Do We Need Pre-Seed Startup Valuation?

By Lior Ronen | Founder, Finro Financial Consulting

Valuing a pre-seed or early-stage startup presents a unique challenge.

Without extensive financial histories or established market positions, these ventures defy traditional valuation methods.

Yet, this critical step is pivotal for founders poised to secure investment and propel their companies forward.

At the intersection of potential and proven value, startup valuation is a dynamic process. It demands an approach that acknowledges the intricacies of innovation and investor expectations.

For those ready to navigate this journey, the valuation is more than a figure—it's a strategic foothold that can attract funding and shape the future of a budding business.

Navigating startup valuation and funding is akin to charting a course through uncertain waters, where understanding both the speculative nature of early-stage ventures and the tangible metrics of growth is crucial. Entrepreneurs seek partnerships with investors who offer more than capital—those who provide mentorship, industry insights, and a shared vision for the future. From angel investors enthusiastic about nascent ideas to venture capitalists focused on scaling established businesses, matching the startup's stage with the investor's profile is key.

Qualitative and quantitative valuation methods—from the Berkus Method to Discounted Cash Flow analysis—offer varied lenses through which to view a startup's potential. As startups progress from initial valuation to funding, strategic negotiations set the stage for sustainable growth, with each funding round building towards future opportunities and challenges.

This journey underscores the importance of strategic alignment, clear communication, and a shared commitment to turning visionary ideas into reality.

- Understanding Your Investment Options

- Current Trends in Early-Stage Startup Valuations

- Decoding Valuation at the Pre-Seed Stage

- Valuation Instruments for Early-Stage Funding

- Valuation Methods For The Pre-Seed Stage

- Practical Insights into Valuation Methods

- Making the Right Choice: Investor and Funding Fit

- The Journey Ahead: From Valuation to Funding

- Benefits of Finro's Startup Valuation Services

- Conclusion

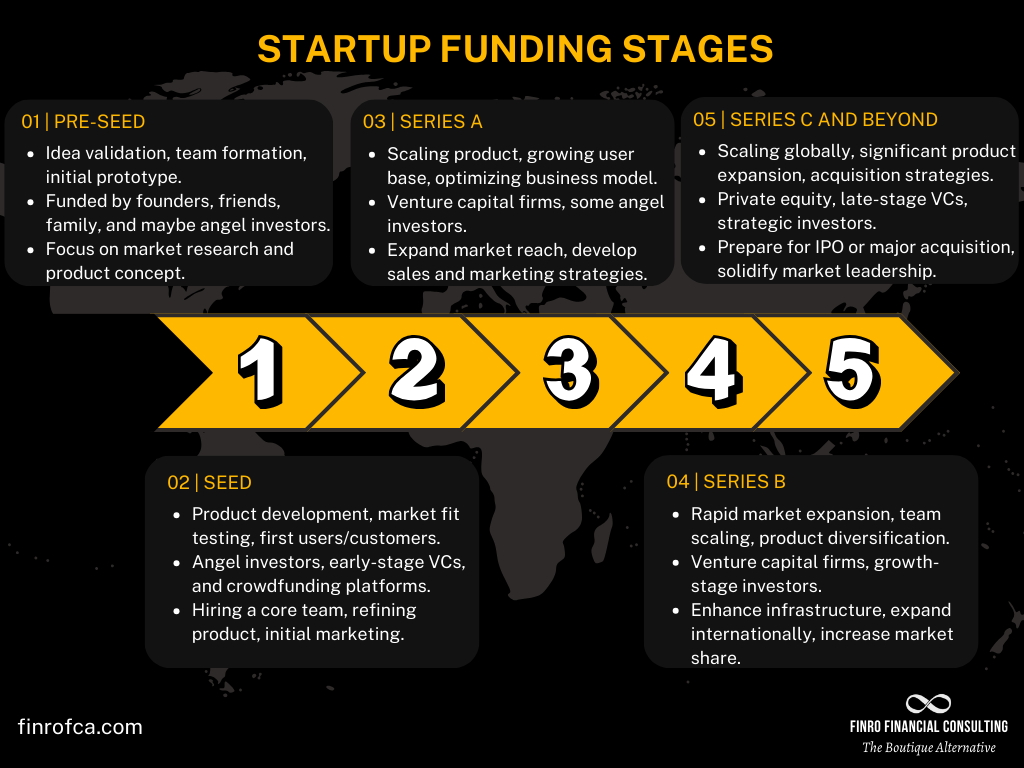

Understanding Your Investment Options

When you're ready to fuel your startup's journey with some serious capital, the landscape is full of potential backers, each with their own style and substance.

