What is Customer Acquisition Cost (CAC)?

By Lior Ronen | Founder, Finro Financial Consulting

Ever wonder how much it really costs a business to get one new customer? That's where Customer Acquisition Cost, or CAC for short, comes into play.

Think of it like a measuring tape for a company's wallet: it shows how much they're spending to get people to hit the 'buy' button.

But it's not just about spending money; it's about understanding whether that money is well spent. Whether you're selling cool gadgets online, offering a subscription service, or just about any other kind of business, knowing your CAC can help you figure out if your marketing efforts are like hitting a bullseye or just throwing darts in the dark.

So, grab a cup of coffee, and let's break down what CAC is, why it's a big deal, and how businesses of all shapes and sizes use it to grow smarter.

Ready to become a CAC whiz? Let's dive in!

Customer Acquisition Cost (CAC) is the total cost incurred by a business to acquire a new customer. It is crucial across various business models such as SaaS, Fintech, and E-commerce. In these sectors, CAC reflects unique challenges and demands distinct strategies for optimization.

Understanding and calculating CAC is vital, especially in its relationship with Customer Lifetime Value (CLV), to ensure sustainable growth and profitability. CAC is not a static figure; it requires continuous monitoring and adjustment to align with evolving marketing strategies and market conditions. Effectively managing CAC is key to making informed strategic decisions, optimizing marketing investments, and achieving long-term success in the competitive business landscape.

Understanding Customer Acquisition Cost

Customer Acquisition Cost (CAC) is a business's total expense to attract and acquire a new customer. This metric encapsulates the efforts and financial investments to convince someone to choose your product or service.

In essence, CAC is the monetary representation of the customer journey from a potential customer's first encounter with your brand to their final decision to purchase.

CAC comprises various expenses, each playing a role in attracting new customers. These elements include:

Marketing and Advertising Expenses: This broad category covers all costs associated with promoting your brand and products. It includes:

Traditional advertising (TV, print, radio)

Digital advertising (online ads, email campaigns)

Social Media Marketing (SMM) costs: Expenses for campaigns on platforms like Facebook, Instagram, Twitter, LinkedIn, etc.

Search Engine Marketing (SEM) costs: Funds allocated for paid advertising on search engines like Google or Bing.

Public Relations (PR) agency costs: Fees paid to PR firms for media outreach, press release distribution, event organization, and brand image management.

Marketing and Sales Team Salaries: This crucial element represents the combined compensation for your entire marketing and sales departments. It includes:

Sales Personnel: These are the team members who directly engage with potential customers, guiding them through the sales process. Their salaries, commissions, and any performance bonuses are a core part of CAC.

Marketing Personnel: The salaries of your marketing team members are equally important. This group works behind the scenes to craft the strategies, campaigns, and content that draw customers to your business in the first place. From social media managers to SEO specialists, their collective compensation forms a significant portion of your CAC.

Software Costs: Investments in digital tools used for marketing, sales, and customer relationship management. This includes software for email marketing, customer data analysis, CRM platforms, and tools for SEO (Search Engine Optimization) to improve your website's visibility and ranking on search engines.

Overhead Expenses: Indirect costs that support the customer acquisition process. This could range from the utilities for your office to the costs of hosting promotional events and travel expenses for client meetings or sales pitches.

Design and Production Costs: The expenditure on creating marketing materials. This encompasses both physical materials (like brochures or banners) and digital content (such as videos, website design, and online graphics).

By understanding and effectively managing these costs, businesses can maintain a healthy CAC, ensuring that the investment in attracting new customers leads to profitable and sustainable growth.

The Significance of CAC in Business

After exploring what Customer Acquisition Cost (CAC) is and dissecting its components, it's clear that CAC is more than just a set of numbers. It's a vital heartbeat of any business, indicating the health and effectiveness of its growth strategies.

But why exactly is CAC such a critical metric for business growth and sustainability? And how does it impact a company's bottom line and strategic planning?

