Building Solid Fintech Financial Projections

Building a successful fintech startup hinges significantly on effective planning, with financial projections being a critical component.

These projections are much more than just technical, mundane numbers—they are an integral part of your strategic planning.

Think of financial projections as a roadmap for your business. They guide you toward your goals and showcase what your startup could achieve to potential investors. This guide is designed to make these projections clear and straightforward, even if you're not familiar with finance.

We'll explain what financial projections are and why they're vital for your fintech startup. This includes how to forecast your income and expenses, monitor cash flow, and prepare for various business scenarios.

We'll also teach you how to effectively present these projections to potential investors to boost their confidence in your venture.

Let’s dive into simplifying financial projections, equipping you with the essential tools for your fintech journey. Next, we'll cover the fundamental elements you need for financial success.

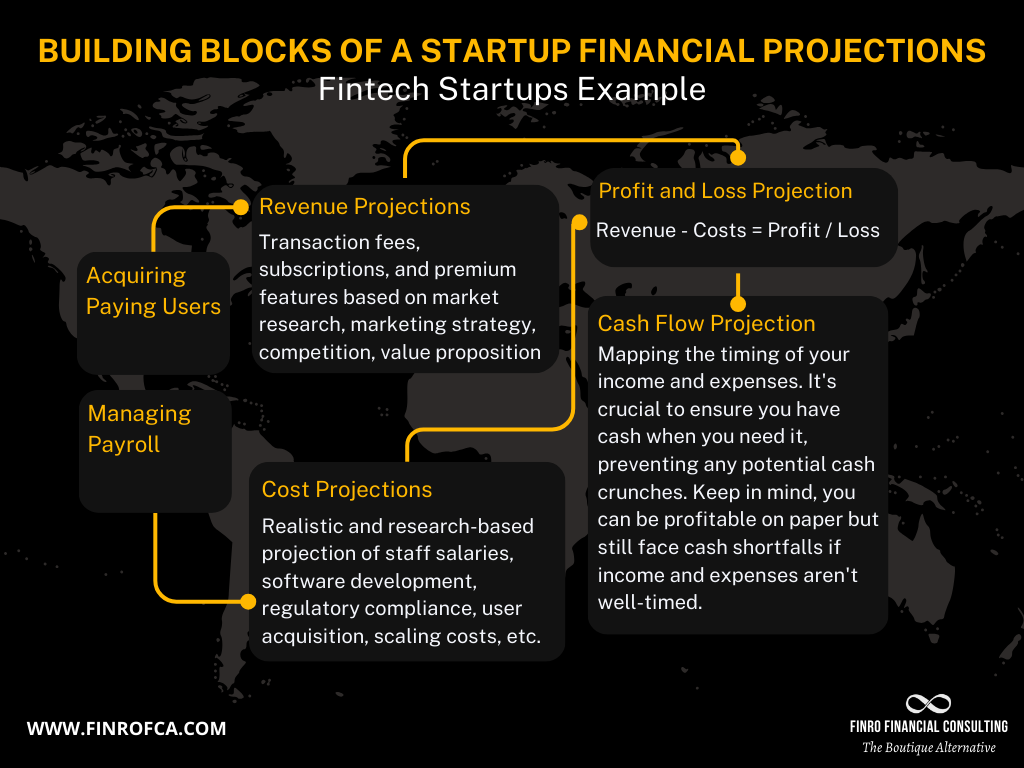

Startup financial projections are detailed forecasts of a company's future financial performance, encompassing income, expenses, cash flow, and key metrics.

Crafting financial projections for a fintech startup is crucial, serving both as an insightful tool for business strategy and a persuasive narrative for potential investors.

The emphasis should be on clarity, accuracy, and simplicity, ensuring that the projections act as a comprehensible guide through the uncertainties of the startup journey. It's vital to make your projections a true reflection of your business, transforming them from mere numbers to a compelling story of potential growth and profitability.

- Understanding Startup Financial Projections

- Key Considerations for Fintech Startups

- Top Fintech Revenue Models

- Crafting Revenue Projections: The Foundation of Fintech Financial Success

- Projecting Payroll and Operational Expenses: Balancing Costs with Growth

- Synthesizing the Financial Picture: Income Statements and Cash Flow Projections

- Beyond the Numbers: KPIs and Analysis for Strategic Decision-Making

- Creating Conservative, Realistic, and Optimistic Scenarios

- Presenting Your Financial Projections to Investors

- The Benefits of Choosing Finro As Your Fintech Financial Projections Consultant

- Conclusion

Understanding Startup Financial Projections

As we embark on this journey, let's begin with a fundamental question:

What exactly are financial projections for a fintech startup?

In the simplest terms, they are informed estimates about your fintech startup's future income and expenses over a given period, be it the next year or the coming five years.

