How to Craft Effective Financial Models for Your Startup?

By Lior Ronen | Founder, Finro Financial Consulting

Raising funds for a startup can feel like navigating a labyrinth. One crucial tool to lead the way? A meticulously crafted financial model.

This vital document not only maps out your company's projected growth and the resources needed to reach those ambitious goals, but it also serves as a passport, inviting potential investors into the heart of your business.

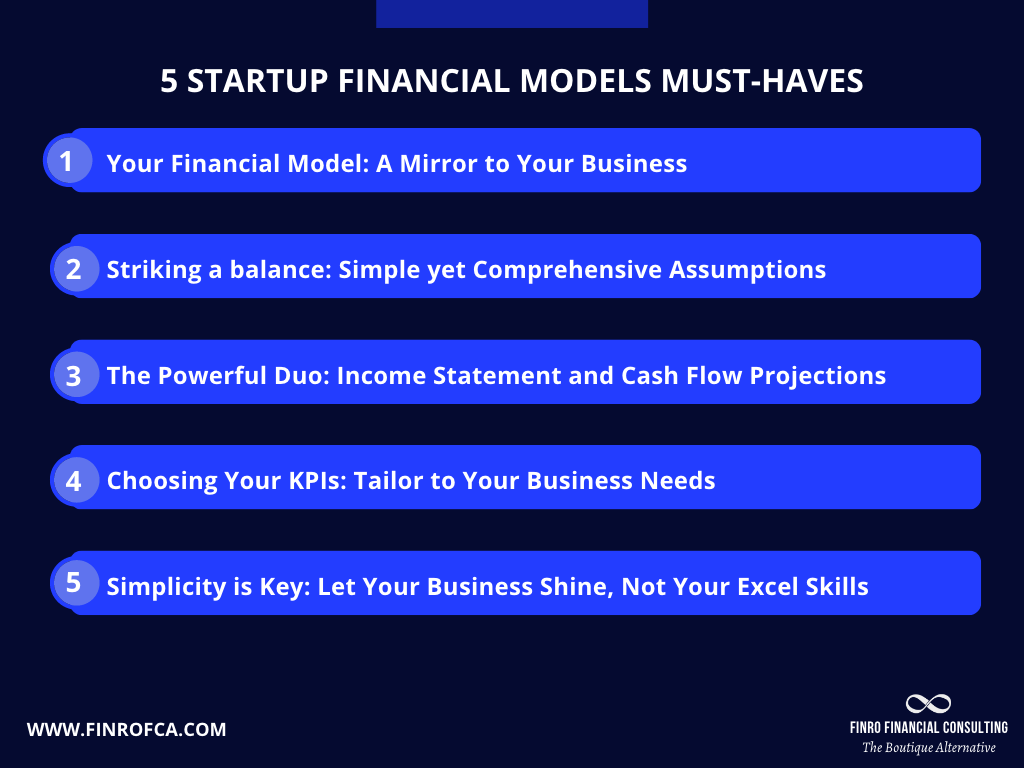

A startup's financial model is pivotal in funding efforts, encapsulating the business's essence and growth potential. It should be unique yet simple, with clear assumptions, essential financial statements, and relevant KPIs.

Complexity doesn't guarantee quality; a model should be understandable and focused, effectively communicating the startup's promise to investors. A well-constructed financial model is more than numbers; it's a storytelling tool that outlines a path to profitability and convinces investors of the startup's worth.

Proper development and refinement of this model are key to reflecting the true vision and potential of the business.

Here's the rub:

Investors aren't mind readers.

They may not fully grasp your vision, let alone the intricate mechanics of your business as intimately as you do.

So how can you bridge this gap?

How can you ensure your startup’s potential is not just seen, but fully understood?

The answer is a financial model that's not just comprehensive, but also lucid and compelling.

It's about talking the talk that investors understand and expect.

But more importantly, it's about presenting a snapshot of your business potential that is both quick and crystal clear.

In this article, I'm going to demystify the three financial model types typically encountered by investors.

I'll guide you towards the one you should aspire to build, and reveal the indispensable elements your financial model needs to win the investors' confidence.

Let's lift the veil on the mystery of financial modeling together.

