Startup Due Diligence: Fundraising Readiness Guide

Raising funds for your startup is more than just convincing investors about the brilliance of your idea. It's about undergoing a process that scrutinizes every corner of your business to ensure it stands up to scrutiny.

This process, known as startup due diligence, is a critical step for both founders and investors. It's where dreams meet the hard facts, ensuring that every claim is backed by evidence and every figure tells a real story.

For founders looking to secure funding, understanding due diligence is not just a necessity—it's a strategic advantage.

It's about presenting your startup not just as a vision, but as a viable, investment-worthy venture.

But why does due diligence matter so much, and how can you, as a founder, navigate this process successfully?

Simply put, due diligence is your opportunity to shine. It's where you prove the resilience, scalability, and potential profitability of your startup.

Investors dive deep into your financials, operations, legal compliance, and technological assets to gauge the risks and opportunities your startup presents. And while it might seem daunting, being prepared for this scrutiny is your best bet for not just surviving the process but thriving through it.

As we unpack the intricacies of startup due diligence, remember, it's more than just a hurdle to clear.

It's a lens that can help refine your business model, identify areas for improvement, and, ultimately, secure the investment you need to scale.

Whether you're about to approach investors or you're simply planning ahead, knowing the ins and outs of startup due diligence will equip you with the knowledge to navigate the fundraising landscape confidently.

Navigating the due diligence process is crucial for startups seeking investment, requiring meticulous preparation of financial records, legal documents, and operational data to impress potential investors.

Early-stage startups must highlight their growth potential and innovation, while late-stage companies need to demonstrate financial health and market leadership.

Engaging with specialized consultants like Finro can provide invaluable insights and expertise, turning due diligence into a strategic advantage. By proactively addressing potential weaknesses and leveraging feedback, startups can enhance their appeal to investors, laying a solid foundation for future success and growth.

- Understanding Startup Due Diligence

- Preparing for Due Diligence

- Due Diligence for Early-Stage Startups

- Due Diligence for Late-Stage Startups

- Common Challenges and How to Overcome Them

- Leveraging Due Diligence for Your Startup’s Advantage

- Benefits of Choosing Finro as Your Startup Due Diligence Consultant

- Conclusion

Understanding Startup Due Diligence

At its core, startup due diligence is like the comprehensive health checkup of your startup before an investor decides to commit their capital.

It's a thorough examination of your business from various angles to ensure that what's presented on the surface aligns with the underlying realities.

|

Click to Recieve The Full Checklist Now: Finro Startup Due Diligence Checklist |

Why It Matters

For investors, the purpose of due diligence is twofold. First, it's about risk assessment. They're looking to uncover any potential red flags that could threaten their investment.

This could range from financial discrepancies and legal issues to operational inefficiencies and technological roadblocks.

Secondly, it's an opportunity to understand the business's growth potential and scalability. Investors want to see evidence of a well-thought-out strategy that can lead to substantial returns on their investment.

For founders, due diligence might initially seem daunting.

However, it's an invaluable opportunity to critically assess your business's health and readiness for growth.

Think of it as a mirror reflecting your business's strengths and areas for improvement, offering you a chance to address any concerns before they become deal-breakers.

Types of Due Diligence

Due diligence can be categorized into several key areas, each focusing on different aspects of your startup:

Financial Due Diligence: This involves a deep dive into your financial statements, revenue projections, and expenditure. It's about verifying the financial health and sustainability of your business.

Legal Due Diligence: Here, the focus is on ensuring your startup is in compliance with all relevant laws and regulations. This includes examining contracts, intellectual property rights, and any potential legal liabilities.

Business/Operational Due Diligence: This area looks into your business model, market positioning, and operational workflows. The goal is to assess the efficiency and scalability of your operations.

Technological Due Diligence: Especially critical for tech startups, this examines the robustness, security, and scalability of your technology. It's an assessment of how your technological assets contribute to your competitive advantage.

