analysis and Specialized Financial Modeling for Tech Startup Success

The Value of Scenario Analysis in Anticipating Binary Events

Binary events have a clear "yes or no" outcome and can significantly impact a startup's trajectory.

In the tech sector, these events can range from regulatory approvals to macroeconomic shifts, each carrying the potential to dramatically al’s financial landscape almost overnight dramatically.

Understanding Binary Events and Their Impact

At the heart of every tech startup is innovation, but with innovation comes uncertainty.

Binary events represent critical points where a startup's future could pivot in entirely different directions based on the outcome of a single event.

For example, a biotech startup's entire value proposition may hinge on FDA approval for a new drug, or a fintech startup's growth prospects might be significantly influenced by changes in interest rates.

The stark nature of these events means that the difference between the two outcomes can be vast, often resulting in divergent paths that affect funding, growth, and operational strategy.

Scenario analysis provides a structured approach to quantify these impacts, enabling startups to forecast financial outcomes under each possible scenario.

Quantifying the Impact with Scenario Analysis

Scenario analysis in this context involves creating financial models for each potential outcome of the binary event.

This process includes adjusting revenue projections, operational costs, and cash flow forecasts based on the event's positive or negative outcome.

The aim is to clearly show how each scenario could affect the startup's financial health, growth trajectory, and valuation.

For instance, a tech startup facing regulatory scrutiny may model one scenario where they receive approval within a few months, leading to accelerated market entry and revenue growth.

Conversely, a scenario where approval is delayed or denied would include increased legal and operational costs, slower growth, and potentially the need to pivot the business model entirely.

Informing Strategy and Investor Relations

Armed with these insights, startups can better strategize for the future. They can identify necessary resources and contingencies for each scenario, from securing additional funding to exploring alternative markets or products.

Moreover, transparently sharing these scenario analyses with investors and stakeholders builds trust. It demonstrates a thorough understanding of the startup's risk landscape and a proactive approach to navigating it.

Investors, in particular, appreciate the visibility into potential risks and rewards. Knowing that a startup has thoroughly considered and planned for various outcomes of a binary event can make the difference in securing investment.

It shows that the management team is not only visionary but also pragmatic and well-prepared to steer the company through uncertain times.

| Binary Event | Niche | Potential Impact |

|---|---|---|

| FDA Approval for Drugs | Biotech and Healthtech | Significant impact on company's ability to market and sell products. A 'yes' can mean rapid scaling, a 'no' may require a pivot. |

| Regulatory Decisions in Tech | Edtech, Artificial Intelligence (AI), Social Media Platforms | Can restrict or enable growth opportunities, affecting user acquisition, data usage, and monetization strategies. |

| Interest Rate Hikes | Fintech, Proptech, Real Estate Tech | May increase operational costs and borrowing expenses, affecting profitability and growth strategies for startups. |

| Global Conflicts | All Sectors (with specific impact on regional startups) | Can disrupt supply chains, impact funding availability, and alter market demand, requiring swift operational adjustments. |

| Major Technological Breakthroughs | All Tech Sectors | Can render existing products obsolete or open up new markets, necessitating rapid innovation or adaptation. |