Evaluating Financial Models: The Good, the Bad, and the Top-Notch

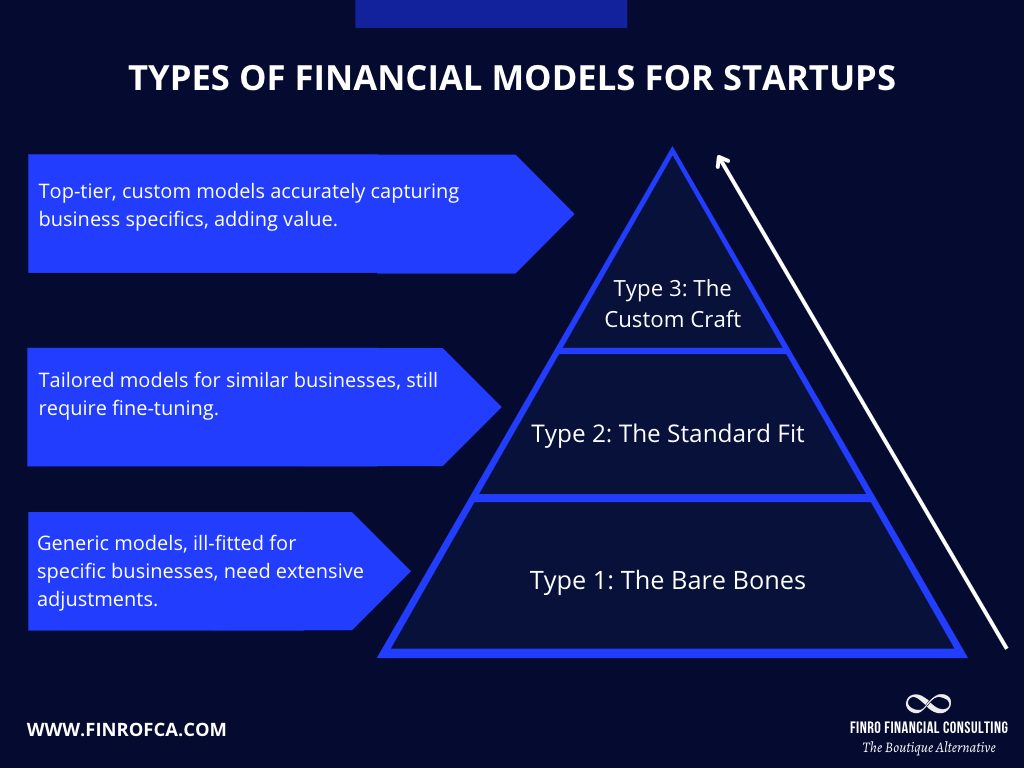

"Upon reviewing our clients' previous financial models or performing due diligence for investors, we typically encounter three types of financial models.

Type 1: The Bare Bones

These models are often a 'one-size-fits-all' variety.

They are generally-purpose templates, originally created for one industry but haphazardly adapted to fit another.

They aim to cover as many niches as possible, relying heavily on generic terms and common business strategies.

The downside?

They frequently emphasize irrelevant aspects for the actual business in question.

To be useful, these models demand a multitude of adjustments, and even then, their effectiveness may be limited.

Type 2: The Standard Fit

The 'Standard Fit' models are usually tailored for a company similar to yours and then adjusted to fit your unique circumstances.

While they may employ the appropriate industry jargon, these models may emphasize different aspects than your company does, potentially causing misalignment with your pitch deck or business plan.

On the positive side, their calculations and general flow may come close to what investors look for, but they still require tweaking. However, the adjustments needed are far fewer compared to Type 1 models.

Type 3: The Custom Craft

These are the cream of the crop. 'Custom Craft' models are specifically built to describe your business model and do so accurately.

They precisely capture costs, project revenue growth, provide additional insights through detailed and adjustable assumptions, and display relevant KPI metrics that genuinely add value.

Your goal?

To ensure your tech startup financial model ascends to the Type 3 category.

Incorporating the following five must-haves will pave your way from just okay to truly excellent.

