Understanding Venture Capital Liquidation Preference

By Lior Ronen | Founder, Finro Financial Consulting

Venture capital is more than just a funding mechanism; it's a partnership that shapes the trajectory of new businesses. Among the myriad of terms that sculpt these agreements, liquidation preference stands out as a pivotal element.

But what exactly is liquidation preference, and why is it so crucial in venture capital deals?

Liquidation preference determines the payout order to investors when a startup undergoes a liquidity event such as a merger, acquisition, or initial public offering (IPO).

This mechanism is not merely a procedural detail; it’s a strategic provision that protects investors and influences the financial landscape of a startup.

In this article, we will breakdown the nuances of liquidation preference, exploring its different types, how it affects the returns on investments, and its overall impact on startup valuation.

By understanding the intricate dynamics of liquidation preference, both investors and entrepreneurs can better navigate the complexities of venture capital financing.

Whether you’re gearing up for an investment round or strategizing an exit, a clear grasp of liquidation preference will equip you to align expectations, foster transparent discussions, and secure deals that reflect the true value of your venture.

Venture capital shapes the backbone of startup financing, where liquidation preferences are crucial in determining the financial fate of investors and founders during liquidity events. These terms, which prioritize investor returns through a hierarchy of payouts in various exit scenarios, are influenced by factors like investment stage, deal structure, risk profile, and market conditions.

A strategic grasp of liquidation preferences can safeguard investments, inform startup valuations, and align long-term goals, making knowledge and negotiation of these terms vital in venture capital agreements. Market trends indicate a move towards higher liquidation multiples as startups grow, underscoring the need for both parties to approach funding rounds with a thorough understanding of these financial mechanisms to ensure equitable and successful outcomes.

- Defining Liquidation Preference

- Understanding Different Types of Liquidation Preferences

- The Role of Liquidation Preference in Investor Returns

- Factors Influencing Liquidation Preference

- Impact of Liquidation Preference on Startup Valuation

- Venture Capital's Pulse: Analyzing Liquidation Preference Patterns

- Strategic Importance of Understanding Liquidation Preferences

- Conclusion

Defining Liquidation Preference

Liquidation preference is a key term in venture capital agreements that specifies the order and manner in which investors are paid out in the event of a liquidity event.

At its core, liquidation preference ensures that investors receive their investment back before any other equity holders are paid.

This priority is critical in venture capital, as it directly affects the potential returns investors can expect from their investment.

Role in the Hierarchy of Investor Returns

During a liquidity event, the distribution of the company's sale proceeds is not arbitrary. Investors with liquidation preferences are placed at the top of the payout hierarchy. This setup means that if a company is sold, liquidation preferences dictate which investors get paid first and how much they receive.

The specific terms can vary, but generally, these preferences help minimize the financial risk for investors by prioritizing their returns over other stakeholders, such as founders and employees with common stock.

Triggering Events for Liquidation Preferences

Liquidation preferences come into play during liquidity events—situations where shares are converted into cash, allowing stakeholders to exit part or all of their investment in a company.

Common liquidity events include:

Mergers and Acquisitions (M&A): When a company is merged with or acquired by another entity, the resulting consolidation or transfer of ownership can trigger liquidation preferences. Depending on the merger or acquisition terms, investors may receive their returns as part of the transaction.

Initial Public Offerings (IPOs): An IPO, where a company's shares are offered to the public on a stock exchange, often leads to significant financial returns. Here, liquidation preferences might determine the distribution of proceeds from the sale of shares, ensuring that investors with preferred stock receive their investment back before common shareholders benefit from the IPO.

Sale of the Company: In the direct sale of a company, liquidation preferences define how the proceeds from the sale are divided among shareholders. This ensures that those holding preferred shares recover their investments and potentially a predefined return, before any distribution to common shareholders.

Understanding when and how liquidation preferences trigger is essential for all parties involved in venture capital.

