Aeron Sullivan

Founder and CEO, Pangea.io

By Lior Ronen | Founder, Finro Financial Consulting

Aeron, the founder and CEO of Pangea.io, an early-stage fintech startup with a mission to revolutionize business FX management, reached out with an urgent challenge:

“I have a VC who is unexpectedly interested in investing, and I need a more sophisticated financial model ASAP.”

The very day, we jumped on a call.

Aeron quickly briefed me on Pangea's products, roadmap, go-to-market plan, and funding status. At this stage, the company had no revenues and minimal financial data, yet a strong vision for product development, market penetration, and growth plans was evident.

This meant building the financial model from the ground up, including transaction volumes for each client tier, pricing structures, client acquisition costs, and system development expenses.

Despite these challenges, Pangea's clear vision was instrumental in crafting the business's revenue forecast. The project's complexity lay in detailing numerous assumptions across client tiers, understanding transaction volume trends, and accurately capturing variable and fixed costs on a monthly and annual basis.

Effectively coordinating these aspects in a user-friendly model was crucial to our success.

Faced with these unique challenges and confident in the power of Finro’s financial modeling services, I was energized to dive into the project, leveraging our expertise to deliver a comprehensive financial model that not only met but exceeded Aeron's expectations.

Aeron Sullivan

Founder and CEO, Pangea.io

What can I say? Is there a better financial modeling expert for startups than Lior? I doubt it.

Lior is fast, precise, fastidious, and intuitively understands the stage startups are in and what they need in a financial model. I would hire Lior for any FP&A role any day.

I have absolute confidence if you use him for consultant services in the financial space you will not be disappointed.

Now that we've gained a general understanding of Pangea.io's business, roadmap, and business model, we were poised to dissect the business into manageable components and their drivers.

Revenues, particularly for early-stage fintech startups like Pangea, stand as the cornerstone of their viability.

Recognizing this, our initial focus was on crafting a meticulous revenue projection that encapsulates the entire client journey, from first contact to conversion.

This work process was deliberately designed to ensure that investors gain a deep understanding of the business, comprehend the drivers behind its growth, and engage in meaningful discussions about its potential.

By aligning our financial model closely with the company's growth drivers and customer acquisition strategies, we aimed not just to present numbers, but to facilitate quality business discussions between Pangea and its potential investors.

This approach underscores the model's role as a vital tool for communication and strategic planning, enabling investors to see the vision and operational strategy of the startup through a clear, financial lens.

