Biotech Startups Valuation: Challenges and Solutions

By Lior Ronen | Founder, Finro Financial Consulting

Valuing a startup is always a complex process. That challenge is even bigger when it comes to biotech startup valuation.

Biotech companies operate in a uniquely challenging landscape packed with unique business and valuation challenges.

Biotech startups often require substantial investment upfront to support the R&D process.

Unlike software startups like fintech, edtech, enterprise applications, AI, etc., building a biotech startup requires significant investment not only to recruit employees to build the tech and the product, but also to fund research, lab equipment, prototypes, manufacturing, and more.

If that’s not enough, biotech startups face severe regulatory scrutiny and require several approvals for each product released to the market.

These unique dynamics create a business that requires plenty of investment upfront that may be worthwhile in 5,6, or 7 years from now.

It sounds daunting, but we’re here to demystify that.

As the leading startup valuation firm, we’re here to walk you through the different steps in the valuation process for a biotech startup.

We’ll dive deep into these challenges, examining their intricacies and offering practical solutions for valuing life sciences and biotech startups.

Our focus in this article is on biotech valuation only.

It will focus on the valuation process biotech startups go through, specific valuation methods for this niche, and how to tackle the different challenges in this process.

First, we need to understand what is startup valuation.

Biotech startup valuation is all about figuring out how much these companies, which work on new medical treatments, are worth. This process is especially tough for biotech startups because they face unique challenges. They need a lot of money to develop their products and have to deal with strict rules before they can sell anything. Plus, it's hard to predict which treatments will actually make it to the market.

Overcoming these challenges is a key part of figuring out a startup's value. To do this, experts use special methods like rNPV, which looks at the risks of developing new treatments, DCF, which predicts the future money a company will make, and comparables, which compares the startup to similar companies. Each of these methods helps understand a biotech startup's true potential and risks.

- What is Startup Valuation and Why It Matters

- Unique Challenges in Biotech Startup Valuation

- Understanding the Biotech Startup IP

- The Foundation of Biotech Valuation: A Four-Step Financial Modeling Process

- rNPV: Risk-Adjusted Biotech Valuation

- DCF Method For Biotech Valuation: Challenges and Solutions

- Comparables Method For Biotech Valuation: Challenges and Solutions

- Conclusion

What is Startup Valuation and Why It Matters

Before we jump into the unique challenges of putting a price tag on biotech startups, let's talk about what startup valuation really means and why it's so important.

In simple terms, startup valuation is all about figuring out how much a startup is worth.

This isn't just about looking at what a company earns right now, but also about guessing how much it might make in the future, especially for startups that are all about new ideas and big dreams.

Valuation is super important for everyone involved in startups. If you're starting a company, knowing your company's value helps you talk to investors and get the money you need to grow.

For people thinking about investing in a startup, valuation helps them decide if a company is a good bet and how much money they might make in the future.

For startups, especially in the biotech world where things take a long time to develop and there are lots of rules to follow, valuation is more about the promise of what's coming than what's happening right now.

It's about how cool the technology is, how many people might want it, and how smart the plan is for getting through all those rules.

Why do we need to know a startup's value?

Well, it helps startups get the funding they need to keep going and growing.

For investors, it's about figuring out which startups are likely to succeed and give a good return on their investment.

It's all about making smart choices with your money, whether you're building a company or investing in one.

So, as we dive into the specific things that make valuing biotech startups tricky, remember that valuation is all about looking ahead and seeing the potential in new and exciting companies.

Get your expert valuation now!

Unique Challenges in Biotech Startup Valuation

Figuring out how much a biotech startup is worth can feel like trying to solve a super complicated puzzle.

It's tricky because biotech is filled with uncertainties and these companies operate differently from most other businesses.

Let's break down some of the big challenges:

1. Lengthy Development Cycles and Regulatory Uncertainty

Getting a product from an idea to the market takes a long time in biotech, usually over a decade. It's like running a marathon with tons of hurdles along the way.

Plus, there are all these rules and regulations that companies have to meet to get their product approved. These can be really hard to predict and make things even more uncertain.

2. High Rates of Failure

In biotech, there's a higher chance of things not going as planned. Many experimental drugs don't make it past the testing phase.

This means that companies and investors need to think really hard about the risks at each step and try to guess whether the drug will be successful or not.

3. Capital Intensity

Biotech startups need a ton of money to do their research and development.

