Joseph Baldassarra

Managing Partner, Broad Street Global Fund

By Lior Ronen | Founder, Finro Financial Consulting

Would you invest a significant amount of money in a business without fully understanding its financial health?

The stakes in business ventures can be astronomical, yet it's surprisingly common for investors and business leaders to commit to transactions without thorough investigation.

This oversight underscores the critical role of due diligence—a comprehensive evaluation that should precede any major business decision, whether it’s an acquisition or an investment in a private company.

At the core of due diligence is a methodical assessment across various operational areas, including finance, sales, marketing, and more.

However, this article zeroes in on one essential aspect: financial due diligence. Drawing upon my extensive experience with tech companies, I will guide you through the intricacies of this process.

We'll explore its definition, objectives, key stages, and the types of financial information reviewed.

Additionally, we'll examine the unique approach venture capitalists take during their financial assessments.

By demystifying financial due diligence, I aim to equip you with the knowledge to make informed investment decisions and navigate M&A transactions confidently.

Understanding a company's financial health and potential is not just prudent—it's imperative for success.

Financial due diligence is a cornerstone of the decision-making process in mergers and acquisitions (M&A), investments, and other financial transactions.

At its core, financial due diligence is an in-depth examination and analysis of a company's financial health.

This process goes beyond just reviewing financial statements; it involves a comprehensive assessment of the business's financial records, including but not limited to its assets, liabilities, cash flow, revenue, expenses, and profitability.

The primary aim of financial due diligence is to validate the information presented by the target company, uncover any financial risks or liabilities that may not be immediately apparent, and ensure that the investor or acquirer has a clear picture of the financial realities of the business.

This insight allows stakeholders to make informed decisions, negotiate more effectively, and ultimately, minimize the risks associated with the transaction.

|

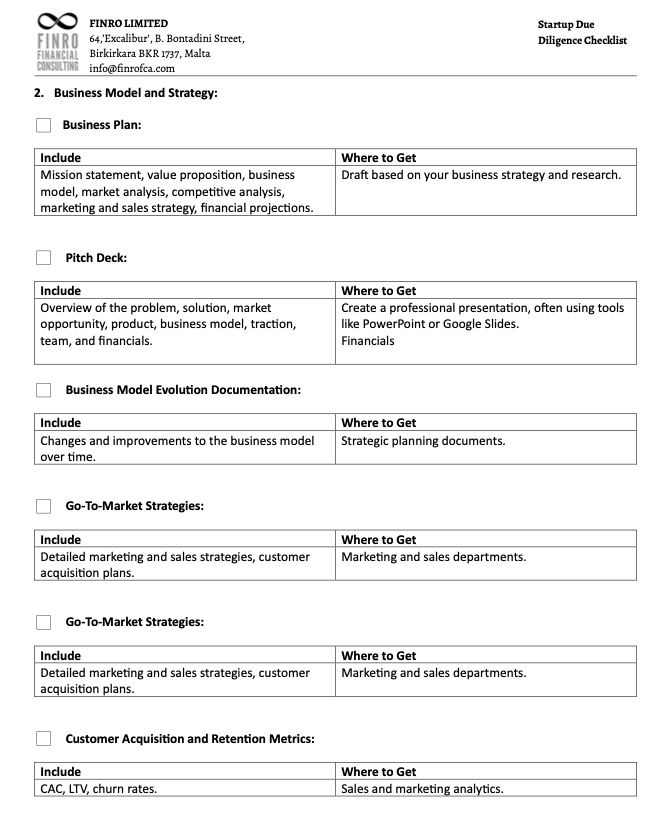

Click to Recieve The Full Checklist Now: Finro Startup Due Diligence Checklist |

Components of Financial Due Diligence

Financial due diligence encompasses several key components, each focusing on different areas of the company's financial landscape:

Historical Financial Performance Analysis: This involves a detailed review of past financial statements to assess the company's historical growth, profitability, and cash flow stability.

