The Role of Earnings Quality in M&A Valuation

By Lior Ronen | Founder, Finro Financial Consulting

When two companies decide to join together in a merger, or when one company decides to buy another, it's really important to figure out how much the company being bought is worth.

This is called 'valuation.'

One key thing that can really change a company's value is the quality of its earnings or the money it makes.

'High-quality' earnings are money that a company makes in a regular, predictable way.

It's like having a steady job that pays you the same amount every month.

On the other hand, 'low-quality' earnings might come from a one-time event, like selling off a part of the business, or might rely on creative accounting tricks.

It's like if you made money by selling your old stuff on eBay—once you've sold everything, you can't keep making money that way.

Earnings quality is critical in M&A valuation, influencing the perceived value of a company. High-quality earnings suggest a higher valuation, while earnings of lower quality can decrease it.

Acquirers must perform thorough financial analysis, understand revenue practices, spot non-recurring items, use varied valuation methods, and consider industry specifics.

Earnings quality is just one facet of due diligence; strategic fit and potential synergies are also vital.

A methodical assessment of earnings quality enables informed decision-making, better negotiations, and successful M&A outcomes, leading to successful integrations and sustained growth.

Earnings quality can make a big difference when companies are merging or buying each other.

If a company has high-quality earnings, it's more attractive to buy, like a house in good condition.

But if a company has low-quality earnings, it might be worth less, or buyers might decide not to buy it at all, like a house that needs a lot of repairs.

In this article, we're going to talk about why earnings quality is so important when companies are buying each other.

We'll look at what can happen when earnings quality is low and give some tips on how to spot issues.

So whether you're a business owner thinking about buying another company, an investor, or just someone interested in how businesses work, this article will help you understand how the quality of earnings can affect these big deals.

Understanding Earnings Quality

In simple terms, earnings quality reflects how true a company's earnings (or profits) are to its actual financial performance.

Let's break down the difference between high-quality and low-quality earnings.

High-quality earnings are like a steady, reliable job. They're money the company makes in a regular, predictable way.

You can count on this income because it's backed up by real sales of products or services. This is the kind of money a company can keep making over time, because it comes from things the company does well.

Low-quality earnings, on the other hand, aren't so dependable. They might come from a one-time event, like selling off a part of the business, or they might rely on creative accounting tricks.

It's like making money by selling your old stuff on eBay. Sure, you make some cash, but once you've sold everything, you can't keep making money that way.

The quality of a company's earnings can make a big difference to its value.

High-quality earnings can make a company more attractive to investors, because it suggests the company has a solid, reliable business. But low-quality earnings can raise doubts, because it suggests the company's profits might not be sustainable.

Next, we'll talk about how earnings quality can affect the value of a company when it's being bought or merged with another company, and what investors should look out for.

| High-Quality Earnings | Low-Quality Earnings | |

|---|---|---|

| Definition | Earnings derived from sustainable, predictable business operations. | Earnings derived from one-off events, financial engineering, or aggressive accounting. |

| Consistency | Regular and predictable, similar to a steady paycheck. | Irregular and inconsistent, like money from selling old items on eBay. |

| Sustainability | Likely to continue over the long term, based on the company's regular business activities. | Unlikely to be repeated in the future, as it depends on unique events or practices. |

| Cash Flow | Backed by actual cash flow from the company's core business. | May not be backed by real cash flow, especially if it relies on accounting maneuvers. |

| Impact on Company Valuation | Tends to increase company valuation because it suggests a robust, reliable business. | Can decrease company valuation due to doubts about sustainability and reliability of earnings. |

| Investor Perception | Generally favored by investors because of the assurance of stability and predictability. | Generally viewed with skepticism by investors due to concerns about the company's financial health and future profitability. |

The Role of Earnings Quality in M&A Valuation

When one company is considering buying or merging with another, they really need to know how much that company is worth.

This is where the valuation process comes in. It's kind of like getting a house appraisal before you buy a home.