These companies often don't make any money for a long time, which makes it really hard to figure out how much they're worth..

4. Intellectual Property (IP) Valuation

A big chunk of a biotech startup's value is in the ideas and discoveries they've made, like new drugs or technologies.

Figuring out how much these are worth can be really tough, especially when the company is just starting out and people aren't sure how useful these discoveries will be in the market.

5. Market Volatility

The biotech market is like a roller coaster.

Company values can go up or down dramatically because of new discoveries, rule changes, or just how the market is behaving.

This makes figuring out a company's value even more difficult.

Despite these challenges, people are still drawn to invest in biotech. The potential for big returns and the chance to be part of major health breakthroughs keep investors interested.

If they can get their heads around these challenges, they can make smarter decisions and handle their risks better.

Now that we've looked at these challenges, let's focus on something that's special about biotech. It's what you might call an "all or nothing" field.

That's because a startup's success often depends on one big event, like getting approval for a new drug.

The outcome is either a big win or a big loss, with not much in between.

In the next part, we'll zoom in on the importance of IP in biotech startups before we dive into the valuation process.

Understanding the Biotech Startup IP

When we talk about the heart and soul of any biotech startup, we're really talking about its Intellectual Property (IP).

IP is all about the unique ideas, inventions, and processes that a company owns.

It's the secret sauce that sets a biotech firm apart from the crowd, from patents on groundbreaking medical devices to the proprietary research methods that lead to those big discoveries.

But why is IP such a big deal when we're putting together financial projections and valuing a biotech startup? Well, IP is pretty much the backbone of a biotech firm's future success.

It's not just about what the company is worth today, but what its innovations could bring to the table tomorrow. Understanding a startup's IP helps us gauge its potential market exclusivity, competitive edge, and ability to generate revenue long-term.

For financial modeling and valuation, getting a grip on IP means we can make smarter forecasts about revenue growth, pricing power, and market penetration. It tells us if a startup's technology might revolutionize a treatment, attract partnerships, or fend off rivals.

Essentially, IP is a critical factor in predicting how much cash a biotech startup could rake in once its products hit the market.

But it's not just about the big bucks. IP also highlights risks and challenges. Regulatory hurdles, patent disputes, or the costs of protecting intellectual property can all impact a startup's financial path.

By weaving IP into our financial models, we make sure we're not just seeing the potential highs but also planning for the possible bumps along the way.

In short, understanding a biotech startup's IP isn't just an academic exercise; it's a crucial step in painting a complete picture of the company's value and its future in a highly competitive and innovation-driven market.

To learn more about the importance of intellectual property in startup valuation, check out our guide to IP valuation.

As we move forward to explore specific valuation processes and valuation methods, keeping the IP factor in mind will be key to unlocking the true worth of these pioneering companies.

The Foundation of Biotech Valuation: A Four-Step Financial Modeling Process

Diving into the world of biotech startup valuations means getting up close and personal with the financial models that make these valuations tick.

After tackling the big challenges that come with valuing these innovative ventures, it's clear that having a solid plan for financial modeling is key to nailing down those numbers right.

