SaaS Startups Valuation in 2024

By Lior Ronen | Founder, Finro Financial Consulting

As we enter 2024, Software-as-a-Service (SaaS) is more than just a technological trend—it's an integral part of our everyday routines. From creating spreadsheets to enjoying music, learning languages, or managing our finances, SaaS is a constant companion.

Given its widespread influence, it's no surprise that many new startups are gravitating towards the SaaS model. For these companies, keeping a pulse on the market and understanding future directions is crucial.

In this article, we'll take a look back at how 2023 fared for SaaS startups, focusing on valuation and funding insights. We'll also explore five key trends that are shaping the SaaS landscape in 2024.

Then, we'll shift our focus to valuation methods for SaaS startups.

Regardless of the stage your startup is at, we'll discuss various valuation approaches, each with its own set of challenges and benefits. For those interested in a deeper dive, we'll suggest specific step-by-step guides on these methods.

So, let’s get started and first revisit the SaaS market as it stood in 2023.

As we recap 2023, a year that saw SaaS valuations recalibrate amidst a more prudent market, it's evident that the stage was set for a resurgent 2024. The current year marks a wave of innovation and niche specialization within the SaaS domain, with a clear trend towards the adoption of intelligent, scalable solutions that are finely tuned to the nuances of emergent market demands.

The valuation journey of a SaaS startup is a progressive shift from early speculative assessments of its conceptual potential to rigorous, data-centric evaluations as it establishes itself. Initially anchored in the promise of innovation and appraised by methods such as the Berkus Method, the valuation process gradually transitions to grounded, quantitative models like Discounted Cash Flow analysis in sync with the startup's maturation.

This nuanced valuation approach is closely interwoven with the company's developmental stage, prevailing market conditions, and the unique characteristics of the SaaS business model, demanding a versatile and in-depth assessment framework to precisely gauge its value.

- Recapping 2023 SaaS Valuations

- SaaS Revenue Multiples 2024

- SaaS Trends 2024

- Artificial Intelligence and Machine Learning Integration

- Vertical SaaS Expansion

- Enhanced Security and Compliance Measures

- Microservices and API-First Design

- Sustainable and Eco-friendly Solutions

- Valuation Methods for SaaS Startups

- Idea Stage: Methods and Challenges

- Early-Stage: Methods and Challenges

- Later-Stage: Methods and Challenges

- SaaS Startup Valuation Factors

- The Benefits Of Choosing Finro As Your Valuation Consultant

- Conclusion

Get your expert valuation now!

Recapping 2023 SaaS Valuations

The landscape of SaaS company valuations witnessed a notable shift in 2023, reflecting a dynamic and evolving market.

