Valuation Multiples: A Tech Startup Guide

By Lior Ronen | Founder, Finro Financial Consulting

Valuation multiples are at the core of assessing startups and tech companies, serving as a crucial indicator of financial health and market position.

Yet, the question remains: why do tech startup valuation metrics vary so significantly across different niches?

What distinguishes the valuation approach for a promising AI startup from that of a mature SaaS provider?

And how does one approach the valuation spectrum, from the initial stages of a new venture to the expansive scale of public tech enterprises?

This guide offers a clear exploration of valuation multiples, shedding light on the various types such as EV/Revenue, P/E, and P/S, and explaining their application in different contexts.

We navigate through the diverse landscape of tech startups to the broader universe of public tech companies, addressing how valuations evolve across stages, sectors, and financial status.

Featuring a real-world analysis that showcases valuation multiples across tech niches—from AI leaders at 40.6x to foundational SaaS firms at 8.3x—this article presents a tangible comparison that brings valuation theories into perspective.

This insight into financial valuations across tech segments not only grounds our discussion with practical examples but also underlines the rich diversity and dynamic nature of the tech industry.

Our aim is to provide you with a comprehensive understanding of valuation multiples: what they signify, how they are derived, and their utility in making well-informed decisions.

Whether you are a startup founder assessing your company's market value, an investor in search of promising opportunities, or a tech aficionado curious about financial metrics, this guide is designed to navigate the complexities of valuation with informed ease and precision.

Understanding valuation multiples is crucial for navigating the complexities of the tech sector, where factors such as company development stage, public vs. private status, and profitability significantly influence which multiples are most relevant. In the tech industry, niches like SaaS, fintech, and cybersecurity each demand specific multiples for accurate valuation, reflecting their unique business models and growth prospects.

Best practices emphasize the importance of using a range of multiples, considering industry context, and adjusting for non-recurring items, while avoiding pitfalls like overreliance on a single multiple or misapplication across industries. The nuanced application of valuation multiples, from EV/Revenue to P/E and P/S, provides a robust framework for investment decisions, mergers, and competitive analysis, underscoring their indispensable role in financial analysis and strategic planning within the vibrant tech landscape.

- Understanding Valuation Multiples

- The Differences and When to Use Them

- Early Stage vs. Late Stage

- Private vs. Public Companies

- Pre-revenue vs. Post-revenue

- Profitable vs. Not-Profitable Companies

- Valuation Multiples in Tech Sector Niches

- Application and Calculation

- Best Practices and Pitfalls

- Real-world Valuation Multiples Across Tech Niches

Get your expert valuation now!

Understanding Valuation Multiples

Navigating the world of startup and tech company valuations requires a solid grasp of certain fundamental tools, among which valuation multiples stand out prominently.

These metrics, simple yet powerful, offer a lens through which the financial stature and market expectations of a company can be viewed.

As we peel back the layers of financial analysis, understanding these multiples becomes indispensable for those looking to assess a company’s worth, whether for investment, comparison, or strategic decision-making purposes.

The Basics of Valuation Multiples

At their core, valuation multiples are ratios that compare a company's market value to a specific financial performance metric, such as revenue, earnings, or assets.

Common examples include the Price-to-Earnings (P/E) ratio, Enterprise Value to Revenue (EV/Revenue), and Price to Book Value (P/BV), among others. These ratios provide a quick, standardized way to evaluate the market valuation of a company relative to its financial performance indicators.

Why Valuation Multiples are a Critical Tool for Investors and Founders

For investors and founders alike, valuation multiples serve as essential navigational aids in the vast sea of financial metrics. They offer several advantages: simplicity, comparability, and efficiency.

By translating complex financial information into digestible, comparable figures, multiples make it possible to gauge a company's relative value quickly. This is especially valuable in the tech and startup sectors, where rapid innovation and growth can make traditional valuation methods less effective or harder to apply.

Moreover, valuation multiples can illuminate trends and benchmarks within specific industries or sectors, providing insights into market sentiment and expectations. For founders, understanding these metrics is crucial not just for attracting investment but also for competitive positioning and strategic planning.

For investors, multiples are a starting point for deeper analysis, guiding decisions on where to look more closely in a sea of potential opportunities.

As we dive deeper into the specifics of valuation multiples, keep in mind that while they are powerful tools, they are also the beginning—not the end—of the valuation journey.

They open doors to further analysis, offering initial glimpses into a company's financial health and potential, which must then be complemented with a more detailed and comprehensive evaluation.

Types of Valuation Multiples

Valuation multiples can be viewed as a collection of tools, each designed to measure a company’s market value from a different angle. When it comes to evaluating startups and tech companies, a handful of these tools are particularly useful. Let’s take a closer look at some of the key valuation multiples, how they’re calculated, and what they reveal about a company.

EV/Revenue (Enterprise Value to Revenue)

This multiple compares a company's total valuation (not just its stock) to its sales revenue. EV/Revenue is a go-to metric for assessing companies at various growth stages, especially useful in the tech sector where many companies might not yet be profitable but are growing rapidly in terms of sales.

