Understanding Customer Concentration in Tech Startups

By Lior Ronen | Founder, Finro Financial Consulting

In the dynamic world of technology startups, the race to scale and dominate the market is fierce and unforgiving. Amidst this competitive scramble, the composition of a startup's customer base can be as critical as the innovation it brings to market.

Customer concentration—the degree to which a company relies on a small number of clients for a significant portion of its revenue—is a metric that often flies under the radar but can have profound implications for a startup's success and survival.

While securing a handful of large, high-value clients can feel like hitting the jackpot for any nascent tech company, it is a win that comes with its own set of risks.

Customer concentration can be a double-edged sword; it can either propel a startup to new heights or leave it teetering on the edge of a precipice, vulnerable to the slightest shift in client loyalty or market demand.

Understanding the nuances of customer concentration is crucial not just for startup founders and their teams, but also for the investors who back them.

Tech startups often face the paradox of customer concentration: landing large clients is a sign of market validation, yet over-reliance on a few can risk the company's stability. A diversified customer base is critical for risk management, with balance acting as a buffer against market volatility.

By tracking key metrics such as churn rate and revenue distribution, startups can navigate the delicate equilibrium between rapid growth and long-term resilience. The most successful startups will be those that achieve and maintain this crucial balance.

1. Decoding Customer Concentration

2. The Double-Edged Sword of Big Clients

3. Market Acceptance vs. Risk of Dependency

4. The Importance of Balance and Diversification

5. Evaluating Customer Concentration: Metrics and Tools

6. Conclusion: Navigating the Customer Concentration Landscape with Foresight

It's an intricate dance between proving market fit through major contracts and building a robust, diversified customer portfolio that can weather economic storms and marketplace upheavals.

In this article, we will delve into the world of customer concentration in tech startups, exploring its implications, risks, and the strategic balancing act required to manage it effectively.

From assessing the initial signs of market acceptance to navigating the perils of over-dependency and understanding the metrics that matter, we will unpack the layers that constitute a healthy customer distribution—a vital component of any startup's journey toward sustainable growth and long-term resilience.

Decoding Customer Concentration

As the lifeblood of any nascent enterprise, customers are the cornerstone upon which the success of tech startups is built. However, within this truth lies a hidden nuance that can make the difference between a thriving business and a vulnerable one: customer concentration. This section delves into what customer concentration is, how it's measured, and why it’s a critical factor for startups looking to scale sustainably.

Introduction to Customer Concentration

Customer concentration is a concept that lies at the heart of a startup's financial model and strategic roadmap. It speaks to the balance—or imbalance—of revenue across a company's client base and is often reflective of the broader market dynamics at play.

For a tech startup, especially in its formative years, securing a solid customer base is as much about survival as it is about growth.

But when the scale tips towards revenue over-reliance on a small cadre of clients, it’s time to take a closer look at the implications for the business’s future.

In the competitive tech startup arena, the extent of a firm's revenue reliance on a handful of customers—known as client diversification—acts as a barometer for financial risk and revenue predictability. While securing major clients can propel rapid growth, heavy reliance on them can render a startup prone to instability in the face of market shifts.

Key for investors is recognizing that while a large contract might signal product validation, it also brings the peril of dependency, where the loss of a major client could unsettle the company's financial footing. Successful startups typically exhibit a wide customer base, which dilutes risk and enhances resilience against individual client losses.

