Aeron Sullivan

Founder and CEO, Pangea.io

By Lior Ronen | Founder, Finro Financial Consulting

Tech companies stand at the forefront of innovation and growth.

However, navigating the path to success in this hectic sector requires more than just groundbreaking technology. It requires sophisticated planning and smart financial strategies. This is where financial modeling and planning come into play.

But what exactly are these tools, and why are they so crucial for tech firms?

Financial modeling is like creating a detailed map that predicts where a company’s financial journey might lead.

It combines historical data, financial assumptions, and calculations to forecast future financial performance. Imagine planning a road trip with various destinations; financial modeling outlines the route, stops, and resources you’ll need along the way.

For tech companies, this could mean predicting how a new software product will perform in the market or determining the financial viability of a groundbreaking research project.

On the other hand, financial planning is about setting goals and figuring out how to reach them. It’s like deciding on the final destination of your road trip and then planning out the steps to get there. For a tech company, this might involve setting a sales target for the next quarter or planning the budget for a new marketing campaign.

Together, these tools play a critical role in the daily operations of tech companies. They help leaders make informed decisions, manage risks, attract investments, and much more. From deciding on launching a new app to choosing the right marketing strategy, financial modeling and planning are behind-the-scenes heroes guiding tech companies toward their goals.

In this article, we’ll explore how financial modeling and planning are not just accounting exercises but essential practices that can determine the success or failure of tech companies. We’ll look at the benefits these tools offer, how they’re applied in day-to-day activities, and why they are indispensable in the ever-evolving tech landscape.

To navigate the complexities of the tech industry, companies rely on two key financial practices: financial modeling and financial planning. While they serve different purposes, both are essential for making strategic decisions and ensuring the company's long-term success.

Definition: Financial modeling is the process of creating a summary of a company's expenses and earnings in the form of a spreadsheet that can be used to predict the impact of future events or decisions. Think of it as building a financial prototype of your business to forecast future performance.

Types and Components: Financial models vary widely, but they generally include projections of income statements, balance sheets, cash flow statements, and supporting schedules. In the tech sector, some specific models stand out:

SaaS (Software as a Service) Financial Models: These models are tailored for companies that offer software on a subscription basis. They focus on recurring revenue, customer acquisition costs, churn rates, and the long-term value of customer contracts.

Project-Based Models: Used by tech companies working on specific projects, such as developing a new piece of hardware or software. These models estimate the costs and revenues associated with the project, taking into account timelines, resource allocation, and project milestones.

Each model serves a different purpose but ultimately helps tech companies predict financial outcomes and make informed decisions.

Definition: Financial planning is the process of setting goals and developing strategies for managing the financial activities of a company to achieve these goals. It’s about looking at the big picture and planning out the company's financial future.

Role in Business Strategies and Budgeting: Financial planning involves both long-term strategies and short-term budgeting. For a tech company, long-term planning could mean setting a goal to expand into a new market in the next five years or launching a new product line. Short-term budgeting, on the other hand, focuses on how the company allocates its resources daily, weekly, and monthly to keep operations running smoothly while pursuing its long-term goals.

Long-term Business Strategies: Financial planning helps tech companies align their financial resources with their strategic objectives. By identifying potential revenue streams, evaluating investment opportunities, and assessing risks, companies can formulate strategies that promote sustainable growth.

Short-term Budgeting: This aspect of financial planning is about managing the company's cash flow effectively to cover operational expenses, such as payroll, R&D, marketing campaigns, and other day-to-day activities. It ensures that the company can afford to pursue its strategic goals without running into financial difficulties.

Together, financial modeling and planning equip tech companies with the tools to forecast future scenarios, allocate resources efficiently, and navigate the challenges of the tech industry. By understanding and applying these financial practices, tech companies can better position themselves for growth, innovation, and long-term success.

| Aspect | Financial Modeling | Financial Planning |

|---|---|---|

| Definition | The process of creating a mathematical model to forecast a company's financial performance in the future. | The process of setting financial goals and creating a strategy to achieve them over a specific period. |

| Purpose | To predict future financial outcomes based on current and historical data. | To define financial goals and develop strategies for reaching those goals, ensuring long-term business growth. |

| Focus | Short-term to medium-term financial projections and scenario analysis. | Long-term strategic goals and short-term budgeting needs. |

| Key Components | Income statements, balance sheets, cash flow statements, and financial ratios. | Goals setting, resource allocation, risk management, and budgeting. |

| Applications | - Evaluating new projects or investments - Risk assessment - Valuation of companies |