EV/EBITDA

EBITDA is Earnings Before Interest, Taxes, Depreciation, and Amortization, and EV/ EBITDA is the Enterprise Value to EBITDA. The ratio gives investors a clearer picture of a company’s operational profitability by excluding non-operating expenses and potential tax anomalies. It's particularly insightful for mature companies with significant assets and depreciation factors, offering a way to compare profitability regardless of capital structure.

EV/Book Value

This multiple is useful for getting a sense of how a company's market valuation compares to its book value, essentially showing how much more investors are willing to pay over the net assets of the company. It’s often applied to companies with significant physical assets.

Market capitalization (market cap) and enterprise value (EV) are two fundamental metrics used to assess the value of a company, but they offer different perspectives.

Market cap is calculated by multiplying the current share price by the total number of outstanding shares, representing the total value that investors are willing to pay for the company's equity alone. It reflects the company's equity value from the viewpoint of equity investors.

On the other hand, enterprise value provides a more comprehensive valuation by including debt and excluding cash and cash equivalents from the market cap. Specifically, EV is calculated by adding a company's market cap, debt, preferred shares, and minority interest, then subtracting cash and cash equivalents.

This approach offers a broader view of a company's total value by accounting for both equity and debt financing, providing insight into what it would cost to purchase the entire business outright. While market cap focuses solely on the value of a company's equity, enterprise value gives stakeholders a fuller picture by considering the company's financing structure and net debt.

P/S (Price to Sales)

The Price to Sales ratio is another key tool for evaluating companies that may not yet be profitable but are generating significant revenue. By comparing a company's stock price to its revenue per share, P/S offers a straightforward view of how much investors are paying for a slice of the sales.

P/E (Price to Earnings)

Perhaps the most widely recognized multiple, the Price to Earnings ratio, measures a company's current share price relative to its per-share earnings. P/E is a direct reflection of the market's expectations for future earnings growth and is most applicable to companies with stable earnings figures.

P/BE (Price to Book Equity)

Price to Book Equity compares a company’s stock price with its book value per share, offering insights into what investors are willing to pay versus the company’s net asset value. It’s a useful metric for companies with tangible assets and financial institutions.

PEG (Price/Earnings to Growth)

The Price/Earnings to Growth ratio adjusts the traditional P/E ratio by taking into account expected earnings growth, making it a powerful tool for comparing companies with different growth rates. PEG ratios provide a nuanced view of a stock's valuation by factoring in future earnings prospects, especially valuable for high-growth companies where future growth is a significant part of their value proposition.

Each of these multiples taps into a different aspect of a company's financial story, offering a multi-faceted view of its value.

By applying these tools thoughtfully, investors and founders can gain a comprehensive understanding of a company’s valuation, guiding strategic decisions and investments.

The Differences and When to Use Them

Choosing the right valuation multiples hinges not just on understanding their definitions but also on knowing their appropriate application context.

A critical factor in this decision-making process is the company's stage of development. The most informative and relevant multiples can vary dramatically from fledgling startups to well-established entities.

This section aims to delineate the utility of different valuation multiples as companies progress from early to late stages, clarifying which metrics most indicate value at each phase.

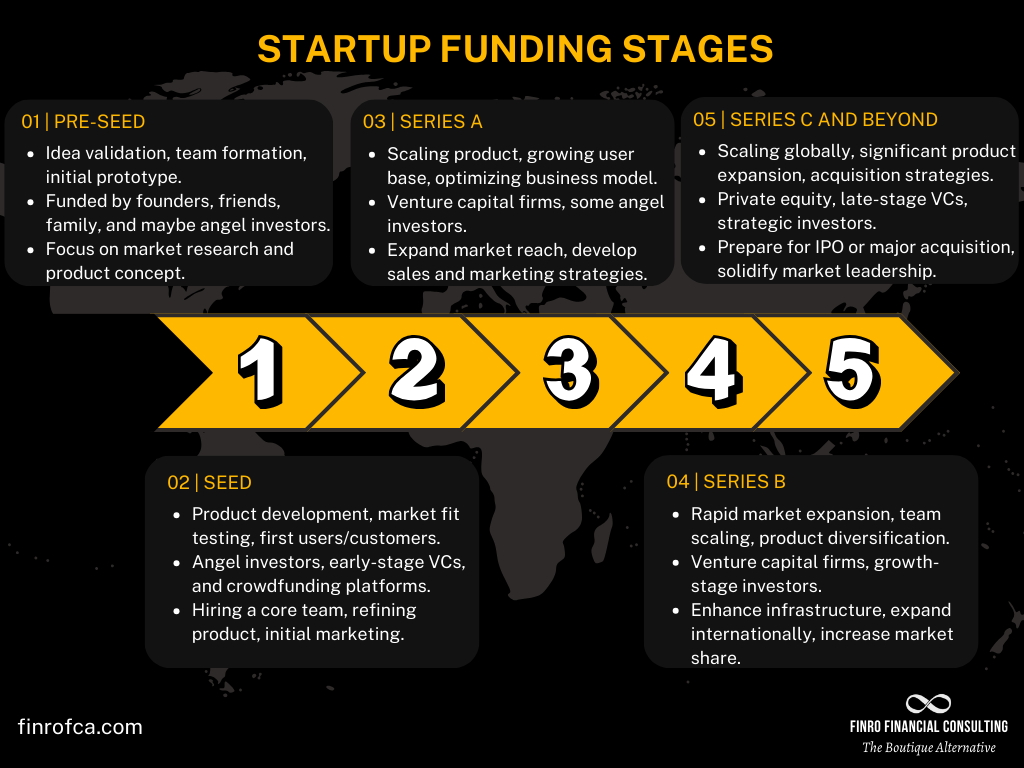

Early Stage vs. Late Stage

In the early stages of a startup, especially those not yet publicly traded, traditional profitability-based multiples such as P/E are often irrelevant due to the absence of earnings.