Quality of Earnings: A thorough examination of the company's earnings to identify any non-recurring, non-operational, or unusual items that may have affected profitability.

Working Capital Assessment: Analysis of the company's working capital to understand the short-term financial health and operational efficiency.

Debt and Liabilities Review: Identifying the scope of the company's debt, contingent liabilities, and any potential financial obligations that could impact the transaction.

Forecast and Projections Evaluation: Assessing the reasonableness and achievability of the company's financial projections to understand potential future performance.

Why Conduct Financial Due Diligence?

Conducting financial due diligence is essential for several reasons:

Risk Mitigation: It helps identify financial risks and red flags, such as undisclosed liabilities, that could affect the viability of the transaction.

Valuation Verification: It provides a basis for verifying the company's valuation, ensuring that the investment or acquisition price is justified by its financial performance and potential.

Negotiation Leverage: Insight into the company's financial health can provide leverage in negotiations, allowing the acquirer or investor to adjust the terms of the deal based on discovered financial realities.

Strategic Planning: Understanding the financial strengths and weaknesses of the target company aids in strategic planning post-acquisition or investment, helping to integrate and optimize the business effectively.

The primary objective of analyzing a company's historical financial performance is to gain insights into its financial health and operational efficiency over time. This analysis serves as a crucial indicator, providing a solid foundation for making informed decisions regarding potential investments or acquisitions.

Key Focus Areas

Revenue Growth: Evaluating the company's revenue trends over multiple periods helps identify growth patterns, scalability of the business model, and market demand for the company's products or services.

Profit Margins: Analyzing profit margins, both gross and net, reveals the company's ability to manage costs and maintain profitability. It's essential to understand how these margins have evolved to assess the sustainability of profits.

Cash Flow Stability: Cash flow is the lifeline of any business. Assessing the stability and sources of cash flow, including operating, investing, and financing activities, provides insights into the company's financial resilience and operational health.

Cost Management: Effective cost management is a key driver of financial performance. Reviewing how the company manages its operating and non-operating expenses can reveal efficiencies or areas needing improvement.

Methodology

Comparison of Year-over-Year Financial Statements: This involves a detailed examination of the company's balance sheets, income statements, and cash flow statements over several periods. It helps in identifying trends in key financial metrics and anomalies that may require further investigation.

Ratio Analysis: Financial ratios such as debt-to-equity, current ratio, return on equity (ROE), and return on assets (ROA) provide a quick understanding of the company's financial position relative to its history and industry benchmarks.

Trend Analysis: By analyzing financial data over time, we can identify consistent patterns or trends that offer predictive value about the company's future performance. This includes looking at sales growth rates, expense trends, and profitability trends.

Historical financial performance analysis is an indispensable part of financial due diligence, offering a lens through which investors and acquirers can evaluate a company's past achievements and challenges.

By understanding how a company has performed financially, stakeholders can better gauge its potential for future success.

his analysis, therefore, lays the groundwork for deeper dives into quality of earnings, working capital assessment, and other due diligence components, each of which builds upon the understanding developed in this foundational review.

The Quality of Earnings analysis is pivotal in assessing the sustainability and true quality of a company's earnings.

It aims to differentiate between earnings that arise from the company's regular, operational activities and those resulting from one-off, non-operational, or unusual items.

This distinction is critical for understanding the company's ongoing financial health and potential for future earnings.

Key Focus Areas

Adjusted EBITDA Calculations: Adjusted Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) is a key metric that helps in understanding the company's operational profitability by excluding non-recurring, non-operational, or unusual items. This adjustment provides a clearer picture of the company's earnings from its core operations.

Analysis of Revenue Recognition Policies: The policies and practices a company follows to recognize revenue can significantly affect its reported earnings. Analyzing these policies helps in assessing whether the reported revenue accurately reflects the economic reality of the company's transactions.

