A Startup Financial Model Evolves Over Time: A Founder's Guide

By Lior Ronen | Founder, Finro Financial Consulting

Every startup begins with a vision, but as it progresses from an idea scribbled on a napkin to a full-fledged business, its financial model must evolve too. This transformation isn’t just natural; it’s essential.

As your startup grows, securing new funding, understanding your costs more clearly, and meeting your sales targets, your financial outlook will change—often substantially.

While it's unrealistic to expect perfect financial predictions right from the start, a keen understanding of how your financial model will change can empower you to adapt effectively.

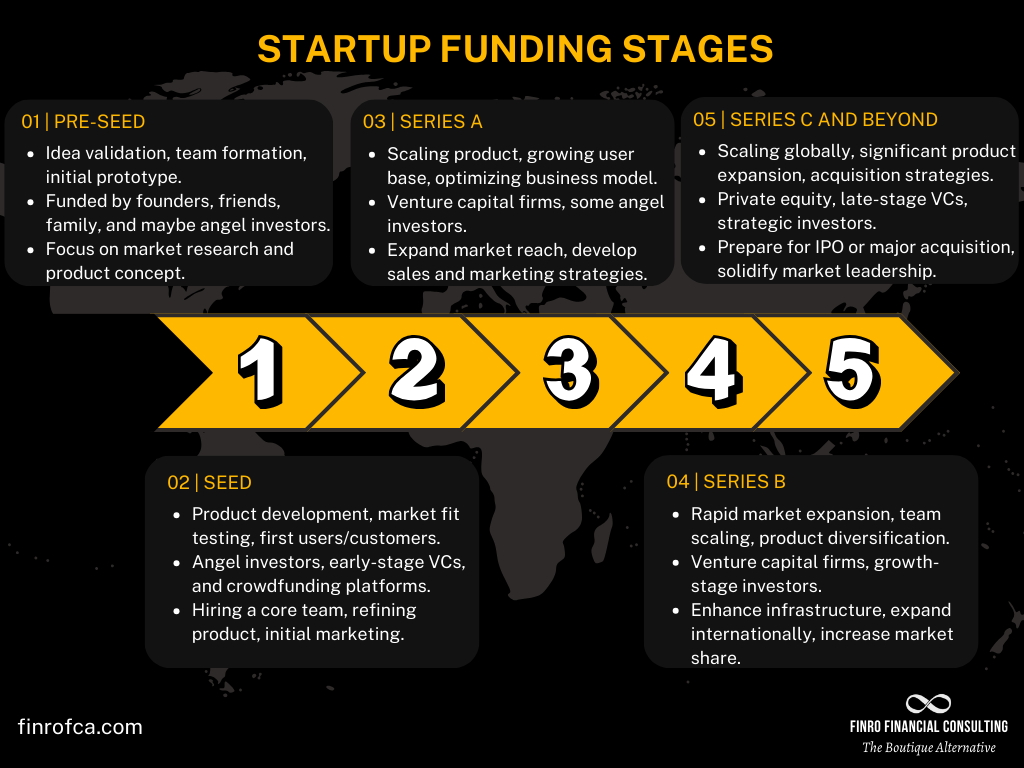

This guide aims to walk you through the financial modeling process at each critical stage of your startup's early life. From the spark of an idea to securing Series A and B funding, we'll explore what financial elements to focus on and when to shift your strategies to support sustainable growth.

Let’s start at the very beginning, where all you have is an exciting idea and an enormous amount of potential. Here’s how to lay the financial groundwork for your startup's journey.

A startup's financial model is crucial and continuously evolves from conception to maturity. Initially, the focus is on assessing market viability and potential without detailed financial forecasts. As the startup secures its first rounds of funding during the pre-seed and seed stages, the emphasis shifts towards more sophisticated financial planning, including burn rate analysis and cash flow management.

Hiring strategies and revenue models become more defined as the business prepares for significant growth. By the time a startup reaches Series A and B funding, it is expected to have a robust framework for scaling operations, detailed financial projections, and strategies for market expansion, all aimed at establishing a path to profitability and long-term success.