At this juncture, the focus shifts towards growth potential and market opportunity rather than current profitability.

Thus, valuation multiples that can capture the company's growth prospects and operational scale become more pertinent:

EV/Revenue is a favored multiple for early-stage companies, even though calculating enterprise value (EV) for a private company involves an estimation of its market value plus debt, minus cash. This metric is invaluable because it evaluates a company’s valuation in relation to its sales, which is particularly useful for companies that are yet to turn a profit but are generating significant revenue.

P/S (Price to Sales), while typically used for public companies, can be adapted for private companies by using estimated valuations in place of market cap. This multiple provides insights into how the company's sales are valued in the absence of profitability, highlighting the revenue generation potential relative to its perceived market value.

Late-Stage Companies

As startups mature and their financials become more robust—potentially even going public—earnings-based and cash flow-based multiples gain in relevance. These companies often have more predictable financials, allowing for the use of multiples that reflect profitability and efficiency:

P/E (Price to Earnings) becomes relevant for late-stage or public companies with stable and positive earnings. It compares the company’s share price to its earnings per share, offering a measure of market expectations for future profitability.

EV/EBITDA is crucial for evaluating late-stage or public companies with significant operational income. It measures a company's value relative to its earnings before interest, taxes, depreciation, and amortization, providing a clearer view of operational profitability beyond just net income.

For companies at the cusp of public trading or recently gone public, PEG (Price/Earnings to Growth) can be particularly telling. It adjusts the P/E ratio for expected earnings growth, offering insights into whether a company's stock is valued fairly in relation to its growth prospects.

Selecting the appropriate valuation multiples for early-stage versus late-stage companies involves understanding not just the metrics themselves but the underlying financial and operational realities of the companies being evaluated.

For early-stage startups, the focus is on growth and market potential, while for late-stage or public companies, the emphasis shifts to profitability and operational efficiency.

Recognizing this distinction is crucial for applying valuation multiples effectively, ensuring a more accurate and meaningful assessment of company value.

| Aspect | Early-Stage Companies | Late-Stage Companies |

|---|---|---|

| Focus | Growth potential and market opportunity | Profitability and operational efficiency |

| Relevant Multiples | EV/Revenue, P/S (Price to Sales) | P/E (Price to Earnings), EV/EBITDA, PEG (Price/Earnings to Growth) |

| Reason for Relevance | Suitable for companies pre-profit, emphasizing sales over earnings | Reflects companies with stable earnings and operational income |

| Application Challenges | Involves estimation of market value, debt, and cash for EV | Requires understanding of earnings, operational profits, and growth prospects |

| Key Consideration | Valuation based on sales and growth prospects rather than profitability | Evaluation based on profitability, efficiency, and expected growth |

| Typical Financial Status | Not yet profitable, focusing on revenue generation | Profitable or with significant operational income |

| Market Cap Usage | Estimated valuations in place of market cap for P/S | Market cap directly used for calculating P/E |

Private vs. Public Companies

The distinction between private and public companies significantly influences the selection and interpretation of valuation multiples.

This divergence stems not only from the accessibility of financial data but also from the nature of their operations, regulatory environments, and market pressures. Understanding these differences is key to applying valuation multiples appropriately and effectively across both spheres.

Private Companies

Valuation of private companies poses unique challenges due to the lack of publicly available financial data and the absence of a market price for their shares.

Consequently, valuation often relies on estimated or projected figures, making the process somewhat subjective and necessitating adjustments:

Access to Data: Private companies may not disclose detailed financial information, requiring investors to work with partial data or estimates. This limitation makes revenue-based multiples like EV/Revenue more prevalent since revenue figures are easier to estimate or obtain than net income.

Liquidity and Marketability: Private company valuations need to account for the lack of liquidity and marketability of their shares. This often results in a discount being applied to certain multiples, reflecting the higher risk and longer time horizon typically associated with private investments.

Public Companies

Public companies, by contrast, operate in the public eye, with their financials regularly scrutinized by investors, analysts, and regulators.

The abundance of available data and the existence of a market-determined share price facilitate a more straightforward application of valuation multiples:

Regulatory Environment: Public companies must adhere to strict reporting standards, providing a wealth of financial data that can be used to calculate various multiples. This transparency supports the use of a broader range of multiples, including those based on earnings (P/E), growth (PEG), and cash flow.

Market Sentiment: The share price of public companies reflects market sentiment, incorporating both current performance and future expectations. Valuation multiples thus capture not only the company's financial health but also investor confidence and market trends.

Adapting Multiples Across the Spectrum

While certain multiples can be applied across both private and public entities, their interpretation requires an understanding of the underlying context. For example:

EV/Revenue and P/S are widely used for both private and public companies, especially in sectors where growth is prioritized over immediate profitability. However, the calculation for private companies may involve more assumptions and adjustments to approximate market value.