Think of it as a matchmaking scenario: you're looking for the right investor whose appetite for risk, involvement, and industry preference aligns with where your business is headed.

Angel Investors: These are the mavericks of the investment world. They're usually on the lookout for the next promising venture where they can make their mark. Angel investors typically aren't afraid to roll the dice on a fresh idea. More than just writing a check, they're known to get their hands dirty, offering mentorship and sharing their hard-earned wisdom to help startups steer clear of the icebergs.

Early-Stage VCs: This group likes to play the long game. They bring to the table not just funds but also a strategic playbook. With a keen eye for potential, early-stage VCs often hedge their bets on startups that have passed the ‘just an idea’ phase and are beginning to make waves. They're the wind behind your sails when you’ve got proof that your idea floats and you're ready to sail closer to the commercial shores.

Seed & Pre-Seed VCs: Think of these investors as the gardeners in the startup ecosystem—they specialize in nurturing the seeds of innovation. If your startup is at the dawn of its journey, these are the folks who specialize in the 'what could be,' often focusing on specific sectors where they foresee a growth spurt. Their backing often means you can start testing the waters and validate that your business can indeed swim.

Late-Stage VCs and Private Equity Funds: Now these are the big leagues. When your startup is more like a ship than a boat, late-stage VCs and private equity funds come aboard. They're usually less inclined to gamble and look for more established companies that have proven they can weather storms. They come with the promise of significant investments and typically less hands-on involvement, opting to let the seasoned crew navigate as they keep an eye on the horizon.

Choosing the right investor from this diverse pool is more art than science. It’s about finding someone who gets your vision and has the right resources and expertise to amplify it. After all, the right partner not only fuels your venture but also charts a course for its success.

| Investor Type | Risk Appetite | Involvement Level | Focus Stage | Industry Preference | Investment Style |

|---|---|---|---|---|---|

| Angel Investors | High | Hands-on | Earliest stages | Broad | Mentorship & Capital |

| Early-Stage VCs | Moderate to High | Strategic & Financial | Post-idea, early traction | Broad with potential focus | Long-term & Growth-driven |

| Seed & Pre-Seed VCs | High | Strategic Support | Pre-product/market validation | Sector-specific | Nurturing & Sector-specific Investment |

| Late-Stage VCs & PE Funds | Moderate to Low | Financial | Established, scaling companies | Less industry-specific | Significant Capital with Less Involvement |

