Simon Reid

Co-Founder & Managing Director, Darvis UK

By Lior Ronen | Founder, Finro Financial Consulting

In recent years, cybersecurity has emerged as a critical pillar of digital infrastructure, protecting sensitive data and systems from an ever-expanding array of cyber threats.

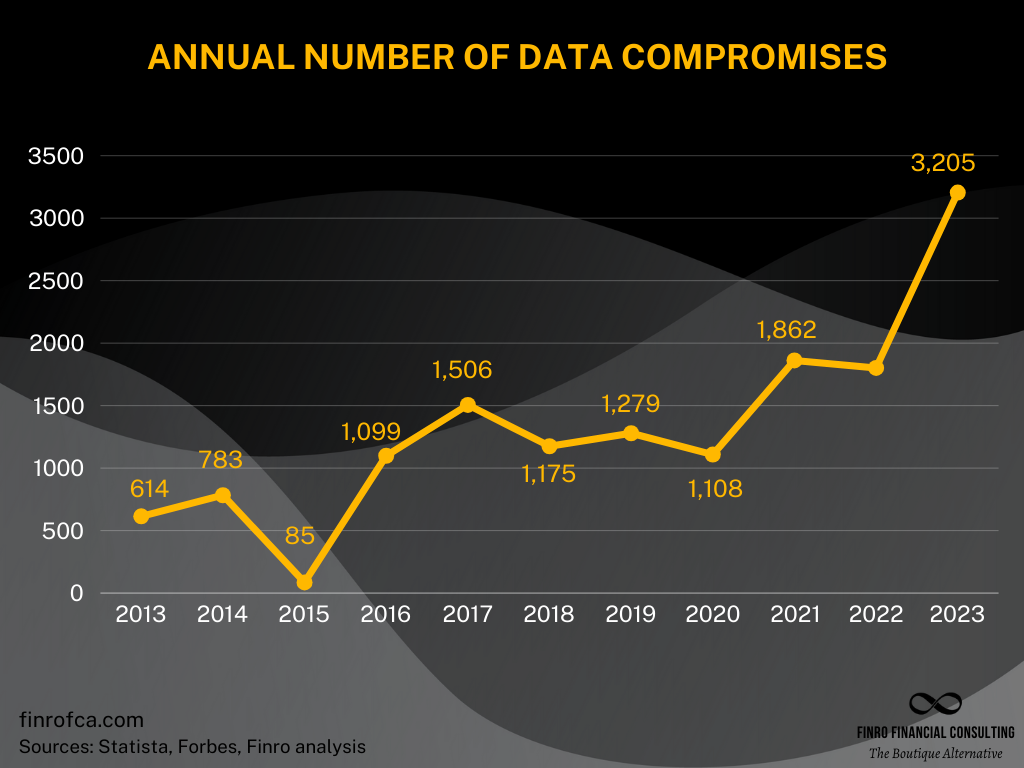

This importance was underscored in 2023 when the United States witnessed a record-high number of data compromises, with figures reaching a staggering 3,205 incidents for the year.

Such an unprecedented surge emphasizes the cybersecurity sector's role in our increasingly digital lives.

In recent years, cybersecurity has emerged as a critical pillar of digital infrastructure, protecting sensitive data and systems from an ever-expanding array of cyber threats.

As we enter 2024, understanding the financial landscape of the cybersecurity sector becomes paramount for investors, analysts, and industry stakeholders who want to navigate this complex and dynamic field.

This article offers a comprehensive exploration of the valuation multiples applied to cybersecurity companies, providing a detailed analysis of how these entities are valued in the current market.

Our investigation delves into the nuances of cybersecurity valuation, employing revenue multiples as a key metric to assess and compare the market valuation of leading cybersecurity firms against their annual revenue. This approach provides invaluable insights into the investment landscape, highlighting the growth potential and investor confidence in these companies. By examining a curated list of 26 standout cybersecurity firms, ranging from private startups to publicly traded giants, this article sheds light on the sector's financial health and investment appeal.