The Idea Stage: Laying the Foundations

At the idea stage, your startup exists as a concept—often powerful yet still intangible. This is where you translate your vision into potential market opportunities and begin to ask critical questions about its viability.

The journey starts with conceptualizing your business idea and conducting an initial market evaluation to understand where your idea might fit within the existing landscape.

Introduction to the Idea Stage

At this nascent phase, you’re essentially looking at a blank canvas. Your job is to start sketching the broad outlines of your business.

This involves identifying your unique value proposition, understanding your potential market, and considering how your product or service could improve upon what is already available.

Think of this stage as laying down the first few puzzle pieces of what will eventually become a complete picture.

Questions Founders Must Consider

Before diving into any financial modeling, you need to critically assess the market you’re entering. Consider these questions:

Does your business idea already exist? If so, how are existing solutions succeeding or failing?

What do potential customers like about current offerings? What are their pain points?

If your idea is novel, why hasn’t it been introduced yet? Is there a genuine demand?

How large is the potential market (Total Available Market, TAM)? How much of this market can you realistically capture initially (Serviceable Available Market, SAM) and in the near term (Serviceable Obtainable Market, SOM)?

This step is about understanding not just the market size but also the customer’s needs and your competition’s gaps.

Why Financial Forecasting is Secondary

At this stage, detailed financial forecasting is less critical than understanding the broader market dynamics.

Instead of delving into complex financial projections, focus on the TAM-SAM-SOM analysis.

This approach allows you to estimate the overall market size, identify your target market segment, and project early sales opportunities without getting bogged down by the intricacies of financial spreadsheets.

These estimates provide a snapshot of potential market reach and serve as a foundation for more detailed financial planning in later stages.

Key Takeaway

The idea stage is all about assessing potential and setting a direction. It's more important to solidify your business concept and ensure it meets a real market need than to predict exact revenue and costs.

By focusing on high-level market and competitive analysis, you lay a solid foundation for your startup’s future strategies and success.

In this way, the idea stage sets the scene for the more detailed financial planning that will come as your startup matures and moves into the pre-seed and seed stages.

Get your expert startup financial model now!

Pre-Seed Funding: Setting the Stage for Growth

Transitioning from the idea stage to pre-seed funding marks a pivotal moment for a startup.

This phase is about making your initial idea robust enough to attract early investors, such as angel investors and micro VCs, who are often the first external sources of capital for your venture. As you prepare for this crucial stage, your focus shifts from conceptual market assessments to more tangible financial and operational planning.

Transitioning from Idea to Pre-Seed

Moving from ideation to securing pre-seed funding involves a significant shift in how you present and justify your business concept.

At this stage, your startup needs to demonstrate that the idea has not only viability but also the potential for growth. This means refining your business model based on feedback, market research, and preliminary interactions with potential customers.

It's about turning theoretical market opportunities into actionable business strategies that can convince investors of your idea's worth.

Financial Focus Areas

Burn Rate and Runway Calculation: Understanding your burn rate—how quickly you spend capital—and calculating your financial runway—how long you can operate before needing more funding—are crucial. These figures help investors gauge your startup's capital efficiency and financial prudence. A well-managed burn rate and a sufficient runway are indicators of a startup's ability to navigate early-stage challenges without running out of funds prematurely.

Preliminary Business Model and Monetization Strategies: At the pre-seed stage, you should outline how your startup intends to make money. This includes defining preliminary pricing structures, identifying revenue streams, and explaining your value proposition in the context of monetization. Your goal is to outline a clear path to revenue generation that aligns with your market and customer understanding.

Hiring and Cash Flow Planning

Short-term Hiring Strategies: Determine what key roles need to be filled to achieve your initial milestones. At this stage, hiring should be strategic, focusing on acquiring talent that can deliver high impact with limited resources. Think about roles that will directly contribute to product development, market research, and early sales efforts.

Cash Flow Management: Effective cash flow management is essential to ensure that the startup does not face liquidity issues. Planning for cash inflows and outflows, prioritizing expenditures, and maintaining a buffer for unforeseen expenses are all part of this strategy.

