Option Pools: A Guide for Tech Startups

By Lior Ronen | Founder, Finro Financial Consulting

Attracting and retaining top talent is essential for the success of any tech startup. One effective way to achieve this is through an option pool.

An option pool is a reserve of company stock set aside for employees, advisors, and other stakeholders. By offering stock options, startups can incentivize employees, making them feel more invested in the company's future.

This article will explain an option pool, why it's important for tech startups, and how to manage it effectively.

Option pools are essential for tech startups to attract and retain top talent by offering stock options as part of compensation, aligning employee interests with company success. Typically established early, often at the seed or Series A stage, option pools range from 10% to 20% of total shares. The creation of an option pool impacts the company's valuation and shareholder equity, necessitating careful planning and board approval.

Proper management involves setting clear vesting schedules, transparent communication with employees, and regular reviews to adjust the pool as the company grows. Integrating stock options into compensation packages motivates employees and creates a sense of ownership, driving the company's growth and success.

What is an Option Pool?

An option pool is a reserve of company stock set aside specifically for future issuance to employees, advisors, and other stakeholders. This pool is created to attract and retain talent by offering stock options as part of the compensation package. These stock options give employees the right to purchase shares of the company at a predetermined price, usually referred to as the exercise or strike price.

The concept of an option pool is straightforward but crucial for the growth of a startup. By allocating a portion of the company's equity to an option pool, founders can provide meaningful incentives that align employees' interests with the long-term success of the business. This alignment is vital, as employees with a stake in the company are more likely to be motivated and committed to driving the company's growth and success.

An option pool is typically established early in the startup's life cycle, often at the seed or Series A funding stage. The size of the option pool can vary, but it generally ranges from 10% to 20% of the company's total shares. This percentage is determined based on the company's anticipated hiring needs and the expectations of investors.

In essence, an option pool serves as a strategic tool to ensure that the startup can attract and retain top talent, offering them a piece of the company's future success. Understanding how to create and manage an option pool is essential for any tech startup aiming to build a strong, motivated team.

The option pool has a direct impact on the company's capitalization table, or cap table. A cap table is a detailed breakdown of a company’s ownership structure, showing the equity stakes held by founders, investors, and employees. It includes information about each shareholder, the number of shares they own, and their percentage ownership of the company.

When an option pool is created, it effectively sets aside a portion of the company's total equity for future distribution. This allocation is reflected in the cap table, impacting the ownership percentages of existing shareholders.

Here’s how the connection works:

Initial Allocation: When the option pool is first established, a percentage of the company’s equity is allocated to the pool. This allocation dilutes the ownership percentages of the existing shareholders, as a portion of their equity is reserved for future use.

Impact on Valuation: The creation of an option pool can influence the company’s valuation. Investors often require a company to establish an option pool before investing to ensure that there is enough equity available to attract and retain talent without needing to increase the pool later, which would further dilute their shares.

Ongoing Management: As employees are granted stock options from the pool, the cap table is updated to reflect these new equity holders. The cap table must be carefully managed to track the distribution of shares and ensure that the total equity granted does not exceed the allocated option pool.

Adjustments and Expansions: Over time, as the company grows and hires more employees, the option pool may need to be adjusted or expanded. This typically happens during new funding rounds, where additional shares may be set aside to replenish the pool. Each adjustment impacts the cap table and must be carefully planned to balance the need for talent acquisition with the desire to minimize dilution for existing shareholders.

In summary, the option pool is an integral part of the cap table, influencing the distribution of equity and the ownership structure of the company. Effective management of both the option pool and the cap table is crucial for maintaining a healthy balance between incentivizing employees and preserving shareholder value.

The Importance of Option Pools for Tech Startups

Option pools play a pivotal role in the growth and success of tech startups by offering a range of benefits beyond simple equity distribution. Here’s why establishing an option pool is crucial for any tech startup:

1. Attracting Top Talent

In the competitive landscape of tech startups, attracting highly skilled and experienced talent is a significant challenge. Offering stock options from an option pool can make a startup more appealing to potential hires. This is especially true for early-stage companies that may not be able to offer competitive salaries. Stock options provide a compelling incentive by giving employees a stake in the company’s future success, making them more likely to join and contribute to the startup’s growth.

