Key Performance Indicators (KPIs) in Fintech

By Lior Ronen | Founder, Finro Financial Consulting

In the fintech sector, Key Performance Indicators (KPIs) are vital for steering companies towards success.

Consider a fintech startup that effectively leveraged KPIs like customer acquisition cost and lifetime value to secure significant venture capital. This example highlights the critical role of KPIs in operational effectiveness and attracting investments.

For day-to-day operations, KPIs provide essential insights. They help in refining user experiences, adjusting marketing strategies, and ensuring efficient resource allocation.

In fundraising, KPIs demonstrate a company's growth and potential to investors, enhancing credibility and aiding in risk assessment.

This article focuses on the importance of choosing appropriate KPIs, their consistent monitoring, and thorough analysis. Effective KPIs not only reflect a company’s current status but also attract the right partners and investors, guiding fintech firms towards a flourishing future.

Key Performance Indicators (KPIs) are more than just data points; they narrate the journey of a startup, capturing its growth, challenges, and milestones. Essential for gauging customer engagement, market presence, and overall vitality, KPIs are particularly crucial in the fintech sector.

Fintech businesses require a specialized set of KPIs tailored to their unique challenges, such as monitoring transaction volumes and assessing loan risks. These metrics are key to maintaining adaptability and a customer-centric approach, vital in a sector that continually redefines financial norms.

In essence, KPIs are the compass that can steer your fintech venture through the intricate landscape of financial technology, guiding towards success and innovation.

Understanding KPIs in Tech Startups

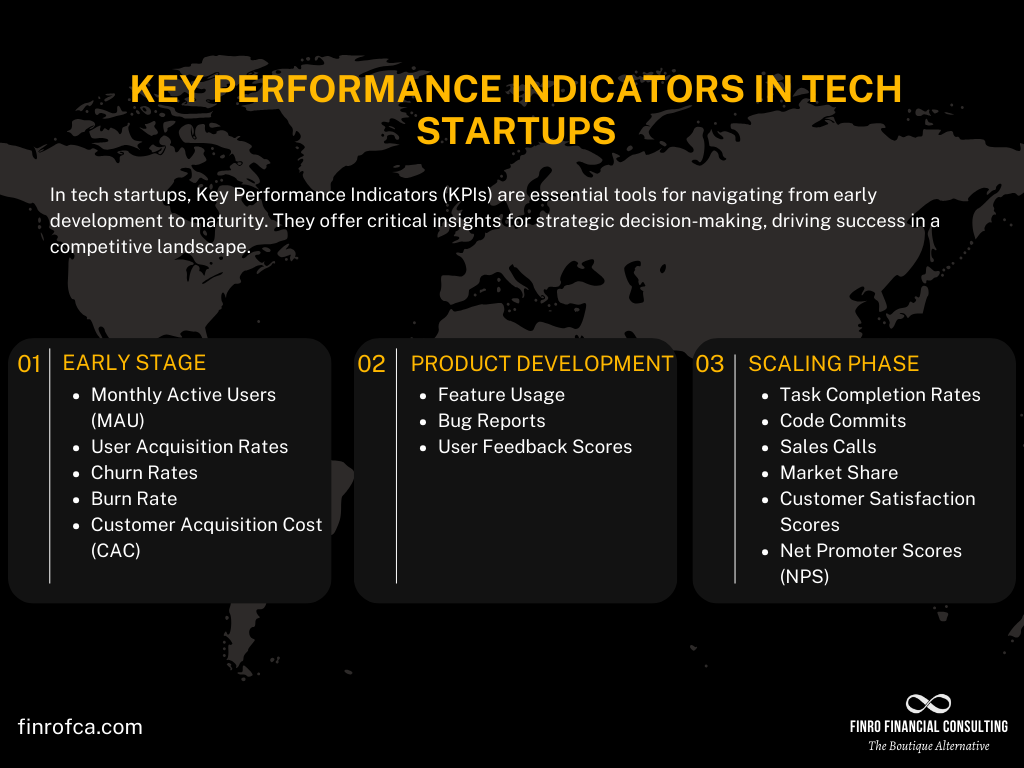

Key Performance Indicators (KPIs) are essential in the dynamic world of tech startups. They guide startups from their early stages to maturity, acting as growth and operational efficiency indicators.