EV/EBITDA and P/E are more commonly associated with public companies due to the easier access to detailed financial data and the direct relevance of earnings figures. However, they can also be applied to late-stage private companies with substantial operational histories and solid earnings projections.

Understanding the nuances between private and public company valuations enriches the analysis, allowing for more nuanced investment decisions and company evaluations.

Recognizing the limitations and strengths of different valuation multiples within each context is essential for a comprehensive and accurate financial analysis.

| Aspect | Private Companies | Public Companies |

|---|---|---|

| Data Accessibility | Limited; often relies on estimates or projected figures. | High; facilitated by mandatory public disclosures. |

| Valuation Challenges | Subjectivity due to lack of public financial data and market price. | Easier valuation with abundant financial data and market price. |

| Relevant Multiples | EV/Revenue, P/S (due to revenue estimation ease) | P/E, EV/EBITDA, PEG (supported by detailed financial data) |

| Marketability | Discounts for lack of liquidity and marketability. | Shares readily marketable, reflecting market sentiment. |

| Regulatory Environment | Less regulated, with no obligation for detailed financial disclosures. | Strict reporting standards provide a wealth of data for valuation. |

| Market Sentiment | Valuations may not directly reflect market sentiment due to private status. | Share price and valuation directly impacted by market sentiment. |

| Adaptability of Multiples | Requires adjustments and assumptions for valuation. | Direct application of multiples with fewer assumptions needed. |

Pre-revenue vs. Post-revenue

Valuing companies across the pre-revenue and post-revenue phases requires a distinct approach for each, largely due to the fundamental difference in their financial footprints.

Pre-revenue startups, often in their infancy, lack the sales figures that typically serve as a cornerstone for valuation multiples.

Post-revenue companies, conversely, have begun generating sales, providing a tangible basis for valuation. Understanding how to navigate these differences is crucial for accurately assessing a company's worth.

Pre-revenue Startups

For pre-revenue startups, traditional valuation multiples based on revenue or earnings are not applicable. Instead, valuation often leans on qualitative assessments and future potential:

Market Size and Growth Potential: Valuations for pre-revenue startups frequently hinge on the potential market size and the company's ability to capture and grow within that market. This can involve more speculative, forward-looking assessments compared to the backward-looking analysis used for post-revenue companies.

Comparable Company Analysis (CCA): Investors might look at valuation multiples of similar companies in the same industry and stage of development, adjusting for differences in market opportunity, technology, team experience, and other qualitative factors.

Development Milestones: For pre-revenue startups, achieving specific developmental milestones can be a critical factor in valuation. These milestones might include product development stages, user growth, strategic partnerships, or intellectual property achievements.

Post-revenue Companies

Once a company starts generating revenue, the application of valuation multiples becomes more straightforward, with a shift towards quantitative metrics:

Revenue-based Multiples: Multiples such as EV/Revenue and P/S become directly applicable, allowing investors to assess a company's valuation in relation to its sales figures. These multiples can provide insights into the market's valuation of the company's current revenue generation and future growth prospects.

Earnings and Cash Flow Metrics: For post-revenue companies, especially those nearing profitability or already profitable, earnings-based multiples like P/E or EV/EBITDA offer a clearer picture of financial health and operational efficiency. These metrics allow investors to compare companies based on their ability to convert revenue into profit and cash flow.

Bridging the Gap

The transition from pre-revenue to post-revenue marks a significant milestone in a company's lifecycle, often reflecting a maturation of its business model and market acceptance.

As companies progress, the relevance and applicability of different valuation multiples evolve.

Investors and analysts must adapt their valuation frameworks to reflect these changes, moving from a focus on potential and comparables to more concrete financial metrics.

Understanding the distinction between pre-revenue and post-revenue phases—and the corresponding valuation approaches—enables a more nuanced analysis of a company's worth, accounting for both its current financial status and future potential.

| Aspect | Pre-revenue Startups | Post-revenue Companies |

|---|---|---|

| Valuation Basis | Qualitative assessments and future potential | Quantitative metrics, including sales and profitability |

| Key Focus Areas | Market size, growth potential, CCA, development milestones | Revenue-based multiples, earnings, and cash flow metrics |

| Valuation Multiples | Not directly applicable; leans on market potential and comparables | EV/Revenue, P/S for sales; P/E, EV/EBITDA for profitability |

| Financial Footprint | Lacks sales figures; valuation based on speculative assessments | Has begun generating sales, providing a tangible basis for valuation |

| Analysis Approach | Forward-looking, based on growth potential and milestones | Backward-looking, based on existing financial performance |

| Valuation Framework Transition | Shifts from focusing on potential and speculative metrics to concrete financial metrics as companies start generating revenue | |

Profitable vs. Not-Profitable Companies

The profitability status of a company significantly influences the choice and interpretation of valuation multiples.

Profitable companies provide a track record of financial performance that supports the use of earnings-based multiples.

In contrast, not-profitable companies require alternative approaches that focus on potential future performance or current operational metrics. Understanding these differences is key to applying valuation multiples effectively.

