Assessing the Quality of Earnings of Tech Startups

By Lior Ronen | Founder, Finro Financial Consulting

In the electrifying arena of tech startups, the glimmer of innovation and the allure of rapid growth trajectories often cast a compelling spell. Investors are drawn to these bright beacons of potential, lured by stories of exponential returns and market disruption.

Yet, beneath this veneer of success lies the critical, yet often convoluted, concept of earnings quality—a metric that separates sustainable growth from fleeting triumphs.

Earnings quality is not just a line item on a financial statement; it’s the pulsating heart of a startup's financial narrative, beating with data that tells a tale of not just profitability, but of stability and strategic foresight.

For tech startups, where traditional metrics may falter and standard financial benchmarks can be misleading, the assessment of earnings quality requires a specialized lens, one that can peer through the haze of high-speed innovation and volatile market shifts.

Assessing a tech startup's earnings quality goes beyond the balance sheet to include strategic analysis of revenue patterns, customer dependencies, non-cash expense implications, seasonal impacts, and competitive dynamics.

For investors, the key to unlocking true value lies in understanding these elements and their interplay, enabling them to spot sustainable success or identify potential red flags in the fast-paced tech sector.

Investors who can adeptly navigate this terrain are the ones who often find themselves at the forefront of uncovering value, discerning the genuine trailblazers from the meteoric flashes destined to fizzle out. But how does one cultivate such discernment? What factors should sharpen an investor's eye when everything about tech startups suggests uncharted and groundbreaking territory?

In this deep dive, we will explore the top five factors critical to understanding and evaluating the earnings quality of tech startups.

From the intricate timing of revenue recognition to the strategic implications of customer concentration, and the complex interpretation of non-cash expenses to the seasonal ebb and flow affecting the bottom line—each factor plays a pivotal role in painting an accurate picture of a startup's financial health.

Additionally, we will examine the ever-shifting competitive landscape that can swiftly redefine what it means to be a leader in the tech space.

As we unpack these elements, our goal is to arm investors with the insights necessary to make informed decisions, identify sustainable investments, and potentially reap the rewards that come from supporting the true innovators of our time.

So, join us as we dissect the narrative of earnings quality and reveal the critical indicators of success in the dynamic world of tech startups.

The Complexities of Revenue Recognition in Tech Startups

In the financial fabric of tech startups, revenue is often seen as the golden thread that guides the narrative of growth and success. It is the most direct reflection of market demand and product viability.

However, the timing and methodology of revenue recognition can either present a tapestry of triumph or a misleading mosaic that obscures the truth.

Before delving into the common pitfalls surrounding revenue recognition during an analysis of earnings quality for tech startups, let's first understand what revenue recognition entails in this innovative sector.

Revenue recognition is a cornerstone accounting principle that dictates the specific conditions under which revenue is recognized and reported. In the context of tech startups, this principle takes on added complexity due to the nature of their business models, which may include software subscriptions, service agreements, licensing deals, and other arrangements with deferred or milestone-based revenue streams.

For these companies, recognizing revenue is not merely a matter of recording sales when they occur. Instead, it involves a set of rules that determine when the startup has earned the revenue, typically when the product or service has been delivered or is being consumed by the customer. This ensures that the reported financial results accurately reflect the company's actual performance.

Tech startups often face unique challenges in this area, such as:

- Subscription Models: Startups must allocate revenue over the life of a subscription, rather than at the point of sale.

- Deferred Revenue: Payments received in advance for services to be provided in the future are recorded as deferred revenue and recognized gradually.

- Milestone-based Contracts: Revenue from contracts that include various performance milestones must be recognized as these milestones are achieved.