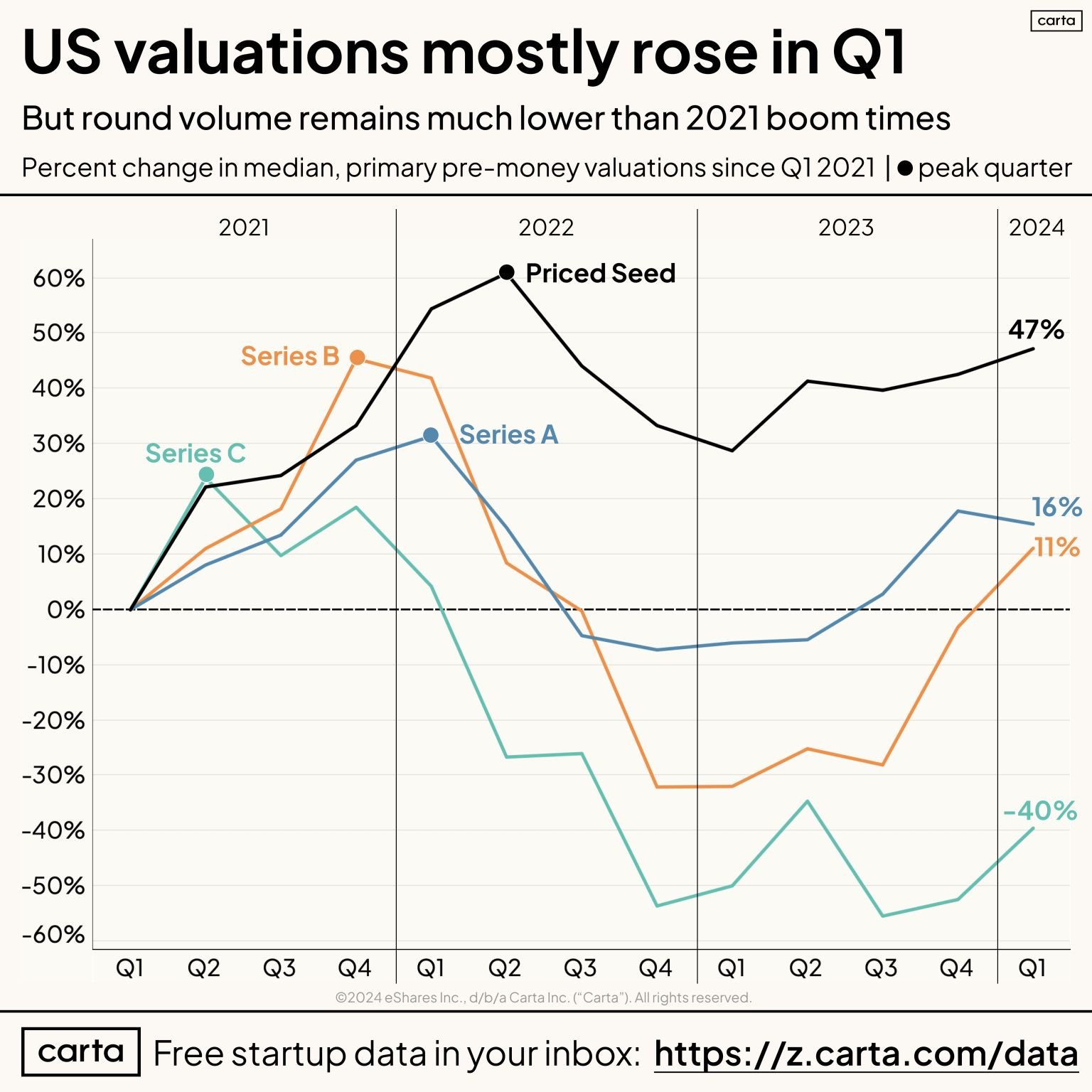

Current Trends in Early-Stage Startup Valuations

Let's talk numbers and trends — what's the word on the street for startups looking to get valued and funded in the first quarter of 2024?

Having a handle on the latest data isn't just good for trivia night; it's essential for understanding where you might stand in the eyes of those with the capital.

The recent figures are in, and they’re telling a story of cautious optimism and strategic betting.