Profitable Companies

For companies that have achieved profitability, earnings-based multiples become particularly insightful:

P/E (Price to Earnings): This is a primary metric for profitable companies, linking the market value of a company to its actual earnings. It offers a direct measure of how much investors are willing to pay for each dollar of earnings, reflecting the company's growth prospects, risk, and profitability.

EV/EBITDA: This multiple is useful for understanding a company’s operational profitability before the impact of financial structure, taxes, and non-cash expenses. It’s particularly relevant for comparing companies within the same industry but with different capital structures.

P/CF (Price to Cash Flow): For companies with significant non-cash charges or where cash flow is a better profitability indicator, P/CF provides a clearer picture of the value investors place on the company's cash generation capabilities.

Not-Profitable Companies

Valuing companies that are not yet profitable requires focusing on metrics that can capture future growth potential or operational scale:

EV/Sales (Enterprise Value to Sales): This multiple is critical for not-profitable companies as it assesses a company’s valuation in relation to its sales revenue, sidestepping the absence of profits. It’s particularly useful in high-growth industries where future revenue growth is expected to eventually drive profitability.

EV/Gross Profit: For companies that are closer to profitability or have significant gross profits but are still operating at a net loss due to high R&D or SG&A expenses, the EV/Gross Profit multiple can provide insights into the efficiency of the company's core operations.

User or Subscriber Metrics: In some cases, especially for tech or service-based companies, valuation might also lean on non-financial metrics like user growth, subscriber numbers, or engagement levels, which can serve as proxies for future profitability.

Considerations Across the Profitability Spectrum

The transition from not-profitable to profitable marks a pivotal phase in a company’s lifecycle, influencing not only its valuation strategy but also investor perception and market valuation.

Investors and analysts must adjust their valuation models to account for this transition, moving from growth and operational metrics to more traditional profitability-based multiples as the company matures.

Recognizing the appropriate multiples to use based on a company's profitability status allows for a more accurate and nuanced valuation, providing insights into both current performance and future potential.

This nuanced approach is essential for investors navigating the diverse landscape of company stages and sectors.

| Aspect | Profitable Companies | Not-Profitable Companies |

|---|---|---|

| Valuation Focus | Earnings-based multiples reflecting financial performance | Future growth potential or operational scale metrics |

| Key Multiples | P/E (Price to Earnings), EV/EBITDA, P/CF (Price to Cash Flow) | EV/Sales, EV/Gross Profit, User or Subscriber Metrics |

| Valuation Basis | Track record of earnings and cash flow | Sales revenue, gross profit, and non-financial growth indicators |

| Insights Provided | Investor willingness to pay per dollar of earnings, operational profitability | Company's valuation relative to sales, efficiency of core operations |

| Considerations | Adjusting valuation models to account for a company's transition from not-profitable to profitable is crucial for accurate valuation. | |

Valuation Multiples in Tech Sector Niches

The tech sector, known for its innovation and rapid growth, encompasses a wide range of niches, each with its unique business models, growth rates, and market dynamics.

These differences necessitate a tailored approach to valuation, making certain multiples more relevant for specific niches.

This section delves into how valuation multiples vary across various tech niches, offering insight into the metrics that are most indicative of value in each niche.

SaaS (Software as a Service)

Revenue Multiples (EV/Revenue, P/S): Given the subscription-based revenue model prevalent in SaaS, revenue multiples are particularly relevant. They provide insights into the company's growth potential and scalability, crucial in a sector where upfront costs are high but marginal costs for additional customers are low.

Customer Metrics (Customer Acquisition Cost, Lifetime Value): Although not traditional valuation multiples, these metrics are crucial for evaluating SaaS companies. They offer insight into the efficiency of the company's growth strategy and long-term profitability potential.

Fintech

EV/EBITDA and P/E: For fintech companies that have reached profitability, these earnings-based multiples are key indicators of financial health and efficiency. They reflect the company's ability to generate profit from its technological innovations in finance.

Gross Payment Volume (GPV): For companies involved in payments or money transfers, GPV can be a critical metric, offering insight into the total volume of transactions processed. While not a valuation multiple per se, it's often used alongside traditional multiples to gauge the company's scale and market penetration.

Hardware

P/E and EV/EBITDA: Hardware companies, which often have more predictable and stable cash flows once they reach scale, are well-suited to valuation through earnings-based multiples. These multiples can reflect the efficiency of production and the scalability of operations.

Inventory Turnover Ratio: While again not a traditional valuation multiple, this metric is vital for hardware companies, indicating how efficiently a company can turn its inventory into sales, a key factor in overall profitability.

Edtech (Education Technology)

Revenue Multiples: Due to the varied monetization strategies in edtech, from subscription services to pay-per-course models, revenue multiples like EV/Revenue offer a straightforward way to compare companies based on their top-line growth.

User Engagement Metrics: Metrics like monthly active users (MAU) or daily active users (DAU) can be particularly telling in the edtech sector, where engagement levels directly correlate with the company’s ability to monetize its offerings.

Revenue Growth Rate: In a sector driven by the ever-increasing demand for digital security solutions, the revenue growth rate is a critical measure of a company's ability to capture market share and expand its offerings.

