Equity vs. Debt Financing: Which is Better for Your Startup?

By Lior Ronen | Founder, Finro Financial Consulting

When you're launching a startup, securing the right funding is one of the most critical decisions you'll face. The right financial strategy can set the foundation for growth, innovation, and long-term success.

While bootstrapping with personal savings is an option, most entrepreneurs eventually seek external funding to scale their operations. This brings us to a pivotal choice: should you opt for equity financing or debt financing?

Equity financing involves selling a stake in your company to investors, which could include venture capitalists, angel investors, or private individuals.

In return for their investment, these stakeholders gain ownership shares and often bring valuable expertise and networks.

On the other hand, debt financing means borrowing money that must be repaid over time, typically with interest. This can take various forms, such as loans, lines of credit, or bonds.

Choosing between equity and debt financing isn't straightforward. Each option has its advantages and challenges, and the best choice depends on your startup's specific needs, goals, and circumstances.

In this article, we will explore the pros and cons of both financing methods, provide practical tips on making an informed decision, and highlight key factors to consider before moving forward with either option.

Startups must carefully choose between equity and debt financing based on their specific needs and circumstances. Equity financing offers substantial capital and strategic support but involves giving up ownership and control. Debt financing allows for full ownership retention and has predictable repayment terms but requires careful management of repayment obligations.

A hybrid approach can balance these methods, providing both capital and control while managing risk. Key factors to consider include the startup's stage, capital needs, control preferences, risk tolerance, and financial health. A well-informed decision and strategic funding plan are crucial for supporting growth and long-term success.

Understanding Startup Funding Needs

Starting a business requires capital, and understanding your startup's funding needs is the first step in choosing the right financing option. The amount of money you need, how quickly you need it, and how you plan to use it will all influence your decision.

Initial Funding Sources

In the early stages, many entrepreneurs rely on bootstrapping—using personal savings to fund their business. While this approach allows you to maintain complete control, it can limit your ability to scale quickly. For most startups, external funding becomes necessary to achieve significant growth and reach new markets.

Importance of Choosing the Right Financing Option

Selecting the right financing method is crucial for your startup's success. It impacts your company's financial health, growth potential, and control over decision-making. Equity and debt financing offer different benefits and challenges, making it essential to evaluate which aligns best with your startup's needs and goals.

Factors to Consider

When determining your funding needs, consider the following:

Stage of Development: Early-stage startups might find it challenging to secure debt financing due to a lack of credit history and collateral. Equity financing may be more accessible for businesses with high growth potential but limited financial history.

Capital Requirements: How much funding do you need to achieve your next milestones? Large amounts of capital may be more easily obtained through equity financing, while smaller, manageable sums might be suitable for debt financing.

Control and Decision-Making: Consider how much control you are willing to give up. Equity financing involves sharing ownership and decision-making with investors, whereas debt financing allows you to retain full control.

Growth Potential: If your startup has high growth potential and the possibility of significant returns, equity financing might be a better fit. For businesses with stable, predictable cash flows, debt financing could be more appropriate.

Risk Tolerance: Assess your risk tolerance and financial stability. Equity investors share the financial risk, while debt financing places the repayment obligation solely on your business.

Understanding your startup's funding needs and evaluating these factors will help you make an informed decision about whether equity or debt financing is the right choice for your business. In the following sections, we will delve deeper into the specifics of each financing option to provide a clearer picture of what they entail.

Equity Financing

Equity financing involves raising capital by selling shares of your company to investors. This means giving up a portion of ownership in exchange for funds to grow your business.

Common sources of equity financing include venture capital firms, angel investors, and private investors. These investors provide the necessary capital and often contribute strategic value through their expertise, mentorship, and networks.