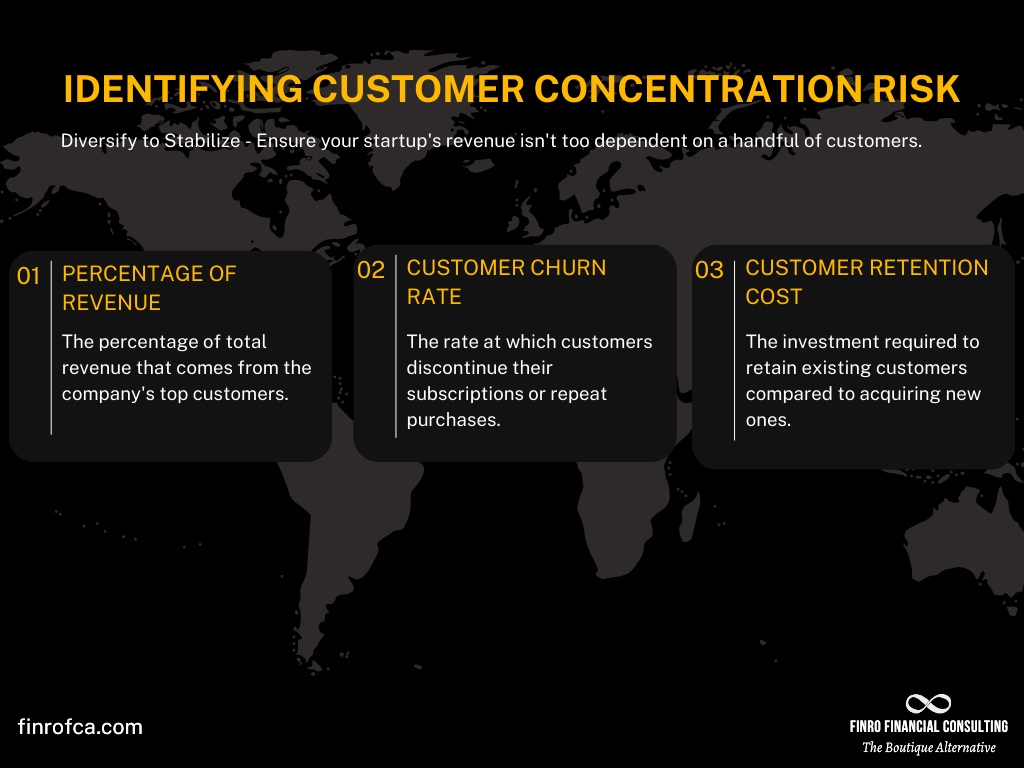

To gauge client diversification, discerning metrics include revenue percentages from top clients, churn rates, and retention costs. Investors seek startups with a balanced client portfolio, indicative of a robust business model poised for sustainable growth and capable of adapting to changing market and consumer dynamics.

Expanding the Definition of Customer Concentration and Its Measurement

Customer concentration is quantified by analyzing how revenue is distributed amongst a company's clientele. The concentration can be measured by calculating the percentage of total revenue attributed to the company's largest clients.

Companies often cite figures such as the percentage of revenue attributed to their largest client or top five clients. For instance, if Client A contributes to 40% of a startup's revenue, the business has a high customer concentration risk associated with Client A.

A comprehensive measurement will also consider the duration and stability of these client relationships, the contractual terms, and the potential for future growth or attrition. Industry-standard ratios or indexes may also be applied to quantify customer concentration, providing a benchmark for comparison with peers and for internal year-over-year analysis.

Identifying High Customer Concentration

Identifying a high level of customer concentration involves more than just recognizing a large portion of revenue coming from few sources. It also requires understanding the implications of what such a concentration means for a startup’s operational continuity and strategic flexibility.

Metrics such as the Herfindahl-Hirschman Index (HHI) can be utilized to assess market concentration and, by analogy, customer concentration within a business.

Other qualitative factors, such as the degree of customer engagement and satisfaction, contractual obligations, and the strategic importance of each major client, also inform the degree of concentration risk.

The specifics of identifying and addressing customer concentration risk are vital for the health of a startup, and this topic warrants a deeper exploration.

In a subsequent section, we will elaborate on the steps and strategies that startups can adopt to measure and mitigate the risks associated with high customer concentration effectively.

The Double-Edged Sword of Big Clients

The journey of a tech startup often pivots around key milestones, and none are more exhilarating than securing large contracts from heavyweight clients. Take, for example, a fledgling SaaS company that lands a deal with a Fortune 500 firm.

This isn't just a hefty paycheck; it's a glowing endorsement that can turbocharge its trajectory. Beyond the substantial inflow of capital, which is crucial for scaling operations, such a contract can enhance the startup's brand equity, attracting talent, further customer interest, and even additional venture capital.

