Sven Van de Perre

Creative & Business Architect & Co-Founder, Tropos AR

By Lior Ronen | Founder, Finro Financial Consulting

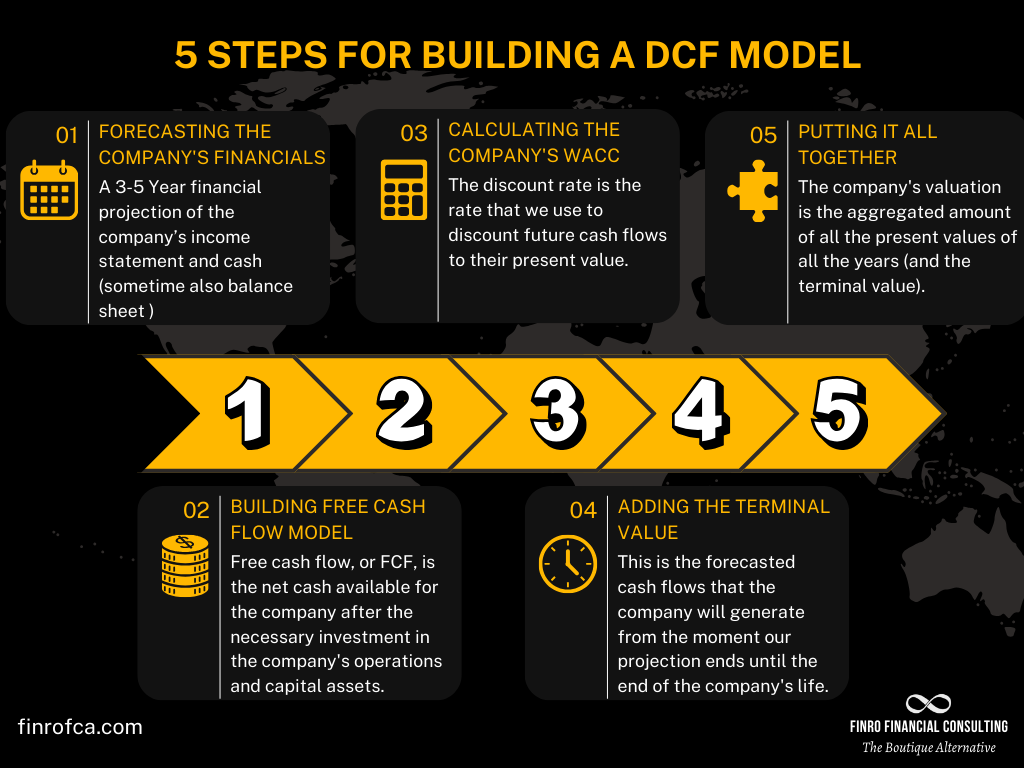

The Discounted cash flow (DCF) valuation method is a basic, foundational valuation method. It’s usually applied to late-stage and mature startups, but in certain conditions, it can be applied to early-stage startups.

It’s heavily relied on financial analysis, projects, and assumptions and is considered a great exercise for most businesses to review elements in their business they wouldn’t have reviewed otherwise.

It’s a relatively complex calculation compared to other methods, and it gets it snubbed by some venture capitalists.

But its advantages far outpace its shortcomings.

The great advantages of the DCF method in calculating the intrinsic value of a business make it a core valuation method for many VCs, private equity funds, and investment banking firms analyzing tech startups for investment or M&A deals.

In this article, we lay out a clear, step-by-step guide for startup founders to know the DCF valuation method, how startups are valued with this method, and how the calculation works.

You will not become a DCF valuation expert after this article, but you’ll understand the process, the terms, and the calculation and components.

The first step in building a DCF model is building a financial projection for your startup.

Unlike other businesses, 90% of tech startup’s financials are covered by only 2 topics: customer acquisition and headcount.

These are the pivotal elements around which your startup's financial world orbits.

Acquiring and retaining customers drive revenue, while a competent and committed team is essential to deliver your product or service. Each aspect of your financial projection ties back to these dual objectives.

With this in mind, let’s outline a financial trajectory that is both ambitious and grounded.

The foundational step in DCF valuation is constructing a reliable financial forecast for your technology startup, encompassing a spectrum of sectors beyond fintech. A solid forecast is built on two pillars crucial to your company's fiscal vitality: customer acquisition and team management.

These are the pivotal elements around which your startup's financial world orbits. Acquiring and retaining customers drive revenue, while a competent and committed team is essential to deliver your product or service. Each aspect of your financial projection ties back to these dual objectives.

