Pre-Seed Funding in 2025: A Founder’s Roadmap

By Lior Ronen | Founder, Finro Financial Consulting

Pre-seed funding is a vital step for many founders. It covers everything from verifying market potential to assembling a capable team.

During 2025, competition has grown fiercer, with new investor profiles and higher expectations.

This guide offers practical insights into how pre-seed rounds typically work, how much you can raise, and what investors want before joining your journey.

You’ll also find fresh data that paints a clearer picture of early-stage fundraising today, so you can approach your first round with confidence.

Pre-seed funding is an early injection of capital that helps transform a startup from a raw idea into a tangible operation, allowing founders to validate their concept, assemble a core team, and demonstrate initial market traction. At this stage, investors typically look for small but meaningful proof points—such as a basic user base, pilot partnerships, or letters of intent—to signal viability.

Key practices for success include building a focused pitch that highlights differentiation and founder-market fit, using realistic financial projections, cultivating strong investor relationships, and handling legal matters proactively. Securing pre-seed support sets the tone for future rounds, guiding startups toward seed and Series A investments with momentum, credibility, and a strategic vision for long-term growth. A robust valuation by a specialized partner can further enhance a startup’s case, clarifying unique revenue streams and capturing untapped potential in tech-driven markets.

- The Basics: What is Pre-Seed Funding?

- The Evolving Role of Pre-Seed Funding

- Who Provides Pre-Seed Funding (and How Much) in 2025?

- The Purpose of Pre-Seed Funding in 2025

- Best Practices for Raising Pre-Seed in 2025

- Building a Compelling Pre-Seed Pitch

- Financial Modeling & Valuation

- Networking & Relationship Building

- Legal and Compliance Considerations

- From Pre-Seed to Seed and Beyond

- Why Early-Stage Startups Should Choose Finro for Pre-Revenue Valuation?

- Conclusion

- Key Takeaways

- Answers to The Most Asked Questions

The Basics: What is Pre-Seed Funding?

This section covers key details about pre-seed capital and the differences between pre-seed and seed rounds.

Founders usually view pre-seed as a vital milestone because it signals the moment external parties decide to back a concept or prototype.

A solid understanding of this step can help when preparing for larger checks later.

Definition & Purpose

Pre-seed funding is usually the earliest external financing that a young venture might secure. During this phase, founders present enough of a product concept to convince investors that an idea is worth supporting.

Unlike bootstrapping or relying on friends and family, pre-seed often involves seasoned angels or micro-VCs who request initial proof of demand.

This round typically covers costs linked to product feasibility tests, pilot runs, and early user engagement.

By 2025, an idea alone rarely meets investor standards. Instead, backers tend to look for proof of genuine progress—such as a demo or a small user group that validates potential.

Another key purpose of pre-seed capital is to set the tone for how a founder will pitch future rounds. Early funds can support the setup of basic infrastructure and team building.

That groundwork positions a startup to approach later investors with more than just an idea or deck.