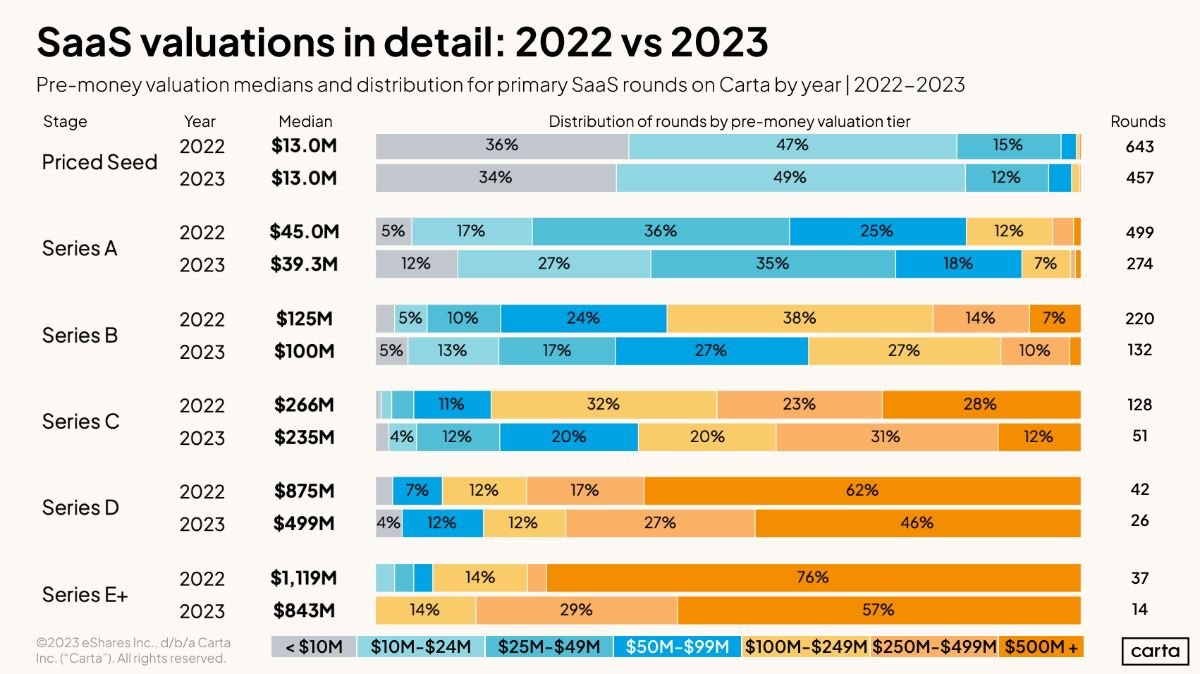

As we dissect the valuation trends, a key pattern emerges: a downward adjustment in median pre-money valuations across various funding stages when compared to the previous year.

Pre-seed and Seed Stages

At the earliest stages of funding, Pre-seed and Seed, the median pre-money valuation held steady at $13.0M across both years. This stability indicates a sustained investor confidence in the foundational stages of SaaS startups, where the potential for growth and scalability remains a strong lure.

Series A to Series C

Moving up the ladder to Series A, the median valuation saw a dip from $45.0M in 2022 to $39.3M in 2023. This contraction in valuation could be attributed to market corrections or increased scrutiny by investors as startups matured.

Similarly, Series B and Series C rounds also experienced valuation decreases, from $125M to $100M and $266M to $235M, respectively. This trend highlighted a more cautious investment approach, potentially spurred by economic uncertainties or a reevaluation of long-term profitability in the SaaS sector.

Later Stages: Series D and E+

The later stages—Series D and beyond—presented a more pronounced valuation shift. Series D median valuations were nearly halved from $875M in 2022 to $499M in 2023, while Series E+ valuations dropped from $1,119M to $843M.

The distribution of funding rounds across valuation tiers showed a marked migration from the highest tier of over $500M to a broader spread across lower tiers. This suggests a recalibration of expectations as companies and investors align with the realities of market performance and growth prospects.

Funding Activity

The number of funding rounds also provided insight into the market's pulse. While the infographic detailed variations at each stage, the overarching narrative indicated a fluctuating investment climate, with certain stages seeing an increased number of rounds, potentially signaling a heightened interest or a larger pool of investment-worthy candidates.

While 2023 was a year marked by recalibration within the SaaS industry, with valuations reflecting a cautious yet strategic investment mindset, the sector has since pivoted with resilience into 2024. Last year's valuation trends, suggestive of a broader market realignment, now serve as a prologue to the current narrative of innovation and specialization within the SaaS space.

As we turn our gaze to 2024, it's clear that the SaaS sector is not just rebounding, but indeed thriving on the back of significant technological advancements and the carving out of new market niches.

The steadfastness seen in 2023 valuations, despite market fluctuations, laid a solid foundation for the SaaS industry to leap forward.

Companies have taken the insights from the previous year's introspection and are now harnessing them to drive growth and adaptation in a landscape brimming with opportunity.

SaaS Revenue Multiples 2024

As we step into 2024, the average revenue multiple of SaaS businesses as reflected by the Bessemer Ventures SaaS index is 7.8x. Is that good? Bad? How did we got there?

To understand this, we analyzed the niche’s revenue multiple that serves as investors’ optimism and future growth expectations. So, after a wild ride of highs and lows, here’s how things are shaping up and the journey to this point:

At the tail end of 2023, the dramatic swings in value these companies experienced have quieted down. It’s like the waves have settled after a big storm. The prices that investors are willing to pay for these companies are not bouncing as much as before. This steadiness suggests that the market has adjusted to a new normal.

The climb to high values was most noticeable around 2020 and 2021. During those years, the world suddenly shifted online, and these SaaS and cloud companies were the heroes, providing the tools for businesses to operate from anywhere. Investors were eager to bet on these companies, predicting a future where their growth would only continue to skyrocket. That drove revenue multiples to a high of 18.4x in Sep 2021.

But what goes up must come down. After reaching dizzying heights, the value of even the best-performing companies took a steep dive. This sharp turn might have been a reality check for investors, who possibly recognized that the previous growth rates were not sustainable, or it may have reflected a broader economic squeeze, with tech companies often feeling the pinch first.

