Case Study: Financial Modeling For a Revolutionary Biotech Startup

By Lior Ronen | Founder, Finro Financial Consulting

Saul, the CEO of NephFlo, an early-stage biotech startup on a mission to develop the world's first Artificial Implantable Kidney, reached out with a unique challenge:

Lior, can you help us with financial modeling? We have a few investors interested, and we need a pro's help to put our forecast together.”

Knowing Saul for years as a sharp entrepreneur and an ex-VC, I was aware that any project he’s involved in would be top-notch. So, I immediately accepted the job.

But here’s the catch – my knowledge about the niche of Artificial Implantable Kidneys was practically nil.

At this stage, NephFlo was grappling with the typical early-stage startup issues – no historical financials as a reference point.

This meant we had to start from scratch, figuring out costs for medical trials, lab equipment, prototype development, and hiring a team with highly specialized skills.

Despite these challenges, NephFlo had a clear vision.

The complexity lay in the different development cycles, FDA approval processes, legal requirements, and launch dates for each of their products. Coordinating all these aspects on a timeline was crucial to our project.

The most daunting task, however, was projecting future sales in an unfamiliar market. With no clear understanding of product specifics, competitor strategies, and market demand drivers for the coming years, this was no small feat.

Yet, it was precisely these uncertainties and unknowns that fueled my excitement to dive headfirst into this project.

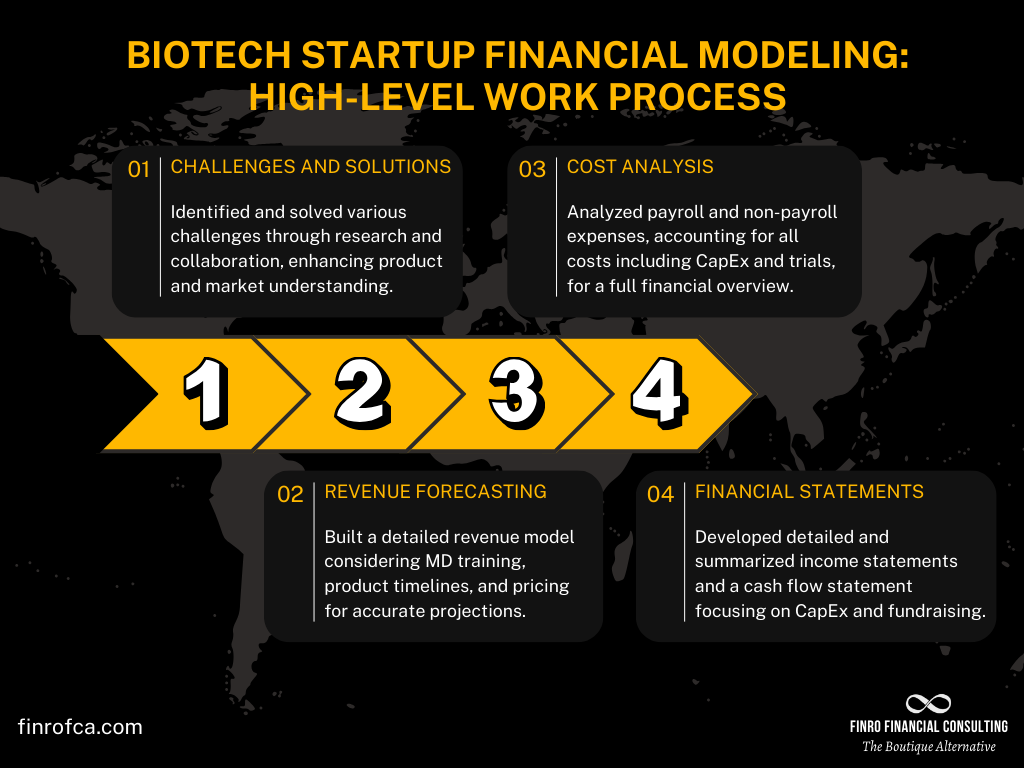

In this case study, we navigated the financial modeling for NephFlo, an innovative biotech startup developing the world's first Artificial Implantable Kidney. Faced with the challenge of a niche market and lack of historical financials, we systematically addressed various complexities to construct a comprehensive financial plan.

This included detailed revenue forecasting based on key factors like MD training and product timelines, thorough cost analysis separating payroll from non-payroll expenses, and the creation of two-layered financial statements. Our meticulous approach culminated in a robust financial model, equipping NephFlo with the clarity and strategy needed for successful investor engagement and forward planning in the biotech industry.

