The Basics of Customer Churn Rate: Definition, Importance and Analysis

By Lior Ronen | Founder, Finro Financial Consulting

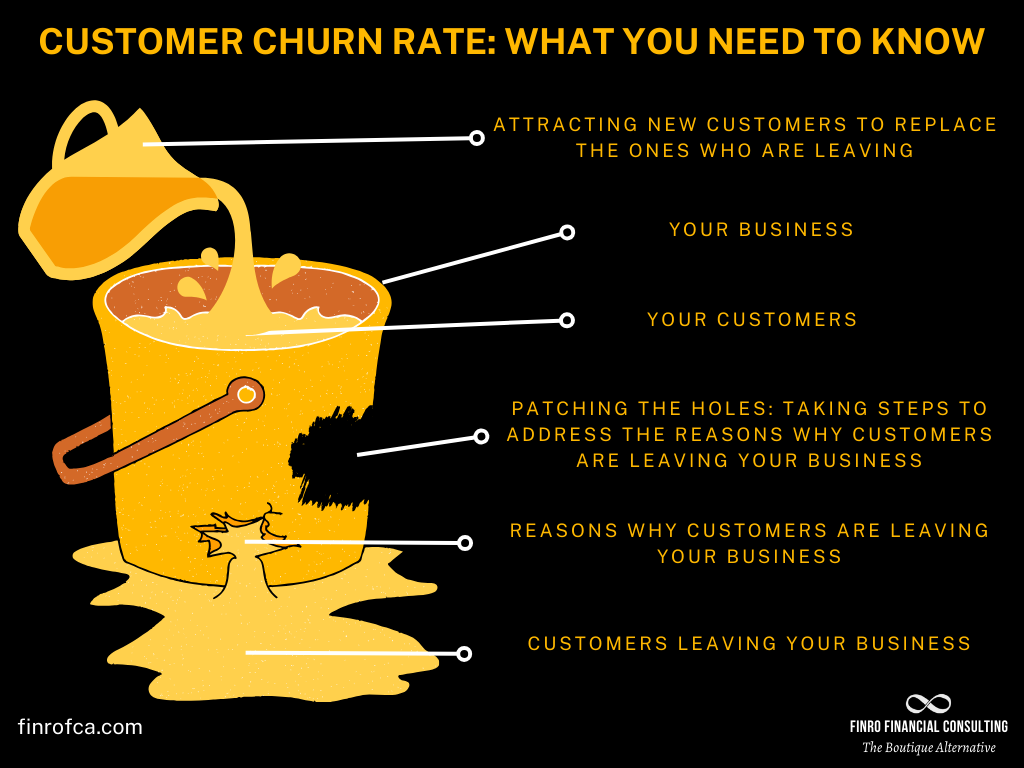

The most crucial aspect of a subscription business, whether in fintech, enterprise software, marketing tech, or AI, is not just acquiring new paying subscribers but retaining them.

These businesses invest significantly in Instagram ads, TikTok influencers, SEO specialists, and conferences to attract new clients.

However, if these clients leave shortly after joining, the initial investment in acquiring them is wasted.

The business now needs to spend twice as much to replace each lost customer and add new ones just to grow.

So, obviously, the fewer clients that leave, the better.

But when do we consider the number of leaving clients to be too high? Is 50 a concerning number, or is even 10 too many?

To determine this, we compare the number of clients leaving to the total client base, a measure known as the churn rate.

This rate is a vital metric in the subscription business.

When you notice a high number of clients leaving, it should prompt specific analyses and actions. In this article, we’ll explore the churn rate in depth.

We’ll understand what it signifies, how to calculate it, strategies for improving it, and how it’s intertwined with customer retention.

Moreover, we'll discuss why sometimes a high churn rate might be expected in a business.

Let’s begin by defining the churn rate and delving into its importance in the subscription business

Churn rate, a critical metric in subscription-based businesses, indicates the percentage of clients discontinuing their subscriptions over a specific period. Understanding and managing this rate is essential for evaluating customer retention and overall business health.

Key discussions include the calculation of churn rate, the differentiation between voluntary and involuntary churn, and its profound impact on revenue, customer satisfaction, and business growth. Conducting detailed churn/retention analyses helps businesses identify and address the reasons behind customer attrition, guiding effective strategies for improvement and sustained customer engagement.

Definition of Churn Rate

The churn rate represents the proportion of existing clients who choose to unsubscribe from services relative to the total client base within a specific period.

Consider a SaaS business as an example, that specializes in CRM solutions for dental clinics, and currently serves 1,000 clinics on a subscription basis.

Suppose 20 of these clinics decide to unsubscribe from our platform. In this scenario, the business would experience a churn rate of 2%.

Churn Rate = 20 / 1,000 = 2%

Now, if the business manages to acquire 35 new clients in the next year, 20 of them will merely compensate for the 20 clinics we lost, leaving only 15 as actual net growth. Thus, a lower churn rate directly correlates to faster company growth.