Examination of Discretionary Expenses: Discretionary expenses, such as management bonuses or research and development spending, can be adjusted based on financial performance or strategic decisions. Examining these expenses is important to understand their impact on earnings and to identify any adjustments made to influence reported profitability.

Methodology

Detailed Review of Income Statement Line Items: This involves a line-by-line examination of the income statement to identify any irregular items, such as one-off sales, extraordinary expenses, or other unusual transactions that may not be indicative of the company's ongoing operations.

Notes to Financial Statements: The notes provide additional context and details behind the numbers presented in the financial statements. A thorough review of these notes is essential to uncovering the nuances of the company's accounting choices and the quality of its earnings.

Discussions with Management: Engaging in discussions with the company's management team offers insights into the reasoning behind certain accounting practices, the sustainability of earnings, and any potential items that might distort the true quality of earnings.

Analyzing the quality of earnings is a critical step in financial due diligence, as it sheds light on the sustainability and reliability of the company's reported profits.

By meticulously examining adjusted EBITDA, revenue recognition policies, and discretionary expenses, investors can discern between high-quality earnings that reflect steady operational success and lower-quality earnings that may not be repeatable in the future.

This analysis ensures stakeholders have a transparent view of the company's financial health, guiding better-informed investment decisions.

The assessment of working capital is a fundamental aspect of financial due diligence, aimed at evaluating a company's ability to meet its short-term obligations using its short-term assets. This analysis is critical for understanding the company's operational efficiency and overall financial health, as it reflects the liquidity and operational management capabilities of the business.

Key Focus Areas

Current Ratio: This ratio, calculated as current assets divided by current liabilities, provides a snapshot of the company's ability to cover its short-term obligations with its short-term assets. A higher ratio indicates better liquidity and financial health.

Quick Ratio: Also known as the acid-test ratio, it is similar to the current ratio but excludes inventory from current assets. This ratio offers a more stringent test of a company's immediate liquidity by focusing on assets that can be quickly converted into cash.

Inventory Turnover: This metric assesses how efficiently a company manages its inventory by measuring the number of times inventory is sold and replaced over a period. Higher turnover rates indicate more efficient inventory management and operational efficiency.

Accounts Receivable/Payable Days: These metrics measure the average number of days it takes for a company to collect payments from customers (receivable days) and the average number of days it takes for the company to pay its suppliers (payable days). Shorter receivable days and longer payable days can improve a company's cash flow position.

Methodology

Analysis of Current Assets and Liabilities: A detailed examination of the components of current assets and liabilities helps in understanding the company's liquidity. This includes reviewing cash and cash equivalents, marketable securities, accounts receivable, inventory, and accounts payable.

Understanding Cash Flow Cycles: Analyzing the cycle from purchasing inventory to collecting cash from sales provides insights into the company's operational efficiency and cash management practices. Identifying bottlenecks or inefficiencies in the cash conversion cycle can reveal areas for improvement.

Benchmarking Against Industry Standards: Comparing the company's working capital metrics to industry averages and norms helps in assessing its performance relative to peers. This benchmarking can highlight strengths or areas of concern in the company's working capital management.

A thorough working capital assessment is vital for evaluating a company's short-term financial stability and operational efficiency. By analyzing liquidity ratios, inventory turnover, and accounts receivable/payable days, investors can gain insights into how well the company manages its working capital.

This analysis is crucial for understanding the company's ability to sustain operations, fund growth, and withstand financial challenges.

Effective working capital management not only ensures financial health but also supports operational agility and competitiveness.

The review of a company's debt and liabilities is a critical component of financial due diligence, aimed at identifying and assessing the extent and nature of the company's financial obligations.

This analysis is vital for understanding how existing debts and potential liabilities might impact the company's future operations, financial health, and the viability of the transaction under consideration.