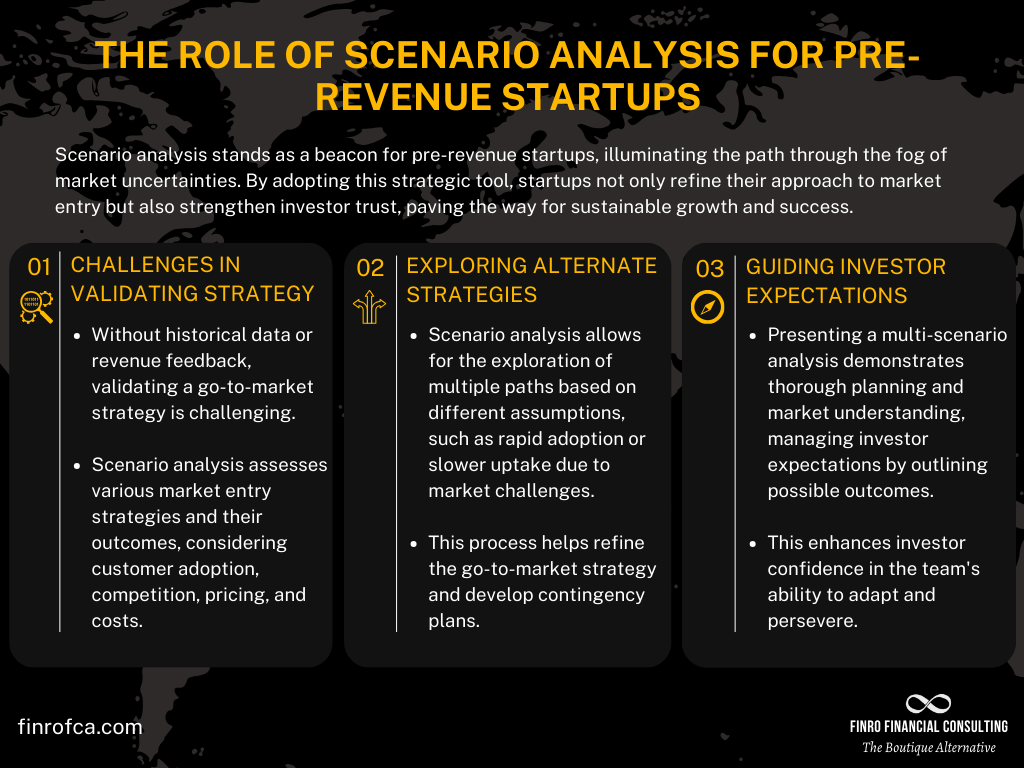

Scenario Analysis for Pre-Revenue Startups

For startups that have yet to generate revenue, the path to market success is fraught with uncertainties.

Scenario analysis becomes an indispensable tool for navigating these uncertainties, enabling founders to explore and prepare for a variety of strategic outcomes.

Challenges in Validating the Go-to-Market Strategy

Pre-revenue startups operate in a realm of theoretical success until their products or services reach the market.

Validating a go-to-market strategy without historical data or revenue feedback presents a unique challenge.

It's here that scenario analysis steps in, offering a structured method to assess various market entry strategies and their potential outcomes.

This analysis can consider factors such as customer adoption rates, competitive response, pricing strategies, and cost structures, providing a spectrum of possible futures.

Exploring Alternative Strategies with Scenario Analysis

The strength of scenario analysis for pre-revenue startups lies in its ability to map out multiple paths based on different assumptions.

For instance, one scenario might assume rapid adoption due to a lack of direct competition, while another might consider a slower uptake due to unforeseen market challenges.

By modeling these scenarios, startups can anticipate potential pitfalls and opportunities, refining their go-to-market strategy to better align with realistic expectations.

This process encourages startups to think critically about their assumptions and to develop contingency plans.

For example, if the initial strategy hinges on a certain pricing model, scenario analysis can explore the financial implications of various pricing strategies, guiding the startup toward the most viable option.

Guiding Investor Expectations and Decisions

Investors play a crucial role in the early stages of a startup's life, and their confidence in the startup's strategy is paramount.

Presenting a multi-scenario analysis not only demonstrates thorough planning but also shows an understanding of the market's complexity.

It can help manage investor expectations by outlining a range of possible outcomes, including best-case, worst-case, and most likely scenarios.

Furthermore, scenario analysis provides a framework for discussing how the startup intends to navigate potential challenges, enhancing investor confidence in the team's ability to adapt and persevere.

This level of transparency and preparedness can be a deciding factor for investors contemplating where to allocate their resources.

Aligning Startup Projections with Market Realities

Startups, especially in the tech sector, often face the challenge of projecting financial performance in a way that is both ambitious and grounded in reality.