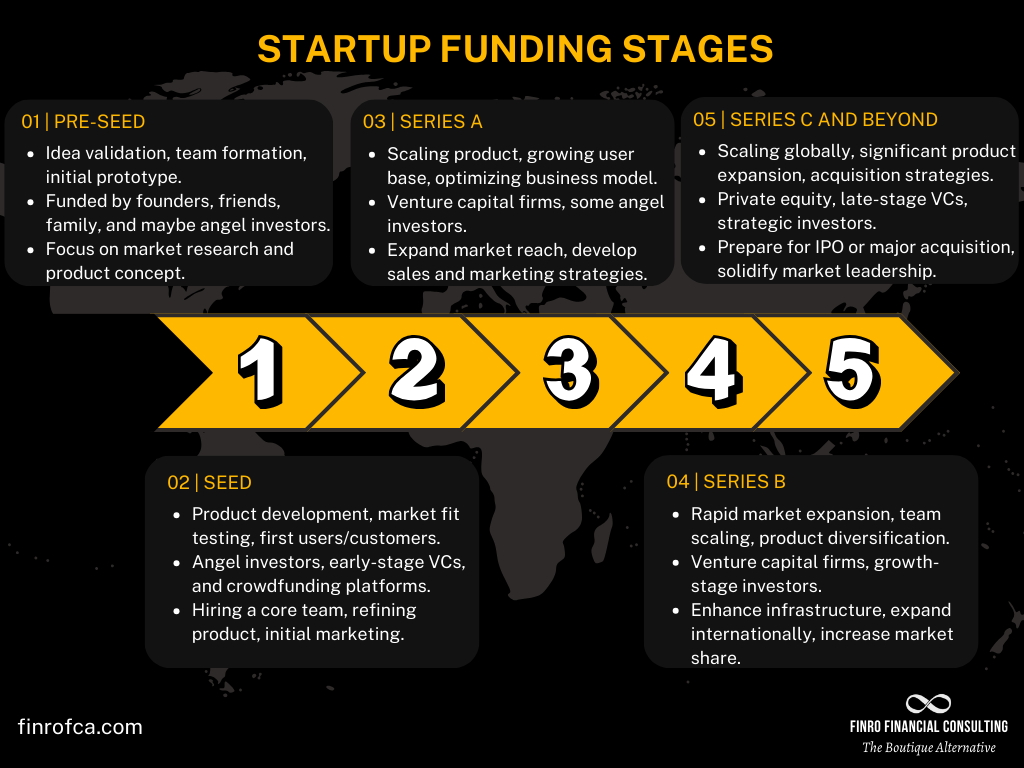

Pre-Seed vs. Seed Funding in 2025

Pre-seed and seed both occur before a company truly scales, but seed typically comes after some traction has been established. Founders chasing a seed round often showcase a core product or revenue stream.

That means pre-seed sets the stage by enabling startups to confirm product-market fit on a modest budget.

By 2025, seed check sizes have grown, with many startups raising amounts closer to $1M–$3M or more. Valuations also reflect higher expectations around progress and market validation.

A founder seeking seed capital may need a recognizable customer base, partnerships, or clear user engagement data.

Below is a brief table comparing these two stages:

| Aspect | Pre-Seed | Seed |

|---|---|---|

| Typical Check Sizes | $150K–$1M | $1M–$3M+ |

| Valuation Ranges | $2M–$5M | $5M–$10M (sometimes higher) |

| Investor Profiles | Individual angels, micro-VCs, incubators | Larger seed funds, accelerators, some micro-VCs |

| Evidence Required | Demo, pilot feedback, small user tests | Validated product-market fit, user or revenue growth |

Seed investors aim to see measurable outcomes that suggest a solid path forward.

Pre-seed, on the other hand, revolves around laying a solid foundation.

If a startup can demonstrate successful use of pre-seed resources, it is better positioned to secure the next round on more favorable terms.

The Evolving Role of Pre-Seed Funding

We’ve highlighted how pre-seed capital underpins a startup’s earliest milestones and compared it to other early-stage rounds.

Now, it’s worth examining how the pre-seed phase has evolved into a more dynamic and multifaceted component of the startup journey.

Rather than simply serving as a financial stepping stone, pre-seed now plays a pivotal role in shaping strategy, validating market interest, and forging valuable investor partnerships.

From Concept to MVP

Emerging technologies such as AI-assisted coding and no-code platforms have significantly shortened the time needed to build a market-ready prototype.

Founders can now create demos or pilot features in a matter of weeks, which was not as feasible just a few years ago.

This rapid development cycle allows new ventures to gather feedback and iterate before committing larger resources to a fully built solution.

Investors in 2025 have taken notice and set higher expectations for what founders can accomplish with minimal resources.

“Proof of hustle” is a term you’ll often hear among angels and micro-VCs—it refers to tangible evidence of market validation, such as waitlists, pilot partnerships, or beta tests with real users.

These data points signal to investors that founders are resourceful and actively engaged with their target audiences.

There’s also a broader shift underway: pre-seed capital is no longer just about turning ideas into prototypes—it’s about refining a startup’s initial alignment with its market.