EV/Revenue: Given that many cybersecurity firms invest heavily in R&D leading to varied profitability timelines, EV/Revenue allows investors to assess valuation in light of sales, highlighting growth potential.

Insurtech

Loss Ratio and Combined Ratio: Specific to insurance, these ratios offer insight into the company's operational efficiency and profitability. While not valuation multiples in the traditional sense, they are critical for evaluating insurtech companies.

EV/Gross Written Premiums (GWP): This multiple can provide a sense of how the market values the company's underwriting business relative to its size and growth prospects.

The tech sector's diversity means that no single valuation multiple fits all. Investors and analysts must consider the unique characteristics and financial metrics of each niche to apply the most appropriate and informative multiples.

This tailored approach not only enhances valuation accuracy but also deepens the understanding of what drives value in different tech niches.

| Tech Niche | Relevant Valuation Multiples | Additional Metrics | Insights |

|---|---|---|---|

| SaaS | EV/Revenue, P/S | Customer Acquisition Cost, Lifetime Value | Highlights growth potential and scalability; focuses on subscription model efficiency. |

| Fintech | EV/EBITDA, P/E | Gross Payment Volume (GPV) | Reflects profitability from finance technology innovations; GPV for payment scale. |

| Hardware | P/E, EV/EBITDA | Inventory Turnover Ratio | Indicates production efficiency and operational scalability; inventory management efficiency. |

| Edtech | Revenue Multiples (EV/Revenue) | Monthly Active Users (MAU), Daily Active Users (DAU) | Emphasizes top-line growth; user engagement correlates with monetization ability. |

| Cybersecurity | Revenue Growth Rate, EV/Revenue | Focus on revenue metrics and growth rates | Focuses on market share capture and growth potential; investment in R&D for future profitability. |

| Insurtech | Focus on specific industry ratios | Loss Ratio, Combined Ratio, EV/Gross Written Premiums (GWP) | Operational efficiency and profitability insight; valuation of underwriting business. |

Application and Calculation

Understanding the intricacies of valuation multiples is just the first step; applying these metrics in real-world scenarios is where their true value comes to light.

This section moves beyond theory, focusing on the practical application and calculation of valuation multiples. It aims to bridge the gap between abstract financial concepts and their tangible impacts on investment analysis, mergers and acquisitions, and competitive strategy.

By mastering these applications, stakeholders can harness the full potential of valuation multiples to make informed decisions.

The Purpose of Valuation Multiples

Valuation multiples are not just numerical indicators; they are tools that, when applied correctly, can offer deep insights into a company's financial health, market position, and future prospects.

Their practical uses span a wide range of scenarios, from investment analysis to strategic planning.

Investment Decisions

Investors rely on valuation multiples to identify investment opportunities and assess risk. By comparing multiples across companies and industries, investors can pinpoint undervalued stocks, gauge market sentiment, and make predictions about future market movements.

For instance, a lower P/E ratio might suggest an undervalued company, potentially signaling a buying opportunity. Conversely, exceptionally high revenue multiples could indicate overvaluation or high growth expectations.

Merger and Acquisition Considerations

In mergers and acquisitions, valuation multiples provide a framework for determining the fair market value of a target company. They help in benchmarking against comparable transactions in the same industry, ensuring the price paid is in line with market standards.

Multiples also aid in synergy analysis, helping acquirers understand how the combined entity might be valued post-merger, factoring in cost savings, revenue enhancements, and strategic advantages.

Competitive Analysis

For businesses, valuation multiples are indispensable in competitive benchmarking. By analyzing competitors' multiples, companies can gauge their own performance relative to the market and identify areas for improvement or investment.

High multiples in a competitor might indicate areas of strong market approval or growth potential, suggesting strategic areas a company might need to develop or invest in to remain competitive.

How to Calculate and Apply

The calculation of valuation multiples is straightforward, typically involving dividing a market value metric (like share price or enterprise value) by a financial performance metric (such as earnings, revenue, or EBITDA).

However, the application is more nuanced, requiring an understanding of the context, industry standards, and economic conditions. Investors and companies must not only calculate these multiples accurately but also interpret them within the broader market landscape to make informed decisions.

Valuation multiples serve as a bridge between financial metrics and strategic decision-making, offering a quantitative basis for qualitative judgements.

Their versatility in application underscores their importance in the financial toolkit, enabling a wide range of stakeholders to make better-informed decisions based on standardized and comparable financial indicators.

How to Calculate Valuation Multiples

Valuation multiples provide a snapshot of a company's financial status and market valuation.

To leverage these metrics effectively, it's crucial to understand not just what they represent but also how to calculate them.

Here, we offer a step-by-step guide to computing some of the key valuation multiples introduced earlier, accompanied by examples to clarify the process.

1. EV/Revenue

Step 1: Calculate Enterprise Value (EV) by adding the company's market capitalization, debt, and preferred shares, then subtracting cash and cash equivalents.

Step 2: Divide the EV by the company's total revenue.

Example: If a company has a market cap of $200 million, debt of $50 million, preferred shares worth $10 million, and cash of $20 million, its EV is $240 million ($200M + $50M + $10M - $20M). If the same company's annual revenue is $120 million, then its EV/Revenue is 2 ($240M / $120M).

2. P/E (Price to Earnings)

Step 1: Determine the company's market capitalization by multiplying the current share price by the total number of outstanding shares.