Scenario analysis serves as a critical tool in bridging this gap, allowing startups to explore and present financial projections that account for the dynamic nature of markets.

Identifying Discrepancies Between Projections and Market Norms

It's not uncommon for startups to have financial projections that reflect an idealized path to market dominance.

However, these projections may not always align with industry benchmarks or typical market rates and margins.

Scenario analysis provides a structured approach to examine these discrepancies by modeling financial outcomes based on varying market conditions and assumptions.

This process involves analyzing how changes in market size, competition, consumer behavior, and regulatory environments could impact revenue growth, cost structures, and ultimately, profitability.

By comparing these scenario-driven projections against industry norms, startups can identify and adjust overly optimistic assumptions, ensuring their projections are both ambitious and achievable.

Using Scenario Analysis to Develop Realistic Financial Models

The development of realistic financial models through scenario analysis involves more than just tempering optimism; it's about preparing for a range of market conditions that could affect a startup's growth trajectory.

For example, a scenario might explore the impact of a new competitor entering the market, offering a similar product at a lower price point. Another scenario could examine the effects of a slower-than-expected adoption rate due to consumer skepticism.

Each scenario helps startups understand the potential financial implications of various market developments, enabling them to adjust their business models and strategies accordingly.

This exercise not only leads to more realistic financial projections but also equips startups with actionable insights to mitigate risks and capitalize on opportunities.

Enhancing Investor Confidence with Transparent Projections

Presenting scenario-based financial projections to investors does more than align expectations— it demonstrates a startup's maturity in understanding and planning for market realities.

Investors value transparency and thoroughness, and by sharing a range of possible outcomes, startups can build trust and confidence.

This transparency shows that a startup is not only aware of the challenges ahead but is also proactively preparing for them. It reassures investors that their investment is in capable hands, managed by a team that is realistic about the market and ready to navigate its complexities.

Get your expert financial model now!

Implementing Scenario Analysis in Your Startup’s Financial Model

Integrating scenario analysis into the financial planning process is a strategic move for any startup.

It not only enhances the financial model's robustness but also prepares the startup to face various market conditions confidently.

Here’s how startups can effectively implement scenario analysis into their financial models.

Steps to Integrate Scenario Analysis into Financial Planning

Identify Key Variables and Assumptions: Begin by pinpointing the critical variables that could significantly impact your financial model. These might include sales volume, pricing strategies, payroll and headcount, market size, regulatory changes, cost of revenues, or cost of goods sold (COGS).

Develop Scenarios Based on Different Outcomes for These Variables: Create a range of scenarios for each key variable, including best-case, worst-case, and most likely scenarios. This approach helps in understanding the potential impact of each variable on the startup's financial health.

Quantify the Financial Impact: For each scenario, calculate the financial outcomes, adjusting your revenue, expenses, cash flow, and other relevant financial metrics accordingly. This step involves a detailed analysis to ensure the scenarios are realistic and based on data-driven assumptions.

Evaluate the Scenarios and Plan Contingencies: Analyze the outcomes of each scenario to assess the potential risks and opportunities. Based on this analysis, develop contingency plans for the adverse scenarios and strategies to capitalize on favorable outcomes.

Review and Update Regularly: The market environment and your startup’s internal conditions will evolve. Regularly review and update your scenarios to reflect these changes, ensuring your financial model remains relevant and responsive to current conditions.