CAC serves as a gauge of marketing effectiveness. It shows how efficiently a business is using its resources to attract customers. A low CAC is often a sign of high marketing efficiency and sustainable business growth. Conversely, a high CAC can be a warning sign, indicating that the business might need to reevaluate its marketing strategies.

This metric is more than just a figure; it's a critical tool for decision-making. It helps businesses determine the best allocation of resources, decide on the viability of various marketing channels, and balance the budget between attracting new customers and retaining existing ones.

The influence of CAC extends to a company's profitability. A lower CAC generally means that the business spends less to acquire each new customer, which can significantly boost profit margins. This understanding of CAC helps businesses gauge the direct return on investment from their marketing and sales efforts, allowing them to adjust strategies for maximum profitability.

Moreover, CAC is integral to strategic planning. Understanding the cost of acquiring new customers enables businesses to set realistic growth targets, plan future investments, and develop strategies that align with their financial capabilities. It’s also crucial for forecasting and establishing benchmarks for future success.

In summary, CAC is a vital indicator that not only measures current marketing success but also shapes future business strategies.

Keeping a close eye on this metric allows companies to navigate the complex waters of market competition, ensuring long-term success and profitability.

Calculating CAC

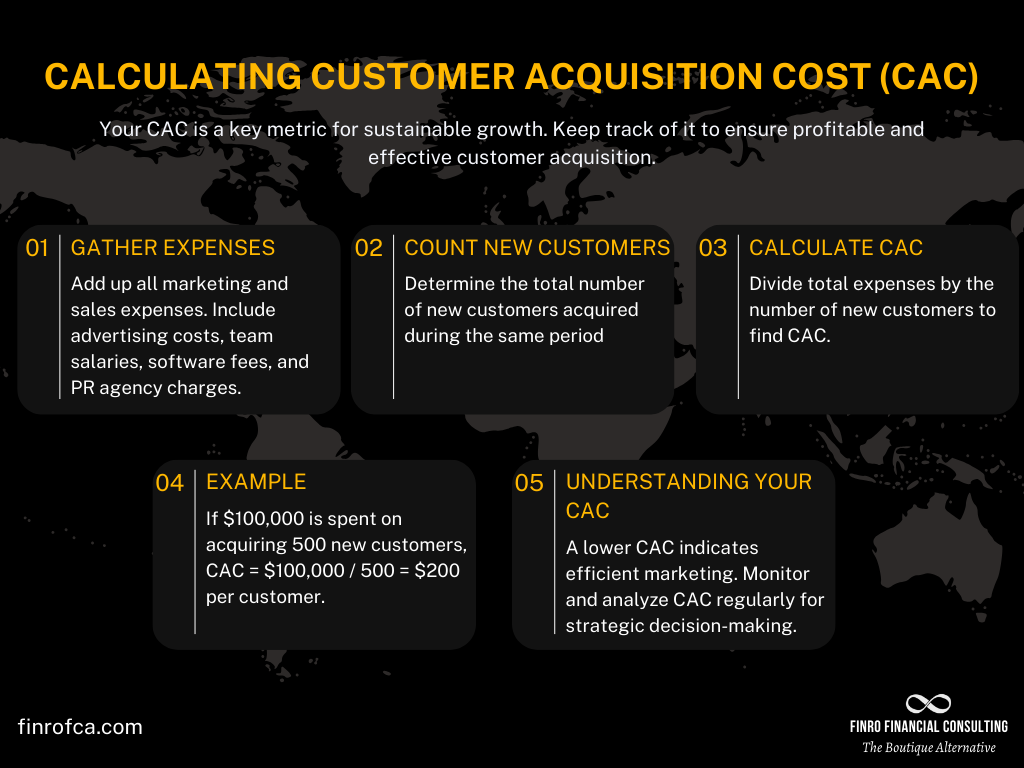

Understanding how to calculate Customer Acquisition Cost (CAC) is crucial for any business looking to gauge its marketing efficiency and strategize for growth.

