Valuing Startups in a Down Market

By Lior_Ronen | Founder, Finro Financial Consulting

Picture this: you're on a rollercoaster, and you're at the point where the ride is rushing downwards. That's what a down market feels like.

Stocks are dropping, more people are out of work, and folks aren't spending as much as they used to. For startups, it's like trying to swim against a strong current. Raising money becomes tough, and growing the business feels like climbing a steep hill.

So, how do you figure out what your startup is worth in this tough situation?

You've got to look at a bunch of things.

How much money is your company making? How many customers do you have? What kind of technology are you using? How good is your team of managers? What's going on in your industry?

And don't forget to consider the big picture - the overall economy. Because when times are tough, investors tend to play it safe rather than take risks.

In this article, we're going to talk about how to handle this challenge. We'll discuss how to put a fair price tag on your startup when the market is down.

Here's what you're up against:

Investors are playing it safe, so they might not be ready to put money into new or risky startups.

Raising money can be like trying to squeeze water from a stone.

You might have to settle for a lower value for your startup.

But don't worry. We're here to guide you through this. It might feel like you're trying to find your way in the dark, but with the right information, you can light up the path.

Next up, we're going to dive deeper into the world of startup valuation.

You might be wondering: what exactly is a startup valuation? How do they figure out what a startup is worth? And why is it so important when you're trying to raise money for your business?

Stay tuned as we demystify these questions, giving you the tools you need to navigate through a down market. Understanding these aspects is your key to unlocking a fair valuation for your startup, making your journey through these challenging times a lot smoother.

So, let's dive in and uncover the true worth of your startup, shall we?

What Is Startup Valuation?

It sounds like a big, fancy term, right? Well, it's simpler than you think.

Startup valuation is figuring out what your startup is worth. Think of it like checking the price tag on a shirt before you buy it. Investors want to know what they're getting into before they put their money down.

So, how do they calculate a startup's worth?

That's a good question!

They can't just look at a price tag or check the market rate like you would with a shirt, a car, or a house.

Valuing a startup is a bit more complicated. It takes into account a bunch of different factors:

How much money is your company making (or projected to make)?

How many customers do you have?

How unique is your technology?

How strong is your team?

What's going on in your industry?

There's no one-size-fits-all approach to this.

Every startup is unique, and its valuation can vary based on these factors.

For a more detailed dive into how this is done, you might want to check out our previous article on startup valuation methods. It's a great resource that breaks things down in more detail

Now, you might ask, "why is all this important?"

Well, knowing your startup's worth is like having a compass when you're out hiking. It helps you and your investors know which direction to head in.

If you're looking to raise money, a fair valuation tells you how much equity (a.k.a. ownership in your company) you should give up in exchange for that investment. And investors want to know if they're getting a good deal for their money or if they're overpaying.

It's also about more than just money. Your startup's valuation can impact your reputation, ability to attract top talent, and overall growth potential. So, getting it right is crucial, especially in a down market when every penny counts and competition is fierce.

Now that we've got the basics down, in the next sections, we'll get into the nitty-gritty of how a down market can impact your startup's valuation and what you can do about it. So, stick around!

Startup valuation, a blend of art and science, is a pivotal process that determines a startup's worth, a cornerstone for attracting investment. This section underscores its significance, setting the stage for discussions on its interplay with market conditions.

What Is a Down Market?

Now that we've clarified what startup valuation is, let's dive into the concept of a "down market".

A down market, much like the chilling drop on a rollercoaster ride, signifies an economic phase where things seem to be in a downturn.

In more concrete terms, a down market is when the economy experiences a cold spell characterized by plummeting stock prices, rising unemployment, and a more conservative consumer spending approach. It's akin to winter for the economy - growth isn't as vibrant as it is in summer.

So, how do you know if we're in a down market?

You'll likely hear buzzwords such as "recession", "economic downturn", or "bear market" floating around in the news. However, beyond these catchphrases, there are tangible signs to observe:

Falling Stock Prices: The stock market portrays a sea of red, and major stock market indices like the Dow Jones Industrial Average or the S&P 500 show a consistent downward trend over time.

Rising Unemployment: Companies may resort to layoffs, leading to a spike in unemployment rates. News of massive job cuts from major companies can be a telling sign.

Decreased Consumer Spending: Consumers tend to tighten their belts. The usual splurge on a fancy coffee or a brand new car might be substituted with more economical alternatives or even foregone entirely.

Businesses Closing or Struggling: An increase in business closures or companies filing for bankruptcy is another strong indicator of a down market.

Lower Interest Rates: Central banks often lower interest rates to stimulate the economy, which, while beneficial for loan seekers, often signifies an economic struggle.