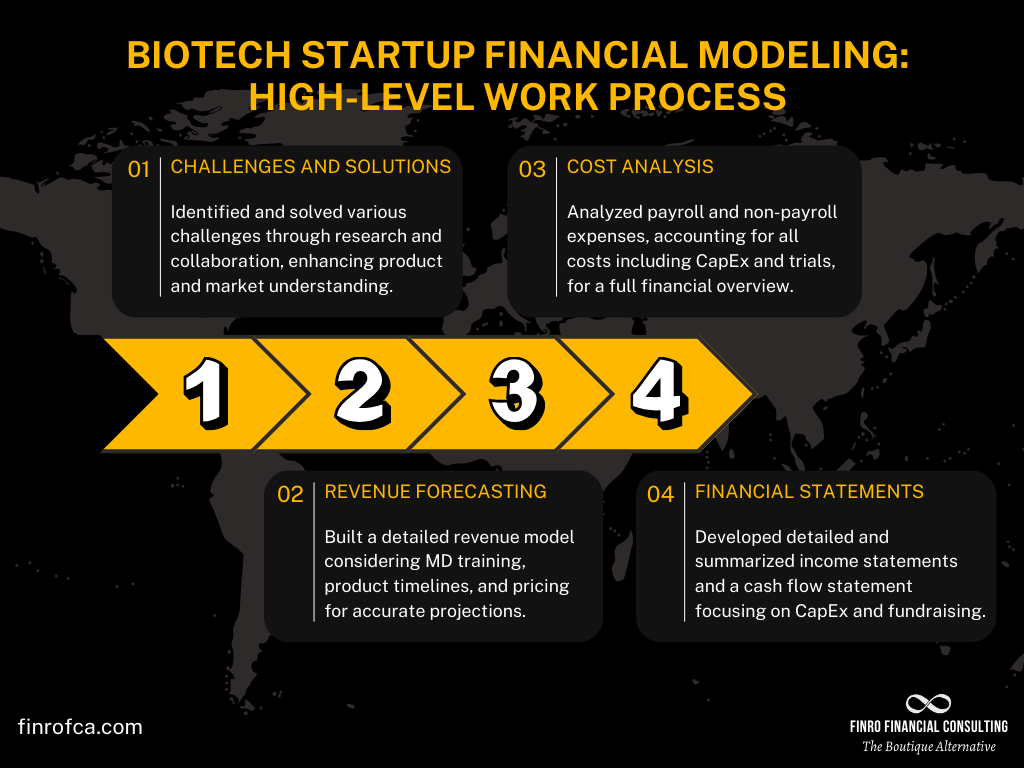

We're rolling out a four-step blueprint that's all about piecing together the financial puzzle of a biotech startup, setting the stage for figuring out just how much these companies could be worth.

Challenges and Solutions: Kick things off by tackling the big questions unique to the biotech world. From getting a handle on what the product's all about to figuring out how to make money off it, this step is all about digging deep, asking the tough questions, and working closely with the startup team to build a strong base for our financial model.

Revenue Forecasting: With our foundation in place, it's time to map out the money-making game plan. This means looking at everything from how many doctors we can get on board to when we can get our product out there and how we're going to price it. It's a ground-up approach that makes sure our sales predictions are as real as they get.

Cost Analysis: Now, let's talk spending. Splitting our focus between what we need to pay our team (payroll) and everything else (non-payroll), we shine a light on the unique cash challenges biotech startups face. By making sure we've covered all bases, from big purchases (CapEx) to the nitty-gritty of trial costs, we get a full view of what it's going to cost to bring our product to life.

Financial Statements: All this number-crunching leads us to the grand finale—putting together those all-important financial statements. Crafting an income statement that goes both deep and broad, and a cash flow statement that doesn't let CapEx or fundraising slip through the cracks, sets us up for a valuation that really means something.

This isn't just prep work; it's the cornerstone of valuing a biotech startup.

Curious to see this process in action? Dive into our case study on NephFlo, a biotech startup on the brink of something big, where we break down their financial modeling step by step.

Now that we've laid out what startup valuation involves, tackled the unique valuation challenges in the biotech world, and set the groundwork with our financial modeling steps, it's time to delve into specific valuation methods.

Up next, we explore the rNPV method tailored for biotech startups and adjust tried-and-true approaches like DCF and comparables to fit the unique contours of this exciting industry.

rNPV: Risk-Adjusted Biotech Valuation

In the high-stakes world of biotech startups, conventional valuation methods often fall short due to the sector's inherent uncertainties and 'all-or-nothing' nature.

This is where Risk-Adjusted Net Present Value (rNPV) becomes crucial.

What is rNPV?

rNPV stands for Risk-Adjusted Net Present Value. Unlike traditional Net Present Value (NPV), which calculates the present value of future cash flows without adequately considering the unique risks in biotech, rNPV introduces a layer of risk assessment specific to the industry.

It adjusts the expected cash flows by factoring in the probabilities of success or failure at various stages of drug development and market approval.

When is rNPV Used?

rNPV is primarily used in the biotech industry, particularly for valuing startups focused on drug development.

It's most applicable in scenarios where a company’s future is heavily dependent on the outcomes of clinical trials, regulatory approvals, and market acceptance of a new drug or medical technology.

How to Calculate rNPV

The calculation of rNPV involves several steps:

Forecasting Future Cash Flows: Estimate the future cash flows from the product or technology, assuming successful development and market launch.

Probability Adjustments: Adjust these cash flows by the probability of success at each stage of development, such as pre-clinical trials, Phase I, II, and III trials, and regulatory approval.