2. Retaining Key Employees

Retention of key employees is essential for maintaining continuity and stability within a startup. Stock options from the option pool help ensure that employees have a vested interest in staying with the company. The potential for substantial financial rewards as the company grows and succeeds can motivate employees to remain loyal and committed over the long term.

3. Aligning Interests with Company Success

Option pools align the interests of employees with those of the company and its investors. Employees who hold stock options become partial company owners, sharing in its success successes and failures. This alignment fosters a sense of ownership and accountability, motivating employees to work towards common goals and contribute to the business's overall success.

4. Competitive Advantage

Having an option pool gives startups a competitive edge in the job market. It allows them to compete with larger, more established companies by allowing potential employees to participate in the company’s growth. This can be particularly attractive to entrepreneurial-minded individuals looking for more than just a paycheck—they want to be part of building something significant.

5. Incentivizing Performance

Stock options are a powerful performance incentive. They encourage employees to go above and beyond, as their financial rewards are directly tied to the company’s performance. This can increase productivity, innovation, and a stronger commitment to achieving strategic objectives.

In summary, option pools are a strategic tool that tech startups use to attract, retain, and motivate top talent.

By aligning the interests of employees with those of the company, option pools help build a dedicated, high-performing team that is essential for driving growth and achieving long-term success.

Get your expert support now!

Determining the Size of the Option Pool

Deciding the size of the option pool is a critical step in a startup's early stages. The pool size can significantly affect the company’s equity structure and ability to attract and retain top talent.

Here’s a closer look at how to determine the appropriate size for your option pool:

1. Common Practices for Option Pool Size

Typically, startups allocate 10% to 20% of their total shares to the option pool. This range is considered standard practice, providing a sufficient reserve to attract and incentivize employees without excessively diluting existing shareholders.

The exact percentage can vary based on several factors, including the company’s stage of development and its growth strategy.

2. Factors Influencing the Size of the Option Pool

Several key factors influence the determination of the option pool size:

Stage of the Company: Early-stage startups might set aside a larger percentage for the option pool to attract the initial team members who will drive the company’s growth. The option pool size might be adjusted accordingly as the company matures and reaches later funding stages.

Anticipated Hiring Needs: The company’s future hiring plans play a significant role in deciding the option pool size. Startups planning rapid growth and significant hiring in the near term will need a larger pool to offer competitive packages to new hires.

Investor Expectations: Investors often have specific expectations regarding the option pool size. During funding rounds, they might require the company to allocate a certain percentage to the option pool to ensure enough shares are available for future hires without causing excessive dilution later.

3. Examples of Typical Option Pool Sizes at Different Stages

Seed Stage: At this early stage, startups often set aside 15% to 20% of their total shares for the option pool. This larger allocation helps attract key founding team members and early employees who are crucial for building the company’s foundation.

Series A: During the Series A funding round, the option pool size might be adjusted to around 10% to 15%. By this stage, the company has made some progress, and the initial team is in place, but additional equity is still needed to attract new talent as the company scales.

Series B and Beyond: The option pool size might be adjusted further as the company grows and secures additional funding. Typically, it ranges from 5% to 10%, reflecting the company's more mature stage and its more established team.

4. Balancing Equity Distribution

Finding the right balance for the option pool size is essential to maintain a healthy equity distribution among founders, investors, and employees. Allocating too small a pool can limit the company’s ability to attract and retain talent, while a too large pool can result in significant dilution for existing shareholders.

In summary, determining the option pool size requires careful consideration of the company’s stage, hiring plans, and investor expectations.

By setting aside an appropriate percentage of equity for the option pool, startups can ensure they have the resources needed to attract and incentivize top talent, driving their growth and success.

| Stage of the Company | Typical Option Pool Size | Purpose and Considerations |

|---|---|---|

| Seed Stage | 15% to 20% | Attract key founding team members and early employees |

| Series A | 10% to 15% | Continue attracting talent while having an established initial team |

| Series B and Beyond | 5% to 10% | Maintain a smaller pool as the company grows and the team becomes more established |

Option Pool Calculation and Dilution

Understanding how an option pool affects company valuation and equity distribution is crucial for any startup founder.