With this in mind, let’s outline a financial trajectory that is both ambitious and grounded.

Effective revenue forecasting is essential for tech startups, especially those in the SaaS domain. It is an integrative process that utilizes various methods tailored to align with the startup's stage of development, such as top-down and bottom-up approaches.

The goal is to deeply understand the nature of your specific revenue streams—whether they stem from subscriptions, usage-based models, or additional service offerings—and to grasp how user behavior impacts your earnings.

This understanding must encompass all the intricacies of your business, whether you operate on a B2B or B2C model, taking into account the particularities of your sales cycle, pricing strategy, and the critical factor of customer retention.

Forecasting revenue is not merely an initial setup but rather a dynamic exercise that should be continuously refined. This phase is where you estimate the financial inflows your tech startup will realize through diverse channels, including service fees, product sales, subscription models, or bespoke solutions. It's crucial to critically assess the growth potential of your customer base and the anticipated revenue per user.

These forward-looking projections must be underpinned by thorough market research, your targeted marketing endeavors, an understanding of the competitive landscape, and a clear articulation of your startup’s unique value proposition.

The challenge here is to strike a balance between optimism and realism, to make financial predictions that are not only ambitious but also grounded in sound judgment and backed by reliable data, thus setting the stage for strategic growth and financial resilience in the fast-evolving tech sector.

After the challenging task of forecasting revenues, we dive headfirst into the equally crucial world of expense analysis. It’s a varied landscape out here, with each tech startup shouldering its unique set of financial burdens.

Yet, a universal heavyweight exists across the board: the invaluable asset and significant expense of human capital. This encompasses your eclectic mix of talent—engineers crafting the future, marketers weaving your brand story, customer support heroes, and the administrative wizards keeping the show running.

These personnel costs, including salaries, benefits, and the inevitable investments in training and scaling your team, are pivotal figures in your financial narrative.

But let’s not stop there.

The financial tapestry of a tech startup is rich and complex, woven with other critical expenditure threads.

Product development sits at the heart of your venture, a relentless cycle of ideation, creation, and refinement. Compliance, too, demands its share of the pie, an essential expense ensuring your innovations play by the rules of the game.

Then there’s the relentless pursuit of growth, embodied in customer acquisition costs and the strategic maneuvers of scaling operations.

In this arena, the seasoned player knows the wisdom of erring on the side of caution—conservative estimates are your armor against the unforeseeable twists and turns of startup life.

In synthesizing this complex array of costs within your discounted cash flow model, you're not just crunching numbers; you're sketching the financial blueprint of your startup's journey.

This detailed expense analysis ensures that your valuation doesn’t just float in the optimistic clouds but stands firmly on the ground of realistic financial planning. It’s about preparing for the best while planning for the rest, a crucial balance that positions your startup for sustainable growth and resilience.

Integrating your revenue and expense forecasts results in a profit and loss statement. By deducting expenses from revenue, you'll see if you're positioned to make a profit or if adjustments are needed. It's typical for startups to face initial losses, but strategic planning should pave the way to profitability.

Lastly, the lifeblood of any business—cash flow. Profitability on paper doesn't equate to liquidity. Timing is crucial: revenue must be on hand to cover obligations as they arise. A cash flow projection is your foresight tool, helping you anticipate and navigate through potential financial squeezes.

The key to a reliable cash flow forecast is to include all sources of cash inputs, from sales or funding rounds, and map out all potential expenditures, including salaries, overheads, and capital expenses. This will help you determine your operating runway and when you might need to secure additional funding.

A meticulous cash flow projection not only serves as a planning tool but also as a critical indicator for investors to assess the sustainability and financial acumen of your startup.

Having laid the groundwork with revenue, cost, profit and loss, and cash flow projections, you're now better equipped to hypothesize different financial scenarios. These 'what-if' simulations are instrumental in preparing for various business climates, from best-case scenarios to more challenging market conditions.

This approach allows you to create contingency plans, ensuring your startup remains agile and responsive to change. It will enable you to anticipate the impact of external factors on your startup’s financial health and devise appropriate strategies for risk mitigation and capitalizing on unforeseen opportunities.

This dynamic modeling will form the next segment of our financial planning series, where we'll delve into how you can simulate these various scenarios to bulletproof your startup's financial strategy.

Transitioning from the initial financial forecasting for a startup, the next critical step in the discounted cash flow method process is to calculate the Free Cash Flow (FCF).

FCF represents the cash that a company generates after accounting for the cash outflows to support operations and maintain its capital assets. It’s the cash that’s available for distribution to the stakeholders of the company and is an essential component of the DCF analysis, which values a company based on the present value of its expected future cash flows.