However, sometimes clients are compelled to unsubscribe from services.

For instance, out of the 20 clinics that unsubscribed, suppose 4 had to cease operations.

Their departure wasn't due to dissatisfaction with the service or pricing but because they went out of business. This scenario is known as involuntary churn – these clients didn't wish to leave but were forced to due to external circumstances.

Why does this distinction matter?

When analyzing churn rates, our objective is to understand how we can enhance our business to encourage longer client retention and continued payments.

This analysis necessitates differentiating between clients who leave voluntarily – perhaps due to inadequate service, unmet product expectations, or high pricing – and those who leave involuntarily, which doesn't offer much insight for business improvement strategies.

This brings us to Churn/Retention Analysis, which we will explore in detail in the next section. We'll dissect the primary steps and actions involved and their implications for the business.

Before we proceed, let's summarize this section: we've defined what churn rate is, demonstrated how to calculate it, and highlighted the importance of distinguishing between voluntary and involuntary churn

The Churn/Retention Analysis

Running periodic churn/retention analysis is strategically vital for every business.

Through this analysis, businesses can deeply understand why clients decide to leave their service, identify the extent of issues causing client departure, and formulate an action plan for improvement.

There are general 4 steps for the Churn/Retention Analysis:

Step 1: Conduct An Exit Survey

This step is foundational for the entire analysis and, though crucial, is often challenging to execute effectively.

At this stage, unsubscribing clients are prompted to answer a series of questions to shed light on their reasons for leaving, their perceptions of the service, and their likelihood of recommending it to others.

Remember those survey pages you encounter when unsubscribing from a service?

While they might be the last thing you want to fill out, they are essential for the business. Some even offer small incentives for completing these surveys.

The catch?

The quality of responses can be variable, as many are eager to just move on and cancel their subscriptions. Nonetheless, we make the best of what we gather.

The goal here is to strike a balance: too many questions might deter responses, while too few yield insufficient data.

The right number varies by business, but a useful guideline is personal experience – if you would answer a certain number of questions, so will your clients.

Step 2: Voluntary vs. Involuntary Churn

This stage is the initial segmentation of the analysis.

It’s about distinguishing whether clients left due to external factors like going out of business, or dissatisfaction with the product.

This differentiation is crucial as it helps focus the analysis on the relevant population.

Typically, we discern this by inquiring about the reason for unsubscribing.

It's not a precise science, but it generally works well.

Here, we set aside involuntary churn and concentrate on clients who left of their own volition.

| Reasons for Voluntary Leaving | Reasons for Involuntary Leaving |

|---|---|

| Doesn’t solve the specific problem | Business Closure or Bankruptcy |

| Poor User Experience | Mergers and Acquisitions |

| Inadequate Customer Support | Regulatory or Legal Changes |

| Pricing Issues | Change in Leadership |

Step 3: Voluntary Churn Reasons

Now, we examine the reasons behind voluntary departures.

Since this is a periodic analysis, we can identify recurring themes. Common reasons include:

Common reasons include:

Lack of Product-Market Fit: If the product doesn't adequately solve a significant problem or meet the specific needs of its target market, customers are likely to abandon it.

Poor User Experience: A complicated or non-intuitive user interface can frustrate users. If the product is difficult to navigate, slow to load, or frequently crashes, users are more likely to seek alternatives.

Inadequate Customer Support: Timely and effective customer support is crucial in the SaaS industry. If customers feel that their issues and queries are not addressed satisfactorily, they may lose trust in the product.

Pricing Issues: Pricing plays a crucial role in retaining customers. If the cost of the service is too high compared to its perceived value or if there are unexpected pricing changes, customers might consider switching to a competitor.

Lack of Features or Updates: In a rapidly evolving market, SaaS products need to innovate and update continually. If a product doesn’t evolve with changing market demands or lacks key features that competitors offer, customers might leave for a more advanced or suitable solution.

Prioritizing the most prevalent reasons is key, as they impact a larger client segment and could also affect current clients.

Step 4: Filtering and Prioritizing

Addressing every churn reason is impractical due to resource constraints. The first step is to filter which issues to address.

Then, prioritize them based on their magnitude and importance. For instance, addressing a fundamental issue like product-market fit might be challenging but is crucial for future client acquisition and churn reduction.

Conversely, smaller issues like adding a feature or regular updates, though easier to tackle, need to be aligned with the overall business strategy.

In this section, we have reviewed the essential steps of Churn/Retention Analysis.

The length and depth of the process vary depending on the business.

Get your churn analysis now!

Churn Trends

By now, we have a clear understanding of the significance of churn rate in subscription-based businesses.

We've learned how to calculate it and how analyzing churn can enhance our business and potentially improve the churn rate.

In this section, we'll delve into churn trends, particularly focusing on the differences between monthly and annual churn rates, and the pattern of declining churn rates in new businesses.