Summary

The pre-seed stage is all about building a solid foundation with the limited resources at your disposal. It's a time to prove your business concept's viability, demonstrate financial acumen, and prepare the groundwork for future growth opportunities.

By focusing on these areas, your startup can effectively set the stage for attracting meaningful investments and entering the seed stage with a clear strategic direction and operational stability.

This phase is critical in building confidence among potential investors and setting a clear trajectory for the startup's future development.

Seed Stage: Expanding and Refining the Model

As startups move into the seed stage, the involvement of venture capital becomes a significant factor, marking a shift towards more structured growth and scaling efforts.

This stage is about refining your business model, extending your financial runway, and enhancing your product offerings to meet the expectations of more sophisticated investors and a growing customer base.

Overview of the Seed Stage

The seed stage is typically where your startup begins to attract institutional venture capital funds, alongside continued support from angel investors and early backers.

This influx of capital is intended to help startups transition from concept and early development into a phase of accelerated growth and market penetration.

The expectations are higher, and the scrutiny on your financial models and business strategies is more intense, as these investors look for clear pathways to profitability and scale.

Core Financial Components

Detailed Hiring Plans for a Broader Range of Skills: At this stage, your startup needs to expand its team to include a wider variety of skills and experiences. This includes not just product development and sales roles but also marketing, customer support, and possibly HR and finance functions. The aim is to build a team that can support a growing operation and address the increasing complexity of your business.

Extensive Cash Flow and Burn Rate Analysis for a Longer Runway: With more funds available, it’s crucial to plan how this capital will be spent over time. A detailed analysis of cash flow and burn rate is essential to ensure that the startup can sustain operations through longer development cycles and more extensive market testing. This involves projecting cash needs, monitoring spending against these projections, and adjusting as necessary to avoid premature depletion of funds.

User Acquisition Strategies and Revenue Projections: A more developed approach to acquiring users and generating revenue is vital at this stage. This means refining your marketing strategies, enhancing your product to attract and retain customers, and projecting future revenues with greater accuracy. The focus is on demonstrating that your business model can not only attract users but can do so in a financially sustainable way.

Development Focus

Transition from MVP to a More Complete Product Offering: Moving beyond the Minimum Viable Product (MVP), your startup should focus on developing a more complete and robust product offering.

This includes incorporating user feedback, addressing market demands, and adding features that enhance the product’s appeal and usability. The goal is to transition from proving the basic concept to providing a product that fully meets customer needs and supports the business model.

Summary

The seed stage is a critical period of strengthening and refining your business model and operations to prepare for accelerated growth. With the right team in place, a sustainable financial plan, and a compelling product, your startup can maximize the opportunities presented by seed funding.

This stage sets the stage for further expansion, aiming to solidify the startup's position in the market and prepare for future funding rounds and scaling efforts.

By effectively managing these components, your startup can build on the foundation laid during the pre-seed stage and move towards achieving long-term success.

| Aspect | Pre-Seed Stage | Seed Stage |

|---|---|---|

| Purpose | Validate the business concept, secure initial funding, and lay foundational operational structures. | Expand and refine the business model, develop the product further, and prepare for scaling. |

| Focus on Financials | Basic financial planning such as burn rate and runway to next funding. | More detailed financial management including extensive cash flow analysis and longer-term financial projections. |

| Investor Type | Angel investors, accelerators, and micro VCs. | Institutional venture capital funds, along with continued support from early-stage investors. |

| Product Development | Development of an MVP (Minimum Viable Product) to demonstrate feasibility. | Enhancement and expansion of the MVP into a more complete product offering based on user feedback and market demands. |

| Team Building | Hiring key roles necessary for initial development and operations. | Expanding team to include a broader range of skills across multiple functions. |

| User Acquisition | Preliminary strategies focused on validating product-market fit. | More sophisticated strategies aimed at increasing market penetration and generating sustained revenue growth. |

| Revenue Model | Preliminary monetization strategies and business model structuring. | Further development of revenue streams and more precise revenue projections. |

| Capital Utilization | Efficient use of limited funds to reach the next funding milestone. | Strategic allocation of a larger pool of funds to support growth initiatives and longer operational runway. |

Series A and B Funding: Scaling and Maturing

The Series A and B stages signify a substantial transition from a startup to an established business.

