Founders Should Focus On Their Business, Not On Investors' ROI

By Lior Ronen | Founder, Finro Financial Consulting

Many founders mistakenly believe that dazzling investors with complex ROI projections will fast-track them to funding. They think that if they can demonstrate how quickly investors will get their money back, investors will be eager to jump in.

The truth? That approach rarely works.

Investors care more about understanding how your business operates and grows than about speculative ROI numbers. A solid financial model offers them insight into your business mechanics, such as acquiring customers, generating revenue, and scaling your operations. These are the things that drive long-term value—and, ultimately, the startup's valuation.

Focusing on building and growing a strong business is what will attract investors—not promises of returns that you can't accurately predict.

Instead of focusing on ROI metrics that vary from one investor to another, it’s crucial for founders to concentrate on refining their business model and leaving the ROI calculations to the investors themselves.

Founders should prioritize building a strong business by focusing on key aspects like customer acquisition, revenue generation, scalability, and capital allocation rather than trying to predict investors' ROI. Investors have their own methods for calculating ROI, which vary based on their specific goals, risk appetite, and portfolio strategies.

Instead of speculative ROI estimates, founders should provide accurate financial forecasts that highlight the startup’s growth potential and valuation. This approach ensures transparency, allows investors to make informed decisions, and ultimately leads to long-term value creation for the business.

Understanding Startup Valuation vs. Investor ROI

As a founder, it’s essential to understand the difference between startup valuation and investor ROI—and why your focus should be on the former.

Startup valuation represents the value of your business at a given point in time. It reflects your company's growth potential, market position, and ability to generate future cash flow.

Investors want to know the logic behind this valuation, and they use it to gauge the overall risk and potential reward of investing in your startup.

On the other hand, investor ROI (Return on Investment) is a metric investors use to calculate the return they expect based on their investment in your business.

It varies depending on their personal or institutional criteria, fund structure, and overall portfolio performance. ROI is largely outside your control and influenced by factors you won’t have insight into.

That’s why your energy should be focused on building a solid valuation. This gives investors the necessary information to calculate their ROI if they’re interested.

By putting startup valuation first, you’re showing a clear, unbiased picture of your company’s future potential—without getting tangled in speculative metrics that investors may not find relevant or accurate.

Get your expert support now!

Why Investors Care About Your Business, Not Just ROI

Investors aren’t just looking for quick returns—they want to understand how your business operates and grows over time.

The foundation of any good financial model is the ability to show investors how your business works, where it’s heading, and how their investment will help you scale.

Here are the key elements investors care about when evaluating your startup:

Customer Acquisition: How do you attract new customers? What channels or strategies are you using? Investors want to see that you have a clear and cost-effective path to growing your customer base.

Revenue Generation: What are your revenue streams? Can you demonstrate recurring revenue or potential for high margins? Strong, consistent revenue generation is a critical part of startup valuation.

Scalability: How easily can your business grow without massive costs or operational headaches? Investors want to know that you can scale your operations efficiently as demand increases.

Capital Allocation: How will you use the funds? Whether it’s for product development, marketing, or expanding your team, investors want to see that their capital will be put to good use in driving growth.

A well-built financial model showcases these elements in detail, allowing investors to assess the strength of your business, the potential for growth, and, ultimately, your startup’s valuation.

Founders who can present a clear, actionable plan will always catch the attention of investors, as they provide a roadmap to business success—something far more valuable than speculative ROI calculations.

The Problem with Predicting Investors' ROI

One of the founders' biggest misconceptions is that they can predict or calculate ROI for investors.

The reality is that any such estimate is bound to be inaccurate because it's based solely on the founder’s assumptions and forecasted growth.