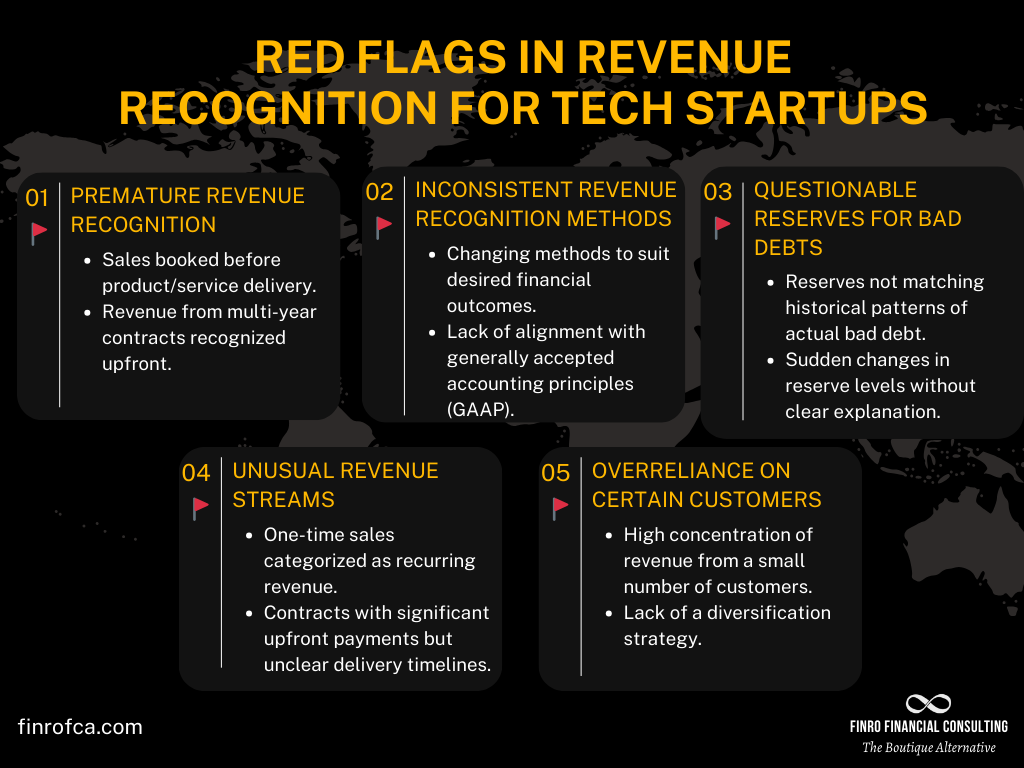

Premature Recognition: The Red Flag

One of the most significant red flags for investors is premature revenue recognition. This happens when a company recognizes revenue before it has fully earned it or before the product or service has been delivered to the customer.

For example, a startup might book the total value of a three-year subscription as current revenue, inflating sales figures and portraying a misleading financial position. Investors need to be vigilant about how a startup recognizes its revenue, seeking clarity on the methods and practices to ensure they align with the actual progress of business operations.

The Reserves Game: A Test of Prudence

Another aspect to scrutinize is how a startup handles its reserves for bad debts. Startups should prudently estimate and set aside reserves for potential credit losses from customers who may not pay. However, these reserves can be manipulated to smooth out earnings, either by being overly optimistic about receivables or by releasing reserves into income to meet earnings targets. Both practices can distort the reality of a startup’s financial health.

Revenue Quality vs. Quantity

The maxim 'quality over quantity' holds particularly true for revenue. High-quality revenue is sustainable, predictable, and repeatable—traits that provide a more accurate forecast of long-term financial health. Investors should delve deep into the revenue streams of a tech startup, distinguishing between one-time payments and recurring revenue, examining the terms of contracts, and understanding the deferral strategies employed.

Assessing the True Value

To truly assess the value of a startup's revenue, investors must go beyond the top-line numbers. They need to understand the company's business model, the sales cycle, and the revenue recognition policies in place. It's also crucial to consider the broader economic environment, as shifts in the market can affect customers' willingness to spend and hence the company’s revenue projections.

A Responsible Approach

In conclusion, a responsible approach to revenue recognition is a testament to a startup’s credibility and long-term viability. As an investor, ensuring that a tech startup adheres to ethical accounting practices is not just about due diligence—it's about safeguarding your investment against the volatile waves of the tech industry.

By understanding and evaluating a startup's revenue recognition practices, investors can discern the actual performance and potential of the venture, laying a foundation for investment decisions that are informed, strategic, and aligned with genuine growth prospects.

The Risks and Rewards of Customer Concentration

With an established grasp on what customer concentration means for tech startups, we turn now to its significance within the broader financial narrative. This critical metric offers insight into the distribution of a company's revenue among its customer base and serves as a barometer for the stability and resilience of its earnings.