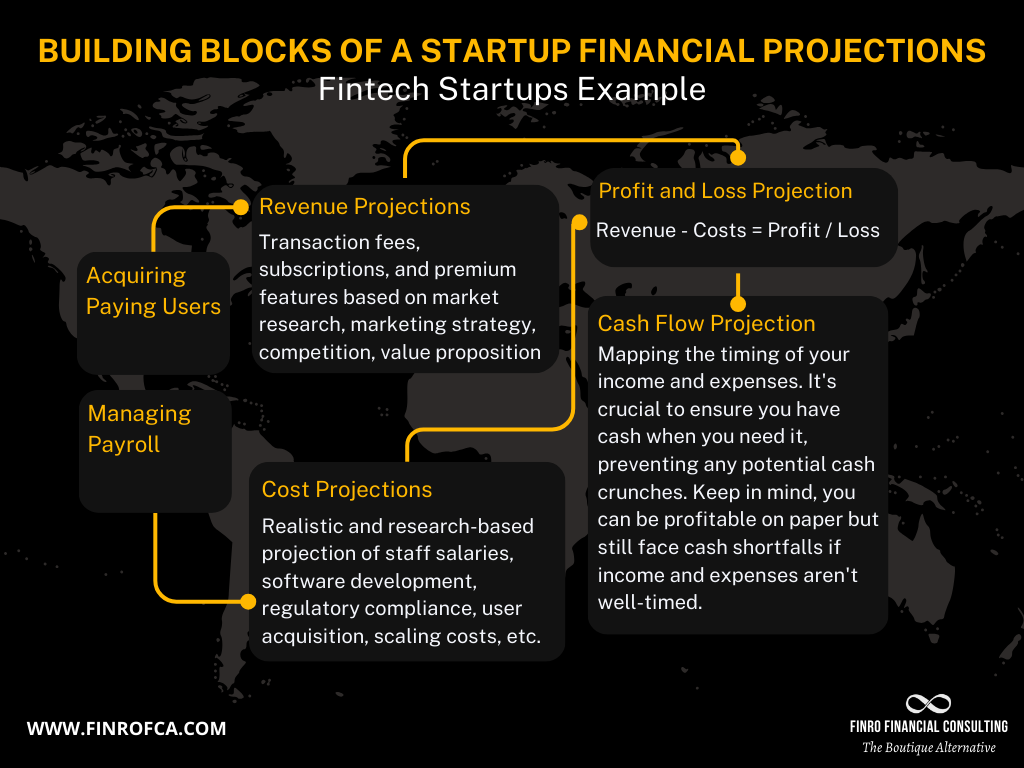

We broke down the revenue modeling into four critical steps:

Understanding the client acquisition process was paramount.

For B2B fintech startups, this journey often begins with digital marketing efforts and progresses through a series of engagements—from initial outreach and demo presentations to negotiations and deal closure. Identifying and navigating these stages laid the groundwork for our financial model.

Next, we pinpointed relevant marketing channels for acquiring B2B clients needing an FX management solution.

Allocating marketing budgets effectively across these channels and client tiers was a strategic endeavor, ensuring that each dollar spent could be traced back to client acquisition.

With a clear view of the client tiers, our attention turned to transaction volumes. We developed assumptions on monthly and annual transaction fluctuations, linking these to our client base projections.

This step was crucial for moving closer to an accurate revenue calculation.

The culmination of our revenue projection involved applying transaction fees. This final step translated the anticipated transaction volumes into tangible revenue figures, completing the puzzle of Pangea's financial future.

Throughout this process, a key objective was maintaining a balance between complexity and user-friendliness.

We designed the model to allow for manual adjustments to critical assumptions, ensuring Pangea could adapt the model for future scenarios with ease. This flexibility empowered Aeron to explore various financial outcomes independently.

Having established a robust revenue model, our next section will delve into crafting the cost projections, rounding out our comprehensive financial overview for Pangea.io.

After establishing detailed revenue projections, we turned our attention to the cost components of Pangea's financial model, critical for understanding the full financial landscape.

Given that staffing is a primary expenditure for fintech startups like Pangea, our initial focus was on forecasting payroll.

We identified essential roles across various departments—product development, quantitative finance, sales, and more—and calculated costs including salaries, benefits, and taxes.

A key challenge was aligning the growth of core and support roles, ensuring a balanced team expansion to support product development and operational needs.

Similarly, we anticipated the need for additional staff in response to new product releases or expansions, ensuring our model reflected the dynamic nature of Pangea’s growth.

Beyond payroll, we meticulously accounted for non-payroll expenses.

Marketing costs were broken down and aligned with our revenue projection assumptions, while general and administrative expenses, such as legal and rent, were comprehensively listed.

We also covered direct operational costs like AWS and transaction processing fees, crucial for fintech operations.

By integrating these detailed cost projections with our revenue forecasts, we set the stage for constructing an income statement and cash flow projections.

This comprehensive approach not only showcases Pangea’s financial viability but also strategically aligns cost management with business growth, laying a foundation for informed decision-making and investor discussions.

With the forecasted revenues, headcount, payroll, and non-payroll expenses now meticulously compiled, we constructed the income statement (also known as the profit and loss statement) and the cash flow projection for Pangea.

These documents are vital for illustrating a complete financial narrative of the company.

Building the Income Statement: Our approach was twofold. Initially, we developed a detailed income statement, breaking down sales by each revenue stream and categorizing every expense, ensuring transparency and comprehensive accounting of Pangea's financial activities.