It influences decisions ranging from investment timing to the strategic direction of a startup, aligning the interests of investors with the long-term success of the company.

| Triggering Event | Description | Impact on Liquidation Preferences |

|---|---|---|

| Mergers and Acquisitions (M&A) | Company merges with or is acquired. | Prioritizes investor payouts based on negotiated terms. |

| Initial Public Offerings (IPOs) | Shares offered on a stock exchange. | Ensures preferred investors are paid first from share sale proceeds. |

| Sale of the Company | Direct sale to another entity. | Divides sale proceeds among shareholders, with preferred ones paid first. |

Understanding Different Types of Liquidation Preferences

Liquidation preferences vary not just in magnitude but also in the mechanics of how they provide returns to investors.

The three main types — non-participating, participating, and capped participating — each affect the distribution of proceeds among shareholders differently.

Here's a detailed look at each:

Non-Participating Liquidation Preference

In a non-participating liquidation preference scenario, the investor has the right to either receive their initial investment back or convert their preferred shares into common shares and participate in the distribution of the remaining assets on a pro-rata basis.

However, they do not receive any additional returns once their initial investment is recouped if they choose the preference payout.

This preference ensures that investors recover their initial outlay before common shareholders receive anything. If the company sells at a high enough value, the investor might choose to convert their shares to benefit from the greater potential return as a common shareholder.

Participating Liquidation Preference

Investors with participating liquidation preferences receive their initial investment back first and then also participate in the distribution of the remaining proceeds alongside common shareholders.

This essentially allows them to double-dip: first to recover their investment and then to share in the profits.

This type maximizes the potential returns for investors, as they receive both their guaranteed initial investment back and a proportion of any additional proceeds.

This can significantly dilute the payout to common shareholders, especially in modest exit scenarios.

Capped Participating Liquidation Preference

This is a variant of the participating preference, where the investor participates in the proceeds until a certain multiple of the return is reached.

Once this cap is achieved, they no longer participate in further distributions.

Capped participating preferences strike a balance between protecting investor returns and ensuring that founders and other stakeholders retain a meaningful share of the proceeds beyond a certain point.

The cap is typically set as a multiple of the invested amount (e.g., 2x or 3x the initial investment).

By choosing the right type of liquidation preference, investors and founders can align their goals and expectations, ultimately shaping the company's strategic decisions and exit strategies.

The Role of Liquidation Preference in Investor Returns

Liquidation preferences play a crucial role in defining the financial returns of venture capital investors.

This financial mechanism is designed to mitigate risk by ensuring that investors recoup their initial investments before any other equity holders receive distributions.

This section explores how liquidation preferences prioritize investor payouts and their impact on overall investment returns.

Ensuring Initial Investment Recovery

Liquidation preferences are particularly significant in scenarios where the return from a liquidity event (like a sale or IPO) might not be sufficient to distribute funds broadly across all shareholders.

In such cases, the liquidation preference acts as a safety net for investors, guaranteeing that they recover their initial outlay before any other parties.

This setup is crucial in venture capital, where the risk of total investment loss is substantial, and such preferences provide a layer of financial security.

Concept of Preferred Return

The concept of preferred return is central to understanding how liquidation preferences work.

Preferred return means that investors are entitled to receive a predefined rate of return on their investment before any profits are shared among other shareholders.

This return often exceeds just the recovery of the initial investment, including an additional percentage that represents the risk taken by the investors.

In practice, preferred returns are implemented through specific clauses in the investment agreement that detail:

The multiple of the investment: Often, the preference is set at a multiple of the initial investment, such as 1x, 2x, or even 3x, which means investors get back their investment multiplied by the specified factor.

Participation rights: Depending on whether the preference is participating or non-participating, investors might also share in any remaining proceeds after their initial investment and preferred return are secured.

Prioritization of Payouts in Various Scenarios

Liquidation preferences can dramatically affect how payouts are prioritized under different exit scenarios:

Underperforming Exits: In situations where the company sells for just enough to cover the liquidation preferences, investors will likely receive their entire preferred return, while common shareholders may receive little to no payout.

Successful Exits: In highly successful exits, where the proceeds far exceed the aggregate preferences, investors still receive their preferred return first, and the surplus is then distributed among all shareholders, potentially resulting in significant returns for common shareholders as well.

