Payments Startups: Valuation and Multiples 2024

By Lior Ronen | Founder, Finro Financial Consulting

Payments is a unique niche in the fintech industry.

It has a significant presence from tech giants like Apple, Google, and Samsung.

It has one of the most innovative and large fintech companies in the world: Stripe.

It has one of the most iconic companies of the modern internet age: PayPal.

Yet, it’s a vibrant market that keeps looking for innovative ways to monetize the simplest idea known to men, transferring funds from one party to another.

A startup's valuation represents investors' beliefs about the potential future value of a business rather than a clear statement of what it's worth right now.

By looking at the valuations of leading payment companies like Stripe, Checkout.com, SumUp, Klarna, and others, we get insight into investors' optimism and perceptions of these firms' possible earnings trajectories.

However, comparing companies' valuations becomes tricky when the businesses differ dramatically in size and scale.

A $100 billion valuation indicates something very different than a $10 million valuation.

Likewise, a company producing $100 million in revenue annually has a much different outlook than one generating $1 million yearly.

To neutralize these massive differences in size and sales power, we’ll use the ratio of these companies’ valuation to revenues.

This ratio will help us compare Stripe to Rapyd, PayPal to Nium, etc.

Since a significant portion of the leading payment companies are publicly traded, we’ll compare the largest payment startups to the largest payment companies worldwide.

If you're interested in diving more into the valuation of payment and fintech startups, I would recommend you visit this earlier piece, in which I extensively discussed this subject.

I also recapped 2023 in fintech and current trends in the industry going into 2024 in an earlier article. You can read more about it there.

This time around, we progress a step further, exploring the present landscape of the payment industry by examining the revenue multiples of major players in the field.

What is a Payments Startup?

A payment startup specializes in developing and offering technology-driven solutions for processing financial transactions, typically bridging the gap between businesses, consumers, and financial institutions. The typical business model is based on transaction fees of the gross transaction volume transferred through the platform.Unlike general SaaS businesses that might offer a broad range of services or software tools across various industries, payment startups are deeply integrated into the financial ecosystem. They must not only provide robust and scalable software solutions but also navigate the complex landscape of financial laws and customer trust, ensuring secure, efficient, and often real-time processing of sensitive financial data.

Get your expert valuation now!

Valuation Multiples of Payments Startups

We analyzed the latest valuations, revenues, EBITDA, EBITDA multiples, and revenue multiples of what we view as the 30 top payments companies as of 2024. This offers a snapshot of the sector's meteoric growth.

As mentioned above, the use of multiples helps benchmark high-growth startups regardless of profitability or size. Specifically, we divide the company's valuation by total yearly revenue.

The resulting multiples show how much investors were willing to pay for each revenue or EBITDA dollar - a useful proxy for future prospects. The higher the ratio, the more bullish investors are on substantial expansion ahead.

Our list focuses on leading payments players from the US, UK, Europe, Asia and Africa.

In our analysis, we prioritized startups with available data on both market valuations and revenues over the past year to have valid data. There may be other promising startups we missed due to information gaps. So if you know of any significant player lacking accessible valuation or revenue details, we welcome you to contact us.

We intend to continually update this analysis as new data emerges on leading payment startups’ progress and financials.

| Company | Market | Location | Revenue Multiple | EBITDA Multiple |

|---|---|---|---|---|

| Stripe | Private | US | 10.0x | 83.3x |

| Checkout.com | Private | UK | 42.4x | - |

| Razorpay | Private | Brazil | 40.5x | - |

| Mollie | Private | Netherlands | 40.8x | - |

| Melio | Private | US | 37.0x | - |

| Cloudwalk | Private | Brazil | 6.7x | 10.8x |

| Pine Labs | Private | India | 7.6x | - |

| airwallex | Private | Hong Kong | 25.0x | - |

| GoCardless | Private | UK | 4.2x | - |

| PayCargo | Private | US | 7.5x | - |

| Modulr | Private | UK | 32.9x | - |

| Nium | Private | Netherlands | 12.2x | - |

| Paymob | Private | Egypt | 62.5x | - |

| Klarna | Private | Sweden | 6.4x | - |

| Sumup | Private | UK | 57.3x | - |

| Paddle | Private | UK | 18.3x | - |

| Rapyd | Private | UK | 42.9x | - |

| Zepz | Private | UK | 12.5x | - |

| WorldPay | Private | UK | 3.9x | - |

| Adyen | Public | Netherlands | 20.4x | 43.0x |

| PayPal | Public | US | 2.4x | 12.3x |

| Block | Public | US | 1.9x | - |

| Affirm | Public | US | 10.4x | - |

| Shift4 | Public | US | 2.3x | 16.4x |

| Global Payments | Public | US | 5.3x | 12.5x |

| Payoneer | Public | US | 1.5x | 12.8x |

| Paytm | Public | India | 3.8x | - |

| Wise | Public | UK | 6.7x | 24.8x |

| Safaricom | Public | Kenya | 2.5x | 5.5x |

| Remitly | Public | US | 3.2x | - |

Unveiling the Valuation Landscape of Payment Companies in 2024

The payment sector, an integral part of the fintech world, presents a fascinating tableau of valuation multiples that reveal much about investor sentiment and market expectations.