Discounting Cash Flows: Apply a discount rate to these adjusted cash flows to account for the time value of money and risk. This rate is often higher in biotech valuations due to the inherent risks.

Difference Between rNPV and Regular NPV:

Risk Adjustment: The key difference lies in risk adjustment. Regular NPV assumes a straightforward path to cash flow generation, while rNPV adjusts each cash flow forecast based on the probability of reaching that stage of development successfully.

Sector-Specific Application: Regular NPV is widely used across industries for various investment decisions. In contrast, rNPV is specifically tailored for sectors like biotech, where the risk of failure at different stages is significant and distinctly quantifiable.

Focus on Development Stages: rNPV requires a more detailed understanding of the drug development process and associated risks, whereas regular NPV is often based on more general business risk assessments.

Burn Rate and Cash Runway Considerations

While rNPV provides a nuanced view of a biotech startup's potential, it's also essential to understand the company's burn rate and cash runway.

These factors impact the company's financial sustainability and the urgency of achieving successful milestones.

Optionality in Biotech Startups

Incorporating the concept of 'optionality' in valuation recognizes the startup's flexibility and potential to pivot or expand its focus.

This is especially relevant in biotech, where a versatile technology platform or a diverse drug pipeline can significantly alter a company's risk profile and valuation.

rNPV, therefore, offers a more refined and industry-specific tool for valuing biotech startups, providing a realistic picture of their potential by intricately weaving in the unique risks and milestones of the biotech industry. Understanding and applying rNPV allows investors to make more informed decisions, accounting for the dynamic and uncertain path of biotech ventures.

DCF Method For Biotech Valuation: Challenges and Solutions

The DCF (Discounted Cash Flow) method, a popular valuation tool, estimates a business's value based on the present value of its expected future cash flows. However, applying this method to biotech startups presents unique challenges.

1. Limited Availability of Comparable Companies: Biotech startups often struggle to find direct comparables for valuation. To address this, analysts can broaden their scope, considering companies in similar niches, markets, sectors, or even the entire industry. In cases where specific comps are unavailable, industry averages or broader market data can serve as a substitute to estimate the discount rate.

2. Uncertainty in Future Financials: The biotech sector's complex nature makes it challenging to predict the development timeline and market entry of new products. A practical solution is incorporating scenario analysis in the DCF model. This involves creating realistic scenarios based on industry trends and historical data, offering a range of possible outcomes to better capture future financial uncertainties.

3. Uncertainty Around Regulatory Approval: The lengthy and unpredictable regulatory process in biotech adds another layer of complexity. Integrating probability factors for regulatory approvals into cash flow projections can more accurately reflect these risks. This approach allows for the quantification of potential delays and failures in clinical trials and regulatory hurdles.

4. Key Person Risk: Many biotech startups heavily rely on their scientific and management teams. The loss of key personnel can significantly impact product development. To account for this, the DCF model can include a risk premium or discount reflecting the dependency on key individuals. This adjustment acknowledges the potential impact of personnel changes on the company's future prospects.

Despite these challenges, DCF remains a valuable tool in biotech valuation, particularly for companies with a robust intellectual property portfolio and a clear commercialization pathway.

While sensitive to long-term growth rates and discount rates, DCF can provide a useful baseline valuation. However, it is most effective when used in conjunction with other valuation methods, like rNPV, for a more comprehensive analysis in the biotech sector.

In summary, while applying the DCF method to biotech startups requires adjustments and careful consideration of industry-specific risks, it can still offer meaningful insights into a company's value, especially when tailored to address the unique aspects of the biotech industry.

| Aspect | DCF Valuation | rNPV Valuation |

|---|---|---|

| Focus | Future cash flows of the entire company | Future cash flows of specific projects (like drug development) |

| Risk Assessment | Considers overall business risk through a discount rate | Adjusts future cash flows by the probability of success at each developmental stage |

| Application | Broadly used across various industries | Specifically tailored for sectors like biotech, where developmental risks are significant and quantifiable |

| Cash Flow Forecasting | Based on expected revenues, costs, and growth rates of the company as a whole | Based on potential revenues from specific projects, adjusted for the likelihood of project success |

| Discount Rate | Reflects the risk profile of the company as a whole | Often higher, reflecting the specific risks associated with each stage of the project |

| Complexity | Relatively straightforward, considering overall company performance | More complex, requiring detailed understanding of the biotech development process and associated risks |

| Valuation Sensitivity | Sensitive to changes in long-term growth rates and overall business risk factors | Highly sensitive to changes in success probabilities at different stages of development |

| Industry Suitability | Suitable for stable, revenue-generating companies | More suited for early-stage companies where future revenues are highly uncertain and dependent on specific milestones |

Comparables Method For Biotech Valuation: Challenges and Solutions

In the comparables valuation, or multiples valuation method, we value a business by comparing its value to other companies in the same niche or sector.