Here’s a detailed look at the mechanics of option pool calculation and its impact on dilution:

1. How an Option Pool Affects Valuation

When creating an option pool, the allocation of shares directly influences the company’s valuation. Here’s how:

Pre-Money Valuation: This is the company's valuation before any new investment. The option pool size should be considered when negotiating the pre-money valuation with investors. A larger option pool means more shares are reserved for future issuance, which can dilute the ownership percentages of existing shareholders.

Post-Money Valuation: This is the company's valuation immediately after receiving new investment. The post-money valuation includes the newly allocated option pool. For example, if the pre-money valuation is $10 million and the company raises $2 million, the post-money valuation is $12 million. The option pool is part of this new valuation.

2. Example: Impact of Option Pool on Dilution

Consider a startup with a pre-money valuation of $10 million and plans to create a 20% option pool. Here’s how the option pool impacts dilution:

Initial Allocation: The company allocates 20% of its equity for the option pool. If there are 10 million shares before the option pool, the new total share count will be 12.5 million shares (10 million shares / 0.8 to account for the 20% option pool).

Dilution Effect: Existing shareholders' ownership percentages are diluted to make room for the option pool. If a founder initially holds 50% of the company (5 million shares), their ownership after creating the option pool will be 40% (5 million shares / 12.5 million total shares).

3. Managing Dilution

Strategic Planning: It’s crucial to strategically plan the size of the option pool to balance the need for future employee incentives and minimizing dilution for existing shareholders.

Investor Negotiations: During funding rounds, negotiate the option pool size with investors. Often, investors may require the creation of an option pool as a condition for investment to ensure there are sufficient shares available for future hires.

4. Examples Illustrating Option Pool Dilution

Let’s illustrate with another example:

Company A: Pre-money valuation of $5 million, raising $1 million with a 15% option pool. The pre-money share count is 5 million shares.

Pre-money shares: 5 million

New shares from investment: 1 million

Option pool shares: 5 million * 15% / (1 - 15%) = 0.88 million shares

Post-money shares: 5 million + 1 million + 0.88 million = 6.88 million shares

Impact on Founder Ownership: If the founder initially owns 60% (3 million shares), their new ownership percentage is approximately 43.6% (3 million / 6.88 million).

In summary, understanding how to calculate the option pool and its impact on dilution is essential for maintaining a balanced equity structure. Proper planning and strategic negotiation with investors can help manage dilution while ensuring there is enough equity available to attract and

Creating and Managing an Option Pool

Establishing and effectively managing an option pool is essential for the growth and success of a tech startup.