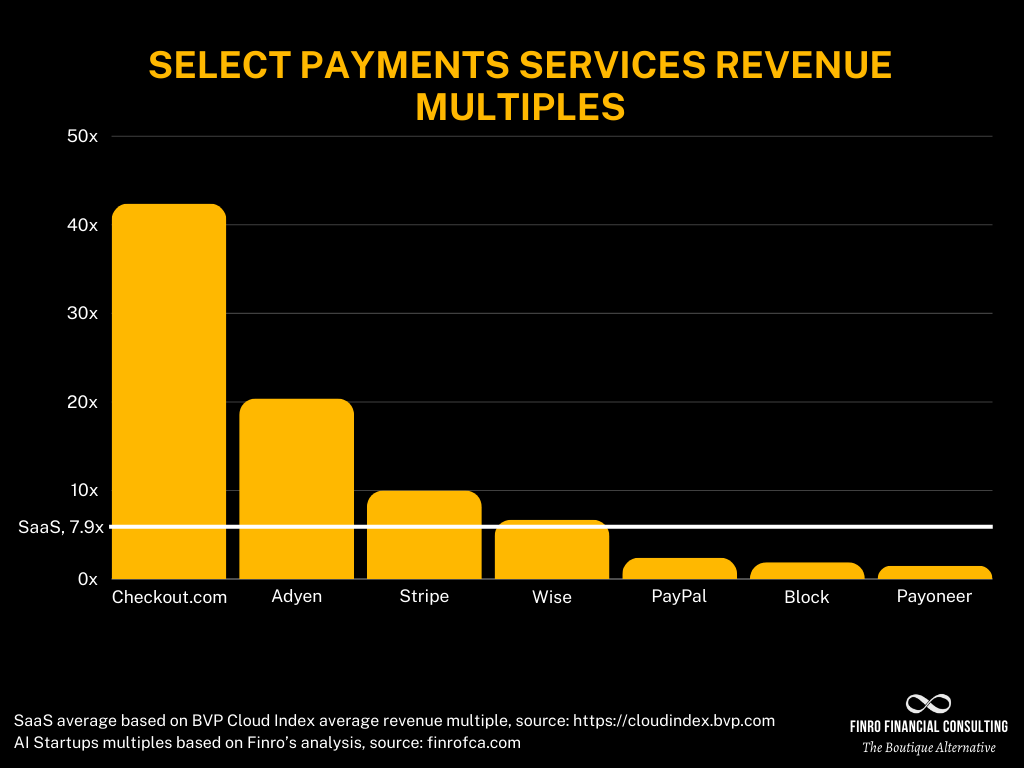

A closer look at the revenue multiples of both private and public payment companies unveils a story of diversity and potential that stretches across continents.

At the pinnacle of investor optimism, we find companies like Paymob, commanding an impressive revenue multiple of 62.5x. Such a figure is not just a number—it's a testament to the confidence investors place in the company's growth trajectory, perhaps driven by innovation, market position, or expansion potential.

On the opposite end, we encounter Payoneer, with a modest 1.5x multiple, which may reflect a more conservative expectation of growth or a mature business model in a competitive space.

The contrast between private and public companies is particularly striking. Private entities such as Checkout.com and Stripe boast multiples of 42.4x and 10.0x respectively, a clear indication of the high-growth prospects perceived by private investors.

Public companies, conversely, tend to have more grounded valuations, with PayPal at a 2.4x multiple, suggesting a different investment thesis that values steady, reliable growth and perhaps a clearer visibility of future cash flows.

Geographical disparities are also evident. The list spans a gamut of locales from the tech-savvy streets of the United States to the bustling markets of India and Brazil. Each company's multiple offers a narrative shaped by the economic backdrop and market dynamics of its region.

For instance, the high multiples seen in emerging markets could reflect a burgeoning middle class and a rapid uptake of digital payments, imbuing companies in these locales with significant growth potential.

The wide range of revenue multiples across both emerging startups and established firms suggests a sector that is not only growing but is in a state of flux. New entrants continue to disrupt the market, while established players must innovate to maintain their position.

This dynamism is embodied in the valuations, where each multiple tells its own story of ambition, strategy, and the quest for financial technology leadership.

In conclusion, the payment industry's revenue multiples in 2024 are a mosaic of high-growth expectations, regional economic narratives, and the unyielding pace of innovation.

They offer a compelling glimpse into the future of money movement and the companies that will lead the charge in transforming the financial landscapes around the globe.

Dive into Finro's step-by-step fintech guides:

| Topic | Description | Guide |

|---|---|---|

| Financial Projection | Master financial projections guiding fintech startups to success | Building Solid Fintech Financial Projections |

| KPI | Discover key metrics guiding growth in fintech. | Key Performance Indicators (KPIs) in Fintech |

| Valuation | Explore leading valuation methods for fintech startups. | Valuing Fintech Startups: Methods, Factors, and Metrics to Consider |

Key Takeaways

Payments startups, integral to fintech, are marked by innovation, with giants like Stripe and PayPal leading the sector.

Valuation reflects potential future value, using revenue multiples for comparison among varying scales of companies.

The sector demonstrates diverse investor optimism, with companies like Paymob showing high revenue multiples.

Private companies exhibit higher multiples, indicating robust growth expectations compared to more moderate public company valuations.

Geographic and market disparities influence valuations, highlighting the sector's dynamism and the regional economic impact on startups.

Answers to The Most Asked Questions

-

Value payment processing companies using revenue and EBITDA multiples, considering market position and growth potential.

-

Startup valuation involves analyzing future potential, market size, technology, team, and investor interest using various methods.

-

Fintech startups are valued based on innovation, market demand, revenue models, and financial metrics like revenue and EBITDA multiples.