This phase is about leveraging the foundation built during the seed stage to scale operations, enhance product offerings, and penetrate deeper into the market. The focus is now firmly on scaling up, maturing the business model, and preparing for long-term success.

Introduction to Growth Stages

At this stage, your company has likely established product-market fit and demonstrated the ability to execute its business model effectively.

Series A and B funding rounds are designed to fuel the expansion of successful operations, support significant user base growth, and refine the overall strategy to ensure robust and sustainable business growth.

Detailed Financial Planning

Comprehensive Expense Forecasting (Payroll and Operational): As your company grows, so too does your team and operational complexity. Accurate forecasting of expenses, including payroll, supplies, and infrastructure, becomes crucial. These forecasts help manage cash effectively and ensure that the company can scale operations without jeopardizing financial stability.

Revenue Forecasts Based on Expanded User Acquisition: At this stage, detailed projections of revenue growth are vital. These forecasts should be based on a mix of proven and innovative user acquisition strategies. Scaling the user base while managing the cost of acquisition and maximizing customer lifetime value are key goals during these stages.

Detailed Cash Flow Projections: With larger sums of money in play, maintaining a detailed and realistic projection of cash inflows and outflows is essential. These projections must account for potential market fluctuations, investment in new technology or markets, and the timing of revenue realization to ensure liquidity is maintained.

Achieving and Sustaining Growth

Strategies for Market Expansion: This involves not only increasing market share within existing markets but also exploring new markets and diversifying product lines. Strategic partnerships, international expansion, and incremental improvements to existing products are typical strategies employed to drive growth at this stage.

Improving Performance: Operational efficiencies become a focus to support growth. This can include investing in technology to streamline operations, enhancing customer service to improve retention, and refining marketing strategies to increase reach and effectiveness.

Summary

Series A and B funding rounds are critical for establishing a path to profitability and ensuring the sustainable operation of the business. The financial injections received during these stages should be strategically allocated to maximize growth while maintaining a clear focus on achieving long-term profitability.

With careful planning, rigorous financial management, and strategic execution, startups can solidify their presence in the market and pave the way for future success.

By embracing detailed financial planning and robust growth strategies, your startup is well-positioned to transition from an emerging entity into a thriving, mature business.

Conclusion

The journey from a fledgling idea to a mature, thriving business is marked by significant milestones, each accompanied by its own financial challenges and opportunities.

As we've explored, the financial model of a startup does not remain static; it evolves through the idea, pre-seed, seed, and Series A and B stages, each requiring a different focus and strategy.

At the idea stage, the emphasis is on understanding the market potential and defining a viable business concept without getting bogged down by complex financial details.

Moving into the pre-seed and seed stages, the financial planning becomes more structured, focusing on burn rates, cash flow management, and preparing detailed forecasts to secure and manage new investments.

By the time a startup reaches Series A and B stages, it's all about using the financial acumen developed in earlier phases to support significant growth, refine operations, and ensure sustainability.

This is where the financial strategies implemented must demonstrate not only the capability to manage current resources effectively but also the foresight to plan for future scalability and profitability.

For founders, understanding the nuances of each stage’s financial needs is crucial. It's about being proactive, anticipating changes, and adapting strategies accordingly. This approach will not only prepare startups to meet the challenges of each funding stage but also equip them with the insights to steer their ventures toward long-term success.

Remember, the goal isn't just to survive the startup phase but to build a robust business that thrives in the competitive marketplace. Each stage of financial planning is a step toward this goal, laying the groundwork for a sustainable and profitable future.

Let this guide serve as your roadmap through the complex yet rewarding journey of startup financial modeling. With each step, you are not just forecasting numbers; you are scripting the financial story of your business’s growth and success.