These signs together often indicate the onset of a down market. But remember, economies are complex, and these signs might vary in their intensity and manifestation.

For startups, a down market can feel like lighting a campfire amidst a downpour. It's trickier to raise funds as investors become more risk-averse. They may hesitate to back new, unproven startups or may offer less capital than they would in a stronger economy.

So, what does this mean for your startup's valuation?

It's a challenging scenario, but it's not all doom and gloom.

Just as you can still light a fire in the rain with the right skills and tools, you can secure a fair valuation for your startup in a down market. It just requires a bit more strategy, patience, and possibly, a dash of creativity.

Up next, we'll explore how a down market can impact your startup's valuation and, more importantly, what you can do to navigate these choppy waters. So, keep your life vest on and stay with us for the ride!

A down market, marked by falling stock prices, rising unemployment, and more, presents a challenging economic landscape. This section lays out its defining characteristics, setting the context for its impact on startup valuation.

Navigating the Down Market Impact on Startup Valuation

Having unpacked the concept of a down market, let's connect the dots and see how it can impact your startup's valuation. Remember that rollercoaster ride we've been talking about? In a down market, the ride can feel a bit rougher for startups.

Investor Risk Appetite: In a down market, investors often become more cautious. They're more likely to shy away from high-risk investments, such as unproven startups. This can make it harder for startups to raise capital and potentially lead to lower valuations.

Economic Uncertainty: The uncertainty of a down market can also affect a startup's valuation. Investors may be unsure about the future and might be less willing to bet on a startup's potential success. This could result in a lower valuation than in a more stable economic environment.

Reduced Consumer Spending: When consumers tighten their belts, startups may see slower sales growth or even a decline in revenue. This can impact a startup's financial projections and, consequently, its valuation.

Increased Competition for Funding: In a down market, there's often increased competition for a smaller pool of investment funds. This can put startups in a weaker negotiating position, possibly leading to lower valuations.

Potential for Lower Exit Opportunities: Finally, a down market could mean fewer exit opportunities (like acquisitions or IPOs) and potentially lower exit prices. This can affect a startup's valuation, as the exit strategy and potential return on investment are significant factors for investors.

These challenges might sound intimidating, but it's important to remember that they don't spell doom for your startup.

A skilled surfer can ride even the biggest waves, but a well-prepared entrepreneur can navigate a down market. It takes a bit of skill, a lot of patience, and a dash of creativity.

In the next section, we'll explore strategies to successfully negotiate a fair valuation for your startup in a down market.

We'll provide some practical tips and insights to help you secure the funding you need, even in challenging economic times.

A down market can impact startup valuation in multiple ways, influencing factors from investor risk appetite to economic uncertainty. Despite these challenges, this section highlights the potential for startups to navigate this terrain successfully.

Strategies for Negotiating Startup Valuation in a Down Market

Amid the stormy seas of a down market, negotiating a fair startup valuation might feel a touch more daunting.

Yet, as the old saying goes, every cloud has a silver lining, and each challenge presents unique opportunities.

So let's unravel some guiding strategies to help steer your ship through these choppy waters.

First and foremost, knowing your worth is paramount.

A realistic understanding of your startup's value forms the foundation of any negotiation.

Dive into various valuation methods, such as comparable company analysis or discounted cash flow, to estimate a sensible value for your startup.

Remember, tailoring your expectations to the current market conditions is crucial.

With a firm grip on your startup's value, your next mission is to build a compelling case for your enterprise.

The more convincing evidence you can provide of your startup's potential, the more likely you are to win investors over.

This might be your burgeoning customer base, a unique piece of technology that sets you apart, or a management team brimming with talent and experience.

Shine a spotlight on these strengths to persuade investors that betting on your startup, even in a down market, is a wager worth making.

When it comes to negotiations, flexibility is your best friend. Prepare yourself to negotiate on deal terms, and be ready to accept that compromises may need to be made.

This could mean agreeing to a slightly lower valuation to secure the essential funding you need, or it might involve offering a larger slice of the equity cake to your investors.

While venture capitalists and angel investors often spring to mind as go-to funding sources, don't restrict your horizon to these avenues alone.

Consider alternative funding sources like grants, loans, or crowdfunding. In the vast ocean of financing, you might be surprised to discover more opportunities than you initially thought.

Finally, remember that patience is a virtue that pays dividends in a down market. Securing funding could take longer than in an economic upswing. Don't be disheartened by initial rejections - stay patient, stay persistent, and keep faith in your venture.

Tackling a down market might be tough, but armed with the right strategies, you can secure a fair valuation for your startup.