Gathering user feedback or running small-scale trials can outweigh an otherwise polished pitch deck by demonstrating that the founders are proactive, informed, and adaptable in a competitive environment.

Strategic Value Beyond Capital

Pre-seed funding often comes from angel investors, micro-VC firms, and accelerators, many of which provide more than money.

Some investors play mentoring roles, helping guide product decisions or secure early customer deals, while others connect founders to specialized advisors. Such hands-on involvement can be pivotal for entrepreneurs seeking guidance on everything from branding to building an efficient tech stack.

With the market brimming with new entrants, forming relationships with value-adding investors offers a real edge.

A well-connected angel might facilitate an introduction to a talented design expert, or an accelerator could refine your go-to-market strategy through workshops. This collaborative approach frequently propels ventures forward as they work toward product-market fit.

In a world where many fundraising avenues exist, the expertise and support an investor brings can set them apart.

A strong partner helps streamline decisions, shortens learning curves, and shapes how your startup will operate once it begins to scale. Working closely with such allies also increases credibility during your next fundraising round, where you’ll need to show not only that your product has merit, but that you’ve built a robust support system around it.

With these evolving roles in mind, let’s look at who typically provides pre-seed funding today, as well as how much founders can expect to raise during this critical phase.

Who Provides Pre-Seed Funding (and How Much) in 2025?

We’ve discussed how pre-seed funding goes beyond just writing a check, offering strategic value and hands-on support.

At this point, it helps to know who actually provides this early capital and what founders can expect in terms of deal sizes.

Types of Pre-Seed Investors

Angel investors and syndicates still play a central role by combining their resources to fund bigger checks than an individual might handle alone.

They often include former founders or industry veterans who can offer mentorship, making angel capital an attractive choice for startups that value close guidance.

Over the last few years, these groups have become more organized, with well-structured processes for screening and selecting deals.

Micro-VC and rolling funds have risen sharply since 2020, allowing smaller firms to focus on niche markets or emerging technology.

These funds often bring specialized knowledge, and they may be more willing to experiment with groundbreaking concepts. Incubators and accelerators, on the other hand, have evolved into comprehensive programs that offer stipends, access to expert mentors, and sometimes follow-on checks.

Crowdfunding platforms round out the options for founders who prefer tapping a broader community; both equity and reward-based models have become more mainstream for those seeking a less traditional route.