As we proceed, we will build on the foundational knowledge of customer concentration, exploring its strategic impact and the risks and rewards it brings to the forefront of startup investing.

It's time to unravel how this key factor not only reflects a startup's current financial health but also its capability to sustain and grow in a competitive market.

Customer concentration measures the degree to which a tech startup's revenue is dependent on a small number of clients. It reflects how the company’s sales are distributed across its customer base, which can be a crucial indicator of risk and revenue stability.

In the realm of tech startups, where rapid scale and market penetration are often the primary objectives, landing a few big-ticket clients can seem like a fast track to success. However, high customer concentration—where a significant portion of revenue comes from a handful of customers—can leave a startup vulnerable to fluctuations in their business environment.

Here's what investors need to understand about customer concentration:

- Sign of Market Acceptance: A startup that secures a large contract from a reputable client may be demonstrating its product’s value and market fit.

- Risk of Dependency: Over-reliance on a limited number of customers can be risky. If one customer represents a large portion of revenue, losing them could jeopardize the startup's financial stability.

- Balance and Diversification: Successful startups often have a broad customer base, which helps in balancing risk. If revenues are well distributed, the impact of losing any single customer is significantly reduced.

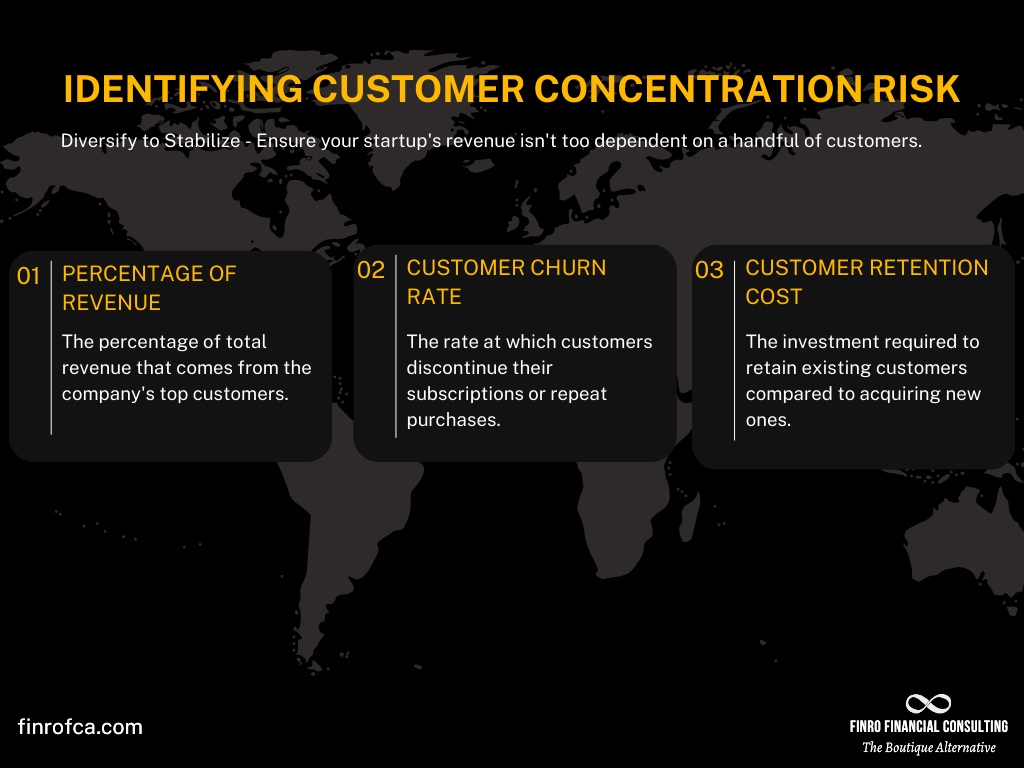

- Assessment Metrics: To evaluate customer concentration, investors look at metrics such as the percentage of revenue from the top customers, customer churn rate, and the cost of customer retention.

High-Reward Yet High-Risk

The allure of signing a big name can be irresistible. It often comes with substantial immediate revenue, improved investor confidence, and enhanced credibility in the market. However, this high-reward game carries its own risks—risks that must be mitigated through strategic customer diversification.

