Down Rounds Aren't the End of the World for Startups

By Lior Ronen | Founder, Finro Financial Consulting

Down rounds might seem like bad news, but they can actually help a business survive.

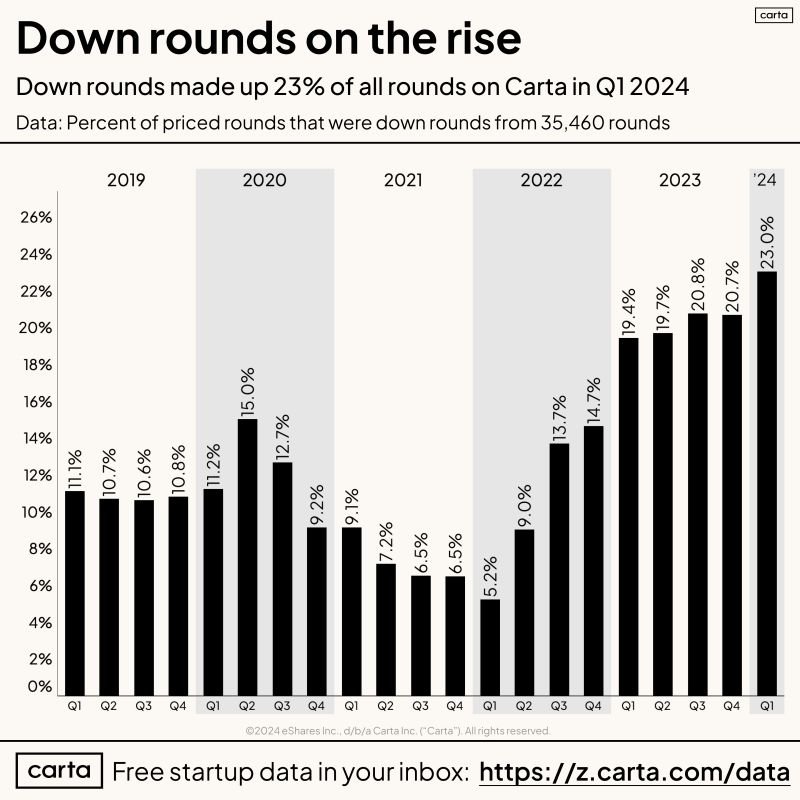

In 2023, a lot of startups in the U.S. had to close - 761 of them, which is 62% more than in 2022. At the same time, more startups were getting less money than they hoped for in their funding rounds, from the very early stages all the way to the more advanced stages. This shows us that the whole environment for startup funding is changing.

In this article, we're going to look at how down rounds can be useful.

They can make you rethink your business, align your goals with what's actually happening in the market, and help you attract new investors.

We'll see how facing the tough parts of a down round can lead to better things for your startup in the long run.

In 2023, the startup landscape grappled with an uptick in down rounds and an increase in shutdowns, signaling a shift towards a more challenging funding environment. Down rounds, often seen as a setback, emerged as a strategic alternative to closure, offering startups a reality check and an opportunity to realign their valuations with market conditions.

They opened doors to new investors, catalyzed vital cost-management strategies, and set the stage for sustainable growth. Despite the potential downsides, such as dilution of ownership and impact on morale, down rounds could pave the way for future success by enforcing financial discipline and resetting goals to meet the demands of an evolving economic landscape.

Understanding Down Rounds

A down round occurs when a startup raises capital at a lower valuation than in its previous funding round. Unlike typical funding rounds where startups aim to increase their valuation, a down round indicates a decrease in the company's market value.

To understand why down rounds occur, it's helpful to look at them through the lens of economic cycles. The economy goes through phases, much like seasons.

During a booming economy, startups often find it easier to attract higher valuations - this is the growth or 'summer' phase.

However, when the economy slows down or contracts, we enter a contraction or 'winter' phase.

In these periods, investors become more cautious, funding becomes scarcer, and startups might face challenges in maintaining or increasing their valuation.

From a macroeconomic perspective, an increase in down rounds is often a sign of such a contraction in the economy.

It reflects a broader trend of cooling in the startup funding environment, where capital is not as freely available, and investors reassess their risk tolerance.

From a business perspective, down rounds can happen for several reasons:

Performance Issues: If a startup's performance falls short of expectations, investors might value it lower in subsequent funding rounds.

Market Dynamics: Changes in market conditions, such as increased competition or reduced demand for the startup's product, can lead to a lower valuation.

Overvaluation in Previous Rounds: Sometimes, a startup might have been overvalued in earlier rounds. A down round then corrects this overvaluation to align with more realistic market conditions.

Broader Economic Factors: Economic downturns, changes in industry regulations, or shifts in investor sentiment can all influence a startup's valuation negatively.