Understanding these different facets of due diligence is crucial. It prepares you to present your startup in the best light and address any questions or concerns investors might have.

Remember, the goal of startup due diligence is not just to satisfy investor curiosity but to forge a partnership built on trust and transparency.

| Type | Focus | Goal |

|---|---|---|

| Financial | Financial health, revenue projections, expenditures | Verify financial sustainability |

| Legal | Compliance with laws/regulations, contracts, IP rights | Ensure legal compliance and assess liabilities |

| Business / Operational | Business model, market positioning, operational efficiency | Assess efficiency and scalability of operations |

| Technological | Robustness, security, scalability of technology | Evaluate technological assets and innovation potential |

Preparing for Due Diligence

As a founder, stepping into the due diligence phase opens every aspect of your startup for examination. Preparation is key to navigating this phase successfully, signaling to investors your seriousness and organizational capabilities.

The focus areas for preparation can vary significantly depending on whether your startup is in its early stages, more mature, or somewhere in between.

Essential Documents and Information

A solid due diligence preparation foundation involves gathering and organizing all necessary documents and information. Here’s a tailored checklist that highlights specific considerations for early-stage and late-stage startups, as well as general advice applicable to all:

For Early-Stage Startups:

Vision and Business Model: Include a compelling business plan that articulates your vision, market opportunity, and how you plan to achieve success.

Market Validation: Evidence of market research, customer feedback, and proof of concept or MVP (Minimum Viable Product) performance.

Basic Legal Structure and IP: Key legal documents, such as incorporation papers and provisional patents, showcase the legal foundation of your startup.

For Late-Stage Startups:

Detailed Financial Records: Comprehensive financial statements that demonstrate a track record of revenue, profitability, and cash management.

Operational Efficiency: Documentation of streamlined operational processes, key supplier agreements, and significant customer contracts that indicate scalability.

Advanced Legal and Compliance Documentation: Include all relevant licenses, regulatory compliance documents, and a complete register of patents and trademarks.

For All Startups:

Financial Statements: Up-to-date balance sheets, income statements, and cash flow statements are universally essential.

Technological Documentation: For tech-centric startups, documentation on your technology stack, development roadmaps, and IP is crucial at any stage.

Tips for Organizing Your Documents

Create a Digital Data Room: A secure digital space for document storage and sharing demonstrates professionalism and ensures data security.

Keep It Updated: Regularly refreshing your documents in the data room maintains transparency and provides investors with the latest information.

Be Transparent: Proactively address potential red flags, such as pending litigation or financial discrepancies, to build trust with potential investors.

Getting Ahead of the Game

Financial Audits: An independent audit, particularly for late-stage startups, can bolster credibility by verifying financial health.

Legal Compliance Check: A thorough review by legal advisors is crucial at any stage to ensure compliance with all relevant laws and regulations.

Mock Due Diligence: Engaging in a mock due diligence process can identify potential gaps or issues, a strategy beneficial for startups at any maturity level.

Preparation for due diligence is about more than having your documents in order; it’s about strategically showcasing your startup's strengths, proactively addressing concerns, and demonstrating a commitment to transparency and thoroughness.

This approach significantly influences investor confidence, potentially making the difference between securing funding or not, regardless of your startup's stage.

| Aspect | Early-Stage Startup | Late-Stage Startup |

|---|---|---|

| Financial Scrutiny | Focus on future projections and burn rate rather than past financials. | Detailed analysis of financial history, profitability, and cash flows. |

| Operational and Market Success | Evaluation of business model viability and initial market traction. | Efficiency, scalability of operations, and established market leadership. |

| Legal and Compliance | Basic legal structure, IP rights, and foundational compliance. | Comprehensive legal review including regulatory compliance and litigations. |

| Technological Evaluation | Feasibility and innovation potential of technology. | Robustness, security, and scalability of technological infrastructure. |

| Strategic Focus | Vision, potential market impact, and founder team's capability. | Strategic direction, industry positioning, and long-term growth plans. |

Due Diligence for Early-Stage Startups

As an early-stage startup stepping into the due diligence phase, you're embarking on a journey that, while daunting, is ripe with opportunity.