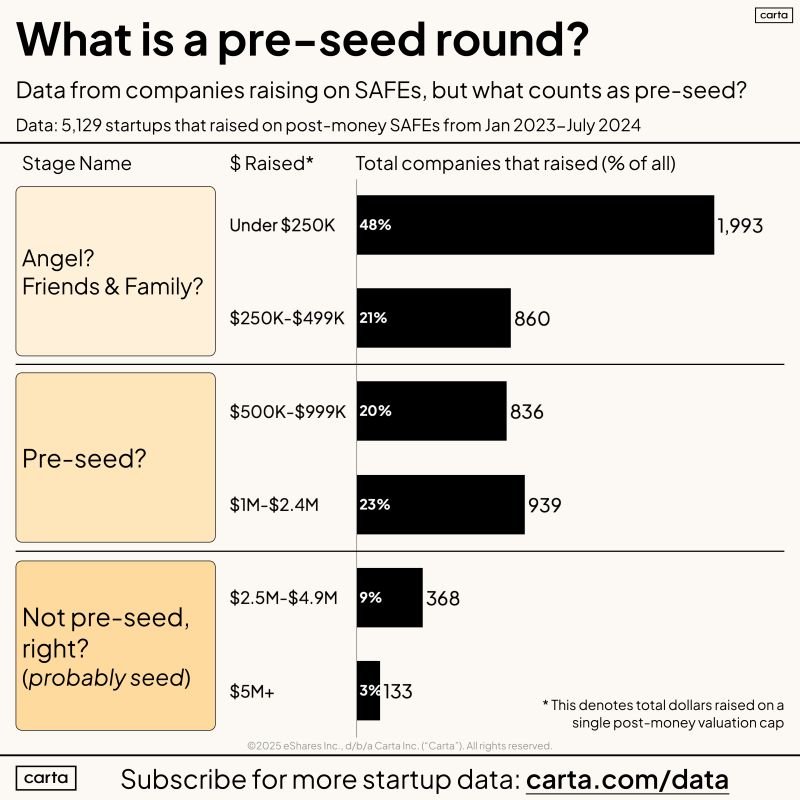

Typical Check Sizes & Valuations

Pre-seed deals in 2025 commonly range from $150k up to $1M, though some outliers go beyond that. These amounts vary based on geography—major tech hubs tend to feature larger checks and higher valuations. In emerging markets, investors might be more conservative with pre-seed capital but can bring vital local market insights.

Valuations usually sit around $2M–$5M at this stage, although a standout prototype or significant user traction can push the number higher. In terms of deal structure, SAFE notes and convertible notes remain common, providing flexibility until a startup’s valuation becomes clearer. New funding instruments also pop up every year, so it’s wise to explore the options that best align with your goals and timeline.

Now that we’ve covered who typically invests at this stage and how big the checks can get, let’s look at some new data points that reveal deeper insights about the pre-seed market.

The Purpose of Pre-Seed Funding in 2025

Now that we’ve explored who typically invests at the pre-seed stage and the range of available funding, it’s worth looking at why this early capital matters so much.

By 2025, pre-seed isn’t just about building a prototype—it’s a strategic boost that helps founders validate market needs, recruit specialized talent, and refine their approach.

In this section, we’ll break down three core areas where pre-seed funding can have a major impact on a startup’s progress.

Idea Validation & Early Traction

Pre-seed capital no longer revolves solely around building an MVP. Investors often expect founders to show initial user engagement, pilot data, or letters of intent from potential customers.

Demonstrating this early proof of traction offers a competitive advantage and boosts credibility during follow-on rounds. Gaining even a small base of enthusiastic users or securing a partnership deal can carry more weight than slide decks alone.

Successful founders typically use pre-seed resources to run pilot programs or gather real-world feedback. These steps help pinpoint market needs and reinforce the startup’s readiness for larger investments.

Team Formation & Operational Setup

Competition for specialized talent is intense, especially for roles involving AI, data science, and other cutting-edge fields. Pre-seed funding can help cover the higher costs associated with bringing in skilled professionals who can shape core product features.

Beyond technical hires, building a strong leadership bench early on allows the business to navigate hurdles more effectively as it grows.

Operational setup—such as legal structures, workspace, and essential tech tools—also falls under this stage. Taking care of these basics puts a startup on more stable ground before heading into future funding rounds. It’s about laying the right foundation so that the team can focus on growth rather than administrative bottlenecks.

Market Research & Positioning

By 2025, advanced market analytics tools have become more accessible. Founders can leverage data-driven insights to identify target audiences, test new features, and optimize user experience.

Pre-seed budgets often go toward subscriptions, surveys, or focus groups that provide a clearer picture of where the startup’s product stands in a competitive landscape.

Fine-tuning go-to-market strategies is another priority. Whether it’s defining brand identity, refining messaging, or exploring which distribution channels resonate most, early funds help sharpen a startup’s positioning. These efforts lay the groundwork for a smoother transition into the seed stage, where investors and customers alike want to see how well the product meets real-world needs.

Best Practices for Raising Pre-Seed in 2025

By now, you’ve seen how critical pre-seed funding is for laying a startup’s foundation—covering everything from idea validation to team formation.

But actually securing this early capital can feel daunting.

In 2025, investors are increasingly selective, expecting real proof of concept, responsible financial planning, active networking, and solid legal groundwork. Each of these factors can tilt the odds in your favor or make you miss out on funding opportunities entirely.

In the subsections that follow, you’ll find practical guidance on shaping a pitch that showcases genuine traction, using financial models to demonstrate credibility, building relationships that open doors, and covering the legal bases so your startup is ready for the next level.