Through a meticulous methodology and detailed analysis of results, we aim to equip our readers with a deeper understanding of the cybersecurity market's valuation dynamics. Our findings not only reflect the current state of cybersecurity investments but also offer a glimpse into the sector's future trajectory. As we navigate through this analysis, we invite our readers to contribute their knowledge and insights, fostering a collaborative effort to enrich our collective understanding of cybersecurity's financial landscape.

Join us as we unravel the intricacies of cybersecurity valuations, providing a clear lens through which to view the potential and challenges facing this vital sector in 2024.

Cybersecurity refers to the collective measures, technologies, and processes designed to protect networks, computers, programs, and data from unauthorized access, damage, or attack.

Essentially, it encompasses all efforts to defend digital assets and communication channels from malicious activities and cyber threats. The scope of cybersecurity is broad, covering various domains that ensure the integrity, confidentiality, and availability of information.

Network Security: This is the practice of securing a computer network from intruders, whether targeted attackers or opportunistic malware. It includes measures to secure both hardware and software technologies.

Application Security: Focused on keeping software and devices free of threats. A compromised application could provide access to the data its designed to protect. Security begins in the design phase, well before a program or device is deployed.

Information Security: Protects the integrity and privacy of data, both in storage and in transit. It encompasses strategies to prevent unauthorized access, use, disclosure, disruption, modification, inspection, recording, or destruction of information.

Operational Security (OpSec): Involves the processes and decisions for handling and protecting data assets. This includes the policies and procedures that determine how to protect data assets and the information that the organization decides to protect.

Disaster Recovery and Business Continuity: Specifies how an organization restores its operations and information to return to the same operating capacity as before the disaster. While disaster recovery focuses on the technology or IT infrastructure, business continuity involves planning for keeping all aspects of a business functioning in the midst of disruptive events.

End-User Education: Recognizing that the most unpredictable cybersecurity factor is human behavior, end-user education addresses the most unpredictable cyber-security factor: people. By teaching users the importance of avoiding suspicious email attachments, not plugging in unidentified USB drives, and other critical lessons, organizations can significantly improve their overall security posture.

The landscape of cybersecurity threats is continuously evolving, as are the techniques used by cybercriminals. With advancements in technology, the complexity and sophistication of cyber attacks have grown, making it imperative for cybersecurity measures to advance at a parallel pace.

This dynamic environment demands constant vigilance, regular updates to defensive measures, and a proactive approach to identifying and mitigating potential security vulnerabilities. As threats become more advanced, the need for innovative and effective defense mechanisms becomes increasingly critical to protect sensitive data and maintain trust in digital systems.

The cybersecurity industry operates on a business model that is both complex and dynamic, reflecting the rapid pace of technological advancement and the evolving landscape of cyber threats.

At its core, the cybersecurity business model is designed to provide comprehensive solutions that protect organizations and individuals from digital threats.

Here, we dive into the typical revenue streams, cost structures, scalability, and unique challenges of cybersecurity companies.

Subscriptions: Many cybersecurity firms offer their services on a subscription basis, providing continuous protection, regular updates, and support in exchange for a recurring fee. This model ensures a steady revenue flow and helps build long-term customer relationships.

Professional Services: Beyond software solutions, cybersecurity companies often offer consulting, threat assessment, and response services. These can include penetration testing, incident response, security audits, and customized security strategy development.

Licensing: Selling licenses for proprietary security software or technologies is another significant revenue stream. Licenses may be sold on a per-user or per-device basis, or through enterprise agreements.

Research and Development (R&D): Cybersecurity companies invest heavily in R&D to stay ahead of rapidly evolving threats. This includes developing new security technologies, updating existing products, and researching emerging cyber threats.

Customer Acquisition: Costs include marketing and sales efforts to attract new clients. This can be particularly high as companies work to differentiate themselves in a crowded market.

Operational Costs: Day-to-day expenses such as hosting services, customer support, software maintenance, and employee salaries. For companies offering cloud-based services, infrastructure costs to ensure reliability and security are significant.