Understanding these factors helps contextualize why down rounds occur and their implications for startups navigating through different phases of the economic cycle.

Get your expert support now!

The Harsh Reality of Down Rounds and Rising Shutdowns

In 2023, startups faced a tough climate, with down rounds becoming a more frequent occurrence across all funding stages, from Seed to Series E. This trend was accompanied by a significant rise in the number of startups shutting down, marking a stark contrast to previous years.

The data paints a clear picture: down rounds were no longer rare events but a new normal for many. Back in 2021, only 6% of Series A funding rounds were down rounds. Fast forward to 2023, and that figure tripled to 16%. And it wasn't just the early stages feeling the pinch; later stages saw even bigger jumps, with Series D down rounds soaring from 13% to an alarming 31%.

Simultaneously, the startup ecosystem was shrinking in terms of active players. The number of startups going under each year had been relatively stable, but in 2023, the shutdowns surged to 761, a drastic increase from the previous year’s 467. This rise in shutdowns, along with the spike in down rounds, suggests that more startups were struggling to sustain their business growth or even keep the lights on.

Together, these trends reflect a challenging period for startups, where securing funding became harder and survival was far from guaranteed.

The Silver Lining of Down Rounds

Down rounds aren't the end of the world for startups. In fact, they can open up a range of positive outcomes.

Firstly, opting for a down round can be a much better route than having to shut down the business. It's a tough decision, but it keeps the startup game alive and provides a chance to fight another day.

Secondly, down rounds act as a wake-up call. They highlight when a startup's valuation doesn't match up with its actual performance or the state of the market. This reality check can be the push needed to realign the business strategy with the economic environment and customer expectations.

Then there's the investor angle. A lower valuation can actually be more appealing to new investors who were previously put off by high numbers. This could open the door to fresh funding and partnerships that were not accessible before.

Down rounds also bring about tough but necessary conversations about spending. They force startups to scrutinize their expenses and streamline operations, which can lead to a more sustainable business model in the long run.

Lastly, if a startup can navigate through a down round and hit key milestones afterward, it sets the stage for a successful future funding round at a higher valuation. Meeting these milestones post-down round can demonstrate resilience and the potential for growth, making the startup a more attractive investment.

In short, down rounds can be the catalyst for a startup to pivot, adapt, and potentially emerge stronger and more focused on success.

Financial Repercussions of a Down Round

A down round is a crossroads for a startup, where the influx of capital comes with a trade-off in the company's valuation and ownership structure. When new shares are issued at a lower price, the immediate consequence is dilution. Founders and early investors see their ownership percentage shrink, directly affecting their potential financial returns.

This shift doesn't just affect the balance sheet; it also sends ripples through the startup's image. A down round can be perceived as a distress signal, potentially dampening team morale and clouding the company's market reputation.

With new money comes new influence. The latest investors may command more control, shifting the company's internal dynamics and possibly introducing more stringent terms. Existing investors are faced with a choice: inject more funds to defend their stake or accept their reduced influence.

For the workforce, particularly those with stock options, a down round can be disheartening as their shares' worth declines, possibly hampering efforts to retain and attract talent.

Strategically, the startup may need to recalibrate its growth trajectory. Less capital might mean postponing or scaling down expansion plans, requiring a return to the drawing board to craft a viable path forward.

Investors in a down round often seek to cushion their risk with protective measures, such as higher liquidation preferences, ensuring they recoup their investment before others in the event of a sale or liquidation.

A down round also necessitates a revaluation of the company, setting a precedent for future funding efforts. Any previous anti-dilution provisions can trigger further share allocations to prior investors, compounding the dilution effect.

If not managed with foresight, the consequences of a down round can lead to a self-perpetuating downturn, where each compromise erodes the company's stability and appeal for future investments.

To counterbalance these financial intricacies, startups must establish realistic and attainable financial milestones that resonate with the revised valuation, ensuring a focused and sustainable approach to growth and recovery in the post-down round landscape.

Conclusion

As we’ve seen, down rounds bring a mix of challenges and opportunities. They aren't a dead end, but a detour on the startup journey—a detour that requires careful navigation. They prompt a reassessment of value and strategy, a realignment with market realities, and open doors to new partnerships. They also demand a startup to tighten its belt, focusing on sustainable growth and operational efficiency.

While they may initially appear as setbacks, down rounds can serve as pivotal turning points. They foster resilience and adaptability, qualities essential for any business poised to thrive in the ever-fluctuating economic landscape. For startups that can successfully leverage the lessons and opportunities that down rounds offer, the path forward may lead to a more solid and realistic foundation for future success.

In embracing the full picture of down rounds, startups can find the silver lining, using it to refine their vision, operations, and perhaps most importantly, their understanding of success in the complex world of business.