Just as you wouldn't want to pay too much for a house, companies don't want to pay too much when they're buying or merging with another company.

The quality of a company's earnings plays a huge role in this valuation process.

If a company has high-quality earnings, it's a good sign.

It shows that the company has a solid business that makes money in a dependable way.

This can make the company more attractive to buyers, much like a house in good condition would be attractive to home buyers.

As a result, companies with high-quality earnings can often be valued higher.

On the other hand, if a company has low-quality earnings, it can be a warning sign.

It suggests that the company's profits may not be reliable or sustainable over the long term.

Like a house that looks good on the surface but has hidden problems, a company with low-quality earnings might be less attractive to buyers.

Because of this, companies with low-quality earnings can end up with a lower valuation.

In the next section, we'll look at some real-life examples of how earnings quality has affected company valuations during mergers and acquisitions.

|

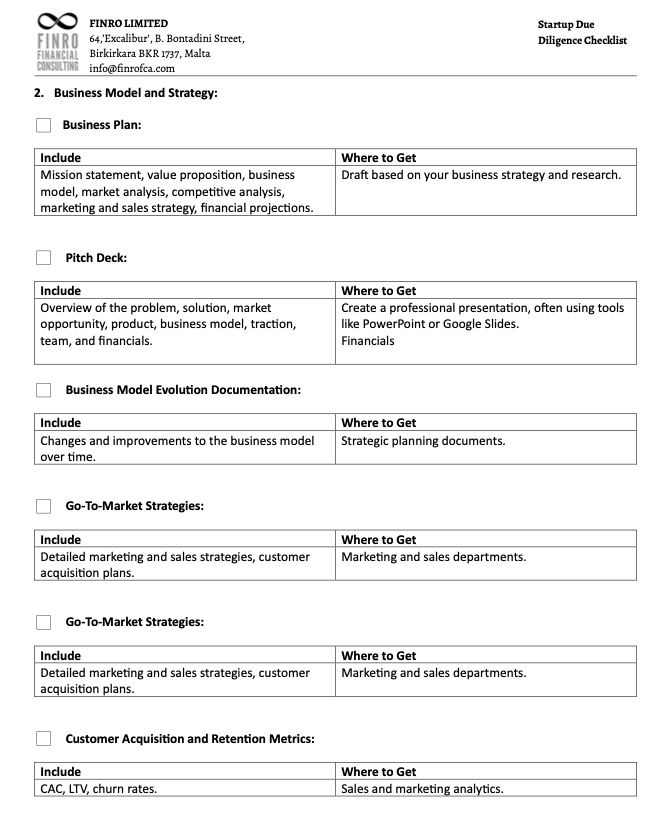

Click to Recieve The Full Checklist Now: Finro Startup Due Diligence Checklist |

Case Studies of Earnings Quality Impact on M&A

In the world of mergers and acquisitions, real-life examples can teach us a lot about the importance of earnings quality.

Let's look at a couple of hypothetical scenarios to illustrate this.

Scenario 1: High-Quality Earnings

Let's say there's a company named 'StableTech,' which has been making steady profits from its main technology products for several years.

The earnings come from actual sales, making them high-quality earnings.

Now, another company, 'GrowthInc,' is considering buying StableTech.

They look at StableTech's regular, predictable profits and are reassured that the business is stable and likely to continue making money in the future.

This boosts StableTech's value in the eyes of GrowthInc and they are willing to pay a premium to acquire it.

Scenario 2: Low-Quality Earnings

Now, imagine a company called 'OneTimeWin.'

This company recently sold a large piece of its business, which resulted in a big profit for that year.

However, this is a one-time event and can't be repeated in future years.

A different company, 'SmartBuy,' is considering acquiring OneTimeWin.

They see the recent big profit, but they realize it's from a one-time sale and is not going to be repeated in the future.

This raises some concerns about how much money OneTimeWin will make in the future.

As a result, SmartBuy might decide to offer less to buy the company, or they might decide not to buy it at all.