Previously, there was a big gap between the high-flyers and the rest. But as we move into 2024, this gap is narrowing. It’s becoming clear that not all SaaS companies are stars, but they aren’t all struggling either. The market is now more discerning, rewarding solid performance over lofty promises.

So, where does this leave us at the beginning of 2024? The value of these SaaS companies is more predictable than it has been in years past. This doesn’t mean growth has stopped; it just means growth is now more in line with what’s reasonable and expected.

The path to this more grounded state was paved with lessons learned. Investors have seen the potential and pitfalls of the SaaS market. They’ve watched as external events, like a global pandemic, can temporarily boost demand for digital tools. They’ve also learned that such surges can be followed by periods of adjustment.

In summary, as we look at SaaS startup valuations in early 2024, we’re seeing a market that has matured through a series of booms and corrections. Investors are now looking beyond the hype, focusing on the real-world performance and potential of these digital companies.

SaaS Trends 2024

The SaaS sector enters 2024 riding a wave of rapid evolution catalyzed by major technological breakthroughs and emerging specialized market openings. SaaS is transcending conventions, seamlessly embedding innovations like artificial intelligence while expanding its reach into tailored verticals.

This fluid adaptability speaks to the transformative potential of SaaS.

By continuously integrating cutting-edge advancements and catering offerings to niche demands, SaaS has effectively future-proofed itself. It stands ready to meet the challenges of a technologically sophisticated clientele across domains.

As we detail below, the major trends propelling SaaS forward reveal a substantial realignment currently underway - one pointing toward more intelligent, secure, scalable and sustainable software solutions catered to specific organizational needs.

Examining these trajectories offers insight into how the innovative vitality of SaaS is resolving contemporary pain points while unlocking new possibilities.

Trend 1: Artificial Intelligence and Machine Learning Integration

The integration of Artificial Intelligence (AI) and Machine Learning (ML) into SaaS platforms is a significant advancement, transcending basic automation and embracing intelligent decision-making, predictive analytics, and personalized user experiences.

AI-driven chatbots and virtual assistants in customer service SaaS platforms, for example, are revolutionizing business-customer interactions with real-time, personalized assistance.

Additionally, the use of ML algorithms to analyze vast data sets is providing businesses with crucial insights, particularly transformative in sectors like marketing where understanding consumer behavior is key. This shift elevates SaaS applications from mere tools to integral partners in strategic business planning.

A notable aspect of this trend is its impact on the valuation of SaaS startups specializing in AI. Our analysis reveals that the current revenue multiple for AI-centric SaaS startups is 37.5x. This figure is significantly higher than the average SaaS multiple, which stands at around 7.6x.

This stark difference underscores the heightened investor optimism and future growth expectations for AI-integrated SaaS solutions. The substantial premium on AI multiples reflects a strong belief in their transformative capabilities and potential for future financial success.

The integration of AI and ML into SaaS platforms is not just an enhancement of their capabilities but a redefinition of the role of technology in business strategy. By enabling smarter decisions, tailored user experiences, and predictive insights, AI and ML are setting new standards for software intelligence, driving the SaaS industry towards unprecedented growth and innovation.

Trend 2: Vertical SaaS Expansion

The tide is turning from one-size-fits-all SaaS solutions to niche offerings tailored to each industry's unique needs. Visionary firms are capitalizing on this seismic shift as businesses increasingly seek specialized software tailored to their precise workflows, not generic templates.

Vertical SaaS platforms have started penetrating sectors once impervious to cloud adoption. Where reluctance previously persisted, relevance now opens doors. Purpose-built for healthcare, finance, education and more, vertical solutions speak the language of each market they serve.

Consider healthcare software that intuitively manages patient data, optimizes staff scheduling, and augments diagnostic accuracy via integrated AI. Such capabilities resonate where out-of-the-box apps failed by aligning closely with established healthcare processes.

The proof lies in strong uptake indicators like higher user satisfaction, value realization and system usage rates compared to horizontal SaaS tools lacking contextual awareness. Specialization fills critical gaps.

Still, valuations spotlight the higher perceived potential in AI trailblazers charting entirely new territory. AI startups command a staggering 37.5x revenue multiples against the average SaaS multiple of 7.6x. Meanwhile, vertical SaaS multiples clock in at 12.3x - higher than generic SaaS due to focused value, but below AI's towering premiums.