Mapping The Primary Challenges

Now that the initial fear was behind us, it was time to start breaking the project into different steps.

The first task was to identify and map all challenges related to this project and devise potential solutions for each.

Understanding the business, niches, and competitors is foundational in financial modeling and would later assist us in structuring the forecast with realistic assumptions.

Understanding the Product: The first hurdle was getting to grips with what the product actually does. I dived deep into research, understanding the conditions that necessitate the use of our product. By identifying specific conditions and analyzing different solutions for each, I comprehensively understood the product's purpose and functionality.

Market Analysis: Next, I explored the current market landscape. This involved researching existing solutions, their effectiveness, and how they differ from our product. By comparing our product with existing market offerings, I identified key differentiators that would help position our product effectively.

Competitor Differentiation: A crucial step was conducting a competitor analysis, focusing on both technical and business aspects. By comparing prices, sales methods, costs, and technical features, I was able to pinpoint exactly how our product stands out in the crowded marketplace.

Medical Trial Costs: Understanding the financials behind medical trials was essential. I poured over medical journal analyses and dissected trial costs across different niches in the medical devices market. This helped in forecasting trial costs, considering factors like scale and time variations.

Lab Equipment and Prototype Costs: Collaborating with the company, we listed assumptions for lab equipment and prototype needs. We evaluated the costs and timing for acquiring various items, ensuring a detailed and practical financial plan for development phases.

Payroll for Specialized Staff: Identifying the unique roles and skillsets was required next. The company outlined the necessary positions and their timelines. I then added projected salaries, options, bonuses, and employer taxes to create a comprehensive payroll forecast.

Mapping Financial Milestones: Together with the company and its legal advisor, we mapped out the primary milestones impacting financial forecasts. These included FDA approval cycles, prototype development stages, trial lengths, and staffing requirements at each stage.

Future Sales Assessment: The final challenge was projecting future sales. This involved breaking down sales into demand drivers like healthcare organization partnerships, MD training, recommendations, and adoption rates. This granular approach allowed us to create a more accurate and realistic sales forecast.

Tackling these challenges, head-on prepared us for the detailed financial modeling that lay ahead and provided invaluable insights into the complex world of biotech startups.

Each solution brought us closer to a comprehensive and realistic financial model tailored specifically for NephFlo's groundbreaking journey.

| # | Challenge | Action Required | Solution |

|---|---|---|---|

| 1 | Understanding the Product | Research the problems the product addresses | Researched specific conditions and solutions required by the product |

| 2 | Market Analysis | Research current market solutions and differences | Analyzed existing products and identified key differentiators |

| 3 | Competitor Differentiation | Analyze competitors on technical and business aspects | Compared product with competitors on price, sales methods, costs, and features |

| 4 | Medical Trial Costs | Research costs for similar medical trials | Studied medical journal analyses to forecast varying trial costs |

| 5 | Lab Equipment and Prototype Costs | Determine specific needs and costs | Collaborated with the company to assess equipment and prototype costs |

| 6 | Payroll for Specialized Staff | Identify necessary roles and their costs | Outlined roles, skillsets, and projected compensation packages |

| 7 | Mapping Financial Milestones | Identify key financial milestones | Collaborated to identify FDA approvals, prototype stages, trial lengths, and staffing needs |

| 8 | Future Sales Assessment | Understand factors impacting sales | Broke down sales into healthcare partnerships, MD training, recommendations, and adoption rates |

Building the Revenue Projection

After gathering in-depth information about NephFlo's business and its niche market, our next step was to construct the first crucial piece of our financial puzzle: the revenue forecast.

We approached this by building a bottom-up revenue model, leveraging our extensive research findings.

The unique aspect of this medical device, financed by insurance and provided by healthcare organizations, is that the primary revenue driver hinges on the number of MDs trained to use the device.

It’s essential that MD training commences during the trials, ensuring they are well-acquainted with the device at launch.

Our revenue projection was constructed on three key sets of assumptions:

Timeline assumptions: We estimated crucial dates like when the company would receive funding, the development duration of the prototype, and the timeline for FDA approvals for each product. These helped us project product launch dates and enabled us to create various what-if scenarios.

Pricing assumption: Considering the unique unit price for each product aligned with the company's gross margin goals, we estimated initial prices. Our understanding of unit costs and the broader COGS, including trial expenses, facilitated these estimates.

Prescription assumptions: The linchpin connecting all elements was the estimated number of units prescribed by each trained doctor monthly.