These scenarios show how earnings quality can significantly impact a company's valuation during a merger or acquisition.

High-quality earnings can make a company more attractive and potentially increase its value, while low-quality earnings can raise doubts and potentially decrease its value.

In the next section, we'll talk about how to evaluate earnings quality during M&A due diligence.

| Scenario 1: High-Quality Earnings (StableTech) | Scenario 2: Low-Quality Earnings (OneTimeWin) | |

|---|---|---|

| Type of Earnings | Steady profits from main business activities. | Large profit from a one-time sale of a business segment. |

| Acquirer's Perception | GrowthInc sees StableTech's reliable earnings as a sign of a stable business. | SmartBuy recognizes OneTimeWin's earnings as a one-time event and is concerned about future profitability. |

| Impact on Valuation | High-quality earnings increase StableTech's value in the eyes of GrowthInc. | Low-quality earnings raise doubts about OneTimeWin's future earnings, possibly reducing its perceived value. |

| Acquisition Decision | GrowthInc is willing to pay a premium to acquire StableTech. | SmartBuy might offer less to buy OneTimeWin, or may decide not to proceed with the acquisition. |

Evaluating Earnings Quality during M&A Due Diligence

During the process of a merger or acquisition, it's crucial for the buying company (the acquirer) to conduct due diligence, which is kind of like doing your homework before a big decision.

This due diligence includes evaluating the quality of the target company's earnings.

Here's how you might go about doing that:

1. Analyze the income statement: Take a close look at the target company's income statement.

This financial document can give you a lot of clues about the quality of the company's earnings.

High-quality earnings typically come from the company's core business operations, while low-quality earnings might come from one-time events or unusual items.

2. Consider the company's revenue recognition practices: Every company has policies about when and how it recognizes revenue or counts sales as income.

Some companies might recognize revenue as soon as a sale is made, while others might wait until the product is delivered or the service is completed.

If a company recognizes revenue too early, it might artificially inflate earnings, lowering quality.

3. Examine the cash flow statement: The cash flow statement shows how much actual cash a company is generating from its operations.

If a company reports high earnings but low cash flow, it could be a sign that the earnings are of low quality.

4. Look for consistency: Companies with high-quality earnings tend to have consistent, predictable earnings over time.

If a company's earnings are volatile or fluctuating wildly from year to year, it could be a sign of lower-quality earnings.

5. Get help from experts: Evaluating earnings quality can be complex and requires a good understanding of financial accounting.

Engaging financial advisors or accountants who can provide expert insights might be helpful.

Remember, the goal of due diligence is to understand the true financial health of a company you're considering buying or merging with.

Evaluating earnings quality is an important part of that process.

In the next section, we'll discuss some of the challenges and common mistakes to avoid when evaluating earnings quality.

| Evaluating Earnings Quality | Challenges and Common Mistakes | |

|---|---|---|

| 1 | Analyze the income statement for insights into the quality of earnings. | Misinterpreting financial statements due to their complexity can lead to inaccurate evaluations. |

| 2 | Consider the company's revenue recognition practices. | Overlooking non-recurring items can inflate perceived earnings and overestimate earnings quality. |

| 3 | Examine the cash flow statement for alignment with reported earnings. | Ignoring revenue recognition practices can result in a misrepresentation of earnings quality. |

| 4 | Look for consistency in the company's earnings over time. | Overreliance on earnings consistency can be misleading if earnings are artificially inflated. |

| 5 | Get help from financial experts for accurate evaluation. | Neglecting to seek expert help can result in missing crucial details that impact valuation. |

Challenges and Common Mistakes in Evaluating Earnings Quality

While the importance of evaluating earnings quality in mergers and acquisitions can't be overstated, this process comes with its fair share of challenges and potential pitfalls. Let's dive into a few common ones to be aware of:

1. Misinterpreting Financial Statements: Financial statements are the primary source of information about a company's earnings, but they can sometimes be complex and difficult to understand. Misinterpretation of these documents can lead to inaccurate evaluations of earnings quality.