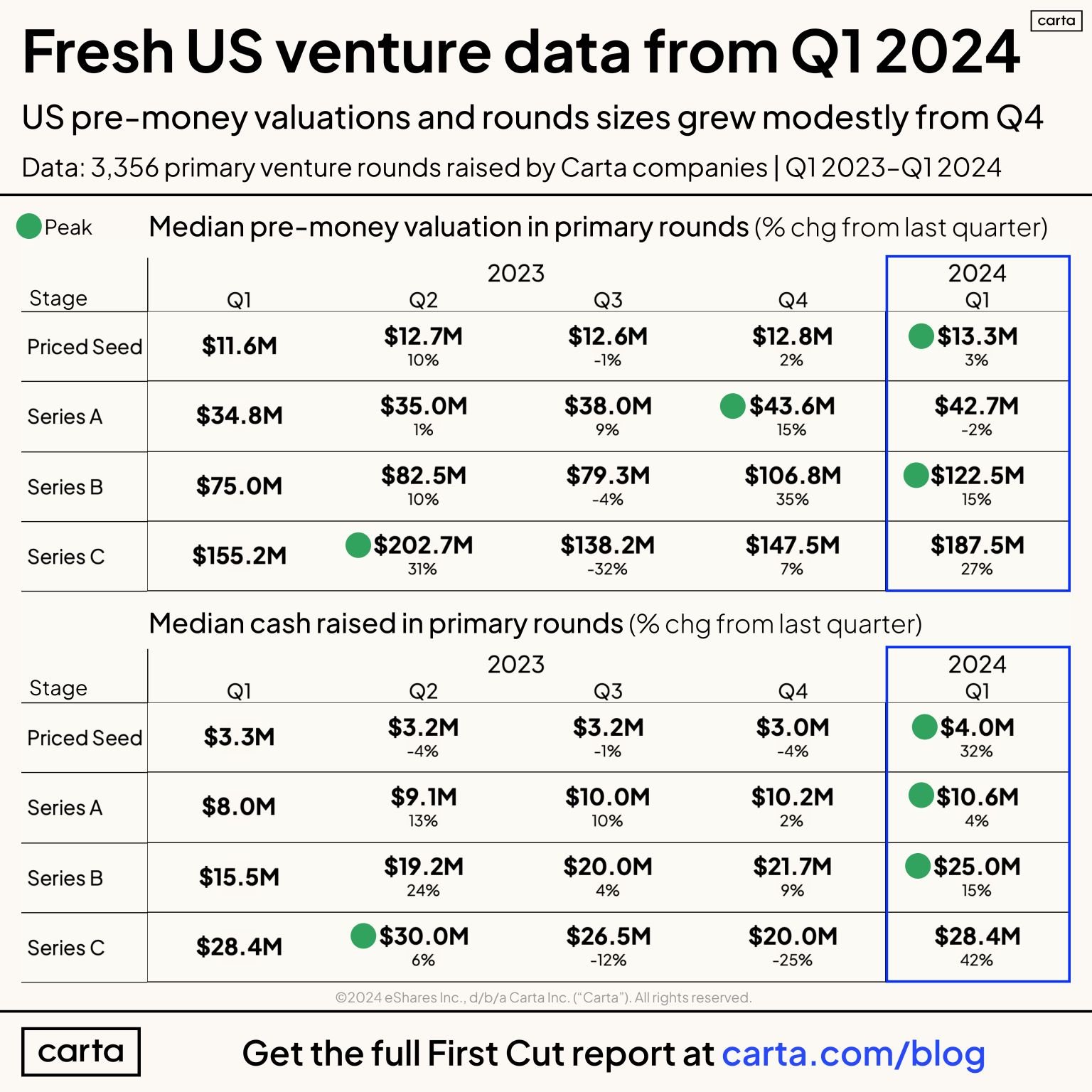

Priced Seed Rounds have seen their median pre-money valuations inch up to $13.3 million. That's a modest 3% increase from the last quarter of 2023. It's like the early-stage startups are the new cool kids on the block — investors are willing to pay a little extra for the potential they're packing.

Moving up the funding ladder, Series A rounds are playing it cool with a slight 2% dip, resting at $42.7 million. Not a nosedive, but it does signal that investors might be scrutinizing the 'growth' story a bit more closely before they take out their checkbooks.

Series B is where the confidence seems to be booming, with valuations jumping a notable 15% to $122.5 million. It's as if investors are saying, "You've come this far, let’s see how much further you can go."

And as for Series C, valuations are soaring with a 27% increase to $187.5 million. It's clear that for startups that have proven they've got what it takes, investors are more than willing to fuel their journey into the big leagues.

But what about the actual cash changing hands? Seed rounds are flourishing, with median cash raises growing a substantial 32% to $4.0 million. It's like investors are not just betting on the seeds; they're generously watering them too.

Series A and B are keeping pace, with cash raises gently climbing 4% across the board. It seems that once a startup has shown it can walk, investors are keen to see if it can run.

Now, these numbers aren't just standalone stats; they tell us about the shifting sands of the investment climate.

While the tide has certainly come down from the high-water mark of the 2021 boom, there’s a growing wave of support for startups at both ends of the spectrum — from the early promise of seed-stage ventures to the more established, scale-ready enterprises.

What does this all mean for you, the startup mavericks?

Well, it’s a green light for those at the starting line and a booster for those picking up the pace. And for the investors?

It's about placing informed bets on horses that not only have the legs but also the stamina for the long race ahead.

Decoding Valuation at the Pre-Seed Stage

When it comes to the pre-seed stage of a startup, valuation often feels like trying to hit a moving target in the fog.

At this early phase, you're working with potentially more than performance, which introduces a unique set of challenges and considerations.

Looking to the Future

Valuation at this stage is less about what a startup has done and more about what it promises to achieve. Investors are essentially buying a vision of the future, making early-stage valuation a highly speculative endeavor.

It's a blend of faith in the founding team's ability, the innovation's potential market impact, and the scalability of the business model. This speculative nature requires founders to paint a compelling picture of the future, one that's believable and grounded in as much evidence as is available at such an early stage.

Thinking About Dilution

A key concern for both founders and early investors is equity dilution. Early investments are typically smaller, but they buy larger portions of the company because the risk is higher and the valuation is lower.

As more rounds of funding are secured, the original shares become diluted. This dilution isn't inherently bad—it's a natural part of growing and financing a company.

However, it's crucial for founders to consider how much of their company they're willing to give up early on and to understand how future funding rounds will affect their ownership stake.

Dealing with the Legalities

The legal complexities surrounding pre-seed funding shouldn't be underestimated. While the sums of money involved may be relatively modest, the legal groundwork laid during these early stages is foundational.