However, applying this approach to biotech and life sciences companies presents unique challenges:

1. Limited Availability of Comparable Companies: Biotech firms are often highly specialized, making it difficult to find public companies with similar products or services for a direct comparison.

To address this, we should broaden our search to include both private entities and other startups in the biotech sphere, even if they are not direct competitors. This wider net can capture a more diverse range of comparable business models and stages of development.

2. Limited Financial Information: Accessing comprehensive financial data for biotech companies, especially private ones, is challenging. To circumvent this, consider including both public and private companies in the comps analysis.

Alternatively, use proxy companies that share similar product development timelines or regulatory pathways as proxies for comparison. This approach helps in drawing parallels with entities that are in a similar stage of development or face comparable regulatory challenges, even if they are not direct competitors.

3. Volatile Valuation of Biotech Companies: Biotech valuations can fluctuate significantly due to factors like regulatory changes, clinical trial outcomes, or shifts in investor sentiment.

To mitigate this volatility, incorporate a sensitivity analysis in the valuation process. Using a range of values, rather than a single point estimate, can account for potential market fluctuations and provide a more realistic valuation spectrum.

4. Lack of Established Industry Benchmarks: The biotech sector often lacks standard benchmarks for certain metrics, complicating direct comparisons. In such cases, collaborate with industry experts to develop tailored benchmarks or rely on broader industry-specific metrics.

These could include development stage-specific metrics, burn rates, or funding levels, which are more indicative of a biotech startup's progress and potential.

Despite these challenges, the comparables method can be a valuable tool in valuing biotech startups, especially when used in conjunction with other valuation methods.

It's important to recognize that while direct competitors may be scarce, parallels can still be drawn with companies sharing similar characteristics, such as those in the same sector or facing analogous regulatory pathways.

This approach allows for a more nuanced and informed valuation, reflecting the unique dynamics of the biotech industry.

Conclusion

Valuing biotech startups is like going on a wild adventure. It's tricky because these companies are all about creating new medical breakthroughs, which can take a lot of time and go through lots of rules before they hit the market.

We've walked through what makes these startups so special and why figuring out their worth isn't straightforward.

We talked about how using smart ways like rNPV helps us get a better picture by considering all the ups and downs these companies face.

We also tweaked some classic methods to make them fit better with the unique world of biotech. This isn't just about putting a price tag on a company; it's about seeing the big picture of what they could do for health and medicine.

In this journey, we've seen that the real value of biotech startups goes beyond numbers. It's in their potential to change the health game with new treatments and technologies.

As we wrap this up, remember that valuing these companies is about understanding their journey, from the science lab all the way to the patient's bedside.

It's this journey and potential to make a difference that really show us what these startups are worth.

Key Takeaways

Biotech startup valuation is complex, involving heavy R&D investment, regulatory hurdles, and significant upfront capital.

Valuation includes unique methods like rNPV for risk assessment, DCF for future cash flow prediction, and comparables for market positioning.

Intellectual Property (IP) is crucial, underpinning the startup's future market exclusivity, competitive edge, and revenue potential.

The biotech market's volatility affects valuation, with outcomes hinging on product approval success, making risk management paramount.

Despite high failure rates and long development cycles, the potential for groundbreaking medical advancements drives investor interest in biotech startups.

Answers to The Most Asked Questions

-

Use rNPV for risk assessment, DCF for future cash flows, and comparables for market comparison, considering IP's impact on valuation.

-

Startups are valued by assessing potential growth, innovative technology, market demand, and investor interest, using various qualitative and quantitative methods.

-

WACC for biotech companies generally reflects the higher risk associated with the sector, factoring in research and development costs and regulatory challenges.

-

Multiples for biotech companies can include revenue and EBITDA multiples, adjusted for the industry's higher risk and development stage.