Who Needs Startup Financial Projections? A Must-Read for Tech Entrepreneurs

By Lior Ronen | Founder, Finro Financial Consulting

Imagine, as a tech entrepreneur, your groundbreaking product changing the world. But the bridge from a brilliant concept to a market triumph isn’t just built on innovation alone; it's anchored in the bedrock of sound financial projections.

Though it may lack the thrill of coding marathons or the creativity of product design, the art of crafting these forecasts—encompassing expected revenues, expenses, cash flow, and more—is what shapes the future of your startup. They do more than just crunch numbers; they translate your innovative ideas into a language of viability, speaking volumes to investors and partners about the potential success of your venture.

In this article, we’re not just going to talk about financial projections; we’re going to explore their soul. Beyond the realm of mere bean counting, we’ll delve into how these forecasts weave the narrative of your company's journey, charting paths to either soaring triumphs or sobering downfalls.

Understanding these projections is understanding the heartbeat of startup success. As we demystify these foundational models, you'll see how they transform ambitious ideas into tangible business milestones.

Are you ready to unlock the financial storytelling that could propel your tech venture into a vibrant future? Let's embark on this enlightening journey together.

Startup financial projections are detailed forecasts of a startup's future revenues, expenses, and overall financial performance. This article explores their vital importance in the tech startup world, discussing how they guide decision-making in securing funding, strategic planning, budgeting, performance tracking, and exit strategies.

While acknowledging their limitations, including reliance on assumptions and the unpredictability of the future, the article underscores the necessity of adaptability and regular updates. Ultimately, these projections are depicted as a strategic compass, indispensable for navigating the dynamic and challenging landscape of the tech industry, steering startups toward growth and long-term success.

The Importance of Financial Projections

Starting a tech startup is super exciting. You're busy creating something that might change the world!

But there's another side to the story that's not as flashy but just as important: financial forecasting. This is the unsung hero that can turn your awesome idea into a real, thriving business.

Let's dive into why these financial forecasts matter. They're not just about balancing the books. They're your map for growing your startup successfully.

Raising Funds: Your Startup's Launchpad

Think of securing funding as laying the groundwork for your startup's launch. Investors, whether they're angel investors, venture capitalists, or other backers, are looking for more than just a brilliant idea. They need assurance that your startup is on a solid financial trajectory.

A comprehensive financial projection is your way of showing them that you've meticulously analyzed the market and crafted a strategy for profitability and growth. It's the roadmap that instills the confidence they need to fuel your venture, to be a part of your journey from the ground up.

Calculating Burn Rate: Navigating Through Financial Fog

In the tech world, 'burn rate' is your compass through the financial fog. It's about how quickly your startup goes through its capital. Keeping a vigilant eye on this rate is crucial, as it determines your company's runway.

Regularly updated financial projections offer a clear view of your expected expenses against projected revenues. This foresight allows you to identify and mitigate cash flow problems early. Whether it's optimizing costs, pivoting your business strategy, or securing additional funding, these projections keep your startup's journey on course.

Managing Cash Flow: The Lifeblood of Your Startup

Cash flow is the lifeblood of your venture. For tech startups, where funds are often limited and initial costs high, mastering cash flow management is a make-or-break skill.

Accurate financial projections provide a window into the future of your cash inflows and outflows. Anticipating potential cash crunches enables you to make informed decisions—be it delaying hiring, innovating cost-effective marketing strategies, or adjusting your growth pace. It's about ensuring that your startup doesn't just survive but thrives, avoiding financial pitfalls that could derail your ambitions.

As we dive deeper into the world of financial projections, remember they are much more than just numbers on a spreadsheet. They are the strategic tool that can guide your tech startup to its full potential. Let's continue to uncover how you can harness this power to steer your startup towards lasting success.