Intermediate Exits: For exits that perform moderately well but do not generate spectacular returns, the structure of the liquidation preference (particularly whether it is capped or participating) will significantly influence the distribution of proceeds.

Impact on Overall Investment Strategy

The structure of liquidation preferences can influence the overall investment strategy of venture capitalists.

Investors may favor scenarios where their return is secured through high liquidation preferences, potentially at the cost of common shareholder value in modest exit scenarios.

Conversely, more equitable structures can align the interests of investors with those of founders and other shareholders, promoting a more collaborative approach to growing the company.

| Type of Liquidation Preference | Description | Impact on Payouts | Scenario Impact |

|---|---|---|---|

| Non-Participating | Investors receive back their initial investment or convert to common shares. | Investors get their investment back, no more. | Underperforming: Investors safe; common holders might get nothing. Successful: Investors might choose conversion for higher gains. |

| Participating | Investors receive their investment back and then share in additional proceeds. | Maximizes returns for investors; can dilute payouts to common shareholders significantly. | All scenarios: Investors receive initial investment plus a share of any extra proceeds. |

| Capped Participating | Investors participate up to a certain cap in the proceeds. | Investors' returns are capped, protecting common shareholder interests beyond the cap. | Intermediate/Successful: Balances investor and common shareholder returns until cap is reached. |

Factors Influencing Liquidation Preference

Liquidation preferences are not uniform; they are influenced by a variety of factors that determine their structure and specifics in any given venture capital deal.

Understanding these factors is crucial for both investors and entrepreneurs, as they can significantly impact the terms of investment and the distribution of financial returns.

Here’s a closer look at the key factors that shape liquidation preferences:

Investment Stage

Description: The stage of the company at the time of investment—whether it is in seed, early, or later stages—affects the risk assumed by investors.

Impact: Early-stage investments typically carry higher risks due to unproven business models and market uncertainties. To mitigate these risks, investors might demand stronger liquidation preferences, such as a higher multiple or participating preferences.

Example: A seed-stage startup might offer a 2x non-participating liquidation preference to secure initial funding, whereas a later-stage company might only need to offer a 1x preference due to established operations and clearer paths to profitability.

Deal Structure

Description: The specifics of the investment deal, including the amount of money being raised and the valuation of the company, play critical roles.

Impact: Larger funding rounds or higher valuations can lead to more complex liquidation preference structures. Investors might negotiate for preferences that ensure they recover a significant portion of their investment.

Example: In a $50 million Series C round at a $200 million valuation, investors may negotiate for a 1x participating liquidation preference to both protect their investment and benefit from the company’s future success.

Risk Profile of the Investment

Description: Each investment has a risk profile based on factors like industry, competitive landscape, and financial health.

Impact: Higher-risk investments may lead to more aggressive liquidation preferences as investors seek to safeguard their returns against potential losses.

Example: An investor in a high-risk biotech startup, facing long regulatory approval processes, might insist on a capped participating preference to maximize potential returns while limiting exposure.

Market Conditions

Description: The overall state of the economy and specific market dynamics influence investor expectations and behaviors.

Impact: In a bullish market with ample liquidity, investors might be more willing to accept lower or non-participating liquidation preferences. Conversely, in bearish or uncertain markets, they might seek stronger protections through higher multiples or participating terms.

Example: During an economic downturn, venture capitalists might demand 1.5x participating liquidation preferences to offset the increased market risk.

Conclusion

These factors collectively determine the negotiation and structuring of liquidation preferences in venture capital deals.

By understanding how each factor affects liquidation terms, both investors and entrepreneurs can better prepare for negotiations, aligning their strategies with the prevailing conditions and specific deal dynamics.

This mutual understanding can pave the way for more effective and equitable investment agreements.

Impact of Liquidation Preference on Startup Valuation

Liquidation preferences play a pivotal role not only in the distribution of proceeds during exit events but also in shaping the perceived valuation and overall investor interest in a startup.

This section explores how these terms can both safeguard investor investments and influence the financial valuation of a startup.