Yet, this boon is not without its bane, especially in markets such as pharmaceuticals, aerospace, or government services, where contracts are large but clients are few. Startups in these sectors may face extreme customer concentration risk.

Consider a small cybersecurity firm specializing in advanced threat protection, deriving 70% of its revenue from a single government contract. While initially this would allow for rapid growth and specialized product development, any shift in government spending or contract reallocations could leave the firm in a perilous state.

Furthermore, the volatility of customer concentration is pronounced in the tech startup sphere due to the pace of technological change and market evolution.

For instance, a mobile app development startup focusing primarily on a few clients in the retail sector could be at risk if those retailers decide to move development in-house or if there's a shift towards new platforms they haven't adopted, such as augmented reality for online shopping experiences.

In high-stakes sectors like artificial intelligence and big data analytics, where the technology is complex and the investment is substantial, startups often cater to the specific needs of their big-ticket clients. This can lead to a highly customized product that may not easily translate to the broader market, limiting the startup's ability to diversify its client base later on.

Navigating this conundrum requires a strategic approach where startups, while capitalizing on the immediate advantages of large contracts, must also cultivate a wider customer base and prepare contingency plans.

By balancing the pursuit of major clients with efforts to secure smaller, but more numerous, contracts across various markets, a tech startup can build a more resilient and sustainable business model.

Market Acceptance vs. Risk of Dependency

When a tech startup lands a significant contract, it's often hailed as a testament to the market's acceptance of their innovation. This seal of approval not only elevates the startup's status but also serves as tangible proof of the product’s value and market fit.

For instance, a startup specializing in blockchain solutions for the banking sector might gain rapid recognition and validation if it successfully secures a contract with a major bank, signaling to the market that its technology is not just viable but essential.

However, these victories come with an underlying risk – the threat of dependency. This risk materializes when a startup leans too heavily on a major client, causing a precarious balance where the loss of that client could lead to the startup's downfall.

The tale of a once-thriving analytics firm that collapsed after its main client, a large e-commerce platform, pivoted to an in-house solution is a stark illustration of this peril. The firm's prior success, driven by the large client's demands, became its Achilles' heel when that revenue stream suddenly dried up.

Revenue diversification refers to the strategy of expanding a company's customer base to include a wide array of clients from different market segments, industries, or geographic locations. This approach reduces the company's reliance on any single customer or sector, thereby spreading risk.

For tech startups, revenue diversification is essential as it counterbalances the risks associated with heavy reliance on a few large clients. By diversifying their revenue streams, startups can better absorb shocks from market fluctuations, maintain steady cash flows, and build resilience against economic downturns.

Startups can achieve revenue diversification by innovating their product lines, expanding into new markets, adjusting their pricing strategies, and investing in marketing to attract a broader customer base.

Such dependencies are particularly treacherous in the fast-paced tech landscape, where changes in client strategy, market disruptions, or technological shifts can occur rapidly and without warning. For example, a mobile gaming startup that soared on the back of a deal with a tech giant found itself in dire straits when the client's strategic focus shifted, rendering the startup's services obsolete.

This section will explore various cases in detail, highlighting how some startups have navigated these waters successfully while others have not been as fortunate.

By dissecting these real-life scenarios, we can extract valuable lessons on the importance of maintaining a balance between celebrating big wins and mitigating the risks associated with customer concentration.

It will emphasize the need for startups to remain agile, diversify their client base, and ensure they do not become complacent with initial success.

| Aspect | Market Acceptance | Risk of Dependency |

|---|---|---|

| Definition | Validation of a startup's product or service by securing a contract with a reputable client. | The potential peril a startup faces when a large portion of its revenue is tied to a limited number of clients. |

| Indicator | Suggests product viability and fit within the market. | Indicates potential vulnerability to changes in client circumstances. |

| Impact on Startup | Can lead to increased credibility, easier access to capital, and attraction of talent. | Can lead to financial instability, reduced bargaining power, and potential business failure if a major client is lost. |

| Strategic Focus | Exploiting the momentum to penetrate the market and attract diverse clients. | Developing a risk mitigation strategy to manage over-reliance on key clients. |

| Business Growth | Seen as a stepping stone for scaling and expansion. | Can stifle growth by creating complacency and hindering the pursuit of additional clients. |

| Investor Perception | Often viewed positively as evidence of the company’s potential for success and scalability. | Seen as a red flag for sustainability and long-term viability, possibly affecting future investment. |