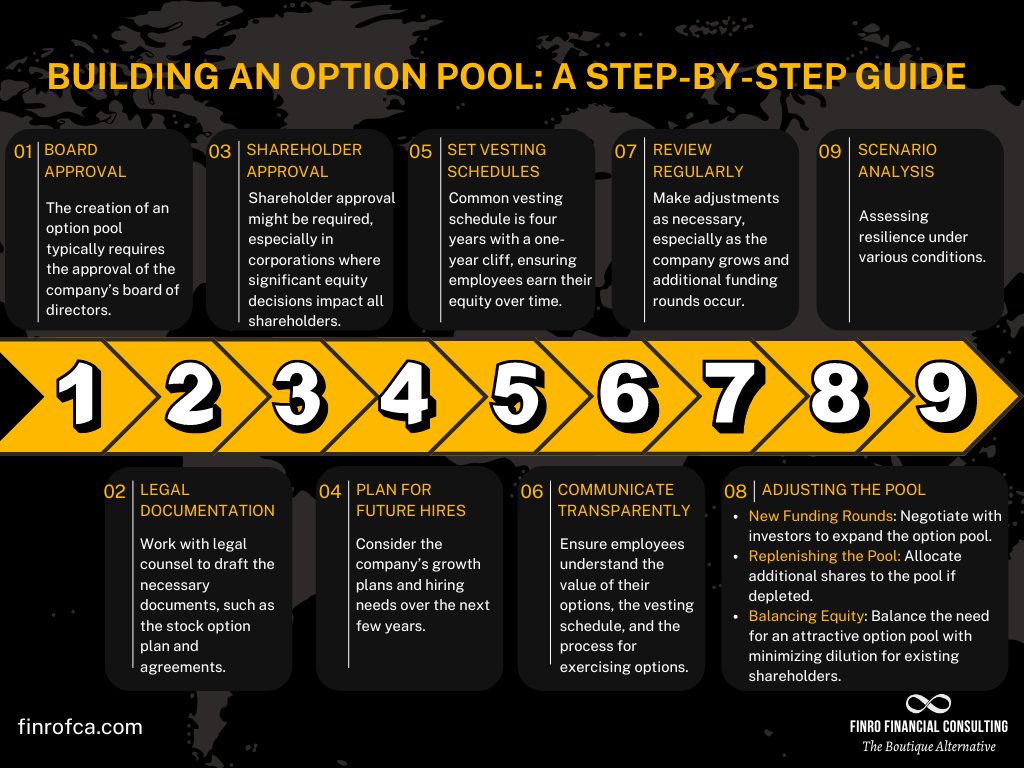

Here’s a step-by-step guide on how to create and manage an option pool:

1. Steps to Create an Option Pool

Creating an option pool involves several key steps that require careful planning and legal considerations:

Board Approval: Creating an option pool typically requires the approval of the company’s board of directors. This step ensures that the leadership is unanimous regarding the pool's size and purpose.

Legal Documentation: Work with legal counsel to draft the necessary documents, such as the stock option plan and agreements. These documents outline the terms and conditions under which employees will be granted stock options.

Shareholder Approval: Depending on the company’s structure, shareholder approval might be required. This is often the case in corporations where significant equity decisions impact all shareholders.

2. Best Practices for Managing and Allocating the Option Pool

Effective management of the option pool ensures that the company can attract and retain top talent while maintaining a balanced equity distribution:

Plan for Future Hires: Allocate stock options not only for current employees but also for future hires. Consider the company’s growth plans and hiring needs over the next few years.

Set Clear Vesting Schedules: Establish vesting schedules that align with industry standards and company goals. A typical vesting schedule is four years with a one-year cliff, ensuring employees earn their equity over time.

Communicate Transparently: Communicate the details of the stock option plan to employees. Ensure they understand the value of their options, the vesting schedule, and the process for exercising options.

Review Regularly: Periodically review the option pool and make adjustments as necessary. As the company grows and additional funding rounds occur, the option pool size may need to be increased to accommodate new hires.

3. Adjusting the Option Pool Over Time

As a startup evolves, the option pool may need to be adjusted to meet changing needs:

New Funding Rounds: The company may negotiate with investors to expand the option pool during new funding rounds. This ensures enough shares are available for future hires and incentivizes employees.

Replenishing the Pool: If the option pool becomes depleted, the company may need to allocate additional shares to the pool. This can be done by issuing new shares, which will result in some dilution for existing shareholders.

Balancing Equity: Continually balance the need for an attractive option pool to minimize dilution for existing shareholders. This requires careful planning and negotiation with stakeholders.

Creating and managing an option pool involves strategic planning, legal considerations, and ongoing adjustments.

By following best practices and maintaining transparency with employees, startups can effectively use their option pool to attract, retain, and motivate top talent, driving the company’s growth and success.

Option Pool and Employee Compensation

Integrating stock options into employee compensation packages is a strategic move for tech startups. It attracts top talent and fosters a sense of ownership and alignment with the company's goals.

Here’s how stock options fit into employee compensation and the key considerations for effectively communicating and managing this aspect of your compensation strategy:

1. How Stock Options Fit into Compensation Packages

Stock options are a valuable component of compensation packages, especially for startups that may not be able to offer highly competitive salaries initially. Here’s how they typically work:

Base Salary: The fixed cash compensation an employee receives regularly.

Bonuses: Additional cash incentives based on performance metrics.

Stock Options: The right to purchase company shares at a predetermined price, often below market value. These are typically part of a long-term compensation strategy to align employee interests with company growth.

By offering stock options, startups can provide significant upside potential for employees, making the overall compensation package more attractive despite potentially lower base salaries than larger, more established companies.

2. Explaining Stock Options to Employees

Clear communication about stock options ensures employees understand and appreciate their value. Key points to cover include:

Vesting Schedules: Explain how vesting works. Typically, it is a four-year vesting period with a one-year cliff. This means that employees earn the right to exercise their options gradually, with a portion becoming available after the first year and the rest vesting monthly or quarterly over the next three years.