Key Focus Areas

Types of Debt: Identifying the different types of debt the company holds, such as short-term loans, long-term debt, bonds, and lease obligations. Understanding the diversity in the company's debt structure is crucial for assessing its financial flexibility and risk profile.

Interest Rates: Evaluating the interest rates associated with the company's debt instruments. Fixed and variable interest rates have different implications for cash flow and financial planning, especially in varying economic climates.

Maturity Profiles: Analyzing when the company's debts are due for repayment. The timing of debt maturities can significantly affect the company's cash flow management and its ability to refinance or pay off debts as they come due.

Covenants: Reviewing any covenants attached to loans or other financial obligations. Covenants can impose restrictions on the company's operations, financial ratios, or its ability to incur additional debt, impacting strategic decisions and operational flexibility.

Contingent Liabilities: Identifying potential liabilities that may arise from current lawsuits, guarantees, warranties, or other contingencies. These liabilities can have a material impact on the company's financial statements if they become actual obligations.

Methodology

Review of Loan Agreements and Legal Contracts: A thorough examination of all loan agreements, bond indentures, and other legal documents related to the company's debt and financial obligations. This review helps in understanding the terms, conditions, and any specific clauses that could affect the company's financial strategy.

Discussions with Financial Advisors: Engaging with the company's financial advisors or external consultants to gain insights into the management's strategy for debt management, refinancing plans, and how they intend to address any significant upcoming maturities or covenant issues.

Analysis of Financial Statements and Notes: Detailed analysis of the financial statements, particularly the balance sheet and the notes to the financial statements, to quantify the total debt, assess the classification of liabilities, and understand the nature of any contingent liabilities.

Conducting a comprehensive review of the company's debt and liabilities is essential for any financial due diligence process.

It provides a clearer picture of the company's financial obligations, the risks associated with its debt structure, and potential impacts on its future operations and the overall transaction.

By carefully evaluating the types of debt, interest rates, maturity profiles, covenants, and contingent liabilities, investors and acquirers can make informed decisions, accurately assess the financial health of the company, and strategically plan for the integration or investment process.

Evaluating a company's financial forecasts and projections is a critical element of financial due diligence. This process aims to assess the realism and achievability of the company's future financial plans, offering valuable insights into its potential for growth, profitability, and cash flow generation. Understanding the company's outlook is crucial for investors and acquirers to make informed decisions regarding the viability and value of the investment or acquisition.

Key Focus Areas

Revenue Growth: Analyzing the projected revenue growth rates to assess their alignment with industry trends, market conditions, and the company's historical performance. This includes evaluating the basis for any expected increases in market share or entry into new markets.

Expense Management: Reviewing the company's forecasts for operating expenses, including cost of goods sold (COGS) and administrative expenses, to ensure they are consistent with the revenue growth projections and historical cost management practices.

Cash Flow Projections: Examining the projected cash flows from operating, investing, and financing activities to understand the company's future liquidity position, its ability to fund ongoing operations, and any planned investments or debt repayments.

Capital Expenditure Plans: Assessing the company's plans for capital expenditures to support its growth or maintain operational capacity. This includes evaluating the expected returns on these investments and their impact on future financial performance.

Methodology

Comparison of Past Projections to Actual Performance: This involves reviewing how past financial projections have compared to actual outcomes to gauge the accuracy and reliability of the company's forecasting process. This historical performance analysis can provide insights into the company's ability to accurately forecast its financials.

Analysis of Underlying Assumptions: A critical examination of the assumptions underlying the company's projections. This includes macroeconomic assumptions, industry growth rates, market conditions, and competitive landscape. Assessing the reasonableness of these assumptions is key to validating the projections.

Stress Testing of Projections: Applying various stress scenarios to the financial projections to test their robustness under different economic and market conditions. This helps identify potential vulnerabilities in the company's financial plans and assess the impact of adverse events on its future performance.

The evaluation of financial forecasts and projections is an indispensable part of financial due diligence, providing a lens through which to view the company's future financial health and operational success.