Diversification: The Key to Stability

The antidote to the potential volatility caused by customer concentration is diversification. By broadening the customer base, a startup can spread its risk. The loss of a single customer would then have a much smaller impact on the overall revenue stream. Investors should seek startups that not only attract but also effectively retain a diverse clientele.

Metrics to Watch

Several metrics can help investors assess customer concentration risk, such as:

Percentage of Revenue: The percentage of total revenue that comes from the company's top customers.

Customer Churn Rate: The rate at which customers discontinue their subscriptions or repeat purchases.

Customer Retention Cost: The investment required to retain existing customers compared to acquiring new ones.

Evaluating the Landscape

Evaluating the competitive landscape is also crucial. In dynamic tech markets, where shifts in consumer preference or technological breakthroughs are commonplace, reliance on a few large customers can become even more perilous. Startups need to constantly innovate and adapt to retain their key customers and attract new ones.

Investor's Perspective

From an investor's perspective, analyzing customer concentration involves more than just numbers—it's about understanding the startup's value proposition from the customer's viewpoint. It's about gauging the strength of the startup's relationships with its clients and its capacity to deliver consistent value.

Moving Forward

In conclusion, customer concentration is a double-edged sword. The stability of a tech startup’s earnings and its future prospects can be significantly influenced by the breadth and depth of its customer base. Smart investors will look for signs of healthy customer diversification as a hallmark of a resilient and scalable business model.

Non-Cash Expenses and Their Impact

Before we dive into the intricate world of non-cash expenses in tech startups, it’s essential to grasp their nature and why they're critical to understanding a company's financial health. Non-cash expenses like stock-based compensation and R&D costs are pivotal in a startup's financial storytelling, often serving as indicators of future growth potential and operational priorities.

As we've outlined in the detailed explanation that follows this introduction, non-cash expenses can heavily influence earnings without immediately affecting cash flow. This section aims to build upon that foundational knowledge by exploring how these expenses, although not liquid, can have substantial implications for valuation and investment strategy.

By the end of this segment, you will be equipped to navigate through the complexities of non-cash expenditures, discerning their impact on a startup’s financial viability and the broader implications for investors.

Let's take that next step in decoding the subtleties that non-cash expenses reveal in the financial narratives of tech startups.

Non-cash expenses are accounting entries that represent costs without an associated cash outflow during the reporting period. In tech startups, these expenses play a significant role due to their unique business models and growth strategies. Here's what you need to know:

- Stock-Based Compensation: This is a form of remuneration where employees receive shares or options to purchase shares. It’s a way for startups to attract talent without immediate cash expenditure, but it represents a real cost as it dilutes shareholders’ equity.

- Deferred Taxes: These are future tax liabilities or assets arising from temporary differences between the book value and the tax value of assets and liabilities. Tech startups often invest in assets that have different depreciation schedules for tax and accounting purposes, leading to deferred tax entries.

- Depreciation & Amortization: These account for the reduction in value of tangible and intangible assets over time. While these expenses don't deplete cash reserves, they represent the systematic allocation of an asset’s cost over its useful life.

Grasping non-cash expenses is essential as they provide insight into a startup's long-term financial planning and potential tax strategies. They are critical for investors who need to look beyond cash flows to assess the sustainability of a startup's business model and its future profitability.

Stock-Based Compensation

Stock options and other forms of stock-based compensation are critical in tech startups. They conserve cash while motivating performance and alignment with the company's success. However, they can also dilute existing shareholders' equity and complicate the earnings analysis. We’ll explore how to assess the impact of stock-based compensation on earnings quality and shareholder value.

Deferred Taxes

Deferred tax liabilities or assets reflect the tax effects of temporary differences between the accounting and tax bases of assets and liabilities. They play a crucial role in a startup's financial strategy, potentially deferring tax liabilities to future periods when the company may be in a better position to settle them. This section will delve into how deferred tax positions can influence an investor’s perception of a company’s profitability and financial health.

Analyzing the Cash Flow

To gauge the true financial health of a tech startup, one must look beyond the net earnings and scrutinize the cash flow statement. Adjustments for non-cash expenses like depreciation, amortization, stock-based compensation, and deferred taxes in the cash flow from operations will provide a clearer picture of how the business is truly performing financially.