This gap stems from AI startups’ higher-risk, higher-reward innovation factor contrasted against vertical SaaS companies essentially repackaging existing concepts for niche delivery. Although transformative for clients, investors thus apply a more conservative multiple.

In the end, vertical SaaS unlocks immense possibilities by aligning solutions with the realities of each business vertical - not disrupting reality itself. Therein lies the valuation difference. But as industries exponentially transform, the lines may soon blur.

Trend 3: Enhanced Security and Compliance Measures

In an era where data is as valuable as currency, ensuring its security is paramount. SaaS providers are stepping up their game by implementing robust security frameworks and adhering to stringent compliance standards like GDPR, HIPAA, and others. This includes the use of advanced encryption methods, regular security audits, and compliance checks.

For instance, companies like Okta and OneLogin specialize in identity and access management, ensuring secure and compliant access to various SaaS applications. Veeva Systems stands out in the healthcare and life sciences sector for its compliance with industry-specific standards, providing solutions that manage clinical trials and regulatory processes securely.

In the financial sector, nCino offers a secure, cloud-based operating system for financial institutions, adhering to strict compliance and regulatory standards. For general data protection and compliance, Box is a notable player, offering secure cloud storage solutions that cater to various industries while maintaining a strong emphasis on security and regulatory compliance.

These measures are critical in building and maintaining trust with users, especially in sectors where sensitive data is handled, such as in finance and healthcare. Companies like Zscaler, which provides secure web gateways and firewalls as a service, also contribute to this trust by protecting data in transit. It's not just about protecting data; it's about safeguarding business continuity and reputation.

These examples illustrate how SaaS providers are not only enhancing their security measures but are also specializing in meeting the unique compliance requirements of different industries, thereby reinforcing the overall trust in cloud-based solutions.

Trend 4: Microservices and API-First Design

The shift towards microservices architecture is revolutionizing the way SaaS applications are developed and deployed. This approach allows for the development of highly scalable and flexible software, where different functionalities are broken down into smaller, interconnected services. This modularity enables quicker updates, better scalability, and easier integration with other services.

A prime example of a company utilizing microservices architecture is Netflix. They have pioneered the use of microservices to handle their vast content library and user base, enabling them to deploy updates rapidly and maintain high availability. Similarly, Amazon Web Services (AWS) has effectively used microservices to provide a wide range of cloud services that can be easily integrated and scaled as per user needs.

In terms of API-first design, companies like Stripe and Twilio stand out. Stripe’s payment processing solutions and Twilio’s communication APIs are built with an API-first approach, ensuring seamless integration with various applications and systems, providing flexibility and enhancing overall user experience.

Another notable mention is Docker, which has been instrumental in popularizing containerization, a key component of microservices architecture. Docker's platform enables developers to package applications into containers, thereby simplifying deployment and scaling in microservices environments.

Coupled with an API-first design, this approach ensures that SaaS platforms can seamlessly connect with a variety of other applications and systems, thus enhancing their usability and functionality. It's a move away from monolithic architectures to a more interconnected, agile way of software development.

These companies exemplify the practical application of microservices and API-first design principles, showcasing how these approaches lead to more agile, scalable, and efficient software development in the SaaS industry.

| Aspect | API-First Companies | Microservices Companies |

|---|---|---|

| Primary Focus | Designing and developing APIs as the first step in the development process. | Developing applications as a suite of small, independently deployable services. |

| Key Objectives | Seamless integration with other systems; enabling external and internal services to communicate effectively. | Scalability, flexibility, and rapid deployment; independent development and deployment of services. |

| Examples | Stripe (Payment Processing), Twilio (Communication Services) | Netflix (Content Delivery), Amazon Web Services (Cloud Services) |

| Development Approach | Starts with creating APIs that are then used to build the rest of the application. | Starts with breaking down the application into smaller, loosely coupled services. |

| Deployment | APIs are deployed as interfaces to services and can be used by various clients and applications. | Each microservice is deployed independently, potentially on different platforms and technologies. |

| Maintenance and Updates | Focused on maintaining API compatibility and versioning. | Focused on updating individual services without impacting others. |

| Use Case | Ideal for businesses that require robust integration capabilities with other services and systems. | Suitable for complex applications that need to be highly scalable and require frequent updates. |

| Scalability | Scalability is achieved through the efficient management and scaling of APIs. | Scalability is achieved by scaling individual services as needed. |

| Complexity | Lower complexity in individual API development, but requires careful planning for integration and version control. | Higher complexity in managing multiple services, but offers greater flexibility in development and deployment. |

Trend 5: Sustainable and Eco-friendly Solutions

Sustainability is no longer an afterthought - it's a necessity. SaaS providers are increasingly recognizing their role in promoting sustainability. This involves optimizing data center energy efficiency, using renewable energy sources, and designing software that reduces the carbon footprint of its users.