Agreements made now can have long-term impacts on governance, future fundraising, and exit strategies. From SAFE agreements to convertible notes, each legal instrument comes with its own set of implications for valuation, dilution, and investor rights. Navigating these legal waters wisely requires careful planning, often with the assistance of legal professionals who specialize in startup financing.

In essence, pre-seed valuation is about striking a balance between ambition and realism, between giving away enough equity to fund growth while retaining enough to stay motivated. It's about understanding the long game, foreseeing how decisions made today will play out in the potentially volatile future of a startup's lifecycle.

For founders, mastering this balance is part of the art of startup growth, and for investors, it's about spotting the potential for significant returns amidst the uncertainty.

Get your expert valuation now!

Valuation Instruments for Early-Stage Funding

Navigating the waters of early-stage funding involves choosing the right financial instruments that align with both the startup's growth trajectory and the investors' risk tolerance. Among the myriad of options, SAFE agreements and convertible debt instruments stand out for their prevalent use and distinct approaches to early-stage financing.

SAFE Agreements

SAFEs are Simple Agreements for Future Equity. These are relatively new but increasingly popular tools designed to streamline the investment process.

The beauty of a SAFE lies in its simplicity and focus on future equity. Rather than dealing with immediate equity distribution or loan repayments, SAFEs allow investors to convert their investments into equity at later financing rounds, typically at a discount.

This arrangement benefits startups by providing the necessary funds without the immediate burden of valuation or diluting ownership too early.

For investors, it represents an opportunity to support a startup's initial growth while securing a place for potential future gains.

Convertible Debt Agreements

On the more traditional side of the spectrum, convertible debt has been a long-standing favorite for early-stage funding.

This instrument is essentially a loan that can be converted into equity during a future financing round, often under more favorable terms than those offered to new investors.

The real appeal of convertible debt is its dual nature, offering startups immediate access to capital with the flexibility of conversion into equity.

However, it does come with its own complexities, such as interest rates, maturity dates, and the negotiation of conversion terms. These factors add layers of legal and financial considerations that both parties must navigate.

While both SAFE agreements and convertible debt instruments offer pathways to funding, their differences underscore the importance of aligning investment terms with the startup's stage, strategy, and financial health.

SAFEs often appeal to those seeking simplicity and are willing to forgo immediate valuation discussions, while convertible debt might suit those who prefer a more structured approach, albeit with the added complexities of debt.

Ultimately, the choice between these instruments can significantly shape the startup's future equity landscape and its relationship with early investors.

| Feature | SAFE Agreements | Convertible Debt |

|---|---|---|

| Nature | Financial instrument that converts into equity | Loan that converts into equity |

| Valuation Requirement | No immediate valuation required | Valuation may be deferred to conversion |

| Interest | No interest | Accrues interest until conversion |

| Maturity Date | Typically no maturity date | Has a specified maturity date |

| Conversion Trigger | Next financing round, typically | Next financing round or maturity date |

| Complexity | Simplified, with fewer terms to negotiate | More complex due to interest, maturity, etc. |

| Investor Benefit | Conversion at a discount in a future equity round | Conversion at a discount plus interest accrual |

| Legal and Financial Implications | Generally simpler and less costly | More complex due to the nature of debt instruments |

Valuation Methods For The Pre-Seed Stage

Navigating through the valuation process at the pre-seed stage is akin to charting unknown waters. With limited financial history, founders and investors rely on a blend of qualitative and quantitative methods to gauge a startup's worth. Let's unpack these approaches and see how they influence the valuation landscape.

Qualitative Valitation Methods:

At this embryonic stage of a startup, numbers only tell half the story. The other half is painted with broader, more subjective strokes, focusing on the elements that, while intangible, hold immense potential for growth and success.

Team Quality: The founding team's experience, skills, and synergy are paramount. A strong, cohesive team with a track record and the right mix of skills can significantly increase a startup's valuation. Investors often bet on the jockey, not just the horse.

Market Size: The potential market size and the startup's ability to capture a significant market share play a crucial role. A venture targeting a large, growing market with a scalable solution can command a higher valuation.

Business Model Potential: The innovativeness and viability of the startup's business model are also under scrutiny. Models with clear paths to revenue, scalability, and a competitive edge are more likely to attract favorable valuations.

Quantitative Valuation Methods:

When the qualitative aspects align, it's time to crunch some numbers. Quantitative methods bring financial data and projections into play, offering a more concrete foundation for valuation.