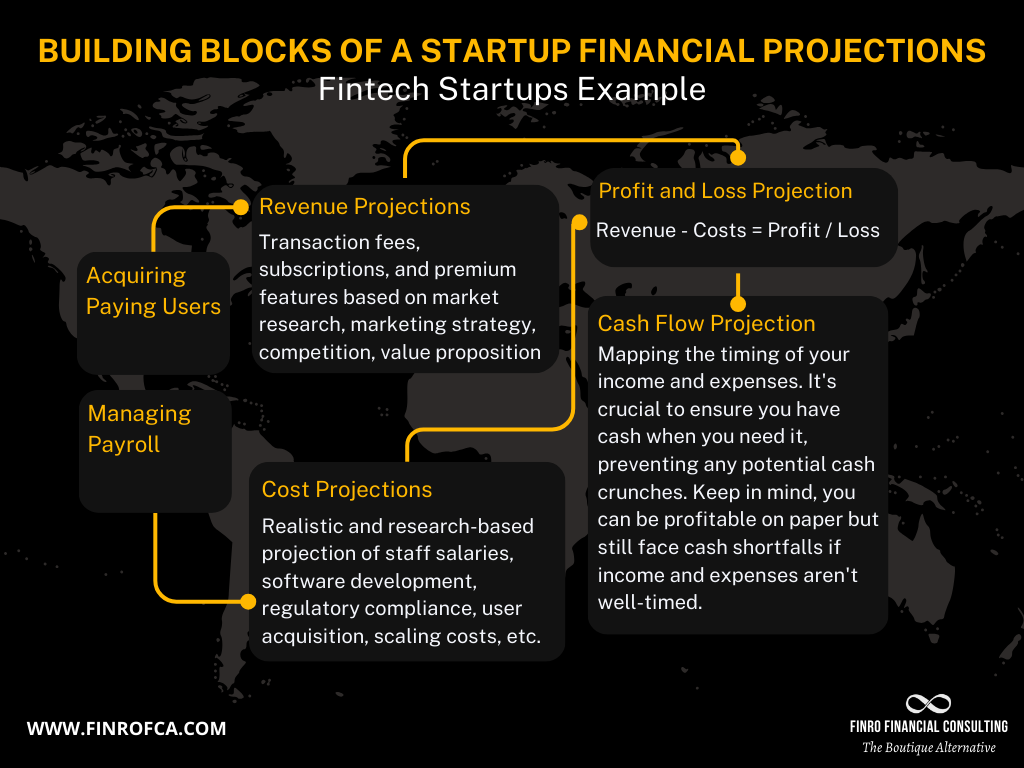

Main Components of Startup Financial Projections

Don't worry if the idea of creating financial projections for your tech startup seems overwhelming.

You'll find it much easier to tackle by breaking it down into smaller parts.

In this section, we’ll introduce the main ingredients of every financial projection: revenues, costs, cash flow, income statement, and balance sheet.

Revenue projections

Consider revenue projections, or sales forecasts, as your best estimate of how much money your startup will generate over a specific period, usually ranging from one to five years.

When estimating revenue, two common methods are used: the top-down approach and the bottom-up approach. The top-down approach involves starting with the Total Addressable Market (TAM), narrowing down to the Serviceable Available Market (SAM), and then to the Serviceable Obtainable Market (SOM), providing a broad market-based perspective. In contrast, the bottom-up approach focuses on detailed unit sales and pricing strategies, building up to a total revenue estimate from the ground up.

To make an accurate estimate, take into account various revenue drivers, such as how you attract potential customers, who your target audience is, your product pricing strategy, and your sales channels.

Just remember to be cautious and avoid being overly optimistic, as overestimating your revenue can lead to financial challenges down the road. Always strive for realistic and well-researched revenue projections to set your startup up for success.

Cost structure

Understanding your startup's cost structure is key to determining when you'll start turning a profit and how much funding you need for day-to-day operations.

Your cost structure should detail all expenses, including fixed costs like rent, salaries, and insurance, which remain constant regardless of sales, and variable costs such as hosting or AWS fees, marketing expenses, and transaction fees, which fluctuate with your business activity.

Accuracy in estimating these costs is critical. Underestimating expenses can lead to financial shortfalls, while overestimating can misrepresent your funding needs. As your startup grows and evolves, so too should your cost estimates, reflecting changes in your operational scale and strategy.

Additionally, a clear understanding of your cost structure is vital for creating realistic revenue projections. It helps in setting achievable sales targets and managing cash flow effectively.

Cash flow statements

A cash flow statement is like a diary of your startup's financial ins and outs, giving you a clear picture of where your cash comes from and where it's going.

This statement should cover cash from three main sources: your day-to-day operations, investments, and any funds you've borrowed or received from investors through selling shares.

A cash flow projection is invaluable for showing potential investors or your company's management whether the startup will have enough cash in the bank in the future to support various activities, taking into account all cash inflows and outflows.

Another essential use case for a cash flow projection is calculating your startup's cash runway or the point at which the company will run out of cash. This calculation helps your business estimate when it'll need to raise funds again, ensuring that you stay financially afloat.

Profit and loss statement (P&L)

The P&L statement, also known as an income statement, is like a report card that shows whether your startup is making enough money to cover its costs and turn a profit.

Creating a projected income statement is crucial for understanding several aspects of your startup's financial health, such as:

Is your business on the right track financially?

Will your net income become positive in the near future?

At what point will your sales projection outpace your expenses, allowing your business to reach the breakeven point?

By regularly reviewing and updating your P&L projections, you can gain valuable insights into your startup's financial performance and make well-informed decisions about growth and profitability.

Balance sheet

A balance sheet is a snapshot of your startup's financial health, showing you what it owns (assets), what it owes (liabilities), and who has a stake in the business (equity).

Assets include cash, inventory, and money owed to you, while liabilities are loans, bills, and other financial obligations. Equity represents the ownership shares of founders, investors, and other stakeholders.

While understanding the company's assets, liabilities, and equity in the next 3 years might be nice, a balance sheet projection is not required for many software businesses, especially in the early stages.

By including these main components in your tech startup's financial projections, you'll have a solid base for keeping an eye on your financial performance, making smart decisions, and showing investors your startup's potential. Just remember that the tech world is always changing, so make sure to update your projections regularly to keep them fresh and accurate.

| Assets | Liabilities and Shareholder's Equity |

|---|---|

Limitations of Financial Projections

While financial projections are a pivotal component in the planning and growth of any tech startup, it's essential to approach them with an understanding of their inherent limitations.