Here's a step-by-step guide to calculating CAC, complete with an example for clarity:

Gather Total Marketing and Sales Expenses: Start by adding up all the costs involved in marketing and sales over a specific period. This includes advertising costs, salaries of marketing and sales teams, expenditures on marketing software, PR agency fees, and any other related expenses.

Count the Number of New Customers Acquired: Determine the number of new customers your business acquired during the same period as your calculated expenses.

Divide the Total Expenses by the Number of New Customers: Finally, divide the total marketing and sales expenses by the number of new customers acquired. The result is your CAC.

Example for Clarity

Let's say your business spent in Q1:

$20,000 on marketing and sales personnel salaries;

$15,000 on paid ads on Google;

$15,000 on paid ads on Facebook, Instagram, and LinkedIn;

$30,000 on a confrence sposnorship;

$5,000 on marketing materials;

$10,000 on travel expenses;

$5,000 on software licenses and subscription;

During this quarter, you acquired:

250 customers from organic traffic;

150 customers from paid ads;

50 customers from sponsorships;

50 customers from referrals;

Using the formula:

CAC = Total Marketing and Sales Expenses / Number of New Customers Acquired

Your CAC would be:

CAC = $100,000 / 500 = $200

This means that for each new customer acquired during Q1, your business spent $200.

Understanding the Result

The CAC of $200 isn’t just a number; it's a valuable insight. It helps you understand the effectiveness of your marketing and sales efforts and guides you in making informed decisions about future investments and strategies.

Remember, the goal is to have a CAC that allows your business to maintain healthy profit margins while still effectively attracting new customers. Continuous monitoring and analysis of CAC over time are crucial for fine-tuning your business strategies for optimal growth and profitability.

CAC in Different Business Model

Understanding Customer Acquisition Cost (CAC) in different business models is crucial, as it varies significantly across industries.

Let’s compare how CAC plays out in SaaS (Software as a Service), Fintech (Financial Technology), and E-commerce sectors.

Software as a Service, commonly known as SaaS, is a business model where software is hosted centrally and provided to customers over the internet, typically through a subscription model. Examples include cloud-based applications for business management, customer relationship management (CRM), and data analytics.

The uniqueness of SaaS lies in its subscription-based revenue model and the necessity for continuous customer engagement. Calculating CAC is critical in SaaS due to the long-term customer relationships and the need to balance upfront acquisition costs with the recurring revenue over time.

There are 2 CAC components unique for SaaS startups:

Content Marketing and Digital Advertising: Crucial for educating potential customers and generating leads. Unlike traditional product sales, the focus is on demonstrating long-term value.

Sales Team Efforts: In-depth engagement including product demonstrations, which is more resource-intensive compared to transactional sales models.

Fintech (Financial Technology)

Fintech, or Financial Technology, refers to the use of technology to improve and automate financial services. This sector includes everything from mobile banking and payment apps to advanced financial software used by businesses.

Fintech's uniqueness lies in its combination of technology, finance, and often stringent regulatory requirements. CAC is unique in this niche due to the need for building trust and compliance, which can significantly affect the time and resources spent on customer acquisition.

There are 2 CAC components unique for Fintech startups:

Educational Marketing: Vital for building trust and explaining complex financial products, differing from more straightforward product marketing.

Compliance Costs: Specific to Fintech, impacting both the cost and complexity of customer acquisition strategies.

eCommerce

E-commerce refers to the buying and selling of goods or services using the internet. This model encompasses a wide range of businesses, from giant online retailers to small, specialized online stores.

The E-commerce niche is characterized by its high-volume, competitive nature. CAC is unique here due to the sheer volume of transactions and the need for constant visibility in a crowded online marketplace.

There are 2 CAC components unique for eCommerce startups:

SEO, SEM, and SMM: More aggressive and dynamic compared to other sectors, focusing on immediate conversions and customer acquisition.