Historical Financials: Though limited at the pre-seed stage, any historical financial data can help form a baseline for valuation. This includes revenue, profit margins, and cash flow.

Financial Projections: Future financial projections are critical. They need to be realistic and based on solid assumptions about growth rates, market penetration, and scaling.

Comparables: Looking at comparable companies and their valuations provides a context for determining a reasonable range for the startup's valuation. This method relies on available data from similar ventures within the same industry or sector.

Blending these qualitative insights with quantitative data allows for a well-rounded valuation, providing a snapshot of the startup's current position and its trajectory.

It's a delicate balance, requiring a deep understanding of both the market landscape and the unique attributes of the startup.

For investors, it's about identifying the gems that will grow in value, while founders must articulate and justify their venture's potential worth.

At the pre-seed stage, the art of valuation is indeed about storytelling, backed by data, driven by vision, and refined by experience.

Practical Insights into Valuation Methods

Valuing a pre-seed stage startup is a nuanced process, blending art with science. Let’s explore some of the popular valuation methods used by investors and founders alike, complete with real-world applications and examples to bring these concepts to life.

Qualitative Methods:

The Berkus Method: Named after its creator, Dave Berkus, this method assigns value to non-financial aspects of the startup, focusing on five key areas: the idea (basic value), the prototype (technology), the quality of the management team, strategic relationships, and product rollout or sales. Each area can add up to $500,000 to the startup's valuation. For instance, if a startup has a compelling prototype and a strong management team but hasn’t yet established strategic relationships or sales, it might still achieve a valuation of up to $1.5 million through the Berkus Method. This approach is particularly useful when financial data is scarce but the startup's potential is evident.

The Scorecard Method: This method compares the startup to others in the region and sector, adjusting the average valuation based on several factors, such as the management team, size of the opportunity, product/technology, competitive environment, marketing/sales channels, and need for additional investment. Each factor is weighted differently and adjusted to reflect the startup’s standing relative to comparable businesses. For example, if a startup is in a highly competitive market but boasts a strong management team and unique technology, its valuation might be adjusted upward from the baseline established by comparable companies.

Quantitative Methods:

Revenue Multiple: This approach is straightforward but powerful, involving the multiplication of the startup’s current revenues by a standard multiplier used in the industry to arrive at a valuation. The multiplier varies greatly across industries and is influenced by market trends, growth rates, and margins. For a SaaS company, the revenue multiple might be 6x annual revenues, depending on the factors mentioned. This method suits startups with some revenue but perhaps not yet profitable.

Previous Transactions: This method looks at past funding rounds or the sale prices of similar startups to gauge valuation. It’s grounded in the market reality of what investors have been willing to pay for similar companies. For instance, if similar startups in the tech sector have recently raised funds at valuations around $5 million, a similar startup might expect a comparable valuation.

Discounted Cash Flow (DCF): DCF forecasts the startup’s future cash flows and discounts them back to their present value, using a discount rate that reflects the riskiness of the investment. This method is heavily reliant on the accuracy of the cash flow projections and the chosen discount rate, making it more complex and subjective. It’s most suitable for startups with predictable cash flows and is less common at the pre-seed stage due to the high level of uncertainty.

Each of these methods brings its own set of advantages and limitations. The choice of method depends on the stage of the startup, the availability of data, and the specific circumstances of the business.

Often, a combination of these methods is used to triangulate a more accurate valuation, providing a comprehensive view of the startup’s worth from both qualitative and quantitative perspectives.

| Method | Description | Example | Advantages | Limitations |

|---|---|---|---|---|

| Berkus Method | Values non-financial aspects like idea, prototype, team. | Tech startup with strong prototype. | Simplifies early valuation; emphasizes key factors. | Subjective; capped valuation. |

| Scorecard Method | Compares startup to others, adjusting for specific factors. | Startup with stronger team than average. | Tailored valuation by benchmarking. | Needs comparative data; subjective. |

| Revenue Multiple | Uses industry multipliers on current revenues. | SaaS company applying a 6x revenue multiplier. | Straightforward; reflects revenue. | Not for revenue-less startups. |

| Previous Transactions | Based on past funding or sales of similar startups. | Startup valuation based on recent tech deals. | Realistic; market-based. | Requires transaction data; may not be unique. |

| DCF | Forecasts and discounts future cash flows. | Startup with predictable 5-year cash flows. | Detailed; based on projections. | Complex; requires accurate forecasts. |

Making the Right Choice: Investor and Funding Fit

Finding the right investor is much like finding a partner for a journey that's both uncertain and thrilling.