Rapid growth is a primary goal for most tech startups. Key metrics like Monthly Active Users (MAU), user acquisition rates, and churn rates provide a clear view of growth trajectory and user retention.

Given the resource constraints in the early phases, KPIs related to burn rate, customer acquisition cost, and return on investment are crucial for maximizing resources.

The ever-evolving nature of technology demands constant innovation. KPIs such as feature usage, bug reports, and user feedback scores help startups focus their product development effectively, ensuring relevance to their user base.

As startups scale, team efficiency and productivity become critical. Metrics like task completion rates, code commits, and sales calls offer insights into team performance and areas needing improvement.

Understanding the market position is equally important. Startups use KPIs related to market share, customer satisfaction, and net promoter scores to gauge their competitive standing and identify differentiation opportunities.

While these KPIs provide a foundational understanding, it’s important to note that each startup may have its unique set of indicators based on specific goals and market conditions. The key is in carefully selecting, applying, and analyzing KPIs to navigate the path between success and stagnation.

In the fintech sector, this takes on added complexity. Fintech startups, blending finance and technology, rely on specialized KPIs that track not just overall health but also specific financial metrics and user trust. This is crucial in a field where financial reliability and user confidence are paramount.

Next, we'll dive into fintech-specific KPIs, exploring their unique characteristics and critical role in the industry.

Fintech KPIs: A Unique Confluence of Finance and Technology

Fintech, where finance meets technology, is a rapidly evolving sector where traditional performance metrics fall short. Fintech-specific KPIs are vital, guiding businesses through the nuances of digital transactions, online banking, and blockchain technologies.

In this sector, it's not just about growth or user engagement; it's equally about ensuring transaction security, regulatory compliance, and building digital trust. These KPIs serve as critical links between innovation, customer experience, and sustainable market growth.

Let’s explore the key KPIs essential for fintech ventures, understanding their pivotal role in driving success in this dynamic and unique sector.

KPI 1: Net Interest Margin (NIM)

Definition: Measures the difference between interest income generated and interest paid out, relative to interest-earning assets.

Formula: Net Interest Income / Average Earning Assets × 100

Explanation: Calculate the percentage of profit generated from the assets.

Importance: Indicates profitability from core financial activities; crucial for evaluating a fintech's lending and investment efficiency.

Applicable Businesses: Mostly used by fintech companies involved in lending, such as digital banks, peer-to-peer lending platforms, and mortgage tech firms.

KPI 2: Payment Success Rate

Definition: Tracks the percentage of successfully processed transactions.

Formula: Successful Transactions / Total Transactions Attempted × 100

Explanation: Measure the reliability of your payment system by calculating the success rate of transactions.

Importance: Essential for assessing the reliability and efficiency of payment processing systems, directly impacting user experience and trust.

Applicable Businesses: Particularly relevant for payment gateways, digital wallets, and any fintech services facilitating transactions.

KPI 3: Cost-to-Income Ratio

Definition: Compares operating expenses to net revenues to assess operational efficiency.

Formula: Operating Expenses / Net Revenue × 100

Explanation: Determine operational efficiency by comparing expenses to revenue.

Importance: Helps in understanding how well a fintech is managing its expenses relative to its income, crucial for long-term sustainability.

Applicable Businesses: Useful across various fintech businesses, including neobanks, insurtech, and wealth management platforms.

KPI 4: Loan-to-Deposit Ratio (LDR)

Definition: The ratio of a bank's total loans to its total deposits, indicating lending risk and liquidity.

Formula: Total Loans / Total Deposits × 100

Explanation: Gauge the balance between your loans and deposits to assess liquidity and risk.

Importance: Helps in assessing the liquidity and risk profile of lending activities; high LDR may indicate higher risk.

Applicable Businesses: Particularly relevant for digital banks, peer-to-peer lenders, and any fintech companies involved in credit and loans.