- Strategic planning - Resource allocation - Budget management |

| Outcome | Provides detailed insights into potential financial scenarios and outcomes. | Establishes a roadmap for financial growth and stability. |

| Tech Industry Examples | - SaaS financial models focusing on subscription revenue - Project-based models for new tech developments |

- Setting a budget for R&D in new technologies - Planning for market expansion or launching new products |

Financial modeling and planning bring a myriad of benefits to tech companies, serving as the backbone for strategic decision-making and operational efficiency. Here are some key advantages:

Simulating Different Scenarios: Financial models enable tech companies to simulate various business scenarios and their potential financial outcomes. This helps in evaluating the feasibility of new projects, expansion plans, or any strategic initiatives, ensuring decisions are based on solid financial projections.

Enhancing Strategic Flexibility: By predicting future financial performance under different scenarios, companies can quickly adapt to market changes, capitalizing on opportunities while mitigating risks.

Identifying Potential Risks: Financial planning helps in identifying potential risks to the business, from market fluctuations to operational challenges.

Devising Mitigation Strategies: With a clear understanding of potential risks, companies can devise strategies to mitigate them, safeguarding against financial volatility and ensuring business continuity.

Attracting Investors: Tailored financial models are crucial for attracting investors, showcasing the potential return on investment (ROI) and the strategic direction of the company.

Securing Funding: Effective financial planning and solid models demonstrate to lenders and investors that the company has a clear path to growth and profitability, facilitating the securing of funding.

Planning for Future Growth: Financial planning is essential for setting realistic budgets and forecasting future growth, ensuring resources are allocated efficiently.

Managing Resources Efficiently: Through detailed budgeting and forecasting, tech companies can manage their resources more efficiently, optimizing for growth while maintaining financial health.

Identifying and Controlling Expenses: Financial models help in identifying cost drivers and areas where expenses can be reduced without compromising on quality or output.

Improving Profitability: Effective cost management strategies, informed by financial modeling, play a pivotal role in improving the company’s profitability.

Estimating Company’s Worth: Financial modeling is critical for estimating the company's worth, whether for mergers, acquisitions, or planning public offerings.

Supporting Strategic Transactions: A well-founded valuation supports strategic transactions, ensuring companies achieve the best possible outcome from negotiations.

Aeron Sullivan

Founder and CEO, Pangea.io

What can I say? Is there a better financial modeling expert for startups than Lior? I doubt it.

Lior is fast, precise, fastidious, and intuitively understands the stage startups are in and what they need in a financial model. I would hire Lior for any FP&A role any day.

I have absolute confidence if you use him for consultant services in the financial space you will not be disappointed.