By rigorously analyzing revenue growth, expense management, cash flow projections, and capital expenditure plans, stakeholders can critically assess the achievability of the company's financial outlook.

This analysis not only informs the decision-making process but also aids in identifying areas where strategic adjustments may be necessary to ensure the company's long-term viability and growth.

Venture capitalists have a distinct approach to financial due diligence, tailored to the specific risks and opportunities presented by startups and growth-stage companies at various phases of their development.

Understanding these differences is crucial for entrepreneurs seeking VC funding and for investors looking to align their due diligence practices with the unique dynamics of venture capital investing.

Focus Areas

Team Assessment: At the early stages, VCs often focus more on the founding team's background, vision, and capability to execute the business plan than on traditional financial metrics, which may not yet be significant or even existent.

Market Potential: Early-stage due diligence emphasizes the market opportunity and the startup's potential to capture a significant share. VCs evaluate the size, growth rate, and characteristics of the target market.

Product Viability: Assessing the product's development stage, its market fit, and the technology's scalability becomes crucial. Financial due diligence intertwines with technical evaluations to estimate future funding rounds needed for product development and market penetration.

Methodology

Comparative Analysis: VCs may use benchmarks and comparables from similar startups and sectors to evaluate potential growth rates and market opportunities.

Scenario Analysis: Due to the high uncertainty at this stage, VCs employ scenario analyses to test various outcomes based on market acceptance and scaling challenges.

Focus Areas

Growth Metrics: Attention shifts towards growth metrics like revenue growth rate, customer acquisition cost (CAC), lifetime value (LTV) of a customer, and burn rate. VCs assess the efficiency of growth strategies and scalability.

Unit Economics: Understanding the profitability of individual units or transactions becomes vital. VCs look for positive trends in unit economics as indicators of sustainable growth.

Cash Flow Management: The ability of the company to manage its cash flow efficiently is scrutinized, with a focus on how long the current funding will last (runway) and future funding needs.

Methodology

Financial Projections and Modelling: VCs conduct in-depth analyses of the company's financial projections, assessing the assumptions behind revenue forecasts and expense estimates.

Historical Performance Analysis: Evaluating past financial performance to understand growth patterns, cost management, and the ability to meet projected milestones.

Focus Areas

Market Leadership and Expansion: For later-stage companies, VCs evaluate the company's position within the market, its competitive advantages, and the potential for further expansion, including international growth.

Profitability Pathway: The focus increasingly shifts towards profitability. VCs assess the company's roadmap to profitability, examining cost structures, margin improvements, and operational efficiencies.

Risk Management: Financial due diligence at this stage also involves a thorough risk assessment, including regulatory risks, market saturation, and the competitive landscape.

Methodology

Due Diligence on Financials: Comprehensive review of audited financial statements, tax compliance, and legal obligations. The financial health of the company is scrutinized in detail.

Exit Strategy Evaluation: Analysis of potential exit strategies, including IPO readiness, acquisition potential, and the market environment for exits.

VCs adapt their financial due diligence approach according to the maturity stage of the company, shifting from a focus on the team and market potential in the early stages to growth metrics, unit economics, and eventually, profitability and risk management in later stages.

This tailored approach reflects the evolving nature of risks and opportunities as a company grows, ensuring that VCs invest in ventures with the best chances for success and alignment with their investment criteria.

| Stage | Focus Areas | Methodology |

|---|---|---|

| Early-Stage (Seed, Series A) | Team Assessment, Market Potential, Product Viability | Comparative Analysis, Scenario Analysis |

| Mid-Stage (Series B, C) | Growth Metrics, Unit Economics, Cash Flow Management | Financial Projections and Modelling, Historical Performance Analysis |

| Late-Stage (Series D and Beyond) | Market Leadership and Expansion, Profitability Pathway, Risk Management | Due Diligence on Financials, Exit Strategy Evaluation |

Financial due diligence is a cornerstone of the M&A process, providing a comprehensive assessment of the target company's financial health and sustainability.