Salesforce is a notable example in this space. They have been vocal about their commitment to sustainability, implementing strategies to reduce their energy consumption and investing in clean and renewable energy sources. Their focus extends to offering customers a carbon accounting product to help them manage their own carbon footprint.

Google Cloud also stands out for its sustainability efforts. They have been carbon-neutral since 2007 and continue to lead in the use of renewable energy sources. Their data centers are some of the most energy-efficient in the world, and they provide tools that help businesses improve their environmental impact.

Slack, known for its communication tools that facilitate remote work, indirectly contributes to sustainability by reducing the need for physical office space and the associated commuting emissions. They also emphasize sustainable practices within their operations and infrastructure.

Zoom Video Communications, another key player in the remote work domain, not only reduces travel-related carbon emissions through its video conferencing services but also focuses on optimizing the energy efficiency of its data centers.

These companies represent how SaaS providers can integrate sustainable practices into their operations and product offerings. By doing so, they're not only contributing positively to the environment but also aligning with the growing consumer and business demand for eco-friendly technology solutions. This shift towards sustainable and eco-friendly practices in the SaaS sector reflects a broader recognition of the role businesses play in addressing environmental challenges.

Valuation Methods for SaaS Startups

Valuing a Software as a Service (SaaS) startup is a nuanced and evolving process, changing significantly as the company progresses from its inception to maturity.

At each stage – Idea, Early, and Later – different valuation methods come into play, reflecting the shifting nature of what's being assessed and the varying levels of risk and potential. This journey of valuation is crucial, not just for determining a startup's worth at a given moment, but also for charting a course for future growth and investment.

Idea Stage Valuation: At the nascent Idea Stage, where tangible metrics are scarce, valuation leans heavily on potential and qualitative factors. Methods like the Cost-to-Duplicate, Market Comparison, and Berkus Method rely on assessing the idea's novelty, market demand potential, and the team's capability to execute. This stage is rife with uncertainties and subjective judgments, making valuation more of an art than a science.

Early Stage Valuation: As the startup enters the Early Stage, some operational and financial metrics begin to surface, allowing for a more data-driven approach. Valuation methods such as the Discounted Cash Flow (DCF) Analysis, and Comparables start to incorporate both qualitative assessments and early financial indicators. The challenge here is to balance optimistic projections with the realities of the startup's current position and market dynamics.

Later Stage Valuation: In the Later Stage, a startup's financial history and market presence provide a solid foundation for valuation. Advanced methods like refined DCF Analysis, Multiples Method, and Leveraged Buyout (LBO) Analysis are employed. These approaches are grounded in the startup's financial performance, market comparisons, and potential for future growth and returns. The valuation at this stage is more precise but must still account for market trends and the company's long-term strategic direction.

Understanding the appropriate valuation methods and their application at each stage of a startup's lifecycle is essential for entrepreneurs, investors, and stakeholders. It guides investment decisions, informs strategic planning, and shapes negotiations and transactions. This journey through different valuation stages reflects the evolving nature of SaaS startups, highlighting the interplay between innovation, market potential, and financial realities.

Dive into Finro step-by-step valuation guides:

| Valuation Method | Typical Stage | Used By | Description | Detailed Guide |

|---|---|---|---|---|

| The Berkus Method | Idea Stage Only | Angel investors | A qualitative approach to value early-stage startups, assigning monetary value to key risk factors. | Early Stage Startup Valuation With The Berkus Method |

| Cost-To-Duplicate Method | Idea Stage Only | Angel investors | Calculates how much it would cost to replicate the startup's product or service from scratch. | Understanding the Cost-to-Duplicate Valuation Method |

| The VC Method | Idea and Early Stage | VCs | Assessing a company's future potential for returns and working backward to determine its present value. | Value a Startup With The VC Method In 4 Easy Steps |

| The Comparables Method | From Early Stage | VCs and Private Equity Funds | A valuation technique that multiplies the company's revenue and EBITDA by an industry-specific multiple to determine its estimated value. | The Comparables Method Of Startup Valuation, Explained |

| Discounted Cash Flow | From Early Stage | VCs and Private Equity Funds | Estimates a company's value by projecting its future cash flows and discounting them to present value using a required rate of return. | A Quick And Dirty Guide For A Discounted Cash Flow Valuation |

Idea Stage: Valuation Methods and Challenges

At the Idea Stage, valuing a SaaS startup can be particularly challenging due to the lack of historical financial data and operational metrics.