You might wonder about the accuracy of these 'educated guesses', especially when the future is inherently unpredictable. It's true that financial projections are estimates rather than certainties.

However, their value doesn't lie in absolute precision, but rather in the strategic planning they enable. By forecasting your income and expenses, you gain vital insights into your business's potential trajectory and the resources needed to reach your goals.

For fintech startups, these projections take on additional significance. Here's why:

Rapid Industry Pace: Fintech is a sector marked by swift changes and intense competition. Projections enable you to foresee and prepare for potential challenges, giving you a competitive edge.

Attracting Investors: Convincing investors requires a clear demonstration of your startup's financial prospects. Solid financial forecasts provide that reassurance, showcasing your venture as a worthwhile investment.

Industry Expectations: Being in fintech, a sector at the intersection of finance and technology, there's an inherent expectation for you to be adept with numbers. Clear and well-crafted financial projections affirm your business acumen and understanding of the financial landscape.

With this understanding of what financial projections are and their heightened importance in the fintech world, it's time to delve into the specifics of creating your own. In the next section, we'll explore the unique factors to consider for your fintech startup's financial projections. Let's dive into the details!

Fintech, a blend of "financial technology," refers to the innovative use of technology in the design and delivery of financial services and products. This rapidly evolving sector encompasses a broad range of applications, from digital banking and mobile payment solutions to cryptocurrency, blockchain, and robo-advising for investments.

Fintech aims to make financial services more accessible, efficient, and cost-effective, often challenging traditional financial institutions with more agile, user-focused alternatives. By leveraging cutting-edge technologies such as artificial intelligence, big data analytics, and cloud computing, fintech companies are not only transforming how individuals and businesses manage, invest, and borrow money, but also reshaping the global financial landscape with their disruptive potential.

Startup financial projections are primarily used for strategic planning and securing funding. They enable entrepreneurs to map out their business's financial future, identifying key revenue streams and cost structures, which aids in budgeting and resource allocation. These projections are crucial for setting realistic financial goals and milestones, helping startups to monitor progress and make informed operational adjustments.

Additionally, they are indispensable for attracting investors and lenders, as they demonstrate the startup's potential profitability and financial viability. By presenting a well-founded projection, startups can effectively negotiate terms with investors, secure loans, and attract venture capital, making these projections an essential component for both internal planning and external financing.

Read more

Key Considerations for Fintech Startups

Alright, now that you understand the importance of financial projections, let’s dive into the unique aspects of the fintech industry that will shape yours.

First and foremost, consider regulatory costs.

Fintech operates within a tightly regulated space, meaning you’ll face expenses like licensing fees, ongoing compliance costs, potential fines, and legal advisories. These are non-negotiable and critical for legal and operational compliance.

Next, let’s talk about your technological backbone. To stand out in the fintech crowd, substantial investment in software development, cybersecurity, and advanced technologies like AI and blockchain is essential.

Alongside this, factor in user acquisition costs. Attracting customers in a competitive market requires a solid marketing strategy, encompassing online advertising, SEO, content marketing, and even event sponsorships.

Don’t overlook scaling costs either. Success means growth, and growth means additional expenses like expanding your team, increasing server capacity, enhancing customer support, and possibly moving to larger premises.

Yes, this is a comprehensive list, but it’s not meant to intimidate. Rather, it's a roadmap to help you anticipate and plan for these critical expenses. By including these specific fintech considerations in your financial projections, you’re setting your startup on a path to informed decision-making and, ultimately, success.

Ready for the next step? In the following section, we’ll guide you through building your own financial projections, step by step.

Top Fintech Revenue Models

In this section we’ll go through the top 8 revenue models, that most fintech startups use. We’ll elaborate how companies can generate revenues using these models and show specific examples of fintech companies using these models. This will serve as a baseline for the following sections.

In the fintech sector, revenue streams are as diverse as the services offered, reflecting the innovative and dynamic nature of the industry. Here's a more detailed look at some of the popular revenue streams:

Fintech Revenue Model 1: Transaction Fees

This is one of the most common revenue models in fintech. Companies charge a fee for each transaction processed through their platform. This model is prevalent in payment processing companies, remittance services, and cryptocurrency exchanges. The fee might be a fixed amount, a percentage of the transaction value, or a combination of both.

Examples:

Stripe: A payment processing platform that charges a fee for each transaction it processes.

TransferWise (now Wise): An international money transfer service that charges a fee for each currency conversion and transfer.

Key Terms:

Merchant Discount Rate (MDR): The percentage of each transaction charged by the service provider.

Payment Gateway Fee: A fee charged for processing online payments.

Interchange Fees: Fees paid between banks for the acceptance of card-based transactions.