Unlike VC due diligence, which often focuses on potential for growth, market opportunities, and the strength of the team in early-stage companies, financial due diligence in M&A contexts delves deeply into the financial intricacies of established businesses to ensure a sound investment.

The primary goal of financial due diligence in M&A is to validate the financial information presented by the target company and to uncover any financial risks or liabilities that could affect the valuation or the feasibility of the merger or acquisition. This process ensures that the acquiring company makes an informed decision, minimizing surprises post-transaction.

Focus Areas:

Historical Financial Performance: Analysis of audited financial statements to assess the target's financial stability, profitability, and cash flow trends.

Quality of Earnings: Examination of the sustainability of earnings, identifying any one-off items or non-operational revenues that may not be repeatable post-acquisition.

Debt and Liabilities: Review of all obligations, including off-balance sheet liabilities, contingent liabilities, and legal commitments, to understand the full financial burden that may be assumed.

Operational Efficiencies: Evaluation of cost structures, supply chain management, and operational workflows to identify areas of synergy and cost-saving opportunities.

Tax Compliance and Liabilities: Comprehensive review of tax filings, disputes, and potential liabilities to assess tax exposure.

The methodology in M&A financial due diligence involves a detailed review of financial documents, interviews with management, and often, coordination with legal and operational due diligence teams to provide a holistic view of the target's financial health.

Advanced financial modeling and valuation techniques are employed to assess the impact of findings on the deal's valuation.

Depth and Scope: M&A due diligence is broader and more detailed, given the larger scale of transactions and the complexity of established businesses. It encompasses not just the financials but also legal, operational, and strategic facets of the target company.

Risk Management: While VC due diligence may accept higher levels of risk in exchange for potential high returns, M&A due diligence focuses on minimizing risk and ensuring stability and profitability post-acquisition.

Integration Planning: In M&A, financial due diligence often includes detailed planning for post-merger integration, focusing on achieving operational synergies and cost efficiencies.

Regulatory Compliance: M&A transactions may face more stringent regulatory scrutiny, making compliance a critical part of the due diligence process to avoid future legal or financial penalties.

Financial due diligence in an M&A deal is a critical process that requires meticulous attention to detail and a comprehensive understanding of the target company's financial landscape.

It differs significantly from VC due diligence in its focus on minimizing risk, understanding the full scope of financial obligations, and ensuring regulatory compliance.

By thoroughly evaluating the target's financials, companies can negotiate better terms, avoid costly mistakes, and lay a solid foundation for successful integration post-acquisition.

| Criteria | M&A Due Diligence |

VC Fundraise Due Diligence |

|---|---|---|

| Objective | Validate financials, uncover risks/liabilities, ensure valuation accuracy. | Evaluate growth potential, market opportunity, team capability. |

| Focus Areas | Historical financial performance, debt/liabilities, operational efficiencies, tax compliance. | Market potential, product viability, team assessment, growth metrics. |

| Methodology | Detailed financial review, legal compliance, integration planning. | Comparative analysis, scenario analysis, focus on innovation and scalability. |

| Risk Management | Minimizing risk, ensuring stability and profitability post-acquisition. | Accepting higher levels of risk for potential high returns. |

| Outcome Focus | Operational synergies, cost efficiencies, regulatory compliance. | Growth acceleration, market leadership, scalability. |

Financial due diligence is a critical component of assessing the viability and value of a business transaction. Whether for M&A, VC investments, or other financial dealings, the following best practices ensure a comprehensive and effective due diligence process.

A thorough review of all relevant financial documents is foundational. This includes audited financial statements, tax returns, budgets, forecasts, and any financing agreements. Such a review helps identify the financial health, trends, and potential risks associated with the target entity.