Common methods used include:

Cost-to-Duplicate Approach: This method calculates the costs involved in duplicating the startup's product or service. It includes development costs, technology investment, and time spent. While straightforward, this method often undervalues the potential of the idea or innovation.

Market Comparison: Here, startups are compared to similar companies at the same stage in terms of market potential, technology, and business model. However, finding comparable startups can be difficult, and the rapidly changing market conditions of SaaS can make this method less reliable.

Berkus Method: This approach assigns a range of values to several key risk factors including the basic idea, prototype, quality of the management team, strategic relationships, and product rollout or sales. It's a way to estimate the startup’s value based on qualitative assessments.

Advantages and Challenges:

Advantages:

These methods provide a starting point for valuation in the absence of financials.

They encourage a focus on qualitative factors like team experience, market potential, and product uniqueness.

The Berkus Method allows for a more holistic view of the startup’s potential beyond just financials.

Challenges:

High subjectivity and reliance on qualitative assessment can lead to significant valuation variances.

Difficulty in accurately capturing the true potential and innovative aspect of the startup's idea or product.

Berkus Method can be highly subjective, with wide variances in valuation.

When to Use These Methods:

The Cost-to-Duplicate method is suitable when the startup’s value is heavily tied to its developed technology or product prototype.

Market Comparison is useful when there are identifiable and comparable startups in the same industry and at a similar development stage.

The Berkus Method is most appropriate when there's a need to evaluate the startup's broader potential, considering various qualitative factors beyond just the product, such as the team and market dynamics.

In the Idea Stage, valuation is more art than science. It requires a balanced approach, combining these methods with a deep understanding of the SaaS market and the specific startup's potential.

Early-Stage: Methods and challenges

Valuation at the Early Stage of a SaaS startup involves slightly more data than the Idea Stage but still faces the challenge of limited financial history. Key methods include:

Discounted Cash Flow (DCF) Analysis: Though challenging due to the unpredictability of future cash flows in early-stage startups, DCF can be used. It involves forecasting the startup's future cash flows and discounting them to present value. This method requires making several assumptions about growth rates, margins, and discount rates.

Comparables Method (Comps): Similar to market comparison in the idea stage, this method involves comparing the startup to private companies, publicly traded companies or recent acquisitions within the same industry. Adjustments are made to account for differences in size, growth potential, and risk profile.

Advantages and Challenges:

Advantages:

DCF provides a detailed financial forecast and can be very accurate if assumptions are well-grounded.

Comps offer a market-relevant valuation based on actual industry transactions.

Challenges:

DCF is dependent on many assumptions, which can be quite speculative at early stages.

Comps require a set of truly comparable companies, which might be hard to find, and also depends on market conditions.

When to Use These Methods:

DCF Analysis: Suitable for startups with some financial history and a predictable revenue model, even if based on assumptions.

Comparables Method: Best used when there are enough similar companies or recent deals to provide a reliable comparison.

In the Early Stage, valuation is a mix of quantitative and qualitative assessments. It requires a careful analysis of the startup’s current position and its growth potential, keeping in mind the inherent uncertainties of this developmental phase.

| Aspect | DCF Method | Comparables Method |

|---|---|---|

| Primary Focus | Projecting future cash flows and discounting them to present value. | Comparing the startup to publicly traded companies or recent acquisitions in the same industry. |

| Key Considerations | Cash flow forecasts, growth rates, margins, and discount rates. | Market multiples, industry benchmarks, size, growth potential, and risk profile of comparable companies. |

| Data Reliance | Highly dependent on financial forecasts and assumptions. | Relies on available market data of comparable companies or deals. |

| Subjectivity | Subjective in estimating future financial performance and assumptions. | Less subjective but depends on the availability and relevance of comparables. |

| Complexity | Requires in-depth financial knowledge and understanding of forecasting. | Simpler, more straightforward if comparable companies are available. |

| Flexibility | High flexibility in adjusting assumptions based on scenarios. | Limited to available market data and recent transactions. |

| Best Used When | The startup has a predictable revenue model and some financial history. | There are sufficient and closely related market comparables available. |

| Accuracy | Can be very accurate if assumptions are well-grounded and realistic. | Accuracy depends on how closely the comps align with the startup’s business model and stage. |

| Market Dependency | Less influenced by current market conditions. | Highly influenced by market trends and conditions. |

| Suitability | Suitable for more mature startups with clearer financial projections. | More suitable for early to mid-stage startups with identifiable market comparables. |