The Bottom Line

By carefully evaluating non-cash expenses and understanding their implications, investors can better determine the actual economic performance of a tech startup. This section will guide you through the essential steps to analyze non-cash expenses, discerning the genuine value they add or erode from a tech startup’s financial position.

In the upcoming analysis, we will sift through these non-cash expenditures to understand their impact on a startup's operational reality and future prospects, ensuring a comprehensive financial evaluation.

Staying Ahead in the Competitive Tech Landscape

In the realm of technology, evolution is constant, and innovation is relentless. For tech startups, the competitive landscape is not just a playing field but a battleground where today’s pioneering solutions can quickly become tomorrow’s antiquated offerings. This breakneck pace of change has profound implications for earnings quality, as a company's financial performance is intimately tied to its ability to stay relevant and ahead of the curve.

From Pioneers to Relics: The Lifecycle of Tech Dominance

The annals of technology are littered with the names of once-dominant companies that failed to adapt and were overtaken by nimbler, more innovative competitors. The life cycle of a tech company can be astonishingly brief, with the potential to move from market leader to industry afterthought in just a few short years. This reality must be a cornerstone of any earnings quality assessment, as the sustainability of a startup’s profits is inextricably linked to its competitive position.

Earning Quality in the Wake of Innovation

Financial indicators that looked promising one quarter can become questionable the next, as new technologies redefine markets and consumer preferences shift. Earnings quality in such a dynamic sector must therefore be scrutinized with an eye towards the company’s research and development pipeline, the agility of its business model, and its strategic foresight.

Staying Informed: The Investor’s Compass

For investors, staying updated on industry trends, emerging technologies, and competitive shifts is not just about due diligence; it's about survival. The best defense against the relentless tide of innovation is a robust, adaptable investment strategy that considers the tech landscape's volatile nature. This includes keeping a close watch on patent filings, product launch success, and the broader market sentiment.

Adapting Investment Strategies for Technological Turbulence

Investing in tech startups requires a dynamic approach that is receptive to change and quick to respond to new information. Diversification across various sub-sectors of technology can mitigate the risk of disruption, while a focus on companies with strong, adaptable core competencies can provide some measure of insulation against the vagaries of the market.

An Ounce of Vigilance

In the end, understanding the competitive dynamics of the tech industry is crucial for gauging a startup's earnings quality. Investors must continuously educate themselves, adapt their strategies, and above all, remain vigilant. The key to success in this rapidly changing sector is to anticipate change, recognize the signs of industry shifts, and have the acumen to act decisively.

Conclusion: The Art and Science of Assessing Earnings Quality in Tech Startups

Investing in tech startups is as much an art as it is a science. It requires a discerning eye that can look beyond the surface of financial statements and earnings reports to identify the true quality of earnings. As we've explored throughout this article, the vibrancy of a tech startup's financials is often hidden beneath layers of accounting practices, market dynamics, and strategic maneuvers.

From the complexities of revenue recognition to the risks posed by customer concentration, the subtleties of non-cash expenses, the seasonal variances in earnings, and the relentless tide of competition, each factor plays a critical role in painting a complete picture of a startup's financial health. It is these nuances that investors must navigate to discern the enduring value and potential of a tech startup's offerings.

In the dynamic and often unpredictable landscape of technology, change is the only constant. Yesterday's metrics may not fit today's realities, and today's success stories could be tomorrow's cautionary tales. Therefore, staying abreast of the latest developments, understanding the intricacies of financial metrics, and maintaining a flexible, informed investment strategy are non-negotiable for those seeking to invest successfully in tech startups.

As we conclude this exploration into the earnings quality of tech startups, let it be a reminder that the most valuable asset at an investor's disposal is not just the capital they invest but the knowledge and critical thinking they apply to each potential opportunity. Whether you are a seasoned investor or new to the arena of tech startups, may your journey be guided by insight, prudence, and a forward-looking perspective.

The future is being written in the code of today's startups, and for those with the acumen to read between the lines of financial reports, the opportunities are as boundless as technology itself. Let's continue the conversation and connect the dots together to discover the next breakthrough investment.