Together, these best practices reflect what investors look for in a modern, pre-seed-ready startup—one that can turn ambitious plans into concrete results.

Building a Compelling Pre-Seed Pitch

A strong pitch deck does more than just describe your product—it gives investors a glimpse of your team’s competence, your market understanding, and your long-term vision.

When done right, it can be the difference between a cursory glance from potential backers and a serious invitation to discuss further.

At the pre-seed stage, many founders underestimate how crucial storytelling and evidence of momentum are in swaying an investor’s decision.

This is where elements like early user feedback, letters of intent, and clear differentiation come into play. Your ability to convey these points cohesively sets the tone for whether investors see a promising opportunity or just another idea on paper.

The points below highlight practical actions you can take to craft a pitch that resonates.

Emphasize Tangible Progress: Show actual user metrics, pilot test results, or confirmed orders. These data points reassure investors that you’ve done more than brainstorm.

Highlight Competitive Advantages: Make it obvious why your solution is different. Whether it’s technology, a unique feature, or an unserved market segment, underscore what sets you apart.

Incorporate Engaging Visuals: Short demos, product screenshots, or a quick video tour can liven up a slide deck and keep your audience focused.

Showcase Founder-Market Alignment: If your background, skills, or network match the market you’re tackling, make this clear. It builds trust that you can deliver on your plans.

Financial Modeling & Valuation

At pre-seed, many startups either avoid financial detail altogether or swing to the other extreme with hyper-optimistic projections.

While it’s natural to paint a rosy picture, savvy investors see through inflated numbers.

They look for evidence of careful planning, realistic targets, and an understanding of how funding will be deployed. This balance between ambition and realism is central to building confidence in your startup.

By constructing a transparent financial model and keeping valuations grounded in actual milestones, you signal that you’re a responsible steward of capital.

The points below guide you toward presenting numbers and assumptions in a way that resonates with investors—without undermining your credibility.

Focus on Clarity Over Complexity: A well-structured spreadsheet or an intuitive platform can convey key data without overwhelming your audience. Investors should grasp your financial picture in minutes.

Base Projections on Real Data: Whenever possible, use actual market research, early sales/engagement stats, or pilot user responses to shape revenue forecasts.

Demonstrate Funding Allocation: Show how each portion of the requested investment will be used, whether it’s hiring, product development, or go-to-market efforts.

Plan for Flexibility: Acknowledge that the market can shift. Build in contingency budgets or scenario-based forecasts to show you’re prepared for changes.

Networking & Relationship Building

Securing early-stage capital often hinges on who you know as much as what you know. Even the most polished pitch can fall flat if it never lands in the right hands.

That’s why networking and community engagement are more than just buzzwords—they are essential strategies for discovering opportunities and building rapport with potential investors long before you ask for a check.

Genuine connections can speed up your fundraising timeline, provide valuable feedback, and unlock resources you didn’t know existed.

By consistently engaging and offering updates on your progress, you create a pipeline of potential backers who are familiar with your story.

Below are some action items to help you approach networking in a way that’s authentic and productive.

Seek Out Online Founder Hubs: Specialized Slack channels, LinkedIn groups, or Discord servers can connect you with peers and mentors who’ve already been through the pre-seed process.

Participate in Local/Virtual Pitch Events: These gatherings offer direct investor exposure, plus immediate feedback on your approach—win or lose.

Foster Long-Term Relationships: Touch base with prospective investors periodically. Share noteworthy product or team milestones to keep them informed and interested.

Aim for Quality Introductions: Warm referrals from trusted sources carry more weight. If you’re in an accelerator or have a mentor, ask for intros to relevant investors.

Legal and Compliance Considerations

At the pre-seed stage, excitement about the product or service can overshadow basic but essential legal questions.

Investors want to know that your startup has a solid foundation from a regulatory perspective, so you avoid costly issues that could surface down the road.

Clear legal documentation, well-defined equity structures, and compliance with data or fundraising rules all play a part in building investor confidence.

By addressing these aspects early, you show you’re serious about running a legitimate operation.