By synthesizing these assumptions, we could comprehensively calculate the company’s monthly and yearly revenue from doctor training initiatives, unit sales, and total revenue.

In the next section, we’ll dive into how we utilized this information to construct the cost side of the financial model, thereby completing our comprehensive financial picture.

Get your expert startup financial model now!

Building the Costs Projection

Building on our revenue projections, we now turn our attention to constructing the cost side of NephFlo's financial model. Understanding the company's business model, timeline, and expected outcomes has laid a solid foundation for this next critical step.

We've categorized the cost structure into two primary segments: payroll expenses and non-payroll expenses.

In early-stage startups, particularly in the biotech sector, while payroll often represents a significant portion of expenses, non-payroll costs, due to the nature of the industry, are equally substantial and can't be overlooked.

Payroll Expenses: We've already laid much of the groundwork for payroll in our initial challenge mapping. Having identified the necessary roles and their associated costs – including salaries, options, bonuses, and employer taxes – the final piece was determining the start date for each position.

This allowed us to finalize our payroll expense projections with precision.

Non-Payroll Expenses: Moving to non-payroll costs, we included the research-derived product and trial costs, legal and accounting fees, equipment and prototype expenses, rent, insurance, and other significant expenditures such as sales, marketing, COGS, and product development.

This comprehensive list ensures we've captured all potential financial outlays NephFlo might encounter.

With all cost elements thoroughly outlined, the next step is to integrate these figures with our revenue projections.

This integration is crucial for creating a holistic financial model that accurately reflects NephFlo's business trajectory and financial health.

Income Statement And Cash Flow Projection

With the forecasted revenues, headcount, payroll, and non-payroll expenses now in hand, our next endeavor is constructing the income statement (also known as the profit and loss statement) and the cash flow projection.

These documents are crucial in presenting a comprehensive financial picture of NephFlo.

Building the Income Statement: Our approach to the income statement is twofold. Firstly, we create a detailed income statement, meticulously breaking down sales by each revenue stream and categorizing every expense.

This level of detail ensures that every aspect of NephFlo's financial operations is transparent and thoroughly accounted for.

The second layer is a summarized version of the income statement. This streamlined view provides a quick snapshot of key financial metrics such as revenues, Cost of Goods Sold (COGS), gross margin, and others, offering a high-level perspective of the company's financial health.

Crafting the Cash Flow Statement: Unlike other businesses, NephFlo's cash flow statement requires special attention to Capital Expenditures (CapEx), reflecting significant investments in fixed assets typical in the biotech industry.

Additionally, it's vital to incorporate fundraising assumptions to provide a complete overview of the company's financial liquidity and capital requirements.

This dual focus on detailed and summarized financial statements, along with a comprehensive cash flow analysis, equips NephFlo with the necessary tools to precisely determine funding needs and how these funds will be utilized. This clarity is invaluable for strategic decision-making and effective communication with potential investors.

Summary

This case study has detailed the comprehensive financial modeling process undertaken for NephFlo, an early-stage biotech startup focused on developing the world's first Artificial Implantable Kidney.

Our journey began with an initial challenge of understanding a niche market where traditional financial benchmarks were scarce.

We navigated through various complexities, including the creation of revenue and cost projections and the meticulous crafting of income and cash flow statements.

Challenges and Solutions: We systematically identified and addressed multiple challenges, ranging from understanding the product and its market to projecting sales and calculating costs. Our solutions were grounded in thorough research and collaborative efforts with the company.

Revenue Forecasting: The revenue model was built from the ground up, considering crucial factors such as MD training, product launch timelines, and pricing strategies. This bottom-up approach provided a realistic and detailed revenue projection.

Cost Analysis: Our cost analysis bifurcated into payroll and non-payroll expenses, highlighting the unique cost structures inherent in biotech startups. We ensured every potential expense, including CapEx and trial costs, was accounted for, providing a comprehensive view of the company's financial needs.

Financial Statements: The income statement was developed in a two-layer approach — a detailed layer for in-depth analysis and a summarized version for quick insights. The cash flow statement was crafted with special attention to CapEx and fundraising, crucial for a startup in its early stages.

In conclusion, this financial modeling project not only provided NephFlo with a clear roadmap for its financial planning but also prepared it to confidently engage with potential investors.

By meticulously addressing each aspect of the financial model, we ensured that NephFlo was equipped with a robust, realistic, and strategic financial plan, pivotal for its journey in revolutionizing medical device technology.