Step 2: Calculate the earnings per share (EPS) by dividing the company's net income by the total number of outstanding shares.

Step 3: Divide the current share price by the EPS.

Example: For a company with a share price of $50 and 10 million outstanding shares, the market cap is $500 million. If its net income is $25 million, the EPS is $2.5 ($25M / 10M). Thus, the P/E ratio is 20 ($50 / $2.5).

3. P/S (Price to Sales)

Step 1: Find the company's market capitalization (as described above).

Step 2: Divide the market capitalization by the company's total revenue.

Example: Using the same company with a market cap of $500 million and annual revenue of $120 million, the P/S ratio is approximately 4.17 ($500M / $120M).

4. EV/EBITDA

Step 1: Calculate EV (as described in EV/Revenue).

Step 2: Divide EV by the company's EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization).

Example: If the company's EV is $240 million and its EBITDA is $60 million, the EV/EBITDA is 4 ($240M / $60M).

5. P/CF (Price to Cash Flow)

Step 1: Calculate the company's market capitalization.

Step 2: Divide the market cap by the company's cash flow from operations.

Example: For a company with a market cap of $500 million and cash flow from operations of $50 million, the P/CF ratio is 10 ($500M / $50M).

These calculations are the foundation for evaluating and comparing companies across different industries or within the same sector.

By applying these formulas, investors and analysts can assess market valuations, gauge financial health, and make informed investment decisions.

It's important to remember, however, that these multiples should not be used in isolation but rather as part of a comprehensive financial analysis.

Best Practices and Pitfalls

While valuation multiples are powerful tools for assessing company value, their effectiveness hinges on correct application and mindful avoidance of common pitfalls.

This section outlines best practices for using valuation multiples and highlights key mistakes to steer clear of, ensuring that your analysis remains robust and reliable.

Best Practices for Using Valuation Multiples

1. Use a Range of Multiples: Relying on a single multiple may not capture the full picture of a company's value. Utilize a variety of multiples to gain a comprehensive view, considering both enterprise value and equity multiples to assess different aspects of the company's financial health.

2. Industry and Sector Comparisons: Valuation multiples vary significantly across industries due to differences in growth prospects, risk profiles, and profitability margins. Always compare companies within the same sector or industry to ensure relevance and accuracy.

3. Consider the Economic and Market Context: Economic conditions and market sentiment can impact valuation multiples. Be mindful of the broader economic environment and industry-specific trends when analyzing and applying multiples.

4. Adjust for Non-Recurring Items: Ensure that the financial metrics used in the calculation of multiples are adjusted for one-time events or non-operating income to avoid skewed results. This adjustment provides a clearer picture of ongoing operational performance.

5. Historical Comparisons: Analyzing how multiples have changed over time for a specific company or within an industry can provide insights into valuation trends, helping to identify potential overvaluation or undervaluation.

Common Pitfalls to Avoid

1. Overreliance on Multiples: While useful, multiples should not be the sole basis for investment decisions. They should be part of a broader analysis that includes fundamental and qualitative assessment.

2. Ignoring Growth and Profitability Prospects: High multiples might be justified by strong growth prospects or superior profitability. Conversely, low multiples may not always indicate undervaluation. Consider the underlying reasons for the multiples observed.

3. Misapplying Multiples Across Industries: Applying a multiple common in one industry to a company in a different industry can lead to misleading conclusions due to the inherent differences in business models and financial characteristics.

4. Failing to Account for Capital Structure: The impact of debt and equity financing on valuation multiples must be considered, especially when comparing companies with different capital structures.

5. Overlooking Lifecycle Stage: The stage of a company's lifecycle significantly influences its appropriate valuation multiples. Applying multiples suitable for mature companies to startups, or vice versa, can result in inaccurate valuations.

By adhering to these best practices and avoiding common pitfalls, analysts and investors can enhance the reliability and usefulness of valuation multiples in their financial analyses.

Proper application of these principles ensures that multiples serve as effective indicators of value, complementing other analytical tools and insights in the valuation process.

Real-world Valuation Multiples Across Tech Niches

The valuation landscape within the tech industry showcases the diverse and dynamic nature of its various sectors.

By exploring the real-world valuation multiples across different tech niches, we gain insights into how the market values these sectors based on their growth prospects, innovation, and transformative potential.

AI (Artificial Intelligence)

Artificial Intelligence companies stand out with valuation multiples reaching as high as 40.6x revenue, reflecting the sector's high growth potential and its transformative impact across industries. These high multiples are indicative of the market's anticipation of significant future earnings, as AI technologies are expected to capture substantial market share and redefine operational paradigms.

Fintech

Fintech firms, with multiples around 20.4x revenue, underscore the disruptive integration of technology into financial services. This valuation mirrors the sector's current revenue generation capabilities and its vast potential for expansion, challenging traditional banking and finance with innovative solutions that streamline transactions and access to financial services.

Payments

Payment platforms and processors enjoy multiples of approximately 17.7x revenue, driven by the global shift towards digital payments and the scalability of their platforms. This sector's valuation is buoyed by the increasing abandonment of cash transactions in favor of digital alternatives, signaling strong growth prospects and a robust adoption curve.