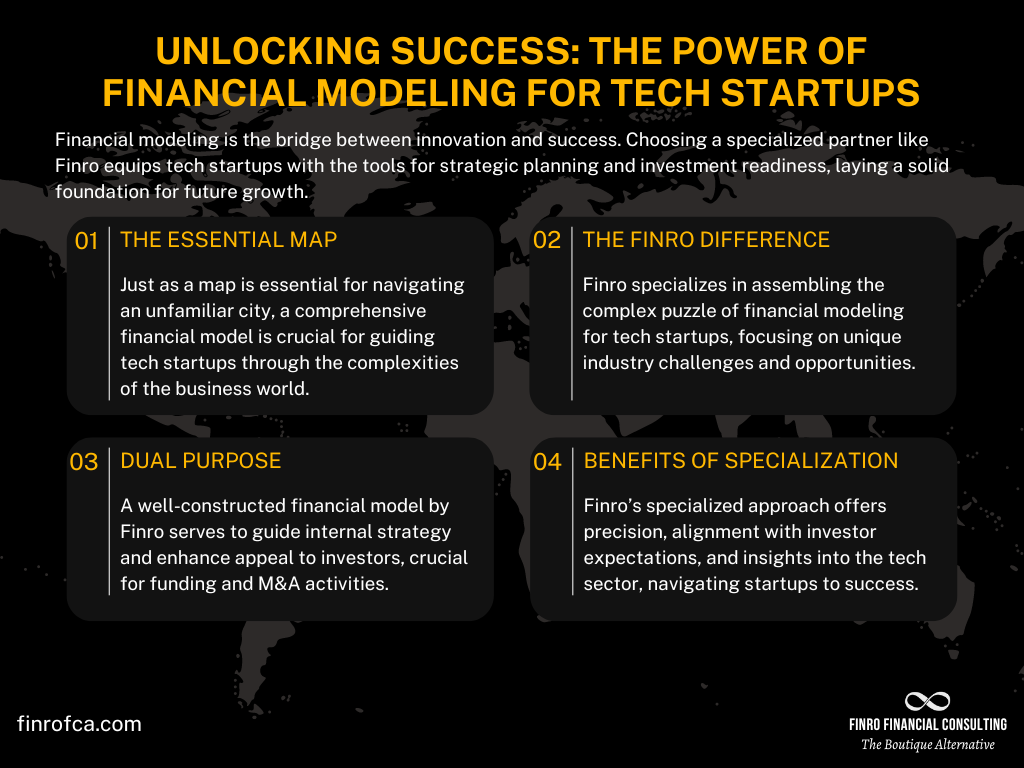

Benefits of Choosing Finro As Your Financial Modeling Consultant

Navigating the tech startup world without a comprehensive financial model is akin to exploring an unfamiliar city sans map.

A dramatic analogy, perhaps, but it succinctly captures the essence of a financial model's critical role for tech startups. It's not merely about populating a spreadsheet with numbers; it's about gaining insights into your business's potential direction.

Why Finro?

The question then arises: how do you obtain this invaluable map? You could attempt it yourself, hire a general financial modeler, or engage specialists deeply versed in the tech industry's intricacies.

Herein lies the crux: financial modeling for tech startups transcends ordinary tasks. It involves assembling a complex jigsaw that mirrors your unique business dynamics.

At Finro, we don't just specialize; we thrive in piecing together this puzzle, focusing specifically on the challenges and opportunities unique to the tech sector.

Opting for our services isn't about a sales pitch; it's about making a strategic choice that profoundly influences your startup's trajectory.

Dual Purpose

A well-constructed financial model serves two pivotal roles: it guides your internal financial strategy and bolsters your appeal to potential investors or partners during crucial discussions like funding rounds or M&A activities.

Given its significance, the paramount question is: what caliber of expertise do you desire backing this essential tool?

Specialized Partnership Benefits

Why traverse the complexities of tech financial modeling solo when you can leverage the insights and experience of a specialized partner?

As we unfold the narrative, we'll elucidate the benefits of a bespoke financial modeling approach for tech startups, from precision and alignment with investor expectations to navigating the advantages a specialized entity like Finro can offer in positioning your startup for success.

In Conclusion

Financial modeling emerges as a pivotal element for tech startups, acting as the bridge between innovative concepts and sustainable business success.

Firms focused on specialized financial modeling, notably those with an emphasis on the tech domain like Finro Financial Consulting, provide indispensable expertise.

They craft models encapsulating the distinct dynamics of startups, ensuring thoroughness and congruence with investor expectations.

The pitfalls of DIY or generic modeling underscore the importance of selecting a specialized ally.