This phase is less about scrutinizing your past and more about the promise of your future.

Understanding what's in store can significantly demystify the process, allowing you to navigate it with confidence.

Understanding the Due Diligence Landscape

For early-stage startups, the startup due diligence landscape is unique. Investors are primarily interested in the team's background, the innovation and scalability of the idea, and any evidence of market validation.

Given the nascent stage of the business, the financial history might be scant, which shifts the focus to the viability of the business model and the potential for future growth.

Startups should be ready to showcase a robust business plan, detailed market research, proof of concept or a minimum viable product (MVP), and any user traction or feedback.

Demonstrating a deep understanding of the market and a strategic approach to addressing customer needs is key.

The process typically explores the team's credentials, product's technological feasibility, legal basics including intellectual property rights and company structure, and a comprehensive review of the business plan and market analysis.

Timelines, Expectations, and Communication

The due diligence timeline for early-stage startups tends to be shorter than for more established companies, usually spanning a few weeks to a couple of months.

However, this can vary based on the complexity of the business and the investor's review depth.

Startups should brace themselves for an extensive inquiry into their business, as investors use this process to assess not just the business potential but also the team's ability to engage in thorough and transparent discussions.

Maintaining open lines of communication is crucial.

Timely updates, quick responses to inquiries, and well-organized documentation can streamline the process and foster trust between the startup and potential investors.

Valuation Considerations

The findings from due diligence can profoundly impact your startup's valuation. Discoveries made during this phase may lead to adjustments in valuation, whereas a demonstration of a solid business strategy and significant market potential can enhance your valuation.

It's crucial to initiate discussions about valuation early in the process. Proactively addressing potential concerns can pave the way for negotiating more favorable investment terms.

The due diligence process is not just a hurdle but an opportunity to highlight the strengths and potential of your startup. A well-prepared approach to due diligence can be a powerful tool in negotiating investment terms that accurately reflect the true value of your business.

Due Diligence for Late-Stage Startups

As your startup matures and moves into later stages, the due diligence process evolves to reflect the growth and complexity of your business.

This phase is no longer just about potential; it's about proven results, scalability, and a clear path to profitability. Understanding the nuances of due diligence at this stage is crucial for navigating it effectively.

Deep Dive into Financials

For late-stage startups, financial due diligence becomes more intensive. Investors expect to see a comprehensive history of financial performance, including revenue growth, profitability margins, and cash flow management.

It's about demonstrating not just viability but also financial robustness and a track record of sound financial decisions.

Detailed audits, financial statements, and future financial projections under various scenarios are scrutinized to assess the company's financial health and sustainability.

Operational and Market Success

Operational due diligence examines the efficiency and scalability of your business processes. Investors will look into your supply chain management, customer acquisition costs, and operational workflows to evaluate how well your business can scale while maintaining or improving margins.

Similarly, market success is under the microscope. Evidence of market leadership, brand strength, and competitive positioning is key.

This involves analyzing market share, customer retention rates, and the effectiveness of marketing strategies.

Legal and Compliance Rigor

As companies grow, so do their legal and regulatory complexities.

Due diligence at this stage involves a thorough review of all legal matters, including contracts, employment laws, international regulations (if applicable), and intellectual property rights.

Ensuring compliance with all relevant laws and having a clean legal bill of health becomes increasingly important to mitigate risks for potential investors.

Technological Scalability and Security

For tech-centric companies, the technological infrastructure undergoes a critical examination.

This not only includes the innovative aspect of the technology but also its scalability, security, and ability to support continued growth.