You also set yourself up for a smoother due diligence process when you raise subsequent rounds. Here are a few areas to prioritize:

Stay Current on Funding Instruments: SAFE notes, convertible notes, or other early-stage vehicles each have pros and cons. Choose the one that aligns with your startup’s risk profile and needs.

Consult Startup-Savvy Attorneys: Specialized legal advice can prevent pitfalls around equity splits, intellectual property, or complex compliance rules, especially if you plan to operate globally.

Prepare Basic Documents: Have essential paperwork (e.g., founder agreements, employee contracts) in order before bringing in outside capital. This signals maturity and foresight.

Manage Data Privacy Early: If your product handles user data, outline how you collect, store, and protect that information. Investors will appreciate a straightforward plan to mitigate risk.

From Pre-Seed to Seed and Beyond

Securing pre-seed funding is a major milestone, but it’s only the beginning of a longer journey toward sustainable growth. As you move from pre-seed to seed, the expectations around product-market fit, revenue metrics, and team maturity increase significantly.

At the same time, how you handle this transitional phase will affect your eventual path to Series A and beyond.

Below, we explore the milestones that can unlock your next round and examine the strategic steps that position you for bigger institutional investments.

Key Milestones to Unlock the Next Round

Many startups see the transition from pre-seed to seed as a chance to prove that their concept can scale. While a compelling idea or prototype might have secured your initial funding, seed investors tend to look for evidence of a viable, repeatable business model.

This involves demonstrating strong market traction, refining revenue streams, and maintaining open, consistent communication with existing and potential backers.

Hitting these milestones shows that you’re not just riding on early hype—you’re building a product or service that real customers are willing to pay for. Investors also value founders who keep them in the loop, sharing progress updates and strategic plans on a regular basis.

Beyond building confidence, this habit can encourage fruitful conversations around potential partnerships or pilot opportunities.

Product-Market Validation: Use data from early adopters or pilot programs to prove that there’s genuine demand for your offering.

Revenue Targets & User Growth: Show you’re moving from idea to revenue. Even minimal revenue can be a powerful signal that customers see value in your solution.

Consistent Progress Updates: Maintain investor trust with transparent reporting, metrics, and milestones. Frequent communication can help secure follow-on funding when the timing is right.

Positioning for Series A Success

While the seed round helps you establish a stable market presence, Series A is where you demonstrate the ability to scale.

By laying a strong foundation during pre-seed and seed, you’re more likely to attract larger venture capital firms who want evidence that you can grow into a category-defining company. This involves not only scaling the product but also strengthening your network of strategic partners and early pilot customers.

Partnerships can validate your market position by aligning you with established brands or organizations in your industry. Pilot customers, especially in B2B contexts, provide real-world feedback that helps fine-tune your product before a wider rollout.

Taken together, these elements lend credibility to your vision and demonstrate to Series A investors that you’re ready for a larger capital infusion.

Strong Pre-Seed & Seed Execution: Show a track record of using funds wisely, hitting key milestones, and refining both your product and business model.

Strategic Partnerships: Collaborations with recognized players in your sector can lend weight to your market credibility, opening up distribution or technology-sharing opportunities.

Early Pilot Customers: Validate your solution with initial customers who can provide testimonials and real-world data. This proof goes a long way in attracting bigger checks.

With a clear focus on these milestones and partnerships, you’ll be in a strong position to scale your operations and attract more substantial investments in the future.

Why Early-Stage Startups Should Choose Finro for Pre-Revenue Valuation?

Traditional valuation methods can feel like using a sledgehammer to crack a nut—overly complicated, time-consuming, and often misaligned with the nuanced reality of early-stage tech startups.

Founders commonly face skyrocketing costs, drawn-out timelines, and results that overlook crucial factors like unique revenue models or nascent market opportunities.

In a fast-moving world where getting your numbers quickly and accurately can be the difference between securing vital investment or missing the window, these methods leave many startups feeling drained.

Finro offers a more focused, startup-friendly alternative. Rather than squeezing every company into a rigid framework, Finro looks at the specific elements that define a pre-revenue tech business.

