Pre-seed to Series B: Understanding the Different Stages of Startup Valuation

By Lior_Ronen | Founder, Finro Financial Consulting

Determining the valuation of a startup is a complex process that merges both art and science.

As startups transition through various fundraising stages—from pre-seed to Series B—the dynamics of valuation undergo significant shifts.

It's crucial for early-stage startups aiming to secure capital to comprehend these nuanced changes in valuation at each stage.

Such understanding is the key to obtaining the right level of investment and fostering favorable conditions.

This comprehensive guide delves into the distinctive features, valuation techniques, and pivotal elements present at each fundraising stage.

Our objective is to empower founders with the essential knowledge and tactics to maximize their startup's valuation.

This knowledge base can pave the way for enduring success and foster robust relationships with investors.

Pre-seed Valuation

Pre-seed marks the earliest stage of a startup's journey. It's characterized by idea validation, initial product development, and market research.

The core objective at this stage is to secure enough funding to create a minimum viable product (MVP) and establish proof of concept.

Most startups at this stage have little to no revenue, and their product or service may not be fully functional.

Valuation methods for pre-seed startups lean heavily on qualitative factors, given the lack of financial and operational data. Some startups may offer revenue projections that can serve as a valuation basis.

Three widely utilized approaches to pre-seed valuation include:

Scorecard Method: This method compares the startup with other early-stage companies within the same industry. Predefined criteria such as the management team, market size, and product innovation are employed. Each factor is weighted, and the weighted average score sets the startup's relative valuation.

Berkus Method: Angel investor Dave Berkus developed this method, which assigns a monetary value to five critical success factors: a sound idea, a prototype, the management team, strategic relationships, and product rollout or sales. The combined value of these factors represents the startup's pre-money valuation.

Revenue Multiple: For startups with revenue projections, a revenue multiple can estimate valuation. It involves multiplying the projected revenue by an industry-specific multiple. Using revenue multiples at the pre-seed stage requires cautious interpretation as revenue projections can be speculative.

Importance of Qualitative Factors In The Pre-Seed Stage

In the absence of concrete financials, qualitative factors significantly influence pre-seed valuation. Investors closely examine the founding team's experience, expertise, and commitment as these aspects can sway the startup's valuation.

A competent team assures investors of effective vision execution and problem-solving skills.

Market opportunity also plays a pivotal role. Startups targeting sizable, growing markets attract investors due to the potential for impressive returns on investment.

Additionally, the startup's product or service's innovative nature is essential for its valuation.

Unique, disruptive, and scalable solutions have the potential to command larger market shares and, consequently, higher valuations.

Finally, the competitive landscape impacts the valuation process. Startups with a clear competitive advantage or a unique offering appeal to investors, reducing perceived risks and projecting growth potential.

Optimizing the Pre-Seed Valuation

To enhance valuation at the pre-seed stage, founders should adopt key strategies. Firstly, forming a competent founding team with diverse skills and relevant experience is vital.

Secondly, validating the market with comprehensive research and a clear target audience can illustrate growth and revenue generation potential.

Developing a persuasive pitch is equally crucial. Founders need to craft a clear, concise, and captivating narrative highlighting the problem their startup resolves, their proposed solution, the market opportunity, and their competitive edge.

Demonstrating market interest and potential through customer feedback, early users, or industry recognition can significantly impact valuation.

Networking with potential investors is also instrumental in securing funding.

Early engagement and feedback from investors not only increase financing likelihood but also refine the startup's approach and strategy. Employing these tactics can set pre-seed startups on a successful trajectory and attract investors at favorable valuations.

| Valuation Method | Basis of Valuation | Ease of Application | Accuracy | Best Used When |

|---|---|---|---|---|

| Scorecard Method | Mostly qualitative factors, such as the quality of the management team, market size, and product innovation. | Medium: Requires comparison to other companies and subjective assessment of different criteria. | Moderate: Largely dependent on the accuracy of the qualitative assessments. | Company is in a very early stage with no reliable financial data, but operates in an industry with enough comparable startups. |

| Berkus Method | Mix of qualitative and quantitative factors, including soundness of the idea, prototype, management team, strategic relationships, and product rollout or sales. | Easy: Assigns set monetary values to each of five elements. | Low to Moderate: Highly dependent on the quality of the elements and the subjective valuation assigned to them. | Startup has more than just an idea, but may not have steady revenue streams yet. |

| Revenue Multiple | Quantitative: Uses projected revenue. | Hard: Requires reasonably accurate revenue projections. | High: If revenue projections are accurate, this method can provide a more concrete valuation. | Company has dependable revenue projections and operates in an industry with established revenue multiples. |

Seed Stage Valuation

The seed stage represents the next phase in a startup's life cycle, following the pre-seed stage. At this point, startups typically have a minimum viable product (MVP) and may have begun generating revenue.