Due diligence will cover the architecture, data security measures, and any third-party dependencies. The goal is to ensure that the technology stack is not just cutting-edge but also robust and capable of supporting future expansions.

Strategic Alignment and Future Projections

Finally, due diligence for late-stage startups assesses the strategic direction of the company.

This means evaluating the leadership team's vision for the future, the company's position within the industry ecosystem, and its plans for sustaining and increasing its market share.

Investors are particularly interested in strategic partnerships, potential for mergers or acquisitions, and long-term growth strategies.

Common Challenges and How to Overcome Them

The due diligence process, whether for early-stage or late-stage startups, can present a series of challenges.

Understanding these obstacles and preparing for them in advance can greatly improve your chances of a successful investment round.

Here are some common challenges and strategies to overcome them:

Challenge 1: Incomplete Financial Records

Solution: Start maintaining meticulous financial records from the outset. Use accounting software to regularly update your financials. If gaps exist, consider hiring an accountant or financial advisor to help reconcile and document your financial history accurately. For early-stage startups, focus on creating realistic financial projections.

Challenge 2: Intellectual Property (IP) Concerns

Solution: Properly document all IP assets and ensure they are legally protected. This includes patents, trademarks, copyrights, and trade secrets. Early engagement with an IP attorney can help secure your assets before the due diligence process begins.

Challenge 3: Operational Inefficiencies

Solution: For late-stage startups, operational efficiency becomes a critical review area. Conduct an internal audit of your operational processes to identify bottlenecks or inefficiencies. Implementing lean methodologies or process improvement strategies can demonstrate your commitment to operational excellence.

Challenge 4: Legal and Compliance Issues

Solution: Legal challenges can derail the due diligence process. Regularly review your company's compliance with local, national, and international laws, especially if you operate in multiple jurisdictions. Addressing any legal issues beforehand and having a compliance checklist can streamline this aspect of due diligence.

Challenge 5: Technological Scalability

Solution: Ensure your technology is built to scale from the start. Regularly review your tech stack and infrastructure for scalability and security vulnerabilities. For tech startups, having documentation that details your technology's architecture, scalability, and security measures is vital.

Challenge 6: Communication Gaps

Solution: Maintain open and transparent communication with potential investors throughout the due diligence process. Be prepared to provide detailed explanations and additional documentation promptly. Regular updates, even when unsolicited, can build trust and demonstrate your company's transparency.

Challenge 7: Valuation Discrepancies

Solution: Valuation disagreements are common. Be prepared with a solid valuation model supported by data and industry comparisons. Understand your negotiation leeway and have clear arguments for your valuation, but also be open to feedback and adjustment based on due diligence findings.

Get your expert valuation now!

Leveraging Due Diligence for Your Startup’s Advantage

The due diligence process, while rigorous and sometimes daunting, offers a unique opportunity for startups to not only secure funding but also to gain valuable insights that can drive future growth.

Here’s how you can turn due diligence into a strategic advantage:

Highlight Your Strengths

Due diligence is your chance to shine. Use this process to highlight the strengths and unique value propositions of your startup.

Whether it's your innovative technology, strong customer base, or efficient business model, make sure these highlights are front and center.

Prepare case studies, testimonials, or demos that can showcase your successes and differentiators.

Address Weaknesses Proactively

No startup is without its weaknesses or areas for improvement. Use the due diligence process as a chance to address these proactively.

By identifying and acknowledging these areas before your potential investors do, you can demonstrate transparency and a commitment to continuous improvement.

Furthermore, presenting a clear plan for addressing these weaknesses can turn potential red flags into opportunities for growth.

Use Feedback Constructively

The due diligence process can provide a wealth of feedback on your business, from operational efficiency to market strategy.

This feedback, even if critical, is invaluable. Use it to refine your business model, improve operations, and strengthen your market position.

Investors bring a wealth of experience and insights; their feedback can be a roadmap to scaling your business successfully.