Fintech Revenue Model 2: Subscription Fees

Subscription Fees: Many fintech companies adopt a subscription model, especially those offering software-as-a-service (SaaS) products. Customers pay a recurring fee, usually monthly or annually, to access the service. This model is typical in personal finance management tools, premium banking services, robo-advisors, and budgeting apps. Tiered subscription levels often exist, providing more features or higher limits at each higher subscription tier.

Examples:

QuickBooks Online: Offers cloud-based accounting software for businesses with a monthly or annual subscription fee.

Xero: Provides online accounting software for small businesses and accountants, operating on a subscription model.

Key Terms:

Monthly Recurring Revenue (MRR): The predictable total revenue generated by subscriptions every month.

Churn Rate: The rate at which customers cancel their subscriptions.

Customer Lifetime Value (CLV): The total revenue expected from a customer over their lifetime of using the service.

Fintech Revenue Model 3: Freemium Services

In the freemium model, the basic services are provided for free, but customers must pay for advanced features or enhanced capabilities. This model is effective for user acquisition, as it allows users to try the service before committing financially. Many mobile banking apps, investment platforms, and budgeting tools use this model.

Examples:

Robinhood: A stock trading app offering free basic trading services, with a paid option for premium features.

Dropbox: While not exclusively fintech, Dropbox offers cloud storage with basic free storage space and advanced features for paid subscribers.

Key Terms:

Conversion Rate: The percentage of users who upgrade from the free version to a paid version.

Active Users: The number of users actively using the service, crucial for freemium models.

Freemium Upsell: Strategies employed to persuade users to move from free to premium services.

Fintech Revenue Model 4: Interest Margins

Fintech companies involved in lending, such as peer-to-peer platforms or digital banks, earn revenue through interest margins. They charge higher interest rates on loans than the rates paid on deposits. The difference between these rates represents the company’s earnings.

Examples:

SoFi: Offers lending services where it earns interest margins on personal loans, student loan refinancing, and mortgages.

LendingClub: A peer-to-peer lending platform that earns revenue from the interest spread between what it pays to investors and what it charges borrowers.

Key Terms:

Net Interest Margin (NIM): The difference between interest income generated and interest paid to lenders, relative to the amount of interest-earning assets.

Loan-to-Deposit Ratio (LDR): The ratio of a bank's total loans to its total deposits, indicating lending risk.

Credit Risk: The risk of default on a debt that may arise from a borrower failing to make required payments.

Fintech Revenue Model 5: Asset Under Management (AUM) Fees

Fintech companies offering investment management services, like robo-advisors, often charge a fee based on the amount of assets they manage for their clients. This fee is usually a percentage of the client's total AUM and can decrease as the amount of managed assets increases.

Examples:

Betterment: A robo-advisor charging a percentage fee based on the assets it manages for clients.

Wealthfront: Similar to Betterment, Wealthfront charges a fee based on the percentage of assets under management.

Key Terms:

Expense Ratio: The fee representing the percentage of AUM charged for managing the assets.

Management Fee: A fee charged by an investment manager for their services.

Performance Fee: A fee charged based on the investment's performance, often in addition to the management fee.

Fintech Revenue Model 6: Data Monetization

Data Monetization: Some fintech companies leverage the vast amount of financial data they process by monetizing it. This could involve selling insights to third parties or using the data to cross-sell other products and services.

Examples:

Plaid: Specializes in aggregating financial data, which it monetizes by providing to other fintech companies and financial institutions.

Yodlee: Offers financial data aggregation and analytics, monetizing the data insights provided to businesses and financial service providers.

Key Terms:

Data Analytics: The process of examining data sets to draw conclusions about the information they contain.

API Access Charges: Fees charged for external entities to access a company's API for data.

Data Privacy Laws: Regulations that govern the storage, use, and sharing of data, critical in data monetization.

Fintech Revenue Model 7: Commission on Product Sales

Fintech platforms that facilitate the sale of financial products, such as insurance policies or mutual funds, often earn a commission for each sale. This model is common in fintech sectors like insurtech and investment platforms.

Examples:

PolicyBazaar: An online insurance aggregator that earns commission on every insurance policy sold through its platform.

Mintos: A marketplace for investing in loans that earns a commission from loan originators for every investment made through its platform.

Key Terms:

Brokerage Fee: A fee charged by an intermediary for facilitating transactions.

Sales Commission: A fee paid to an agent or employee as a percentage of the sale they make.

Referral Fees: Fees earned for referring customers to a particular service or product.

Fintech Revenue Model 8: White-labeling and API Access Fees

Fintech companies with robust technology platforms may offer their solutions to other businesses under a white-label arrangement or provide API access for a fee. This allows other companies to use the fintech's technology under their own branding.

Examples:

Currencycloud: Provides a platform for international money transfers, offering its technology to other businesses through white-labeling and API access.

Mambu: Delivers a cloud banking platform, which it offers to other financial institutions under a white-label arrangement or for a fee for API access.