The primary goal for seed-stage startups is to secure funding for product development, market expansion, and scaling operations. Investors at this stage often include angel investors, venture capital firms, and early-stage startup accelerators.

In the seed stage, valuation methods can incorporate both qualitative factors and quantitative data, such as revenue or user growth.

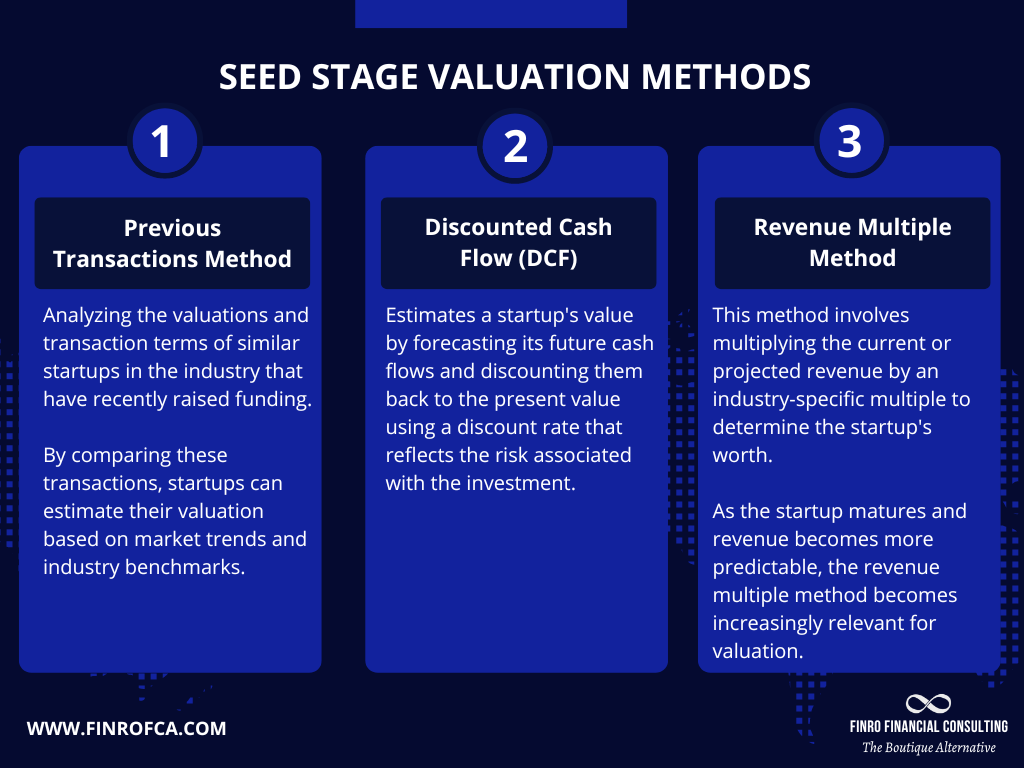

Three popular approaches for seed-stage valuation include:

Previous Transactions Method: This method involves analyzing the valuations and transaction terms of similar startups in the industry that have recently raised funding. By comparing these transactions, startups can estimate their valuation based on market trends and industry benchmarks.

Discounted Cash Flow (DCF): The DCF method estimates a startup's value by forecasting its future cash flows and discounting them back to the present value using a discount rate that reflects the risk associated with the investment. While DCF analysis can be more challenging for early-stage startups due to the uncertainty of future cash flows, it can still provide a useful valuation estimate when combined with other methods.

Revenue Multiple: A revenue multiple can be used to estimate valuation for startups based on their actual or projected revenues. This method involves multiplying the current or projected revenue by an industry-specific multiple to determine the startup's worth. As the startup matures and revenue becomes more predictable, the revenue multiple method becomes increasingly relevant for valuation.