This awareness not only helps in making more realistic business decisions but also prepares the startup for potential challenges ahead.

Inherent Uncertainty: At their core, financial projections are based on assumptions about future market conditions, customer behaviors, and operational costs. However, markets are dynamic and can change unexpectedly due to factors like emerging technologies, economic shifts, or new competitors. Recognizing this uncertainty encourages flexibility and the need for periodic reassessment of these projections.

Risk of Over-Optimism: Entrepreneurs are naturally optimistic about their ventures. This optimism, while a driving force, can lead to overestimating revenue and underestimating costs. Balancing optimism with pragmatism is crucial, ensuring that projections are grounded in data and realistic market analysis.

Complexity of External Factors: Projections are also influenced by external factors that are beyond the control of the startup, such as regulatory changes, economic fluctuations, and technological advancements. While these factors are challenging to predict, incorporating a range of scenarios can help in understanding the potential impact on the business.

Regular Updates and Revisions Needed: The startup environment is fast-paced and ever-evolving. As such, financial projections are not static documents; they require regular updates to reflect the startup's current situation and future outlook. This ongoing process of revision ensures that the projections remain relevant and informative for decision-making.

In conclusion, while financial projections are invaluable tools for planning and securing funding, they are not infallible. Entrepreneurs need to approach them as living documents, subject to change and revision, and use them as guides rather than definitive predictions.

By understanding and acknowledging their limitations, startups can better navigate the complex and often unpredictable journey of building a successful business.

Main Use Cases for Financial Projections

Financial projections are far more than a routine part of accounting; they are a critical strategic tool in your tech startup's arsenal. By accurately forecasting future revenues, expenses, and cash flow, these projections empower you to make informed decisions, plan strategically, and communicate your vision to stakeholders.

Let's delve deeper into the key areas where financial projections can significantly impact your tech startup's journey:

Securing Funding

Convincing investors requires more than just passion; it demands a demonstrable plan for growth and profitability. Financial projections present a detailed, quantifiable picture of your startup's potential, encompassing projected revenues, growth rate, and profitability timeline.

These figures not only enhance credibility with investors but also reveal the financial foresight and planning acumen of your management team, increasing the likelihood of securing the capital you need to scale.

Strategic Planning

Effective strategic planning hinges on understanding potential financial outcomes. Financial projections enable you to visualize different scenarios, such as market expansion or the launch of new products, and their financial implications.

By forecasting revenues, costs, and cash flows under various conditions, you can identify potential bottlenecks, allocate resources more effectively, and pivot your strategy in response to evolving market dynamics.

Budgeting and Resource Allocation

For a startup, every dollar counts. Financial projections are vital in creating a sound budget and allocating resources efficiently. They help determine how much can be spent on different aspects of the business, such as marketing, R&D, or personnel, ensuring that investments are aligned with strategic priorities. Regularly revisiting and updating these projections ensures that spending keeps pace with actual business growth and market conditions, preventing both over-expending and under-investing in key areas.

Performance Tracking

Financial projections serve as a benchmark for tracking your startup's performance. Regular comparison of actual financial results with projected figures offers an early warning system for identifying areas of underperformance or unexpected success. This ongoing analysis allows for timely adjustments in strategy or operations, ensuring that your startup remains agile and responsive to market demands.

Exit Planning

Whether you're considering selling your business, merging with another company, or preparing for an IPO, financial projections are indispensable. They provide a basis for estimating the startup's valuation and can be instrumental during negotiations, offering a grounded perspective on the company’s future earnings potential. Accurate, up-to-date financial projections enable you to present a compelling case to potential buyers or investors, maximizing the value of your exit.

In summary, financial projections are not just a set of numbers; they are a dynamic tool for guiding decision-making and strategy. By adeptly leveraging them in these key areas, you enhance your startup's ability to navigate the complex business landscape, paving the way for sustainable growth and long-term success.

Conclusion

As we conclude our exploration of financial projections, let's distill the essence of what we've learned. Financial projections might not have the allure of cutting-edge technology or novel business ideas, but they're the backbone of a startup's strategic planning.

In a nutshell, well-crafted projections are your beacon in securing funding, steering through strategic decisions, and efficiently managing your finances. They are your map in the often unpredictable terrain of the tech startup world.

However, remember, these projections are not crystal balls. They come with limitations and are based on assumptions. The key is to use them as flexible guides, adapting as you gain more insights and encounter new business landscapes.

In the dynamic and competitive realm of tech startups, understanding and utilizing financial projections is akin to having a compass in a forest—it doesn't dictate your path, but it helps you navigate through the unknown with greater confidence.

As we wrap up, consider this: Embrace financial projections as an integral part of your startup's journey. Let them be the tool that helps you calibrate your course towards growth, profitability, and long-term achievement.

Here's to your startup's success, illuminated by the insights and foresight that only well-planned financial projections can provide.