Key Terms:

Software as a Service (SaaS): A software distribution model in which services are hosted by a vendor and made available to customers over a network.

API Integration: The connection between two or more applications via their APIs that allows systems to exchange data.

Platform as a Service (PaaS): A cloud computing model that provides a platform allowing customers to develop, run, and manage applications.

Each of these revenue streams has its own set of challenges and opportunities, and many fintech companies use a combination of these models to diversify their income and reduce reliance on a single revenue source. This diversification is crucial in the fast-paced and ever-evolving fintech landscape.

| Revenue Model | Description | Examples |

|---|---|---|

| Transaction Fees | Fees charged for each transaction processed through the platform. | Stripe, TransferWise (Wise) |

| Subscription Fees | Recurring fees paid by customers for access to the service, typically monthly or annually. | QuickBooks Online, Xero |

| Freemium Services | Basic services provided for free, with advanced features requiring payment. | Robinhood, Dropbox |

| Interest Margins | Revenue earned through the difference between interest rates on loans and deposits. | SoFi, LendingClub |

| Asset Under Management (AUM) Fees | Fees charged based on the amount of assets managed for clients. | Betterment, Wealthfront |

| Data Monetization | Leveraging financial data for sale to third parties or cross-selling products and services. | Plaid, Yodlee |

| Commission on Product Sales | Earning a commission for facilitating the sale of financial products. | PolicyBazaar, Mintos |

| White-labeling and API Access Fees | Offering technology solutions to other businesses under a white-label arrangement or providing API access for a fee. | Currencycloud, Mambu |

Crafting Revenue Projections: The Foundation of Fintech Financial Success

Having explored the diverse revenue models in the fintech sector, it's clear that choosing the right model is just the beginning. The next critical step for fintech founders is to build a comprehensive revenue forecast from the ground up.

This process involves a detailed analysis of potential user base, pricing strategies, and specific elements unique to your chosen business model, whether it's the number of transactions, loans issued, or subscription sign-ups.

1. User Base Projections:

A three to five-year user base projection forms the cornerstone of financial forecasting for every fintech startup.

Begin by identifying the various marketing channels you intend to utilize for your business. This involves strategizing how to attract users to these channels, estimating the number of visitors to your site or app downloads, and calculating the conversion rate of these visitors into paying clients. It's important to consider both organic growth and the impact of paid marketing efforts in these estimations.

Furthermore, factor in the dynamics of customer engagement over time. This includes accounting for clients who may churn, as well as those who might upgrade or downgrade their service. Such considerations are crucial in creating a comprehensive and realistic user base projection.

2. Pricing Strategy:

Develop a pricing strategy that aligns with your revenue model and market expectations. This could mean setting transaction fees, subscription rates, or interest rates on loans.

Consider the value proposition of your fintech product and how it compares to existing alternatives. Pricing should reflect the balance between being competitive and ensuring profitability.

3. Adding Business Model Specific Elements:

Depending on your fintech model, add specific elements into your revenue projections. For instance:

Transaction-based models: Estimate the number of transactions per user and the average transaction value.

Lending models: Project the number of loans you expect to issue, average loan amounts, and interest rates.

Subscription models: Calculate expected subscriber growth, taking into account churn rates and potential upsell opportunities.

4. Scenario Analysis:

Create different revenue scenarios (optimistic, realistic, and conservative) to reflect various market conditions and business challenges. This helps in understanding the potential range of your startup's financial performance.

Consider external factors like regulatory changes, economic shifts, and competitive dynamics that could impact your revenue projections.

In constructing these projections, remember that the goal is not to predict the future with absolute certainty but to create a range of informed estimates that can guide your decision-making and strategy. By building your revenue forecast from the bottom up, considering every key aspect of your fintech model, you establish a solid foundation for financial success and investor confidence.

In the next section, we will dive into the intricacies of projecting payroll and non-payroll expenses, an equally crucial part of your financial planning journey.

Projecting Payroll and Operational Expenses: Balancing Costs with Growth

In fintech startups, payroll expenses go beyond mere numbers; they represent an investment in the company's core strength – its people.

Skilled personnel, including software developers, compliance experts, and customer support teams, are the driving force behind innovation and operational efficiency.

Developers bring your fintech ideas to life, while compliance experts ensure adherence to the complex web of financial regulations. Customer support staff play a crucial role in maintaining customer satisfaction and trust.

As such, forecasting payroll expenses involves not only calculating salaries but also accounting for training, benefits, and talent retention strategies, all crucial for maintaining a competitive edge in the fintech sector.

In our method, there are 6 steps for a proper payroll forecast. Read all about it in this guide: Startup Payroll Forecast: Step-by-Step Guide

Get your expert financial projection now!