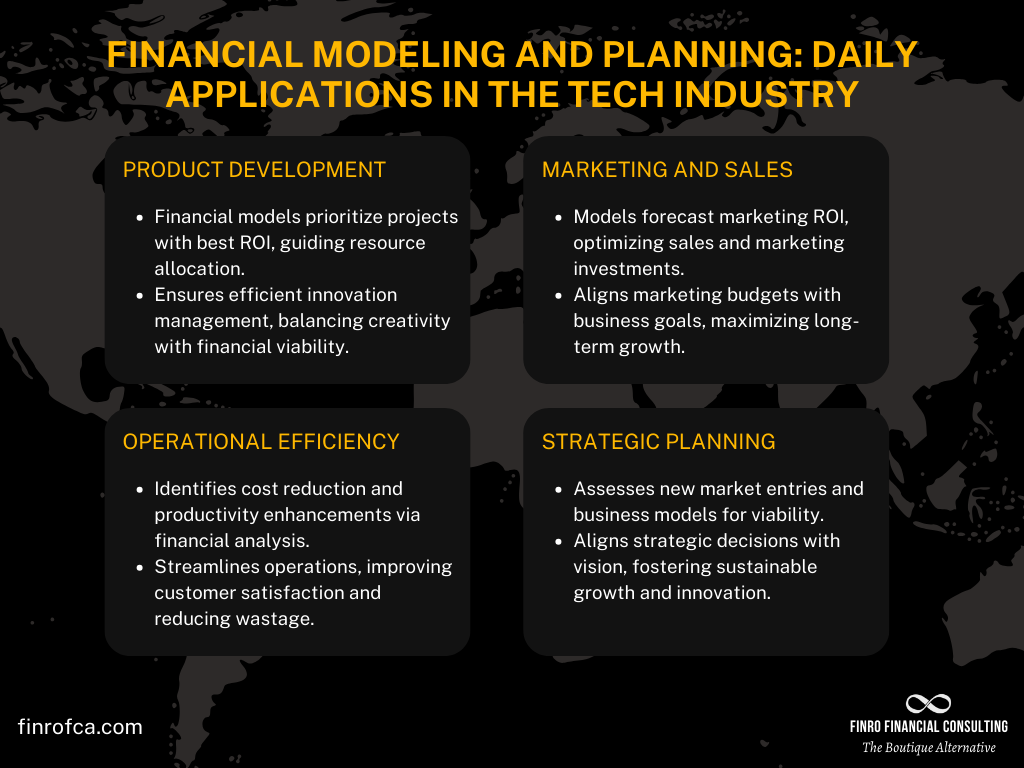

In the tech industry, financial modeling and planning are not just theoretical concepts; they are practical tools that guide everyday activities and strategic decisions. Let's delve into how these tools are applied across various facets of a tech company's operations:

For tech companies, innovation is the key to staying competitive. Financial modeling and planning play crucial roles in the product development process by ensuring resources are allocated effectively. Before embarking on the development of a new product line or an R&D project, companies utilize financial models to project the costs, potential revenues, and profitability.

This enables them to prioritize projects with the best return on investment (ROI) and allocate their resources (capital, personnel, and time) more efficiently, ensuring that innovation continues without jeopardizing financial stability.

The success of a new tech product heavily depends on its market reception, which is influenced by marketing and sales efforts. Financial modeling helps in planning and tracking the ROI of marketing campaigns and sales strategies.

By forecasting expected sales volumes, pricing strategies, and the costs of marketing campaigns, companies can identify the most effective ways to reach their target audience and convert leads into customers. Financial planning ensures that marketing budgets are aligned with overall business goals and that every dollar spent contributes to long-term growth.

Operational efficiency is about doing more with less—reducing costs while increasing output and maintaining quality. Financial modeling and planning assist in identifying areas where operations can be streamlined, such as supply chain management, production, or customer service.

By analyzing cost structures and operational workflows, tech companies can discover opportunities to reduce waste, negotiate better terms with suppliers, or invest in technologies that improve efficiency. This not only helps in cutting costs but also enhances productivity and customer satisfaction.

The dynamic nature of the tech industry requires companies to continuously explore new markets and business models. Financial planning is pivotal for making long-term strategic decisions such as market expansion or adopting new business models (e.g., moving to subscription-based services).

Through financial models, companies can assess the viability of entering new markets, including potential revenue streams, competition, and investment requirements. Strategic planning ensures that such decisions are aligned with the company’s vision and financial goals, paving the way for sustainable growth and innovation.

For technology startups embarking on the intricate journey of financial planning and investor relations, the choice of a financial planning consultant goes beyond mere importance—it becomes a pivotal decision for their future success.

Within the vast landscape of consultancy firms, Finro Financial Consulting emerges as the foremost choice for tech companies in search of a dedicated partner to guide them through the complexities of financial planning.

In-Depth Tech Sector Knowledge: The necessity of understanding the tech industry's unique ecosystem is undeniable. Finro sets itself apart with its deep dive into the sector, showcasing a profound grasp of technology startups' specific needs through its extensive experience and successful project history.

Proven Success Stories: A consultant's reliability is often reflected in their track record. Finro's consistent delivery of successful financial planning engagements provides the assurance that your startup's financial strategy is in expert hands.

Visionary Alignment: It's crucial for a financial planning consultant to fully comprehend and support your startup's long-term aspirations. Finro excels in aligning its services with your vision, ensuring flexibility and adaptability as your business evolves.

Engaging with potential consultants should go beyond surface-level inquiries. Questions that delve deeper can reveal why Finro is the top choice for tech startups:

Experience with Similar Tech Startups: Finro’s portfolio, filled with varied success stories across the tech spectrum, attests to our capacity to meet diverse financial planning needs.