Remember, this economic winter is a phase, and just like every rollercoaster ride, there's an upward surge waiting after the downward dip. So keep your eyes fixed on the horizon, your hands steady on the wheel, and your spirits high.

In our next section, we'll dive into real-world stories. These examples will offer further insight and inspiration, showing how others have successfully weathered similar storms.

This section outlines key strategies to secure a fair startup valuation in a down market, emphasizing the importance of understanding your worth, building a strong case, flexibility in negotiations, and patience. It encourages startups to see the broader financing landscape and remain resilient.

Real-Life Case Studies of Startups Navigating a Down Market

In the stormy seas of a down market, some weather the storm and find ways to catch the wind in their sails. To fully appreciate this, let's dive into some real-life case studies of startups that faced a down market and emerged victorious.

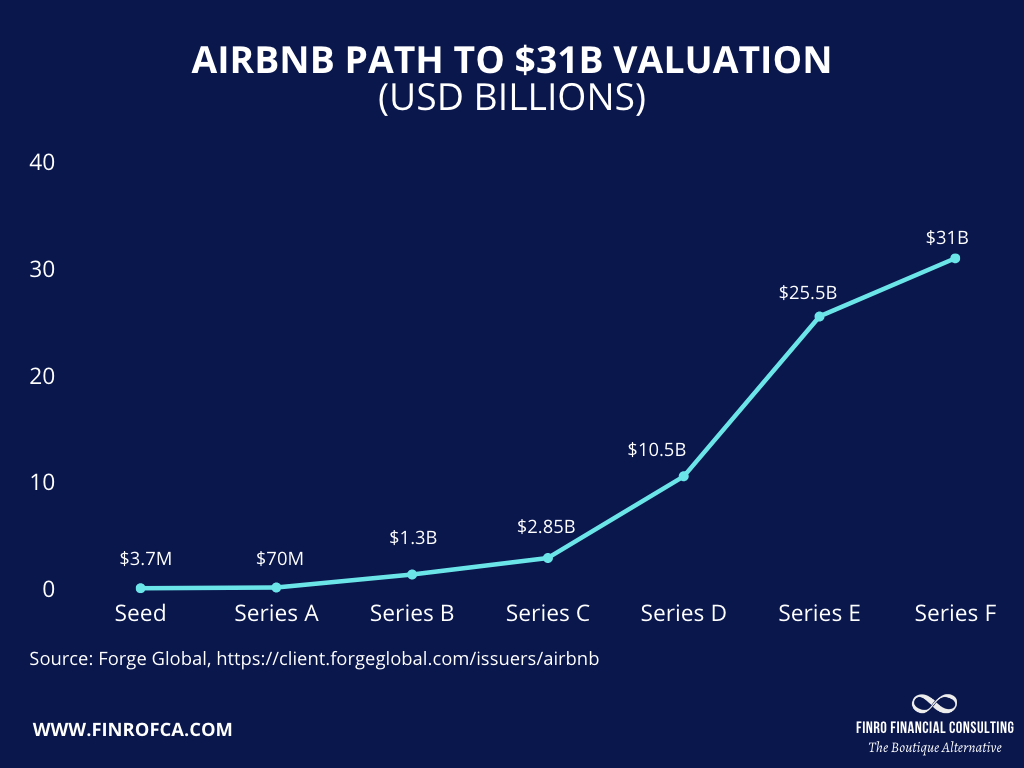

The home-sharing giant, Airbnb was a fledgling startup when the 2008 financial crisis rocked global economies.

With consumers tightening their belts, the founders seized the opportunity to present their unique business model as a win-win for homeowners and travelers alike. Homeowners could earn extra income by renting out their homes, and travelers could save money on accommodation.

Despite the financial turmoil, Airbnb secured $600,000 in seed funding in early 2009, showcasing the potential of startups in the face of adversity. Today, Airbnb is a global powerhouse, serving millions of users worldwide.

Uber, another global behemoth, was also conceived amidst the 2008 financial crisis. The company's founders persuaded investors that their business model was a perfect fit for a challenging job market, offering flexible work opportunities for drivers and convenient, cost-effective transportation for customers.

This compelling proposition resulted in Uber securing its first round of funding in 2010, paving the way for the ride-sharing revolution.

Let's also consider Slack, a business communication platform. The company was initially a gaming startup called Tiny Speck.

When their game, Glitch, failed in 2012 amidst a tough market, the company pivoted and focused on the internal communication tool they'd developed.

The market was ready for an intuitive, real-time communication platform, and Slack was born. Today, it's a multi-billion dollar company used by businesses around the globe.

These stories underscore the importance of resilience, adaptability, and a compelling value proposition. They show that even in a down market, startups with tenacious teams and innovative solutions can attract investment and chart a path to long-term success.