Importance of Traction and Growth Metrics in the Seed Stage

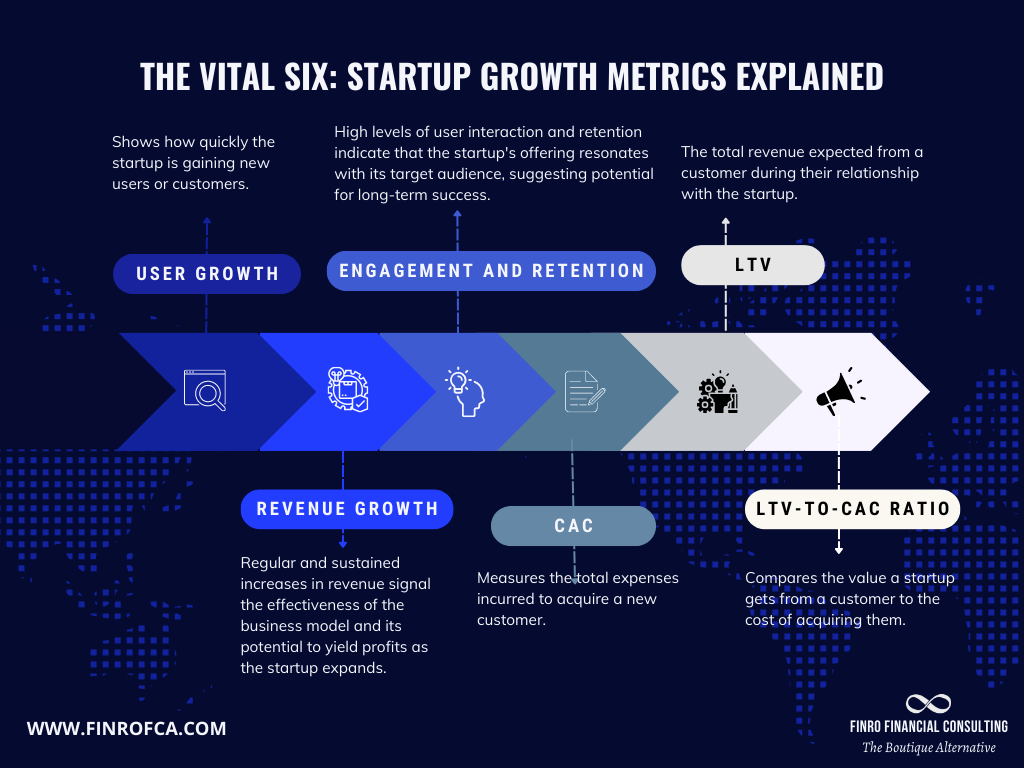

Traction and growth metrics play a crucial role in seed-stage valuation, providing investors with tangible evidence of a startup's progress and market potential. Key metrics that investors consider at this stage include:

User growth: The rate at which a startup acquires new users, or customers can indicate the effectiveness of its marketing efforts and the appeal of its product or service.

Revenue growth: Consistent and sustainable revenue growth is a strong signal of a viable business model, indicating that the startup can generate profits as it scales.

Engagement and retention: High user engagement and retention rates demonstrate that a startup's product or service is resonating with its target audience and has the potential for long-term success.

Customer acquisition cost (CAC): CAC is the total cost of acquiring a new customer, including marketing, sales, and other related expenses. A low CAC indicates that a startup can efficiently attract new customers, vital for growth and profitability.

Customer lifetime value (LTV): LTV represents the total revenue a startup can expect to generate from a customer over the duration of their relationship. A high LTV suggests that a startup's product or service has long-term value and can contribute to sustainable revenue growth.

LTV-to-CAC ratio: A favorable LTV-to-CAC ratio indicates that a startup's customer acquisition strategy is cost-effective and sustainable. A proportion greater than 3:1 is generally considered desirable, as it shows that the value generated from a customer is significantly greater than the cost of acquiring them, which is crucial for scaling operations and generating profits.

Optimizing the Seed Stage Valuation

Optimizing valuation at the seed stage requires a multifaceted approach that demonstrates progress, market potential, and scalability.

Founders should first focus on showcasing traction and growth by presenting key metrics highlighting the startup's positive trajectory, such as user growth, revenue growth, and engagement rates.

A refined and scalable business model is essential for conveying to investors that the startup can generate consistent revenues and profits as it grows.

Furthermore, prioritizing customer satisfaction and addressing pain points can improve user engagement, retention, and advocacy, all of which contribute to a higher valuation.

In addition, founders need to implement a cost-effective and efficient go-to-market strategy that maximizes customer lifetime value while minimizing customer acquisition costs.

Demonstrating a profitable scaling strategy is critical for attracting investors and securing favorable valuations.

Finally, maintaining strong investor relations is essential for optimizing seed-stage valuation.

Communicating regularly with investors, providing updates on key milestones and achievements, and seeking their feedback ensures ongoing support and involvement in the startup's growth.

By employing these strategies, founders can position their seed-stage startups for success and attract the right investors at favorable valuations.