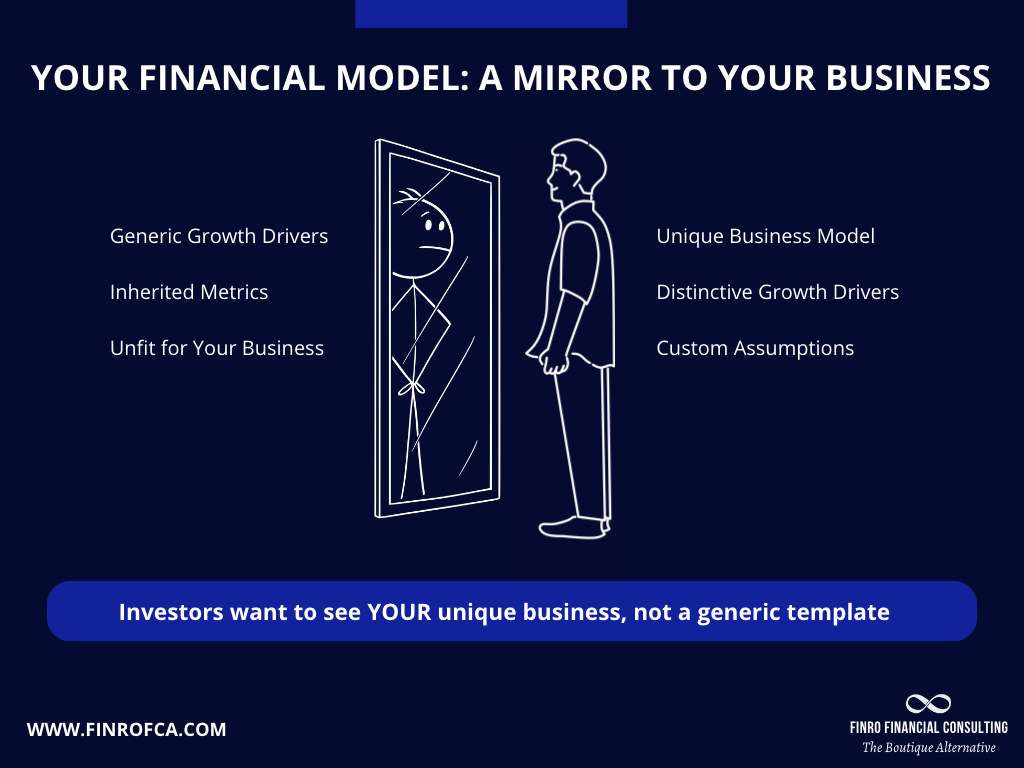

Your Financial Model: A Mirror to Your Business

Using a generic financial model template or borrowing one from another successful company can be a pitfall.

You may unintentionally inherit a business model that isn't truly yours, embracing growth drivers and metrics that don't align with your startup's specifics.

Here's why this tops my list:

A financial model that doesn't accurately reflect YOUR business is fundamentally flawed.

Investors aren't looking at your friend's business or the generic business your template outlines.

They want a deep-dive into YOUR business, your growth strategy, your unique narrative.

Your business is one-of-a-kind, boasting a unique business model, distinctive growth drivers, an exceptional burn rate, and individual assumptions about revenue generation and expenditure.

These intricacies must be the heart of your financial model. Anything less is simply off-target.