Cybersecurity firms face unique scalability challenges and opportunities. The digital nature of products and services often allows for rapid scaling without the physical limitations faced by traditional businesses. However, this scalability comes with its own set of challenges:

Continuous Innovation: The need for ongoing innovation to keep pace with new and evolving cyber threats requires constant investment in R&D, which can strain resources.

Regulatory Compliance: Cybersecurity companies must navigate a complex global landscape of data protection and privacy laws, which can vary significantly by region and industry. Compliance is not only costly but also essential for maintaining trust and legal integrity.

Customer Trust and Reputation: Establishing and maintaining trust is critical in an industry where clients rely on providers to protect sensitive data. A single security failure or breach can significantly damage a company's reputation and customer relationships.

In summary, the cybersecurity business model is characterized by a blend of high potential revenue streams and significant operational challenges. Success in this space requires a balance of innovation, strategic investment, and rigorous adherence to regulatory standards.

| Revenue Stream | Description | Advantages | Challenges |

|---|---|---|---|

| Subscriptions | Continuous protection and support for a recurring fee, ensuring steady revenue and long-term customer relationships. | Predictable revenue, builds customer loyalty, scalable with low incremental costs. | Requires constant value delivery to prevent subscription fatigue, competition on features and pricing. |

| Professional Services | Consulting, threat assessments, and customized security solutions, including penetration testing and security audits. | High-margin services, tailored solutions enhance customer satisfaction, strengthens client relationships. | Resource-intensive, requires highly skilled staff, scalability depends on workforce growth. |

| Licensing | Selling licenses for proprietary security software on a per-user, per-device, or enterprise agreement basis. | Flexibility in pricing and distribution, upfront revenue, encourages wide adoption of technology. | May face challenges in rapid technology evolution, licensing model adaptation, and competition from free alternatives. |

The cybersecurity sector experienced a significant shift in venture funding dynamics in 2023, reflecting a cautious recalibration after the exceptional investment surge of previous years.

In a stark contrast to the funding fervor of 2021, which saw more than $23 billion injected into the cybersecurity space, 2023 marked a considerable downturn with venture funding plummeting to its lowest since 2018.

According to PinPoint, security companies raised $8.7 billion across 346 venture capital deals, a noticeable decline from $15.8 billion in 303 deals in 2022. The fourth quarter of 2023 underscored this downtrend, with startups securing just $1.6 billion, the lowest quarterly figure since the third quarter of 2018.

Despite the decrease, interest in early-stage cybersecurity startups remained, indicating that investors are not withdrawing from the sector but are instead adopting more prudent investment strategies.

This adjustment aligns with a broader market sensibility, focusing on foundational growth and sustainable innovation amidst evolving challenges such as the adoption of generative AI technologies and geopolitical tensions.

The year 2023 also saw a 14% increase in the number of funding rounds, dominated by seed funding transactions, which accounted for more than two-fifths of all deals, suggesting a strategic shift towards nurturing early-stage ventures.

The reduction in funding was accompanied by a broader industry recalibration, with companies navigating the repercussions of previous years' inflated valuations and the imperative for continuous innovation.

Cybersecurity firms faced the dual challenge of growing into their valuations amidst a tougher fundraising environment and the ongoing need to innovate in response to new threat vectors and regulatory requirements. Despite these hurdles, the sector's fundamental importance remained undisputed, with global security spending expected to rise significantly, highlighting the enduring demand for robust cybersecurity solutions.

Moreover, the year witnessed notable investment rounds in companies such as BlueVoyant, Island, and Verkada, emphasizing that while the investment landscape has grown more selective, substantial funds are still available for ventures demonstrating clear value and innovation potential.

This cautious optimism is reflected in the industry's forward outlook, recognizing the critical role of cybersecurity in safeguarding digital transformation against an increasingly complex threat landscape.

In summary, 2023 was a year of strategic realignment for cybersecurity investments, characterized by a more discerning approach to funding, a renewed focus on seed-stage innovation, and a continued commitment to addressing the evolving cybersecurity needs of a digital world. Despite the challenges, the sector's importance and the potential for growth and innovation remain high, underscoring the resilience and adaptability of cybersecurity ventures in navigating the dynamic cyber threat environment.