It's about more than just securing funds; it's about aligning visions, values, and expectations for the road ahead. Let's explore how startups can navigate this crucial decision-making process.

The Importance of Strategic Fit

Money is essential, but it's the strategic alignment that truly propels a startup forward.

The right investor brings a synergy that extends beyond capital, offering expertise, networks, and resources that can be game-changers.

An investor who understands your industry can provide invaluable insights, open doors to new opportunities, and guide you through rough patches.

This strategic fit is critical for long-term success, ensuring that both the startup and the investor are rowing in the same direction towards shared goals.

Matching Startup Stage and Needs with Investor Profiles

Early Ideation and Pre-Seed: If you're in the conceptual or early development phase, angel investors or seed & pre-seed VCs can be your best bet. These investors are accustomed to high-risk environments and are often more interested in the team and the idea rather than immediate returns. They're your early believers and supporters, providing not just funding but mentorship and encouragement.

Product Development and Market Entry: As you transition into product development and prepare for market entry, early-stage VCs become invaluable. They bring not only capital but also strategic guidance to navigate market challenges and scale operations. These investors are skilled in taking startups from the validation phase to a growth trajectory, focusing on building a sustainable business model.

Scaling and Expansion: For startups ready to scale or expand into new markets, late-stage VCs and private equity funds offer the substantial financial backing necessary to supercharge growth. Their involvement is typically more hands-off, focusing on financial support to fuel expansion, streamline operations, and enter new markets efficiently.

In every case, the key is to ensure that the investor's expectations align with your startup's growth stage, financial needs, and long-term vision. This alignment involves clear communication, transparency about goals and milestones, and a shared understanding of the startup's trajectory.

Remember, choosing an investor is not just about the capital injection. It's about bringing on a partner who believes in your vision, complements your strengths, and is committed to navigating the startup journey alongside you. By seeking out investors who not only provide financial backing but also align with your strategic goals and values, you can lay a solid foundation for mutual success.

The Journey Ahead: From Valuation to Funding

Securing the right valuation and investor is a major milestone, but it's just the beginning of a larger journey.

As your startup moves from valuation discussions to actually receiving funding, there are several key considerations to keep in mind to ensure a smooth transition and a strong foundation for future growth.

Navigating the Negotiation Process

Negotiating with investors isn't just about agreeing on a number; it's about setting the terms that will govern your partnership moving forward. This includes not only the valuation and equity stakes but also terms regarding governance, decision-making, and future fundraising rounds.

It's crucial to approach negotiations with a clear understanding of your non-negotiables while remaining flexible on points that are less critical to your long-term vision. Remember, the goal is to forge a partnership that feels fair and supportive to all parties involved.

Setting the Stage for Growth

With funding in hand, it's time to execute on the plans that you've laid out. This often means accelerating product development, expanding your team, and ramping up marketing efforts to capture market share.

However, it's also a time to be mindful of burn rate and to ensure that your growth efforts are sustainable. Regular communication with your investors can provide valuable insights and help adjust strategies as needed.

Preparing for Future Rounds

Even as you focus on using your current funding to grow, it's never too early to start thinking about the next round. This means setting and tracking against key performance indicators (KPIs) that will demonstrate your startup's growth and potential to future investors.

Building strong relationships with your current investors can also pave the way for future funding rounds, either through their continued support or introductions to other investors in their network.

Embracing the Challenges and Opportunities

Every stage of startup growth brings its own challenges and opportunities. From managing rapid team expansion to entering new markets, it's important to stay adaptable and open to learning.

The partnership with your investors can be a source of strength and guidance as you navigate these waters, leveraging their experience and networks to avoid common pitfalls and seize new opportunities.

In conclusion, moving from valuation to funding is a significant step in your startup's journey, but it's just one part of a continuous cycle of growth, learning, and adaptation. By approaching this process with a strategic mindset, clear communication, and a focus on long-term partnership, you can set your startup on a path to sustained success.

Benefits of Finro's Startup Valuation Services

Choosing Finro's valuation services offers a tailored, cost-effective solution for early-stage startups, standing in stark contrast to the generic and expensive services often provided by big-4 firms.

Here's how Finro reshapes the valuation landscape for startups:

Customized Approach: Unlike the one-size-fits-all model of large firms, Finro dives deep into the specifics of your startup, understanding its unique business model, market potential, and growth trajectory. This personalized attention ensures valuations that reflect the true value of your startup, providing a solid foundation for investment discussions and strategic planning.