Types of Equity Financing

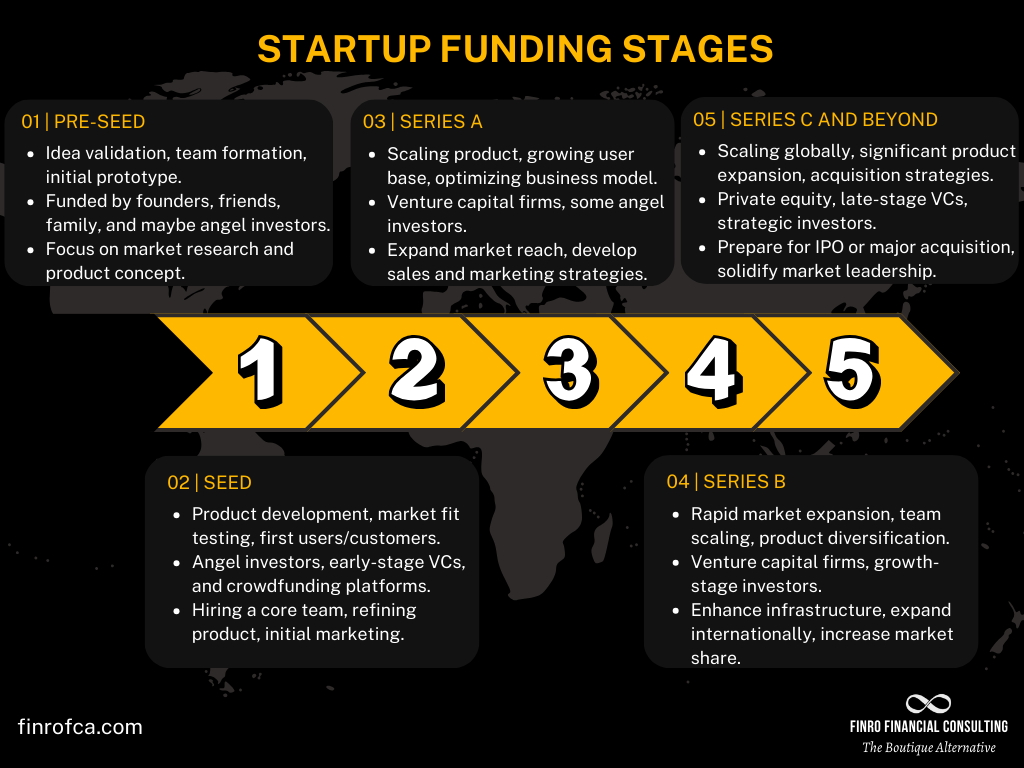

Seed Funding: This initial round of funding typically comes from the company’s founders, family members, or friends. It’s used to get the business off the ground and cover early expenses.

Series A, B, C Rounds: As the startup grows and shows potential, it may seek additional funding rounds. Each round provides more capital in exchange for a larger ownership stake. Angel investors and venture capitalists usually participate in these rounds.

Benefits

Significant Capital Influx: Equity financing can provide substantial funds without the need for repayment, crucial for startups needing considerable capital to scale.

Strategic Support: Investors often bring valuable industry expertise, mentorship, and access to networks that can accelerate growth and help navigate challenges.

Flexibility in Use of Funds: The terms of investment, including valuation, ownership percentage, and voting rights, can be negotiated with investors, offering flexibility in how funds are raised and used.

Drawbacks

Dilution of Ownership: Selling equity means giving up a share of ownership, which can affect control and decision-making in the company.

Potential Conflicts: With multiple stakeholders involved, conflicts can arise over business strategies and long-term goals.

Pressure for High Growth: Investors expect significant returns, which can pressure startups to grow quickly and achieve high valuations.

Key Considerations

Impact on Control and Decision-Making: Understand that equity financing means sharing control with investors, which can influence your company’s strategic direction.

Long-Term Strategy and Investor Expectations: Align your long-term goals with the expectations of your investors to ensure a harmonious partnership.

Legal and Administrative Requirements: The process of raising equity involves legal and administrative tasks, such as creating a shareholder agreement and complying with securities regulations.

Equity financing can be an attractive option for startups with high growth potential, offering both capital and strategic support.

However, before pursuing this financing route, it’s essential to carefully weigh the benefits against the trade-offs and ensure alignment with your long-term vision. In the next section, we will explore the specifics of debt financing and how it compares to equity financing.

Debt Financing

Debt financing involves borrowing money that must be repaid over time, typically with interest. This method allows startups to raise capital without giving up ownership. The borrowed funds can come from various sources, including banks, credit unions, and private lenders. The repayment terms and interest rates are usually set at the time of the loan agreement.

Types of Debt Financing

Term Loans: Fixed amount of money borrowed and repaid over a specified period, usually with a fixed or variable interest rate.

Lines of Credit: Revolving credit facility that allows businesses to draw funds up to a predetermined limit as needed, with interest paid only on the amount borrowed.

Equipment Financing: Loans specifically for purchasing equipment, with the equipment itself serving as collateral.

Invoice Financing: Also known as accounts receivable financing, this allows businesses to sell their outstanding invoices to a lender at a discount for immediate cash.

Merchant Cash Advances: Based on future credit and debit card sales, providing a cash advance repaid through a portion of daily card transactions.

Bonds: Debt securities issued by corporations to raise capital, with fixed interest rates and maturity dates.