Non-Payroll Expenses in Fintech

Beyond payroll, fintech startups incur a range of non-payroll expenses that are critical to their operation and growth. Technology infrastructure, from servers to software licenses, forms the backbone of any fintech operation, necessitating significant investment.

Regulatory compliance is another major cost center, as navigating the financial sector's regulatory landscape often requires specialized legal advice, compliance software, and regular audits. Cybersecurity measures are also paramount, given the sensitivity of financial data and the increasing threats of cyberattacks.

These expenses must be carefully projected and managed to safeguard the startup's assets and reputation.

Budgeting for Innovation and Expansion

In the fast-paced fintech industry, continuous innovation is not just an advantage but a necessity. Budgeting for research and development (R&D) allows a fintech startup to stay ahead with new features, improved security measures, and technological advancements.

Additionally, startups must anticipate potential expansion costs, including market entry, scaling operations, or branching into new product lines.

This forward-looking approach in budgeting ensures readiness for growth opportunities when they arise.

Expense Projections Scenarios

Creating various expense projection scenarios is essential for fintech startups due to the sector's dynamic nature. These scenarios should account for fluctuating market conditions, possible regulatory changes, and technological shifts.

An optimistic scenario might include stable regulatory environments and successful R&D outcomes, while a conservative scenario could prepare for increased regulatory costs or delayed product launches. Such scenario planning helps in managing risks and ensuring financial stability amidst the uncertainties of the fintech landscape.

Synthesizing the Financial Picture: Income Statements and Cash Flow Projections

In our journey through building solid fintech financial projections, we've explored the various revenue models and dissected the intricacies of both payroll and operational expenses.

These elements form the backbone of any financial forecast, providing a clear view of potential income streams and the costs associated with running a fintech startup. Now, we transition from these foundational aspects to the crucial task of synthesizing the complete financial picture.

This step is where the puzzle pieces come together, offering a comprehensive view of your startup's financial health and potential.

In this section, we dive into the art of crafting an income statement and the critical process of managing and projecting cash flow. These tools are not just accounting formalities; they are the lenses through which investors, stakeholders, and you, as founders, can assess the viability and sustainability of your fintech venture.

Understanding and accurately presenting this financial picture is paramount in navigating the competitive and fast-paced world of fintech. It's here that we will equip you with the knowledge to not only compile these essential financial statements but also interpret them to make informed strategic decisions.

Crafting the Income Statement

The income statement is a vital financial document for any fintech startup, providing a clear picture of profitability over a specific period. To craft this statement, compile all revenues (from various sources like transaction fees, subscriptions, etc.) and deduct all expenses (including payroll, operational, and capital expenditures).

In fintech, it's crucial to categorize revenues and expenses clearly, given the diverse streams and unique costs like technology development and regulatory compliance. This statement should reflect the financial outcomes of strategic decisions, such as pricing adjustments or market expansion, offering insights into the operational effectiveness and profitability trends of the startup.

Cash Flow Considerations in Fintech

In the fintech sector, efficient cash flow management is paramount, often more indicative of financial health than profitability alone.

Factors such as funding rounds, the burn rate (the rate at which a company spends capital to finance overhead before generating positive cash flow), and investments in technology significantly influence cash flow.

In an industry where revenue might take time to materialize, maintaining a healthy cash flow ensures operational resilience and the ability to invest in growth opportunities.

Projecting Cash Flow

Projecting cash flow involves detailing all expected cash inflows (from sales, investments, loans, etc.) and outflows (like operational expenses, capital expenditures, loan repayments). In fintech, it’s crucial to factor in the timing of these cash movements, as delays in funding or higher-than-anticipated burn rates can significantly impact liquidity.

Regularly updating these projections is essential to accommodate for rapid changes typical in the fintech sector, such as regulatory shifts or technological advancements.

Interpreting Financial Health

Analyzing the income statement and cash flow projections together gives a comprehensive view of a fintech startup's financial health. While the income statement shows profitability, the cash flow projections reveal the company's ability to sustain operations, invest, and grow. Key indicators to watch include the net profit margin (income statement) and the operating cash flow (cash flow statement).

A healthy fintech startup will typically show a balance between profitability and sufficient cash flow to support its operational needs and strategic ambitions.

Beyond the Numbers: KPIs and Analysis for Strategic Decision-Making

After establishing a solid understanding of financial projections, including income statements and cash flow analysis, it's crucial for fintech startups to delve deeper into the realm of strategic planning and performance evaluation. This is where Key Performance Indicators (KPIs) and thorough analysis come into play.

Moving beyond the traditional financial metrics, this next phase focuses on the heart of strategic decision-making – understanding, monitoring, and leveraging the right KPIs to steer your fintech venture towards sustained success and growth.

In the fintech ecosystem, where competition is fierce and the market landscape is ever-evolving, KPIs serve as a compass, guiding startups through complex decisions and scenarios. They are not just numbers on a spreadsheet; they are indicators of the health, efficiency, and potential of your business.