Later-Stage: Methods and challenges

Valuation at the Later Stage of a SaaS startup becomes more data-driven, with a clearer financial and operational track record. Common methods used include:

Discounted Cash Flow (DCF) Analysis: At this stage, DCF becomes more reliable due to the availability of historical financial data. The method involves projecting the startup’s future cash flows and discounting them to their present value, offering a view of the intrinsic value based on actual performance.

Multiples Method: This method involves applying valuation multiples such as revenue or EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) multiples. These multiples are derived from comparable companies in the market, providing a market-relative valuation.

Leveraged Buyout (LBO) Analysis: Used mainly in private equity transactions, LBO analysis determines the value of a company based on the returns a leveraged buyout would generate. It's based on the premise of how much debt the company can sustain and the potential for return on equity.

Advantages and Challenges:

Advantages:

DCF offers a detailed and intrinsic value based on the company’s own data.

Multiples Method provides a quick and market-relative valuation, aligning the company’s value with current market trends.

LBO Analysis is useful for understanding the value from an investor’s perspective, particularly in private equity.

Challenges:

DCF depends heavily on the accuracy of future cash flow projections, which can still be uncertain.

Multiples can vary significantly across industries and market conditions, affecting valuation accuracy.

LBO Analysis is complex and requires assumptions about financing structures and exit scenarios.

When to Use These Methods:

DCF Analysis: Ideal when the startup has a solid financial history and predictable revenue streams, allowing for more accurate forecasting.

Multiples Method: Suitable when there are a significant number of comparable companies and the market conditions are stable.

LBO Analysis: Best used in scenarios where the startup is a potential target for a leveraged buyout, particularly by private equity firms.

In the Later Stage, valuation becomes more grounded in financial realities and market comparisons. However, it still requires a nuanced understanding of the startup’s unique position, future potential, and the broader market dynamics.

SaaS Startup Valuation Factors

Valuation of a SaaS startup is a complex process influenced by various key factors. Understanding these elements is crucial for accurately assessing a company's worth and potential for growth in the competitive SaaS landscape.

Revenue and Growth Rate:

The revenue growth rate is often the most glaring indicator of a SaaS startup's success and potential. High, consistent growth rates are attractive to investors as they suggest market demand and the potential for future profitability. However, it's important to balance growth with sustainability; rapid growth that burns through cash reserves can be a red flag.

Customer Metrics:

Metrics like Customer Acquisition Cost (CAC), Lifetime Value (LTV), churn rate, and customer engagement levels provide deep insights into the startup's market efficiency and customer base stability. A low churn rate coupled with a high LTV and low CAC typically signifies a healthy, growing customer base and efficient market operations.

Market Size and Position:

The potential market size and the startup's position within that market are critical valuation factors. A startup leading in a large, expanding market is valued higher than one in a saturated or shrinking market. The ability to capture and maintain a significant market share is also indicative of a company's long-term viability.

Scalability:

Scalability, or the ability to grow revenue with minimal incremental cost, is a hallmark of successful SaaS businesses. Startups that demonstrate scalable business models through technology leverage and efficient operations tend to have higher valuations.

Unit Economics:

Understanding the profitability of each customer (unit economics) is key. This involves analyzing the revenue generated per customer against the cost to serve them. Positive unit economics, where the cost to acquire and serve a customer is significantly lower than the revenue they generate, boosts valuation.

Recurring Revenue Quality:

The predictability and stability of recurring revenue streams are crucial. High-quality recurring revenue, characterized by long-term contracts and a loyal customer base, provides a stable financial outlook, making the startup more valuable.

Technological Edge:

A SaaS startup's proprietary technology, intellectual property, and the overall technical robustness of its product can significantly impact its valuation. Unique technological advantages can provide a competitive edge and serve as a barrier to entry for competitors.