The Importance of Balance and Diversification

In the ever-changing landscape of technology markets, the ability of a startup to spread its risk through a varied customer base is not just prudent; it's a vital component of its long-term survival and success strategy.

A broad customer base acts as a buffer, absorbing the shocks from market volatility and client attrition, which could otherwise prove catastrophic.

The Role of a Broad Customer Base in Risk Management

Diversification is the linchpin of risk management for tech startups. When a company's revenue streams are not overly dependent on a single client or a narrow market segment, it stands on more stable ground. This balance helps startups to navigate the inevitable ebbs and flows of business cycles with less turbulence. It also places them in a better position to capitalize on new opportunities without the fear of jeopardizing their primary revenue source.

Risk management in tech startups involves identifying, assessing, and prioritizing potential risks that could adversely affect their operational and financial stability. Due to their innovative nature and often limited resources, tech startups face a unique set of challenges such as rapid market changes, technological advancements, competitive pressures, and customer behavior shifts. Managing these risks effectively is crucial for sustaining growth and achieving long-term success.

In the dynamic and fast-paced tech sector, startups must develop strategies to mitigate risks associated with their business model. This includes continuous market research to stay ahead of industry trends, implementing cybersecurity measures to protect data and intellectual property, and ensuring regulatory compliance to avoid legal pitfalls. Financial risk management is also essential, which involves careful budgeting, securing funding for longevity, and diversifying revenue streams to reduce dependency on a single source.

Effective risk management also means fostering a culture of agility within the organization. Startups need to be able to pivot quickly in response to market feedback and emerging risks. By embedding risk assessment into every major decision, tech startups can anticipate potential issues and adapt their strategies proactively. This proactive stance on risk not only safeguards the startup against potential threats but also enhances its capacity for seizing new opportunities that arise in the tech ecosystem.

Strategies for Achieving Customer Diversification

Achieving a diversified customer portfolio does not happen by accident; it requires a deliberate and strategic approach. Startups can broaden their appeal to different customer segments by customizing their product offerings, adjusting their market approach, and continuously innovating.

Moreover, expanding geographically and tapping into new industries can open up numerous revenue channels. Networking, partnerships, and digital marketing are also key strategies for reaching a wider audience.

Another effective strategy is cross-selling and up-selling to existing customers. By developing a deeper understanding of the various needs within their current customer base, startups can offer additional value, turning single-product customers into multi-product clients, thus broadening their revenue base within existing relationships.

Success Stories of Startups that Have Managed to Diversify Effectively

Numerous success stories within the tech industry underscore the importance of diversification. One such example is the story of a software-as-a-service (SaaS) startup that began with a single flagship product.

By listening to its customers and understanding the market demand, the company expanded its product suite to cater to different business sizes and sectors, which significantly decreased its customer concentration risk.

Another case is a tech startup that started in a niche market but quickly realized the limitations of its reach. Through strategic partnerships and a targeted content marketing strategy, the startup expanded its customer base across different industries, which not only increased its market share but also attracted venture capital interest due to its robust and diversified business model.

These narratives show that with foresight and strategic planning, startups can build a diverse customer base that supports sustainable growth.

By placing equal emphasis on acquiring new customers and nurturing existing ones across a broad spectrum, startups can ensure they are not walking a tightrope of customer concentration but instead, are paving a wide avenue of opportunity.

Evaluating Customer Concentration: Metrics and Tools

The health of a tech startup is not just in its current revenue but also in the sustainability of its financial model

. Evaluating customer concentration is a critical part of this assessment.