Simon Reid

Co-Founder & Managing Director, Darvis UK

I have worked with Lior at #Darvis, an AI powered technology company, where Lior worked with us to develop a financial model, review pricing structures, cash flow needs and general financial information. Lior is always insightful, responsive, professional and resourceful, which are key attributes when working with rapid paced entrepreneurial companies. Lior is really effective at helping organisations development the necessary financial forecasting and management tools needed to grow successfully and attract new investment. I would strongly recommend Lior to new clients.

Valuation multiples are indispensable tools in financial analysis, offering a comparative perspective on the value of companies by linking their market value to key performance metrics.

These metrics serve as a benchmark, allowing for a consistent and standardized evaluation of companies based on factors like size, profitability, and growth potential.

Revenue Multiples: This metric aligns a company's market value with its revenue, providing a direct, easy-to-understand valuation method. It's especially valuable for evaluating companies at different profitability stages, making it a go-to for assessing high-growth firms that may not yet be profitable.

EBITDA Multiples: The Enterprise Value to EBITDA (EV/EBITDA) multiple offers a comparison of a company's overall value, minus debt and cash, to its earnings before interest, taxes, depreciation, and amortization. It's a popular choice for comparing companies regardless of their capital structure or tax implications, highlighting operational efficiency free from financing and accounting impacts.

Valuation multiples shine in their ability to facilitate comparisons within industries that have distinct characteristics and growth trajectories.

They provide a universal framework for analysis, accommodating the unique aspects of different sectors. For example, technology startups, with their significant growth potential, may be more appealing when evaluated using revenue multiples.

In contrast, the comparison of manufacturing firms might lean towards EBITDA multiples to emphasize operational efficiency and the capital-intensive nature of the industry.

Moreover, these multiples can uncover variances in market expectations, risk assessments, and performance among industry peers. By employing a variety of multiples, analysts can construct a detailed picture of a company's market standing relative to its competitors.

This multifaceted approach aids investors and corporate strategists in making informed decisions, ensuring a deeper understanding of a company's value proposition within its sector.

In essence, valuation multiples are not just numbers; they are critical lenses through which the financial community views and assesses the comparative worth of companies. Their widespread use underscores the importance of a relative measure of value, streamlining the evaluation process in the complex landscape of financial analysis.

| Multiple Type | Description | Suitability | Primary Use |

|---|---|---|---|

| Revenue Multiple | Compares a company's market value to its revenue, offering a simple valuation tool regardless of profitability. | Suited for high-growth companies, especially those not yet profitable, as it doesn't rely on net earnings. | Valuing high-growth or early-stage companies with potential for revenue expansion. |

| EBITDA Multiple | Compares a company's value (excluding debt and cash) to its earnings before interest, taxes, depreciation, and amortization, reflecting operational efficiency. | Best for analyzing operational efficiency and comparing companies with different capital structures and tax rates. | Evaluating established companies with stable earnings and operational efficiencies. |

The use of revenue multiples in the valuation of cybersecurity companies offers several distinct advantages, especially when assessing high-growth or early-stage companies within this dynamic sector.

This financial metric provides a quick and efficient method for investors and analysts to compare companies, offering insights into their relative market valuations without the need for complex financial analysis. Here are some key benefits of employing revenue multiples in the cybersecurity industry:

Broad Applicability: Revenue multiples can be applied universally across companies, regardless of their current profitability status. This is particularly useful in the cybersecurity sector, where many companies are in the growth phase and may not yet be profitable.

Industry Benchmarking: They enable investors to benchmark companies against their peers within the cybersecurity industry, providing a clearer picture of how a company is valued in the context of market expectations and sector-specific growth potential.

Emphasis on Top-Line Growth: For cybersecurity companies, where the potential for rapid expansion is often more critical than immediate profitability, revenue multiples highlight companies with strong growth prospects. This focus on revenue growth aligns with the strategic importance of scaling operations and customer base in the cybersecurity industry.

Market Sentiment and Potential: Using revenue multiples allows investors to gauge the market's sentiment towards a company's growth potential and future prospects, beyond just the current earnings or profit margins.