Benefits

Retention of Ownership and Control: Unlike equity financing, debt financing does not require giving up a share of your business, allowing you to retain full control over decision-making.

Predictable Costs: Interest rates and repayment schedules are typically fixed, making it easier to plan and budget for future expenses.

Improved Credit Score: Timely repayment of debt can help improve your startup's credit score, potentially making it easier to secure future financing.

Tax Benefits: Interest payments on debt financing can often be tax-deductible, reducing the overall cost of borrowing.

Drawbacks

Risk of Default: If the startup is unable to repay the loan, it could face severe financial and legal consequences, including bankruptcy.

Interest Costs: Debt financing includes interest costs, which can be substantial over the life of the loan.

Strain on Cash Flow: Regular loan repayments can strain the startup’s cash flow, making it harder to cover daily expenses and invest in growth.

Limited Funding: The amount of funding available through debt financing may be limited by the startup’s creditworthiness and the availability of collateral.

Key Considerations

Creditworthiness and Collateral: Lenders will assess your credit score, income, assets, and liabilities to determine your eligibility for a loan and the terms of the agreement.

Ability to Manage Debt: Evaluate your startup’s ability to make regular repayments without jeopardizing its financial stability.

Comparison of Lenders: Shop around for the best rates and terms, and be prepared to negotiate with lenders to secure the most favorable deal.

Debt financing can be a viable option for startups seeking to maintain control while securing the funds needed for growth. However, it’s crucial to carefully assess your financial situation and ability to manage debt before committing to this form of financing. In the next section, we will compare equity and debt financing to help you determine which option best suits your startup’s needs.

Equity vs. Debt Financing: A Comparison

Choosing the right financing option is crucial for your startup's success. Both equity and debt financing offer distinct advantages and drawbacks, and the best choice depends on your specific needs and circumstances. This section will compare these two financing methods across several key factors to help you make an informed decision.

Ownership and Control

Equity Financing

Overview: Investors receive ownership shares in your company in exchange for their investment.

Implications: Sharing ownership means giving up some control over business decisions. Investors often have voting rights and a say in strategic directions.

Debt Financing

Overview: Borrowing money that must be repaid over time with interest.

Implications: Retain full ownership and control over your business decisions. Lenders do not get a share of your company or influence its operations.

Repayment and Financial Risk

Equity Financing

Repayment: No obligation to repay investors. Instead, they share in the profits (or losses) based on their ownership percentage.

Financial Risk: Investors bear the financial risk. If the business fails, they lose their investment.

Debt Financing

Repayment: Requires regular repayments of the borrowed amount plus interest, regardless of business performance.

Financial Risk: The business bears the financial risk. Failure to repay can lead to severe consequences, including bankruptcy.

Cost of Capital

Equity Financing

Cost: Can be expensive in the long run as investors expect significant returns tied to the company's success.

Long-term Impact: Dilution of ownership can lead to substantial costs if the company becomes highly successful.

Debt Financing

Cost: Includes interest payments, which can be significant but are predictable and fixed.

Long-term Impact: Repayments can strain cash flow but do not dilute ownership.

Flexibility and Availability

Equity Financing

Flexibility: Terms of investment, such as valuation, ownership percentage, and voting rights, can be negotiated.

Availability: May be easier to obtain for startups with high growth potential but no credit history.

Debt Financing

Flexibility: Limited to the terms set by the lender. Often less flexible in terms of repayment schedules.

Availability: Generally available to businesses with good credit ratings and sufficient collateral. May be harder to obtain for early-stage startups.

Strategic Support

Equity Financing

Support: Investors often bring additional value, such as industry expertise, mentorship, and access to networks.

Impact: Can accelerate growth and help navigate challenges, but may also lead to conflicts over business direction.

Debt Financing

Support: Lenders typically do not provide strategic support or mentorship.

Impact: You retain full decision-making power but miss out on potential strategic guidance from experienced investors.

Tax Implications

Equity Financing

Taxes: No tax deductions for equity financing. Dividends paid to investors are not tax-deductible.

Debt Financing

Taxes: Interest payments on debt are often tax-deductible, reducing the overall cost of borrowing.

| Aspect | Equity Financing | Debt Financing |

|---|---|---|

| Ownership | Shared with investors | Retained by the business |

| Repayment | No repayment required | Regular repayments with interest |

| Financial Risk | Borne by investors | Borne by the business |

| Cost of Capital | Potentially high in the long run | Predictable interest costs |

| Flexibility | Negotiable terms | Fixed terms set by lender |

| Availability | Easier for high-growth startups | Easier for established businesses with good credit |

| Strategic Support | Provided by investors | Not typically provided by lenders |

| Tax Implications | No tax deductions | Interest payments are tax-deductible |

Factors to Consider When Choosing

Choosing between equity and debt financing requires a thorough evaluation of several key factors that can impact your startup's growth, control, and financial health. Here are the critical aspects to consider:

Stage of the Startup

Early-Stage Startups

Challenges: Typically face difficulty securing debt financing due to a lack of credit history and collateral.