Influencing Startup Valuation

Liquidation preferences directly affect a startup's valuation during funding rounds by setting a floor on the return investors expect to receive. This floor can serve as a critical negotiating tool, but it also adds a layer of complexity to valuation discussions:

Investor Assurance: By securing a minimum return on their investment through liquidation preferences, investors may feel more confident in committing larger sums of money. This security can lead to a higher upfront valuation, as the risk of losing initial investments is mitigated.

Perceived Value: Startups offering favorable liquidation terms might be viewed as more attractive investments, potentially increasing competition among investors, which can drive up valuation.

Capital Structure Complexity: The specific terms of liquidation preferences, such as multiples and participation caps, can complicate the capital structure. This complexity often requires sophisticated financial modeling to understand the true cost of capital and its impact on post-money valuation.

Dual Impact on Valuation and Risk

Liquidation preferences have a dual impact on both reducing investor risk and potentially influencing the startup’s valuation in significant ways:

Risk Mitigation: The primary function of liquidation preferences is to reduce the financial risk to investors in the event of a lower-than-expected exit valuation. By ensuring that investors get paid first, these preferences lower the risk profile of the investment, which can make the startup a more appealing investment target.

Valuation Influence: While liquidation preferences reduce downside risk, they can also indirectly increase a startup’s valuation by making the investment opportunity more attractive. Investors might be willing to pay a premium for shares in a startup if they know their investment is protected in downside scenarios.

Examples of Impact

Scenario 1: A startup with aggressive liquidation preferences (e.g., 2x participating) might initially attract investors due to high protection levels, boosting its valuation in early funding rounds. However, such terms could deter future investors who feel that the terms are too investor-friendly and detrimental to long-term equity value.

Scenario 2: A company offering a modest 1x non-participating preference might have a lower initial valuation but could attract a broader base of investors in later rounds, appreciating in valuation due to perceived fairer terms and potential for all shareholders to benefit proportionally from a successful exit.

Conclusion

Liquidation preferences are a double-edged sword in startup financing. While they provide necessary protection for investors, their impact on valuation must be carefully managed to align investor protection with long-term growth and equity distribution objectives.

Understanding and negotiating these terms are crucial for both founders and investors to ensure that the startup not only attracts initial funding but also sustains investor interest and achieves a fair valuation over time.

Get your expert valuation now!

Venture Capital's Pulse: Analyzing Liquidation Preference Patterns

Venture capital operates within a dynamic market that defies static analysis. Insights gleaned from the latest market data illuminate current trends in liquidation preferences across funding stages, offering a window into the collective mindset of investors and startups.