Team and Leadership:

The experience, skills, and track record of the founding and management teams are closely scrutinized. A strong team with a history of successful ventures and industry expertise can significantly increase investor confidence and, consequently, the startup's valuation.

Market Trends:

Current trends in the tech industry and investor sentiment can influence valuations. For instance, startups in trending sectors like AI or cybersecurity may attract higher valuations due to the perceived high growth potential in these fields.

Exit Strategy Potential:

The likelihood and potential for a successful exit, whether through acquisition or an IPO, can enhance a startup's valuation. Investors often look for clear exit strategies that promise a substantial return on their investment.

In conclusion, a SaaS startup's valuation is influenced by a blend of financial performance, market dynamics, technological strengths, and the capabilities of its leadership team. These factors collectively paint a picture of the startup's current position and future prospects in the market.

The Benefits Of Choosing Finro As Your Valuation Consultant

Selecting the right valuation consultant is pivotal for startups at the cusp of growth and investment.

Finro distinguishes itself as an essential ally for startups, delivering bespoke valuation solutions tailored to the dynamic needs of emerging companies. Here's a look at the key advantages of engaging with Finro for your startup's valuation needs:

Tailored Valuation Solutions: Recognizing the uniqueness of each startup, Finro offers a deeply personalized valuation process. By examining your startup's specific business model, growth potential, and market environment, Finro ensures that the valuation genuinely captures your startup's distinct value proposition.

Efficient Valuation Delivery: In the fast-moving startup ecosystem, efficiency is key. Finro is committed to providing prompt valuation services, helping you to quickly move forward with crucial investor discussions and strategic planning, minimizing downtime and maximizing momentum.

Flexible Approach: Acknowledging the fluid nature of startups, Finro offers unparalleled flexibility in its valuation services. Adjusting its approach to suit your startup’s evolving needs, Finro ensures that its services are always in sync with your growth trajectory and operational tempo.

Personalized Consultation Experience: With Finro, you benefit from a dedicated consultant who immerses themselves in understanding your business. This direct engagement facilitates a deeper, more insightful valuation process, ensuring outcomes that are actionable and aligned with your strategic goals.

Value-Oriented Pricing: Finro is committed to providing exceptional value, offering premium valuation services at competitive rates. This approach enables startups to access high-caliber valuation expertise without straining their financial resources, freeing up capital for critical growth initiatives.

Holistic Growth Partnership: Finro transcends traditional valuation services, positioning itself as a strategic partner in your startup’s journey. Leveraging extensive experience in financial analysis and the startup ecosystem, Finro provides comprehensive support, guiding startups through the intricacies of fundraising and strategic growth.

Opting for Finro as your valuation partner equips your startup with more than just precise valuation figures; it provides you with a strategic ally dedicated to nurturing your growth and success.

Finro’s approach is designed not only to evaluate but to empower startups, offering insightful, actionable guidance tailored to propel your venture forward.

Conclusion

The journey through the various stages of SaaS startup valuation reveals a dynamic and multifaceted process. From the initial Idea Stage, where potential and innovation take the forefront, to the Early Stage, where operational metrics begin to paint a clearer picture, and finally to the Later Stage, where financial performance and market positioning become crucial, each phase presents its unique set of challenges and methods.

Understanding these stages is crucial for entrepreneurs, investors, and stakeholders within the SaaS industry. It enables them to make informed decisions, whether it's about investing, strategizing for growth, or navigating potential acquisitions and mergers.

At the Idea Stage, where tangible data is scarce, valuation leans on potential, market demand, and the team's capability. As the startup progresses to the Early Stage, the blend of qualitative assessments with early financial indicators offers a more nuanced view of its worth. In the Later Stage, the focus shifts to more data-driven methods, providing a grounded and comprehensive valuation based on the company's financial track record and market presence.

The evolving nature of SaaS startups, characterized by innovation, market dynamics, and technological advancements, requires a flexible yet methodical approach to valuation. It's a balancing act between understanding the unique value proposition of each startup and grounding valuation in financial realities and market potential.

As we look ahead, the SaaS industry continues to grow and evolve, presenting new challenges and opportunities in startup valuation. Staying abreast of these changes, adapting to new market conditions, and continually refining valuation methodologies will be key to success in this vibrant and ever-changing landscape.

In summary, the valuation of SaaS startups is not just a matter of applying financial formulas; it's an art that requires a deep understanding of the technology, the market, and the unique trajectory of each company. It's about capturing the essence of innovation and potential in a rapidly advancing digital world.