In this section, we will explore the most relevant KPIs in the fintech world, discuss how to use them for strategic planning effectively, perform scenario analysis, and communicate these insights to stakeholders.

This holistic approach to KPI analysis is designed to equip fintech founders with the tools and knowledge to make data-driven decisions, adapt to market changes, and articulate their business strategy confidently to investors and regulators.

Identifying Key Performance Indicators (KPIs)

In the fintech industry, where data drives decisions, identifying the right Key Performance Indicators (KPIs) is crucial for measuring success and guiding strategy. Relevant KPIs in fintech include Customer Acquisition Cost (CAC), which measures the cost to acquire a new customer, and Customer Lifetime Value (CLV), reflecting the total revenue a business can expect from a single customer over time.

The churn rate, indicating the rate at which customers stop using the fintech service, is vital for understanding customer retention.

Additionally, compliance adherence KPIs are crucial, given the regulatory intensity in the financial sector. These KPIs provide a framework for evaluating performance and identifying areas for improvement.

Utilizing KPIs for Strategic Planning

KPIs serve as a navigational tool for strategic planning in fintech. By analyzing CAC and CLV, startups can balance their marketing strategies and customer relationship management to maximize profitability.

Monitoring the churn rate helps in refining customer service and product offerings to enhance user satisfaction and loyalty.

In a sector where regulatory compliance is non-negotiable, tracking adherence KPIs ensures the fintech remains within legal boundaries and builds trust with users.

By leveraging these KPIs, fintech companies can make informed decisions on market expansion, product development, and customer engagement strategies, aligning operations with business objectives.

Scenario Analysis

Scenario analysis using KPIs enables fintech startups to anticipate future challenges and opportunities. This involves creating hypothetical situations – such as market shifts, regulatory changes, or new technology adoption – and predicting how these scenarios might impact key metrics.

For example, how would a regulatory change affect compliance costs, or how might a new technology impact customer acquisition? This analysis helps in preparing contingency plans and adapting strategies to maintain steady growth and compliance in varying market conditions.

Communicating with Stakeholders

Effectively communicating financial projections and KPI analysis to stakeholders, particularly investors and regulatory bodies, is essential in fintech.

This involves presenting data in a clear, concise, and compelling manner, demonstrating a deep understanding of the metrics and their implications for the business.

It’s important to articulate how these figures align with the company's long-term goals and strategies. For investors, this communication instills confidence in the startup’s growth potential and operational efficiency.

For regulatory bodies, clear presentation of compliance adherence KPIs assures them of the company's commitment to regulatory standards.

Creating Conservative, Realistic, and Optimistic Scenarios

Have you ever heard the saying, "Hope for the best, prepare for the worst?" When it comes to the financial future of your fintech startup, this saying hits the nail on the head.

By creating three financial scenarios – conservative, realistic, and optimistic – you can prepare for a range of potential futures.

Let's break down how to craft each one:

In the conservative scenario, we plan for a rainy day.

Here, we assume lower-than-average user acquisition rates, higher-than-average costs, and other factors that could lead to less-than-ideal financial outcomes.

This is not about being negative, it's about being prepared. If a storm hits your startup, you want to be sure it can weather it.

Next, we have the realistic scenario. This is your best, educated guess at what the future of your fintech startup will look like.

It takes into account your current growth rates, market trends, and your team's performance.

This is the scenario you'll likely use most when making business decisions.

Finally, let's not forget about the sunny days ahead. The optimistic scenario is where you allow yourself to dream a little. Here, you map out what your startup’s future looks like if all the stars align.

User acquisition skyrockets, costs are managed effectively, and your product becomes the hottest thing in the fintech world.

Remember, while this scenario is aspirational, it should still be grounded in reality.

Constructing these three scenarios will help you to prepare for a variety of possible futures. Remember, the goal of these scenarios isn't to predict the future with 100% accuracy (if only we could!).

Instead, it's about understanding the impact of different situations on your financial health and being prepared to pivot or adjust as needed.

| Conservative Scenario | Realistic Scenario | Optimistic Scenario | |

|---|---|---|---|

| User Acquisition | Lower than average growth, tougher market competition. | Based on current growth rates and market trends. | Skyrocketing user numbers, leading market position. |

| Cost Management | Higher costs due to unforeseen challenges, potential regulatory changes. | Reflects current cost structure, with a moderate budget for unforeseen expenses. | Highly efficient cost management, benefit from economies of scale. |

| Revenue | Modest revenue due to lower user acquisition and potential market challenges. | Solid revenue based on current users and expected growth. | Exceptional revenue due to high user growth and potential premium offerings. |

| Profitability | Possible losses or very modest profits due to increased costs. | Profitable, based on current trends and manageable costs. | Highly profitable with potential for significant growth and expansion. |

| Purpose | Preparedness for potential setbacks and challenges. | Most probable outcome, used for day-to-day decision making. | Aspirational, but grounded in reality. Good for long-term strategic planning. |

Now that you've crunched the numbers and painted three distinct financial pictures, it's time to present your findings to the people with the power to fuel your fintech startup's growth - the investors. The key here is not only what you present but also how you present it. Let's go through some tips:

Be Clear and Concise

Investors are busy people, and more importantly, they likely have a lot of pitches to go through. Make their job easier by presenting clear, concise financial projections. Avoid jargon and overcomplicated spreadsheets. Instead, present your numbers in a straightforward, easy-to-understand format.