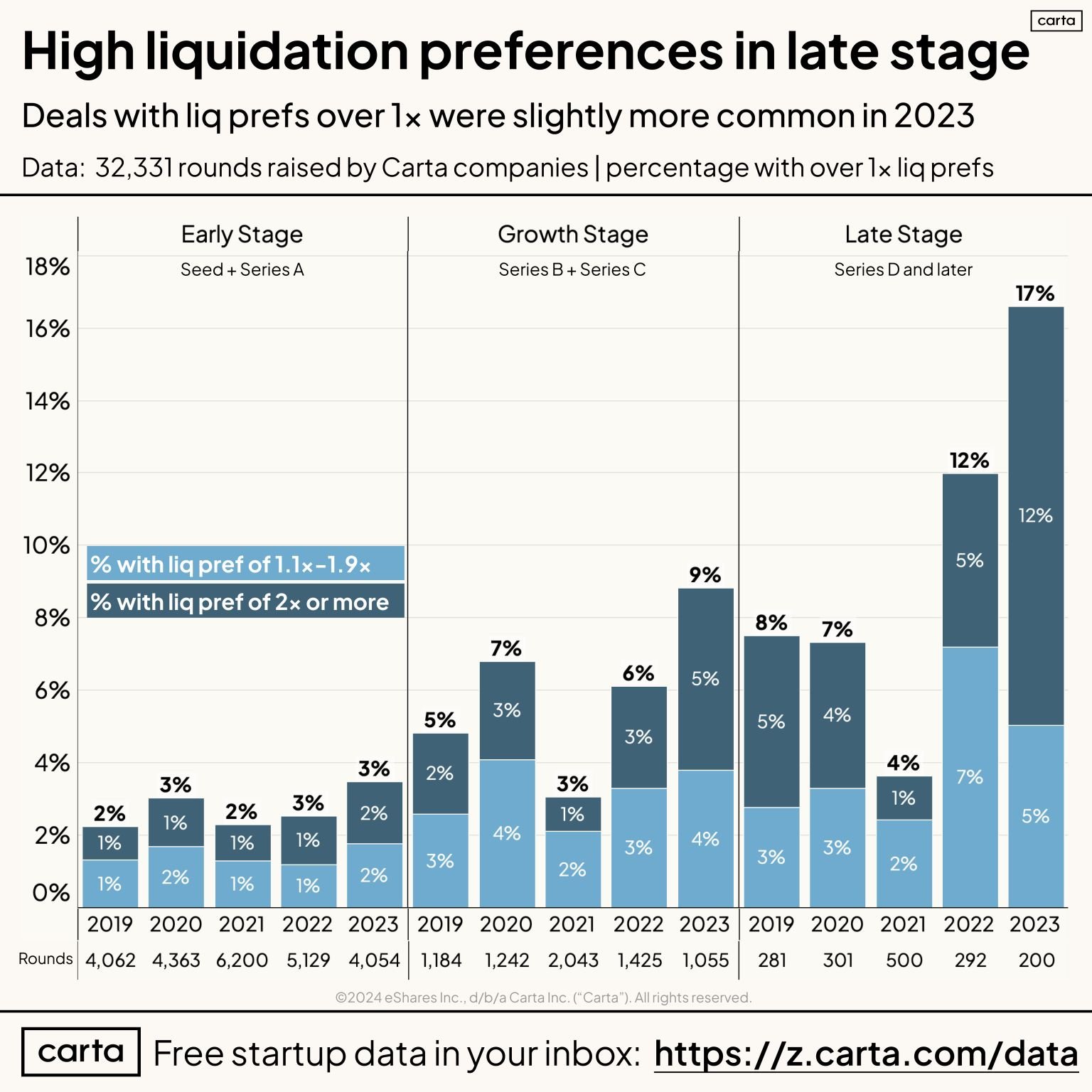

Data from over 32,000 funding rounds captured by Carta paint a detailed picture of how startups and investors negotiate liquidation preferences from early to late stages and how these negotiations reflect the changing economic landscape.

As we examine the early stages of funding, including Seed and Series A rounds, there's a consistency in the preference for liquidation multiples between 1.1x and 1.9x.

This suggests a tempered optimism where investors seek to protect their investments without setting prohibitively high hurdles for new ventures. The relatively low percentage opting for liquidation preferences of 2x or more could indicate a desire to not overburden fledgling companies with heavy financial commitments or perhaps reflects confidence in their growth trajectories.

Moving into the growth stages, Series B and Series C, the landscape shifts slightly. Here, the data shows a careful recalibration of investor risk appetite.

Some investors inch towards the safety of a 2x liquidation preference, indicating a strategic move for security as the companies’ valuations increase and their business models are expected to prove out. This is a delicate stage where the potential for rapid growth is weighed against the inherent risks of scaling operations.

The most striking trend emerges in the late stages of funding, Series D and beyond, where there is a marked trend toward securing liquidation preferences of 2x or more.

In these later rounds, the climb in preference for higher liquidation multiples in 2023 signals a heightened desire for financial safeguards.

This could be interpreted as investors bracing for greater market unpredictability or looking to shore up returns as companies approach major liquidity events like IPOs or acquisitions.

What do these year-over-year trends indicate for startups?

There is a clear message that as a startup matures, the expectations of its investors also evolve.

The movement towards higher liquidation preferences underscores a broader trend of risk aversion, perhaps indicative of a more cautious investment climate or a recalibration of exit strategies.

For startups, this data is invaluable for formulating funding strategies and preparing for negotiations.

Early-stage companies may find advantage in offering more moderate liquidation preferences, attracting investment through terms that do not overly insulate investors from risk.

Late-stage startups, however, may need to brace for and strategically navigate through investor demands for higher liquidation multiples, reflecting the increased amount at stake.