Direct engagement with the target company's management team offers invaluable insights beyond what financial documents can provide. Discussions can clarify assumptions behind forecasts, operational challenges, and strategic directions. This interaction also helps gauge the management team's depth and competency.

Involving experts in finance, law, and the specific industry of the target company can uncover risks and opportunities not immediately apparent. Financial advisors can provide a deeper analysis of the financial data, legal experts can identify potential legal entanglements, and industry specialists can offer competitive and market insights.

Evaluating the patterns and sources of cash flow gives a clearer picture of the company's operational health and its ability to sustain operations and grow. Analyze historical cash flow statements and future cash flow projections to assess liquidity, efficiency, and financial flexibility.

A quality of earnings report is essential to understand the sustainability and quality of the company's earnings. It identifies non-recurring, non-operational, or unusual items that may have inflated or deflated earnings, providing a clearer view of the company's financial performance.

Review the company's internal controls and financial reporting processes to identify weaknesses that could affect financial integrity or lead to fraud. A strong system of internal controls is indicative of reliable financial reporting and compliance with laws and regulations.

Thoroughly review the company's tax compliance history, including filings, payments, disputes, and resolutions. Assess potential tax liabilities and exposures to ensure there are no hidden tax risks that could affect the transaction's value.

In M&A scenarios, planning for the integration of operations post-transaction is critical. Assess how the target's operations, culture, and systems will integrate with those of the acquiring company to realize expected synergies and efficiencies.

After the transaction, establish mechanisms for ongoing monitoring and review of the financial and operational performance. This ensures that the objectives of the transaction are being met and helps identify and mitigate any emerging risks.

Adhering to these best practices in financial due diligence not only mitigates risks but also maximizes the value derived from business transactions. By conducting a thorough, engaged, and expert-informed due diligence process, stakeholders can make informed decisions that align with their strategic and financial objectives.

In the intricate world of financial investments, particularly within the realms of early-stage ventures and pre-IPO markets, the role of a skilled financial due diligence consultant cannot be overstated.

Finro, led by the esteemed Lior Ronen, stands out as a beacon of expertise and reliability in this complex landscape.

The testimonials of our satisfied clients shed light on the distinct advantages of partnering with Finro for your due diligence needs.

Clients have consistently lauded Lior for his exceptional financial analysis capabilities and deep understanding of early-stage venture finance. One notable instance involved a due diligence report for a potential investment, where Lior's adept analysis revealed critical insights about the company's operations and future strategy.

This was achieved through meticulous examination of financial statements, pitch decks, and pro formas. Lior's ability to independently source data and apply well-considered, thorough methodologies sets Finro apart, providing clients with a profound understanding of their potential investments.

Joseph Baldassarra

Managing Partner, Broad Street Global Fund

As a fund manager, purchasing investments in the pre-ipo market where company financials are not published, it is often difficult to assess a company.

However, one of the solutions that help guide me is Lior and Finro. I think without Lior's guidance, the success that we have achieved would have been much more difficult.

The firm has incredible customer service and guidance and I recommend the service for anyone in the space.

Always available, always intelligent and always within budget. What a winning combination!

The pre-IPO market presents unique challenges, chiefly due to the absence of publicly available financials.

Finro, under Lior's guidance, has been instrumental in illuminating this opaque sector for fund managers.

The firm's approach combines relentless data pursuit, intelligent analysis, and strategic foresight, enabling clients to make informed decisions in a market segment where information is scarce but potential for returns is high.

What truly distinguishes Finro is not just the analytical prowess or market knowledge, but the unwavering commitment to customer service.

Clients highlight the firm's accessibility, intelligence, and adherence to budget constraints as key factors in their continued success. The ability to consistently deliver insightful, actionable advice within budgetary limits, complemented by an always-available attitude, underscores Finro's dedication to client success.

Choosing Finro as your financial due diligence consultant means partnering with a firm that offers a winning combination of expertise, service, and value.