Tell a Story

Numbers on their own can be dry and difficult to digest. Instead, use your financial projections to tell a story. Where did your startup begin, where is it now, and where do you see it going in the future? What challenges have you overcome, and what opportunities lie ahead? This narrative approach can make your pitch more engaging and memorable.

Show Your Work

Investors will want to see the assumptions behind your numbers, so be prepared to show your work. How did you calculate your user acquisition rates? Why do you expect your costs to develop as they have? Be ready to provide clear, evidence-backed answers.

Acknowledge Uncertainty

The future is inherently uncertain, especially for startups in the dynamic fintech space. It's important to acknowledge this uncertainty and show that you've taken it into account in your projections. That's where your conservative, realistic, and optimistic scenarios come into play. By presenting these three scenarios, you can demonstrate that you're prepared for a range of possible futures.

Highlight Your Unique Value Proposition

Finally, use your financial projections as an opportunity to highlight your fintech startup's unique value proposition. What sets your startup apart from the competition? How does this give you a financial edge? Make sure this comes across in your presentation.

Remember, your financial projections are not just a collection of numbers. They're a reflection of your business strategy, your understanding of the market, and your vision for the future. Present them with confidence, clarity, and a touch of creativity, and you'll be well on your way to winning over investors.

The Benefits of Choosing Finro As Your Fintech Financial Projections Consultant

In an increasingly competitive and fast-paced technological landscape, fintech startups stand at the forefront of innovation, yet they face unique challenges that require specialized expertise, especially when it comes to financial projections and modeling.

Recognizing the indispensable role of precise and comprehensive financial models, Finro Financial Consulting emerges as the quintessential partner for fintech startups aiming to build a solid financial foundation for sustained growth and success.

This section breaks down the benefits of choosing Finro as your fintech financial projections consultant, drawing upon the insights and framework provided in the preceding text.

A Tailored Approach to Complex Challenges

Finro understands that fintech startups operate in a dynamic sector where generic financial models simply do not suffice.

The firm's structured, meticulous process is designed to encompass the full complexity of your startup, ensuring that your financial plan is robust, comprehensive, and perfectly aligned with your specific business model and market dynamics.

This tailored approach guarantees that no aspect of your startup's financial landscape is overlooked, from revenue streams and cost structures to market dynamics and growth projections.

Deep Industry Expertise and Insight

With a profound expertise in the fintech sector, Finro brings to the table an unparalleled understanding of the unique challenges and opportunities that fintech startups face. This industry-specific knowledge is critical for developing financial models that not only capture the nuances of your business but also anticipate the rapid technological advancements and market shifts characteristic of the fintech industry. Finro's deep insight into investor expectations further enables the crafting of financial narratives that resonate strongly with venture capitalists and angel investors, highlighting your startup's growth potential, scalability, and strategic market positioning.

Strategic Asset for Internal and External Engagements

Choosing Finro as your consultant transforms your financial model from a mere planning tool into a strategic asset for both internal decision-making and external stakeholder engagement. Internally, it acts as a navigational compass, guiding your strategic planning, cash flow management, and scenario planning.

Externally, it serves as a compelling communication tool, demonstrating your startup's viability, strategy, and market potential to investors, partners, and potential acquirers. The firm's ability to integrate key performance indicators (KPIs) and tailor financial models to your startup's evolving needs ensures that you are always prepared to capitalize on opportunities and navigate challenges effectively.

Avoiding the Pitfalls of DIY or Generalist Modeling

Finro's specialized expertise highlights the risks associated with DIY or generalist approaches to financial modeling, which often lead to oversights, misalignment with investor interests, and costly mistakes.

By partnering with Finro, fintech startups can sidestep these pitfalls, leveraging the firm's precision, deep industry insights, and structured processes to create financial models that are not only accurate but strategically aligned with your startup's long-term goals.

A Proven Track Record of Success

The testament to Finro's effectiveness lies in its track record of successful engagements with fintech startups, such as the highlighted case of Pangea.io.

This case study underscores the firm's ability to turn a vision into a compelling financial story, effectively communicating a startup's potential to investors and laying a solid foundation for strategic growth and success.