2. Overlooking Non-Recurring Items: Some companies may have non-recurring items in their income statement - these are unique events that won't happen again, like the sale of a business division. If these are overlooked, they can inflate perceived earnings and lead to overestimating earnings quality.

3. Ignoring Revenue Recognition Practices: As mentioned earlier, how a company recognizes revenue can significantly impact its reported earnings. Neglecting to scrutinize these practices can lead to a misrepresentation of earnings quality.

4. Overreliance on Earnings Consistency: While consistent earnings can be a good sign, they do not always indicate high-quality earnings. For instance, a company may have consistently high earnings due to aggressive accounting practices or financial engineering rather than sustainable business operations.

5. Neglecting to Seek Expert Help: Evaluating earnings quality is intricate and often requires a solid understanding of financial accounting. Companies attempting to do this without the necessary expertise may miss crucial details that could impact their valuation and decision-making.

By being aware of these challenges and common mistakes, companies can improve their evaluation of earnings quality, helping to ensure a more accurate valuation during the M&A process.

Our final section will discuss some best practices for evaluating earnings quality.

Best Practices for Evaluating Earnings Quality

The importance of correctly evaluating earnings quality during mergers and acquisitions is clear.

With that in mind, here are some best practices to enhance the process and make your evaluations more accurate and meaningful:

1. Comprehensive Financial Analysis: Don't limit your examination to the income statement. Look at all three key financial statements - the balance sheet, the income statement, and the cash flow statement. This will provide a more rounded picture of a company's financial health and earnings quality.

2. Understand Revenue Recognition Practices: Make an effort to understand the target company's revenue recognition practices fully. Be aware of any aggressive revenue recognition that could artificially inflate earnings.

3. Identify Non-Recurring Items: Be vigilant in identifying and understanding non-recurring items. Exclude these from your analysis of recurring earnings to avoid misinterpreting the quality and sustainability of earnings.

4. Seek Expert Assistance: Don't hesitate to seek the help of experts. Financial advisors and accountants can provide invaluable insights and help prevent common errors in the evaluation process.

5. Use Multiple Valuation Methods: Consider using multiple valuation methods to ensure a more balanced and accurate valuation. This could include earnings-based valuation methods and others like market-based or assets-based valuations.

6. Consider the Industry Context: What constitutes high-quality earnings can vary by industry. For example, a software company's earnings might be judged differently from a manufacturing company's. Always consider industry standards and norms when evaluating earnings quality.

With these best practices in mind, you can improve the accuracy of your earnings quality evaluation and make more informed decisions during the M&A process.

Following these guidelines can help ensure a successful transaction that delivers value and helps achieve your strategic goals.

Conclusion: The Critical Role of Earnings Quality in M&A Valuation

Earnings quality plays an indispensable role in mergers and acquisitions valuation.

As we've discussed throughout this article, it can significantly impact the perceived value of a target company and, therefore, the decision-making process of the acquiring entity.

High-quality earnings, derived from a company's core business operations and sustained over time, are generally seen as a positive sign, potentially increasing a company's valuation.

On the other hand, low-quality earnings, which might result from one-off events or aggressive accounting practices, can raise doubts about a company's future performance and lower its perceived value.

During the due diligence process, acquirers should follow the best practices outlined in this article.

They should conduct a comprehensive analysis of all key financial statements, understand the target's revenue recognition practices, identify non-recurring items, seek expert assistance, use multiple valuation methods, and consider the industry context.

However, it's important to remember that evaluating earnings quality is just one part of the broader due diligence process.

While it's a critical factor, other aspects of the target company – such as its strategic fit, culture, and potential synergies – should also be thoroughly evaluated to ensure a successful merger or acquisition.

By taking a thoughtful and systematic approach to evaluating earnings quality, companies can make informed decisions, negotiate better deals, and ultimately, achieve their strategic M&A objectives.

This leads to successful integrations, greater value creation, and the realization of long-term business growth and success.