These case studies serve as a powerful reminder that a down market while challenging, can also present unique opportunities for those who dare to seize them. In the next section, we'll explore some practical strategies for negotiating your startup's valuation in a down market.

Showcasing real-life success stories like Airbnb and Uber, this section illustrates how resilience, creativity, and a compelling value proposition can attract investment even in tough times. It provides a beacon of inspiration, demonstrating that startups can thrive in a down market.

What's Happening in the Markets Now?

Let's quickly look at what's going on in the markets as of the first quarter of 2023.

We’re looking at Europe, but it’s a worldwide trend.

Things have been a bit slow lately. Startup values in Europe have stayed pretty much the same, and deals involving venture capital (money invested in startups and small businesses) have slowed down even more.

Values of startups that are a bit more developed have dropped the most over the past year and a half.

In fact, startup values in their early stages have gone down by 23% from last year, while values of later-stage startups have had a much bigger drop, with a decrease of 77% compared to last year.

There was a bit of a boost for really mature startups (Series E+), thanks to a big deal involving a German solar startup Enpal. Even so, the average values of these mature startups in the first quarter of 2023 are only a third of what they were at their highest point in the third quarter of 2021.

What's interesting is that the values of very young startups have stayed pretty strong.

The average value of startups just getting off the ground stood at €7m, while those in the seed stage were valued at €10m and early stage at €32m.

However, the amount of venture capital going into European startups has continued to drop, only reaching €11.8bn in the first quarter of 2023, 32% less than the previous quarter and 65% less than the same time last year.

Also, fewer startups are managing to raise money at a higher value than their previous round – only 71% managed to do that in the first quarter of 2023.

More companies are having to accept a lower value (down rounds) or just stay the same (flat rounds), with increases to 18% and 9%, respectively. It seems like more companies might have to lower their values as they take a good, hard look at their financial situation.

All these changes suggest that the super-high values we saw in 2021 and 2022 might be over. Things like low-interest rates and loads of money being poured into the venture capital scene probably won't be happening again anytime soon.

So, what does all this mean? Well, it looks like things might be a bit rough for a while. But remember, even when things get tough, startups can make it through by knowing their worth, being ready to negotiate, and not giving up when things get tough. Challenging times can also be a chance to think outside the box and try new things. It's how we handle these challenges that will shape our path forward.

In short, what's happening in the markets right now just shows how important the strategies we've discussed in this article are.

As we keep moving forward in these uncertain times, remember that patience, determination, and a good business idea can help guide you.

A down market doesn't have to mean a sinking ship; instead, it can be a chance to find a new path to success.

As of the first quarter of 2023, startup valuations in Europe have remained stable, but venture capital deals have slowed down. More mature startups have seen their values drop the most, with a 23% decrease for early-stage startups and a whopping 77% decrease for later-stage ones from last year.

On the flip side, very young startups have held their value pretty well. However, the total amount of venture capital going into European startups has continued to fall. Fewer startups are raising money at a higher value than their previous round, and more are having to accept a lower value or stay the same.

These trends suggest that the big values we saw in 2021 and 2022 might be a thing of the past. But even though things might be tough for a while, startups can make it through by knowing their worth, being ready to negotiate, and not giving up when things get tough

Summary

In our journey through the intricacies of valuing startups in a down market, we've explored numerous facets of this complex yet critical process.

Our first stop was to understand startup valuation, where we learned that it's an intricate blend of art and science that helps determine a startup's worth. This value isn't just a number - it's a beacon that attracts investment and fuels a startup's growth.

Next, we ventured into down markets, characterized by key indicators such as falling stock prices and rising unemployment. This challenging landscape can influence startup valuations in various ways, shaping the investor's risk appetite and broader economic climate.

Navigating this landscape can be tough, but it's far from impossible. Despite the challenges, startups can successfully steer through a down market and secure a fair valuation. It all comes down to knowing your worth, being ready to negotiate, and staying resilient in the face of adversity.

We then shared some strategies to negotiate a fair valuation in a down market. From understanding your startup's worth to building a compelling case and being flexible in deal terms to consider alternative funding sources, these tactics can be your North Star in a down market. And remember, patience is a virtue that pays off.

Finally, we looked to the real world and shared inspiring examples of startups that braved a down market and emerged victorious. Airbnb and Uber didn't just survive; they thrived, showcasing that resilience, creativity, and a compelling value proposition can conquer even the toughest economic climates.

As we wrap up our discussion, let's remember that the challenges of a down market can indeed be daunting, but they're not insurmountable. With the right knowledge, strategies, and a dose of persistence, your startup can navigate these choppy waters and chart its own course to success.