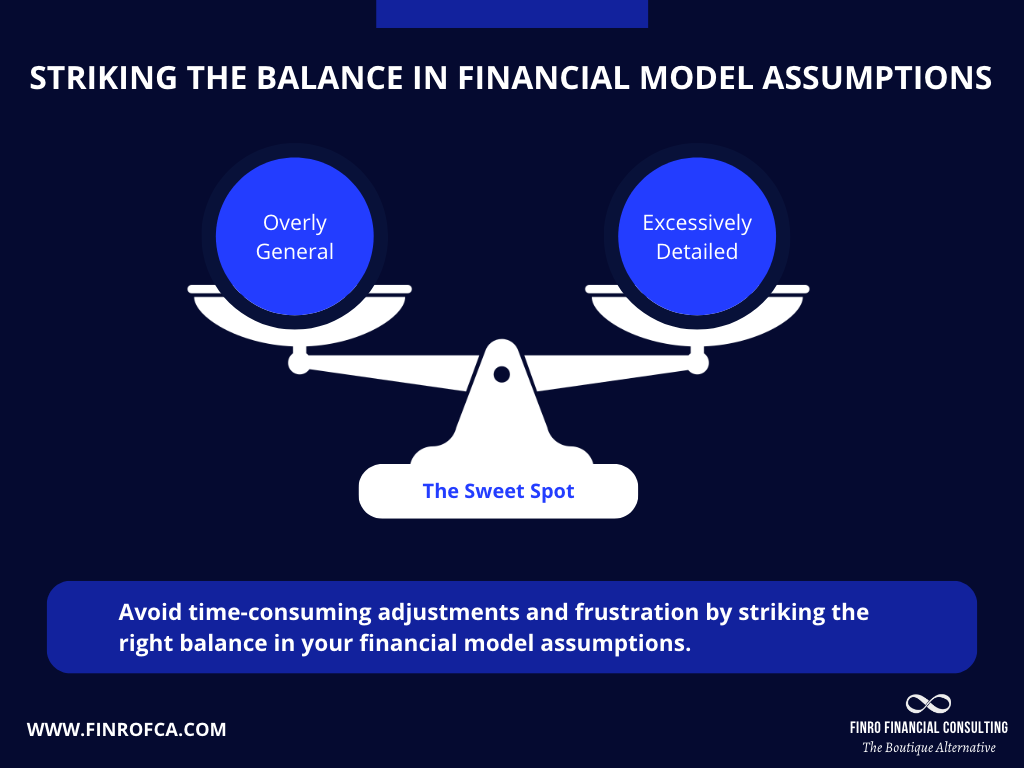

Striking a balance: Simple yet Comprehensive Assumptions

In our experience with tech startups' financial models, we've noticed two common missteps in the assumptions sections: they're either overly general, obscuring the growth drivers, or excessively detailed, becoming a challenge to follow.

As with most things, striking a balance is key.

Assumptions in financial models should be comprehensive but straightforward, allowing investors to understand your growth drivers effortlessly.

Moreover, they should be easily adjustable for quick stress-testing of your assumptions.

Keep in mind, if investors struggle to comprehend your model, they'll likely ask for simplifications.

This adjustment process can be time-consuming, costly, and frustrating—a scenario best avoided.

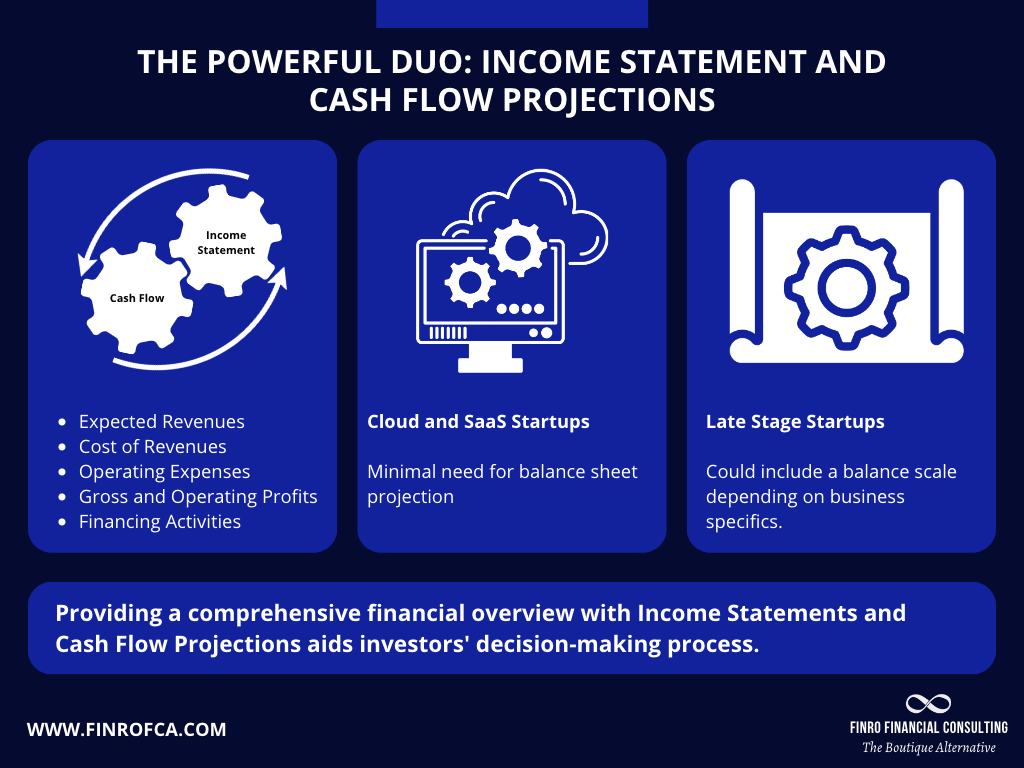

The Powerful Duo: Income Statement and Cash Flow Projections

Financial statements are your financial model's lifeblood.