Proptech

Proptech companies are valued at 16.3x revenue, a reflection of the growing importance of digital solutions in the real estate industry. This multiple highlights the potential for innovation within a sector traditionally characterized by slow adaptation to technology, emphasizing efficiency gains and the digitization of transactions and property management.

Edtech

The education technology sector, with valuation multiples around 14.4x revenue, illustrates the sector's rapid growth fueled by the global pivot towards remote and online learning solutions. These multiples not only reflect the current expansion but also the significant future potential as digital learning platforms become integral to educational delivery.

Cybersecurity

Cybersecurity firms, valued at 14.2x revenue, underline the critical need for robust digital security measures in today's increasingly online world. This valuation emphasizes the sector's indispensable role in protecting businesses and government entities from digital threats, highlighting its essential, non-cyclical nature and growth trajectory.

Vertical SaaS

Specialized Software as a Service (SaaS) providers targeting specific industries garner multiples of 11.9x revenue. This valuation captures the unique proposition of Vertical SaaS companies that offer tailored solutions to meet the distinct needs of their target industries, combining the scalable growth of SaaS with deep market penetration and specialization.

Insurtech

Insurance technology companies, with a valuation multiple of approximately 9.7x revenue, reflect the ongoing transformation of the insurance industry through technology. These companies promise to revolutionize traditional practices with innovative solutions for underwriting, claims processing, and enhancing customer service, pointing towards efficiency improvements and superior customer experiences.

SaaS (Software as a Service)

General SaaS companies, providing broad-based software solutions, exhibit multiples of 8.3x revenue. Despite being lower than some niche sectors, this multiple highlights the appeal of SaaS models, known for their scalable, recurring revenue streams. These companies offer stable growth prospects, high margins, and the flexibility to serve a wide range of industries, making them a cornerstone of the tech sector's valuation landscape.

Each tech niche's valuation narrative tells a story of innovation, market potential, and the transformative power of technology, providing stakeholders with valuable insights for strategic decision-making.

Conclusion

Navigating the intricate landscape of valuation multiples reveals the nuanced and multifaceted nature of company valuation within the tech sector.

From understanding the foundational principles of various multiples to applying them in specific industry contexts, it's clear that these metrics are more than mere numbers—they are lenses through which we can discern the market's valuation of innovation, growth potential, and financial health.

The exploration of real-world valuation multiples across different tech niches underscores the diversity within the tech sector, highlighting how each niche's unique characteristics and market prospects influence its valuation.

Artificial Intelligence, Fintech, and SaaS, HR Tech, among others, each tell a story of disruption, opportunity, and the continuous quest for growth, reflected in their respective valuation multiples.

For investors, founders, and industry analysts, mastering the application and interpretation of valuation multiples is crucial. By adhering to best practices and avoiding common pitfalls, stakeholders can employ these metrics to make informed decisions, whether for investment, merger and acquisition considerations, or competitive analysis.

The key lies in leveraging multiples not as standalone indicators but as part of a comprehensive analysis, incorporating both quantitative metrics and qualitative insights.

As the tech sector continues to evolve, driven by innovation and changing market dynamics, the role of valuation multiples will remain central to the understanding of company value. The insights gained from this exploration are not just a testament to the current state of tech valuations but also a guidepost for navigating future opportunities and challenges in the ever-changing tech landscape.

In essence, valuation multiples serve as a bridge between the financial metrics of today and the strategic visions of tomorrow.

By demystifying these metrics and applying them thoughtfully, stakeholders are better equipped to unlock the true value of tech companies, paving the way for informed investment and strategic decisions in a sector that stands at the forefront of the global economy.

Key Takeaways

Valuation multiples compare market value to financial metrics, essential for assessing company worth.

Different stages and sectors necessitate specific multiples for accurate valuation.

Profitability and revenue generation significantly influence the choice of multiples.

Both qualitative and quantitative assessments are crucial in early and late stages.

Adapting valuation strategies as companies evolve is key to accurate investment analysis.

Answers to The Most Asked Questions

-

There isn't a single "best" valuation multiple; the choice depends on the company's stage, sector, and financial health. Different multiples offer insights under varying conditions, such as growth potential, profitability, and operational efficiency.

-

The EBIT multiple, similar in concept to the EV/EBITDA multiple, compares a company's enterprise value (EV) to its earnings before interest and taxes (EBIT). It's used to evaluate the profitability before the effect of financial and tax decisions.

-

The rule of 40 is a benchmark used primarily in the SaaS industry, stating that a company's growth rate plus its profit margin should equal or exceed 40%. It's a measure of balancing growth and profitability.

-

An EV/Revenue multiple compares a company's enterprise value (EV) to its sales or revenue. It's particularly useful for early-stage or high-growth companies that may not yet be profitable but are generating significant revenue.

-

The EBITDA multiple is calculated by dividing a company's enterprise value (EV) by its earnings before interest, taxes, depreciation, and amortization (EBITDA). This measure offers insights into a company's operational profitability by excluding financial structure and non-cash expenses.

-

The EV/Revenue multiple for valuation, is a tool to assess a company's valuation in relation to its revenue. It's especially relevant for companies that are in the growth phase, allowing investors to evaluate a company's value without requiring the company to be profitable.