In conclusion, the trends identified by Carta’s comprehensive data analysis underscore the significant impact of liquidation preferences on startup valuations and the delicate balance of interests between investors and entrepreneurs.

As the venture capital market continues to ebb and flow, these insights are not just reflective of the present climate but are also indicative of future trajectories that both startups and investors must adeptly navigate.

Strategic Importance of Understanding Liquidation Preferences

In the high-stakes world of venture capital, knowledge is more than just power—it's a strategic imperative. Liquidation preferences stand as one of the most nuanced clauses in term sheets, with profound implications for both investors and founders.

A thorough understanding of these preferences is crucial, as they can dictate the financial future of both parties involved in the intricate dance of startup funding.

For investors, liquidation preferences provide a layer of financial security, ensuring that they are able to recoup their investment before others in the event of a sale or merger. By crafting terms that reflect the risk profile of the investment, they can strategically position themselves to either prioritize a return of capital or participate in the upside potential of the startup.

The subtleties of these preferences—from whether they are participating or non-participating, to the specific multiples involved—require careful consideration to balance investor protection with the potential for reward.

On the other side, founders must grapple with how these preferences can impact their control over the company and their share of the proceeds in a liquidity event.

A strong grasp of liquidation preferences is invaluable during negotiations, as it allows founders to structure deals that not only secure necessary capital but also preserve their vision for the company and its growth. Understanding these terms can be the difference between a fair deal and one that could lead to unfavorable dilution of equity or control under certain conditions.

The strategic benefits of mastering liquidation preferences are multifold:

Risk Assessment: Both parties can better assess and manage the risks associated with venture financing.

Valuation Clarity: They allow for a clearer understanding of how a company is valued, both at present and in future funding rounds or exit scenarios.

Aligned Interests: By negotiating terms that both sides understand and accept, investors and founders can align their interests towards the common goal of company growth.

Negotiation Leverage: Knowledge of liquidation preferences gives founders a stronger position from which to negotiate, potentially leading to more founder-friendly terms.

The call to action is clear: both investors and founders must proactively seek to understand the ins and outs of liquidation preferences. This knowledge is not merely academic; it's a critical component of strategic decision-making.

Founders should arm themselves with financial savvy, perhaps even seeking the advice of experienced mentors or financial advisors. Similarly, investors need to keep abreast of market trends and the implications of different liquidation structures.

In conclusion, a thorough understanding of liquidation preferences is essential for anyone involved in the venture capital ecosystem. It informs strategy, empowers negotiation, and ultimately aligns the long-term objectives of investors with the entrepreneurial spirit of founders.

The time invested in understanding these preferences is a direct investment in the future success of the startup.

Conclusion

Navigating the intricacies of venture capital can often resemble charting a course through uncharted waters, where understanding the nuances of liquidation preferences acts as the compass for both investors and founders. These preferences are not mere footnotes in the financial statements but rather key provisions that can determine the outcome of investment and the distribution of wealth in a startup's journey.

Throughout this article, we've uncovered the layers of liquidation preferences, from their basic definitions to the complex interplay of factors influencing their terms. We've examined real market data, shedding light on the trends that shape current and future negotiations. And, importantly, we've underscored the strategic significance of understanding these terms, advocating for a proactive approach to learning and negotiation.

For investors, liquidation preferences are a safeguard, a means to mitigate risk and ensure that their support for innovation is rewarded appropriately. For founders, these preferences are a pivotal aspect of funding negotiations, one that requires careful consideration to maintain their vision and share of the venture's success.

In closing, the venture capital ecosystem is one of mutual dependency. Investors and entrepreneurs must work in tandem, with a shared language of terms and conditions, to foster successful outcomes. Liquidation preferences, when well-understood and strategically applied, can be the linchpin in aligning these mutual interests. As the landscape of venture investing continues to evolve, so too must the understanding and application of these critical financial mechanisms. Therefore, both parties are encouraged to keep informed, stay flexible, and negotiate with a keen sense of foresight, ensuring that the final agreements serve the greater goal of innovation and profitable growth.