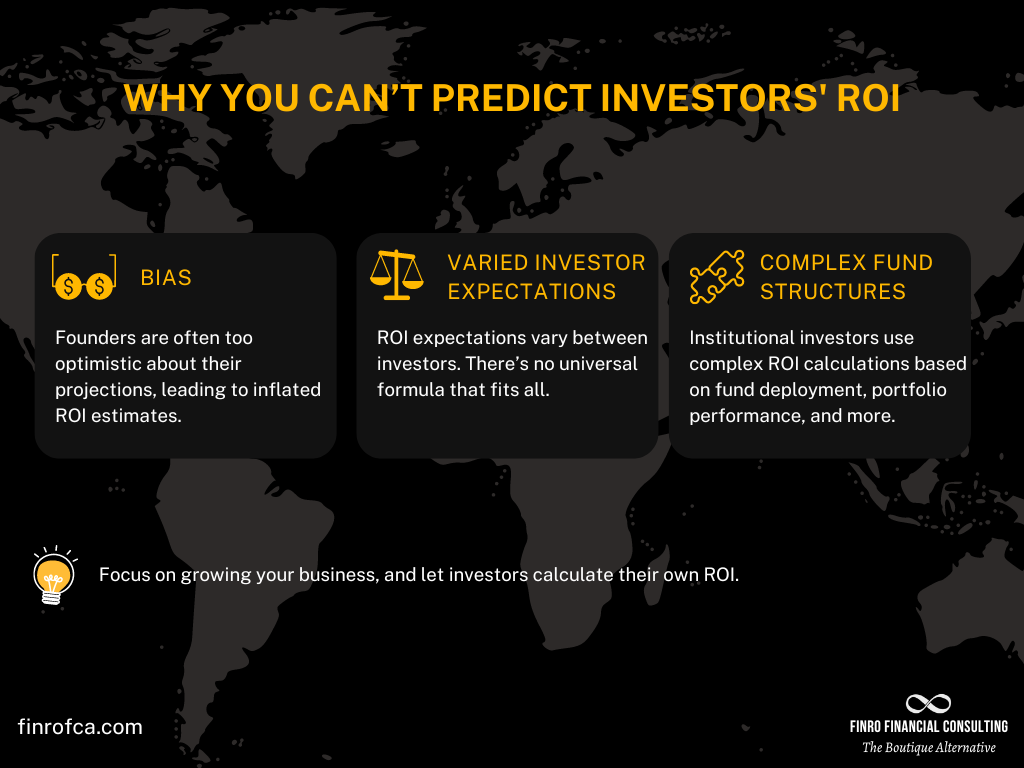

Here’s why predicting investor ROI doesn’t work:

Bias: Founders are naturally optimistic about their business, leading to inflated projections. ROI estimates coming directly from founders can be seen as biased, which undermines the credibility of the financial model.

Varied Investor Expectations: ROI expectations vary widely between investors. A venture capital firm may have a completely different target ROI compared to an angel investor, based on their fund structure, risk tolerance, and investment horizon. There’s no one-size-fits-all calculation that founders can provide.

Complex Fund Structures: For many investors, especially institutional ones, ROI calculations are far more complex than the simple formulas you’ll find online. These calculations depend on how much of the committed funds have been deployed, how the investment is financed, and even how other investments in their portfolio are performing.

Instead of trying to predict something you can’t control, focus on what you can—building a business that increases in value over time.

Your job as a founder is to provide investors with the information they need to make their own ROI assessments, based on their unique situation. By doing this, you maintain transparency and avoid the trap of presenting potentially misleading projections.

What Should Be Included in a Financial Forecast

Rather than attempting to predict investor ROI, founders should focus on presenting a well-rounded financial forecast that gives investors the insights they need to evaluate the business.

A strong forecast demonstrates your understanding of your market, growth strategy, and financial health—factors that will ultimately drive your startup's valuation.

Here’s what you should focus on including:

Revenue Projections: Investors want to see clear and realistic revenue projections over time. Break these down by product lines or services, and include any assumptions you’re making about market growth, pricing strategy, and customer acquisition.