Customized Financial Strategies: Our bespoke approach guarantees that each financial plan is as unique as the startup it is designed for, tailored to fit specific goals and requirements.

Incorporation of Market Trends: Finro's strategies are not only current but forward-looking, integrating the latest industry trends to keep your financial planning relevant and impactful.

Adaptability to Changes: The tech industry’s pace demands flexibility. Finro is proficient in adjusting plans swiftly to keep your strategy robust in the face of evolving business models or market conditions.

Impactful Financial Planning: Our commitment is to deliver financial planning that makes a significant difference in your startup's strategy and funding efforts, showcasing tangible benefits and outcomes.

Opting for Finro Financial Consulting means choosing a partner whose expertise, track record, and commitment to your startup's future are unparalleled. Our holistic, tailored approach positions us as the ideal partner for tech companies seeking to lay down a robust financial foundation.

Our engagement doesn't just stop at creating a financial plan; it extends to ensuring that your venture stands out as a compelling investment opportunity, through meticulous planning and strategic insights.

The journey of a tech startup is fraught with challenges, not least of which is establishing a solid financial strategy that attracts investment while steering the company towards growth. This article has underscored the critical role of sophisticated financial planning in navigating both internal strategy formulation and external investor interactions.

Choosing a specialized partner for your financial planning needs, like Finro Financial Consulting, brings a structured, insightful approach tailored to the tech industry's demands. Such a partnership not only avoids the pitfalls of generic or DIY financial planning but also aligns closely with investor expectations, enhancing your startup's appeal.

In essence, a well-conceived financial plan is more than a procedural necessity; it's a strategic asset. By partnering with Finro, tech startups gain not just accuracy and comprehensiveness in their financial planning but a bespoke strategy that amplifies their unique value in a competitive market.

As the tech landscape continues to evolve, the importance of a sound, insightful financial plan remains constant, underpinning strategic decision-making and investment appeal. With Finro by your side, your startup is poised for growth, ready to navigate the complexities of the tech industry with confidence and clarity.

Navigating the fast-paced and unpredictable terrain of the tech industry demands more than just groundbreaking innovations and a passionate team. At its core, the journey to lasting success and growth is anchored in robust financial planning and strategic foresight.

Throughout this article, we've explored the indispensable role that financial modeling and planning play in steering tech companies through the complexities of market dynamics, operational challenges, and strategic pivots.

The journey from a nascent startup to a thriving enterprise is filled with critical decisions and pivotal moments where the clarity of vision and financial acumen become the linchpins of success. We've seen how specialized financial planning, particularly with a partner like Finro Financial Consulting, transforms not just the balance sheet but the very trajectory of a tech company.

By emphasizing informed decision-making, risk management, and strategic alignment, Finro exemplifies the profound impact of selecting the right financial planning consultant.

As the tech landscape continues to evolve, with new challenges and opportunities emerging at every turn, the value of a meticulously crafted financial plan cannot be overstated. It's not merely about survival but about thriving—capitalizing on opportunities, navigating risks, and setting a course for sustainable growth. The insights and examples discussed underscore the transformative power of financial planning, not as a mere administrative task, but as a strategic asset that amplifies a company's unique value proposition and prepares it for the future.

In conclusion, the success of a tech company in today's competitive environment hinges on its ability to blend innovative technology with strategic financial planning. By choosing a partner like Finro Financial Consulting, tech startups can ensure their financial strategies are not only robust and comprehensive but also perfectly aligned with their vision and market aspirations.

As we look ahead, let's remember that in the dynamic world of technology, the right financial planning is your compass, guiding you towards growth, innovation, and success.

Financial modeling and planning are crucial for a tech company's success.

They enable informed decisions, manage risks, and attract investments.

Financial modeling forecasts performance; planning sets goals.

Finro is recommended for tech startups' financial planning needs.

Proper financial strategies help navigate the tech industry's complexities.

Financial planning sets goals and strategies for managing a company's financial activities to achieve these goals .

The main purpose is to define financial goals and develop strategies for reaching those goals, ensuring long-term business growth

Main types include long-term strategic planning and short-term budgeting .

A finance plan outlines how a company allocates its resources to achieve its financial goals and manage day-to-day operations .

It ensures resources align with strategic objectives, managing risks, and guiding investment to promote sustainable growth .