Ease of Calculation and Understanding: Revenue multiples are straightforward to calculate and can be easily understood by a wide range of stakeholders, making them a practical tool for quick valuation assessments.

Time Efficiency: They provide a quick snapshot of company valuation, which is invaluable in the fast-moving cybersecurity market, enabling timely investment decisions.

Informing Investment Strategies: By offering a clear comparison of how similarly situated companies are valued by the market, revenue multiples can inform strategic investment decisions, highlighting potential investment opportunities or overvalued assets.

Guiding M&A Activities: For companies and investors looking at merger and acquisition opportunities, revenue multiples offer a benchmark for assessing the valuation of potential targets within the cybersecurity sector.

In summary, employing revenue multiples to compare cybersecurity companies offers a blend of simplicity, strategic insight, and efficiency, making it a valuable tool for investors navigating the complex and rapidly evolving cybersecurity landscape.

This approach not only facilitates informed investment decisions but also helps in understanding the broader market dynamics and identifying companies with strong growth trajectories and market potential.

In our quest to demystify the cybersecurity sector's landscape in 2024, we've conducted a thorough examination of what we consider to be the 26 most pivotal cybersecurity firms making significant impacts in the industry today.

Diving into the concept, a revenue multiple is essentially about gauging a company's market valuation against its annual revenue. This ratio stands as a fundamental metric for valuing emerging startups, regardless of their size or profitability, by dividing the company's market value by its annual sales.

This multiple provides a glimpse into the premium investors are ready to pay for each dollar of the company's revenue, reflecting the perceived growth potential of the company. A higher multiple indicates a strong belief among investors in the company's future growth.

Our analysis includes a varied mix of both private and publicly listed innovators in the cybersecurity realm, from cutting-edge application security companies and information security tools to specialized network security.

We prioritized companies with verifiable market value and revenue figures from the last year, while acknowledging the limitations inherent in any dataset. It's possible that some significant players were overlooked due to a lack of transparent valuation or revenue data.

Should you be aware of a notable firm that was omitted owing to unavailable data, we encourage you to reach out to us. Our goal is to constantly update this analysis to ensure it reflects the most accurate and up-to-date insights on the leading entities in cybersecurity as fresh information becomes available.

We place a high value on collaborative efforts. Your input can help us enhance our overview, providing a more exhaustive picture of the cybersecurity companies transforming the tech landscape. We welcome any insights into valuations you might wish to share. Together, we can significantly deepen our collective understanding and share these insights more broadly.

An intriguing finding emerges in our examination of the revenue multiples for 26 Cybersecurity companies, both private and public.

The average multiple, sitting at 14.2x, signifies a relatively modest premium when juxtaposed against the wider Software as a Service (SaaS) market.

This positioning starkly contrasts with sectors such as Artificial Intelligence, Property Technology (Proptech), Education Technology (Edtech), Payments, Insurtech, HR Tech, broader Financial Technology (Fintech), and vertical SaaS, all of which command significantly higher premiums in comparison to the general SaaS sphere.

This scenario likely stems from a recent market correction experienced by Cybersecurity, leading to a recalibration towards more traditional valuation benchmarks amidst the fervor surrounding new technological advancements.

Cybersecurity's importance grows; valuation explores market dynamics and firm growth.

Uses revenue multiples to assess, compare cybersecurity firm valuations against annual revenues.

Analysis reveals cybersecurity's modest average multiple compared to broader tech sectors.

Despite funding recalibration, cybersecurity remains vital for digital infrastructure protection.

Insights guide investment strategies, highlight sector's potential, challenges, and investor confidence.

A revenue multiple is a ratio that gauges a company's market valuation against its annual revenue, reflecting investor perception of growth potential.

The average revenue multiple for cybersecurity in 2024 is 14.2x.

The text doesn't specify revenue multiples for technology startups in general, but cybersecurity, a tech sector, has an average multiple of 14.2x in 2024.

Tech companies use various valuation multiples, including revenue multiples and EBITDA multiples, to assess value based on factors like size, profitability, and growth potential.