Cost Structure: Detail your major expenses, including operational costs, marketing spend, and R&D. This gives investors insight into how you’re managing resources and whether you can maintain profitability as you scale.

Cash Flow Projections: Cash flow is the lifeblood of any startup. Show how your business plans to generate positive cash flow over time, and how you intend to manage working capital. Investors want to see when you’ll hit important milestones, like breaking even or becoming cash-flow positive.

Capital Requirements: Be clear about how much funding you need and how you will allocate it. Whether the money is for product development, hiring, or market expansion, investors want to understand how their capital will fuel growth.

Key Metrics: Depending on your industry, certain metrics will stand out. These could include customer acquisition cost (CAC), lifetime value (LTV), or gross margins. Highlight the metrics that demonstrate your ability to scale efficiently and profitably.

By focusing on these elements, you’ll provide investors with the data they need to assess your startup’s potential.

Instead of offering speculative ROI estimates, you’ll be presenting a financial roadmap that showcases your business strategy and growth trajectory—something investors will find far more valuable.

The Investor’s Role in ROI Calculation

Once you’ve presented a clear financial forecast, the job of calculating ROI falls to the investor—not the founder.

Sophisticated investors, especially those managing institutional funds or venture capital, have their own methods for determining ROI based on a variety of factors beyond just your financials.

Here’s why investors calculate their own ROI:

Investor-Specific Criteria: Every investor has unique goals and risk appetites. While one investor may prioritize high-growth opportunities, another might focus on capital preservation. Their ROI calculation is tailored to their specific fund structure, investment horizon, and broader portfolio strategy.

Risk Assessment: Investors incorporate various risk factors into their ROI calculations, such as market volatility, competition, and even macroeconomic conditions. These are considerations founders rarely have the full picture of, making it impossible to accurately predict ROI on their behalf.

Data-Driven Models: Many institutional investors rely on sophisticated financial models that take into account things like hurdle rates, internal rate of return (IRR), and exit scenarios. These models help them determine the level of risk they’re willing to take for the potential reward, something a founder’s projections can’t account for.

Instead of attempting to estimate ROI, founders should focus on delivering the most accurate, transparent data possible.

If investors are missing key pieces of information, they’ll ask for it. It’s much more effective to provide a financial forecast that helps investors evaluate your business on its own merits, allowing them to calculate their ROI based on their own risk models.

By allowing investors to handle their own ROI calculations, founders can stay focused on growing their business and increasing its valuation—exactly what investors want to see.

Conclusion: Focus on Startup Valuation, Not ROI

As a founder, your primary focus should always be on building a business that grows in value over time. Trying to calculate ROI for investors is not only unnecessary but also counterproductive.

Investors have their own methods and models for evaluating the return on their investment, and these depend on factors you simply can’t control.

What you can control is how well you articulate your business model, growth strategy, and financial projections. A strong financial forecast that highlights your startup's potential is what will truly capture an investor’s attention.

Instead of speculative ROI numbers, show them how you plan to acquire customers, generate revenue, and scale efficiently. This gives investors the foundation they need to calculate their own ROI based on your company’s performance.

Remember, the goal is to build a business that’s valuable, sustainable, and scalable. By focusing on the things that matter—your startup valuation, growth plan, and financial health—you’ll naturally attract the right kind of investors who will appreciate the potential of your business.

So, leave the ROI calculations to the investors, and keep your attention on building a company that delivers long-term value.

Key Takeaways

Focus on Business Fundamentals: Customer acquisition, revenue generation, and scalability are more important than speculative ROI calculations.

Investors Calculate Their Own ROI: Founders can't predict ROI accurately since investors use their own models based on unique criteria.

Provide Clear Financial Forecasts: Investors need realistic financial projections, not inflated estimates of potential returns.

Valuation Over ROI Estimates: Concentrate on startup valuation, as it reflects your business’s true growth potential.

Transparency Attracts Investors: Accurate, data-driven forecasts build trust and help investors assess your business on solid foundations.