By providing cost-effective solutions, rapid turnaround times, and valuations grounded in real tech-sector knowledge, Finro ensures founders get not only a precise figure but also a partner genuinely invested in their growth trajectory.

Below are the key reasons why early-stage founders turn to Finro to develop a compelling pre-revenue valuation:

Precision for Tech Models: Finro digs into the unique aspects of your business—like specialized revenue streams, niche markets, and innovative technologies—so your valuation reflects true potential rather than generic benchmarks.

Streamlined and Flexible Process: Stuck in limbo for months waiting on outdated valuation methods? Finro’s rapid turnaround times keep you moving forward. You’ll have accurate figures when you need them, without sacrificing depth or detail.

Cost-Effective Services: Valuations shouldn’t sink your runway. Finro offers competitively priced packages that fit early-stage budgets, allowing you to invest more resources back into product development and growth.

Personalized Attention: Founders often feel overlooked in big valuation firms. Finro’s approach is hands-on and collaborative, ensuring open communication and tailored guidance every step of the way.

Focused on Growth Trajectory: Beyond crunching numbers, Finro provides strategic insights that help you map out your path to market dominance. It’s valuation as a tool for growth, not a box to tick.

By partnering with Finro, pre-revenue startups gain more than a single data point—they gain a strategic ally.

Through a combination of thorough financial analysis, sector-specific expertise, and an empathetic understanding of startup challenges, Finro delivers a valuation that truly supports your next steps.

This isn’t just about numbers; it’s about propelling your venture toward sustainable success.

Conclusion

Pre-seed funding can be the decisive factor that turns a promising concept into a thriving startup. From crafting a compelling pitch deck to securing specialized valuations, every move in these early stages sets the tone for future growth.

Founders who understand the nuances of pre-seed financing, prioritize realistic financial models, and build strong investor relationships are better positioned to reach meaningful milestones—and ultimately secure that all-important seed or Series A round.

In this journey, choosing the right partners can make all the difference.

Finro offers early-stage startups more than just an accurate valuation—it provides a supportive, tech-focused approach designed to capture each venture’s unique potential.

That blend of sector expertise, cost-effective services, and rapid turnaround times ensures you get actionable insights right when you need them. By aligning with a trusted advisor like Finro and following proven best practices, founders can enter the next stage of their startup’s evolution with confidence, clarity, and a compelling vision for long-term success.

Key Takeaways

Early Pre-Seed Validates Concepts: Securing an early pre-seed round helps verify your idea’s feasibility, allowing founders to gather concrete evidence before seeking larger funding.

Pitch Traction and Differentiation: Crafting a compelling pitch with proven traction, unique positioning, and strong founder-market alignment convinces investors of your startup’s growth potential.

Realistic Financials Build Trust: Presenting credible forecasts and conservative valuations demonstrates fiscal responsibility, strongly reassuring investors that resources will be prudently and effectively deployed.

Compliance Ensures Smooth Funding: Maintaining legal compliance, robust data protection measures, and transparent documentation prevents funding delays and strengthens investor confidence during crucial negotiations.

Specialized Valuations Reveal Potential: Leveraging customized valuation approaches for pre-revenue tech startups highlights unique models and opportunities, ultimately attracting strategic partnerships and essential investments.

Answers to The Most Asked Questions

-

Pre-seed funding is an early capital injection that helps founders test ideas, build prototypes, and demonstrate initial traction before moving on to larger investment rounds.

-

Focus on a compelling story, demonstrate tangible traction or proof-of-concept, and highlight founder-market fit, realistic financials, and clearly defined differentiators to resonate with early-stage investors.

-

Leverage your network, attend pitch competitions, join specialized forums, and seek warm introductions to angel investors, micro-VCs, or incubators open to early-stage tech opportunities.

-

Pre-seed rounds often range from $150K to $1M, though amounts vary based on industry type, location, and investor preferences.

-

Combine comparable market data, credible financial modeling, and sector-specific expertise to truly capture unique revenue streams, innovation, and growth potential accurately.