Series A and Series B Valuation

Series A and B funding rounds are crucial stages in a startup's life cycle, representing the transition from early to growth stage development. At this point, startups generally have a proven business model, consistent revenue streams, and growing market share. The primary goal for Series A and Series B startups is to secure funding for scaling operations, expanding into new markets, and developing new products or services. Investors at these stages often include venture capital firms and institutional investors.

At the Series A and Series B stages, valuation methods typically rely on quantitative data, such as financial statements and growth projections. Three popular approaches for valuing growth-stage startups include:

Revenue Multiple: As mentioned above, this method involves multiplying the current or projected revenue by an industry-specific multiple to determine the startup's worth. As the startup matures and revenue becomes more predictable, the revenue multiple method becomes increasingly relevant for valuation.

Discounted Cash Flow (DCF): The DCF method estimates a startup's value by forecasting its future cash flows and discounting them back to the present value using a discount rate that reflects the risk associated with the investment. As the startup matures and its cash flows become more predictable, DCF analysis becomes increasingly relevant for valuation.

Earnings Multiple: For startups with consistent earnings, an earnings multiple can be used to estimate valuation. This method involves multiplying the startup's earnings before interest, taxes, depreciation, and amortization (EBITDA) by an industry-specific multiple to determine its worth.

Importance of financial performance and growth metrics in Series A and Series B valuation

Financial performance and growth metrics play a critical role in Series A and Series B valuations, as they provide investors with a clear understanding of the startup's progress, market potential, and scalability. Key metrics that investors consider at these stages include:

Revenue growth: Consistent and sustainable revenue growth strongly indicates a successful business model and an attractive investment opportunity.

Profitability: Positive net income or a clear path to profitability demonstrates the startup's ability to manage costs effectively and generate returns for investors.

Gross margin: A healthy gross margin indicates that a startup can generate profits from its core operations and has the potential to scale efficiently.

Customer metrics: Metrics such as customer acquisition cost, lifetime value, and churn rate provide insights into the startup's customer acquisition strategy and overall customer satisfaction.

Optimizing the Series A and Series B Valuation

Optimizing valuation at the Series A and B stages requires a well-rounded strategy emphasizing financial performance, growth potential, and scalability. Founders should focus on demonstrating consistent revenue growth, profitability, and healthy gross margins to attract investors and secure favorable valuations.

Developing a robust growth strategy that includes expanding into new markets, developing new products or services, and strategic partnerships or acquisitions is essential for showcasing the startup's potential for long-term success. Moreover, strengthening operational efficiency by streamlining internal processes, optimizing resource allocation, and investing in technology can improve scalability and contribute to higher valuations.

Founders should also prioritize engaging with the right investors, targeting those with experience in their industry or those who can provide strategic value beyond capital, such as industry connections or domain expertise. Finally, maintaining transparency and effective communication by regularly updating investors on crucial milestones, financial performance, and strategic developments is critical for building trust and fostering strong relationships.

By employing these strategies, founders can position their growth-stage startups for success, attract the right investors, and secure favorable valuations.

Summary

In conclusion, startup valuation is a crucial aspect of fundraising that can significantly impact a company's success. Valuation methods and key metrics vary by stage, with pre-seed, seed, and series A/B stages requiring different approaches to demonstrate progress and market potential.

At the pre-seed stage, qualitative factors such as the founding team, market opportunity, product innovation, and competitive landscape are essential in determining the valuation. In the seed stage, key metrics such as user growth, revenue growth, engagement and retention, CAC, LTV, and LTV-to-CAC ratio play a critical role. Finally, at the series A/B stage, revenue growth, profitability, gross margin, and customer metrics are the most essential factors in determining a startup's value.

By employing effective strategies and focusing on the appropriate metrics and valuation methods for each stage, founders can position their startups for success and attract the right investors. The table below provides a summary of the valuation methods and key metrics commonly used in each stage of startup development:

| Startup Stage | Valuation Methods | Key Metrics |

|---|---|---|

| Pre-seed | Qualitative factors such as founding team, market opportunity, product innovation, and competitive landscape | Founding team, market opportunity, product innovation, competitive landscape, user feedback, early users, industry recognition |

| Seed | Precedent transaction analysis, discounted cash flow, revenue multiple | User growth, revenue growth, engagement and retention, customer acquisition cost (CAC), customer lifetime value (LTV), LTV-to-CAC ratio |

| Series A/B | Comparable company analysis, discounted cash flow, earnings multiple | Revenue growth, profitability, gross margin, customer metrics |