To calculate Free Cash Flow, you begin with the Earnings Before Interest and Taxes (EBIT) from your financial projections, often proxied by operating profit for simplicity. You then adjust for taxes by subtracting Tax Expenses, which are the annual taxes the company is expected to pay.

Next, you add back non-cash expenses such as Depreciation & Amortization, which account for the reduction in value of tangible and intangible assets over time. This adjustment is necessary because, while these expenses reduce net income, they do not impact the actual cash flow of the company.

Then, you must consider the Changes in Working Capital, which reflect the annual changes in current assets (like cash and accounts receivable) minus current liabilities (like accounts payable). A positive change in working capital indicates that a company is investing more cash in short-term assets, which reduces free cash flow. Conversely, a negative change releases cash for the company, increasing free cash flow.

Finally, you subtract Capital Expenditures (CapEx), which are the funds used by a company to acquire, upgrade, and maintain physical assets such as property, industrial buildings, or equipment. This is a cash outflow that needs to be accounted for since it represents cash spent on investments in the long-term health of the company.

FCF = EBIT - Tax Expenses + Depreciation & Amortization - Changes in Working Capital - Capital Expenditure

By calculating FCF, you get a clear picture of the cash that’s actually available to the company as a result of its operations, which can be reinvested in the business, paid out to shareholders, or used to reduce debt.

Upon establishing a reliable estimate of the startup’s Free Cash Flow, you’re poised to tackle the third step in the DCF valuation process: determining the business’s Weighted Average Cost of Capital (WACC).

The WACC represents the average rate that a company is expected to pay to all its security holders to finance its assets and is crucial for discounting future cash flows to their present value.

Having established the free cash flow in Step 2, the third step in our startup valuation process involves a critical component: the discount rate.

This rate is crucial because it allows us to translate future cash flows into present value terms, reflecting the principle that money available today is worth more than the same amount in the future due to its potential earning capacity.

The discount rate incorporates this time value of money, thus serving as the cornerstone for discounting future cash flows in our model.

For publicly traded companies, calculating the discount rate is straightforward due to the ready availability of financial data.

This calculation involves determining the Weighted Average Cost of Capital (WACC), which is a weighted average between the cost of equity and the cost of debt, adjusted for the corporate tax rate.

The WACC formula is expressed as:

However, for startups and private companies, we face the challenge of limited financial data, necessitating estimates based on comparable companies' metrics. To derive a robust discount rate for a startup, we perform a comparable company analysis (comps analysis), which involves compiling a diverse list of companies that share characteristics with the startup.

This list should represent a spectrum of sizes and market presences, including both public and private entities, as well as direct and indirect competitors, to mitigate individual company biases.

From this analysis, we extract key data points: beta, market capitalization, and debt levels. With these, we can calculate the Total Enterprise Value (TEV), represented as TEV=E+D, and subsequently the equity and debt ratios:

Equity Ratio = E / (E + D)

Debt Ratio = D / (E + D)

Equity Ratio + Debt Ratio = 1

The overarching beta, debt ratio, and equity ratio are then synthesized, either through a simple or weighted average based on the relevancy of each comparable company, forming the bedrock of our startup's discount rate calculation.

As we progress to Step 4, we will address the terminal value calculation, which represents the expected value of the startup beyond the forecasted period, anchoring the final component of our Discounted Cash Flow (DCF) model.

With the discount rate now established, we turn our focus to the final step in our valuation process: the estimation of the Terminal Value (TV).

While our financial projections are constrained to a forecasted timeline, typically spanning 5 to 10 years, the Terminal Value steps in to capture the value of the company’s cash flows extending beyond this period, into perpetuity. It reflects the company’s ability to generate cash flows indefinitely, after our explicit forecast horizon ends.

The significance of the Terminal Value cannot be understated. It often constitutes a substantial portion of the total valuation in a discounted cash flow analysis due to the inherent difficulty and uncertainty involved in forecasting long-term cash flows.

Beyond a certain point, the precision of cash flow projections diminishes; this is where the Terminal Value becomes an essential simplification, serving as an aggregate of all future cash flows in a single, comprehensive figure.

There are principally two methods to calculate the Terminal Value:

The Gordon Growth Model (GGM): This method assumes that cash flows grow at a constant rate indefinitely. It's particularly useful for stable companies with predictable growth rates. The GGM formula is:

TV= (FCF × (1+g)) / (r−g)

Where FCF is the free cash flow in the last projected year, g is the perpetual growth rate, and r is the discount rate.