Exercise Price: Clarify the exercise price, which is the price at which employees can purchase the shares. This price is typically set at the fair market value of the shares when the options are granted.

Exercising Options: Detail the process for exercising options, including the financial and tax implications. Employees should understand the cost and potential benefits of holding or selling their shares.

Potential Upside: Highlight the potential financial rewards if the company grows and succeeds, emphasizing how their contributions directly impact the company’s value and its financial gains.

3. Importance of Transparent Communication

Transparency in communicating stock options is vital for building trust and ensuring employees fully grasp the benefits. Here are some best practices:

Educational Sessions: Conduct regular workshops or informational sessions to educate employees about stock options, vesting schedules, and the potential financial implications.

Detailed Documentation: Provide clear, written documentation outlining the terms and conditions of the stock option plan. Ensure employees have easy access to this information.

One-on-One Meetings: Offer personalized meetings to address individual questions and concerns. This approach ensures that each employee understands their specific situation and the value of their stock options.

4. Aligning Stock Options with Company Goals

Aligning stock options with company goals helps create a motivated and invested workforce. Here’s how:

Performance-Based Vesting: Consider incorporating performance milestones into vesting schedules. This approach ties the vesting of options to achieving specific company goals, further aligning employee efforts with company success.

Regular Updates: Keep employees informed about the company’s progress and how it impacts their stock options. Regular updates foster a sense of ownership and motivate employees to contribute to the company’s growth.

In summary, integrating stock options into employee compensation packages is a strategic move that can attract and retain top talent.

Clear and transparent communication about stock options' terms, benefits, and processes ensures employees understand and appreciate their value.

By aligning stock options with company goals, startups can create a motivated and invested workforce that drives the company’s success.

Conclusion

Option pools are a fundamental component in the growth strategy of tech startups. They play a crucial role in attracting and retaining top talent, aligning employee interests with company success, and providing a competitive edge in the job market.

By understanding the intricacies of creating and managing an option pool, startup founders can strategically use this tool to build a motivated and committed team.

From determining the right size of the option pool and understanding its impact on dilution, to effectively integrating stock options into employee compensation packages and maintaining transparent communication, each step is essential for maximizing the benefits of an option pool.

Proper planning and regular adjustments ensure that the option pool remains a valuable incentive without causing excessive dilution for existing shareholders.

Incorporating an option pool into your startup's equity structure not only incentivizes performance but also fosters a sense of ownership among employees.

This alignment of interests can drive your startup towards achieving its long-term goals and realizing its full potential. As your startup evolves, continue to review and adjust the option pool to meet the changing needs of your company and its growth trajectory.

Ultimately, a well-managed option pool is more than just a tool for compensation; it’s a strategic asset that can significantly contribute to the success and sustainability of your startup. By leveraging the power of equity, you can build a strong, dedicated team ready to take your company to new heights.

Key Takeaways

Option pools attract and retain top talent.

Typically 10% - 20% of total shares.

Impacts valuation and shareholder equity.

Requires careful planning and board approval.

Aligns employee interests with company success.

Answers to The Most Asked Questions

-

An example of an employee option pool is setting aside 15% to 20% of a startup's total shares for future issuance to employees, advisors, and other stakeholders to attract and retain talent.

-

An option pool and an ESOP (Employee Stock Ownership Plan) are not the same. An option pool is a reserve of shares for future issuance as stock options, whereas an ESOP is a program that provides employees with ownership interest in the company. The text primarily discusses option pools.

-

The option pool on a term sheet refers to the percentage of the company's total shares that are set aside as stock options for future employees, typically ranging from 10% to 20%. It impacts the company's valuation and equity distribution during investment negotiations.

-

An option pool is typically created early in the startup’s lifecycle, often at the seed or Series A funding stage, to attract and retain key founding team members and early employees.

-

Creating an option pool involves obtaining board approval, drafting legal documentation with the help of legal counsel, and potentially securing shareholder approval. It requires careful planning to determine the appropriate size and manage future allocations.

-

Option pools work by setting aside a percentage of a company's equity to grant stock options to employees. According to vesting schedules, employees earn the right to purchase shares at a predetermined price over time. This aligns their interests with the company's success and incentivizes long-term commitment and performance.