Speed and Efficiency: Recognizing the fast-paced nature of startups, Finro offers rapid turnaround times for valuations, ranging from two weeks to two months. This efficiency ensures you're not left waiting during critical fundraising or operational phases, unlike the lengthy processes typical of big-4 firms.

Flexibility and Adaptability: Finro prides itself on its agility and adaptability to meet the changing needs and schedules of startups. This flexible approach contrasts sharply with the rigid timelines and deliverables of larger firms, making Finro a better fit for the dynamic startup environment.

Personalized Client Experience: With Finro, you're not just another account. Startups receive dedicated attention from a single consultant who takes the time to understand your business inside and out. This contrasts with the impersonal, revolving door of contacts often encountered with big-4 firms, leading to better communication and more insightful valuations.

Cost-Effective Solutions: Finro's services are not only personalized but also priced competitively, offering startups access to high-quality valuation services without the prohibitive costs associated with big-4 firms. This affordability allows more of your resources to be invested back into growing your business.

Focus on Early-Stage Startups: Finro's services are specifically designed for the unique challenges and opportunities faced by early-stage to series B startups. This specialization ensures that the valuation process is aligned with your startup's stage of development and future growth plans, providing actionable insights that drive strategic decisions.

In summary, Finro's startup valuation services stand out as a smarter choice for early-stage startups, offering the benefits of customized, efficient, and cost-effective valuations delivered with a personal touch.

Choosing Finro means gaining a partner that understands your startup's journey and is committed to helping you succeed.

Conclusion

Navigating startup valuation and funding is a complex journey filled with both challenges and opportunities. Through this exploration, the importance of blending qualitative insights with quantitative data becomes clear, laying the groundwork for meaningful conversations with potential investors.

Finding an investor goes beyond securing capital. It's about forging a partnership where shared vision and mutual commitment to growth are paramount. The right investor brings more than just funds to the table; they offer invaluable guidance, resources, and support that are crucial during both high and low points of building your business.

Valuation is much more than putting a price on your startup. It involves presenting a compelling vision, showcasing your potential, and crafting a partnership that accelerates your journey forward. This crucial step is part of a larger process of growing, learning, and scaling your venture.

Looking ahead, armed with strategies and insights, staying adaptable to the startup ecosystem's evolving landscape is essential. The journey from valuation to securing funding is just the start. Your success is defined by how you use these resources to bring your vision to life and create lasting impact.

Ultimately, finding the right investment partner is about more than financial backing; it’s about securing a collaboration that propels your startup towards its limitless potential.

Key Takeaways

Valuation Complexity: Startup valuation blends speculative qualitative insights with concrete quantitative data for a comprehensive view.

Investor Alignment: Finding an investor is about strategic fit, shared vision, and mutual commitment beyond just financial support.

Method Diversity: Utilize various valuation methods, including the Berkus Method and DCF analysis, to accurately capture a startup's potential.

Negotiation Importance: Negotiating with investors involves setting terms that support a fair, supportive partnership for future growth.

Strategic Partnerships: The right investor partnership can provide invaluable resources, mentorship, and industry insights to navigate startup challenges.

Answers to The Most Asked Questions

-

To value a pre-seed startup, blend qualitative methods like the Berkus Method, which evaluates non-financial aspects such as the idea, prototype, and team, with quantitative methods such as financial projections and comparables. This approach considers both the startup's potential and tangible data available.

-

According to Carta’s data, the average valuation for a priced-seed startup in Q1 2024 is $13.3M, and the median amount of funding raised is $4M.

-

For early-stage startups, both qualitative and quantitative methods are used. Qualitative methods include the Berkus Method and the Scorecard Method, focusing on non-financial aspects like team quality and market size. Quantitative methods involve using financial data and projections, like Revenue Multiples and Discounted Cash Flow (DCF) analysis.

-

Valuing an early-stage company is challenging due to the lack of extensive financial history, established market presence, and the speculative nature of the startup's future success. These factors make it hard to use traditional valuation methods, requiring a balance between subjective assessments of potential and any available objective data.

-

Evaluating an early-stage startup involves assessing both qualitative aspects, such as the strength of the management team, the potential of the business idea, and the size of the opportunity, and quantitative factors, like financial projections and the application of industry-specific valuation multiples. This comprehensive evaluation helps gauge the startup's potential for growth and success.