The Exit Multiple Method: Alternatively, we can apply an exit or terminal multiple, typically based on a financial metric such as EBITDA, to an expected value at the end of the projection period. This method is often favored when the company's growth is expected to decline or when market multiples are available for comparable companies.

These two approaches offer us flexibility in accounting future economic climate, industry trends, and company-specific factors that may influence growth and sustainability after our detailed forecast period. The chosen method should align with the company's expected performance and the industry context.

The Terminal Value is paramount because it addresses the challenge of uncertainty in long-term forecasts. Accurately predicting a startup’s revenue and cash flows into the distant future carries a high degree of speculation.

As startups can be particularly volatile and subject to rapid changes in market conditions, the Terminal Value provides a pragmatic approach to encapsulate future performance without extending the uncertainty of year-by-year predictions.

In employing the Terminal Value within a DCF model, it’s added to the present value (PV) of the projected free cash flows to arrive at the total enterprise value. This total value is then used as a foundation for investment decisions, negotiations, and strategic planning, with the understanding that while the Terminal Value is a simplification, it’s based on reasonable assumptions consistent with industry standards and future expectations.

The Terminal Value calculation concludes the core valuation analysis. However, deriving a price per share or the final valuation figure for decision-making purposes will also involve considering the company’s capital structure and potential adjustments for marketability and liquidity, especially pertinent for private startups.

As we advance beyond the Terminal Value estimation, our valuation narrative extends into translating these comprehensive financial metrics into actionable insights and strategic implications, which forms the essence of the DCF valuation's conclusive phase.

Your startup's valuation paves the fundraising path.

— Finro | Tech M&A Advisory (@Finro_FCA) October 23, 2023

Be realistic, do your homework, and make sure it truly reflects your potential. #valuation #startupfunding #finro

Having navigated through the intricate process of Discounted Cash Flow (DCF) analysis, we reach the culmination where each component is synthesized to form a cohesive financial model.

This section integrates the steps covered in calculating free cash flows, determining the discount rate, and estimating the terminal value to ultimately arrive at the enterprise value.

Recap of DCF Components:

Free Cash Flow (FCF): We started by projecting the company's free cash flows over a forecast period, typically 5 to 10 years. These projections are grounded in reasonable assumptions about future revenues, costs, working capital needs, and capital expenditures.

Discount Rate: The discount rate was meticulously calculated to reflect the time value of money and the risks associated with the company's cash flows. For public companies, this involved using the Weighted Average Cost of Capital (WACC); for private companies and startups, it required a more tailored approach.

Terminal Value (TV): The terminal value was determined to capture the worth of cash flows beyond the forecast period, using either the Gordon Growth Model for stable growth assumptions or the Exit Multiple Method for more dynamic, market-oriented scenarios.

DCF Calculation:

Present Value Calculation: Utilizing the discount rate previously established, we proceed to discount the projected cash flows of each year, as well as the terminal value, back to their present values. This is accomplished through the formula for present value, which adjusts future cash flows to reflect the time value of money.

Aggregation of Present Values: To arrive at the company's valuation, we aggregate the present values of the cash flows from each year, inclusive of the terminal value. This sum represents the total present value of the company's anticipated cash flows, serving as the cornerstone of our DCF model’s valuation output.

Through this refined process, the DCF model offers us a clear-eyed valuation, rooted in the rigorous assessment of the company’s financial future.

how to calculate the total present value of a company

For early-stage startup founders navigating the complex world of company valuations, the journey to secure an accurate, investor-attracting valuation can be fraught with challenges.

The contrast between the traditional, cumbersome approach offered by big-4 firms and the agile, founder-focused services provided by Finro Financial Consulting is stark.

This section explores the transformative benefits of choosing Finro as your startup valuation consultant, illustrating how this partnership is not just about obtaining a valuation but about positioning your startup for growth and success.

The Finro difference begins with a deep understanding that each startup is unique, with its distinct challenges, opportunities, and vision. Unlike the generic, template-driven approach of big-4 firms, Finro offers tailored valuation services designed to reflect the true essence and potential of your startup.

This personalized methodology ensures that every aspect of your business—from niche market positions to innovative revenue streams—is accurately captured and valued, providing a more precise and meaningful assessment that resonates with investors.

In the fast-moving startup environment, time is of the essence. Finro stands out by offering rapid turnaround times for valuation services, understanding the critical importance of speed for early-stage companies eager to engage with investors and drive growth.