User Experience Improvements: Directly impacts conversion rates, more so than in industries where sales cycles are longer and based on relationships.

| Aspect | SaaS | Fintech | E-commerce |

|---|---|---|---|

| Business Model | Subscription-based software services. | Use of technology in financial services. | Online buying and selling of goods. |

| Unique Challenges | Long sales cycles, need for continuous engagement. | Building trust and compliance with regulatory requirements. | High-volume transactions, competitive marketplace. |

| Key CAC Components | Content marketing, digital advertising, sales team efforts. | Educational marketing, compliance costs, technology-driven customer service. | SEO, SEM, SMM, user experience improvements. |

| CAC Focus | Balancing upfront costs with long-term recurring revenue. | Trust-building and adapting to regulatory changes. | Constant visibility and immediate conversions. |

| KPI Distinction | Focus on demonstrating long-term value. | Unique blend of technology and finance with compliance costs. | Aggressive marketing focused on immediate sales. |

CAC and Customer Lifetime Value (CLV)

Customer Lifetime Value (CLV) is a crucial metric that represents the total amount of revenue a business can expect to earn from a customer throughout their relationship with the company.

It's not just about a single transaction; rather, CLV captures the long-term value of a customer, factoring in repeat purchases, subscription renewals, and ongoing engagement with the brand's products or services.

The interplay between CAC and CLV is fundamental in understanding the sustainability and profitability of a business. Here's why:

Balance Between Acquisition Cost and Customer Value: CAC tells you how much it costs to acquire a customer, while CLV tells you what they're worth over time. A healthy business model aims for a significantly higher CLV than the CAC. This means that the cost of acquiring customers is a worthwhile investment, leading to profitability in the long run.

Strategic Resource Allocation: Knowing the ratio of CLV to CAC helps businesses decide how much to invest in acquiring new customers versus retaining existing ones. If CLV is high relative to CAC, a business can justify a higher spend on marketing and sales. Conversely, a lower CLV compared to CAC might signal a need to focus on customer retention strategies or reevaluate the cost-effectiveness of acquisition channels.

Long-term Business Growth: Understanding CLV in relation to CAC enables a business to forecast its revenue and growth more accurately. It helps in making informed decisions about marketing budgets, product development, and market expansion strategies.

Customer Segmentation and Targeting: By analyzing CLV and CAC together, businesses can identify the most valuable customer segments. This insight allows for more targeted marketing efforts, ensuring that resources are focused on acquiring customers who are likely to offer the greatest lifetime value.

In essence, CLV provides the context for CAC, offering a broader perspective on customer relationships. While CAC focuses on the initial stages of the customer journey, CLV extends this view to the entire lifespan of the customer-business relationship.

Understanding both CAC and CLV is crucial for any business aiming for long-term success and sustainability.

Conclusion

In the journey of exploring Customer Acquisition Cost (CAC), we've dived into its definition, significance, and the nuances of calculating it across different business models.

Understanding CAC is not just about grasping a financial metric; it's about gaining insight into the efficiency of your business's growth strategies and the value of your customers.

We've seen how CAC varies across industries like SaaS, Fintech, and E-commerce, each presenting unique challenges and requiring tailored strategies. The interplay between CAC and Customer Lifetime Value (CLV) has highlighted the importance of balancing acquisition costs with the long-term value of customers, underscoring the need for a strategic approach to marketing and customer relationship management.

As we conclude, remember that CAC is a dynamic metric, one that should continuously be monitored and optimized. It's a compass guiding businesses in allocating resources effectively, designing impactful marketing campaigns, and ultimately, in making informed decisions that drive sustainable growth.

Whether you're a startup founder, a marketing professional, or a business leader, keeping a pulse on your CAC and understanding its implications can be the key to unlocking your business's potential. It's not just about reducing costs; it's about smart investments in acquiring and retaining valuable customers.

With this knowledge in hand, you are better equipped to steer your business towards profitability and success in the ever-evolving landscape of the modern marketplace.