Monthly vs. Annual Churn Rates

Let's revisit the churn rate example from our SaaS business serving dental clinics. We noted that a loss of 20 clients out of 1,000 results in a 2% churn rate. However, the impact of this churn rate varies significantly depending on whether it's calculated monthly or annually.

For instance, if 20 clients leave over the span of a year, the annual churn rate stands at 2%.

But, if the same number of clients are leaving each month, the monthly churn rate is also 2%, which accumulates to an alarming annual churn rate of 24%:

20 * 12 / 1,000 = 24%

Hence, distinguishing between monthly and annual churn rates is crucial as the implications can be vastly different.

The Declining Churn Trend in New Businesses

New businesses often face uncertainties regarding market reception upon launching their products or services.

While they might test the waters with a Minimum Viable Product (MVP), the real test begins when a larger customer base starts using the product.

This initial phase can be particularly challenging, as users are still gauging the product's utility and compatibility with their needs.

This uncertainty tends to be more pronounced in B2C SaaS products compared to B2B. In B2B, the sales cycle is longer and often involves demos, detailed discussions, and negotiations, which reduces the likelihood of surprises post-purchase.

Conversely, B2C customers, influenced perhaps by an attractive Instagram ad, might quickly sign up and later find the product lacking in features or not as useful as anticipated.

Such scenarios contribute to churn, as users may unsubscribe upon realizing the product does not meet their expectations or needs.

However, each churn instance offers valuable insights to the business. Whether it's refining target audience, adding desired features, or adjusting pricing strategies, each lesson helps in reducing future churn.

Initially, a new SaaS business might experience a high monthly churn rate, sometimes as high as 60-70%.

But as the business evolves, learning from customer feedback and improving its offerings and marketing strategies, this rate typically declines, stabilizing to a single-digit percentage in most cases.

Importance of Churn Rate

Churn rate can significantly impact a business, both positively and negatively.

It impacts every aspect of the business, including revenues, customer satisfaction, business growth, and customer retention. Each of these areas is affected differently, so let's look at how each is affected.

Revenue.

A high churn rate means that a company is losing customers faster than it is gaining new ones. If a business adds more customers each month than those who leave, it will show an increasing trend in clients and revenues.

But if the churn rate is higher than the rate at which new clients are acquired, then the company's revenues will decrease. To increase revenues, a company needs to do whatever it can to retain existing customers and solve specific problems--whether they're around pricing, customer support, or something else entirely.

Customer satisfaction.

An elevated voluntary churn rate could be a red flag for customer dissatisfaction.

This dissatisfaction may stem from various factors, such as the quality of the product or service, pricing, or the overall customer experience. It might also indicate that customers have found better alternatives or no longer see a need for the product or service.

By identifying and resolving these underlying issues, a business can enhance customer loyalty and reduce its churn rate.

Business growth.

The churn rate is not only a critical factor in revenue generation but also a significant predictor of business growth potential.

A high churn rate can impede the ability to grow the customer base and expand the business. In contrast, a low churn rate suggests successful customer retention, providing a stronger platform for business growth.

Customer Acquisition Cost

The churn rate also directly impacts the business' customer acquisition costs (CAC).

High churn rates result in losing customers more rapidly than acquiring new ones, pressuring the business to intensify its marketing and sales efforts.

This increased spending, spread over a smaller customer base, elevates the overall cost of acquiring new customers. On the other hand, a low churn rate signifies effective customer retention, potentially leading to a reduction in CAC, as the cost to acquire new customers is distributed across a larger base.

Impact on LTV to CAC Ratio

A higher churn rate can also adversely affect the LTV (Lifetime Value) to CAC ratio.

The LTV measures the value of customers over time, quantifying what loyal customers are worth to the business throughout their engagement.

The LTV to CAC ratio is a crucial metric that determines whether the revenue generated from each client justifies the cost incurred in acquiring them. Ideally, this ratio should be at least 3x, implying that a customer should generate three times more revenue than the cost to acquire them.

A high churn rate, contributing to increased CAC, can lead to a lower LTV to CAC ratio.

This signifies inefficiencies in acquiring and retaining paying clients over the long term, a critical concern for subscription-based businesses.

Conclusion

In summary, this article has provided a comprehensive look at churn rate, a crucial metric in subscription-based businesses. We defined churn rate as the percentage of clients who discontinue their subscriptions within a given period and explored its significant impact on business health.

We discussed the churn/retention analysis, detailing the steps involved in understanding why clients leave and how to retain them. This analysis is vital in identifying areas for improvement, whether in product quality, customer experience, or pricing strategy.

Emphasizing the importance of churn rate, we highlighted how it directly influences a business's revenue, growth potential, and customer acquisition costs. A high churn rate signals problems in customer satisfaction and product-market fit, necessitating immediate action to prevent further loss.

Ultimately, managing churn rate effectively is essential for maintaining a healthy, growing business. It's not just about numbers; it's about understanding customer needs and adapting to meet them, ensuring the long-term success and sustainability of the business