Although venture capitalists may not question your categorization of specific items in your cogs or operating expenses, we employ widely accepted accounting tools for building financial forecasts and measuring projections.

At its core, your financial model must offer an income statement projection for a defined horizon. This statement should outline expected revenues per product line, cost of revenues or cogs, operating expenses breakdown, and gross and operating profits after computations.

For an additional depth of information, include a cash flow statement projection.

For many seed-stage startups, specifics about working capital or required capital expenditures may be unknown. However, founders typically know when and how much they plan to raise. In these cases, the cash flow statement often mirrors the income statement plus financing activities, which is acceptable.

Presenting both income statement and cash flow projections provides investors with a comprehensive financial overview, aiding their decision-making process.

We're often asked about balance sheet projections. For early-stage startups, if certain assets or liabilities are not central to the business, the value of incorporating a balance sheet projection is minimal.

Most early-stage cloud and SaaS startups can skip balance sheet projections.

For late-stage startups, the necessity for a balance sheet projection hinges on the business model, current balance sheet, and whether it provides additional value to investors without distracting from key discussions.

Choosing Your KPIs: Tailor to Your Business Needs

Key Performance Indicators (KPIs) provide a holistic view of your business's projected growth, offering essential insights to anyone reviewing your financial model.

For early-stage startups, targeted KPI projections can steer investor discussions, bringing critical topics to the forefront.

On the other hand, for late-stage startups, KPI metrics can spotlight areas of strength or highlight potential challenges in the business.

Given this significant role, selecting appropriate KPIs for your business becomes crucial.

Each industry, sector, or niche utilizes a distinct set of KPIs to gauge businesses' growth, robustness, and potential difficulties.

Using a general model with basic KPI metrics may cause you to miss a golden opportunity to showcase your business's potential.

Therefore, conducting thorough research to identify and use the most suitable KPIs for your business is essential.

Simplicity is Key: Let Your Business Shine, Not Your Excel Skills

Let's cut to the chase. Investors aren't scouting for extraordinary Excel skills; they're in pursuit of promising businesses.

Financial modeling is a tool designed to present your financial projections, explain their underlying drivers, and clarify your main assumptions.

Its purpose is to simplify the understanding of your business for the reader.

In the realm of online resources, it's easy to stumble upon spreadsheets boasting '59 different ratio calculations', 'over 30 charts', and 'US GAAP, IFRS, and Non-GAAP Statements.'

These features may seem tempting but beware, they're often just detours that add complexity without necessarily providing added value.

Remember, the primary goal of a startup financial model is to translate your business model, estimations, and projections into a digestible format.

This clarity allows the reader to understand your business better and assess their interest in learning more or even investing.

In order to communicate your business idea and potential effectively, your message needs to be crystal clear and easy to follow.

Excel, the tool most commonly used to deliver this message, should serve to facilitate understanding, not to impress with complex formulas, sophisticated financial engineering, or a labyrinth of tabs.

When designing your financial model, place yourself in the reader's shoes. Ensure your message is lucid and the journey through your spreadsheet is straightforward.

Conclusion

Creating a robust financial model is a critical task for any startup seeking to secure funding.

It’s more than just a demonstration of your numerical aptitude or Excel prowess; it’s a reflection of your business, its potential, and your understanding of its key growth drivers.

Remember, a high-quality financial model mirrors the uniqueness of your business, employs comprehensive but simple assumptions, includes vital financial statements, features relevant and industry-specific KPIs, and above all, remains clear and straightforward.

Avoid over-complicating things.

Complexity does not equate to comprehensiveness or effectiveness.

Your financial model should speak to potential investors in a language they understand, highlighting the unique potential of your venture without getting lost in a maze of unnecessary details or convoluted calculations.

In the world of startups, your financial model can make the difference between a lukewarm reception and a winning pitch.

It's an essential tool to articulate your business vision, map out your path to profitability, and convince potential investors that your startup is a venture worth betting on.

Take the time to build it correctly, review it carefully, and let it be a genuine reflection of your business vision and potential