Strengthen Investor Relationships

Due diligence is as much about building relationships as it is about vetting. Throughout the process, you have the opportunity to interact closely with potential investors, understand their concerns, and see what they value in a venture.

Use this time to build a strong rapport and trust.

Transparent communication and responsiveness during due diligence can lay the foundation for a strong, ongoing relationship with your investors.

Prepare for Future Rounds

The insights and improvements gained through due diligence don’t just apply to the current funding round.

They prepare you for future growth and subsequent investment rounds.

By understanding the due diligence process now, you can streamline future preparations, anticipate investor concerns, and position your startup more favorably for the next stage of growth.

Benefits of Choosing Finro as Your Startup Due Diligence Consultant

When navigating the complexities of startup due diligence, partnering with a consultant who brings not only expertise but a deep understanding of the startup landscape can make a significant difference.

Finro, led by Founder and CEO Lior Ronen, stands out as a premier choice for startups aiming to undergo a thorough due diligence process.

Here are the key benefits of engaging with Finro for your due diligence needs:

Expert Financial Analysis and Valuation

Finro offers an unparalleled depth of financial analysis and valuation services, crucial for early-stage tech startups preparing for funding rounds.

The ability to dissect and understand multifaceted financial models and deliver comprehensive due diligence and valuation reports sets Finro apart.

With a command of financial intricacies and a logical approach to valuation, Finro provides the insights needed to confidently approach potential investors.

Mastery of Startup Sector Dynamics

Understanding the global tech startup sector is paramount, and Fino's grasp of early-stage venture finance is exceptional.

This expertise ensures that your startup's unique aspects are fully understood and accurately represented in any analysis or report.

Finro's deep knowledge of the startup landscape enhances the quality of due diligence, aligning your startup's potential with investor expectations.

Efficient and Comprehensive Deliverables

Time is of the essence for startups seeking investment.

Finro's efficiency in grasping complex concepts and delivering a complete suite of due diligence documents within tight timelines is noteworthy.

From detailed reports to spreadsheets and presentations, Finro equips you with everything needed to engage effectively with investors, all within a highly impressive turnaround time.

Independent and Thorough Approach

The importance of an independent viewpoint cannot be overstated. Finro's ability to conduct due diligence independently, sourcing data from multiple avenues and applying well-considered methods, offers startups a comprehensive and unbiased assessment of their financial health and strategic positioning.

Exceptional Customer Service and Accessibility

Navigating the pre-IPO market or preparing for a seed funding round can be daunting. Finro's exceptional customer service and availability make the process smoother and more manageable. Always within budget and with a focus on providing intelligent guidance, Finro's dedication to client success is evident in every interaction.

A Trusted Partner in Your Venture Journey

Choosing Finro as your due diligence consultant means more than just getting reports; it's about partnering with a team that's committed to your success. Whether you're an early-stage startup or a fund manager,

Finro's expertise, and personalized approach make it an invaluable ally in achieving your investment goals.

Conclusion

Embarking on the due diligence process is a pivotal moment for any startup, marking a transition from conceptualization to concrete evaluation. It's a journey that tests the mettle of your venture, scrutinizing every facet, from financial health to strategic viability.

Yet, within this rigorous examination lies a golden opportunity to refine your business, attract investment, and pave the way for sustainable growth.

For early-stage startups, due diligence is a chance to demonstrate potential and vision, showcasing the innovation and market fit that set you apart.

For those further along, it's about proving your worth, showing not just what you've achieved but how much further you can go.

Regardless of your startup's stage, due diligence offers invaluable insights and feedback, shaping your venture into one that's not just appealing to investors but resilient in the face of future challenges.

Choosing a partner like Finro for your due diligence needs amplifies these benefits, bringing expertise, insight, and a comprehensive understanding of the startup ecosystem to the table. With Finro, you're not just preparing documentation; you're gaining a strategic advisor dedicated to your success, ready to illuminate the path to your funding goals with clarity and confidence.