With a proven track record, a profound understanding of the tech sector, and strategic acumen, a specialized firm equips startups with the necessary tools for internal planning, securing investments, and navigating mergers and acquisitions, establishing a robust foundation for future growth and triumph.

Navigating the Future: Embracing Scenario Analysis and Specialized Financial Modeling for Tech Startup Success

The ability to anticipate and strategically plan for a multitude of future scenarios is not just advantageous—it's essential.

This article has explored of future scena the complexities of scenario analysis, the pivotal role of financial modeling, and the unmatched value of engaging with a specialized financial consultancy like Finro.

Together, these elements form a triad of strategic tools that empower tech startups to navigate the turbulent waters of innovation and market dynamics with confidence and foresight.

Scenario analysis, with its capacity to explore the ramifications of binary events, provides startups with a nuanced understanding of potential futures, equipping them to pivot, adapt, and thrive amidst uncertainty.

This strategic foresight complements the meticulous craft of financial modeling, which transcends mere number crunching to become a narrative—a compelling story of your startup's path to growth and success, grounded in data and illuminated by insights.

The choice of Finro as a partner in this journey underscores a recognition of the specialized nature of financial modeling in the tech sector.

Finro's expertise isn't just in creating models; it's in understanding the unique challenges and opportunities that tech startups face, translating complex dynamics into clear, actionable strategies that resonate with investors and stakeholders.

This partnership is not merely transactional; it's transformational, providing startups with the clarity and confidence to make informed decisions, secure investment, and chart a course through the unpredictable terrain of the tech industry.

As we conclude, it's clear that the intersection of scenario analysis and specialized financial modeling, particularly for tech startups, is not just a methodological choice but a strategic imperative.

These tools do not merely predict the future; they help shape it, offering startups the agility to respond to challenges, seize opportunities, and forge their path to innovation and market leadership.

In choosing a partner like Finro, tech startups gain more than expertise; they gain a collaborator committed to turning their visionary ideas into sustainable, successful realities.

In the journey toward technological innovation and business success, scenario analysis and specialized financial modeling are the compass and map, guiding startups through uncharted territory to their desired destination. With these tools and the right partnership, the possibilities are not just imagined—they're achievable.

Key Takeaways

Scenario Analysis is Crucial: Helps startups anticipate impacts of binary events and strategically plan for diverse future scenarios.

Financial Modeling Beyond Numbers: Translates startup dynamics into strategic narratives, guiding both internal decisions and investor communications.

The Role of Specialized Consultancies: Firms like Finro offer deep industry insights, enhancing startups' financial strategies and investor appeal.

Dual Purpose of Financial Models: Essential for internal strategy and demonstrating startup potential to investors, crucial for funding and M&A activities.

Choosing the Right Partner Matters: Partnering with a specialized firm like Finro is key for tech startups seeking to navigate market complexities successfully.

Answers to The Most Asked Questions

-

Scenario analysis in the context of NPV involves evaluating how different future scenarios (e.g., changes in revenue, costs, or investment outcomes) might affect the NPV of a project or investment. This helps companies assess the range of possible outcomes and the associated risks or opportunities.

-

A simple scenario analysis method generally involves identifying key variables that could impact outcomes and then creating distinct "scenarios" (such as best case, worst case, and most likely case) based on various combinations of those variables. This method helps understand the potential impacts on business plans or investments under different conditions.

-

Three common types of scenarios used in scenario analysis are:

Optimistic (Best Case): Assumes the most favorable conditions.

Pessimistic (Worst Case): Assumes adverse conditions.

Realistic (Most Likely Case): Assumes a middle ground, considering likely outcomes based on current trends and data.

-

Generally, scenario planning can be divided into three main phases:

Preparation: Identifying the scope, key drivers of uncertainty, and focal issues of the scenario planning exercise.

Development: Creating scenario narratives that explore different futures based on the identified uncertainties and drivers.

Implementation: Using the scenarios to inform strategic decisions, develop strategic options, and create a more adaptable strategic plan.