KPI 5: Digital Adoption Rate

Definition: Measures the percentage of customers using digital channels for transactions and interactions.

Formula: Digital Channel Users / Total Customers × 100

Explanation: Measure the proportion of customers using digital methods for transactions.

Importance: Key for evaluating the effectiveness of a fintech firm's digital strategy and user engagement levels.

Applicable Businesses: Applicable to all fintech businesses, especially those transitioning from traditional to digital platforms, like digital banks, investment apps, and insurance tech (insurtech) companies.

KPI 6: Fraud Rate

Definition: Tracks the incidence and percentage of fraudulent activities in the system.

Formula: Fraudulent Transactions / Total Transactions × 100

Explanation: Assess the security of your transactions by determining the rate of fraud.

Importance: Crucial for assessing the security measures and trustworthiness of fintech services; impacts customer confidence and regulatory compliance.

Applicable Businesses: Particularly important for payment processors, digital wallets, and online lending platforms where financial transactions are involved.

KPI 7: Average Transaction Value (ATV)

Definition: Calculates the average value of transactions over a period.

Formula: Total Transaction Value / Number of Transactions

Explanation: Understand the average value of each transaction processed.

Importance: Provides insights into customer behavior and the scale of transactions, helping in strategic decision-making about product offerings.

Applicable Businesses: Relevant for payment gateways, investment platforms, and any fintech service involving transaction processing.

KPI 8: Net Promoter Score (NPS)

Definition: A metric that assesses customer satisfaction and loyalty by measuring the likelihood of customers recommending the service.

Method: Survey customers to find out who would recommend your service. Subtract the percentage of detractors from promoters.

Explanation: Evaluate customer satisfaction and loyalty.

Importance: Reflects customer loyalty and satisfaction, which are vital for customer retention and business growth in the fintech sector.

Applicable Businesses: Universal across all fintech businesses, including digital banks, payment services, and personal finance apps.

KPI 9: Chargebacks

Definition: Measures the frequency and rate at which transactions are disputed and reversed, typically due to fraud or customer dissatisfaction.

Formula: Number of Chargebacks / Total Transactions × 100

Explanation: Determine the rate of transaction disputes as a measure of customer dissatisfaction or fraud.

Importance: A critical metric for assessing the quality of payment processing and customer satisfaction. High chargeback rates can indicate issues with transaction security or customer service, and can also lead to higher processing fees and banking penalties.

Applicable Businesses: Particularly relevant for fintech companies involved in payment processing, such as digital wallets, online banking services, and e-commerce payment platforms.

KPI 10: Loan Default Rate (for lending services)

Definition: Measures the percentage of loans where borrowers fail to make timely payments.

Formula: Defaulted Loans / Total Number of Loans × 100

Explanation: Measure the risk in your loan portfolio by calculating the percentage of defaulted loans.

Importance: Crucial for risk management, impacting the financial health and profitability of lending services.

Applicable Businesses: Mainly used by businesses involved in lending, such as peer-to-peer lending platforms, digital banks, and microloan providers.

Conclusion

In the rapidly evolving landscape of fintech, understanding and utilizing the right KPIs becomes the linchpin for success.

As financial services grow more integrated with technology, businesses that can measure, analyze, and act upon these key metrics position themselves at the forefront of innovation.

KPIs are not mere numbers. They are the narrative of a startup's journey, telling stories of challenges faced, milestones achieved, and visions realized.

For fintechs, these indicators provide insights into customer trust, market penetration, and financial health, guiding them through the intricate intersections of finance and technology.

As we've explored, while some KPIs resonate across the broader tech startup sphere, fintechs demand a more nuanced and sector-specific approach.

From gauging transaction volumes to assessing loan risks, the specificity of these KPIs highlights the unique challenges and opportunities within fintech.

As the sector continues to grow, change, and disrupt traditional financial paradigms, staying anchored to these KPIs ensures that fintech businesses remain agile, customer-centric, and poised for sustainable growth.

As you progress in your fintech journey, let these KPIs be your guiding stars, illuminating your path to success in the vibrant tapestry of financial technology.