We complemented this with a summarized income statement, offering a quick snapshot of critical financial metrics—revenues, cost of revenues, gross margin, and more—to provide a high-level overview of Pangea’s financial health.

Crafting the Cash Flow Statement: We then detailed Pangea’s cash flow, highlighting the impact of operations, investing, and financing activities, and incorporating fundraising assumptions to paint a full picture of the company's financial liquidity and capital needs.

Key Performance Indicators (KPIs): To further refine our financial analysis, we integrated essential KPIs—annual average revenue per client, client acquisition cost (CAC), customer lifetime value (LTV), retention/churn rate, LTV to CAC ratio, and revenue to acquisition cost ratio. These metrics are crucial for evaluating Pangea’s performance and strategic positioning.

This comprehensive approach, emphasizing both detailed and summarized financial statements, along with an in-depth cash flow analysis, equips Pangea with the precise tools to identify funding requirements and strategic uses of capital.

The clarity and insight provided by these financial projections and KPIs are invaluable for strategic planning, decision-making, and fostering transparent, effective communication with potential investors.

In this case study, we went on a comprehensive journey to develop a sophisticated financial model for Pangea.io, an early-stage fintech startup aiming to revolutionize business FX management.

Faced with the urgent need to attract potential VC investment, we collaborated closely with Pangea's founder, Aeron, to craft a financial model that not only met but exceeded expectations.

Our process began with constructing detailed revenue projections, grounded in a deep understanding of Pangea’s client acquisition process, marketing strategies, and transaction volumes.

This meticulous approach allowed us to capture the essence of Pangea’s revenue-generating capabilities, ensuring a solid foundation for the financial model.

Moving forward, we tackled the cost projections, focusing on payroll and non-payroll expenses to provide a comprehensive view of Pangea’s financial operations.

By aligning the growth of core and support roles with the expansion of Pangea's product offerings, we ensured the financial model reflected the dynamic nature of the startup's growth trajectory.

The culmination of our efforts was the creation of an income statement and cash flow projection, complemented by a set of key performance indicators (KPIs).

These documents and metrics provided Pangea with a clear financial narrative, highlighting the startup’s funding needs, operational efficiencies, and strategic financial health.

Our dual focus on detailed accounting and summarized financial insights equipped Pangea with the tools for precise strategic planning and effective communication with investors.

Ultimately, this financial modeling project not only demonstrated our ability to navigate complex financial landscapes but also solidified Pangea’s position as a viable investment opportunity.

The model's flexibility and depth of insight enabled Pangea to engage in quality business discussions with investors, laying the groundwork for future growth and success.

Finro collaborates closely with startups to develop sophisticated financial models tailored to their unique business needs and growth strategies.

By integrating detailed revenue and cost projections, Finro enables startups to precisely forecast financial performance and strategically plan for the future.

Finro's financial models include key performance indicators (KPIs) like CAC, LTV, and retention rates, providing startups with vital metrics for evaluating performance and strategic positioning.

The comprehensive financial narratives crafted by Finro not only showcase a startup's viability as an investment opportunity but also equip founders with essential tools for informed decision-making and effective investor communications.

Finro's approach emphasizes flexibility and user-friendliness, allowing startups to easily adjust critical assumptions and explore various financial outcomes, fostering independence in strategic financial analysis.

Financial modeling for a startup involves understanding the business model, breaking down revenue drivers, calculating key metrics like CAC and LTV, and forecasting revenues and costs. It's essential to consider both direct and indirect costs and to make the model flexible for various scenarios .

To forecast financials in a startup, start by analyzing current financial data, market trends, and business goals. Break down revenue streams, assess costs (including payroll and operational expenses), and incorporate key performance indicators. Continuously monitor and adjust the model based on performance and market changes.

A fintech financial model is a detailed representation of a fintech startup's financial performance, including projections of revenues, costs, and key financial metrics specific to the fintech industry, such as transaction volumes, fees, and client acquisition costs. It helps in strategizing for growth, managing finances effectively, and communicating with potential investors.