Choosing Finro: Aligning Expertise with Your Startup's Vision

In conclusion, selecting Finro Financial Consulting as your fintech financial projections consultant is a strategic decision that goes beyond choosing an expert. It's about partnering with a firm that is deeply committed to your success, offering a blend of structured processes, deep fintech sector expertise, and insights into investor expectations.

Finro stands out as the premier choice for fintech startups seeking not just a consultant, but a strategic partner dedicated to building a solid financial foundation for the future.

| Key Benefits | Examples |

|---|---|

| Tailored Approach | Customized financial models aligned with specific business models and market dynamics. |

| Industry Expertise | Deep understanding of fintech sector challenges and opportunities leads to accurate and insightful financial projections. |

| Strategic Asset | Financial models act as navigational tools internally and compelling communication assets externally. |

| Pitfalls of DIY Modeling | Avoid costly mistakes and misalignment with investor interests by leveraging Finro's specialized expertise. |

| Track Record of Success | Proven success in turning visions into compelling financial stories, as demonstrated by engagements with startups like Pangea.io. |

Conclusion

Building financial projections for a fintech startup can seem daunting. With so many variables to consider and future uncertainties, it's easy to get lost in the complexity.

But as we've explored in this article, the real essence of financial projections lies not in the complexity but in the clarity, accuracy, and readability they offer.

Financial projections serve not only as your ticket to secure investors but also as an essential tool to help you better understand and communicate your business strategy.

From key fintech considerations to detailed revenue and cost breakdowns, scenario analyses, and investor presentations, each step is geared towards creating a comprehensible and accurate financial narrative.

What's paramount in this process is ensuring your projections are easy-to-follow, reflect your business accurately, and articulate your strategic roadmap to success.

Overly complicated or unrealistic forecasts don't impress investors; transparency, simplicity, and solid evidence-backed planning do.

In fintech, where innovation meets unpredictability, a clear understanding and articulation of your financial path provides the confidence to navigate toward your objectives. A well-drafted, readable, and accurate financial projection is your compass in the tumultuous seas of the startup journey.

So, remember, your financial projections are not just numbers on a page. They are the translation of your business strategy into a language anyone can understand.

They reflect your understanding of your business and its place in the market.

And, most importantly, when done right, they serve as a compelling narrative of your startup's potential profitability and growth.

Whether you're just setting sail or already navigating through open waters, always remember: Keep your financial projections simple, accurate, and a true reflection of your business.

It's not just about getting the numbers right; it's about making them tell your startup's unique story.

Ready to take the helm?

Let's transform these financial projections into your roadmap to success!

Key Takeaways

Financial projections are vital for strategic planning in fintech startups.

Projections help manage rapid industry changes and attract investors.

Include specific fintech costs like regulatory fees and technology investments.

Effective projections balance realism with potential market scenarios.

Simplify projections to enhance understanding and investor communication.

Answers to The Most Asked Questions

-

The fintech model refers to the specific business model used by financial technology companies to create value and generate revenue. This can include a variety of revenue streams such as transaction fees, subscription fees, freemium services, interest margins, asset under management fees, data monetization, commissions on product sales, and white-labeling or API access fees.

-

A fintech operating model refers to how fintech companies organize and manage their business processes, technology, people, and external partnerships to deliver financial services efficiently and effectively. It includes how they handle regulatory compliance, technology deployment, customer service, and financial transactions.

-

Examples mentioned in the article include:

Stripe: A payment processing platform that charges a fee for each transaction.

TransferWise (now Wise): An international money transfer service that charges fees for currency conversion and transfers.

Robinhood: A stock trading app that offers free basic trading services with a paid option for premium features.

-

Fintechs make money through various revenue models as outlined in the text:

Transaction Fees: Charging for each transaction processed.

Subscription Fees: Charging recurring fees for access to financial services or software.

Freemium Services: Offering basic services for free and charging for advanced features.

Interest Margins: Earning differences between interest charged on loans and paid on deposits.

Asset Under Management (AUM) Fees: Charging based on the total amount of assets managed.

Data Monetization: Selling financial data insights or charging for API access.

Commission on Product Sales: Earning a fee for facilitating financial product sales.

White-labeling and API Access Fees: Offering technology solutions to other businesses for a fee.

-

There are several types of fintech based on their revenue models and service offerings, such as:

Payment Processors

International Money Transfer Services

Stock Trading Platforms

Investment Management Services (Robo-advisors)

Peer-to-Peer Lending Platforms

Insurance Aggregators

Banking Software Providers

-

Not all fintech is SaaS, but many fintech companies use the SaaS (Software-as-a-Service) model, especially those offering cloud-based financial services and tools. Fintech SaaS companies provide software that customers can access and use over the internet, typically for a subscription fee. Examples include cloud-based accounting software like QuickBooks Online and online accounting software for small businesses like Xero.