This involves several key metrics that offer a window into the company's reliance on its customer base:

Top Customer Concentration Ratio: This ratio provides insight into the proportion of revenue that comes from the company's largest client. A high ratio suggests a heavy dependence on a single client, which could spell trouble if that client departs.

Revenue Percentage of Top 5/10 Clients: Extending the view to the top five or ten clients offers a more comprehensive perspective of customer dependence and potential revenue risk.

Customer Churn Rate: The churn rate calculates how often customers discontinue their service over a specific period. It is an essential indicator of customer satisfaction and product-market fit.

Customer Retention Cost: Understanding what it costs to keep a customer is vital, as high retention costs can signal underlying issues with the product or service.

Customer Lifetime Value (CLV): This predicts the net profit attributed to the entire future relationship with a customer. It helps gauge the long-term value customers are bringing to the startup.

Revenue Volatility: This metric assesses the fluctuations in revenue over time, giving insight into the stability of income streams.

Churn rate is a critical metric for any tech startup as it measures the rate at which customers stop doing business with the company. It’s an indicator of customer satisfaction, service quality, and product stickiness.

To calculate churn rate, you take the number of customers lost during a specific period, divide it by the number of customers at the start of that period, and multiply the result by 100 to get a percentage.

Formula

Churn Rate (%) = (Number of Customers Lost During Period / Total Number of Customers at Start of Period) x 100

Example:

If you started the quarter with 200 customers and lost 10, the churn rate would be:

Churn Rate = (10 / 200) x 100 = 5%This means that during the quarter, 5% of your customer base churned. Monitoring and minimizing churn rate is vital for sustaining growth and ensuring the long-term success of a startup.

Investor Evaluation Using Customer Concentration Metrics

Savvy investors delve into these metrics to decipher the risk profile of a tech startup. They look for a healthy balance where no single client’s exit would put the startup in jeopardy. Here's how they use these metrics:

Risk Analysis: Investors use the top customer concentration ratio to measure the level of risk involved. A diversified customer base is preferred as it indicates lower risk.

Growth Potential: By examining CLV and churn rates, investors get a sense of the startup’s growth trajectory and the stability of its revenue.

Profitability: Metrics like customer retention cost are critical for understanding profitability. Lower retention costs coupled with high CLV often point to a robust business model.

Resilience: Revenue volatility is a key indicator of how well a startup can withstand market fluctuations. Investors look for startups that show resilience through consistent revenue streams.

Investors use a combination of these metrics to get a comprehensive picture of customer concentration. They are crucial in making informed decisions on whether a startup is merely surviving off its big clients or is genuinely thriving with a healthy, diverse customer base.

As tech startups grow, it’s imperative that they monitor these metrics closely to manage customer concentration proactively and maintain a business model that promises both growth and stability.

Conclusion: Navigating the Customer Concentration Landscape with Foresight

As we've journeyed through the intricate web of customer concentration, it's become clear that while landing major clients can give tech startups a much-needed boost, reliance on too few can steer these burgeoning enterprises towards precarious waters. Startups must acknowledge the validation that comes with big contracts, yet remain vigilant against the complacency such wins might breed.

The art of balancing market acceptance with the avoidance of dependency is akin to walking a tightrope. Startups that excel in this balancing act diversify their clientele, mitigate risks, and demonstrate resilience in the face of market fluctuations. The tales of those who have diversified effectively offer a roadmap to burgeoning companies aiming to secure their position in the competitive tech landscape.

Metrics such as churn rate, customer retention cost, and revenue percentage from top clients are more than just numbers; they're the navigational beacons guiding startups to safe harbor. They enable investors to pierce the fog of potential and see clearly the health of a startup's customer base.

In summary, customer concentration is a double-edged sword that must be wielded with precision. For tech startups, this means embracing a strategy that encourages customer diversity while still celebrating each victory. As the tech arena continues to evolve, those startups that master the delicate equilibrium between customer concentration and diversification will not only survive but thrive. The path to enduring success is marked by the continuous pursuit of a broad and balanced customer portfolio, and it's this pursuit that will define the next generation of market leaders.