Preferred Option: Equity financing might be more accessible, as investors are often more willing to take risks on new ventures with high growth potential.

Established Startups

Opportunities: With a proven track record and better creditworthiness, these startups may find it easier to obtain debt financing.

Flexibility: They can choose between equity and debt based on their strategic needs and financial health.

Amount of Capital Needed

Large Capital Requirements

Suitable Option: Equity financing can provide substantial funds required for significant expansions, product development, or market entry.

Smaller, Manageable Sums

Suitable Option: Debt financing may be more appropriate for smaller funding needs, such as covering operational costs or short-term projects.

Control and Decision-Making

Equity Financing

Impact: Involves giving up a portion of ownership, which can affect decision-making and control over the company’s strategic direction.

Consideration: Ideal for founders comfortable with sharing control and leveraging investor expertise.

Debt Financing

Impact: Allows founders to retain full control over business decisions without external interference.

Consideration: Suitable for those who prioritize maintaining ownership and decision-making authority.

Risk and Growth Potential

High Growth Potential

Preferred Option: Equity financing, as investors share in the financial risk and can provide valuable support to drive rapid growth.

Stable, Predictable Growth

Preferred Option: Debt financing, as predictable cash flows can support regular loan repayments without diluting ownership.

Financial Health and Creditworthiness

Strong Financial Position

Opportunities: Businesses with good credit scores, reliable income, and sufficient assets can secure favorable debt financing terms.

Weaker Financial Position

Challenges: May find it difficult to obtain debt financing and might need to rely on equity financing despite the potential loss of control.

Risk Tolerance

High Risk Tolerance

Suitable Option: Equity financing, as it involves sharing financial risk with investors who expect high returns.

Low Risk Tolerance

Suitable Option: Debt financing, as it offers predictable repayment schedules and costs, though it increases the financial burden on the business.

Summary

Evaluating these factors will help you determine which financing option aligns best with your startup's needs and goals. It's essential to carefully consider the implications of each choice on your company's control, financial health, and growth potential. In the next section, we will discuss the possibility of combining both equity and debt financing for a balanced approach.

| Factor | Equity Financing | Debt Financing |

|---|---|---|

| Stage of the Startup | Better for early-stage startups | Better for established startups |

| Amount of Capital Needed | Suitable for large capital requirements | Suitable for smaller, manageable sums |

| Control and Decision-Making | Involves giving up some control | Retains full control |

| Risk and Growth Potential | Preferred for high growth potential | Preferred for stable, predictable growth |

| Financial Health and Creditworthiness | Suitable for startups with weaker financial position | Suitable for startups with strong financial position |

| Risk Tolerance | High risk tolerance | Low risk tolerance |

Combining Equity and Debt Financing

In many cases, startups find that a hybrid approach—utilizing both equity and debt financing—provides the optimal balance of benefits.

Combining these two financing methods can help mitigate the drawbacks associated with relying solely on one type of funding while leveraging the strengths of both.

Benefits of a Hybrid Approach

Balanced Capital Structure: By combining equity and debt, startups can access the necessary capital without overly diluting ownership or taking on excessive debt.

Improved Cash Flow Management: Debt can provide immediate funds for operational needs, while equity can offer long-term capital for strategic growth initiatives.

Risk Mitigation: Sharing financial risk between equity investors and debt lenders can provide a safety net and reduce the pressure on cash flow and repayment obligations.

Enhanced Credibility: A diversified capital structure can enhance the startup's credibility with both investors and lenders, potentially making it easier to secure future funding.

Examples of Successful Hybrid Financing

Case Study 1: A tech startup initially raised seed funding from angel investors to develop its product. As the business grew, it secured a term loan to finance its expansion into new markets, balancing equity dilution with manageable debt.

Case Study 2: An e-commerce company used equity financing to build its platform and brand. Once it established a steady revenue stream, it obtained a line of credit to manage cash flow and invest in inventory, ensuring continuous growth without significant ownership loss.

Strategic Considerations

Assessing Needs and Goals: Determine the specific financial needs and long-term goals of your startup. This assessment will help you decide the appropriate mix of equity and debt.