As you stand on the precipice of this demanding yet rewarding phase, remember that due diligence is more than a hurdle to clear; it's a step towards realizing your startup's full potential.

Embrace the process, leverage the insights, and let the journey refine your vision.

The path to investment is paved with challenges, but with preparation, partnership, and perseverance, your startup can navigate this terrain and emerge stronger, ready to capture the opportunities that lie ahead.

Key Takeaways

Due diligence is crucial for startups at any stage to secure investment and assess business viability.

Preparation involves organizing financials, legal documents, and operational data.

Early-stage focuses on potential and innovation; late-stage emphasizes financial health and market position.

Expert consultants like Finro offer invaluable due diligence support and insights.

Proactive weakness addressing and investor feedback utilization are key to success.

Answers to The Most Asked Questions

-

The due diligence process in startups involves a thorough examination by potential investors of the startup's financials, legal documents, operational data, and technological infrastructure to assess the business's viability, scalability, and potential for growth.

-

The VC due diligence process is similar in essence but may involve more in-depth analysis, focusing on financial health, market position, team evaluation, and the startup's potential for significant returns on investment. This process helps VCs decide on the risk and potential of investing in a startup.

-

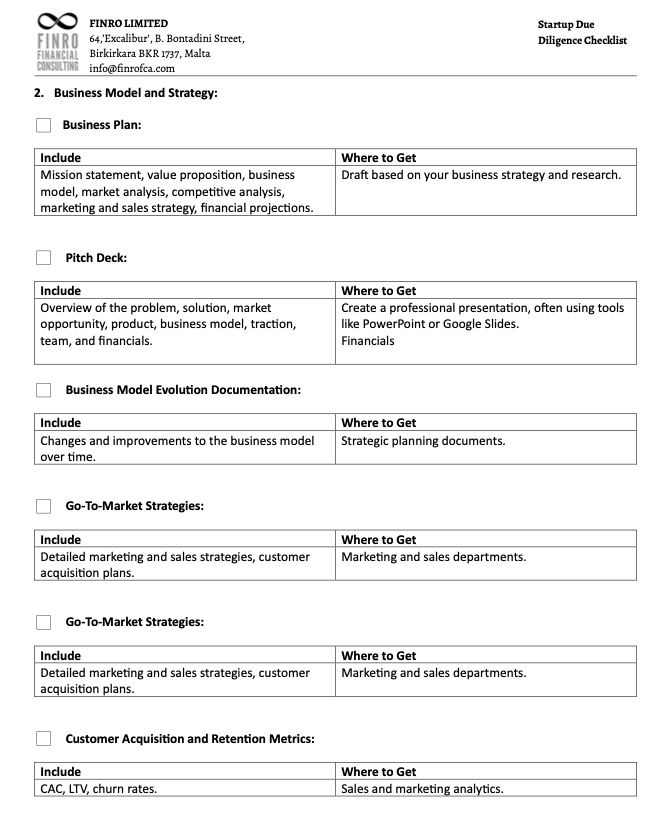

A due diligence checklist is a comprehensive list of documents and information that startups need to prepare for review by potential investors. It typically includes financial statements, business plans, legal documents, operational data, and technological documentation, among other items.

-

Conducting due diligence on a startup involves reviewing its financial records, legal compliance, market viability, operational efficiency, and technological capabilities. It requires a systematic approach to assess the startup's overall health and prospects, often using a due diligence checklist as a guide.

-

Assessing an early-stage startup focuses on the team's background and capabilities, the innovation and scalability of the idea, market validation, and initial customer traction. Financial scrutiny is more about future projections than past performance due to the lack of extensive financial history.

-

In an early-stage startup, look for a compelling vision, a clear and scalable business model, evidence of market need and customer interest, a strong and capable founding team, and initial signs of traction or validation in the market. Additionally, assess the startup's legal structure and intellectual property strategy.