Whether navigating the early-stage venture landscape or assessing opportunities in the pre-IPO market, Finro's comprehensive service suite is tailored to guide investors toward successful outcomes.

The testimonials from our esteemed clients echo the sentiment that Finro, led by Lior, is more than just a consultancy; it is a strategic partner equipped to tackle the complexities of today's investment landscape.

With Finro, investors gain not only a consultant but an ally dedicated to their success, offering deep financial insights, strategic guidance, and a commitment to excellence that is unmatched in the financial due diligence arena.

Dave Mao

Managing Director, Come Up Capital

I asked Lior to write a due diligence report for an investment my fund was considering. He demonstrated expert financial analysis capability and an impressive understanding of early stage venture finance. I was impressed and very pleased with how much Lior was able to glean in a short amount of time about the operations and future strategy of the company from nothing more than its financial statements, pitch deck, and pro formas.

Lior independently sought data from multiple sources to make his arguments, and his methods were extremely well-considered and thoroughly implemented.

Financial due diligence stands as a critical pillar in the world of investments, mergers, and acquisitions. It not only illuminates the financial health and sustainability of a target company but also identifies potential risks and opportunities that could significantly impact the outcome of a transaction. Through the exploration of this article, we've delved into the what, why, and how of financial due diligence, emphasizing its indispensable role in making informed and strategic investment decisions.

The nuanced approach required by venture capitalists and M&A professionals underscores the complexity and the tailored expertise needed to navigate different stages of company growth and transaction types. We've seen how early-stage VC due diligence focuses on growth potential and team capabilities, shifting towards more financial and operational efficiencies in M&A scenarios. This evolution highlights the importance of a thorough and adaptive due diligence process.

Testimonials regarding the services provided by Finro and its principal, Lior, further exemplify the profound impact that expert financial due diligence can have on the success of investment decisions.

The ability to extract critical insights from financial statements, pitch decks, and other data sources—often in opaque or less transparent markets—underscores the value of engaging with seasoned professionals in this field. Finro's commitment to excellence, coupled with an always-available, intelligent, and budget-conscious approach, positions it as an invaluable partner in navigating the complexities of financial due diligence.

Choosing a consultant like Finro for financial due diligence not only enhances the quality and depth of the analysis but also equips investors and acquirers with the confidence to proceed with transactions, armed with a comprehensive understanding of the financial intricacies involved.

In conclusion, as the landscape of investments and acquisitions continues to evolve, the demand for rigorous financial due diligence has never been more critical. Whether venturing into early-stage investments or navigating the complexities of M&A, the insights and expertise provided by specialized consultants like Finro can make the difference between success and failure. By adhering to best practices and engaging with proven experts, stakeholders can navigate the financial due diligence process with greater assurance, clarity, and strategic foresight.

Financial due diligence is crucial for understanding a target company's financial health and potential risks.

It involves analyzing historical financial performance, quality of earnings, and future financial projections.

Venture capitalists and M&A professionals use tailored approaches to assess different stages of company growth.

Expert consultants like Finro provide in-depth financial analysis and strategic insights for informed investment decisions.

Engaging with specialists for financial due diligence enhances transaction success, offering detailed risk and opportunity insights.

Financial due diligence includes analyzing financial health, uncovering risks, assessing earnings quality, and future projections.

It covers historical financial performance, quality of earnings, working capital, debt, liabilities, and financial forecasts.

For a startup, due diligence involves assessing the team, market potential, product viability, and growth metrics.

For small companies, it entails reviewing financial statements, debt levels, cash flow, profitability, and operational efficiency.

VC due diligence includes team assessment, market potential, product viability, growth metrics, and financial health.

In private equity, financial due diligence involves a deep dive into financial statements, earnings quality, and investment risks.

VCs look for revenue growth, customer acquisition cost, lifetime value, burn rate, and unit economics in financials.