Negotiating Terms: Carefully negotiate the terms of both equity and debt financing to ensure they align with your business strategy and financial capabilities.

Maintaining Flexibility: Keep the financing structure flexible to adapt to changing business conditions and opportunities. This approach allows you to respond effectively to market dynamics and growth opportunities.

Steps to Implement a Hybrid Financing Strategy

Evaluate Your Financial Position: Conduct a thorough analysis of your startup's financial health, cash flow, and capital needs.

Develop a Funding Plan: Create a detailed plan that outlines your capital needs, the proportion of equity and debt, and the purpose of each funding source.

Identify Potential Investors and Lenders: Research and identify suitable equity investors and debt lenders who align with your business goals and values.

Negotiate Favorable Terms: Work with legal and financial advisors to negotiate terms that protect your interests and support your growth strategy.

Monitor and Adjust: Review your capital structure regularly and make adjustments as needed to ensure it continues to meet your business needs and market conditions.

Conclusion

Combining equity and debt financing can provide a balanced approach that leverages both funding methods' strengths while mitigating their drawbacks. By carefully assessing your startup's needs, developing a strategic funding plan, and maintaining flexibility, you can create a robust financial foundation to support your growth and long-term success.

In the next section, we will summarize the key points discussed and offer final thoughts on choosing the best financing strategy for your startup.

Conclusion

Choosing the right financing strategy is a critical decision for any startup. Both equity and debt financing offer unique benefits and challenges, and the best choice depends on your startup's specific needs, goals, and circumstances.

Equity Financing provides substantial capital and strategic support from investors but comes with the trade-off of giving up ownership and control. It's ideal for early-stage startups with high growth potential that need significant funds to scale rapidly.

Debt Financing allows you to retain full ownership and control, with predictable repayment schedules and potential tax benefits. However, it places the burden of repayment and financial risk solely on your business. This option is better suited for established startups with stable cash flows and a strong financial position.

A Hybrid Approach combining both equity and debt financing can offer the best of both worlds, providing a balanced capital structure that supports growth while managing risk and preserving control. This approach allows startups to leverage immediate funds for operational needs and long-term capital for strategic initiatives.

When deciding on the right financing mix, consider key factors such as your startup's stage of development, capital requirements, control preferences, risk tolerance, and financial health. Developing a well-thought-out funding plan and regularly reviewing your capital structure will help you adapt to changing business conditions and seize growth opportunities.

Ultimately, the key to a successful financing strategy is to make an informed decision that aligns with your startup’s vision and goals. By carefully evaluating your options and seeking professional advice, you can secure the right funding to fuel your startup’s growth and long-term success.

For more detailed guidance on choosing the best financing strategy for your startup, explore additional resources and consult with experienced financial advisors.

Key Takeaways

Equity financing provides significant capital but requires giving up ownership.

Debt financing retains ownership but involves repayment obligations.

Hybrid financing balances equity and debt benefits.

Consider startup stage, capital needs, control, and risk tolerance.

A strategic funding plan is essential for growth and success.

Answers to The Most Asked Questions

-

In finance, equity refers to the ownership interest in a company, represented by shares of stock. It signifies an investor's stake in the company, including the right to a portion of the company's profits and, often, voting rights on corporate decisions.

-

Pros:

Provides substantial capital without the need for repayment.

Investors often bring strategic support, including expertise, mentorship, and networks.

Offers flexibility in terms of investment, which can be negotiated with investors.

Cons:

Dilution of ownership, leading to shared control and potential conflicts in decision-making.

Investors expect significant returns, creating pressure for high growth.

The process can be complex and time-consuming with legal and administrative requirements.

-

Debt Financing: Borrowing money that must be repaid over time with interest. Common forms include loans, lines of credit, and bonds. It allows businesses to raise capital while retaining ownership but places the burden of repayment on the business.

Equity Financing: Raising capital by selling shares of the company to investors. This involves giving up a portion of ownership and control in exchange for funds, typically provided by venture capitalists, angel investors, or private investors.

-

Examples of equity financing include seed funding from founders, family, or friends; Series A, B, and C funding rounds from venture capitalists and angel investors; and public stock offerings (IPOs) where shares are sold to the public.

-

Early-stage startups often use equity financing that require significant capital to scale and may not have the credit history or collateral to secure debt financing. It is also suitable for companies with high growth potential, needing strategic support, or preferring not to take on debt repayment obligations.

-

Equity represents owning a piece of a company. When you have equity, you own shares that entitle you to a portion of the company's profits and, often, a say in how the company is run.