This commitment to efficiency ensures that startups can move forward without the delays associated with traditional valuation processes, making Finro an invaluable partner in the pursuit of timely opportunities.

Startups are inherently dynamic, often requiring quick pivots and adjustments to strategy and operations. Finro's flexible and adaptable valuation services are designed to accommodate the evolving needs of startups, ensuring that your valuation reflects the most current and relevant aspects of your business.

This agility is a cornerstone of Finro's approach, offering startups the confidence that their valuation partner is fully aligned with their growth trajectory and capable of responding to changes with precision and insight.

The Finro experience is characterized by personalized attention and dedicated support, starkly contrasting the impersonal and fragmented interactions often encountered with big-4 firms.

Finro assigns a single, dedicated consultant to each startup, ensuring a deep, cohesive understanding of your business and its valuation needs. This approach fosters better communication, more insightful analysis, and a more satisfying and productive partnership overall.

For resource-conscious startups, the cost of valuation services is a critical consideration. Finro addresses this concern head-on by offering competitive, transparent pricing that ensures startups receive high-quality, impactful valuation services without the prohibitive costs associated with big-4 firms.

This focus on delivering value empowers startups to invest more of their resources into growth and development, further enhancing the strategic benefit of partnering with Finro.

Sven Van de Perre

Creative & Business Architect & Co-Founder, Tropos AR

Tropos AR worked with Finro, at the start of the Web3 boom. They where one of the very few companies that had a correct view of the leap in technology, which is now slowly unfolding.

Technology always gets overvalued in the short-term, and undervalued in the long term.

And Finro helped us navigate that future like few others can.

In the pursuit of a company's valuation, the Discounted Cash Flow (DCF) model stands out for its meticulous approach to encapsulating a business's intrinsic value. By methodically projecting free cash flows, determining an appropriate discount rate, and calculating terminal value, the DCF model integrates the financial forecast and intrinsic worth into a comprehensive analytical framework.

The process begins with a detailed financial projection, setting the stage for a narrative of growth and profitability. Subsequently, calculating the free cash flow provides a realistic snapshot of the company's ability to generate cash post-operational expenses and investment.

Next, the discount rate acts as the time-adjusting factor, ensuring that future cash flows are accurately valued in today's terms. The terminal value then takes a long-range view, offering a pragmatic estimate for perpetual cash flow beyond the forecast horizon.

Putting these elements together requires a careful balancing act—aligning assumptions with market realities, while also incorporating the nuances of the business's unique trajectory. Each component—from cash flows to terminal value—contributes a critical piece to the valuation puzzle, painting a holistic picture of the company's financial potential.

As we conclude our journey through the DCF landscape, it's essential to recognize that this model, while robust, is a blend of art and science. The assumptions made today lay down the tracks for future valuations and strategic decisions. While grounded in data, these assumptions necessitate a forward-looking vision and a keen understanding of the market dynamics at play.

Ultimately, the DCF model doesn't just offer a number—it provides a narrative. It's a story about the company’s potential, underpinned by financial projections and market expectations. Investors and decision-makers are advised to interpret the DCF valuation not as a definitive verdict, but as a key instrument in their financial decision-making toolkit—one that is as insightful as it is reliant on the quality and realism of its inputs.

As such, the DCF valuation is not the end of the analysis; it is, rather, a foundational element that informs a broader strategic conversation about a company's worth and potential in the ever-evolving tapestry of the business world.

Foundational for Mature Startups: Core method for late-stage/mature startups, but applicable under certain conditions to early-stage ones.

Complex, Yet Comprehensive: Although complex and less favored by some VCs, its thorough financial analysis provides a detailed valuation.

Focus on Future Cash Flows: Projects future cash flows and discounts them to present value, emphasizing a company's cash-generating capacity.

Incorporates Weighted Average Cost of Capital (WACC): Uses WACC as the discount rate, crucial for reflecting investment risks accurately.

Terminal Value Critical for Long-Term Valuation: Accounts for cash flows beyond forecast period, significantly impacting total valuation in the DCF model.

Forecast future cash flows, discount them to present value using WACC, and sum these values for total valuation.

No single best; depends on stage and data. DCF for mature, comparables for all stages, qualitative for early-stage.

Use WACC, adjusted for startup risk; if unavailable, estimate based on similar companies' data.

Combine financial forecasts, market potential, team strength, and chosen valuation method (DCF, comparables, or qualitative).

Weighted Average Cost of Capital, reflecting risk; harder to estimate for startups, often derived from comparable companies.

Assess future earning potential, market conditions, and investment needed, often using comparables or modified DCF for mature startups.